Mercado de reacción en cadena de la polimerasa de EE. UU., por tipo de producto (reactivos, instrumentos, consumibles y software y servicios), método (PCR en tiempo real, PCR con transcriptasa inversa (RT), PCR convencional, PCR multiplex, PCR anidada, PCR de inicio en caliente, PCR de largo alcance, PCR de ensamblaje, PCR inversa y otros), aplicación (investigaciones clínicas, de ciencias de la vida y relacionadas, ciencia forense, microbiología ambiental y otras), usuario final (empresas farmacéuticas y de biotecnología, hospitales y clínicas, laboratorios de diagnóstico, organizaciones académicas y de investigación, laboratorios forenses, laboratorios de referencia y otros), canal de distribución (licitación directa, ventas minoristas y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de reacción en cadena de la polimerasa en EE. UU.

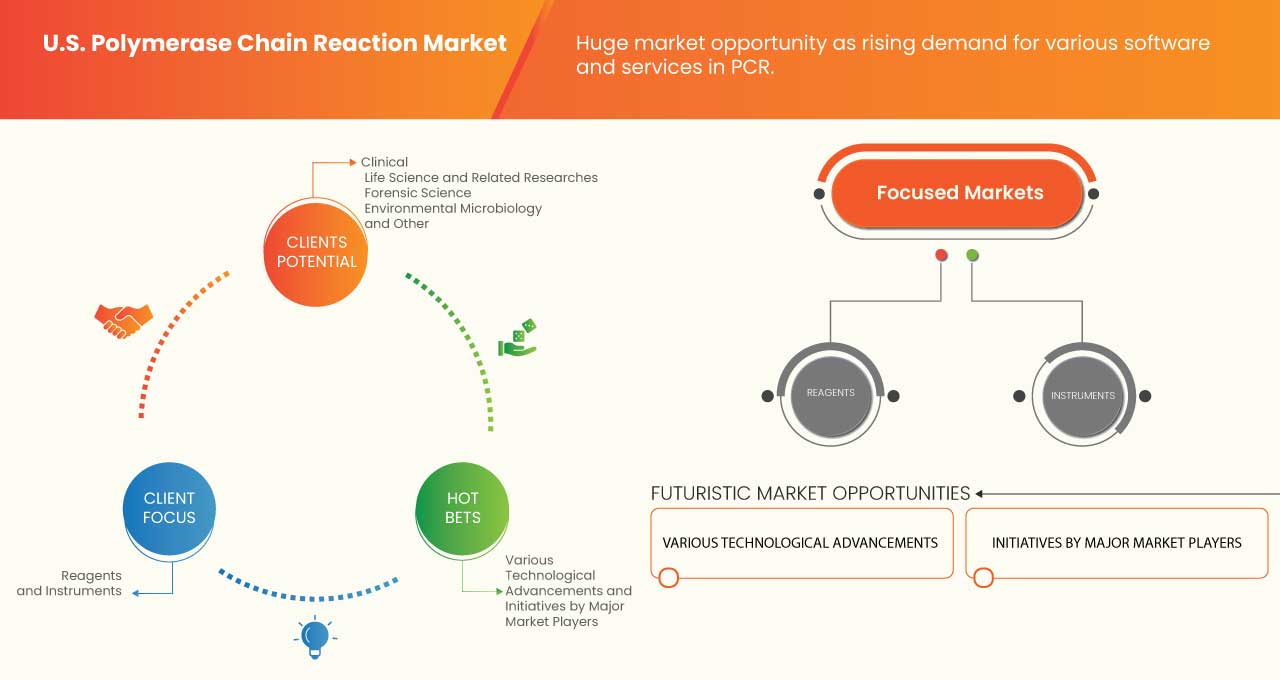

Se espera que el mercado estadounidense de la reacción en cadena de la polimerasa crezca en el año de pronóstico debido al aumento en el número de actores del mercado y la disponibilidad de dispositivos de diagnóstico tecnológicos avanzados. Se espera que el creciente desarrollo en el campo de las técnicas avanzadas impulse aún más el crecimiento del mercado. Sin embargo, se espera que dificultades como las estrictas regulaciones para la producción y comercialización de medicamentos de tratamiento y dispositivos médicos para diagnóstico y cirugía frenen el crecimiento del mercado en el período de pronóstico.

Data Bridge Market Research analiza que se espera que el mercado de reacción en cadena de la polimerasa de EE. UU. alcance un valor de USD 11 168,47 millones para 2030, con una CAGR del 12,2 % durante el período de pronóstico. Este informe de mercado también cubre en profundidad el análisis de precios y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (reactivos, instrumentos, consumibles, software y servicios), método (PCR en tiempo real, PCR con transcriptasa inversa (RT), PCR convencional, PCR multiplex, PCR anidada, PCR de inicio en caliente, PCR de largo alcance, PCR de ensamblaje, PCR inversa y otros), aplicación (investigaciones clínicas, de ciencias biológicas y relacionadas, ciencia forense, microbiología ambiental y otras), usuario final (empresas farmacéuticas y de biotecnología, hospitales y clínicas, laboratorios de diagnóstico, organizaciones académicas y de investigación, laboratorios forenses, laboratorios de referencia y otros), canal de distribución (licitación directa, ventas minoristas y otros) |

|

País cubierto |

A NOSOTROS |

|

Actores del mercado cubiertos |

Beckman Coulter, Inc., F. Hoffmann-La Roche Ltd., Promega Corporation, Illumina, Inc., Bio-Rad Laboratories, Inc., QIAGEN, Merck KGaA, GenScript, Thermo Fisher Scientific Inc., PerkinElmer Inc., Enzo Life Sciences, Inc., bioMérieux Inc., Takara Bio Inc., LGC biosearch Technologies, Meridian bioscience, Inc., Luminex Corporation y Agilent Technologies, Inc., entre otros. |

Definición de mercado

La reacción en cadena de la polimerasa (PCR) es un método ampliamente utilizado para realizar de millones a miles de millones de copias de una muestra específica de ADN rápidamente, lo que permite a los científicos amplificar una muestra muy pequeña de ADN o una parte de ella lo suficiente como para permitir un estudio detallado. Es una técnica que se utiliza para realizar numerosas copias de un segmento específico de ADN de forma rápida y precisa. La PCR se basa en el uso de la capacidad de la ADN polimerasa para sintetizar nuevas hebras de ADN complementarias a la hebra molde ofrecida. La mayoría de los métodos de PCR se basan en el ciclado térmico. El ciclado térmico expone los reactivos a ciclos repetidos de calentamiento y enfriamiento para permitir diferentes reacciones dependientes de la temperatura, específicamente, la fusión del ADN y la replicación del ADN impulsada por enzimas.

Dinámica del mercado de la reacción en cadena de la polimerasa en EE. UU.

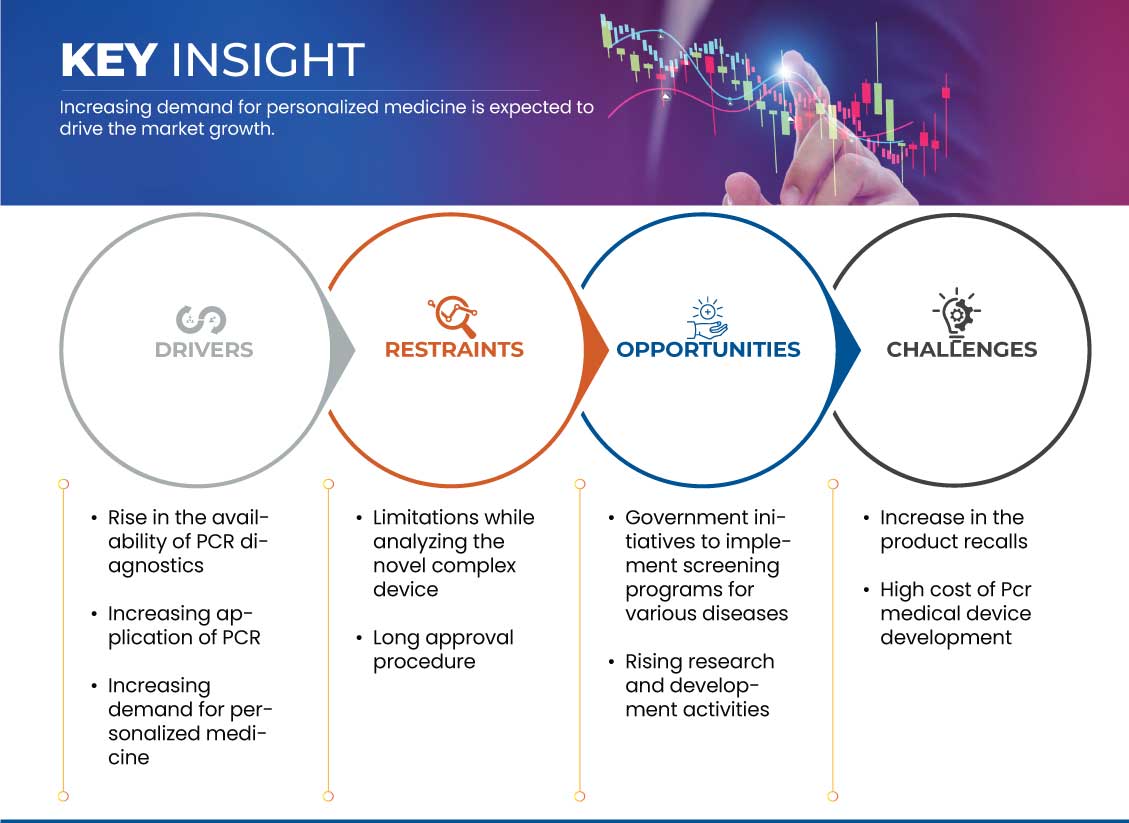

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

CONDUCTORES

- Aumento de la disponibilidad de diagnósticos por PCR

La reacción en cadena de la polimerasa es una de las técnicas más utilizadas en la biología moderna. La PCR se basa en una técnica molecular de amplificación in vitro que genera millones de copias de una región específica de una cadena de ADN. El aumento de la disponibilidad y la adopción de dispositivos de PCR se debe al diagnóstico de diversas enfermedades y a la rapidez de los resultados. La PCR es un proceso sencillo y ampliamente utilizado en el que se pueden amplificar cantidades minúsculas de ADN en múltiples copias. Además de la rapidez con la que funciona este ensayo, puede demostrar cuantitativamente la cantidad presente de una secuencia particular.

Por ejemplo,

- En agosto de 2020, según el Instituto Nacional de Investigación del Genoma Humano, el aumento de la disponibilidad de la PCR se debe a una técnica rápida y económica que se utiliza para amplificar pequeños segmentos de ADN. La disponibilidad de la tecnología está aumentando porque es rápida, precisa y escalable, lo que la hace ideal para las pruebas virales a gran escala.

Por lo tanto, aumentar la producción de instrumentos y reactivos de PCR también mejora la eficiencia de la disponibilidad del producto, por este motivo, se espera que un aumento en la disponibilidad de diagnósticos de PCR impulse el crecimiento del mercado.

- Aumento de la aplicación de la PCR

La PCR tiene muchas aplicaciones prácticas y de investigación. La PCR se ha utilizado de forma rutinaria en la clonación de ADN, el diagnóstico médico y el análisis forense del ADN. La técnica de PCR se ha convertido en una herramienta estándar de diagnóstico e investigación en el campo de la odontología. La PCR y otras técnicas de biología molecular permiten el diagnóstico de microbios infecciosos que causan infecciones maxilofaciales. Esto ayuda en el tratamiento eficaz de afecciones como la enfermedad periodontal, las caries, el cáncer bucal y las infecciones endodónticas.

Por ejemplo,

- En mayo de 2023, según el artículo del NCBI, la PCR es la técnica molecular más desarrollada hasta ahora y tiene una amplia gama de aplicaciones clínicas ya realizadas y potenciales, incluida la detección de patógenos específicos o de amplio espectro, la evaluación de nuevas infecciones emergentes, la vigilancia y la detección temprana de agentes de bioamenaza.

Por lo tanto, para concluir, se espera que las crecientes aplicaciones de PCR impulsen el crecimiento del mercado.

OPORTUNIDAD

- Iniciativas gubernamentales para implementar programas de detección de diversas enfermedades

La carga de enfermedades continúa aumentando a nivel mundial y tiene un gran estrés financiero, emocional y físico en los sistemas de salud, las familias y las personas. En los países donde el sistema de atención médica es fuerte, la tasa de supervivencia en muchos tipos de enfermedades, como el cáncer, mejora debido a la atención de calidad, una mayor conciencia y una detección temprana accesible. Según los Centros para el Control y la Prevención de Enfermedades, las islas y territorios del Pacífico de EE. UU. a través del Programa Nacional Integral de Control del Cáncer (NCCCP) se adaptaron para formar o apoyar alianzas para combatir el cáncer en sus comunidades, lo que llevó a aumentar la conciencia de los programas de detección del cáncer de pulmón y el uso del diagnóstico de PCR para la detección temprana, ya que la PCR permite que se amplifiquen fragmentos de ADN para encontrar y diagnosticar una condición genética o una enfermedad relacionada con el cáncer.

Por ejemplo,

- En marzo de 2021, según el artículo del NCBI, el gobierno ordenó que se realice un programa de detección de covid-19 en los trabajadores de la salud, ya que corren un alto riesgo de infección y potencialmente experimentan riesgos más significativos de enfermedades infecciosas emergentes debido a la exposición ocupacional a pacientes enfermos y superficies contaminadas con virus.

Se espera que las crecientes iniciativas gubernamentales para implementar programas de detección de diversas enfermedades actúen como una oportunidad para el crecimiento del mercado.

RESTRICCIÓN / DESAFÍO

- Limitaciones en el análisis del nuevo dispositivo complejo

El análisis de un dispositivo médico complejo implica comprender el contexto de uso del dispositivo, la carga de trabajo y el entorno en el que se utilizará. Hay varios factores que contribuyen a la complejidad de los productos novedosos que se utilizan en los laboratorios. La interacción continua entre el personal y los fabricantes de dispositivos en las primeras etapas del proceso de desarrollo es muy necesaria y se vuelve obligatoria para comprender el funcionamiento de la pieza o la configuración general. Los desafíos tecnológicos para el diagnóstico por PCR se están volviendo complejos debido a los avances que consisten en un conjunto heterogéneo de tecnologías novedosas y muy dispares.

En los últimos años, ha habido un mayor uso de IA/ML en dispositivos médicos, especialmente para tareas que requieren el análisis de grandes volúmenes de datos o la interpretación de información compleja. Las limitaciones en la detección y el análisis de productos complejos novedosos, como máquinas, herramientas y equipos, están obstaculizando el crecimiento del mercado estadounidense de reacción en cadena de la polimerasa.

Acontecimientos recientes

- En febrero de 2022, Thermo Fisher Scientific Inc. anunció el lanzamiento de una nueva prueba ambiental rápida para ayudar en la lucha contra el COVID-19. La prueba rápida de PCR Renvo de Thermo Scientific es la última solución en la cartera de productos de vigilancia de patógenos en el aire de la empresa. La prueba rápida de PCR Renvo se realiza en muestras de aire recolectadas con el muestreador Thermo Scientific AerosolSense de la empresa. Esto ayudó a la organización a generar más ingresos

- En marzo de 2020, Bio-Rad Laboratories, Inc. anunció que sus productos de PCR cuantitativa en tiempo real se están utilizando en laboratorios de pruebas de todo el mundo para detectar la COVID-19. Esto ayudó a la organización a aumentar sus ingresos generales

Alcance del mercado de la reacción en cadena de la polimerasa en EE. UU.

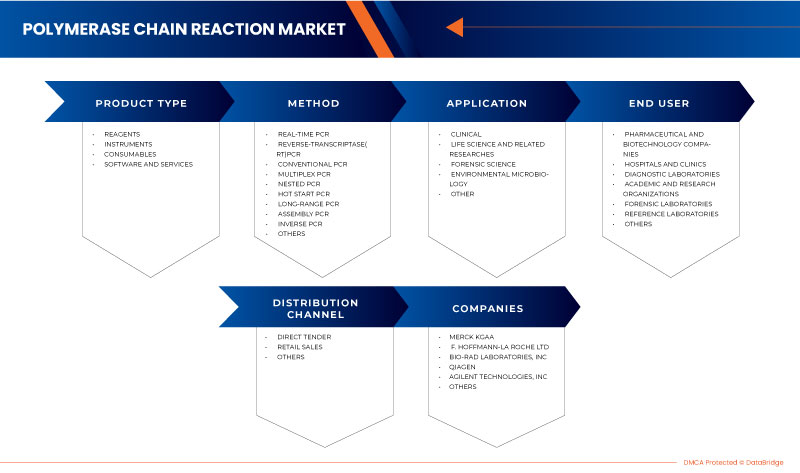

El mercado de la reacción en cadena de la polimerasa en Estados Unidos está segmentado en cinco segmentos notables según el tipo de producto, el método, la aplicación, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Reactivos

- Instrumentos

- Consumibles

- Software y servicios

Según el tipo de producto, el mercado se segmenta en reactivos, instrumentos, consumibles, software y servicios.

Método

- PCR en tiempo real

- PCR con transcriptasa inversa (RT)

- PCR convencional

- PCR multiplexada

- PCR anidada

- PCR de arranque en caliente

- PCR de largo alcance

- Ensamblaje PCR

- PCR inversa

- Otros

Sobre la base del método, el mercado está segmentado en PCR en tiempo real, PCR con transcriptasa inversa (RT), PCR convencional, PCR multiplex, PCR anidada, PCR de inicio en caliente, PCR de largo alcance, PCR de ensamblaje, PCR inversa y otros.

Por aplicación

- Clínico

- Ciencias de la vida e investigaciones relacionadas

- Ciencia forense

- Microbiología ambiental

- Otro

Sobre la base de la aplicación, el mercado está segmentado en investigaciones clínicas, de ciencias de la vida y relacionadas, ciencias forenses, microbiología ambiental y otras.

Por los usuarios finales

- Empresas farmacéuticas y biotecnológicas

- Hospitales y Clínicas

- Laboratorios de diagnóstico

- Organizaciones académicas y de investigación

- Laboratorios forenses

- Laboratorios de referencia

- Otros

Sobre la base del usuario final, el mercado está segmentado en empresas farmacéuticas y de biotecnología, hospitales y clínicas, laboratorios de diagnóstico, organizaciones académicas y de investigación, laboratorios forenses, laboratorios de referencia y otros.

Por canal de distribución

- Licitación directa

- Ventas al por menor

- Otros

Sobre la base del canal de distribución, el mercado se segmenta en licitación directa, ventas minoristas y otros.

Análisis del panorama competitivo y de la cuota de mercado de la reacción en cadena de la polimerasa en EE. UU.

El panorama competitivo del mercado de la reacción en cadena de la polimerasa en EE. UU. proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores del mercado que operan en el mercado de reacción en cadena de la polimerasa de EE. UU. son Beckman Coulter, Inc., F. Hoffmann-La Roche Ltd, Promega Corporation, Illumina, Inc., Bio-Rad Laboratories, Inc., QIAGEN, Merck KGaA, GenScript, Thermo Fisher Scientific Inc., PerkinElmer Inc., Enzo Life Sciences, Inc., bioMérieux Inc., Takara Bio Inc., LGC biosearch Technologies, Meridian bioscience, Inc., Luminex Corporation y Agilent Technologies, Inc., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. POLYMERASE CHAIN REACTION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 INSTALLATION BASE

4.4 COST ANALYSIS

4.5 VALUE CHAIN ANALYSIS

4.6 HEALTHCARE ECONOMY

4.6.1 HEALTHCARE EXPENDITURE

4.6.2 CAPITAL EXPENDITURE

4.6.3 CAPEX TRENDS

4.6.4 CAPEX ALLOCATIONS

4.6.5 FUNDING SOURCES

4.6.6 INDUSTRY BENCHMARKS

4.6.7 GDP RATIO IN OVERALL GDP

4.6.8 HEALTHCARE SYSTEM STRUCTURE

4.6.9 GOVERNMENT POLICIES

4.6.10 ECONOMIC DEVELOPMENT

4.7 INDUSTRY INSIGHTS

4.7.1 MICRO AND MACROECONOMIC FACTORS

4.7.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.7.3 KEY PRICING STRATEGIES

4.8 TECHNOLOGY ROADMAP

5 REGULATORY COMPLIANCE

5.1 REGULATORY AUTHORITIES

5.2 REGULATORY CLASSIFICATIONS

5.3 REGULATORY SUBMISSIONS

5.4 INTERNATIONAL HARMONIZATION

5.5 COMPLIANCE AND QUALITY MANAGEMENT SCENARIO

5.6 REGULATORY CHALLENGES AND STRATEGY

6 MARKET OVERVIEW, U.S. POLYMERASE CHAIN REACTION MARKET

6.1 DRIVERS

6.1.1 RISE IN THE AVAILABILITY OF PCR DIAGNOSTICS

6.1.2 INCREASING APPLICATION OF PCR

6.1.3 INCREASING DEMAND FOR PERSONALIZED MEDICINE

6.2 RESTRAINTS

6.2.1 LIMITATIONS WHILE ANALYZING THE NOVEL COMPLEX DEVICE

6.2.2 LONG APPROVAL PROCEDURE

6.3 OPPORTUNITIES

6.3.1 GOVERNMENT INITIATIVES TO IMPLEMENT SCREENING PROGRAMS FOR VARIOUS DISEASES

6.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 INCREASE IN THE PRODUCT RECALLS

6.4.2 HIGH COST OF PCR MEDICAL DEVICE DEVELOPMENT

7 U.S. POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 REAGENTS

7.2.1 DNA OR PCR TEMPLATES

7.2.2 DNA POLYMERASE I ENZYME

7.2.2.1 TAQ DNA POLYMERASE

7.2.2.2 HIGH-FIDELITY DNA POLYMERASE

7.2.2.3 GREEN TAQ DNA POLYMERASE

7.2.2.4 HOT START TAQ DNA POLYMERASE

7.2.2.5 PROOFREADING DNA POLYMERASE

7.2.2.6 OTHERS

7.2.3 PRIMERS

7.2.4 DEOXYNUCLEOTIDE TRIPHOSPHATES (DNTPS)

7.2.5 PCR BUFFERS

7.2.5.1 TRIS-HCL

7.2.5.2 POTASSIUM CHLORIDE (KCL)

7.2.5.3 MAGNESIUM CHLORIDE

7.2.6 MASTER MIX OR PCR KIT

7.2.7 PROBES

7.2.8 ANTI-TAQ DNA POLYMERASE ANTIBODY

7.2.9 DIGITAL PCR SUPERMIXES

7.2.10 OTHERS

7.3 INSTRUMENTS

7.3.1 BY TYPE

7.3.1.1 DIGITAL PCR

7.3.1.1.1 DIGITAL PCR(DDPCR)

7.3.1.1.2 CHIP BASED DIGITAL PCR

7.3.1.1.3 BEAMING DIGITAL PCR

7.3.1.2 REAL TIME PCR

7.3.1.3 CONVENTIONAL PCR

7.3.1.4 OTHERS

7.3.2 BY MODALITY

7.3.2.1 STANDLONE

7.3.2.2 HANDHELD

7.3.2.3 PORTABLE

7.4 CONSUMABLES

7.4.1 PCR TUBES AND CAPS

7.4.2 PCR STRIPS

7.4.3 PCR WELL PLATES

7.4.4 STRIP TUBES

7.4.5 PLATE SEALS

7.4.6 CARTRIDGES AND GASKETS

7.4.7 OTHERS

7.5 SOFTWARE AND SERVICES

8 U.S. POLYMERASE CHAIN REACTION MARKET, BY METHOD

8.1 OVERVIEW

8.2 REAL-TIME PCR

8.3 REVERSE-TRANSCRIPTASE(RT) PCR

8.4 CONVENTIONAL PCR

8.5 MULTIPLEX PCR

8.6 NESTED PCR

8.7 HOT START PCR

8.8 LONG-RANGE PCR

8.9 ASSEMBLY PCR

8.1 INVERSE PCR

8.11 OTHERS

9 U.S. POLYMERASE CHAIN REACTION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL

9.2.1 ONCOLOGY TESTING

9.2.2 INFECTIOUS DISEASE TESTING

9.2.2.1 HUMAN PAPILLOMAVIRUS

9.2.2.2 HIV

9.2.2.3 HCV

9.2.2.4 HEPATITIS B VIRUS

9.2.2.5 OTHERS

9.2.3 TRANSPLANT DIAGNOSTICS

9.2.4 PATERNITY TESTING

9.2.5 OTHERS

9.3 LIFE SCIENCE AND RELATED RESEARCHES

9.3.1 MICROBIOLOGY

9.3.2 MOLECULAR AND CELL BIOLOGY

9.3.3 OTHERS

9.4 FORENSIC SCIENCE

9.4.1 DNA TYPING

9.4.2 DNA TESTING

9.4.3 GENETIC FINGERPRINTING

9.5 ENVIRONMENTAL MICROBIOLOGY

9.5.1 DETECTION OF TARGETED MICROORGANISMS

9.5.2 QUANTIFICATION OF MICROBIAL POPULATION

9.5.3 MICROBIAL COMMUNITY ANALYSIS

9.5.4 DETECTION OF MICROBIAL PATHOGEN

9.5.5 DETECTION OF GENE EXPRESSION IN THE ENVIRONMENT

9.5.6 DETECTION OF INDICTOR MICROORGANISMS IN WATER

9.5.7 ENVIRONMENTAL DNA ANALYSIS

9.5.8 OTHERS

9.6 OTHERS

10 U.S. POLYMERASE CHAIN REACTION MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.3 HOSPITALS AND CLINICS

10.3.1 PRIVATE

10.3.1.1 TIER 1

10.3.1.2 TIER 2

10.3.1.3 TIER 3

10.3.2 PUBLIC

10.3.2.1 TIER 1

10.3.2.2 TIER 2

10.3.2.3 TIER 3

10.4 DIAGNOSTIC LABORATORIES

10.5 ACADEMIC AND RESEARCH ORGANIZATIONS

10.6 FORENSIC LABORATORIES

10.7 REFERENCE LABORATORIES

10.8 OTHERS

11 U.S. POLYMERASE CHAIN REACTION MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 OTHERS

12 U.S. POLYMERASE CHAIN REACTION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT ANALYSIS

14 U.S. POLYMERASE CHAIN REACTION MARKET, COMPANY PROFILE

14.1 MERCK KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 F. HOFFMANN- LA ROCHE LTD

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 BIO-RAD LABORATORIES, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 QIAGEN

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 AGILENT TECHNOLOGIES, INC.

14.5.1 COMPANY PROFILE

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BECKMAN COULTER, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BIOMERIUX

14.8.1 COMPANY PROFILE

14.8.2 REVENUE ANALYSIS

14.8.4 RECENT DEVELOPMENT

14.9 ENZO LIFE SCIENCES, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 GENSCRIPT

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 ILLUMINA INC

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 LGC BIOSEARCH TECHNOLOGIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LUMINEX CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MERIDIAN BIOSCIENCE INC

14.14.1 COMPANY PROFILE

14.14.2 REVENUE ANALYSIS

14.14.4 RECENT DEVELOPMENT

14.15 PERKINELMER INC

14.15.1 COMPANY PROFILE

14.15.2 REVENUE ANALYSIS

14.15.4 RECENT DEVELOPMENT

14.16 PROMEGA CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 TAKARA BIO INC

14.17.1 COMPANY PROFILE

14.17.2 REVENUE ANALYSIS

14.17.4 RECENT DEVELOPMENT

14.18 THERMO FISHER SCIENTIFIC

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 U.S. POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 U.S. REAGENTS IN POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 U.S. DNA POLYMERASE I ENZYME IN POLYMERASE CHAIN REACTION MARKET, BY REAGENTS, 2021-2030 (USD MILLION)

TABLE 4 U.S. PCR BUFFERS IN POLYMERASE CHAIN REACTION MARKET, BY REAGENTS, 2021-2030 (USD MILLION)

TABLE 5 U.S. INSTRUMENTS IN POLYMERASE CHAIN REACTION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 U.S. DIGITAL PCR IN POLYMERASE CHAIN REACTION MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 7 U.S. INSTRUMENTS IN POLYMERASE CHAIN REACTION MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 8 U.S. CONSUMABLES IN POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.S. POLYMERASE CHAIN REACTION MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 10 U.S. POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 U.S. CLINICAL IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 12 U.S. INFECTIOUS DISEASE TESTING IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 13 U.S. LIFE SCIENCE AND RELATED RESEARCHES IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 U.S. FORENSIC SCIENCE IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 U.S. ENVIRONMENTAL MICROBIOLOGY IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 U.S. POLYMERASE CHAIN REACTION MARKET, BY END USER, 2018-2030 (USD MILLION)

TABLE 17 U.S. HOSPITALS AND CLINICS IN POLYMERASE CHAIN REACTION MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 18 U.S. PRIVATE IN POLYMERASE CHAIN REACTION MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 19 U.S. PUBLIC IN POLYMERASE CHAIN REACTION MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 20 U.S. POLYMERASE CHAIN REACTION MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

Lista de figuras

FIGURE 1 U.S. POLYMERASE CHAIN REACTION MARKET: SEGMENTATION

FIGURE 2 U.S. POLYMERASE CHAIN REACTION MARKET: DATA TRIANGULATION

FIGURE 3 U.S. POLYMERASE CHAIN REACTION MARKET: DROC ANALYSIS

FIGURE 4 U.S. POLYMERASE CHAIN REACTION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. POLYMERASE CHAIN REACTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. POLYMERASE CHAIN REACTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. POLYMERASE CHAIN REACTION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. POLYMERASE CHAIN REACTION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.S. POLYMERASE CHAIN REACTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. POLYMERASE CHAIN REACTION MARKET: SEGMENTATION

FIGURE 11 INCREASING APPLICATION OF PCR IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. POLYMERASE CHAIN REACTION MARKET IN THE FORECAST PERIOD

FIGURE 12 THE REAGENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. POLYMERASE CHAIN REACTION MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE U.S. POLYMERASE CHAIN REACTION MARKET

FIGURE 14 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, 2022

FIGURE 15 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, 2022

FIGURE 19 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, 2023-2030 (USD MILLION)

FIGURE 20 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, CAGR (2023-2030)

FIGURE 21 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, LIFELINE CURVE

FIGURE 22 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, 2022

FIGURE 23 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, 2022

FIGURE 27 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 U.S. POLYMERASE CHAIN REACTION MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.