Les nettoyants et dégraissants sont des composés ou solutions chimiques spécialisés conçus pour éliminer efficacement la saleté, la crasse, l'huile, la graisse et autres contaminants de diverses surfaces et objets. Ces agents nettoyants agissent en décomposant et en dissolvant les substances indésirables, facilitant ainsi leur essuyage ou leur rinçage. Les nettoyants englobent généralement une large gamme de produits répondant à des besoins de nettoyage spécifiques, tandis que les dégraissants ciblent spécifiquement l'élimination des résidus huileux et des accumulations graisseuses. Ils sont largement utilisés dans les environnements domestiques et industriels, garantissant la propreté, l'hygiène et le fonctionnement optimal des équipements, machines, appareils et surfaces. Ces substances jouent un rôle essentiel dans le maintien de la propreté, de la sécurité et de la fonctionnalité dans divers environnements, des cuisines et ateliers automobiles aux usines de fabrication et aux ménages.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/europe-and-us-cleaner-and-degreaser-market

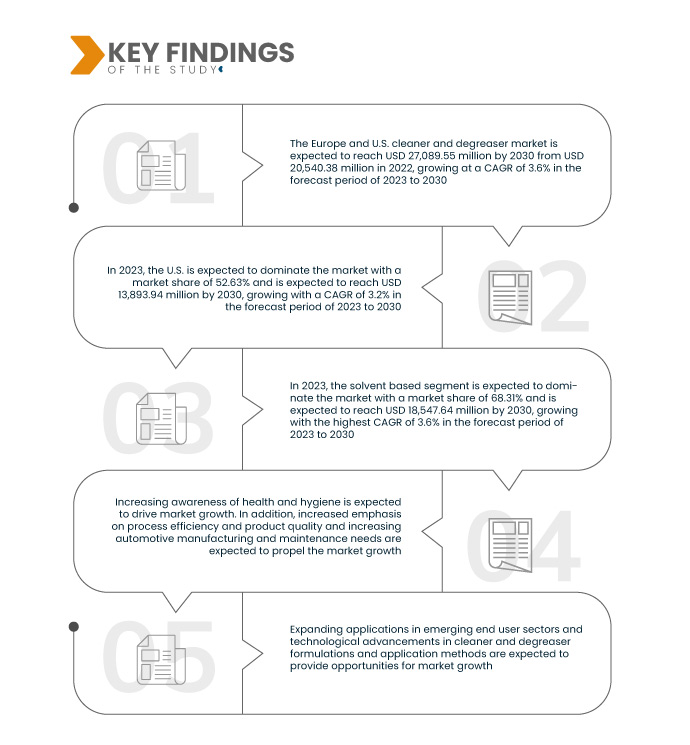

Le marché des nettoyants et dégraissants en Europe et aux États-Unis devrait atteindre 27 089,55 millions USD d'ici 2030, contre 20 540,38 millions USD en 2022, avec un TCAC substantiel de 3,6 % au cours de la période de prévision de 2023 à 2030.

Principales conclusions de l'étude

La sensibilisation croissante à la santé et à l'hygiène devrait stimuler la croissance du marché

La sensibilisation croissante à la santé et à l'hygiène est sur le point de stimuler le marché des nettoyants et dégraissants en Europe et aux États-Unis. Cette sensibilisation accrue est largement attribuée à divers facteurs, notamment les préoccupations sanitaires mondiales actuelles, la conscience environnementale et les initiatives réglementaires visant à garantir des environnements de travail et de vie plus sûrs et plus propres.

Les particuliers, les entreprises et les institutions sont de plus en plus conscients de la nécessité de maintenir des espaces propres et aseptisés afin de réduire les risques d'infection. Par conséquent, la demande de produits de nettoyage et de dégraissage efficaces a fortement augmenté, et cette tendance devrait se poursuivre, l'hygiène restant une priorité. De plus, l'importance croissante accordée à la durabilité environnementale et à l'utilisation de produits écologiques stimule la demande de solutions de nettoyage et de dégraissage plus écologiques, biodégradables et non toxiques. Les consommateurs européens et américains recherchent de plus en plus des produits qui non seulement garantissent la propreté, mais respectent également leurs valeurs environnementales. Cette évolution des préférences des consommateurs a donné lieu à des innovations sur le marché des nettoyants et dégraissants, les fabricants développant des formules respectueuses de l'environnement répondant à des normes environnementales strictes.

En conclusion, la sensibilisation croissante à la santé et à l'hygiène constitue un puissant moteur de croissance du marché. Cette prise de conscience, alimentée par la pandémie, les préoccupations environnementales, les évolutions réglementaires et la demande institutionnelle, devrait se traduire par une croissance soutenue du marché, les consommateurs comme les entreprises accordant une importance primordiale à la propreté et à la sécurité de leur environnement. Les entreprises proposant des solutions de nettoyage et de dégraissage efficaces, écologiques et conformes sont bien placées pour profiter de cette tendance.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2023 à 2030

|

Année de base

|

2022

|

Années historiques

|

2021 (personnalisable de 2015 à 2020)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volume en millions de litres et prix en millions USD

|

Segments couverts

|

Type de produit (à base de solvant et à base d'eau), type (dégraissants/nettoyants puissants, dégraissants/nettoyants au butyle, dégraissants/nettoyants sans butyle, dégraissants/nettoyants naturels et autres), matière première (dégraissants/nettoyants à base de pétrole, dégraissants/nettoyants à base d'ammoniaque, dégraissants/nettoyants écologiques et autres), forme (liquide, solide et mousse), méthodes de dégraissage ou de nettoyage (manuelles et automatisées), emballage (fût, seau, vaporisateur, bombes aérosols et autres), utilisation finale (fabrication générale, automobile, alimentation et boissons, électricité/services publics, bâtiment et construction, aviation/aérospatiale, marine, exploitation minière, agriculture et autres), canal de vente (B2B et B2C)

|

Pays couverts

|

États-Unis, Allemagne, France, Royaume-Uni, Italie, Russie, Espagne, Pays-Bas, Belgique, Suisse, Turquie, Danemark, Suède, Pologne, Norvège, Finlande et reste de l'Europe

|

Acteurs du marché couverts

|

BASF SE (Allemagne), Dow (États-Unis), BP plc (Royaume-Uni), 3M (États-Unis), DuPont (États-Unis), Adolf Würth GmbH & Co. KG (Allemagne), Stepan Company (États-Unis), Valvoline Global Operations (États-Unis), Superior Industries, Inc. (États-Unis), FUCHS (Allemagne), Zep Inc. (États-Unis), Betco (États-Unis), Nyco Products Company (États-Unis), B'laster LLC (États-Unis), Carroll Company (États-Unis), The Claire Manufacturing Company (États-Unis), AIROSOL COMPANY, INC (États-Unis) et CHAMÄLEON GMBH (Allemagne)

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché européen et américain des nettoyants et dégraissants est segmenté en huit segments notables en fonction du type de produit, du type, de la matière première, de la forme, des méthodes de dégraissage/nettoyage, de l'emballage, de l'utilisation finale et du canal de vente.

- Sur la base du type de produit, le marché est segmenté en produits à base de solvant et à base d'eau.

En 2023, le segment à base de solvants devrait dominer le marché des nettoyants et dégraissants en Europe et aux États-Unis

En 2023, les produits à base de solvants devraient dominer le marché avec une part de marché de 68,31 %, car il s'agit de l'appellation la plus pratique, car elle présente des données fiables. Cela s'explique également par leur efficacité à éliminer les graisses et les huiles, ainsi que par la dépendance historique de l'industrie à ces produits.

- Sur la base du type, le marché est segmenté en dégraissants/nettoyants puissants, dégraissants/nettoyants au butyle, dégraissants/nettoyants sans butyle, dégraissants/nettoyants naturels et autres.

En 2023, le segment des dégraissants/nettoyants à usage intensif devrait dominer le marché des nettoyants et dégraissants en Europe et aux États-Unis.

En 2023, le segment des dégraissants/nettoyants à usage intensif devrait dominer le marché avec une part de marché de 35,59 % en raison d'une forte activité industrielle, de normes de propreté strictes et du besoin de solutions efficaces dans les secteurs de la fabrication et de l'automobile.

- En fonction des matières premières, le marché est segmenté en dégraissants/nettoyants à base de pétrole, à base d'ammoniaque, respectueux de l'environnement, etc. En 2023, le segment des dégraissants/nettoyants à base de pétrole devrait dominer le marché avec une part de marché de 37,05 %.

- En fonction de la forme, le marché est segmenté en liquide, poudre et mousse. En 2023, le segment liquide devrait dominer le marché avec une part de marché de 42,58 %.

- Selon les méthodes de dégraissage ou de nettoyage, le marché est segmenté en machines manuelles et automatisées. En 2023, le segment manuel devrait dominer le marché avec 76,76 % de parts de marché.

- En termes d'emballage, le marché est segmenté en fûts, seaux, vaporisateurs, aérosols, etc. En 2023, le segment des fûts devrait dominer le marché avec une part de marché de 44,39 %.

- En fonction de l'utilisation finale, le marché est segmenté en trois secteurs : industrie manufacturière générale, automobile, agroalimentaire, électricité et services publics, bâtiment et construction, aéronautique et aérospatiale, marine, mines, agriculture, etc. En 2023, le segment de l'industrie manufacturière générale devrait dominer le marché avec une part de marché de 30,37 %.

- En fonction des canaux de vente, le marché est segmenté en B2B et B2C. En 2023, le segment B2B devrait dominer le marché avec une part de marché de 79,05 %.

Acteurs majeurs

Data Bridge Market Research analyse BASF SE (Allemagne), Dow (États-Unis), BP plc (Royaume-Uni), 3M (États-Unis) et DuPont (États-Unis) comme les principaux acteurs du marché.

Développements récents

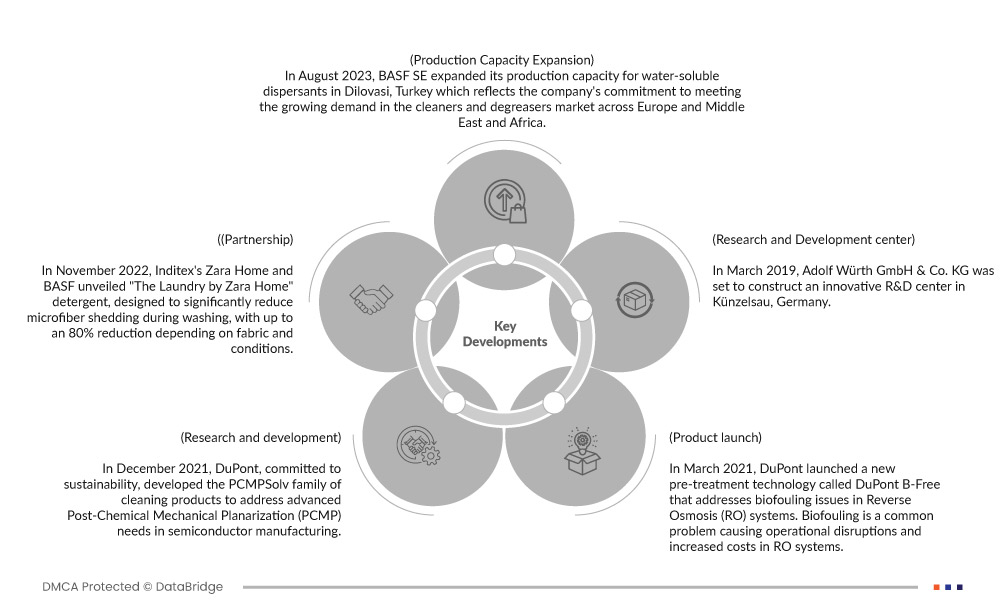

- En août 2023, BASF SE a augmenté sa capacité de production de dispersants hydrosolubles à Dilovasi, en Turquie, témoignant ainsi de sa volonté de répondre à la demande croissante du marché des nettoyants et dégraissants en Europe, au Moyen-Orient et en Afrique. Les dispersants Sokalan, commercialisés par la division Care Chemicals de BASF, notamment les grades Sokalan PA, Sokalan CP et Sokalan NR, jouent un rôle crucial dans l'amélioration de l'efficacité du nettoyage, la prévention des dépôts calcaires et la simplification des procédés techniques des formulations modernes.

- En novembre 2022, Zara Home (filiale d'Inditex) et BASF ont dévoilé la lessive « The Laundry by Zara Home », conçue pour réduire significativement la perte de microfibres au lavage, jusqu'à 80 % selon le tissu et les conditions d'utilisation. Cette formule innovante nettoie efficacement à l'eau froide, réduisant ainsi les émissions de carbone, et prolonge la durée de vie des textiles. Disponible sur plus de 25 marchés, dont l'Espagne et l'Allemagne, cette solution est en passe de révolutionner le marché des nettoyants et dégraissants, tout en offrant un potentiel d'adoption plus large.

- En décembre 2021, DuPont, engagé dans le développement durable, a développé la gamme de produits de nettoyage PCMPSolv pour répondre aux besoins avancés de la planarisation post-mécanique chimique (PCMP) dans la fabrication de semi-conducteurs. Ces produits sont conçus pour nettoyer les résidus et sous-produits générés lors du processus CMP, garantissant ainsi la fiabilité et le rendement des dispositifs. Avec l'évolution de l'industrie des semi-conducteurs vers des dispositifs plus petits et de nouveaux matériaux, le nettoyage PCMP devient plus complexe. Les produits PCMPSolv de DuPont intègrent des principes de conception plus sûre et de chimie verte, remplaçant les nettoyages agressifs par des matières premières soigneusement sélectionnées. Ces nettoyants offrent les mêmes performances et le même contrôle de la corrosion tout en étant hautement concentrés, ce qui permet de réaliser des économies grâce à une dilution efficace. Les clients peuvent se renseigner sur ces produits auprès de leurs chargés de clientèle.

- En mars 2021, DuPont a lancé une nouvelle technologie de prétraitement, DuPont B-Free, qui résout les problèmes d'encrassement biologique dans les systèmes d'osmose inverse (OI). L'encrassement biologique est un problème courant qui entraîne des perturbations opérationnelles et une augmentation des coûts des systèmes d'OI. Fruit de nombreuses années de recherche, cette technologie crée un environnement biostatique dans les systèmes d'OI sans utiliser de produits chimiques, les rendant ainsi durables et fiables. DuPont B-Free réduit jusqu'à 75 % le besoin de nettoyage en place (NEP), doublant potentiellement la durée de vie des membranes et filtres d'OI et réduisant les temps d'arrêt opérationnels jusqu'à 50 %. Cette innovation améliore la fiabilité des installations et s'inscrit dans la continuité des objectifs de développement durable, répondant ainsi aux défis de la pénurie d'eau.

- En mars 2019, Adolf Würth GmbH & Co. KG a prévu la construction d'un centre de R&D innovant à Künzelsau, en Allemagne. Cet investissement permettra de doter l'entreprise de laboratoires et d'ateliers de pointe sur 15 000 m². Ce site de pointe abritera des équipements de pointe, notamment des imprimantes 3D et des bancs d'essais sismiques, renforçant ainsi ses capacités de recherche. Des collaborations avec des institutions prestigieuses telles que l'Institut de technologie de Karlsruhe et les universités d'Innsbruck et de Stuttgart favoriseront l'échange de connaissances. Ce centre d'innovation témoigne de la volonté de l'entreprise d'innover et de proposer à ses clients des solutions performantes dans divers secteurs, notamment celui des nettoyants et dégraissants.

Analyse régionale

Sur la base de la géographie, le marché est segmenté en États-Unis, Allemagne, France, Royaume-Uni, Italie, Russie, Espagne, Pays-Bas, Belgique, Suisse, Turquie, Danemark, Suède, Pologne, Norvège, Finlande et reste de l'Europe.

Selon l'analyse de Data Bridge Market Research :

Les États-Unis devraient dominer le marché des nettoyants et dégraissants en Europe et aux États-Unis

En 2023, les États-Unis devraient dominer le marché grâce à leur industrie chimique robuste et à leurs vastes capacités de fabrication, ce qui se traduira par une large gamme d’offres de produits et des prix compétitifs.

L'Europe devrait être la région connaissant la croissance la plus rapide sur le marché des nettoyants et dégraissants en Europe et aux États-Unis.

En 2023, l'Europe devrait connaître le TCAC le plus élevé en raison des réglementations environnementales strictes dans les deux régions, qui ont stimulé la demande de solutions de nettoyage écologiques et durables, un domaine dans lequel les fabricants européens excellent.

Pour plus d'informations sur le marché des nettoyants et dégraissants en Europe et aux États-Unis, cliquez ici : https://www.databridgemarketresearch.com/reports/europe-and-us-cleaner-and-degreaser-market