La demande mondiale croissante en recherche médicale, en médicaments purs et sûrs, en erreurs médicamenteuses minimales et en avancées technologiques sont quelques-uns des moteurs essentiels du marché de la spectroscopie photoélectronique à rayons X (XPS). Avec l'avancée croissante de la recherche médicale, le besoin de techniques d'analyse précises pour étudier et développer de nouveaux matériaux biomédicaux, systèmes d'administration de médicaments et dispositifs de diagnostic se fait de plus en plus sentir. La XPS joue un rôle crucial dans ce domaine en fournissant des informations détaillées sur la composition de surface et les états chimiques des matériaux utilisés dans les applications médicales. Cette capacité est essentielle pour comprendre les interactions entre les médicaments et les systèmes biologiques, optimiser les biomatériaux pour les implants et les prothèses, et garantir la qualité et la sécurité des dispositifs médicaux.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-x-ray-photoelectron-spectroscopy-market

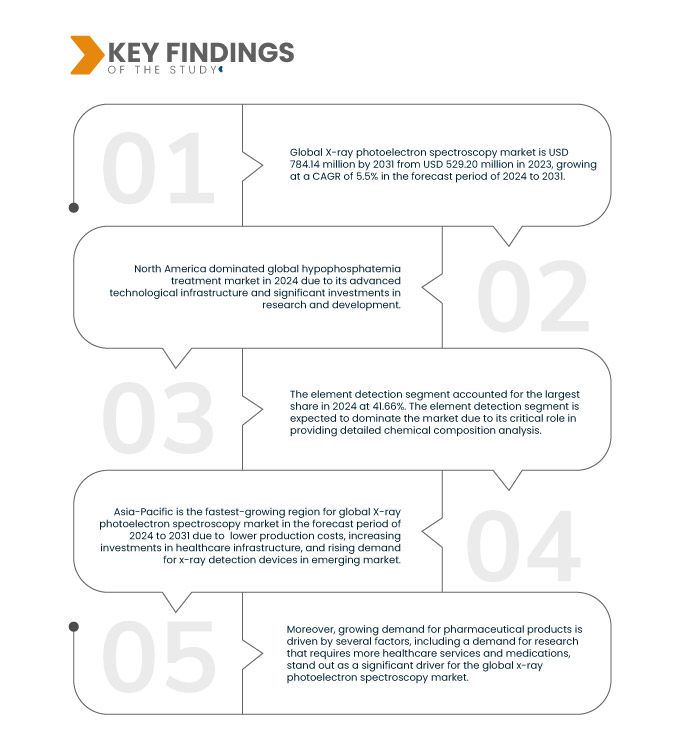

Data Bridge Market Research analyse que le marché mondial de la spectroscopie photoélectronique à rayons X (XPS) devrait croître à un TCAC de 5,5 % au cours de la période de prévision de 2024 à 2031 et devrait atteindre 784 136,56 millions USD d'ici 2031. Le segment de détection d'éléments devrait propulser la croissance du marché en raison de son rôle essentiel dans la fourniture d'analyses élémentaires précises et détaillées pour diverses applications.

Principales conclusions de l'étude

- Augmentation de la demande de recherche médicale

La demande mondiale croissante en recherche médicale, en médicaments purs et sûrs, en erreurs médicamenteuses minimales et en avancées technologiques sont quelques-uns des moteurs essentiels du marché de la spectroscopie photoélectronique à rayons X (XPS). Avec l'avancée croissante de la recherche médicale, le besoin de techniques d'analyse précises pour étudier et développer de nouveaux matériaux biomédicaux, systèmes d'administration de médicaments et dispositifs de diagnostic se fait de plus en plus sentir. La XPS joue un rôle crucial dans ce domaine en fournissant des informations détaillées sur la composition de surface et les états chimiques des matériaux utilisés dans les applications médicales. Cette capacité est essentielle pour comprendre les interactions entre les médicaments et les systèmes biologiques, optimiser les biomatériaux pour les implants et les prothèses, et garantir la qualité et la sécurité des dispositifs médicaux.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Année historique

|

2022 (personnalisable de 2016 à 2021)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD

|

Segments couverts

|

Utilisation (détection d'éléments, détection de contamination, estimation de la densité et détermination de formules empiriques), application (science des matériaux, chimie de surface, dispositifs médicaux , couches minces et revêtements, dispositifs microélectroniques, échantillons médicaux et biologiques, matériaux géologiques et autres), taille du spot de rayons X (jusqu'à 50 μm, 51-200 μm et plus de 200 μm), méthode (méthode qualitative, méthode quantitative et méthode semi-quantitative), industrie (semi-conducteurs et électronique, métallurgie et énergie, santé, chimie , automobile, aérospatiale et défense, emballage, impression et autres)

|

Acteurs du marché couverts

|

Thermo Fisher Scientific Inc. (États-Unis), HORIBA (Japon), Ltd., SPECS GmbH (Royaume-Uni), Staib Instruments (Allemagne), Scienta Omicron (Allemagne), Hitachi High-Tech India Private Limited (Japon), Hitachi, Ltd., Kratos Analytical Ltd. (Royaume-Uni), Intertek Group plc (Angleterre), Nova Ltd. (Israël), JEOL Ltd. (Japon), Spectris (Royaume-Uni), ULVAC-PHI (Japon), INCORPORATED., LANScientific. (Chine) et Bruker (États-Unis), entre autres.

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments

Le marché de la spectroscopie photoélectronique à rayons X est classé en cinq segments notables en fonction de l'utilisation, de l'application, de la taille du spot de rayons X, de la méthode et de l'industrie.

- Sur la base de l'utilisation, le marché est segmenté en détection d'éléments, détection de contamination, estimation de densité et détermination de formules empiriques

En 2024, le segment de détection d’éléments devrait dominer le marché

En 2024, le segment de détection d'éléments devrait dominer le marché avec une part de marché de 41,66 % en raison de son rôle essentiel dans la fourniture d'analyses détaillées de la composition chimique.

- Sur la base de l'application, le marché est segmenté en science des matériaux, chimie de surface, dispositifs médicaux, films minces et revêtements, dispositifs microélectroniques, échantillons médicaux et biologiques, matériaux géologiques et autres.

En 2024, le segment des sciences des matériaux devrait dominer le marché

En 2024, le segment des sciences des matériaux devrait dominer le marché avec une part de marché de 31,61 % en raison de son rôle essentiel dans l'analyse et la caractérisation des matériaux au niveau atomique.

- En fonction de la taille du spot de rayons X, le marché est segmenté en jusqu'à 50 μm, 51-200 μm et plus de 200 μm. En 2024, le segment jusqu'à 50 μm devrait dominer le marché avec une part de marché de 61,21 % grâce à son équilibre optimal entre résolution et efficacité d'analyse des échantillons.

- En fonction de la méthode, le marché est segmenté en méthodes qualitatives, quantitatives et semi-quantitatives. En 2024, le segment des méthodes qualitatives devrait dominer le marché avec une part de marché de 45,99 % en raison de son rôle crucial dans l'identification et l'analyse de la composition chimique et des états électroniques des matériaux.

- Le marché est segmenté par secteur d'activité : semi-conducteurs et électronique, métaux et énergie, santé, chimie, automobile, aérospatiale et défense, emballage, imprimerie, etc. En 2024, le segment des semi-conducteurs et de l'électronique devrait dominer le marché avec une part de marché de 28,08 %, en raison de ses besoins critiques en caractérisation précise des matériaux et en contrôle qualité dans les applications technologiques avancées.

Acteurs majeurs

Data Bridge Market Research reconnaît les entreprises suivantes comme les principaux acteurs du marché, notamment Thermo Fisher Scientific Inc. (États-Unis), HORIBA (Japon), Ltd., SPECS GmbH (Royaume-Uni), Staib Instruments (Allemagne) et Scienta Omicron (Allemagne), entre autres.

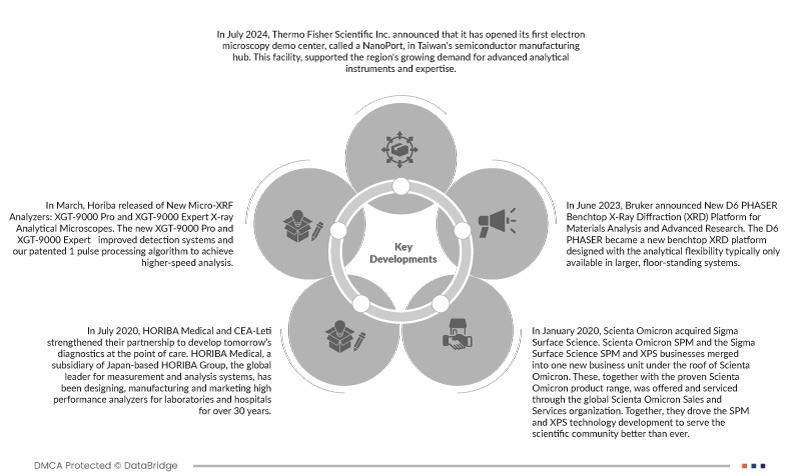

Développement du marché

- En juillet 2024, Thermo Fisher Scientific Inc. a annoncé l'ouverture de son premier centre de démonstration de microscopie électronique, appelé NanoPort, dans le pôle de fabrication de semi-conducteurs de Taïwan. Ce centre répond à la demande croissante de la région en instruments d'analyse avancés et en expertise. Cette initiative stratégique a permis à Thermo Fisher de renforcer ses relations avec ses clients du secteur des semi-conducteurs et d'étendre sa présence dans la région.

- En mars 2023, Horiba a lancé ses nouveaux analyseurs Micro-XRF : les microscopes d'analyse à rayons X XGT-9000 Pro et XGT-9000 Expert. Ces nouveaux XGT-9000 Pro et XGT-9000 Expert bénéficient de systèmes de détection améliorés et de notre algorithme breveté de traitement à une impulsion pour une analyse plus rapide. Ces nouvelles fonctionnalités contribuent à réduire les délais et à optimiser l'analyse des matériaux.

- En juillet 2020, HORIBA Medical et le CEA-Leti ont renforcé leur partenariat pour développer les diagnostics de demain au chevet du patient. HORIBA Medical, filiale du groupe japonais HORIBA, leader mondial des systèmes de mesure et d'analyse, conçoit, fabrique et commercialise depuis plus de 30 ans des analyseurs haute performance pour les laboratoires et les hôpitaux. Cette expertise a fait de l'entreprise l'un des leaders mondiaux en hématologie et un acteur incontournable de l'hémostase et de la chimie clinique.

- En janvier 2020, Scienta Omicron a acquis Sigma Surface Science. Scienta Omicron SPM et les activités SPM et XPS de Sigma Surface Science ont fusionné au sein d'une nouvelle entité sous l'égide de Scienta Omicron. Ces activités, ainsi que la gamme de produits Scienta Omicron éprouvée, étaient proposées et gérées par l'organisation mondiale des ventes et services de Scienta Omicron. Ensemble, elles ont propulsé le développement des technologies SPM et XPS pour servir la communauté scientifique mieux que jamais.

- En juin 2023, Bruker a annoncé la nouvelle plateforme de diffraction des rayons X (DRX) de paillasse D6 PHASER pour l'analyse des matériaux et la recherche avancée. La D6 PHASER était une nouvelle plateforme de DRX de paillasse conçue avec une flexibilité analytique généralement réservée aux systèmes plus grands et sur pied. Grâce à ses nombreuses fonctionnalités, la D6 PHASER a permis de développer davantage d'applications de DRX pour de nouveaux marchés et de nouvelles communautés d'utilisateurs.

Pour plus d'informations sur le rapport sur le marché mondial de la spectroscopie photoélectronique à rayons X (XPS), cliquez ici : https://www.databridgemarketresearch.com/reports/global-x-ray-photoelectron-spectroscopy-market