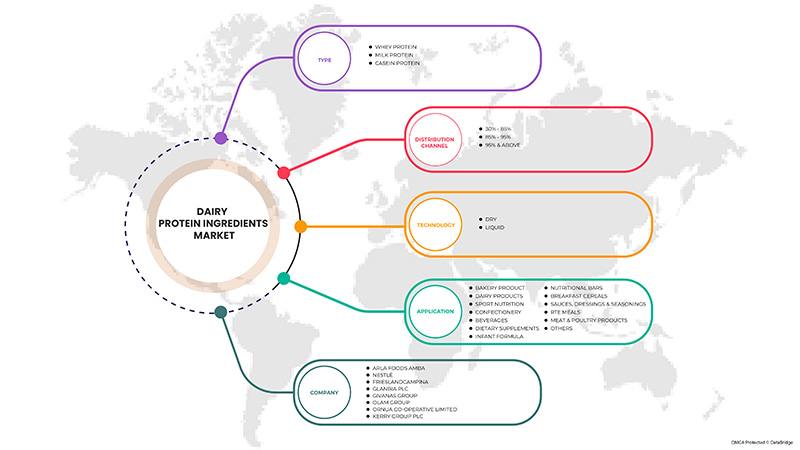

Mercado de ingredientes de proteína de leche láctea de África occidental, por tipo (proteína de suero, proteína de leche y proteína de caseína), contenido (30% - 85%, 85% - 95% y 95% y más), forma (seca y líquida), aplicación (producto de panadería, productos lácteos, nutrición deportiva, confitería, bebidas, suplementos dietéticos, fórmula infantil, barras nutricionales, cereales para el desayuno, salsas, aderezos y condimentos, comidas RTE, productos de carne y aves de corral y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de ingredientes proteicos lácteos de África occidental

Los ingredientes de proteína de leche de vaca son los ingredientes que se pueden utilizar para dar la textura adecuada a los productos lácteos. También tienen una calidad aglutinante que une todo el valor nutricional de los alimentos. Estos son muy ricos en proteínas, lo que ayuda a proporcionar una mejor calidad de dieta a los seres humanos. Las proteínas lácteas también son un ingrediente en la fórmula infantil para proporcionar una mejor nutrición a los recién nacidos en su etapa de crecimiento. Estas proteínas tienen muchas aplicaciones en productos de panadería, bebidas, helados y otros. Para satisfacer la demanda, los fabricantes se centran en proporcionar productos con ingredientes lácteos en el mercado.

Estos ingredientes de proteína láctea se utilizan en la elaboración de productos de panadería, confitería, comidas listas para comer, salsas, aderezos y condimentos, bebidas, productos lácteos, cereales para el desayuno, barras nutricionales, nutrición deportiva, productos cárnicos y avícolas, suplementos dietéticos , fórmulas infantiles y otros. Data Bridge Market Research analiza que se espera que el mercado de ingredientes de proteína láctea alcance el valor de USD 219.130,04 mil para el año 2029, a una CAGR del 11,0% durante el período de pronóstico. "Panadería" representa el segmento de aplicación más destacado. El informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios y análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo (proteína de suero, proteína de leche y proteína de caseína), contenido (30% - 85%, 85% - 95% y 95% y más), forma (seca y líquida), aplicación (producto de panadería, productos lácteos, nutrición deportiva , confitería, bebidas, suplementos dietéticos, fórmula infantil, barras nutricionales , cereales para el desayuno, salsas , aderezos y condimentos, comidas listas para comer, productos cárnicos y avícolas y otros) |

|

Países cubiertos |

Nigeria, Ghana, Benín, Liberia y el resto de África occidental |

|

Actores del mercado cubiertos |

Arla Foods, Nestlé, FrieslandCampina, Glanbia PLC, GIVANAS GROUP, Olam Group, Ornua Co-operative Limited y Kerry Group plc |

Definición de mercado

Los ingredientes de proteína láctea son ingredientes secos con altas propiedades nutricionales que liberan péptidos en el cuerpo humano para fortalecer el metabolismo. La proteína láctea tiene varios ingredientes, que incluyen proteína de leche, proteína de suero, caseína y caseinatos. Está disponible en proteína de suero, proteína de leche y proteína de caseína. La proteína de suero se usa mucho para el rendimiento deportivo y la mejora corporal. La proteína de leche se usa típicamente como fórmula infantil, ya que ayuda al bebé a obtener las proteínas vitales importantes para su crecimiento. La proteína de caseína se usa para minimizar la degradación muscular y mejorar el crecimiento muscular.

El COVID-19 tuvo un impacto mínimo en el mercado de ingredientes de proteína láctea

EspañolLa COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y restricciones en el transporte. Debido al cierre, el mercado de ingredientes de proteína láctea ha experimentado un impacto significativo en la importación y exportación de productos con ingredientes de proteína láctea en los últimos años. Debido al brote de COVID-19, el sector agrícola se vio afectado negativamente. Alrededor de 5 millones de personas se empobrecieron en Nigeria debido a las tasas de infección, la gravedad de la enfermedad y la mortalidad. Para la seguridad de las personas, se impusieron limitaciones a la producción agrícola, el comercio agrícola internacional y el acceso seguro a dietas saludables para todas las personas. Pero con el desarrollo de COVID-19, surgieron desafíos en África Occidental para reiniciar la producción y la fuerza laboral agrícola, que ya tenía un perfil nutricional y de salud relativamente pobre. Con la creciente demanda de alimentos saludables entre los consumidores de África Occidental, aumentó la necesidad de ingredientes de proteína láctea.

La dinámica del mercado de ingredientes de proteína láctea incluye:

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, los desafíos y las limitaciones del mercado. Todo esto se analiza en detalle a continuación:

Factores impulsores del mercado de ingredientes de proteína láctea

- Aumento de la importancia de la nutrición deportiva

El consumo de nutrición deportiva no se limita a los atletas profesionales o deportistas, sino que también lo consumen ampliamente los millennials y las generaciones más jóvenes para desarrollar un cuerpo y mantenerse saludables. La demanda de energía, fuerza y salud muscular está aumentando en casi todos los grupos de edad, como los millennials y las personas mayores. Esta nutrición proporciona altos niveles de energía y se consume antes o después del entrenamiento. Por lo tanto, es probable que la creciente conciencia sobre la actividad física en personas de todos los grupos de edad impulse el uso de la nutrición deportiva, lo que conducirá a una mayor demanda de ingredientes de proteína láctea.

- Crecimiento de la demanda de productos de panadería y lácteos

Algunos productos de panadería y lácteos se elaboran con proteínas lácteas, lo que aumenta el factor nutricional de los productos. Las proteínas de suero, leche y caseína se utilizan para elaborar productos con diversas aplicaciones, como pan, pasteles, bollería, galletas y galletas saladas, glaseados, rellenos y glaseados. La proteína de suero se utiliza en panadería por sus propiedades emulsionantes, espumantes, gelificantes, estabilizadoras, colorantes y nutricionales, y se utiliza como sustituto de las claras de huevo. La demanda de baguettes está aumentando ampliamente en África occidental, lo que contribuye al crecimiento de los productos de panadería en la región. Varios productos lácteos, como yogures, quesos y helados, se elaboran con proteínas lácteas. El suero se utiliza para producir quesos de suero, como ricota, brunost y mantequilla.

- Fuerte demanda de ingredientes de proteína láctea para resolver un importante problema de la dieta humana

A medida que los africanos se vuelven cada vez más conscientes de los riesgos para la salud, han comenzado a cambiar su estilo de vida. El aumento de la conciencia sobre los principales problemas dietéticos humanos ha contribuido a la presencia de gimnasios y al consumo de proteínas lácteas en las regiones. La gente recurre al ejercicio para tener un corazón sano o para tratar afecciones médicas específicas como la hipertensión, la diabetes, la obesidad y el cáncer. Con el gimnasio, la gente consume más ingredientes de proteínas lácteas para su salud. Por lo tanto, la fuerte demanda de ingredientes de proteínas lácteas para los principales problemas dietéticos humanos es un impulsor del mercado.

La oportunidad para el mercado de ingredientes proteicos lácteos

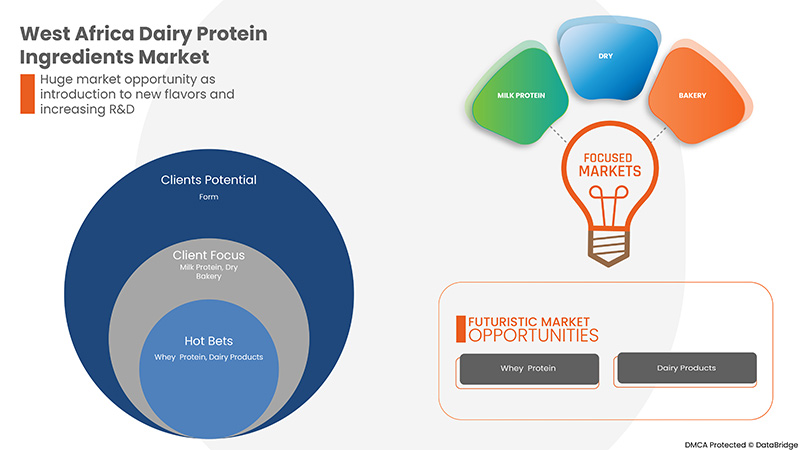

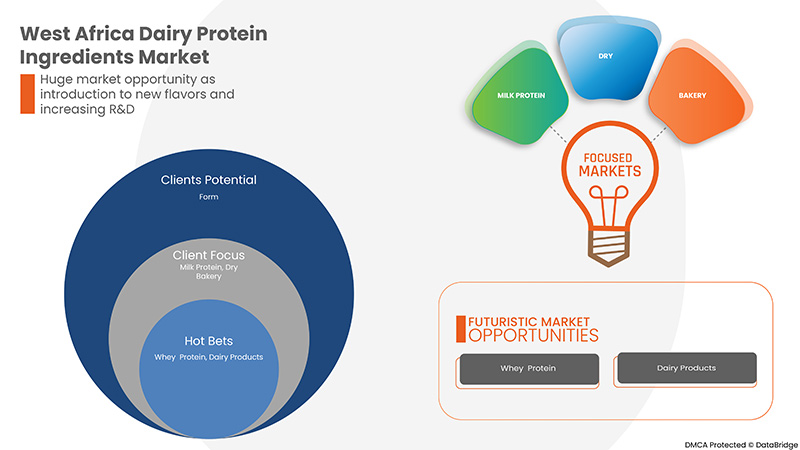

- Introducción de nuevos sabores y aumento de la I+D

Los hábitos alimentarios actuales han reducido la ingesta diaria de micronutrientes a cantidades inferiores a las recomendadas. Debido a esto, la necesidad de enriquecer los alimentos o los productos lácteos está aumentando rápidamente. Los nuevos avances en la tecnología alimentaria están ayudando a los fabricantes a aumentar la vida útil y las propiedades del producto. Los fabricantes dedicados a producir ingredientes de proteína láctea se centraron en la I+D. Algunos trabajan con empresas emergentes innovadoras y marcas de consumo multinacionales bien establecidas para lanzar productos exitosos con proteínas nutritivas de alta calidad. Por lo tanto, la introducción de nuevos sabores y el aumento de la I+D es una oportunidad para contribuir al crecimiento del mercado de ingredientes de proteína láctea.

Restricciones y desafíos que enfrenta el mercado de ingredientes proteicos lácteos

- Profunda preocupación por la intolerancia a la lactosa y las alergias a la leche

El consumo de productos lácteos ha aumentado más rápidamente entre los consumidores. Además, la creciente demanda de ingredientes de proteína láctea es uno de los factores importantes para el crecimiento de la industria láctea. Sin embargo, la creciente incidencia de la intolerancia a la lactosa reducirá la ingesta de ingredientes de proteína láctea. La intolerancia a la lactosa es un trastorno en el que el individuo tiene una capacidad deteriorada para digerir la lactosa de los productos lácteos. La intolerancia a la lactosa ha aumentado entre la población. Por lo tanto, el aumento de la tolerancia a la lactosa impedirá el crecimiento del mercado de ingredientes de proteína láctea. Además, una población específica sufre alergias a la leche, que son causadas principalmente por dos proteínas de la leche, la caseína y el suero. Debido a las alergias a la leche, las personas pueden sufrir sibilancias, vómitos, urticaria y problemas digestivos y, a veces, pueden llegar a ser mortales.

- Una amenaza creíble de sustitutos, principalmente ingredientes proteicos de origen vegetal

La mayoría de los seres humanos suelen dejar de producir lactasa después del destete y, como resultado, se vuelven intolerantes a la lactosa. Por lo tanto, el creciente número de intolerantes a la lactosa conduce a la demanda de productos que puedan reemplazar el valor nutricional de los productos lácteos. Esto ha aumentado el consumo de proteínas de origen vegetal en lugar de productos lácteos. Estos ingredientes de proteína vegetal actúan como un sustituto de los ingredientes de proteína láctea, lo que se espera que obstaculice el crecimiento del mercado de ingredientes de proteína láctea de África Occidental en el período de pronóstico.

- Incertidumbre en el suministro y los precios de la leche cruda

Varios factores han afectado al suministro de leche en África Occidental, como el clima, la calidad del suelo, la baja productividad animal y la falta de inversión. El desarrollo de la producción de leche en África Occidental es insuficiente para el mercado local y la leche se importa del mercado europeo. Las empresas que fabrican ingredientes proteínicos lácteos tienen dificultades para juzgar correctamente el riesgo de grandes fluctuaciones en la leche como materia prima. Si el aumento de los costos de la materia prima y la disminución de los precios de venta ocurren al mismo tiempo, entonces la rentabilidad de la empresa disminuye gradualmente. Los costos de la materia prima altamente fluctuantes y la gestión ineficaz de los precios pueden poner en grave peligro el éxito de las empresas. Por lo tanto, se espera que la incertidumbre en el suministro y los precios esenciales de la leche desafíe el crecimiento del mercado de ingredientes proteínicos lácteos.

Este informe sobre el mercado de ingredientes de proteína láctea de África occidental proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de ingredientes de proteína láctea, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En septiembre de 2021, Arla Foods Ingredients, de Arla Foods amba, lanzó Lacprodan MFGM-10, el primer ingrediente MFGM (membrana de glóbulos de grasa de leche) para el mercado mundial de fórmulas infantiles. Es rico en fosfolípidos y gangliósidos. Esto ayudó a la empresa a producir más recetas a partir de un polvo base y a aumentar su cartera de productos.

- En agosto de 2020, Glanbia Nutritionals de Glanbia PLC anunció la adquisición de Foodarom, un diseñador y fabricante de sabores personalizados con sede en Canadá que brinda servicios a las industrias de alimentos, bebidas y productos nutricionales con sabores llave en mano y soporte de formulación. Esto ayudó a la empresa a aumentar su negocio y sus ingresos.

Alcance del mercado de ingredientes proteicos lácteos en África occidental

El mercado de ingredientes de proteínas lácteas de África occidental está segmentado en función del tipo, el contenido, la forma y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Proteína de suero

- Proteína de la leche

- Proteína caseína

Según el tipo, el mercado de ingredientes de proteína láctea de África Occidental está segmentado en proteína de suero, proteína de leche y proteína de caseína.

Contenido

- 30% - 85%

- 85% - 95%

- 95% y más

Según el contenido, el mercado de ingredientes de proteína láctea de África occidental está segmentado en 30% - 85%, 85% - 95% y 95% y más.

Forma

- Líquido

- Seco

Sobre la base de la forma, el mercado de ingredientes de proteínas lácteas de África Occidental está segmentado en seco y líquido.

Solicitud

- Panadería

- Productos lácteos

- Nutrición deportiva

- Confitería

- Suplementos dietéticos

- Fórmula infantil

- Barra nutricional

- Cereales para el desayuno

- Salsas, aderezos y condimentos

- Comidas RTE

- Productos cárnicos y avícolas

- Bebidas

- Otros

Según la aplicación, el mercado de ingredientes de proteínas lácteas de África Occidental está segmentado en panadería, productos lácteos, nutrición deportiva, confitería, suplementos dietéticos, fórmulas infantiles, barras nutricionales, cereales para el desayuno, salsas, aderezos y condimentos, comidas RTE, productos de carne y aves de corral, bebidas y otros (si los hay).

Análisis y perspectivas regionales del mercado de ingredientes de proteínas lácteas de África occidental

Se analiza el mercado de ingredientes de proteínas lácteas de África occidental y se proporcionan información y tendencias del tamaño del mercado por país, tipo, contenido, forma y aplicación, como se menciona anteriormente.

Los países cubiertos son Nigeria, Ghana, Benin, Liberia y el resto de África Occidental. Nigeria domina el mercado de ingredientes de proteína láctea de África Occidental debido a su gran población, lo que crea una gran base de clientes en la región para el mercado de ingredientes de proteína láctea.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación del mercado que influyen en las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de África Occidental y los desafíos que enfrentan debido a la competencia significativa o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los ingredientes de proteína láctea en África occidental

El panorama competitivo del mercado de ingredientes de proteínas lácteas de África occidental proporciona detalles de los competidores. Los componentes incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en África occidental, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos y la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas asociado con el mercado de ingredientes de proteínas lácteas de África occidental.

Arla Foods amba domina el mercado de ingredientes de proteínas lácteas de África occidental. Algunos de los principales actores que operan en el mercado de ingredientes de proteínas lácteas son Nestlé, FrieslandCampina, Glanbia PLC, GIVANAS GROUP, Olam Group, Ornua Co-operative Limited, Kerry Group plc, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER-LEVEL TRENDS

4.2.1 CONSUMER NUTRITIONAL PREFERENCES

4.2.2 VARIOUS MARKET PARTICIPANTS' TRENDS

4.2.3 TRENDS IN SOCIAL MEDIA

4.2.4 ONLINE SHOPPING IS BECOMING MORE POPULAR

4.3 NEW PRODUCT LAUNCH STRATEGY

4.3.1 THE NUMBER OF NEW PRODUCT LAUNCHES

4.3.2 ADVERTISING AND MARKETING

4.3.3 MEETING CUSTOMER EXPECTATIONS

4.3.4 DESIGNING AND PACKAGING

4.3.5 PRODUCT BRANDING

4.3.6 CONCLUSION

4.4 PRIVATE LABEL VS BRAND LABEL IN THE

4.5 PROMOTIONAL ACTIVITIES

4.6 SHOPPING BEHAVIOUR AND DYNAMICS

4.7 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

4.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.9 SUPPLY CHAIN

4.1 RAW MATERIAL PROCUREMENT

4.11 MARKETING AND DISTRIBUTION

4.12 END USERS

4.13 REGULATORY FRAMEWORK AND GUIDELINES

5 GLOBAL OVERVIEW-

6 REGIONAL SUMMARY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING IMPORTANCE OF SPORTS NUTRITION

7.1.2 GROWING DEMAND FOR THE BAKERY AND DAIRY PRODUCTS

7.1.3 STRONG DEMAND FOR DAIRY PROTEIN INGREDIENTS FOR MAJOR HUMAN DIETARY PROBLEM

7.1.4 INCREASE IN THE NUMBER OF BIRTHRATES AND WORKING WOMEN

7.2 RESTRAINTS

7.2.1 HIGH CONCERNS OVER LACTOSE INTOLERANCE AND MILK ALLERGIES

7.2.2 CREDIBLE THREAT OF SUBSTITUTES, PARTICULARLY PLANT-BASED PROTEIN INGREDIENTS

7.3 OPPORTUNITY

7.3.1 INTRODUCTION TO NEW FLAVORS AND INCREASING R&D

7.4 CHALLENGE

7.4.1 UNCERTAINTY IN SUPPLY AND PRICES OF RAW MILK

8 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 MILK PROTEIN

8.2.1 MILK PROTEIN CONCENTRATES

8.2.2 MILK WHEY PROTEIN HYDROXYLATES

8.2.3 MILK PROTEIN ISOLATES

8.3 WHEY PROTEIN

8.3.1 WHEY PROTEIN CONCENTRATES

8.3.2 WHEY PROTEIN HYDROXYLATES

8.3.3 WHEY PROTEIN ISOLATES

8.4 CASEIN PROTEIN

8.4.1 CONCENTRATES

8.4.2 HYDROXYLATES

8.4.3 ISOLATES

9 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT

9.1 OVERVIEW

9.2 30%-85%

9.3 85%-95%

9.4 95% & ABOVE

10 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 LIQUID

11 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 BAKERY

11.2.1 BAKERY, BY APPLICATION

11.2.1.1 BREAD & ROLLS

11.2.1.2 CAKE & PASTRIES

11.2.1.3 COOKIES & BISCUITS

11.2.1.4 MUFFINS & DONUTS

11.2.1.5 OTHERS

11.2.2 BAKERY, BY TYPE

11.2.2.1 MILK PROTEIN

11.2.2.2 WHEY PROTEIN

11.2.2.3 CASEIN PROTEIN

11.3 DAIRY PRODUCTS

11.3.1 DAIRY PRODUCTS, BY APPLICATION

11.3.1.1 CHEESE

11.3.1.2 YOGURTS

11.3.1.3 DAIRY DESSERTS

11.3.1.4 CREAMER

11.3.1.5 TOFU

11.3.1.6 OTHERS

11.3.2 DAIRY PRODUCTS, BY TYPE

11.3.2.1 MILK PROTEIN

11.3.2.2 WHEY PROTEIN

11.3.2.3 CASEIN PROTEIN

11.4 SPORT NUTRITION

11.4.1 SPORT NUTRITION, BY APPLICATION

11.4.1.1 PROTEIN POWDER

11.4.1.2 PROTEIN READY TO DRINK

11.4.2 SPORT NUTRITION, BY TYPE

11.4.2.1 MILK PROTEIN

11.4.2.2 WHEY PROTEIN

11.4.2.3 CASEIN PROTEIN

11.5 CONFECTIONERY

11.5.1 CONFECTIONERY, BY APPLICATION

11.5.1.1 CHOCOLATE

11.5.1.2 CANDIES

11.5.1.3 CHEWING GUM

11.5.1.4 GUMMIES & MARSHMALLOWS

11.5.1.5 OTHERS

11.5.2 CONFECTIONERY, BY TYPE

11.5.2.1 MILK PROTEIN

11.5.2.2 WHEY PROTEIN

11.5.2.3 CASEIN PROTEIN

11.6 BEVERAGES

11.6.1 BEVERAGES, BY APPLICATION

11.6.2 DAIRY ALTERNATIVE DRINKS

11.6.3 FLAVORED DRINKS

11.6.3.1 VANILLA

11.6.3.2 STRAWBERRY

11.6.3.3 CHOCOLATE

11.6.3.4 OTHERS

11.6.4 RTD DRINKS

11.6.4.1 RTD COFFEE

11.6.4.2 RTD TEA

11.6.5 OTHERS

11.6.6 BEVERAGES, BY TYPE

11.6.6.1 MILK PROTEIN

11.6.6.2 WHEY PROTEIN

11.6.6.3 CASEIN PROTEIN

11.7 DIETARY SUPPLEMENTS

11.7.1 DIETARY SUPPLEMENTS, BY TYPE

11.7.1.1 MILK PROTEIN

11.7.1.2 WHEY PROTEIN

11.7.1.3 CASEIN PROTEIN

11.8 INFANT FORMULA

11.8.1 INFANT FORMULA, BY APPLICATION

11.8.1.1 STANDARD FORMULA

11.8.1.2 GROWING-UP FORMULA

11.8.1.3 FOLLOW-ON FORMULA

11.8.1.4 SPECIALTY FORMULA

11.8.2 INFANT FORMULA, BY TYPE

11.8.2.1 MILK PROTEIN

11.8.2.2 WHEY PROTEIN

11.8.2.3 CASEIN PROTEIN

11.9 NUTRITIONAL BARS

11.9.1 NUTRITIONAL BARS, BY TYPE

11.9.1.1 MILK PROTEIN

11.9.1.2 WHEY PROTEIN

11.9.1.3 CASEIN PROTEIN

11.1 BREAKFAST CEREALS

11.10.1 BREAKFAST CEREALS, BY TYPE

11.10.1.1 MILK PROTEIN

11.10.1.2 WHEY PROTEIN

11.10.1.3 CASEIN PROTEIN

11.11 SAUCES, DRESSINGS & SEASONINGS

11.11.1 SAUCES, DRESSINGS & SEASONINGS, BY TYPE

11.11.1.1 MILK PROTEIN

11.11.1.2 WHEY PROTEIN

11.11.1.3 CASEIN PROTEIN

11.12 RTE MEALS

11.12.1 RTE MEALS, BY TYPE

11.12.1.1 MILK PROTEIN

11.12.1.2 WHEY PROTEIN

11.12.1.3 CASEIN PROTEIN

11.13 MEAT & POULTRY PRODUCTS

11.13.1 MEAT & POULTRY PRODUCTS, BY TYPE

11.13.1.1 MILK PROTEIN

11.13.1.2 WHEY PROTEIN

11.13.1.3 CASEIN PROTEIN

11.14 OTHERS

11.14.1 OTHERS, BY TYPE

11.14.1.1 MILK PROTEIN

11.14.1.2 WHEY PROTEIN

11.14.1.3 CASEIN PROTEIN

12 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET

12.1 WEST AFRICA

12.1.1 NIGERIA

12.1.2 GHANA

12.1.3 BENIN

12.1.4 LIBERIA

12.1.5 REST OF WEST AFRICA

13 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: WEST AFRICA

13.2 MERGER & ACQUISITION

13.3 NEW PRODUCT DEVELOPMENT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ARLA FOODS AMBA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 GLANBIA PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 KERRY GROUP PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 NESTLÉ

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ORNUA CO-OPERATIVE LIMITED

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 FRIESLANDCAMPINA

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 GIVANAS GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 OLAM GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF WHEY AND MODIFIED WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; HS CODE - 040410 (USD THOUSAND)

TABLE 2 EXPORT DATA OF WHEY AND MODIFIED WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; HS CODE - 040410 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 GLOBAL DAIRY PROTEIN INGREDIENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 WEST AFRICA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 WEST AFRICA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 WEST AFRICA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 14 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 WEST AFRICA BAKERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 WEST AFRICA BAKERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 WEST AFRICA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 19 WEST AFRICA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 WEST AFRICA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 WEST AFRICA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 WEST AFRICA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 WEST AFRICA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 WEST AFRICA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 WEST AFRICA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 WEST AFRICA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 27 WEST AFRICA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 WEST AFRICA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 WEST AFRICA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 WEST AFRICA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 WEST AFRICA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 WEST AFRICA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 WEST AFRICA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 WEST AFRICA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 WEST AFRICA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 WEST AFRICA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NIGERIA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NIGERIA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NIGERIA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 43 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 44 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 NIGERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NIGERIA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 NIGERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 NIGERIA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 NIGERIA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 NIGERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 NIGERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 NIGERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NIGERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NIGERIA CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NIGERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NIGERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NIGERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NIGERIA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 NIGERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NIGERIA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NIGERIA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 NIGERIA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 NIGERIA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 NIGERIA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 NIGERIA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 GHANA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 GHANA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 GHANA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 71 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 GHANA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 GHANA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 GHANA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 GHANA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 GHANA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 GHANA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 GHANA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 GHANA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 GHANA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 GHANA CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 GHANA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 GHANA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 GHANA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 GHANA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 GHANA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 GHANA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 GHANA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 GHANA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 GHANA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 GHANA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 GHANA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 BENIN WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 BENIN MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 BENIN CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 99 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 BENIN BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 BENIN CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 BENIN BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 BENIN FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 BENIN RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 BENIN DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 BENIN SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 BENIN INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 BENIN BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 BENIN CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 BENIN BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 BENIN DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 BENIN SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 BENIN DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 BENIN INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 BENIN NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 BENIN BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 BENIN SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 BENIN RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 BENIN MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 BENIN OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 LIBERIA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 LIBERIA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 LIBERIA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 127 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 128 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 LIBERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 LIBERIA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 131 LIBERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 LIBERIA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 LIBERIA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 LIBERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 LIBERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 LIBERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 LIBERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 LIBERIA CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 LIBERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 LIBERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 LIBERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 LIBERIA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 LIBERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 LIBERIA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 LIBERIA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 LIBERIA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 LIBERIA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 LIBERIA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 LIBERIA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 REST OF WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: SEGMENTATION

FIGURE 2 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: WEST AFRICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR THE BAKERY AND DAIRY PRODUCTS IS DRIVING WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 MILK PROTEIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN OF WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY AND CHALLENGES OF WEST AFRICA DAIRY INGREDIENTS MARKET

FIGURE 18 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2021

FIGURE 19 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2021

FIGURE 20 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2021

FIGURE 21 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2021

FIGURE 22 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: SNAPSHOT (2021)

FIGURE 23 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY COUNTRY (2021)

FIGURE 24 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY TYPE (2022-2029)

FIGURE 27 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.