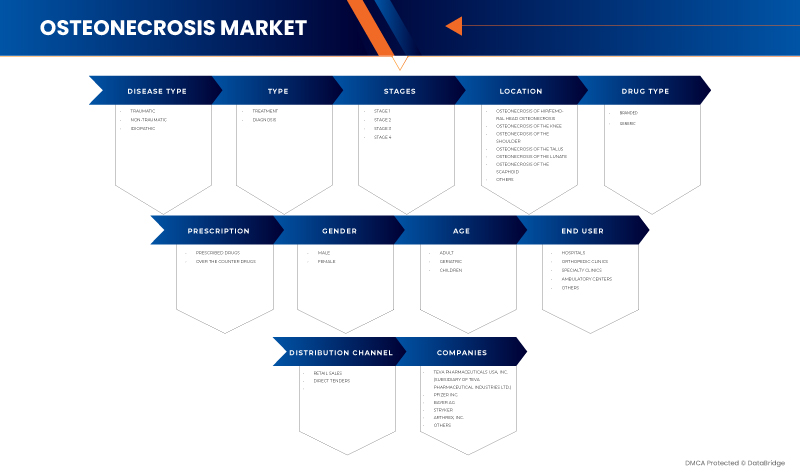

U.S. Osteonecrosis Market, By Disease Type (Traumatic, Non-Traumatic, and Idiopathic), Type (Diagnosis, and Treatment), Stages (Stage 1, Stage 2, Stage 3, and Stage 4), Location (Osteonecrosis of Hip/Femoral Head Osteonecrosis, Osteonecrosis of the Knee, Osteonecrosis of the Shoulder, Osteonecrosis of the Talus, Osteonecrosis of the Lunate, Osteonecrosis of the Scaphoid, and Others), Drug Type (Branded and Generic), Prescription (Over the Counter Drugs and Prescribed Drugs), Gender (Male and Female), Age (Children, Adult, and Geriatric), End User (Hospitals, Specialty Clinics, Orthopedic Clinics, Ambulatory Centers, and Others), Distribution Channel (Direct Tender and Retail Sales) - Industry Trends and Forecast to 2030.

U.S. Osteonecrosis Market Analysis and Insights

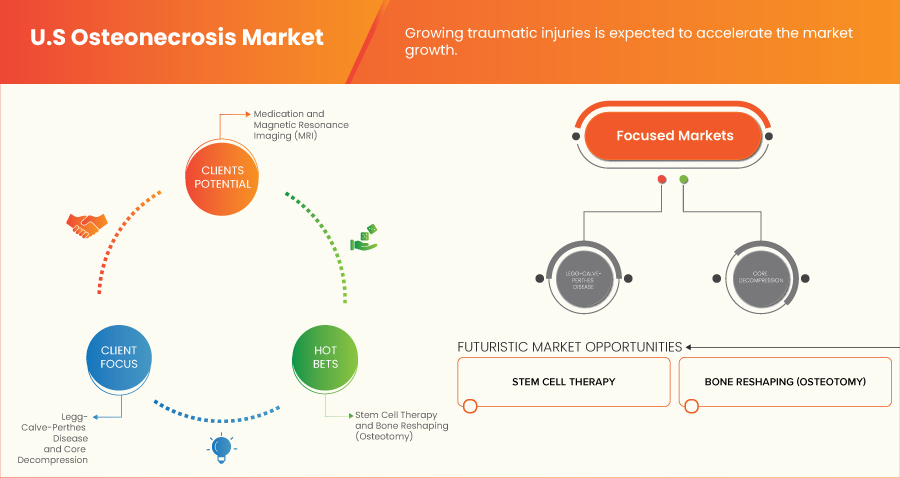

The increasing number of traumatic injuries among the United States population is expected to boost the growth of the U.S. osteonecrosis market. The rising government initiatives and funding for drug discovery and related research programs also contribute to market growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved advancement of imaging techniques for the diagnostic purpose of osteonecrosis is also driving the growth of the market in the forecasted period.

The U.S. osteonecrosis market is expected to grow in the forecast year due to the rise in the number of market players and the availability of advanced technological diagnostic and surgical devices. The increasing development in the field of advanced techniques is further expected to boost market growth. However, difficulties such as the stringent regulations for producing and commercializing treatment drugs and medical devices for diagnosis and surgery are expected to restrain market growth in the forecast period.

Various companies are taking initiatives that gradually lead to market growth:

For instance,

- In January 2021, Stryker announced the acquisition of OrthoSensor, a market player which applies digital technology and big data to total joint replacements. The acquisition would help the company to purchase the digital technologies of OrthoSensor for the use in diagnosis and treatment technologies for osteonecrosis.

- In March 2020, Sciegen Pharmaceuticals received ANDA Approval for Naproxen Tablets USP 250mg, 375mg and 500mg. The approval will further help in the growth of the product portfolio of the company.

Data Bridge Market Research analyzes that the U.S. osteonecrosis market is expected to reach the value of USD 843,039.67 thousand by 2030, at a CAGR of 5.9% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

Tipo de enfermedad (traumática, no traumática e idiopática), tipo (diagnóstico y tratamiento), estadios (estadio 1, estadio 2, estadio 3 y estadio 4), ubicación (osteonecrosis de la cadera/cabeza femoral, osteonecrosis de la rodilla, osteonecrosis del hombro, osteonecrosis del astrágalo, osteonecrosis del semilunar, osteonecrosis del escafoides y otros), tipo de fármaco (de marca y genérico), prescripción (medicamentos de venta libre y medicamentos con receta), género (masculino y femenino), edad (niños, adultos y geriátricos), usuario final (hospitales, clínicas especializadas, clínicas ortopédicas, centros ambulatorios y otros), canal de distribución (licitación directa y ventas minoristas) |

|

País cubierto |

A NOSOTROS |

|

Actores del mercado cubiertos |

Sciegen Pharmaceuticals, Almatica Pharma, Dr. Reddy's Laboratories Ltd., Bayer AG, Pfizer Inc., Haleon Group of Companies, Zimmer Biomet, Stryker, Teva Pharmaceuticals USA, Inc. (subsidiaria de Teva Pharmaceutical Industries Ltd.) y Arthrex, Inc., entre otros. |

Definición del mercado de osteonecrosis en EE. UU.

La osteonecrosis, también conocida como necrosis avascular o necrosis aséptica, es una afección caracterizada por la muerte o el deterioro del tejido óseo debido a un suministro de sangre inadecuado. Puede ocurrir en varios huesos del cuerpo, pero afecta más comúnmente a la articulación de la cadera. El flujo sanguíneo comprometido priva a las células óseas de oxígeno y nutrientes esenciales, lo que lleva a su muerte y al daño posterior del hueso afectado. Como resultado, la estructura ósea se debilita, se vuelve menos capaz de soportar el estrés normal y puede eventualmente colapsar o deformarse. La osteonecrosis puede causar dolor, rango de movimiento limitado y deterioro funcional. Las causas comunes de osteonecrosis incluyen traumatismos, uso de corticosteroides, consumo excesivo de alcohol, ciertas afecciones médicas y factores subyacentes que afectan la circulación sanguínea. El diagnóstico temprano y el tratamiento adecuado son esenciales para prevenir un mayor daño óseo y preservar la función articular. Las opciones de tratamiento para la osteonecrosis pueden incluir medidas conservadoras para controlar los síntomas y retrasar la progresión de la enfermedad e intervenciones quirúrgicas para aliviar el dolor y restaurar la función articular.

Dinámica del mercado de osteonecrosis en EE.UU.

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductor

- Aumento del número de lesiones traumáticas

El creciente número de lesiones traumáticas en los EE. UU. es un factor importante para el mercado de osteonecrosis en ese país. Las lesiones traumáticas, causadas por diversos factores, como accidentes, incidentes relacionados con el deporte, caídas y lesiones en el lugar de trabajo, se han vuelto más frecuentes en los últimos años. Estas lesiones pueden afectar profundamente la salud ósea, a menudo provocando fracturas, dislocaciones e inestabilidad articular. Cuando el suministro de sangre al hueso afectado se ve comprometido durante la lesión, se prepara el escenario para el posible desarrollo de osteonecrosis. Los vasos sanguíneos dañados interrumpen el suministro esencial de oxígeno y nutrientes al tejido óseo, lo que lleva a la muerte de las células óseas. La osteonecrosis postraumática es una consecuencia bien reconocida de las lesiones traumáticas graves. Si no se diagnostica y trata a tiempo, puede provocar complicaciones como colapso articular, dolor crónico y reducción de la función articular.

Una lesión traumática puede dañar los vasos sanguíneos que llevan oxígeno y nutrientes al tejido óseo. Esta alteración provoca una disminución o un bloqueo del flujo sanguíneo, lo que da lugar a la muerte celular y al desarrollo de osteonecrosis. Además, el traumatismo puede aumentar la presión sobre el hueso o la articulación, lo que compromete el flujo sanguíneo y provoca isquemia. La falta de suministro de sangre y el daño celular resultantes pueden desencadenar una respuesta inflamatoria, lo que agrava aún más la afección. El número cada vez mayor de accidentes de tráfico y relacionados con el deporte está aumentando, lo que provoca un aumento de la osteonecrosis.

Restricción

- Alto costo asociado al diagnóstico y tratamiento de la osteonecrosis

Los avances en las técnicas de diagnóstico y las opciones de tratamiento han mejorado los resultados de los pacientes. Aun así, la carga financiera que supone el tratamiento de la osteonecrosis sigue siendo un reto importante para los pacientes, los proveedores de atención médica y el sistema de atención sanitaria. Los factores clave que determinan el coste del diagnóstico y el tratamiento de la osteonecrosis incluyen la institución médica o clínica elegida para el procedimiento, el área de tratamiento, la complejidad y el especialista elegido, entre otros.

El diagnóstico preciso de la osteonecrosis requiere a menudo técnicas de diagnóstico por imagen especializadas, como la resonancia magnética (RM) , la tomografía computarizada (TC) o la gammagrafía ósea. Estos procedimientos de diagnóstico son caros y requieren equipos especializados, personal capacitado e interpretación por parte de radiólogos expertos. El alto costo de estos procedimientos de diagnóstico por imagen limita el acceso a un diagnóstico oportuno y preciso, lo que conduce a un retraso en el tratamiento y a posibles complicaciones. El costo del tratamiento aumenta proporcionalmente, por lo que el alto costo del tratamiento puede obstaculizar la demanda del mercado.

Oportunidad

-

Avances en la tecnología médica para la osteonecrosis

Los avances en tecnología médica presentan oportunidades significativas en el mercado estadounidense de la osteonecrosis. Estas innovaciones mejoran la precisión del diagnóstico, ofrecen opciones de tratamiento regenerativo, permiten procedimientos mínimamente invasivos, facilitan la atención personalizada y mejoran los resultados de los pacientes. La inversión continua en investigación y desarrollo, la colaboración entre la industria y los profesionales de la salud y el apoyo regulatorio para tecnologías innovadoras son vitales para aprovechar todo el potencial de los avances médicos e impulsar el progreso en la osteonecrosis. Por lo tanto, se espera que actúe como una oportunidad en el mercado.

Desafío

- Disponibilidad de opciones de tratamiento limitadas

La ausencia de alternativas terapéuticas en el mercado estadounidense de la osteonecrosis dificulta la atención y los resultados óptimos del paciente. La osteonecrosis, comúnmente llamada necrosis avascular, es un trastorno en el que el tejido óseo se destruye debido a un flujo sanguíneo inadecuado. Aunque existen diversas opciones terapéuticas, las opciones suelen estar limitadas en función del estadio, la ubicación y la etiología subyacente de la osteonecrosis.

Acontecimientos recientes

- En enero de 2023, Zimmer Biomet anunció que había llegado a un acuerdo definitivo para adquirir Embody, Inc., una empresa privada de dispositivos médicos centrada en la curación de tejidos blandos, por 155.000 dólares al cierre de la operación. La adquisición incluye la cartera completa de soluciones biointegrativas basadas en colágeno de Embody para favorecer la curación de las lesiones ortopédicas de tejidos blandos más difíciles, incluido el implante biointegrativo TAPESTRY para la curación de tendones y TAPESTRY RC, uno de los primeros sistemas de implantes artroscópicos para la reparación del manguito rotador. Esta adquisición ayudará a la empresa en su cartera de productos y en la expansión de su negocio.

- En julio de 2022, el Grupo de Empresas Haleon anunció la finalización de la escisión del negocio de Consumer Healthcare del Grupo GSK para formar el Grupo Haleon. Esta escisión ayudó a la empresa a tomar el control de todo el negocio de Consumer Healthcare y expandirlo.

Alcance del mercado de osteonecrosis en EE.UU.

El mercado estadounidense de osteonecrosis está segmentado en diez segmentos notables según el tipo de enfermedad, tipo, estadios, ubicación, tipo de fármaco, prescripción, sexo, edad, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Tipo de enfermedad

- Traumático

- No traumático

- Idiopático

Según el tipo de enfermedad, el mercado se segmenta en traumática, no traumática e idiopática.

Tipo

- Diagnóstico

- Tratamiento

Según el tipo, el mercado se segmenta en diagnóstico y tratamiento.

Etapas

- Etapa 1

- Etapa 2

- Etapa 3

- Etapa 4

Sobre la base de las etapas, el mercado se segmenta en etapa 1, etapa 2, etapa 3 y etapa 4.

Ubicación

- Osteonecrosis de la cadera/cabeza femoral Osteonecrosis

- Osteonecrosis de la rodilla

- Osteonecrosis del hombro

- Osteonecrosis del astrágalo

- Osteonecrosis del semilunar

- Osteonecrosis del escafoides

- Otros

En función de la ubicación, el mercado está segmentado en osteonecrosis de la cadera/osteonecrosis de la cabeza femoral, osteonecrosis de la rodilla, osteonecrosis del hombro, osteonecrosis del astrágalo, osteonecrosis del semilunar, osteonecrosis del escafoides y otras.

Tipo de droga

- De marca

- Genérico

Según el tipo de medicamento, el mercado se segmenta en de marca y genéricos.

Prescripción

- Medicamentos de venta libre

- Medicamentos recetados

En función de la prescripción, el mercado se segmenta en medicamentos de venta libre y medicamentos con receta.

Género

- Masculino

- Femenino

En función del género, el mercado está segmentado en masculino y femenino.

Edad

- Niños

- Adulto

- Geriátrico

En función de la edad, el mercado se segmenta en niños, adultos y geriátricos.

Usuario final

- Hospitales

- Clínicas de especialidades

- Clínicas ortopédicas

- Centros ambulatorios

- Otros

Según el usuario final, el mercado se segmenta en hospitales, clínicas especializadas, clínicas ortopédicas, centros ambulatorios y otros.

Canal de distribución

- Licitación directa

- Ventas al por menor

Sobre la base del canal de distribución, el mercado está segmentado en licitación directa y ventas minoristas.

Análisis y perspectivas del mercado de osteonecrosis en EE. UU.

El mercado estadounidense de osteonecrosis se clasifica en diez segmentos notables según el tipo de enfermedad, tipo, etapas, ubicación, tipo de medicamento, prescripción, género, edad, usuario final y canal de distribución.

Los países cubiertos en este informe de mercado son EE. UU.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas estadounidenses y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la osteonecrosis en EE.UU.

El panorama competitivo del mercado de osteonecrosis de EE. UU. proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, las aprobaciones del producto, la amplitud y amplitud del producto, el dominio de la aplicación y la curva de vida del tipo de producto. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de osteonecrosis de EE. UU.

Algunos de los principales actores del mercado que operan en el mercado de osteonecrosis de EE. UU. son Sciegen Pharmaceuticals, Almatica Pharma, Dr. Reddy's Laboratories Ltd., Bayer AG, Pfizer Inc., Haleon Group of Companies, Zimmer Biomet, Stryker, Teva Pharmaceuticals USA, Inc. (subsidiaria de Teva Pharmaceutical Industries Ltd.) y Arthrex, Inc., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. OSTEONECROSIS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISEASE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS

4.3.1 DEMOGRAPHIC TRENDS: IMAPCTS ON ALL INCIDENCE RATES

4.3.2 PATIENT FLOW DIAGRAM

4.3.3 KEY PRICING STRATEGIES

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 PIPELINE ANALYSIS

4.6 REIMBURSEMENT FRAMEWORK

4.7 TECHNOLOGY ROADMAP

4.8 VALUE CHAIN ANALYSIS

5 EPIDEMIOLOGY

6 REGULATIONS

6.1 REGULATORY APPROVAL PROCESS AND PATHWAYS:

6.2 LICENSING AND REGISTRATION:

6.3 POST-MARKETING SURVEILLANCE:

6.4 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING NUMBER OF TRAUMATIC INJURIES

7.1.2 INCREASING CONSUMPTION OF STEROIDS AND RELATED DRUGS

7.1.3 INCREASING INCIDENCE OF OSTEONECROSIS

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH THE DIAGNOSIS AND TREATMENT OF OSTEONECROSIS

7.2.2 PROGNOSTIC AND DIAGNOSTIC CHALLENGES

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN MEDICAL TECHNOLOGY FOR OSTEONECROSIS

7.3.2 INCREASING REIMBURSEMENTS SCENARIOS

7.4 CHALLENGES

7.4.1 AVAILABILITY OF LIMITED TREATMENT OPTIONS

7.4.2 CHALLENGING LONG-TERM MANAGEMENT AND FOLLOW UP

8 U.S. OSTEONECROSIS MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 TRAUMATIC

8.3 NON-TRAUMATIC

8.4 IDIOPATHIC

9 U.S. OSTEONECROSIS MARKET, BY TYPE

9.1 OVERVIEW

9.2 TREATMENT

9.2.1 SURGERY

9.2.1.1 CORE DECOMPRESSION

9.2.1.2 BONE RESHAPING (OSTEOTOMY)

9.2.1.3 BONE TRANSPLANT

9.2.1.4 JOINT REPLACEMENT THERAPY

9.2.1.5 STEM CELL THERAPY

9.2.2 MEDICATION

9.2.2.1 NSAIDS

9.2.2.1.1 IBUPROFEN

9.2.2.1.2 ASPIRIN

9.2.2.1.3 NAPROXEN

9.2.2.1.4 DICLOFENAC

9.2.2.1.5 OTHERS

9.2.2.2 BLOOD THINNERS

9.2.2.2.1 WARFARIN

9.2.2.2.2 HEPARIN

9.2.2.2.3 ENOXAPARIN

9.2.2.2.4 ARGATROBAN

9.2.2.2.5 DICOUMARAL

9.2.2.2.6 FONDAPARINUX

9.2.2.2.7 XIMELAGATRAN

9.2.2.3 OSTEOPOROSIS DRUGS

9.2.2.3.1 ALENDRONATE

9.2.2.3.2 RISEDRONATE

9.2.2.3.3 IBANDRONATE

9.2.2.3.4 ZOLEDRONIC ACID

9.2.2.3.5 DENOSUMAB

9.2.2.3.6 OTHERS

9.2.2.4 CHOLESTEROL-LOWERING DRUGS

9.2.2.4.1 ATORVASTATIN

9.2.2.4.2 PRAVASTATIN

9.2.2.4.3 FLUVASTATIN

9.2.2.4.4 ROSUVASTATIN

9.2.2.4.5 SIMVASTATIN

9.2.2.4.6 PITAVASTATIN

9.2.2.4.7 LOVASTATIN

9.2.2.5 OTHERS

9.2.3 PHYSICAL THERAPY

9.2.3.1 CRUTCHES

9.2.3.1.1 AXILLA CRUTCHES

9.2.3.1.1.1 METAL ALLOY

9.2.3.1.1.2 WOOD

9.2.3.1.1.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.1.4 OTHERS

9.2.3.1.2 ELBOW CRUTCHES

9.2.3.1.2.1 OPEN-CUFF ELBOW CRUTCHES

9.2.3.1.2.1.1 METAL ALLOY

9.2.3.1.2.1.2 WOOD

9.2.3.1.2.1.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.2.1.4 OTHERS

9.2.3.1.2.2 CLOSED-CUFF ELBOW CRUTCHES

9.2.3.1.2.2.1 METAL ALLOY

9.2.3.1.2.2.2 WOOD

9.2.3.1.2.2.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.2.2.4 OTHERS

9.2.3.1.3 GUTTER CRUTCHES

9.2.3.1.3.1 METAL ALLOY

9.2.3.1.3.2 WOOD

9.2.3.1.3.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.3.4 OTHERS

9.2.3.2 CASTING AND BRACING

9.2.3.2.1 NEWINGTON BRACE

9.2.3.2.2 TORONTO ORTHOSIS

9.2.3.2.3 SCOTTISH RITE ORTHOSIS

9.2.3.2.4 BROOMSTICK PLASTERS

9.2.3.2.5 BIRMINGHAM ORTHOSIS

9.2.3.3 OTHERS

9.2.3.3.1 CONVENTIONAL CALIPERS

9.2.3.3.2 SNYDER SLINGS

9.2.3.3.3 SLINGS WITH CRUTCHES

9.2.3.3.4 TRACTION

9.2.3.3.5 OTHERS

9.3 DIAGNOSIS

9.3.1 IMAGING TEST

9.3.1.1 MAGNETIC RESONANCE IMAGING (MRI)

9.3.1.1.1 CLOSED BORE

9.3.1.1.1.1 LOW FIELD STRENGTH

9.3.1.1.1.2 MID FIELD STRENGTH

9.3.1.1.1.3 HIGH FIELD STRENGTH

9.3.1.1.2 OPEN BORE

9.3.1.1.2.1 LOW FIELD STRENGTH

9.3.1.1.2.2 MID FIELD STRENGTH

9.3.1.1.2.3 HIGH FIELD STRENGTH

9.3.1.2 COMPUTED TOMOGRAPHY SCANNING

9.3.1.2.1 HIGH END SLICE

9.3.1.2.2 MID END SLICE

9.3.1.2.3 LOW END SLICE

9.3.1.2.4 CONE BEAN

9.3.1.3 X-RAY IMAGING

9.3.1.3.1 RADIOGRAPHY

9.3.1.3.1.1 DIGITAL IMAGING

9.3.1.3.1.2 FILM-BASED IMAGING

9.3.1.3.2 FLUOROSCOPY

9.3.1.3.2.1 DIGITAL IMAGING

9.3.1.3.2.2 FILM-BASED IMAGING

9.3.1.3.3 OTHERS

9.3.1.4 OTHERS

9.3.1.4.1 BONE SCAN

9.3.1.4.2 ULTRASOUND

9.3.1.4.2.1 2D ULTRASOUND

9.3.1.4.2.1.1 B/W ULTRASOUND

9.3.1.4.2.1.2 COLOURED

9.3.1.4.2.2 DOPPLER ULTRASOUND

9.3.1.4.2.2.1 B/W ULTRASOUND

9.3.1.4.2.2.2 COLOURED

9.3.1.4.2.3 3D & 4D ULTRASOUND

9.3.1.4.2.3.1 B/W ULTRASOUND

9.3.1.4.2.3.2 COLOURED

9.3.1.4.3 OTHERS

9.3.2 BIOPSY

9.3.2.1 NEEDLE BIOPSY

9.3.2.2 OPEN BIOPSY

9.3.2.3 OTHERS

9.3.3 OTHERS

10 U.S. OSTEONECROSIS MARKET, BY STAGES

10.1 OVERVIEW

10.2 STAGE 2

10.3 STAGE 3

10.4 STAGE 4

10.5 STAGE 1

11 U.S. OSTEONECROSIS MARKET, BY LOCATION

11.1 OVERVIEW

11.2 OSTEONECROSIS OF HIP/FEMORAL HEAD OSTEONECROSIS

11.2.1 TRAUMATIC

11.2.2 NON-TRAUMATIC

11.2.3 IDIOPATHIC OSTEONECROSIS

11.2.3.1 LEGG-CALVE-PERTHES DISEASE

11.2.3.1.1 TREATMENT

11.2.3.1.1.1 NON-SURGICAL

11.2.3.1.1.1.1 ANTI-INFLAMMATORY MEDICATION

11.2.3.1.1.1.1.1 IBUPROFEN

11.2.3.1.1.1.1.2 ASPIRIN

11.2.3.1.1.1.1.3 NAPROXEN SODIUM

11.2.3.1.1.1.1.4 NABUMETONE

11.2.3.1.1.1.1.5 OTHERS

11.2.3.1.1.1.2 BISPHOSPHONATES MEDICATIONS

11.2.3.1.1.1.2.1 ALENDRONATE

11.2.3.1.1.1.2.2 RISEDRONATE

11.2.3.1.1.1.2.3 IBANDRONATE

11.2.3.1.1.1.2.4 ZOLEDRONIC ACID

11.2.3.1.1.1.2.5 PAMIDRONATE

11.2.3.1.1.1.2.6 OTHERS

11.2.3.1.1.1.3 CRUTCHES

11.2.3.1.1.1.3.1 AXILLA CRUTCHES

11.2.3.1.1.1.3.2 ELBOW CRUTCHES

11.2.3.1.1.1.3.3 GUTTER CRUTCHES

11.2.3.1.1.1.4 CASTINGS & BRACINGS

11.2.3.1.1.1.4.1 NEWINGTON BRACE

11.2.3.1.1.1.4.2 TORONTO ORTHOSIS

11.2.3.1.1.1.4.3 SCOTTISH RITE ORTHOSIS

11.2.3.1.1.1.4.4 BROOMSTICK PLASTERS

11.2.3.1.1.1.4.5 BIRMINGHAM ORTHOSIS

11.2.3.1.1.2 SURGICAL

11.2.3.1.1.2.1 FEMORAL OSTEOTOMY

11.2.3.1.1.2.1.1 FEMORAL DEROTATION OSTEOTOMY

11.2.3.1.1.2.1.2 VARUS DEROTATION OSTEOTOMY

11.2.3.1.1.2.2 INNOMINATE OSTEOTOMY

11.2.3.1.1.2.2.1 SALTER (SINGLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.2 SUTHERLAND (DOUBLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.3 STEEL, TONNIS OR CARLOS (TRIPLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.4 GANZ (PERIACETABULAR)

11.2.3.1.1.2.3 SHELF ARTHROPLASTY

11.2.3.1.1.2.4 OTHERS

11.2.3.1.2 DIAGNOSIS

11.2.3.1.2.1 MAGNETIC RESONANCE IMAGING (MRI)

11.2.3.1.2.1.1 CLOSED BORE

11.2.3.1.2.1.1.1 LOW FIELD STRENGTH

11.2.3.1.2.1.1.2 MID FIELD STRENGTH

11.2.3.1.2.1.1.3 HIGH FIELD STRENGTH

11.2.3.1.2.1.2 OPEN BORE

11.2.3.1.2.1.2.1 LOW FIELD STRENGTH

11.2.3.1.2.1.2.2 MID FIELD STRENGTH

11.2.3.1.2.1.2.3 HIGH FIELD STRENGTH

11.2.3.1.2.2 COMPUTED TOMOGRAPHY SCANNING

11.2.3.1.2.2.1 HIGH END SLICE

11.2.3.1.2.2.2 MID END SLICE

11.2.3.1.2.2.3 LOW END SLICE

11.2.3.1.2.2.4 CONE BEAN

11.2.3.1.2.3 X-RAY IMAGING

11.2.3.1.2.3.1 RADIOGRAPHY

11.2.3.1.2.3.1.1 DIGITAL IMAGING

11.2.3.1.2.3.1.2 FILM-BASED IMAGING

11.2.3.1.2.3.2 FLUOROSCOPY

11.2.3.1.2.3.2.1 DIGITAL IMAGING

11.2.3.1.2.3.2.2 FILM-BASED IMAGING

11.2.3.1.2.3.3 OTHERS

11.2.3.1.2.4 OTHERS

11.2.3.2 OTHERS

11.3 OSTEONECROSIS OF THE KNEE

11.3.1 TRAUMATIC

11.3.2 NON-TRAUMATIC

11.3.3 IDIOPATHIC OSTEONECROSIS

11.4 OSTEONECROSIS OF THE SHOULDER

11.4.1 TRAUMATIC

11.4.2 NON-TRAUMATIC

11.4.3 IDIOPATHIC OSTEONECROSIS

11.5 OSTEONECROSIS OF THE TALUS

11.5.1 TRAUMATIC

11.5.2 NON-TRAUMATIC

11.5.3 IDIOPATHIC OSTEONECROSIS

11.6 OSTEONECROSIS OF THE LUNATE

11.6.1 TRAUMATIC

11.6.2 NON-TRAUMATIC

11.6.3 IDIOPATHIC OSTEONECROSIS

11.7 OSTEONECROSIS OF THE SCAPHOID

11.7.1 TRAUMATIC

11.7.2 NON-TRAUMATIC

11.7.3 IDIOPATHIC OSTEONECROSIS

11.8 OTHERS

12 U.S. OSTEONECROSIS MARKET, BY DRUG TYPE

12.1 OVERVIEW

12.2 BRANDED

12.2.1 ORAL

12.2.1.1 TABLETS

12.2.1.2 CAPSULES

12.2.2 PARENTERAL

12.2.3 OTHERS

12.3 GENERIC

12.3.1 ORAL

12.3.1.1 TABLETS

12.3.1.2 CAPSULES

12.3.2 PARENTERAL

12.3.3 OTHERS

13 U.S. OSTEONECROSIS MARKET, BY PRESCRIPTION

13.1 OVERVIEW

13.2 PRESCRIBED DRUGS

13.3 OVER THE COUNTER DRUGS

14 U.S. OSTEONECROSIS MARKET, BY GENDER

14.1 OVERVIEW

14.2 MALE

14.3 FEMALE

15 U.S. OSTEONECROSIS MARKET, BY AGE

15.1 OVERVIEW

15.2 ADULT

15.3 GERIATRIC

15.4 CHILDREN

16 U.S. OSTEONECROSIS MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 PUBLIC

16.2.2 PRIVATE

16.3 ORTHOPEDIC CLINICS

16.4 SPECIALTY CLINICS

16.5 AMBULATORY CENTERS

16.6 OTHERS

17 U.S. OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 RETAIL SALES

17.2.1 HOSPITAL PHARMACY

17.2.2 RETAIL PHARMACY

17.2.3 ONLINE PHARMACY

17.3 DIRECT TENDER

18 U.S. OSTEONECROSIS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: U.S.

19 SWOT ANALYSIS

20 U.S. OSTEONECROSIS MARKET, CPS

20.1 TEVA PHARMACEUTICALS USA, INC. (SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 PFIZER INC. (2022)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 BAYER AG (2022)

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 STRYKER

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 ARTHREX, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 ALMATICA PHARMA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 DR. REDDY'S LABORATORIES LTD. (2022)

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 HALEON GROUP OF COMPANIES

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 SCIEGEN PHARMACEUTICALS.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ZIMMER BIOMET

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Lista de Tablas

TABLE 1 COST OF OSTEONECROSIS TREATMENT SURGERIES

TABLE 2 U.S. OSTEONECROSIS MARKET, PIPELINE ANALYSIS

TABLE 3 U.S. OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 U.S. OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 U.S. TREATMENT IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 U.S. SURGERY IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 7 U.S. MEDICATION IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 8 U.S. NSAIDS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 9 U.S. BLOOD THINNERS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 10 U.S. OSTEOPOROSIS DRUGS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 11 U.S. CHOLESTEROL-LOWERING DRUGS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 12 U.S. PHYSICAL THERAPY IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 13 U.S. CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 14 U.S. AXILLA CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 15 U.S. ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. OPEN-CUFF ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. CLOSED-CUFF ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. GUTTER CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. CASTING AND BRACING IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. OTHERS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. DIAGNOSIS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. IMAGING TEST IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. CLOSED BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. OPEN BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. COMPUTED TOMOGRAPHY SCANNING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. X-RAY IMAGING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. RADIOGRAPHY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. FLUOROSCOPY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 U.S. OTHERS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. 2D ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. DOPPLER ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 U.S. 3D & 4D ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. BIOPSY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. OSTEONECROSIS MARKET, BY STAGES, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. OSTEONECROSIS MARKET, BY LOCATION, 2021-2030 (USD THOUSAND)

TABLE 38 U.S. OSTEONECROSIS OF HIP/FEMORAL HEAD OSTEONECROSIS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. IDIOPATHIC OSTEONECROSIS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. LEGG-CALVE-PERTHES DISEASE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. TREATMENT IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. NON-SURGICAL IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. ANTI-INFLAMMATORY MEDICATIONS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. BISPHOSPHONATES MEDICATIONS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. CRUTCHES IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. CASTING AND BRACING IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. SURGICAL IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. FEMORAL OSTEOTOMY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. INNOMINATE OSTEOTOMY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. DIAGNOSIS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. CLOSED BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. OPEN BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. COMPUTED TOMOGRAPHY SCANNING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. X-RAY IMAGING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. RADIOGRAPHY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. FLUOROSCOPY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. OSTEONECROSIS OF THE KNEE IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. OSTEONECROSIS OF THE SHOULDER IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. OSTEONECROSIS OF THE TALUS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. OSTEONECROSIS OF THE LUNATE IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. OSTEONECROSIS OF THE SCAPHOID IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. BRANDED IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. ORAL IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. GENERIC IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. ORAL IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. OSTEONECROSIS MARKET, BY PRESCRIPTION, 2021-2030 (USD THOUSAND)

TABLE 69 U.S. OSTEONECROSIS MARKET, BY GENDER, 2021-2030 (USD THOUSAND)

TABLE 70 U.S. OSTEONECROSIS MARKET, BY AGE, 2021-2030 (USD THOUSAND)

TABLE 71 U.S. OSTEONECROSIS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. HOSPITALS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. RETAIL SALES IN OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 U.S. OSTEONECROSIS MARKET: SEGMENTATION

FIGURE 2 U.S. OSTEONECROSIS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. OSTEONECROSIS MARKET: DROC ANALYSIS

FIGURE 4 U.S. OSTEONECROSIS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. OSTEONECROSIS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. OSTEONECROSIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. OSTEONECROSIS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. OSTEONECROSIS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.S. OSTEONECROSIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. OSTEONECROSIS MARKET: SEGMENTATION

FIGURE 11 INCREASING NUMBER OF TRAUMATIC INJURIES IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. OSTEONECROSIS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE TRAUMATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. OSTEONECROSIS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC KNEE CARTILAGE REPAIR MARKET

FIGURE 14 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, 2022

FIGURE 15 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, 2023-2030 (USD THOUSAND)

FIGURE 16 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, CAGR (2023-2030)

FIGURE 17 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 18 U.S. OSTEONECROSIS MARKET: BY TYPE, 2022

FIGURE 19 U.S. OSTEONECROSIS MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 20 U.S. OSTEONECROSIS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 21 U.S. OSTEONECROSIS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 U.S. OSTEONECROSIS MARKET: BY STAGES, 2022

FIGURE 23 U.S. OSTEONECROSIS MARKET: BY STAGES, 2023-2030 (USD THOUSAND)

FIGURE 24 U.S. OSTEONECROSIS MARKET: BY STAGES, CAGR (2023-2030)

FIGURE 25 U.S. OSTEONECROSIS MARKET: BY STAGES, LIFELINE CURVE

FIGURE 26 U.S. OSTEONECROSIS MARKET: BY LOCATION, 2022

FIGURE 27 U.S. OSTEONECROSIS MARKET: BY LOCATION, 2023-2030 (USD THOUSAND)

FIGURE 28 U.S. OSTEONECROSIS MARKET: BY LOCATION, CAGR (2023-2030)

FIGURE 29 U.S. OSTEONECROSIS MARKET: BY LOCATION, LIFELINE CURVE

FIGURE 30 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, 2022

FIGURE 31 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, 2023-2030 (USD THOUSAND)

FIGURE 32 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, CAGR (2023-2030)

FIGURE 33 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 34 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, 2022

FIGURE 35 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, 2023-2030 (USD THOUSAND)

FIGURE 36 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, CAGR (2023-2030)

FIGURE 37 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, LIFELINE CURVE

FIGURE 38 U.S. OSTEONECROSIS MARKET: BY GENDER, 2022

FIGURE 39 U.S. OSTEONECROSIS MARKET: BY GENDER, 2023-2030 (USD THOUSAND)

FIGURE 40 U.S. OSTEONECROSIS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 41 U.S. OSTEONECROSIS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 42 U.S. OSTEONECROSIS MARKET: BY AGE, 2022

FIGURE 43 U.S. OSTEONECROSIS MARKET: BY AGE, 2023-2030 (USD THOUSAND)

FIGURE 44 U.S. OSTEONECROSIS MARKET: BY AGE, CAGR (2023-2030)

FIGURE 45 U.S. OSTEONECROSIS MARKET: BY AGE, LIFELINE CURVE

FIGURE 46 U.S. OSTEONECROSIS MARKET: BY END USER, 2022

FIGURE 47 U.S. OSTEONECROSIS MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 48 U.S. OSTEONECROSIS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 49 U.S. OSTEONECROSIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 50 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 51 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 52 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 53 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 U.S. OSTEONECROSIS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.