L'utilisation croissante des drones, de l'imagerie satellitaire et des capteurs avancés a révolutionné la cartographie et l'imagerie agricoles en fournissant des données détaillées et précises, essentielles à l'agriculture de précision. Les drones équipés de caméras multispectrales et hyperspectrales peuvent capturer des images haute résolution des cultures, permettant aux agriculteurs de surveiller la santé des plantes, d'identifier les infestations de ravageurs et d'optimiser les pratiques d'irrigation. L'imagerie satellitaire offre une couverture à grande échelle et des mises à jour fréquentes, permettant de suivre la croissance des cultures, l'humidité des sols et les impacts du changement climatique sur de vastes zones. Des capteurs avancés, intégrés à l'Internet des objets (IoT), fournissent des données en temps réel sur l'état des sols, les conditions météorologiques et l'état des cultures, facilitant ainsi la prise de décisions rapides. Ensemble, ces technologies améliorent la productivité, réduisent le gaspillage des ressources et favorisent même des pratiques agricoles durables, garantissant de meilleurs rendements et une gestion responsable de l'environnement.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-agricultural-mapping-and-imaging-market

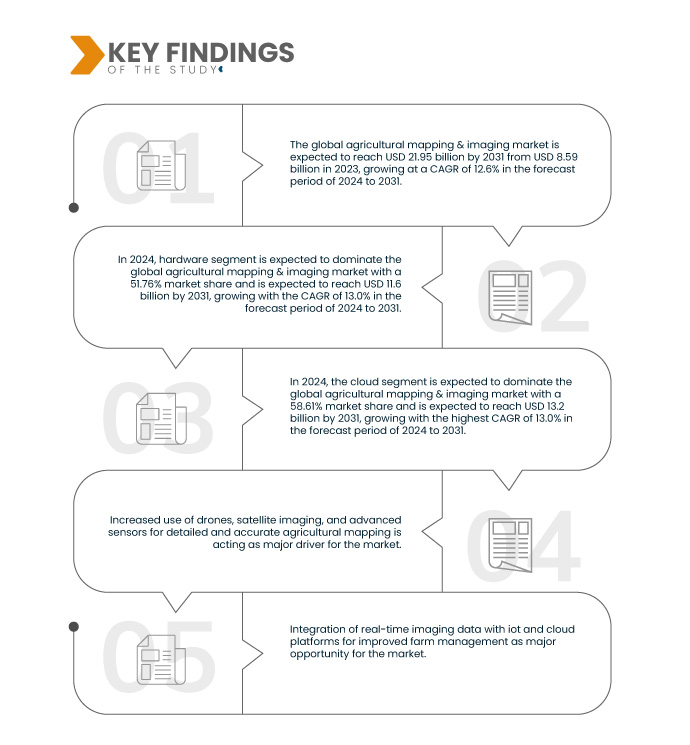

Data Bridge Market Research analyse que le marché de la cartographie et de l'imagerie agricoles devrait atteindre 21,95 milliards USD d'ici 2031, contre 8,59 milliards USD en 2024, avec un TCAC de 12,6 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Adoption croissante des techniques d'agriculture de précision

L'adoption croissante des techniques d'agriculture de précision, soutenue par les progrès des technologies de cartographie et d'imagerie agricoles, révolutionne les pratiques agricoles. L'agriculture de précision utilise des données détaillées provenant de drones, d'images satellite et de capteurs avancés pour adapter les activités agricoles telles que l'irrigation, la fertilisation et la lutte antiparasitaire aux conditions spécifiques du terrain. Avec la montée en puissance de l'agriculture de précision, la demande de solutions de cartographie et d'imagerie sophistiquées devrait augmenter, stimulant ainsi l'innovation et les investissements dans le secteur de la cartographie et de l'imagerie agricoles.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable de 2016 à 2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Offre (matériel, logiciel, services), autonomie (semi-autonome, manuelle, autonome), mode de déploiement (cloud, sur site), application (surveillance de la santé des cultures, cartographie des champs, surveillance du rendement, surveillance et prévisions météorologiques, gestion de l'eau), utilisateur final (exploitations agricoles, entreprises agro-technologiques, instituts de recherche et entreprises agrochimiques)

|

Pays couverts

|

États-Unis, Canada, Mexique, Chine, Japon, Inde, Corée du Sud, Australie et Nouvelle-Zélande, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Taïwan, Vietnam, reste de l'Asie-Pacifique, Royaume-Uni, Allemagne, France, Italie, Espagne, Russie, Pays-Bas, Suisse, Suède, Belgique, Danemark, Pologne, Norvège, Turquie, Finlande, reste de l'Europe, Arabie saoudite, Afrique du Sud, Émirats arabes unis, Israël, Égypte, Qatar, Oman, Koweït, Bahreïn, reste du Moyen-Orient et de l'Afrique, Brésil, Argentine, reste de l'Amérique du Sud

|

Acteurs du marché couverts

|

Yara (Norvège), AGCO Corporation (États-Unis), Corteva (États-Unis), CNH Industrial NV (Royaume-Uni), Trimble Inc. (États-Unis), Syngenta (Suisse), Bayer AG (Allemagne), Raven Industries, Inc. (États-Unis), DJI (Chine), Cargill, Incorporated (États-Unis), YANMAR HOLDINGS CO., LTD. (Japon), Yamaha Motor Co., Ltd. (Japon), Semios (Canada), Farmwise (États-Unis), Sentera (États-Unis), ESRI (États-Unis), METER Group (États-Unis), Climate LLC. (États-Unis), HUMMINGBIRD TECHNOLOGIES LIMITED (Royaume-Uni), HIPHEN (France), Satellite Imaging Corporation (États-Unis) et AGRICOLUS (Italie), entre autres.

|

Points de données couverts dans le rapport

|

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

|

Analyse des segments

Le marché de la cartographie et de l'imagerie agricoles est segmenté en cinq segments notables, basés sur l'offre, l'autonomie, le mode de déploiement, l'application et l'utilisateur final.

- Sur la base de l'offre, le marché de la cartographie et de l'imagerie agricoles est segmenté en matériel, logiciels et services

En 2024, le segment du matériel devrait dominer le marché de la cartographie et de l'imagerie agricoles

En 2024, le segment du matériel devrait dominer le marché avec une part de marché de 51,76 %, en raison du caractère essentiel des appareils physiques tels que les drones, les capteurs et les équipements d'imagerie. Ces composants matériels sont essentiels à la capture de données précises, qui constituent la base des solutions avancées de cartographie et d'imagerie en agriculture.

- Sur la base de l'autonomie, le marché de la cartographie et de l'imagerie agricoles est segmenté en semi-autonome, manuel et autonome.

En 2024, le segment semi-autonome devrait dominer le marché de la cartographie et de l'imagerie agricoles

En 2024, le segment semi-autonome devrait dominer le marché de la cartographie et de l'imagerie agricoles avec une part de marché de 49,00 % en raison de l'intégration des données d'imagerie en temps réel avec les plateformes IoT et cloud.

- Selon le mode de déploiement, le marché de la cartographie et de l'imagerie agricoles est segmenté entre cloud et sur site. En 2024, le cloud devrait dominer le marché de la cartographie et de l'imagerie agricoles avec une part de marché de 58,61 %.

- En fonction des applications, le marché de la cartographie et de l'imagerie agricoles est segmenté en surveillance de la santé des cultures, cartographie des champs, surveillance des rendements, surveillance et prévisions météorologiques, gestion de l'eau, etc. En 2024, le segment de la surveillance de la santé des cultures devrait dominer le marché de la cartographie et de l'imagerie agricoles avec une part de marché de 31,80 %.

- En fonction de l'utilisateur final, le marché de la cartographie et de l'imagerie agricoles est segmenté en exploitations agricoles, entreprises agrotechnologiques, instituts de recherche, entreprises agrochimiques, etc. En 2024, le segment des exploitations agricoles devrait dominer le marché de la cartographie et de l'imagerie agricoles avec une part de marché de 43,87 %.

Acteurs majeurs

Data Bridge Market Research analyse Yara (Norvège), AGCO Corporation (États-Unis), Corteva (États-Unis), CNH Industrial NV (Royaume-Uni) et Trimble Inc (États-Unis) comme les principales entreprises opérant sur le marché de la cartographie et de l'imagerie agricoles.

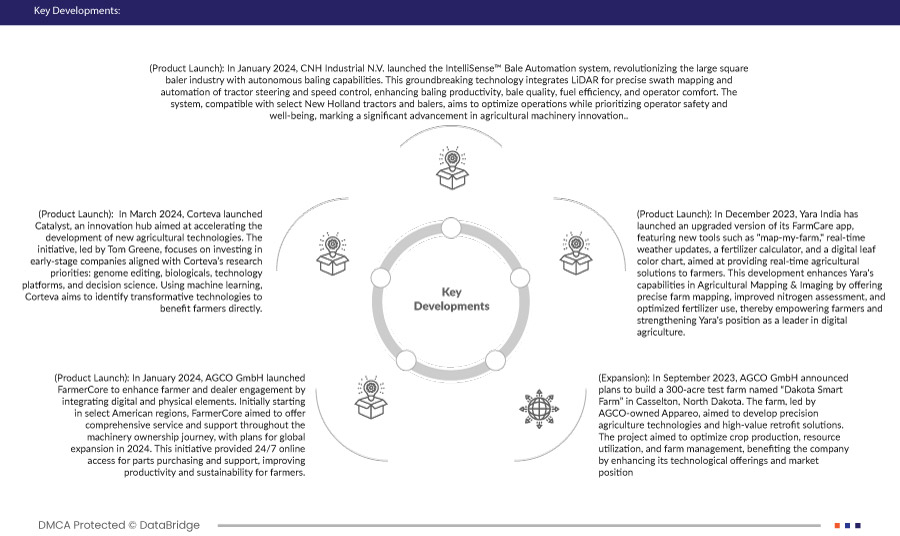

Développement du marché

- En mars 2024, Corteva a lancé Catalyst, un pôle d'innovation visant à accélérer le développement de nouvelles technologies agricoles. Dirigée par Tom Greene, cette initiative privilégie l'investissement dans des entreprises en phase de démarrage, en phase avec les priorités de recherche de Corteva : édition génomique, produits biologiques, plateformes technologiques et sciences de la décision. Grâce à l'apprentissage automatique, Corteva vise à identifier des technologies transformatrices au bénéfice direct des agriculteurs.

- En janvier 2024, AGCO GmbH a lancé FarmerCore afin de renforcer l'engagement des agriculteurs et des concessionnaires en intégrant des éléments numériques et physiques. Initialement déployé dans certaines régions américaines, FarmerCore visait à offrir un service et une assistance complets tout au long du parcours d'achat de machines, avec un projet d'expansion mondiale prévu en 2024. Cette initiative offrait un accès en ligne 24h/24 et 7j/7 pour l'achat de pièces et l'assistance, améliorant ainsi la productivité et la durabilité des agriculteurs.

- En décembre 2023, Yara India a lancé une version améliorée de son application FarmCare, intégrant de nouveaux outils tels que « map-my-farm », des mises à jour météo en temps réel, un calculateur d'engrais et un nuancier numérique de couleurs de feuilles, afin de fournir des solutions agricoles en temps réel aux agriculteurs. Ce développement renforce les capacités de Yara en matière de cartographie et d'imagerie agricoles en offrant une cartographie précise des exploitations, une meilleure évaluation de l'azote et une utilisation optimisée des engrais, donnant ainsi plus de pouvoir aux agriculteurs et renforçant la position de Yara comme leader de l'agriculture numérique.

- En septembre 2023, AGCO GmbH a annoncé son intention de construire une ferme expérimentale de 121 hectares, baptisée « Dakota Smart Farm », à Casselton, dans le Dakota du Nord. Pilotée par Appareo, filiale d'AGCO, cette ferme vise à développer des technologies d'agriculture de précision et des solutions de modernisation à forte valeur ajoutée. Le projet visait à optimiser la production agricole, l'utilisation des ressources et la gestion agricole, renforçant ainsi l'offre technologique de l'entreprise et sa position sur le marché.

- En janvier 2024, CNH Industrial NV a lancé le système d'automatisation des balles IntelliSense™, révolutionnant ainsi le secteur des presses à balles carrées de grande taille grâce à ses capacités de pressage autonome. Cette technologie révolutionnaire intègre le LiDAR pour une cartographie précise des andains et l'automatisation de la direction et du contrôle de la vitesse du tracteur, améliorant ainsi la productivité et la qualité du pressage, le rendement énergétique et le confort de l'opérateur. Compatible avec certains tracteurs et presses à balles New Holland, ce système vise à optimiser les opérations tout en privilégiant la sécurité et le bien-être de l'opérateur, marquant ainsi une avancée significative dans l'innovation des machines agricoles.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché mondial des gestionnaires d'infrastructures virtuelles sont les États-Unis, le Canada, le Mexique, la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie et la Nouvelle-Zélande, Singapour, la Malaisie, la Thaïlande, l'Indonésie, les Philippines, Taïwan, le Vietnam, le reste de l'Asie-Pacifique, l'Italie, la France, l'Allemagne, l'Espagne, la Pologne, les Pays-Bas, la Roumanie, le Danemark, la Belgique, la Grèce, la Hongrie, le Portugal, l'Irlande, l'Autriche, la Tchéquie, la Suède, la Bulgarie, la Finlande, la Croatie, la Lituanie, la Slovénie, la Lettonie, la Slovaquie, Chypre, l'Estonie, le Luxembourg, Malte, l'Europe hors UE, l'Arabie saoudite, l'Afrique du Sud, l'Égypte, Bahreïn, Oman, Israël, le Koweït, le Qatar, les Émirats arabes unis, le reste du Moyen-Orient et de l'Afrique, le Brésil, l'Argentine, le Mexique et le reste de l'Amérique latine.

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord devrait dominer et être la région à la croissance la plus rapide sur le marché de la cartographie et de l'imagerie agricoles.

L'Amérique du Nord devrait dominer le marché grâce à ses pratiques agricoles avancées, à l'adoption massive des technologies d'agriculture de précision, à la robustesse de ses infrastructures prenant en charge l'IoT et le cloud computing, ainsi qu'à des investissements importants dans la recherche et le développement agricoles. Ces facteurs renforcent la capacité de la région à intégrer efficacement des solutions de cartographie et d'imagerie sophistiquées, favorisant ainsi des taux d'adoption plus élevés et un leadership sur le marché de l'innovation technologique agricole.

Sur le marché de la cartographie et de l'imagerie agricoles, les États-Unis dominent l'Amérique du Nord grâce à l'adoption de technologies avancées et à des investissements importants dans l'agriculture de précision. En Europe, l'Italie est leader grâce à ses pratiques agricoles extensives et au soutien gouvernemental aux techniques agricoles modernes. En Asie-Pacifique, la Chine est en pointe, portée par ses activités agricoles à grande échelle et ses avancées rapides en matière d'innovations agrotechnologiques.

Pour plus d'informations sur le rapport sur le marché mondial de la cartographie et de l'imagerie agricoles, cliquez ici : https://www.databridgemarketresearch.com/reports/global-agricultural-mapping-and-imaging-market