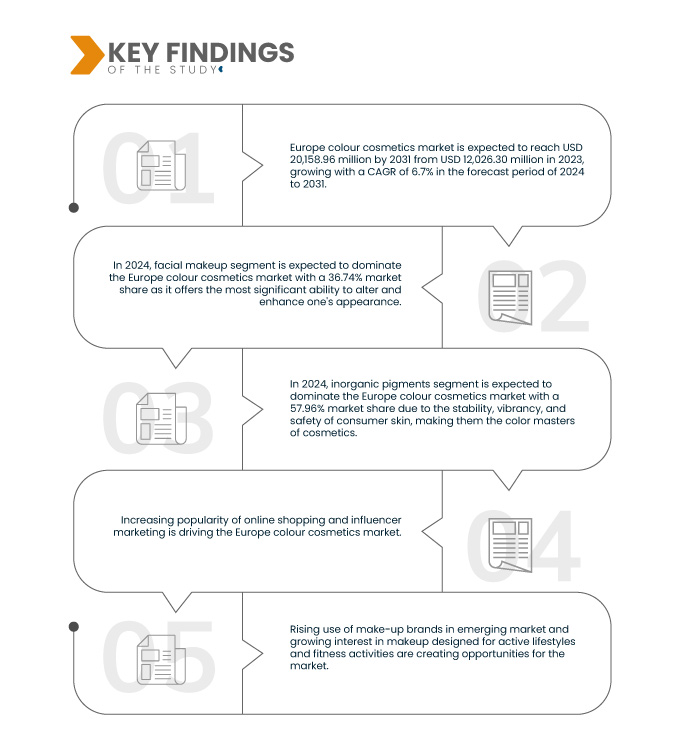

La commodité et la disponibilité des plateformes en ligne ont remodelé les comportements des consommateurs, permettant une expérience d'achat fluide et personnalisée. De nombreuses options sont disponibles pour tous les consommateurs et clients qui explorent et achètent virtuellement des cosmétiques et influencent de manière significative la croissance du marché. Les marques ont tiré parti de ce virage numérique en améliorant leur présence en ligne, en proposant des interfaces interactives et conviviales et en proposant une large gamme de produits adaptés aux divers besoins des consommateurs. Ce changement a élargi la portée du marché et permis un engagement direct avec les consommateurs, favorisant une compréhension plus approfondie des préférences et favorisant l'innovation dans les offres de produits.

L’essor du marketing d’influence a joué un rôle crucial dans l’orientation des choix des consommateurs et dans l’élaboration des tendances en matière de beauté. Réseaux sociaux les influenceurs, les blogueurs beauté et les créateurs de contenu exercent une immense influence sur leurs abonnés, ayant un impact sur les décisions d'achat et les préférences en matière de produits. Grâce à un contenu authentique et pertinent, les influenceurs approuvent et recommandent les cosmétiques colorés, mettant en valeur leur efficacité et leur désirabilité. Leurs approbations et avis servent de pont entre les marques et les consommateurs, favorisant la confiance et l’intégrité dans le paysage numérique en expansion. En conséquence, le marketing d’influence est apparu comme un outil d’influence permettant aux marques d’amplifier leur présence, de générer de la notoriété et de stimuler la croissance du marché.

Accéder au rapport complet @https://www.databridgemarketresearch.com/reports/europe-colour-cosmetics-market

Data Bridge Market Research analyse que le Marché européen des cosmétiques de couleur devrait atteindre 20,16 milliards USD d’ici 2031, contre 12,03 milliards USD en 2023, avec un TCAC substantiel de 6,7 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Hausse des revenus disponibles et urbanisation

Cette synergie crée un changement fondamental dans le comportement des consommateurs, dans la mesure où l’augmentation des revenus disponibles confère aux individus un plus grand pouvoir d’achat, en particulier dans les centres urbains où les aspirations en matière de style de vie donnent souvent la priorité aux soins personnels et à l’amélioration de la beauté. L'urbanisation s'accélère, créant des zones densément peuplées et favorisant une communauté plus interconnectée, la demande de produits de beauté des poussées, motivées par une sensibilisation accrue des consommateurs, des normes de beauté en évolution et un désir d’expression de soi.

La population croissante de la classe moyenne, en particulier dans les régions urbaines des économies émergentes, joue un rôle central dans la demande de cosmétiques colorés. Ce changement démographique, associé à l’évolution des préférences des consommateurs, se traduit par une inclination accrue vers les produits de beauté et de soins. Les individus adoptent la vie urbaine et adoptent des modes de vie modernes, une tendance à la présentation de soi, au bien-être et à la toilettage devient un aspect important, catalysant la croissance du marché européen des cosmétiques de couleur. Cette tendance devrait persister et s’intensifier à mesure que l’urbanisation et la croissance économique continuent de façonner les aspirations et les préférences des consommateurs.

L’influence symbiotique de l’augmentation des revenus disponibles et de l’accélération de l’urbanisation constitue un formidable moteur pour le marché européen des cosmétiques de couleur. Ce duo dynamique alimente une demande croissante de produits de beauté diversifiés, remodelant comportement du consommateur et préférences, en particulier dans les zones urbaines. L'augmentation des revenus disponibles et les modes de vie urbains donnent la priorité à la présentation de soi, le marché des cosmétiques de couleur connaît une croissance soutenue, offrant un paysage opportun aux acteurs de l'industrie pour innover et répondre aux demandes changeantes des consommateurs cosmopolites.

Portée du rapport et segmentation du marché

|

Mesure du rapport

|

Détails

|

|

Période de prévision

|

2024 à 2031

|

|

Année de référence

|

2023

|

|

Années historiques

|

2022 (personnalisable jusqu'en 2016-2021)

|

|

Unités quantitatives

|

Chiffre d’affaires en milliards USD

|

|

Segments couverts

|

Produit (maquillage du visage, maquillage des yeux, produits pour les lèvres, produits pour les ongles, produits capillaires et autres), type de pigment (pigments inorganiques et pigments organiques), marché cible (produits de masse et produits de prestige), emballage (bouteilles et pots, tubes, conteneurs , sachets, distributeurs, sticks et autres), forme (liquide, poudre et spray), canal de distribution (commerce électronique, supermarchés/hypermarchés, ventes directes/B2B, magasins spécialisés et autres), utilisateur final (salon, Industries de la maison, du mannequinat et de la mode, maisons de médias et autres)

|

|

Pays couverts

|

Allemagne, Royaume-Uni, France, Italie, Pays-Bas, Espagne, Russie, Suisse, Turquie, Belgique, Danemark, Norvège, Finlande et reste de l'Europe

|

|

Acteurs du marché couverts

|

L'Oréal GROUPE (France), Unilever PLC (Royaume-Uni), Henkel AG & Co. KGaA (Allemagne), Shiseidio Company, Limited (Japon), The Estée Lauder Companies Inc. (États-Unis), Coty Inc (États-Unis)., Mary Kay Inc (États-Unis)., KOSÉ Corporation (Japon), CHANEL (Royaume-Uni), Oriflame Cosmetics AG (Suisse), Natura & Co (Brésil), AMOREPACIFIC US, INC. (Corée), Clarins (France), LVMH (France) , CHANTECAILLE BEAUTE (États-Unis) et Kryolan (Allemagne), entre autres

|

|

Points de données couverts dans le rapport

|

En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario de marché, le rapport de marché organisé par l'équipe d'études de marché Data Bridge comprend une analyse approfondie d'experts, une analyse d'import/export, analyse des prix, analyse de la consommation de production et comportement des consommateurs

|

Analyse sectorielle

Le marché européen des cosmétiques de couleur est segmenté en sept segments notables en fonction du produit, du type de pigment, du marché cible, de l’emballage, de la forme, du canal de distribution et de l’utilisateur final.

- Sur la base du produit, le marché européen des cosmétiques de couleur est segmenté en maquillage du visage, maquillage des yeux, produits pour les lèvres, produits pour les ongles, produits capillaires et autres.

En 2024, le segment du maquillage du visage devrait dominer le marché européen des cosmétiques colorés.

En 2024, le segment du maquillage du visage devrait dominer le marché européen des cosmétiques de couleur avec une part de marché de 36,74 % car il offre la capacité la plus significative de modifier et d'améliorer l'apparence d'une personne.

- Sur la base du type de pigment, le marché européen des cosmétiques colorés est segmenté en pigments inorganiques et pigments organiques.

En 2024, le segment des pigments inorganiques devrait dominer le marché européen des cosmétiques colorés.

En 2024, le segment des pigments inorganiques devrait dominer le marché européen des cosmétiques colorés avec une part de marché de 57,96 % en raison de la stabilité, du dynamisme et de la sécurité de la peau des consommateurs, ce qui en fait les maîtres de la couleur des cosmétiques.

- Sur la base du marché cible, le marché européen des cosmétiques colorés est segmenté en produits de masse et produits de prestige. En 2024, le segment des produits de masse devrait dominer le marché européen des cosmétiques de couleur avec une part de marché de 63,72 %.

- Sur la base de l'emballage, le marché européen des cosmétiques colorés est segmenté en bouteilles et pots, tubes, récipients, pochettes, distributeurs, bâtonnets et autres. En 2024, le segment des bouteilles et pots devrait dominer le marché avec 29,07 % de part de marché.

- Sur la base de la forme, le marché européen des cosmétiques de couleur est segmenté en liquide, en poudre et en spray. En 2024, le segment des liquides devrait dominer le marché avec 46,78 % de part de marché.

- Sur la base du canal de distribution, le marché européen des cosmétiques de couleur est segmenté en commerce électronique, supermarchés/hypermarchés, ventes directes/B2B, magasins spécialisés et autres. En 2024, le segment du commerce électronique devrait dominer le marché avec 38,27 % de part de marché.

- Sur la base de l’utilisateur final, le marché européen des cosmétiques de couleur est segmenté en secteurs des salons, de la maison, du mannequinat et de la mode, des maisons de médias et autres. En 2024, le segment des salons devrait dominer le marché avec 38,26 % de part de marché.

Acteurs majeurs

Data Bridge Market Research analyse L'Oréal GROUPE (France), Unilever PLC (Royaume-Uni), Henkel AG & Co. KGaA (Allemagne), The Estée Lauder Companies Inc. (États-Unis) et Coty Inc (États-Unis) comme les principaux acteurs opérant sur le marché européen des cosmétiques de couleur.

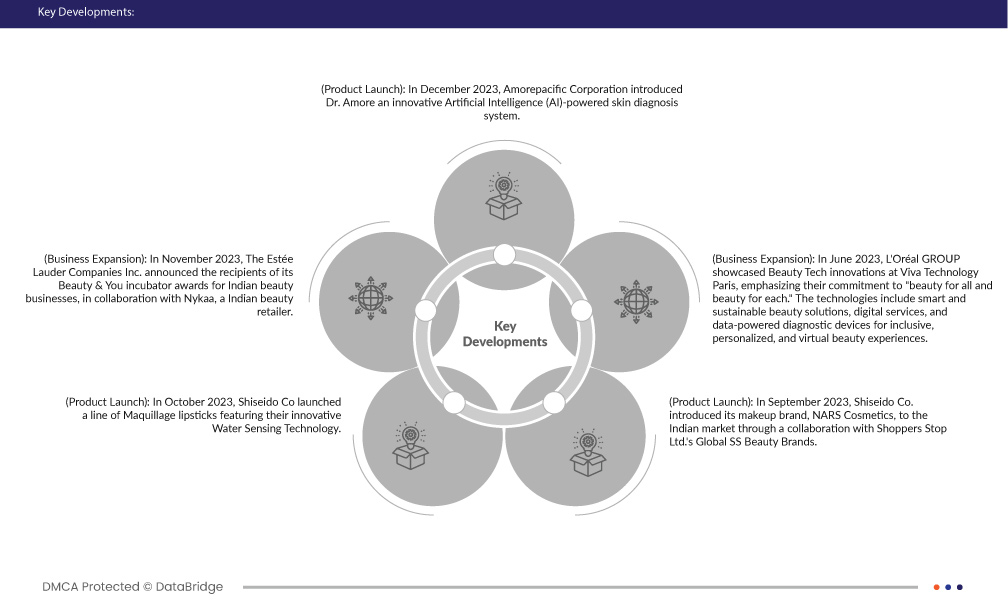

Développements du marché

- En décembre 2023, Amorepacific Corporation a présenté Dr. Amore, un système innovant de diagnostic cutané basé sur l'intelligence artificielle (IA). La récente percée de la société a été documentée dans un article publié dans l'International Journal of Cosmetic Science. Le système utilise des algorithmes d’IA avancés pour fournir des analyses cutanées précises et personnalisées. Cette avancée technologique devrait améliorer les processus de développement et de formulation de produits de l'entreprise, permettant une approche plus ciblée des solutions de soins de la peau. En tirant parti de l’IA, Amorepacific vise à mieux comprendre les besoins individuels de la peau, en garantissant que ses produits cosmétiques sont adaptés aux diverses exigences des clients. Cette avancée scientifique renforce l'engagement d'Amorepacific à rester à la pointe de la recherche et du développement en matière de soins de la peau.

- En novembre 2023, The Estée Lauder Companies Inc. a annoncé les lauréats de ses prix d'incubateur Beauty & You pour les entreprises indiennes de beauté, en collaboration avec Nykaa, un détaillant indien de produits de beauté. La deuxième édition de ces prix, dévoilée plus tôt cette année, a récompensé des réalisations exceptionnelles dans divers secteurs de l'industrie de la beauté, couvrant les ingrédients actifs, la parfumerie, la durabilité et les communautés de marques. Cette initiative a mis en lumière les contributions innovantes des marques et créateurs de beauté indiens et a favorisé une plateforme collaborative permettant au secteur de prospérer. En considérant les divers aspects du secteur de la beauté, les prix de l'incubateur Beauty & You ont joué un rôle essentiel dans le développement et la promotion de la croissance de l'écosystème indien du secteur de la beauté.

- En octobre 2023, Shiseido Co a lancé une gamme de rouges à lèvres Maquillage dotés de leur technologie innovante de détection d'eau. Cette technologie allie harmonieusement couleur résistante aux transferts et confort, marquant une avancée significative dans l’industrie cosmétique. Le lancement de cette gamme unique de rouges à lèvres devrait contribuer à l'avantage concurrentiel de Shiseido en offrant aux consommateurs une expérience de rouge à lèvres durable et confortable. L'incorporation de la technologie Water Sensing reflète l'engagement de l'entreprise en matière de recherche et de développement, positionnant Shiseido comme un leader de l'innovation en matière de beauté.

- En septembre 2023, Shiseido Co. a introduit sa marque de maquillage, NARS Cosmetics, sur le marché indien grâce à une collaboration avec Global SS Beauty Brands de Shoppers Stop Ltd. Il s'agit de la première incursion de Shiseido sur le marché indien du maquillage depuis près d'une décennie. Cette décision vise à exploiter le marché de consommation florissant en rendant la gamme populaire de cosmétiques NARS facilement disponible dans les magasins de beauté locaux. Cette expansion stratégique reflète l'engagement de Shiseido à diversifier sa présence mondiale et à capter une part de la demande croissante de cosmétiques en Inde.

- En juin 2023, le GROUPE L'Oréal a présenté les innovations Beauty Tech à Viva Technology Paris, soulignant son engagement en faveur de « la beauté pour tous et la beauté pour chacun ». Les technologies comprennent des solutions de beauté intelligentes et durables, des services numériques et des dispositifs de diagnostic alimentés par les données pour des expériences de beauté inclusives, personnalisées et virtuelles. Ces innovations contribuent au développement technologique de l'entreprise et améliorent son engagement à fabriquer des produits de beauté

Selon l’analyse de l’étude de marché Data Bridge :

Analyse géographique

Géographiquement, les pays couverts par le marché européen des cosmétiques de couleur sont l’Allemagne, le Royaume-Uni, la France, l’Italie, les Pays-Bas, l’Espagne, la Russie, la Suisse, la Turquie, la Belgique, le Danemark, la Norvège, la Finlande et le reste de l’Europe.

Allemagne devrait être le pays dominant et à la croissance la plus rapide sur le marché européen des cosmétiques colorés.

L'Allemagne devrait être le pays dominant et à la croissance la plus rapide en raison de l'évolution des modes de vie, ainsi que des médias sociaux et de la culture des influenceurs, qui sont à l'origine des tendances en matière de couleur. produits de beauté.

Pour des informations plus détaillées sur le rapport sur le marché européen des cosmétiques colorés, cliquez ici –https://www.databridgemarketresearch.com/reports/europe-colour-cosmetics-market