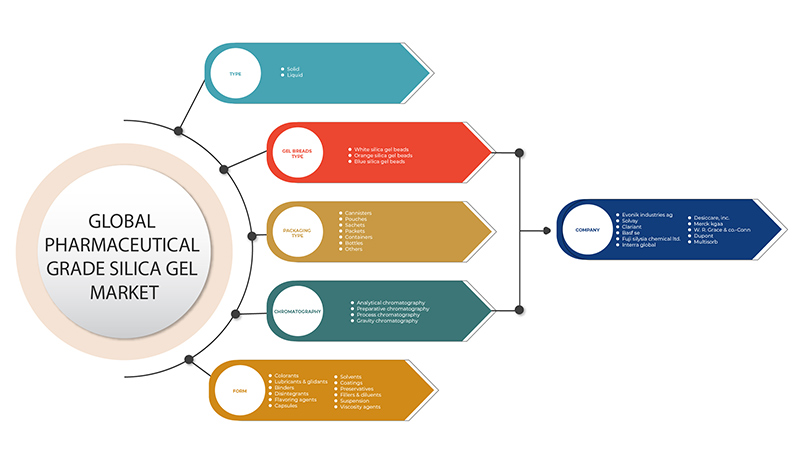

Mercado mundial de gel de sílice de grado farmacéutico , por tipo (líquido y sólido), tipo de pan de gel (pan de gel de sílice blanco, pan de gel de sílice naranja y pan de gel de sílice azul), forma (colorantes, lubricantes y deslizantes, aglutinantes, desintegrantes, agentes aromatizantes, cápsulas, disolventes, recubrimientos, conservantes, rellenos y diluyentes, suspensiones, agentes de viscosidad y otros), tipo de embalaje (botes, bolsas, sobres, paquetes, contenedores, botellas y otros), cromatografía (cromatografía analítica, cromatografía preparativa, cromatografía de proceso y cromatografía de gravedad), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado

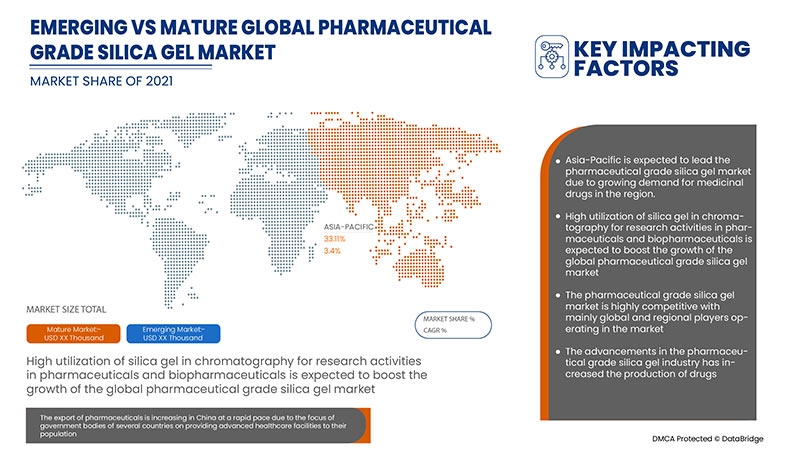

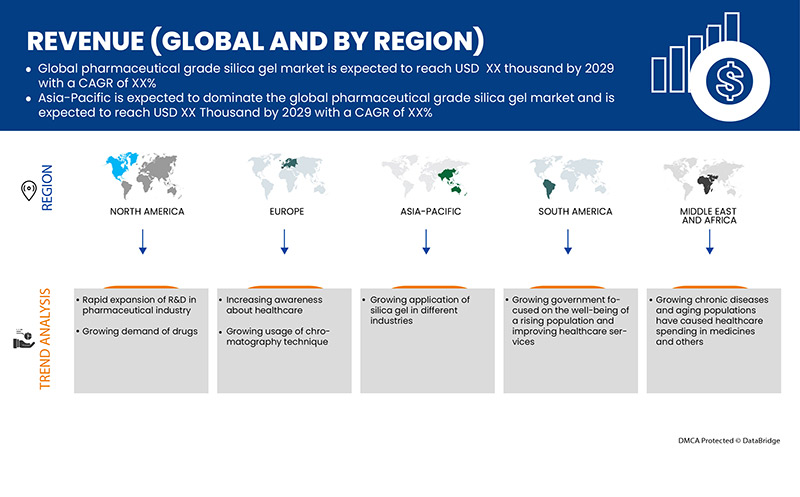

Se espera que el mercado mundial de gel de sílice de grado farmacéutico gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 3,1% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 158.681,13 mil para 2029. El principal factor que impulsa el crecimiento del mercado de gel de sílice de grado farmacéutico es la creciente demanda de medicamentos , el amplio despliegue de I+D en el sector farmacéutico y el aumento del gasto en biotecnología mediante cromatografía para detectar componentes moleculares.

El gel de sílice como fase estacionaria es ampliamente aceptado como uno de los mejores adsorbentes utilizados en la cromatografía en columna, así como en otras técnicas de separación. Una de las principales ventajas es su enorme afinidad por la adsorción. Además, se encuentra disponible comercialmente en varios tamaños y tipos diferentes. La principal razón importante para utilizar el gel de sílice como fase estacionaria en la cromatografía en columna es que permite obtener el tamaño esencial de extracto del tamaño de partícula para un método en particular.

El gel de sílice es un adsorbente polar ligeramente ácido que tiene una gran capacidad para adsorber sustancias básicas. El gel de sílice se utiliza más ampliamente en cromatografía de partición en fase inversa y tiene amplias aplicaciones que consisten en la separación de esteroides, aminoácidos, lípidos, alcaloides y varios procesos farmacéuticos.

El informe de mercado global de gel de sílice de grado farmacéutico proporciona detalles de la participación de mercado, nuevos desarrollos, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD, volúmenes en kilotoneladas, precios en USD |

|

Segmentos cubiertos |

Por tipo (líquido y sólido), tipo de pan de gel (pan de gel de sílice blanco, pan de gel de sílice naranja y pan de gel de sílice azul), forma (colorantes, lubricantes y deslizantes, aglutinantes, desintegrantes, agentes aromatizantes, cápsulas, disolventes, recubrimientos, conservantes, rellenos y diluyentes, suspensiones, agentes de viscosidad y otros), tipo de embalaje (botes, bolsas, sobres, paquetes, contenedores, botellas y otros), cromatografía (cromatografía analítica, cromatografía preparativa, cromatografía de proceso y cromatografía de gravedad) |

|

Países cubiertos |

EE. UU., Canadá y México, Reino Unido, Italia, Francia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Alemania, resto de Europa, Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Sudáfrica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Israel y resto de Medio Oriente y África. |

|

Actores del mercado cubiertos |

BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical |

Dinámica del mercado del gel de sílice de grado farmacéutico

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Demanda creciente de medicamentos

La creciente industria farmacéutica ha impulsado el crecimiento de la producción de medicamentos, lo que ha aumentado el consumo de gel de sílice a lo largo de los años. Se espera que la demanda de gel de sílice aumente aún más, ya que se puede realizar cromatografía con gel de sílice. La cromatografía en columna de gel de sílice se utiliza ampliamente en la industria farmacéutica para recolectar o separar diferentes componentes de medicamentos.

- Amplio despliegue de I+D en el sector farmacéutico

La creciente necesidad de integridad de datos y automatización ha llevado a la integración de software sofisticado con los sistemas de cromatografía contemporáneos. Estos avances en la tecnología para el desarrollo de sistemas mejorados, columnas innovadoras y desechables, resinas de mejor rendimiento y otros accesorios pueden ayudar a que el mercado crezca significativamente.

- Aumenta el gasto en biotecnología que utiliza cromatografía para detectar componentes moleculares

La bioencapsulación implica envolver tejidos o sustancias biológicamente activas en una membrana semipermeable para proteger las estructuras biológicas encerradas, como células, enzimas, fármacos y materiales magnéticos, entre otros. La investigación y el desarrollo continuos de técnicas basadas en gel de sílice, como la cromatografía, desde el punto de vista biotecnológico conducirán al crecimiento del mercado mundial de gel de sílice de grado farmacéutico.

Oportunidades

- Perspectivas lucrativas para la I+D interna

La cromatografía es una técnica en constante evolución y el aumento de la demanda de instrumentos y reactivos de cromatografía para investigación y desarrollo es un factor importante que impulsa el crecimiento y la demanda del mercado mundial de gel de sílice de grado farmacéutico.

- Fácil disponibilidad de materias primas a través de socios estratégicos bien establecidos

La forma amorfa del dióxido de silicio se utiliza para fabricar gel de sílice de uso farmacéutico. La enorme disponibilidad de diferentes materias primas en la superficie de la Tierra, así como la capacidad de producirlas sintéticamente, junto con las asociaciones bien establecidas de las empresas que producen gel de sílice de calidad farmacéutica con varios proveedores y socios, que continuamente suministran materias primas de alta calidad a estos actores para la producción de gel de sílice.

Restricciones/Desafíos

- Regulaciones estrictas por parte del Gobierno

Las normas de la USP para medicamentos son de obligado cumplimiento en los EE. UU. por parte de la Administración de Alimentos y Medicamentos (FDA) y también se utilizan en más de 140 países de todo el mundo. En la Ley de Farmacia de 1948 de la India, existen varias normas estrictas sobre la composición de los medicamentos, que exigen que los farmacéuticos y químicos sigan diversos procedimientos y pruebas para obtener la aprobación del gobierno. Estas normas y normas estrictas pueden ser una de las mayores limitaciones a las que se enfrenta el mercado mundial del gel de sílice de calidad farmacéutica.

- La disponibilidad de sustitutos

Los silanoles libres en la superficie de la sílice son responsables de interacciones perjudiciales entre estos compuestos y la fase estacionaria. Estos presentan una forma de pico deficiente y una baja eficiencia. Esto también ha inclinado a los fabricantes a optar por sustitutos presentes en el mercado. Por estas razones, se están introduciendo en el mercado varias fases estacionarias nuevas, como las fases estacionarias sin sílice, que tienen silanoles reducidos y/o protegidos.

- Los productos farmacéuticos cumplen con estrictos estándares de control de calidad y rendimiento

En todo el mundo, todos los gobiernos destinan una proporción sustancial de su presupuesto total de salud a medicamentos y productos farmacéuticos. En los países en desarrollo, se dedican considerables esfuerzos administrativos y técnicos a garantizar que los pacientes y consumidores reciban medicamentos eficaces y de buena calidad sin comprometer la calidad.

- Ámbito de aplicación limitado a compuestos no volátiles

La temperatura del sistema que utiliza gel de sílice para compuestos volátiles debe mantenerse a niveles bajos para que el compuesto no se vaporice muy rápido y haya una pérdida total de la muestra antes de que se utilice y se separe mediante la placa de gel de sílice. Por lo tanto, el alcance de la aplicación del gel de sílice se limita a compuestos no volátiles, lo que puede desafiar el crecimiento del mercado mundial de gel de sílice de grado farmacéutico.

Desarrollo reciente

- En febrero, DuPont lanzó un nuevo portal de ventas en línea para satisfacer las necesidades de los compradores de la industria de bioprocesamiento. El bioprocesamiento de DuPont permite separaciones y purificaciones sofisticadas para productos terapéuticos, y las diferentes marcas de DuPont, como AmberChrom y AmberLite, están muy bien establecidas en la industria biofarmacéutica.

Alcance del mercado mundial de gel de sílice de grado farmacéutico

El mercado mundial de gel de sílice de grado farmacéutico se clasifica en función del tipo, el tipo de gel, la forma, el tipo de envase y la cromatografía. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Sólido

- Líquido

Según el tipo, el mercado global de gel de sílice de grado farmacéutico está segmentado en sólido y líquido.

Panes tipo gel

- Panes de gel de sílice blanco

- Panes de gel de sílice de color naranja

- Panes de gel de sílice azul

Sobre la base del tipo de pan de gel, el mercado global de gel de sílice de grado farmacéutico está segmentado en pan de gel de sílice blanco, pan de gel de sílice naranja y pan de gel de sílice azul.

Forma

- Rellenos y diluyentes

- Carpetas

- Desintegrantes

- Lubricantes y deslizantes

- Colorantes

- Agentes aromatizantes

- Conservantes

- Disolventes

- Cápsulas

- Agentes de viscosidad

- Suspensión

- Recubrimientos

Sobre la base de la forma, el mercado global de gel de sílice de grado farmacéutico está segmentado en colorantes, lubricantes y deslizantes, aglutinantes, desintegrantes, agentes aromatizantes, cápsulas, solventes, recubrimientos, conservantes, rellenos y diluyentes, suspensiones, agentes de viscosidad y otros hospitales y clínicas, centros de diagnóstico, institutos académicos y otros.

Tipo de embalaje

- Bolsas

- Bolsitas

- Paquetes

- Botes

- Contenedores

- Botellas

- Otros

Según el tipo de embalaje, el mercado mundial de gel de sílice de grado farmacéutico se segmenta en botes, bolsas, sobres, paquetes, contenedores, botellas y otros.

Cromatografía

- Cromatografía analítica

- Cromatografía preparativa

- Cromatografía de procesos

Sobre la base de la cromatografía, el mercado global de gel de sílice de grado farmacéutico está segmentado en cromatografía analítica, cromatografía preparativa, cromatografía de proceso y cromatografía de gravedad.

Análisis y perspectivas regionales del mercado de gel de sílice de grado farmacéutico

Se analiza el mercado de gel de sílice de grado farmacéutico y se proporcionan información y tendencias del tamaño del mercado por país, tipo, tipo de pan de gel, forma, tipo de empaque y cromatografía como se mencionó anteriormente.

Global pharmaceutical-grade silica gel market is further segmented into North America, South America, Asia-Pacific, Europe, and the Middle East and Africa. North America is segmented into U.S., Canada, and Mexico. Europe is segmented into Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, and the rest of Europe. Asia-Pacific is segmented into Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, New Zealand, and the rest of Asia-Pacific. South America is segmented into Brazil, Argentina, and the rest of South America. The Middle East and Africa is segmented into South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the rest of the Middle East and Africa.

Asia-Pacific dominates the pharmaceutical-grade silica gel market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and well-developed healthcare infrastructure in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Pharmaceutical Grade Silica Gel Market Share Analysis

Global pharmaceutical grade silica gel market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the pharmaceutical grade silica gel market.

Some of the prominent participants operating in the global pharmaceutical grade silica gel market are BASF SE, DuPont, Solvay, Merck KGAA, W. R. Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical.

Research Methodology

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, el análisis global frente al regional y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGY ADVANCEMENTS

4.6 REGULATORY COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL PROCUREMENT

4.7.2.1 MANUFACTURING AND PACKING

4.7.2.2 MARKETING AND DISTRIBUTION

4.7.2.3 END USERS

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 GLOBAL

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR MEDICINAL DRUGS

6.1.2 EXTENSIVE DEPLOYMENT OF R&D IN THE PHARMA SECTOR

6.1.3 RISING EXPENSES ON BIOTECHNOLOGY USING CHROMATOGRAPHY FOR DETECTING MOLECULAR COMPONENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS BY THE GOVERNMENT

6.2.2 AVAILABILITY OF SUBSTITUTES

6.2.3 RESTRICTIONS ON DERMAL AND ORAL EXPOSURE TO PHARMACEUTICAL GRADE SILICA GEL

6.2.4 HIGH PRICE OF SILICA GEL

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS IN-HOUSE R&D

6.3.2 EASY AVAILABILITY OF RAW MATERIALS THROUGH WELL-ESTABLISHED STRATEGIC PARTNERS

6.4 CHALLENGES

6.4.1 PHARMACEUTICAL ITEMS MEET STRINGENT QUALITY CONTROL AND PERFORMANCE STANDARDS

6.4.2 LIMITED APPLICATION SCOPE TO NON-VOLATILE COMPOUNDS

7 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 SOLID

7.3 LIQUID

8 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE

8.1 OVERVIEW

8.2 WHITE SILICA GEL BEADS

8.3 ORANGE SILICA GEL BEADS

8.4 BLUE SILICA GEL BEADS

9 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM

9.1 OVERVIEW

9.2 FILLERS & DILUENTS

9.3 BINDERS

9.4 DISINTEGRANTS

9.5 LUBRICANTS & GLIDANTS

9.6 COLORANTS

9.7 FLAVORING AGENTS

9.8 PRESERVATIVES

9.9 SOLVENTS

9.1 CAPSULES

9.11 VISCOSITY AGENTS

9.12 SUSPENSION

9.13 COATINGS

10 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 POUCHES

10.3 SACHETS

10.4 PACKETS

10.5 CANISTERS

10.6 CONTAINERS

10.7 BOTTLES

10.8 OTHERS

11 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY

11.1 OVERVIEW

11.2 ANALYTICAL CHROMATOGRAPHY

11.3 PREPARATIVE CHROMATOGRAPHY

11.4 PROCESS CHROMATOGRAPHY

11.5 GRAVITY CHROMATOGRAPHY

12 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION

12.1 OVERVIEW

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 FRANCE

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 CHINA

12.3.2 INDIA

12.3.3 JAPAN

12.3.4 SOUTH KOREA

12.3.5 SINGAPORE

12.3.6 AUSTRALIA & NEW ZEALAND

12.3.7 THAILAND

12.3.8 MALAYSIA

12.3.9 INDONESIA

12.3.10 PHILIPPINES

12.3.11 REST OF ASIA-PACIFIC

12.4 MIDDLE EAST AND AFRICA

12.4.1 U.A.E.

12.4.2 SAUDI ARABIA

12.4.3 EGYPT

12.4.4 SOUTH AFRICA

12.4.5 ISRAEL

12.4.6 REST OF MIDDLE EAST AND AFRICA

12.5 NORTH AMERICA

12.5.1 U.S.

12.5.2 CANADA

12.5.3 MEXICO

12.6 SOUTH AMERICA

12.6.1 BRAZIL

12.6.2 ARGENTINA

12.6.3 REST OF SOUTH AMERICA

13 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.4.1 COLLABORATIONS

13.4.2 EXPANSIONS

13.4.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 SOLVAY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 MERCK KGAA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 W. R. GRACE & CO.-CONN

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 EVONIK INDUSTRIES AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 CLARIANT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 DESICCARE, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 FUJI SILYSIA CHEMICAL LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 INTERRA GLOBAL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 MULTISORB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 GLOBAL SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 GLOBAL LIQUID IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL LIQUID IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL WHITE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 GLOBAL ORANGE SILICA GEL BEADS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL BLUE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL FILLERS & DILUENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 GLOBAL BINDERS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL DISINTEGRANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 GLOBAL LUBRICANTS & GLIDANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL COLORANTS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 GLOBAL FLAVORING AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL PRESERVATIVES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 GLOBAL SOLVENTS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL CAPSULES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 GLOBAL VISCOSITY AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL SUSPENSION IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 GLOBAL COATINGS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 GLOBAL POUCHES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL SACHETS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 GLOBAL PACKETS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL CANISTERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 GLOBAL CONTAINERS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL BOTTLES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 GLOBAL OTHERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 36 GLOBAL ANALYTICAL CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL PREPARATIVE CHROMATOGRAPHY IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 GLOBAL PROCESS CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL GRAVITY CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 42 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 44 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 46 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 50 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 52 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 56 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 58 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 60 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 64 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 68 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 70 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 74 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 76 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 78 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 80 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 82 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 86 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 88 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 92 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 96 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 98 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 100 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 102 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 104 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 106 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 108 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 110 REST OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 REST OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 112 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 113 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 114 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 120 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 122 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 126 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 128 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 130 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 132 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 134 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 136 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 138 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 140 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 142 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 144 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 146 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 148 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 150 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 152 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 154 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 156 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 160 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 162 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 164 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 166 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 168 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 170 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 172 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 174 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 176 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 178 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 180 REST OF ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 REST OF ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 182 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 184 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 186 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 190 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 191 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 193 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 194 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 195 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 196 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 198 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 200 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 201 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 202 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 204 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 206 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 208 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 210 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 211 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 212 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 214 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 215 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 216 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 218 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 219 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 220 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 221 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 222 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 223 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 224 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 226 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 228 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 230 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 232 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 233 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 234 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 235 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 236 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 237 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 238 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 239 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 240 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 241 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 242 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 243 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 244 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 245 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 246 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 247 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 248 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 249 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 250 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 251 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 252 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 253 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 254 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 255 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 256 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 257 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 258 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 259 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 260 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 261 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 262 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 263 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 264 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 265 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 266 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 267 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 268 REST OF SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 269 REST OF SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, TYPE, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 2 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: TYPE LIFE LINE CURVE

FIGURE 7 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: CHALLENGE MATRIX

FIGURE 11 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 GROWING DEMAND FOR MEDICINAL DRUGS IS EXPECTED TO DRIVE GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET IN THE FORECAST PERIOD

FIGURE 15 SOLID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET IN 2022 & 2029

FIGURE 16 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR PHARMACEUTICAL GRADE SILICA GEL MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 17 SUPPLY CHAIN ANALYSIS- GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 20 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE, 2021

FIGURE 21 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY GEL BEADS TYPE, 2021

FIGURE 22 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY FORM, 2021

FIGURE 23 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY PACKAGING TYPE, 2021

FIGURE 24 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY CHROMATOGRAPHY, 2021

FIGURE 25 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: SNAPSHOT (2021)

FIGURE 26 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET : BY REGION (2021)

FIGURE 27 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY REGION (2022 & 2029)

FIGURE 28 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY REGION (2021 & 2029)

FIGURE 29 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 30 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 31 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 35 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 40 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 41 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 42 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 45 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SNAPSHOT (2021)

FIGURE 46 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 47 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 50 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 51 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 52 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 55 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.