Le marché européen des électrocardiographes de repos (ECG) connaît une expansion significative, principalement portée par la prévalence croissante des maladies cardiovasculaires , qui demeurent la principale cause de mortalité sur le continent. Le vieillissement de la population, la sensibilisation croissante au diagnostic précoce et l'augmentation des maladies chroniques comme l'hypertension et le diabète ont stimulé la demande d'outils de diagnostic avancés tels que les ECG. Les ECG de repos, reconnus pour leur simplicité et leur fiabilité, jouent un rôle crucial dans la détection précoce, essentielle à la réduction des coûts de santé à long terme et à l'amélioration des résultats pour les patients.

Les avancées technologiques, telles que les appareils ECG sans fil, numériques et portables, transforment le paysage médical, améliorant la précision du diagnostic et le confort des patients. De plus, l'intégration de l'intelligence artificielle (IA) permet des analyses plus rapides et des résultats plus précis, ce qui séduit tant les cliniciens que les patients. Cependant, les défis réglementaires, notamment la réglementation européenne stricte sur les dispositifs médicaux, et les préoccupations relatives à la confidentialité et à la sécurité des données, freinent la croissance du marché. La transition vers la santé numérique, soutenue par les initiatives des gouvernements européens, promet d'ouvrir de nouvelles perspectives d'investissement et d'innovation sur ce marché.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/europe-resting-electrocardiograph-ecg-market

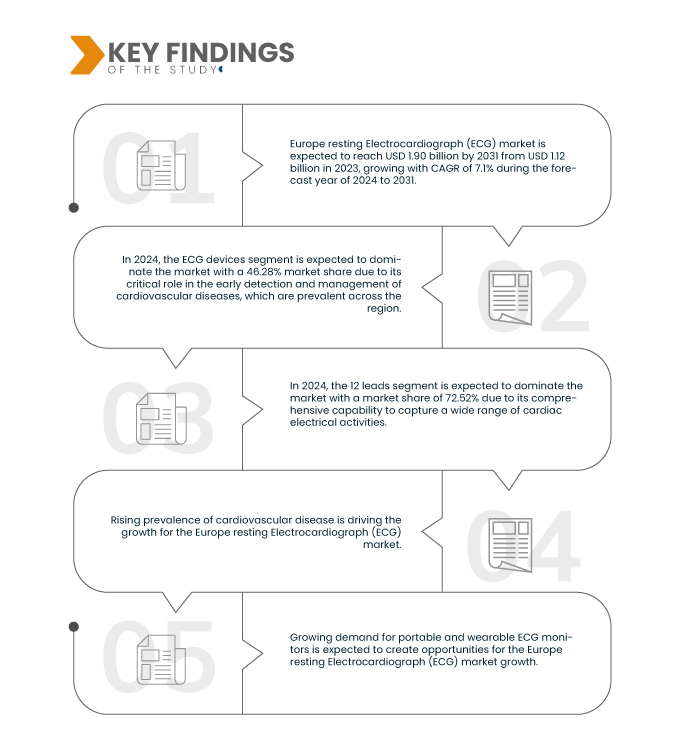

Data Bridge Market Research analyse que le marché européen des électrocardiographes de repos (ECG) devrait atteindre 1,90 milliard USD d'ici 2031, contre 1,12 milliard USD en 2023, avec un TCAC de 7,1 % au cours de l'année de prévision de 2024 à 2031.

Principales conclusions de l'étude

Progrès technologiques croissants dans l'ECG

Les avancées technologiques croissantes en électrocardiographie (ECG) sont un moteur essentiel de la croissance du marché européen des électrocardiographes de repos. Les innovations améliorent la précision, l'efficacité et la facilité d'utilisation de ces appareils de diagnostic. Des avancées telles que les systèmes d'ECG numériques, les algorithmes avancés d'interprétation des signaux cardiaques et la gestion des données dans le cloud transforment les pratiques ECG traditionnelles, permettant un diagnostic plus précis et plus rapide des maladies cardiaques. De plus, l'intégration de l'intelligence artificielle (IA) et de l'apprentissage automatique dans l'analyse ECG permet aux professionnels de santé de détecter les anomalies avec une plus grande fiabilité, réduisant ainsi le risque d'erreur humaine et améliorant les résultats pour les patients.

De plus, l'avènement des appareils ECG portables a facilité l'accès à la surveillance cardiaque, permettant le suivi à distance des patients et facilitant une intervention précoce. Alors que les systèmes de santé privilégient de plus en plus la télémédecine et les solutions de soins à distance, la demande d'appareils ECG à la pointe de la technologie, alliant fonctionnalité et praticité, est en hausse. Ces avancées simplifient non seulement les flux de travail en milieu clinique, mais permettent également aux patients de participer activement à la gestion de leur santé cardiaque, propulsant ainsi le marché vers des solutions de pointe pour les soins cardiovasculaires.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024-2031

|

Année de base

|

2023

|

Année historique

|

2022 (personnalisable de 2016 à 2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Produit (appareils ECG, moniteurs, logiciels et services, enregistreurs de boucle implantables et appareil de télémétrie cardiaque mobile ), nombre de dérivations (12 dérivations, 15 dérivations, 18 dérivations et autres), technologie (numérique et analogique), modalité (fixe et mobile), taille de l'appareil (grand, moyen et petit), connectivité (filaire et sans fil), mode de fonctionnement (automatique, semi-automatique et manuel), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire , soins à domicile et autres)

|

Pays couverts

|

Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse, Pologne, République tchèque, Slovaquie et reste de l'Europe

|

Acteurs du marché couverts

|

GE Healthcare (États-Unis), Koninklijke Philips NV (Pays-Bas), Baxter (États-Unis), SCHILLER AG (Suisse), Cardioline SPA (Italie), EDAN Instruments, Inc. (Chine), FUKUDA DENSHI (Japon), Personal MedSystems GmbH (Allemagne), VYAIRE MEDICAL, INC. (États-Unis), Innomed Medical Inc. (Hongrie), Norav Medical (États-Unis), OSI Systems, Inc. (Spacelabs Healthcare) (États-Unis), Lepu Medical Technology (Beijing)Co., Ltd. (Chine), Dawei medical (Chine), Gima SPA (Italie), Zimmer Benelux BV (Allemagne), AMEDTEC Medizintechnik Aue GmbH (Allemagne), BTL (Inde) et Contec Medical Systems Co., Ltd (Chine), entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie par des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments

Le marché européen des électrocardiographes de repos (ECG) est classé en segments notables en fonction du produit, du nombre de fils, de la technologie, de la modalité, de la taille de l'appareil, de la connectivité, du mode de fonctionnement et de l'utilisateur final.

- En fonction du produit, le marché européen des électrocardiographes de repos (ECG) est segmenté en appareils ECG, moniteurs, logiciels et services, enregistreurs de boucle implantables et appareils de télémétrie cardiaque mobiles.

En 2024, le segment des appareils ECG devrait dominer le marché européen des électrocardiographes de repos (ECG)

En 2024, le segment des appareils ECG devrait dominer le marché avec une part de marché de 46,28 % en raison de son rôle essentiel dans la détection précoce et la gestion des maladies cardiovasculaires, qui sont répandues dans toute la région.

- En fonction du nombre de dérivations, le marché européen des électrocardiographes de repos (ECG) est segmenté en 12 dérivations, 15 dérivations, 18 dérivations et autres

En 2024, le segment des 12 dérivations devrait dominer le marché européen des électrocardiographes de repos (ECG)

En 2024, le segment des 12 dérivations devrait dominer le marché avec une part de marché de 72,52 % en raison de sa capacité globale à capturer une large gamme d'activités électriques cardiaques.

- Sur le plan technologique, le marché européen des électrocardiographes de repos (ECG) est segmenté en deux catégories : numérique et analogique. En 2024, le segment numérique devrait dominer le marché avec une part de marché de 77,87 %.

- En fonction de la modalité, le marché européen des électrocardiographes de repos (ECG) est segmenté en fixe et mobile. En 2024, le segment fixe devrait dominer le marché avec une part de marché de 70,72 %.

- En fonction de la taille des appareils, le marché européen des électrocardiographes de repos (ECG) est segmenté en grands, moyens et petits appareils. En 2024, le segment des grands appareils devrait dominer le marché avec une part de marché de 60,91 %.

- En fonction de la connectivité, le marché européen des électrocardiographes de repos (ECG) est segmenté en modèles filaires et sans fil. En 2024, le segment filaire devrait dominer le marché avec une part de marché de 63,28 %.

- Selon leur mode de fonctionnement, le marché européen des électrocardiographes de repos (ECG) est segmenté en modèles automatiques, semi-automatiques et manuels. En 2024, le segment automatique devrait dominer le marché avec une part de marché de 71,51 %.

- En fonction de l'utilisateur final, le marché européen des électrocardiographes de repos (ECG) est segmenté en hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, services de soins à domicile, etc. En 2024, le segment hospitalier devrait dominer le marché avec une part de marché de 35,05 %.

Acteurs majeurs

Data Bridge Market Research analyse les entreprises suivantes comme les principales entreprises du marché européen des électrocardiographes (ECG), notamment GE Healthcare (États-Unis), Koninklijke Philips NV (Pays-Bas), Baxter (États-Unis), SCHILLER AG (Suisse) et Cardioline SPA (Italie), entre autres.

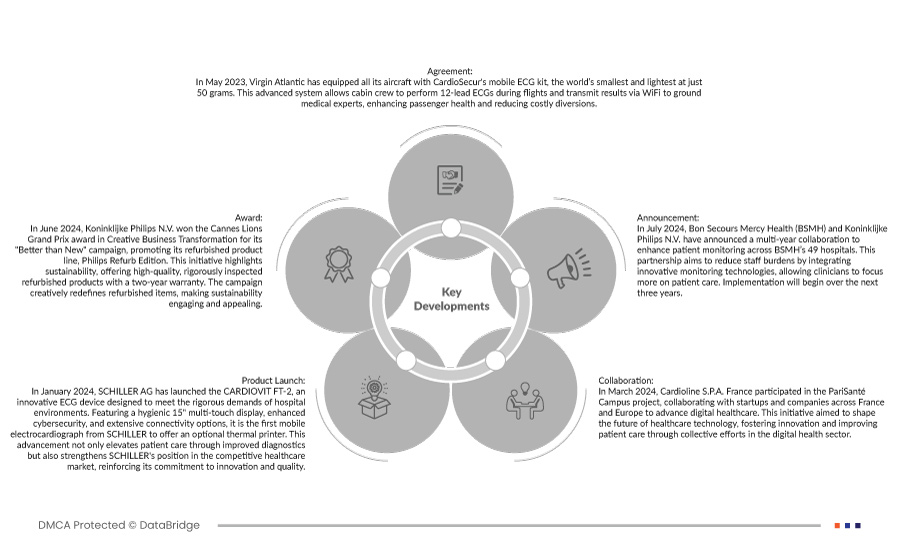

Évolution du marché

- En juillet 2024, Bon Secours Mercy Health (BSMH) et Koninklijke Philips NV ont annoncé une collaboration pluriannuelle visant à améliorer le suivi des patients dans les 49 hôpitaux de BSMH. Ce partenariat vise à alléger la charge de travail du personnel grâce à l'intégration de technologies de surveillance innovantes, permettant ainsi aux cliniciens de se concentrer davantage sur les soins aux patients. La mise en œuvre débutera au cours des trois prochaines années.

- En janvier 2024, SCHILLER AG a lancé le CARDIOVIT FT-2, un appareil ECG innovant conçu pour répondre aux exigences rigoureuses du milieu hospitalier. Doté d'un écran tactile multipoint de 15 pouces, d'une cybersécurité renforcée et de nombreuses options de connectivité, il s'agit du premier électrocardiographe mobile de SCHILLER à proposer une imprimante thermique en option. Cette avancée améliore non seulement la prise en charge des patients grâce à des diagnostics plus performants, mais renforce également la position de SCHILLER sur le marché concurrentiel de la santé, confirmant ainsi son engagement en faveur de l'innovation et de la qualité.

- En mars 2024, Cardioline SPA France a participé au projet PariSanté Campus, collaborant avec des startups et des entreprises françaises et européennes pour faire progresser la santé numérique. Cette initiative visait à façonner l'avenir des technologies de santé, en favorisant l'innovation et en améliorant la prise en charge des patients grâce à des efforts collectifs dans le secteur de la santé numérique.

- En mai 2022, Fukuda Denshi a lancé son site web pour les clients américains, offrant un accès instantané au support produit. Le site proposait des informations sur les produits, des tutoriels vidéo, des manuels et des actualités, améliorant ainsi l'expérience utilisateur et aidant les utilisateurs à optimiser l'utilisation de leurs appareils.

- En mai 2023, Virgin Atlantic s'est associée à CardioSecur pour améliorer la sécurité à bord en équipant tous ses vols du plus petit kit ECG mobile au monde. Ce système permet au personnel de cabine d'enregistrer des ECG à 12 dérivations et de transmettre les résultats aux services médicaux au sol, fournissant ainsi un retour d'information vital et réduisant les déroutements de vol en cas d'accident cardiovasculaire.

Pour plus d'informations sur le marché européen des électrocardiographes de repos (ECG), cliquez ici : https://www.databridgemarketresearch.com/reports/europe-resting-electrocardiograph-ecg-market