La chirurgie minimalement invasive implique l’intervention chirurgicale réalisée avec de minuscules incisions sur le corps. Les interventions chirurgicales comprennent, entre autres, l'arthroplastie, les réparations arthroscopiques de blessures sportives et le traitement microscopique d'affections musculo-squelettiques complexes. Les avantages de la chirurgie mini-invasive comprennent un temps de récupération court, un faible risque d’infection, moins de saignements, de petites cicatrices et des séjours hospitaliers plus courts.

Les techniques mini-invasives offrent de nombreux avantages, notamment des séjours hospitaliers plus courts, des périodes de récupération plus rapides, moins d'inconfort après une intervention chirurgicale et une diminution des risques de problèmes, qui sont privilégiés par les patients et les professionnels de la santé de la région comme alternatives aux procédures chirurgicales ouvertes. La demande d'implants orthopédiques fonctionnant avec des méthodes peu invasives, telles que des implants plus petits, des techniques chirurgicales spécialisées et des instruments, est motivée par cette évolution vers les procédures MIS. Ainsi, l’accent mis sur l’adoption de la chirurgie mini-invasive devrait servir de moteur à la croissance du marché.

Accéder au rapport complet @https://www.databridgemarketresearch.com/reports/mena-orthopedic-implants-market

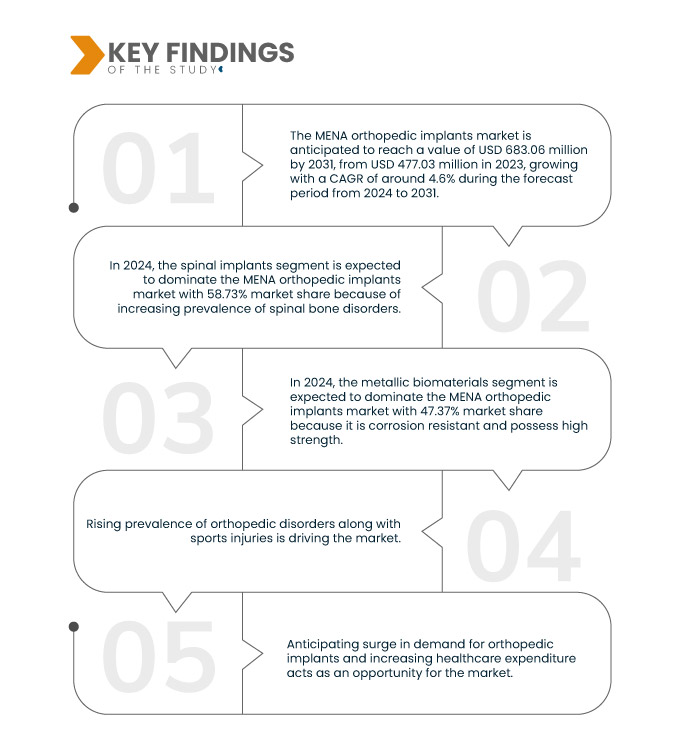

Data Bridge Market Research analyse que le Marché des implants orthopédiques MENA devrait atteindre 683,06 millions USD d’ici 2031, contre 477,03 millions USD en 2023, avec une croissance à un TCAC de 4,6% au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Prévalence croissante des troubles orthopédiques ainsi que des blessures sportives

Il existe un besoin croissant d'implants orthopédiques pour traiter les problèmes musculo-squelettiques tels que les troubles musculo-squelettiques (TMS), les douleurs musculaires et autres. Le vieillissement de la population, les modes de vie sédentaires et l’augmentation de la pratique sportive contribuent tous à une incidence plus élevée de troubles orthopédiques. Le besoin de thérapies orthopédiques est motivé par des blessures graves telles que des fractures et des ruptures de ligaments dues à des activités sportives, ainsi que par des troubles chroniques comme l'arthrose et l'ostéoporose. Les blessures liées au sport sont de plus en plus fréquentes. Des implants orthopédiques et des interventions chirurgicales sont fréquemment nécessaires pour ces blessures afin de stabiliser les articulations, réparer les ligaments et traiter les fractures. En conséquence, on s’attend à une augmentation considérable du besoin d’implants orthopédiques compatibles avec les opérations de médecine sportive.t

Le besoin urgent de thérapies orthopédiques est mis en évidence par la prévalence croissante de maladies telles que l’arthrose, l’ostéoporose et les blessures musculo-squelettiques, qui sont encore exacerbées par les changements démographiques et de mode de vie. En outre, la participation accrue de la région aux sports et aux activités physiques a entraîné une augmentation des blessures liées au sport, nécessitant l'utilisation d'implants orthopédiques et de procédures chirurgicales pour fracture réparation, restauration ligamentaire et stabilisation des articulations. Ainsi, la prévalence croissante des troubles orthopédiques ainsi que des blessures sportives devrait constituer un moteur de croissance du marché.

Portée du rapport et segmentation du marché

|

Mesure du rapport

|

Détails

|

|

Période de prévision

|

2024 à 2031

|

|

Année de référence

|

2023

|

|

Années historiques

|

2022 (personnalisable jusqu'en 2016-2021)

|

|

Unités quantitatives

|

Chiffre d'affaires en millions USD

|

|

Segments couverts

|

Produits (implants rachidiens et implants traumatologiques), biomatériaux (biomatériaux métalliques, biomatériaux polymères, Céramique Biomatériaux, biomatériaux naturels et autres), mode (chirurgie ouverte et chirurgie mini-invasive (MIS)), type de dispositif (dispositifs de fixation interne et dispositifs de fixation externe), application (fracture de la colonne vertébrale, arthroplastie de la hanche, arthroplastie du genou, arthroplastie de l'épaule, fracture du cou et Autres), Utilisateur final (hôpitaux, centres de soins ambulatoires, cliniques spécialisées, centres orthopédiques et autres), canal de distribution (appel d'offres direct, vente au détail et autres)

|

|

Pays couverts

|

Arabie saoudite, Émirats arabes unis, Égypte, Qatar, Koweït, Oman et Bahreïn

|

|

Acteurs du marché couverts

|

Stryker (États-Unis), Arthrex Inc. (Allemagne), CONMED Corporation (États-Unis), B. Braun SE (Allemagne), Globus Medical (États-Unis), Auxein (États-Unis), Matrix Meditec (Inde), Medtronic (États-Unis), Norm Medical (Turquie) et Orthomed (Egypte) entre autres

|

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie d'experts, l'épidémiologie des patients, une analyse du pipeline, une analyse des prix, et cadre réglementaire

|

Analyse sectorielle

Le marché des implants orthopédiques MENA est segmenté en sept segments notables en fonction des produits, du biomatériau, du mode, du type d’appareil, de l’application, de l’utilisateur final et du canal de distribution.

- Sur la base des produits, le marché est segmenté en implants rachidiens et implants traumatologiques.

En 2024, le segment des implants rachidiens devrait dominer le marché des implants orthopédiques dans la région MENA.

En 2024, le segment des implants rachidiens devrait dominer le marché avec une part de marché de 58,73 % en raison de la prévalence croissante des troubles orthopédiques.

- Sur la base de biomatériau, le marché est segmenté en biomatériaux métalliques, biomatériaux polymères, biomatériaux céramiques, biomatériaux naturels, autres

En 2024, le segment des biomatériaux métalliques devrait dominer le marché des implants orthopédiques dans la région MENA.

En 2024, le segment des biomatériaux métalliques devrait dominer le marché avec une part de marché de 47,37 % en raison de l’attention croissante portée à la chirurgie mini-invasive.

- Sur la base du mode, le marché est segmenté en chirurgie ouverte et chirurgie mini-invasive (MIS). En 2024, le segment de la chirurgie ouverte devrait dominer le marché avec une part de marché de 67,01 %

- Sur la base du type d’appareil, le marché est segmenté en appareils de fixation interne et en appareils de fixation externe. En 2024, le segment des dispositifs de fixation interne devrait dominer le marché avec une part de marché de 62,82 %

- Sur la base des applications, le marché est segmenté en fracture de la colonne vertébrale, arthroplastie de la hanche, arthroplastie du genou, arthroplastie de l’épaule, fracture du cou et autres. En 2024, le segment des fractures de la colonne vertébrale devrait dominer le marché avec une part de marché de 30,74 %

- Sur la base de l’utilisateur final, le marché est segmenté en hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées, centres orthopédiques et autres. En 2024, le segment des hôpitaux devrait dominer le marché avec une part de marché de 47,60 %

- Sur la base du canal de distribution, le marché est segmenté en appels d’offres directs, ventes au détail et autres. En 2024, le segment des appels d'offres directs devrait dominer le marché avec une part de marché de 64,28 %

Acteurs majeurs

Data Bridge Market Research analyse Stryker (États-Unis), Arthrex Inc. (Allemagne), CONMED Corporation (États-Unis), B. Braun SE (Allemagne), Globus Medical (États-Unis) comme les principales entreprises opérant sur le marché des implants orthopédiques dans la région MENA.

Développements du marché

- En février 2024, Auxein Medical, fabricant et exportateur d'implants orthopédiques, présente ses dernières innovations en matière de technologie médicale au salon Arab Health, qui se tient au World Trade Center du 29 janvier au 1er février. La société dévoile de nouveaux produits dans les catégories Traumatisme et Arthroscopie, ainsi qu'une gamme complète d'implants orthopédiques avancés sur le stand CC99 dans le hall. La participation à Arab Health et la présentation de nouveaux produits amélioreront la visibilité de la marque Auxein Medical et attireront des clients potentiels, entraînant une augmentation des ventes et une expansion du marché.

- En janvier 2024, Arthrex, Inc. a lancé un nouveau portail axé sur les patients, nommé TheNanoExperience.com, qui met en lumière la science et les avantages de la nano-arthroscopie, une technique orthopédique innovante et mini-invasive qui peut permettre une reprise rapide de l'activité et une réduction de l'inconfort. Les chirurgiens peuvent diagnostiquer et traiter des blessures orthopédiques dans diverses articulations, en particulier dans les petites articulations comme le coude, le poignet et la cheville. Ils peuvent également utiliser la nano-arthroscopie pour les genoux et les épaules blessés ou arthritiques. Ces procédures sont rendues possibles grâce à une petite caméra de haute qualité située à l'extrémité d'un dispositif en forme d'aiguille, ainsi qu'à d'autres instruments arthroscopiques miniatures.

- En décembre 2023, Stryker a annoncé avoir finalisé une offre juridiquement contraignante à Menix pour l'acquisition de SERF SAS. SERF SAS est bien connu parmi les professionnels de la santé du monde entier pour ses avancées dans le domaine des implants de hanche, qui incluent la création de la première cupule à double mobilité. En ajoutant cette acquisition, Stryker serait en mesure d'offrir un service amélioré à une base de patients plus large et d'élargir son portefeuille mondial d'arthroplasties.

- En décembre 2023, B. Braun SE a introduit le dispositif d'accès CARESITE Micro Luer, visant à minimiser l'exposition aux produits chimiques dangereux et à réduire le risque d'infection. Cette innovation vise à améliorer la sécurité de l’accès IV pour les patients et les prestataires de soins de santé. Cela renforcera la position de B. Braun sur le marché en proposant une solution d'accès IV plus sûre, en attirant de nouveaux clients et en renforçant sa réputation d'innovation et de sécurité.

- En septembre 2023, Globus Medical, Inc., une importante société de solutions musculo-squelettiques, a annoncé son engagement envers EUROSPINE en prolongeant son parrainage Argent et en confirmant sa participation à EUROSPINE 2023. Ce partenariat et ce parrainage continus avec EUROSPINE amélioreront la visibilité et la réputation de Globus. Medical, Inc. au sein de la communauté de la chirurgie de la colonne vertébrale, ce qui pourrait potentiellement conduire à une reconnaissance accrue de la marque et à des opportunités commerciales

Analyse géographique

Géographiquement, les pays couverts dans le rapport sur le marché des implants orthopédiques MENA sont l’Arabie saoudite, les Émirats arabes unis, l’Égypte, le Qatar, le Koweït, Oman et Bahreïn.

Selon l’analyse de l’étude de marché Data Bridge :

L’Arabie Saoudite devrait devenir le pays dominant et à la croissance la plus rapide du monde. Marché des implants orthopédiques MENA

L’Arabie Saoudite devrait dominer le marché des implants orthopédiques en raison de l’augmentation des dépenses de santé. En outre, on s'attend à ce que ce soit le pays à la croissance la plus rapide puisque le gouvernement investit dans des activités basées sur la recherche et dans la prévalence croissante des troubles orthopédiques.

Pour des informations plus détaillées sur le rapport sur le marché des implants orthopédiques MENA, cliquez ici –https://www.databridgemarketresearch.com/reports/mena-orthopedic-implants-market