La demande croissante de solutions d'agriculture de précision stimule considérablement le marché des logiciels de gestion agricole. L'agriculture de précision exploite la technologie pour surveiller et gérer la variabilité des champs, optimisant ainsi l'utilisation d'intrants tels que l'eau, les engrais et les pesticides. Grâce à ces logiciels, les agriculteurs peuvent recueillir des données détaillées sur l'état du sol, la santé des cultures et les conditions météorologiques, ce qui leur permet de prendre des décisions éclairées pour améliorer les rendements et l'efficacité des ressources. Cette analyse détaillée des données contribue à réduire le gaspillage, à diminuer les coûts et à améliorer la productivité globale des exploitations, faisant de l'agriculture de précision un choix attractif pour les agriculteurs modernes.

Les solutions d'agriculture de précision permettent de surveiller et de gérer les exploitations agricoles en temps réel, un atout essentiel pour intervenir et agir rapidement. Les logiciels de gestion agricole fournissent des informations en temps réel grâce à l'intégration de capteurs, de drones et d'objets connectés, qui collectent et transmettent des données en continu. Ces informations en temps réel aident les agriculteurs à détecter précocement les problèmes, tels que les infestations de parasites ou les problèmes d'irrigation, et à prendre rapidement des mesures correctives. La capacité à exploiter les données en temps réel améliore non seulement la santé et les rendements des cultures, mais garantit également une utilisation efficace des ressources, contribuant ainsi à la durabilité des pratiques agricoles.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-farm-management-software-market

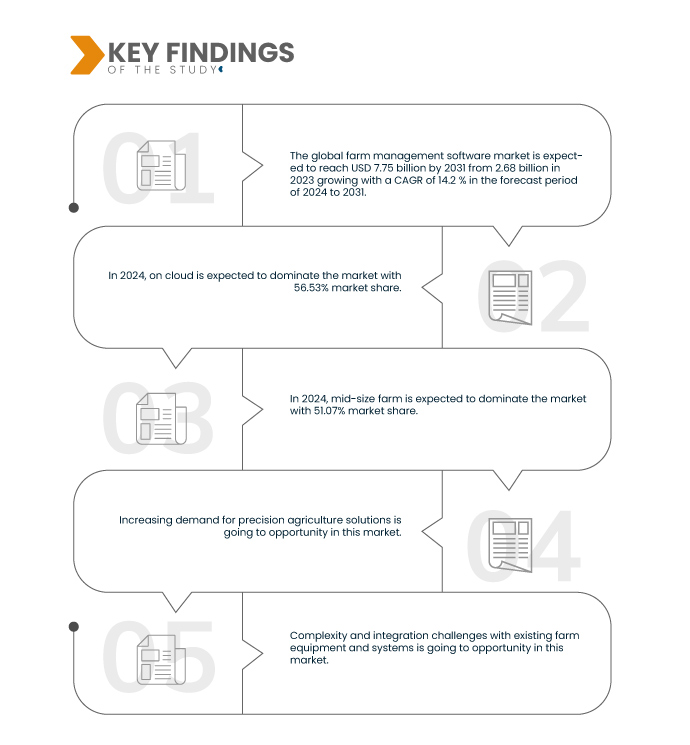

Data Bridge Market Research analyse que le marché mondial des logiciels de gestion agricole devrait atteindre une valeur de 7,75 milliards USD d'ici 2031, contre 2,68 milliards USD en 2023, avec un TCAC de 14,2 % au cours de la période de prévision 2024 à 2031.

Principales conclusions de l'étude

Initiatives et subventions gouvernementales pour l'agriculture numérique

Les gouvernements du monde entier reconnaissent de plus en plus le potentiel de l'agriculture numérique pour améliorer la productivité et la durabilité agricoles. En proposant des initiatives et des subventions, ils visent à encourager les agriculteurs à adopter des technologies avancées, telles que les logiciels de gestion agricole, qui facilitent une gestion efficace des ressources et la prise de décision en temps réel. Ces efforts gouvernementaux comprennent souvent des incitations financières, des subventions et des programmes de formation pour aider les agriculteurs à surmonter les obstacles financiers initiaux liés à l'adoption de nouvelles technologies. Par conséquent, de plus en plus d'agriculteurs intègrent les outils numériques à leurs activités, stimulant ainsi la croissance du marché des logiciels de gestion agricole.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Mode de livraison (sur le cloud et sur site), taille de l'exploitation (ferme de taille moyenne, grande et petite), application (agriculture de précision, élevage de précision, foresterie de précision , aquaculture de précision, serre intelligente et autres), production agricole (planification de préproduction, planification de la production et planification de postproduction), système d'exploitation (Windows, Android, MAC, iOS, Linux et autres), catégorie de prix (abonnement, gratuit/basé sur la publicité et licence unique), type d'utilisateur (agriculteurs et entreprises agricoles)

|

Pays couverts

|

États-Unis, Canada, Chine, Australie, Corée du Sud, Inde, Nouvelle-Zélande, Taïwan, Singapour, Malaisie, Thaïlande, Vietnam, Indonésie, Philippines, reste de l'Asie-Pacifique, Brésil, Argentine, Mexique, reste de l'Amérique latine, Arabie saoudite, Afrique du Sud, Égypte, Bahreïn, Oman, Israël, Koweït, Qatar, Émirats arabes unis, reste du Moyen-Orient et de l'Afrique, France, Espagne, Pologne, Allemagne, Italie, Roumanie, Portugal, Grèce, Hongrie, Croatie, Bulgarie, Lituanie, Irlande, Autriche, Slovénie, Lettonie, Suède, Pays-Bas, Finlande, Danemark, Belgique, Chypre, Tchéquie, Slovaquie, Estonie, Luxembourg, Malte, Europe hors UE

|

Acteurs du marché couverts

|

Farmbrite (États-Unis), ruumi (Royaume-Uni), Shivrai Technologies Pvt. Ltd (Inde), Gatec (Brésil), PickApp (Israël), EasyKeeper Herd Manager (États-Unis), Bushel Inc. (États-Unis), AnimalSoft Kft. (Hongrie), Field Margin Ltd. (Royaume-Uni), AGRIVI (Croatie), Raven Industries, Inc. (États-Unis), Trimble Inc. (États-Unis), Deere & Company (États-Unis), PigCHAMP, Inc. (États-Unis), Topcon (Japon), AgJunction LLC (États-Unis), Agworld Pty Ltd (États-Unis/Australie), Farmers Edge Inc. (Canada), Climate LLC (États-Unis), ABACO SPA (Italie), GEA Group Aktiengesellscha (Allemagne), Afimilk Ltd. (Israël), TELUS (Canada), CropX Inc. (États-Unis), Cropin Technology Solution (Inde), Conservis (États-Unis), Ag Leader Technology (États-Unis) et IBM (États-Unis), entre autres.

|

Points de données couverts dans le rapport

|

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

|

Analyse des segments

Le marché mondial des logiciels de gestion agricole est segmenté en sept segments notables, qui sont basés sur le mode de livraison, la taille de l'exploitation, l'application, la production agricole, le système d'exploitation, la catégorie de prix et le type d'utilisateur.

- Sur la base du mode de livraison, le marché est segmenté en sur cloud et sur site

En 2024, le cloud devrait dominer le marché mondial des logiciels de gestion agricole

- En 2024, le cloud devrait dominer le marché avec 56,53 % de parts de marché en raison de la demande croissante de solutions d'agriculture de précision.

- En fonction de la taille de l'exploitation, le marché est segmenté en exploitations de taille moyenne, grandes exploitations et petites exploitations.

En 2024, les exploitations agricoles de taille moyenne devraient dominer le marché mondial des logiciels de gestion agricole

- En 2024, les exploitations agricoles de taille moyenne devraient dominer le marché avec 51,07 % de parts de marché grâce aux initiatives gouvernementales et aux subventions pour l'agriculture numérique.

- En fonction des applications, le marché est segmenté en agriculture de précision, élevage de précision, foresterie de précision, aquaculture de précision et serres intelligentes, entre autres. En 2024, l'agriculture de précision devrait dominer le marché avec 43,17 % de parts de marché.

- En fonction de la production agricole, le marché est segmenté en planification pré-production, planification de la production et planification post-production. En 2024, la planification pré-production devrait dominer le marché avec 41,79 % de parts de marché.

- En fonction des systèmes d'exploitation, le marché est segmenté entre Windows, Android, Mac, iOS, Linux, etc. En 2024, le segment Windows devrait dominer le marché avec 39,94 % de parts de marché.

- En fonction des catégories de prix, le marché est segmenté en deux catégories : abonnement, gratuit/avec publicité et licence unique. En 2024, le segment de l'abonnement devrait dominer le marché avec 55,50 % de parts de marché.

- En fonction du type d'utilisateur, le marché est segmenté en agriculteurs et en entreprises agricoles. En 2024, le segment des agriculteurs devrait dominer le marché avec 64,34 % de parts de marché.

Acteurs majeurs

Data Bridge Market Research analyse GEA Group Aktiengesellscha (Allemagne), IBM (États-Unis), Deere & Company. (États-Unis), Trimble Inc. (États-Unis), Trimble Inc. (États-Unis) comme les principaux acteurs du marché sur ce marché.

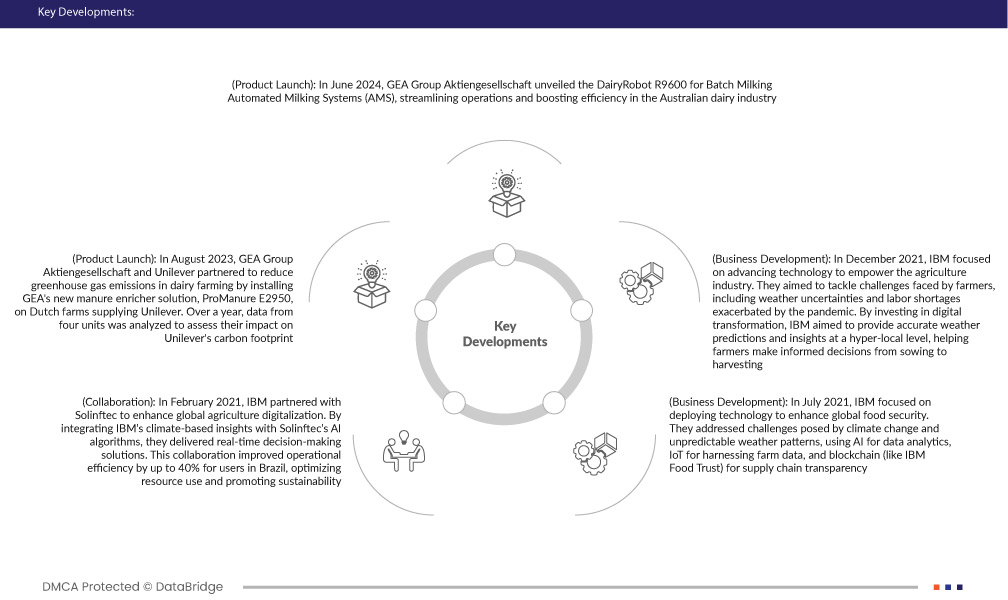

Développement du marché

- En juin 2024, GEA Group Aktiengesellschaft a dévoilé le DairyRobot R9600 pour les systèmes de traite automatisée (SRA) par lots, simplifiant ainsi les opérations et améliorant l'efficacité de l'industrie laitière australienne. Cette innovation répond aux défis de la gestion de l'alimentation et des routines quotidiennes, rendant les SRA plus accessibles aux grandes exploitations. Grâce à sa conception compacte et à sa faible consommation de ressources, le DairyRobot R9600 améliore le bien-être des vaches et l'efficacité opérationnelle, ce qui permet à GEA d'étendre sa présence sur le marché et de soutenir une croissance durable.

- En août 2023, GEA Group Aktiengesellschaft et Unilever se sont associés pour réduire les émissions de gaz à effet de serre dans l'élevage laitier en installant la nouvelle solution d'enrichissement du fumier de GEA, ProManure E2950, dans les exploitations agricoles néerlandaises fournissant Unilever. Pendant un an, les données de quatre unités ont été analysées afin d'évaluer leur impact sur l'empreinte carbone d'Unilever. Cette collaboration a considérablement renforcé la réputation de GEA en tant que leader des solutions agricoles durables, renforçant sa présence sur le marché et ouvrant de nouvelles perspectives commerciales.

- En février 2021, IBM s'est associé à Solinftec pour accélérer la numérisation de l'agriculture mondiale. En intégrant les connaissances climatiques d'IBM aux algorithmes d'IA de Solinftec, ils ont fourni des solutions d'aide à la décision en temps réel. Cette collaboration a permis d'améliorer l'efficacité opérationnelle des utilisateurs brésiliens jusqu'à 40 %, optimisant l'utilisation des ressources et favorisant la durabilité. Les données météorologiques avancées d'IBM ont permis une meilleure gestion agricole, favorisant l'innovation et soutenant l'agro-industrie mondiale. Ce partenariat souligne l'engagement d'IBM à exploiter la technologie pour la protection de l'environnement et le progrès agricole à l'échelle mondiale.

- En juillet 2021, IBM s'est concentrée sur le déploiement de technologies pour améliorer la sécurité alimentaire mondiale. L'entreprise a relevé les défis posés par le changement climatique et les aléas météorologiques en utilisant l'IA pour l'analyse des données, l'IoT pour l'exploitation des données agricoles et la blockchain (comme IBM Food Trust) pour la transparence de la chaîne d'approvisionnement. Ces innovations profitent aux agriculteurs du monde entier, leur permettant de prendre de meilleures décisions, de mettre en œuvre des pratiques agricoles durables et d'améliorer leur compétitivité sur les marchés. Les initiatives d'IBM visent à stabiliser la production alimentaire, à soutenir les petits exploitants agricoles et à atteindre les Objectifs de développement durable des Nations Unies, favorisant ainsi un approvisionnement alimentaire mondial plus sûr et plus résilient.

- En décembre 2021, IBM s'est concentré sur le développement technologique pour renforcer le secteur agricole. L'objectif était de relever les défis auxquels sont confrontés les agriculteurs, notamment les incertitudes météorologiques et les pénuries de main-d'œuvre exacerbées par la pandémie. En investissant dans la transformation numérique, IBM souhaitait fournir des prévisions et des informations météorologiques précises à l'échelle locale, aidant ainsi les agriculteurs à prendre des décisions éclairées, du semis à la récolte.

Analyse régionale

Géographiquement, les pays couverts par le marché mondial des logiciels de gestion agricole sont les États-Unis, le Canada, le Mexique, l'Europe, l'Allemagne, le Royaume-Uni, la France, l'Espagne, l'Italie, la Turquie, la Russie, la Belgique, les Pays-Bas, la Suisse, le Danemark, la Suède, la Norvège, la Finlande, la Pologne et le reste de l'Europe, la Chine, le Japon, la Corée du Sud, l'Australie, la Malaisie, la Nouvelle-Zélande, Singapour, l'Inde, la Thaïlande, l'Indonésie, les Philippines, Taïwan, le Vietnam, le reste de l'Asie-Pacifique, les Émirats arabes unis, l'Arabie saoudite, l'Égypte, Israël, l'Afrique du Sud, Oman, Bahreïn, le Koweït, le Qatar, le reste du Moyen-Orient et de l'Afrique, le Brésil, l'Argentine et le reste de l'Amérique du Sud.

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord devrait dominer et être la région à la croissance la plus rapide sur le marché mondial des logiciels de gestion agricole.

L'Amérique du Nord devrait dominer le marché des logiciels de gestion agricole grâce à ses exploitations agricoles technologiquement avancées, ses infrastructures étendues et ses politiques gouvernementales favorables. Cette région bénéficie de l'adoption précoce des technologies d'agriculture de précision et d'automatisation, soutenue par des investissements substantiels dans la recherche et le développement de technologies agricoles, ainsi que par la présence d'acteurs clés du marché.

Pour plus d'informations sur le rapport sur le marché mondial des logiciels de gestion agricole , cliquez ici : https://www.databridgemarketresearch.com/reports/global-farm-management-software-market