Les excipients nutraceutiques oraux solides sont des substances non actives stratégiquement incorporées dans la formulation de produits nutritionnels sous formes posologiques, telles que des comprimés ou des capsules, pour remplir divers rôles fonctionnels. Ces excipients jouent un rôle central dans le processus global de développement du produit, contribuant aux attributs physiques, à la fabricabilité et aux performances du produit nutraceutique final. Les liants, par exemple, sont utilisés pour assurer la cohésion de la formulation, facilitant ainsi la compression des ingrédients en comprimés. À l’inverse, les diluants augmentent le volume de la formulation, garantissant un dosage constant et facilitant le processus de fabrication. Les désintégrants sont une autre catégorie d'excipients conçus pour favoriser la rupture du comprimé ou de la capsule lors de l'ingestion, facilitant ainsi la libération des ingrédients actifs pour une absorption optimale. Ces excipients contribuent collectivement à la stabilité, à la biodisponibilité et à l'efficacité globale des nutraceutiques oraux solides, permettant la production réussie de produits de haute qualité répondant aux exigences réglementaires et aux attentes des consommateurs.

Accéder au rapport complet @https://www.databridgemarketresearch.com/reports/emea-solid-oral-nutraceutical-excipient-market

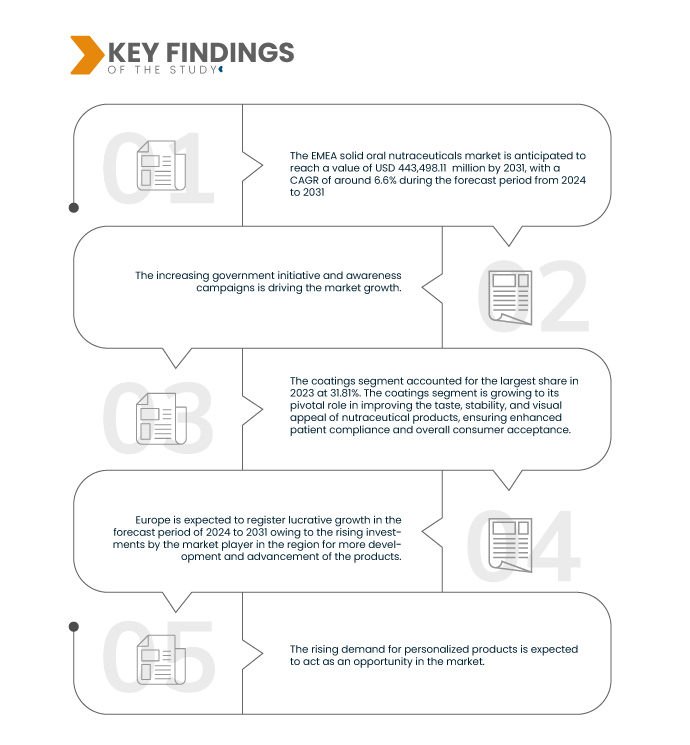

Data Bridge Market Research analyse que le Marché EMEA des excipients nutraceutiques oraux solides devrait croître à un TCAC de 6,6 % au cours de la période de prévision de 2024 à 2031 et devrait atteindre 443 498,11 millions USD d’ici 2031. Le segment des revêtements devrait propulser la croissance du marché en raison de l’adoption et de la demande croissantes de produits nutraceutiques.

Principales conclusions de l'étude

Progrès croissants dans les excipients nutraceutiques

Le besoin d’excipients capables d’aider à formuler et à administrer ces nutraceutiques plus efficacement augmente parallèlement à l’expansion de cette recherche. Dans les produits nutraceutiques, les excipients jouent un rôle crucial pour garantir la stabilité, la biodisponibilité et l’efficacité des principes actifs. Leur rôle est crucial dans la conversion des résultats de la recherche en formulations réalisables et commercialement viables. Les nutraceutiques acquièrent de nouvelles connaissances sur leurs qualités bénéfiques pour la santé grâce à des études scientifiques, essais cliniques, et les efforts de recherche en cours visant à déterminer leur efficacité, leur sécurité et leurs applications possibles.

Les développements répondent aux exigences changeantes du secteur nutraceutique et se caractérisent par des percées dans les formulations et les technologies des excipients. Les fabricants investissent dans la R&D pour fournir des excipients pour les formulations nutraceutiques orales offrant une plus grande fonctionnalité, une biodisponibilité plus élevée et une meilleure stabilité des ingrédients actifs. Cette innovation continue améliore la qualité et l'efficacité des produits finaux en résolvant les problèmes de distribution efficace des composants nutraceutiques délicats ou peu solubles.

Des efforts de recherche accrus conduisent également à la découverte de nouveaux composants et combinaisons, ce qui alimente le besoin d'excipients qui soutiennent ces développements. Le besoin d’excipients contribuant à la formulation et à l’administration efficaces de ces nutraceutiques augmente à mesure que le corpus de recherche sur le sujet se développe. De plus, les développements technologiques en matière d'excipients permettent de créer des formulations qui satisfont toute une gamme de préférences des consommateurs en satisfaisant des besoins spécifiques tels qu'une libération contrôlée, un masquage du goût ou une absorption améliorée. Le marché est en croissance grâce à de nouveaux excipients qui garantissent une meilleure compatibilité avec divers principes actifs et processus de production. Cela crée un paysage dans lequel les produits sont plus différenciés les uns des autres et plus performants.

Portée du rapport et segmentation du marché

|

Mesure du rapport

|

Détails

|

|

Période de prévision

|

2024 à 2031

|

|

Année de référence

|

2023

|

|

Année historique

|

2022 (personnalisable jusqu’en 2016 – 2021)

|

|

Unités quantitatives

|

Chiffre d'affaires en millions USD et prix en USD

|

|

Segments couverts

|

Par fonctionnalité (liants, charges et diluants, agents de suspension et de viscosité, revêtements, désintégrants et autres), formulation (comprimés, capsules, gommes et autres), produit final (Probiotiques, Prébiotiques, suppléments de protéines et d'acides aminés, suppléments de vitamines, Suppléments minéraux, suppléments oméga-3 et autres suppléments), source d'excipient (synthétique et naturel), canal de distribution (appel d'offres direct, vente au détail et autres)

|

|

Pays couverts

|

Allemagne, Italie, Royaume-Uni, France, Espagne, Belgique, Pays-Bas, Russie, Suisse, Turquie, reste de l'Europe, Afrique du Sud, Arabie Saoudite, Émirats arabes unis, Algérie, Oman, Koweït et reste du Moyen-Orient et de l'Afrique.

|

|

Acteurs du marché couverts

|

Ingredion (États-Unis), azelis (Belgique), JRS Pharma (Allemagne), BASF Corporation (Allemagne), Omya (Suisse), Ashland (États-Unis), DuPont (États-Unis), Sigachi Industries (Inde), International Flavors & Fragrances Inc. ( États-Unis), Croda International Plc (Royaume-Uni), Cargill, Incorporated (États-Unis), Grain Processing Corporation (États-Unis), Kerry Group plc (Irlande), Roquette Frères (France), Colorcon (États-Unis), Bioground GmbH (Allemagne), BENEO ( Filiale de Südzucker AG) (Allemagne), Evonik Industries AG (Allemagne) et SEPPIC (France) et entre autres

|

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie d'experts, l'épidémiologie des patients, une analyse du pipeline, une analyse des prix, et le cadre réglementaire.

|

Analyse sectorielle

Le marché des excipients nutraceutiques oraux solides dans la région EMEA est segmenté en cinq segments notables en fonction de la fonctionnalité, de la formulation, du produit final, de la source de l’excipient et du canal de distribution.

- Sur la base de la fonctionnalité, le marché est segmenté en liants, charges et diluants, agents de suspension et de viscosité, revêtements, désintégrants et autres.

En 2024, le segment des revêtements devrait dominer le marché

En 2024, le segment des revêtements devrait dominer le marché avec une part de marché de 31,81 % en raison de son rôle central dans l'amélioration du goût, de la stabilité et de l'attrait visuel des produits nutraceutiques, garantissant ainsi une meilleure observance des patients et une acceptation globale par les consommateurs.

- Sur la base de la formulation, le marché est segmenté en comprimés, gélules, bonbons gélifiés et autres

En 2024, le segment des tablettes devrait dominer le marché

En 2024, le segment des comprimés devrait dominer le marché avec une part de marché de 35,01 % en raison de leur commodité, de leur facilité de fabrication et de leur contrôle précis du dosage, ce qui en fait une forme posologique orale solide préférée et largement acceptée pour les produits nutraceutiques.

- Sur la base du produit final, le marché est segmenté en probiotiques, prébiotiques, suppléments de protéines et d’acides aminés, suppléments vitaminiques, suppléments minéraux, suppléments d’oméga-3 et autres suppléments. En 2024, le segment des suppléments vitaminiques devrait dominer le marché avec une part de marché de 27,57 %.

- Sur la base de la source d’excipient, le marché est segmenté en synthétique et naturel. En 2024, le segment naturel devrait dominer le marché avec une part de marché de 59,64 %

- Sur la base du canal de distribution, le marché est segmenté en canal de distribution, le marché est segmenté en appels d’offres directs, ventes au détail et autres. En 2024, le segment des appels d'offres directs devrait dominer le marché avec une part de marché de 46,60 %

Acteurs majeurs

Data Bridge Market Research analyse BASF Corporation (Allemagne), DuPont (États-Unis), Cargill, Incorporated (États-Unis), Omya (Suisse) et Kerry Group plc (Irlande) en tant qu'acteurs majeurs du marché des excipients nutraceutiques oraux solides dans la région EMEA.

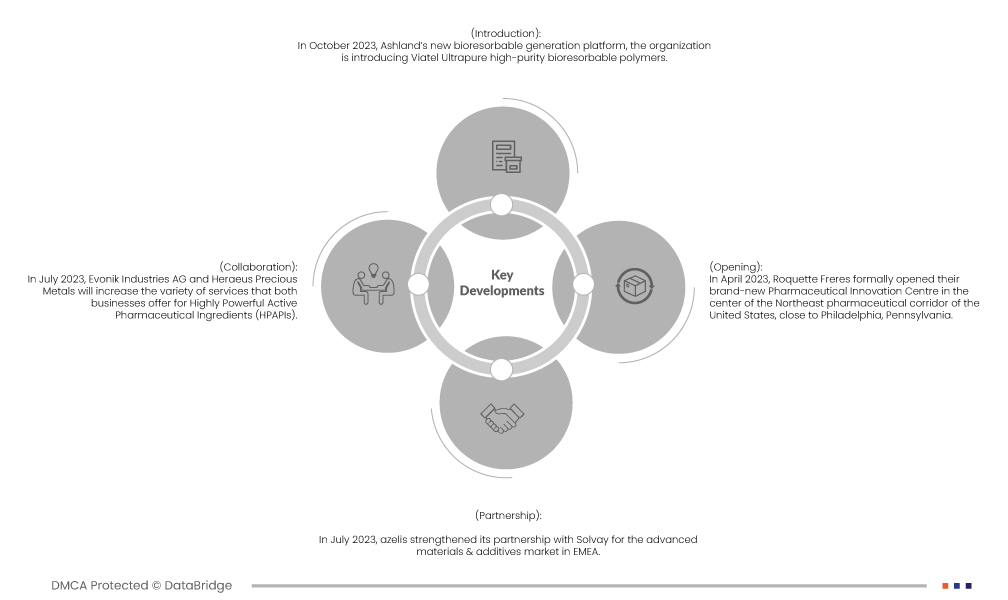

Développement du marché

- En octobre 2023, la nouvelle plateforme de génération biorésorbable d'Ashland, l'organisation, présentera Viatel Ultrapure, un polymère biorésorbable de haute pureté. Cette extension de gamme vous offre un équilibre avancé pour les composés médicamenteux délicats et des profils de lancement de médicaments plus longs et extra-réguliers dans les injectables et implants à longue durée de vie (LAII). Ces polymères ont également une application plus large dans les produits de comblement cutané, les échafaudages de thérapie régénérative et les dispositifs cliniques dégradables. Cela aidera l'entreprise à développer ses activités dans le segment des sciences de la vie.

- En juillet 2023, Evonik Industries AG et Heraeus Precious Metals augmenteront la variété de services que les deux entreprises proposent pour les ingrédients pharmaceutiques actifs hautement puissants (HPAPI). En combinant les capacités HPAPI uniques des deux entreprises, la collaboration offre aux clients une solution entièrement intégrée qui s'étend de la recherche préclinique à la fabrication commerciale.

- En juillet 2023, a renforcé son partenariat avec Solvay pour le marché des matériaux avancés et des additifs de la région EMEA. L'expansion du partenariat avec Solvay s'aligne sur la stratégie d'Azelis de croissance organique avec ses partenaires et sur l'accent mis sur les moteurs stratégiques en matière de durabilité et d'innovation. Ce partenariat permet à azelis d'offrir à ses clients une gamme plus large de solutions hautes performances, renforçant leur compétitivité et leur permettant de répondre à l'évolution de la demande du marché en matière de matériaux légers, économes en énergie et durables. Cela renforce encore l'engagement d'Azelis à promouvoir la durabilité et à stimuler l'innovation dans divers secteurs.

- En avril 2023, Roquette Frères a officiellement inauguré son tout nouveau centre d'innovation pharmaceutique au centre du corridor pharmaceutique du nord-est des États-Unis, près de Philadelphie, en Pennsylvanie. L'installation sert d'incubateur pour l'innovation scientifique appliquée, se concentrant sur les méthodes d'administration de médicaments, les API nutraceutiques, les formes posologiques orales et les composants pharmaceutiques innovants. Cela a contribué à l’expansion commerciale de la société

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché EMEA des excipients nutraceutiques oraux solides sont l’Allemagne, l’Italie, le Royaume-Uni, la France, l’Espagne, la Belgique, les Pays-Bas, la Russie, la Suisse, la Turquie, le reste de l’Europe, l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Algérie et Oman. , le Koweït et le reste du Moyen-Orient et de l'Afrique.

Selon l’analyse de l’étude de marché Data Bridge :

On estime que l’Europe est la région dominante et à la croissance la plus rapide sur le marché EMEA des excipients nutraceutiques oraux solides.

L'Europe devrait dominer le marché en raison du niveau plus élevé d'investissements des fabricants et de l'évolution croissante des attentes. L’Europe continuera de dominer le marché en termes de part de marché et de revenus et consolidera sa domination au cours de la période de prévision. Cela est dû à l’adoption et à la demande croissantes de produits nutraceutiques. En outre, la sensibilisation croissante de la population à la santé devrait propulser la croissance du marché dans cette région.

Pour des informations plus détaillées sur le rapport sur le marché des excipients nutraceutiques oraux solides dans la région EMEA, cliquez ici –https://www.databridgemarketresearch.com/reports/emea-solid-oral-nutraceutical-excipient-market