L'utilisation de seringues préremplies de solution saline réduit considérablement le risque d'erreurs médicales et les risques de contamination, ce qui en fait un élément essentiel des pratiques de santé modernes. En proposant une solution prête à l'emploi éliminant la préparation manuelle, ces seringues améliorent la sécurité et l'efficacité globales des procédures médicales. Les professionnels de santé bénéficient de la commodité des seringues préremplies , qui simplifient le processus d'administration de solution saline, en particulier dans les environnements à haute pression tels que les hôpitaux et les services d'urgence. La réduction des étapes liées au remplissage manuel minimise non seulement les risques d'erreurs de dosage, mais contribue également à prévenir la contamination croisée susceptible de survenir lors de l'utilisation de flacons multidoses. Par conséquent, les seringues préremplies de solution saline contribuent à l'amélioration des résultats pour les patients et à l'amélioration des normes de soins, renforçant ainsi leur adoption par les professionnels de santé. Cette attention accrue portée à la sécurité et à l'efficacité stimule la demande de seringues préremplies de solution saline sur le marché, les positionnant comme un facteur clé dans l'évolution continue de l'offre de dispositifs médicaux.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/emea-prefilled-syringes-market

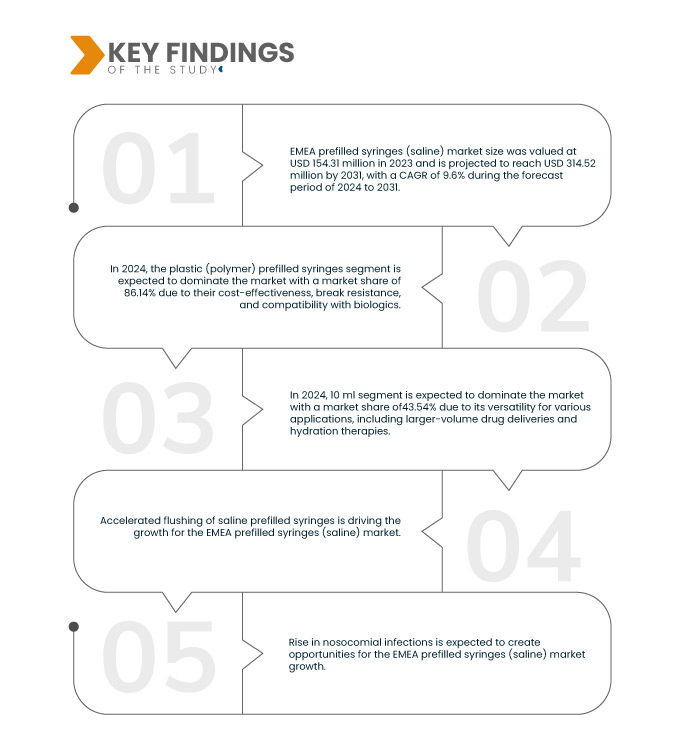

Data Bridge Market Research analyse que la taille du marché des seringues préremplies (solution saline) EMEA était évaluée à 154,31 millions USD en 2023 et devrait atteindre 314,52 millions USD d'ici 2031, avec un TCAC de 9,6 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Augmentation des infections nosocomiales

L'augmentation des infections nosocomiales représente une opportunité significative pour le développement des seringues préremplies de sérum physiologique sur le marché de la santé. Les sachets de sérum physiologique traditionnels peuvent contribuer aux infections nosocomiales en raison des risques de contamination lors de la préparation et de la manipulation. Face aux défis croissants posés par les infections nosocomiales, les hôpitaux et les établissements de santé accordent une importance accrue à la mise en œuvre de stratégies visant à améliorer la sécurité des patients et à réduire les risques d'infection. Les seringues préremplies de sérum physiologique offrent une solution convaincante dans ce contexte, car elles minimisent la manipulation de solutions stériles et réduisent le risque de contamination lors de la préparation et de l'administration des thérapies intraveineuses. Grâce à ces seringues, les professionnels de santé rationalisent leurs processus en éliminant les étapes inutiles susceptibles d'introduire des agents pathogènes dans les environnements stériles. Ceci est particulièrement crucial dans les unités de soins intensifs et les services chirurgicaux, où les patients vulnérables présentent un risque élevé d'infection. De plus, la qualité et la stérilité constantes des seringues préremplies de sérum physiologique disponibles dans le commerce sont conformes aux protocoles de contrôle des infections, ce qui en fait un choix privilégié pour le rinçage des voies intraveineuses et le maintien de la perméabilité des cathéters. À mesure que la sensibilisation à la prévention des infections augmente parmi les professionnels de la santé et les administrateurs, la demande de seringues salines préremplies est susceptible d’augmenter, car elles représentent une approche proactive pour réduire les infections nosocomiales.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Année historique

|

2022 (Personnalisable 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD

|

Segments couverts

|

Produit (seringues préremplies en plastique (polymère) et seringues préremplies en verre), capacité (5 ml, 10 ml, 20 ml et autres), emballage (100/boîte, 120/boîte, 60/boîte et autres), application (cancer, diabète, sclérose en plaques, thrombose, ophtalmologie, polyarthrite rhumatoïde , anaphylaxie, vaccins et autres), utilisateur final (établissements de santé, établissements de soins à domicile, pharmacies par correspondance, sociétés pharmaceutiques et biotechnologiques et autres)

|

Pays couverts

|

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Pays-Bas, Suisse, Turquie, Belgique, Danemark, Suède, Pologne, Norvège, Finlande, reste de l'Europe, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Bahreïn, Koweït, Oman, Qatar, Égypte, Israël et reste du Moyen-Orient et de l'Afrique

|

Acteurs du marché couverts

|

B. Braun SE (Allemagne), BD (États-Unis), MedXL Inc. (Pays-Bas), STI Group (Pays-Bas), Guerbet (France), Terumo Corporation (Japon), Fresenius Kabi AG (Allemagne), Polymedicure (Inde), AGUETTANT (France), Anhui Tiankang Medical Technology Co., Ltd. (Chine), Weigao Medical International Co., Ltd (Chine), Medline Industries, LP (États-Unis) et Nipro Medical Corporation (Japon), entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments

Le marché des seringues préremplies (solution saline) de la zone EMEA est segmenté en cinq segments notables en fonction du produit, de la capacité, de l'emballage, de l'application et de l'utilisateur final.

- Sur la base du produit, le marché des seringues préremplies (solution saline) de la zone EMEA est segmenté en seringues préremplies en plastique (polymère) et en seringues préremplies en verre.

En 2024, le segment des seringues préremplies en plastique (polymère) devrait dominer le marché des seringues préremplies (solution saline) de la zone EMEA.

En 2024, le segment des seringues préremplies en plastique (polymère) devrait dominer le marché avec une part de marché de 86,14 % en raison de leur rentabilité, de leur résistance à la rupture et de leur compatibilité avec les produits biologiques.

- Sur la base de la capacité, le marché des seringues préremplies (solution saline) de la zone EMEA est segmenté en 10 ml, 5 ml, 20 ml et autres

En 2024, le segment 10 ml devrait dominer le marché des seringues préremplies (solution saline) de la zone EMEA

En 2024, le segment de 10 ml devrait dominer le marché avec une part de marché de 43,54 % en raison de sa polyvalence pour diverses applications, notamment les administrations de médicaments à plus grand volume et les thérapies d'hydratation.

- En termes de conditionnement, le marché des seringues préremplies (salines) dans la région EMEA est segmenté en boîtes de 100, 120 et 60. En 2024, le segment des boîtes de 100 devrait dominer le marché avec une part de marché de 39,24 %.

- Sur la base de l'application, le marché des seringues préremplies (solution saline) de la zone EMEA est segmenté en cancer, diabète, sclérose en plaques, thrombose, ophtalmologie, polyarthrite rhumatoïde, anaphylaxie, vaccins et autres. En 2024, le segment du cancer devrait dominer le marché avec une part de marché de 26,75 %.

- En fonction de l'utilisateur final, le marché des seringues préremplies (solution saline) dans la région EMEA est segmenté entre établissements de santé, services de soins à domicile, pharmacies par correspondance, sociétés pharmaceutiques et biotechnologiques, etc. En 2024, le segment des établissements de santé devrait dominer le marché avec une part de marché de 35,43 %.

Acteurs majeurs

B. Braun SE (Allemagne), BD (États-Unis), MedXL Inc. (Pays-Bas) et STI Group (Pays-Bas) entre autres, sont les principaux acteurs du marché.

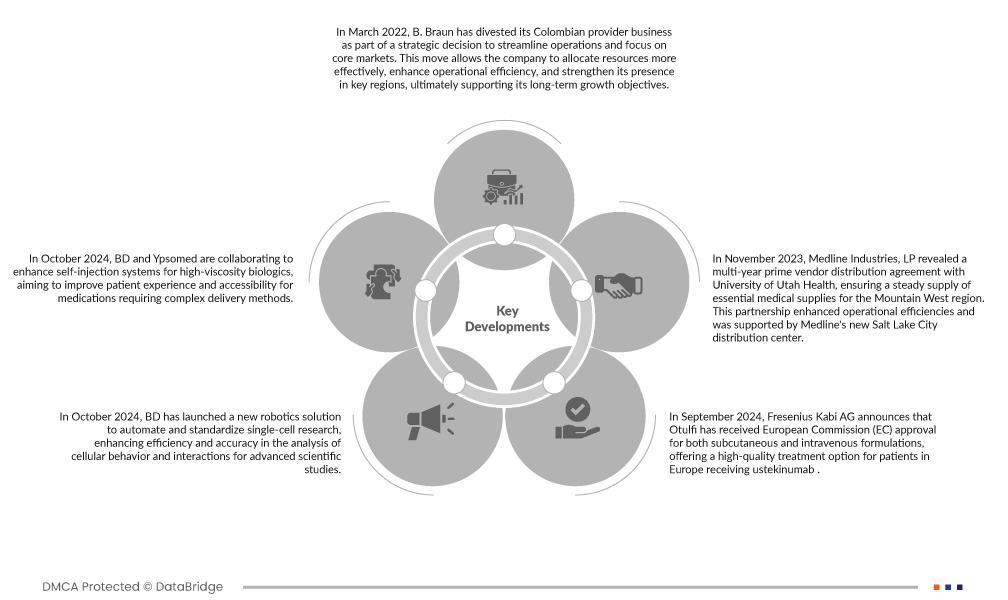

Évolution du marché

- En mars 2022, B. Braun a cédé son activité de fournisseur en Colombie dans le cadre d'une décision stratégique visant à rationaliser ses opérations et à se concentrer sur ses marchés clés. Cette décision permet à l'entreprise d'allouer ses ressources plus efficacement, d'améliorer son efficacité opérationnelle et de renforcer sa présence dans des régions clés, contribuant ainsi à ses objectifs de croissance à long terme.

- En octobre 2024, BD et Ypsomed collaborent pour améliorer les systèmes d'auto-injection de produits biologiques à haute viscosité, dans le but d'améliorer l'expérience des patients et l'accessibilité des médicaments nécessitant des méthodes d'administration complexes.

- En octobre 2024, BD a lancé une nouvelle solution robotique pour automatiser et standardiser la recherche sur les cellules uniques, améliorant ainsi l'efficacité et la précision de l'analyse du comportement et des interactions cellulaires pour les études scientifiques avancées.

- En novembre 2023, Medline Industries, LP a annoncé la signature d'un accord pluriannuel de distribution avec University of Utah Health, garantissant un approvisionnement régulier en fournitures médicales essentielles pour la région des montagnes de l'Ouest. Ce partenariat a permis d'améliorer l'efficacité opérationnelle et a bénéficié du soutien du nouveau centre de distribution de Medline à Salt Lake City.

- En avril 2022, Terumo Corporation a rebaptisé sa division « General Hospital Company » en « Medical Care Solutions Company », à compter du 1er avril 2022. Ce changement s'inscrit dans la stratégie de croissance quinquennale de Terumo (GS26), dans un contexte de transition vers les soins à domicile et les traitements personnalisés. La nouvelle marque, Terumo Medical Care Solutions (TMCS), reflète l'engagement de l'entreprise à améliorer l'efficacité et la sécurité des soins de santé, en s'appuyant sur son expertise centenaire en produits médicaux et en se diversifiant dans le traitement du diabète et les technologies d'administration de médicaments.

Analyse régionale

Géographiquement, les pays couverts par le rapport sur le marché des seringues préremplies (solution saline) EMEA sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Russie, les Pays-Bas, la Suisse, la Turquie, la Belgique, le Danemark, la Suède, la Pologne, la Norvège, la Finlande, le reste de l'Europe, l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, Bahreïn, le Koweït, Oman, le Qatar, l'Égypte, Israël et le reste du Moyen-Orient et de l'Afrique.

Selon l'analyse de Data Bridge Market Research :

La région Europe devrait dominer le marché des seringues préremplies (salines) de la zone EMEA

La région Europe devrait dominer le marché en raison de son infrastructure de soins de santé avancée, de son adoption élevée de technologies médicales innovantes et de l'accent croissant mis sur les soins centrés sur le patient, ce qui stimule la demande de solutions d'accès intraveineux efficaces et fiables.

Pour plus d'informations sur le rapport sur le marché des seringues préremplies (solution saline) de la région EMEA, cliquez ici : https://www.databridgemarketresearch.com/reports/emea-prefilled-syringes-market