Us Glass Door Merchandiser Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5,889.41 Million

USD

7,480.10 Million

2022

2030

USD

5,889.41 Million

USD

7,480.10 Million

2022

2030

| 2023 –2030 | |

| USD 5,889.41 Million | |

| USD 7,480.10 Million | |

|

|

|

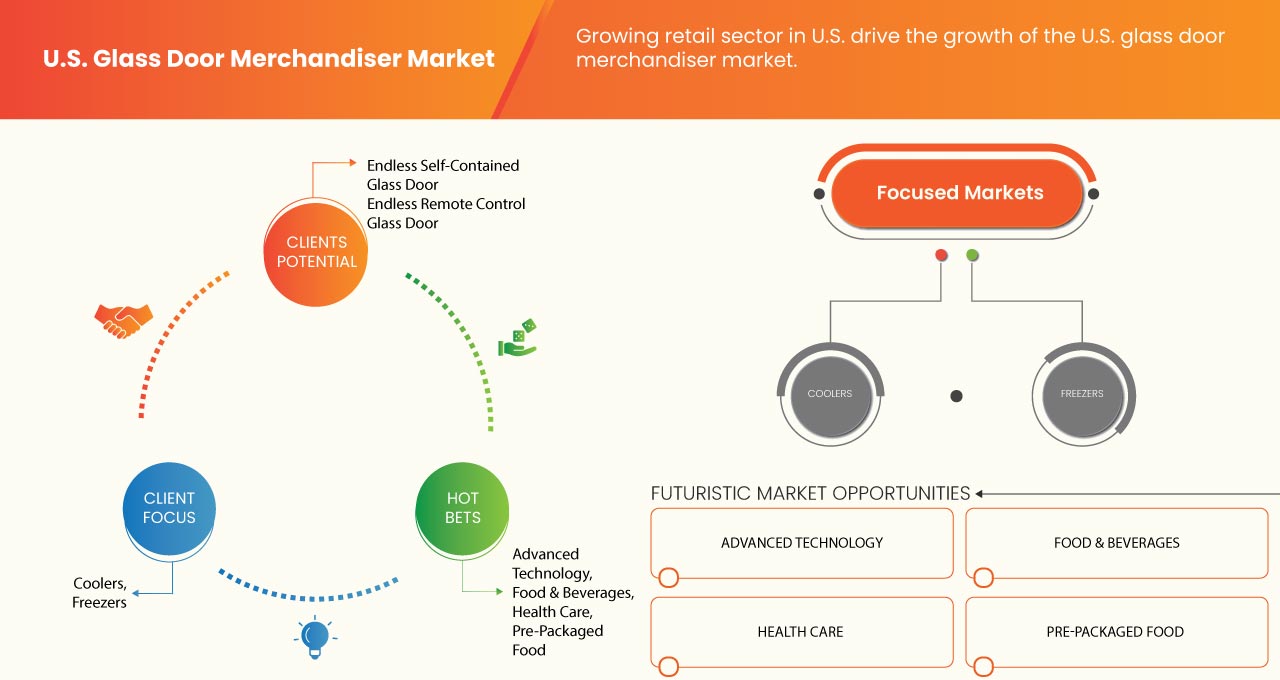

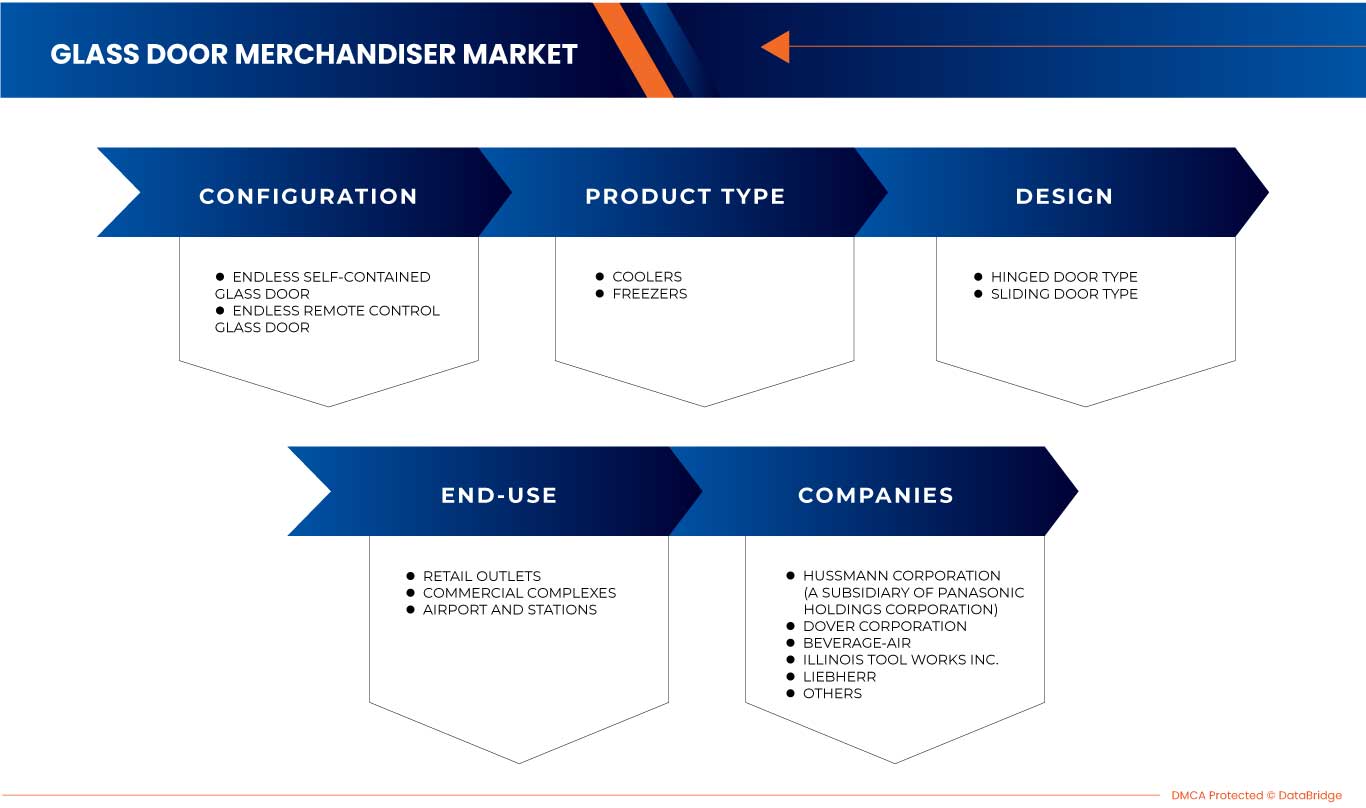

Mercado de exhibidores con puertas de vidrio de EE. UU., por configuración (puerta de vidrio autónoma sin fin y puerta de vidrio con control remoto sin fin), tipo de producto (enfriadores y congeladores ), diseño (tipo de puerta con bisagras y tipo de puerta corrediza) y uso final (puntos de venta minorista, complejos comerciales y aeropuertos y estaciones): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de expositores con puertas de cristal en EE. UU.

Se espera que el mercado estadounidense de exhibidores con puertas de vidrio alcance los USD 7480,10 millones para 2030 desde USD 5889,41 millones en 2022, creciendo con una CAGR sustancial del 3,1 % en el período de pronóstico de 2023 a 2030. El principal factor que impulsa el crecimiento del mercado de exhibidores con puertas de vidrio es la creciente popularidad de los exhibidores con puertas de vidrio en el sector minorista y el sector hotelero.

El mercado de expositores con puertas de cristal está experimentando un crecimiento constante y una demanda creciente impulsada por factores como la expansión del sector minorista, la creciente preferencia por soluciones de exposición visualmente atractivas y energéticamente eficientes y el auge de la industria de alimentos y bebidas. El mercado se caracteriza por una intensa competencia entre los actores clave, lo que impulsa la innovación y los avances tecnológicos en términos de características, diseño y sostenibilidad. Además, el creciente enfoque en la sostenibilidad y las soluciones ecológicas está influyendo en el desarrollo de productos y los patrones de compra de los consumidores. En general, se espera que el mercado de expositores con puertas de cristal continúe su trayectoria ascendente en los próximos años.

El informe de mercado de exhibidores de puertas de vidrio de EE. UU. proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volumen en miles de unidades |

|

Segmentos cubiertos |

Configuración (puerta de vidrio autónoma sin fin y puerta de vidrio con control remoto sin fin), tipo de producto (enfriadores y congeladores), diseño (puerta con bisagras y puerta corrediza) y uso final (puntos de venta minorista, complejos comerciales, aeropuertos y estaciones) |

|

Países cubiertos |

A NOSOTROS |

|

Actores del mercado cubiertos |

Entre las empresas que participan se encuentran: Illinois Tool Works Inc., Turbo Air Inc., Everest Refrigeration, Liebherr, True Manufacturing Co., Inc., Migali, Dover Corporation, Hussmann Corporation (una subsidiaria de Panasonic Holdings Corporation), Arneg USA, Vortex Refrigeration Company, Master-Bilt Products, LLC., Hoshizaki Electric, Helmer Scientific Inc., MTL Cool, Zero Zone, Inc., Maxx Cold, Dukers Appliance Co., USA Ltd, Beverage–Air, Atosa USA, Saba Corp, entre otras. |

Definición de mercado

Un tipo común de equipo de refrigeración comercial que se ve en tiendas minoristas y lugares de restauración se denomina "vitrina con puerta de vidrio". En la mayoría de los casos, adopta la forma de una vitrina con puerta de vidrio que se utiliza para exhibir y almacenar cosas, incluidos bocadillos, bebidas, comidas refrigeradas y otros productos perecederos. Los clientes pueden elegir los productos con mayor facilidad porque pueden ver lo que hay dentro del refrigerador sin abrirlo. Las vitrinas con puerta de vidrio se utilizan con frecuencia en los establecimientos minoristas para mejorar la visibilidad de los productos, mantener un control adecuado de la temperatura y promover las ventas por impulso.

Dinámica del mercado de exhibidores con puertas de vidrio en EE. UU.

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Perspectivas positivas hacia el sector minorista

Una de las ventajas más importantes de los expositores con puertas de cristal es su diseño compacto, que los convierte en una opción ideal para que los minoristas almacenen alimentos de forma segura. Además, sus elegantes vitrinas y puertas transparentes permiten a los minoristas exhibir sus productos de forma eficaz, atrayendo la atención de los clientes e impulsando las ventas. Además, la presencia de grandes minoristas en los EE. UU. contribuye al crecimiento del mercado de expositores con puertas de cristal. Estos importantes minoristas tienen una importante cuota de mercado en las ventas minoristas de alimentos, lo que crea un entorno favorable para la adopción de tecnologías de refrigeración avanzadas, incluidos los expositores con puertas de cristal. Además, los expositores con puertas de cristal ofrecen a los minoristas la oportunidad de mejorar la exposición de sus productos y ofrecer una experiencia de compra superior a los clientes, por lo que se espera que contribuyan al crecimiento del mercado de expositores con puertas de cristal de los EE. UU.

- Aumento del gasto destinado a mejorar la gestión de las instalaciones en el sector hotelero

Los expositores con puertas de cristal almacenan opciones de comida y bebida listas para consumir. La demanda de estas opciones de comida lista para consumir está aumentando hoy en día debido a los cambios en los estilos de vida de los consumidores y las preferencias dietéticas. Estos expositores permiten a los clientes acceder fácilmente a comidas, bebidas y aperitivos preenvasados, especialmente cuando la gente está de viaje. Además de las características transparentes de estos expositores, también desempeñan un papel importante en mantener la seguridad e higiene de los alimentos, especialmente para los alimentos que son perecederos por naturaleza. Además, mediante el uso de este tipo de equipos, se reduce la necesidad de contacto humano directo con los alimentos. Además, los expositores con puertas de cristal ofrecen características en sus equipos como control de temperatura, pantalla de iluminación LED para una visualización clara de los alimentos, seguridad para mantener los alimentos y opciones de pago a través de máquinas expendedoras y, por lo tanto, se espera que fomenten el crecimiento del mercado de expositores con puertas de cristal de EE. UU.

- Escenario favorable en cuanto al gasto predominante en el mantenimiento de almacenes de medicamentos y otros insumos médicos

Los refrigeradores que se utilizan en las farmacias para almacenar medicamentos están equipados con sistemas de control y monitoreo de temperatura que están ganando la atención de los clientes de los exhibidores con puertas de vidrio para el almacenamiento de vacunas y productos farmacéuticos. Dichos sistemas garantizan la seguridad del producto y también les brindan estabilidad de temperatura para que el contenido presente en ellos no se degrade. Además, los fabricantes ofrecen una amplia gama de configuraciones y tamaños de exhibidores que permiten a los centros de atención médica optar por el sistema en función de sus requisitos, como la limitación de espacio. Además de eso, los exhibidores con puertas de vidrio permiten a los médicos ver el stock de medicamentos sin abrir la puerta y alterar la inestabilidad de la temperatura. Además, el uso de exhibidores con puertas de vidrio permite a los profesionales de la salud organizar y realizar un seguimiento eficiente de los niveles de existencias de medicamentos, fármacos y vacunas, por lo que se espera que impulse el crecimiento del mercado de exhibidores con puertas de vidrio de EE. UU.

Oportunidades

Cambiando el enfoque de los fabricantes hacia refrigerantes ecológicos y energéticamente eficientes

Se utilizan nuevas tecnologías, como la refrigeración magnética, que depende de campos magnéticos en lugar de métodos de compresión de gas, lo que ayuda a enfriar el sistema sin el uso de ningún refrigerante . Esto hace que la refrigeración magnética sea energéticamente eficiente y cause un menor impacto ambiental. Además, ha habido varias regulaciones con respecto a los refrigerantes dañinos que han impulsado la adopción de refrigerantes ecológicos que causan menos contaminación. Los refrigerantes como NH3 (amoniaco o R717), CO2 (dióxido de carbono o R744) e hidrocarburos como R290 (propano) tienen valores bajos de potencial de calentamiento global. Además, el creciente cambio de los fabricantes hacia refrigerantes ecológicos y energéticamente eficientes debido a las estrictas regulaciones ha llevado a la adopción de este tipo de productos. Además, los clientes, como los negocios minoristas, deben considerar factores de ahorro de energía y factores ambientales al tomar decisiones de compra de exhibidores con puertas de vidrio, lo que se espera que cree una excelente oportunidad para el crecimiento del mercado de exhibidores con puertas de vidrio de EE. UU.

- Fuerte inversión en potencial publicitario con displays de marca y exhibiciones de productos

El exhibidor con puerta de vidrio tiene puertas de vidrio transparente que atraen a los clientes, especialmente para productos alimenticios y bebidas. Están diseñados de tal manera que tienen el potencial de publicitar a través de exhibidores de marca y vitrinas de productos. Dichos exhibidores constan de pancartas y marcas en los lados superiores, lo que lo convierte en un modo de publicidad eficiente para diferentes tipos de productos. Las exhibiciones en él podrían mostrar las ofertas, los precios y los productos presentados por los exhibidores, por lo que podrían captar la atención del cliente y conducir a las ventas de los productos.

Para maximizar las ventas mediante la publicidad en expositores con puertas de cristal, las empresas utilizan técnicas de marketing visual y de desarrollo de marca. Diferentes gráficos, colores y sistemas de iluminación exclusivos crean una exposición llamativa que atrae a los consumidores para que conozcan los productos ofrecidos. Estos anuncios atractivos, junto con el expositor, informan sobre los productos e impulsan el deseo del consumidor de comprar el producto anunciado.

Además, con la disponibilidad de pantallas interactivas, las empresas fabricantes de productos y los minoristas pueden aumentar la participación de los clientes e impulsar las ventas invirtiendo en anuncios atractivos, lo que se espera que ofrezca una amplia oportunidad para el crecimiento del mercado de exhibidores con puertas de vidrio en EE. UU.

Restricciones/Desafíos

- Amplia participación de los costes

El expositor con puerta de cristal utiliza un sistema de refrigeración que requiere refrigerante. Puede ser necesaria una recarga periódica. Este proceso implica añadir refrigerante para mantener un rendimiento de refrigeración óptimo. Se debe tener en cuenta el coste del refrigerante y la mano de obra necesaria para la recarga. Además de eso, el mantenimiento preventivo regular ayuda a localizar y resolver posibles fallos antes de que se conviertan en problemas mayores. La limpieza del serpentín del condensador, la inspección de la conexión eléctrica, las pruebas de control de temperatura y la lubricación de las piezas móviles son algunos ejemplos que pueden entrar en esta categoría. Los gastos de mantenimiento preventivo pueden incluir los costes de mano de obra, los costes de material y cualquier herramienta o equipo especializado necesario, que pueden considerarse como una implicación importante de los costes y tendrán un impacto negativo en la mentalidad del consumidor, lo que en última instancia conduce a un impacto en el mercado.

En conclusión, la reparación y el mantenimiento de las unidades de refrigeración comercial son extremadamente complejos y el costo de las piezas es enorme. Debido a que implican un mayor gasto monetario, esta reparación y reemplazo costarían mucho más que el costo requerido para reemplazar estas unidades por una nueva. Como resultado, se espera que el alto costo de reparación y mantenimiento de los exhibidores con puertas de vidrio actúe como una restricción considerable que impida el crecimiento del mercado de exhibidores con puertas de vidrio en los EE. UU.

- Desafíos a los que se enfrenta el proceso de fabricación

La naturaleza delicada del vidrio, la exigencia de un control de calidad preciso y la dificultad de integrar sistemas de refrigeración hacen que el proceso de fabricación de los expositores con puertas de vidrio sea un desafío en muchos sentidos. Las puertas de vidrio deben manipularse con cuidado debido a su fragilidad para evitar que se rompan o agrieten. Se necesitan procedimientos de control de calidad estrictos para garantizar la consistencia de la calidad en todas las unidades. Puede resultar difícil sellar y aislar adecuadamente para detener las fugas de aire y preservar la eficiencia energética. Para un rendimiento óptimo, es esencial lograr una regulación precisa de la temperatura y la integridad estructural. El proceso de producción también se complica por elementos como la iluminación de la exposición, el control del ruido y las vibraciones, el embalaje y el envío. Para superar estos obstáculos, necesitará conocimientos, centrarse en los pequeños detalles y mejorar constantemente.

En conclusión, la fabricación de exhibidores con puertas de vidrio es difícil por varias razones. La complejidad está influenciada por factores como la fragilidad del vidrio, el control de calidad, el sellado y el aislamiento, el control de temperatura, la integridad estructural, la iluminación de la exhibición, el control del ruido y la vibración, y las limitaciones de empaquetado y envío. Para superar estos obstáculos, necesitará conocimiento, concentración y un compromiso con el crecimiento y, por lo tanto, se espera que cree desafíos para el mercado.

Acontecimientos recientes

- En diciembre de 2019, Hoshizaki Corporation lanzó un nuevo producto llamado ECO plus KG140, que es un refrigerador con puerta de vidrio transparente que atraerá a los consumidores que prefieren refrigeradores de almacenamiento duraderos y estéticos.

- En enero de 2019, Helmer Scientific lanzó los primeros refrigeradores profesionales de grado médico con sistemas de enfriamiento Opti-Cool optimizados, denominados GX Solutions. Estos productos están diseñados y estructurados de manera que brinden aplicaciones críticas únicas para el cuidado de la salud y ofrecen control optimizado de temperatura, gestión del ruido y gestión de la energía.

Alcance del mercado de expositores con puertas de cristal en EE. UU.

El mercado de exhibidores de puertas de vidrio de EE. UU. está segmentado en cuatro segmentos notables según la configuración, el tipo de producto, el diseño y el uso final. El crecimiento entre estos segmentos lo ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Configuración

- Puerta de vidrio autónoma sin fin

- Puerta de cristal con control remoto sin fin

Sobre la base de la configuración, el mercado está segmentado en puertas de vidrio autónomas sin fin y puertas de vidrio con control remoto sin fin.

Tipo de producto

- Enfriadores

- Congeladores

Según el tipo de producto, el mercado está segmentado en refrigeradores y congeladores.

Diseño

- Puerta con bisagras

- Puerta corrediza

En función del diseño, el mercado está segmentado en puertas batientes y puertas corredizas.

Uso final

- Puntos de venta minorista

- Complejos comerciales

- Aeropuerto y estaciones

En función del uso final, el mercado se segmenta en puntos de venta minorista, complejos comerciales y aeropuertos y estaciones.

Análisis del panorama competitivo y de la cuota de mercado de los expositores con puertas de cristal en EE. UU.

El panorama competitivo del mercado de exhibidores con puertas de vidrio de EE. UU. proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores solo están relacionados con las empresas que se centran en el mercado de exhibidores con puertas de vidrio de EE. UU.

Algunos de los principales actores del mercado que operan en el mercado son Illinois Tool Works Inc., Turbo Air Inc., Everest Refrigeration, Liebherr, True Manufacturing Co., Inc., Migali, Dover Corporation, Hussmann Corporation (una subsidiaria de Panasonic Holdings Corporation), Arneg USA, Vortex Refrigeration Company, Master-Bilt Products, LLC., Hoshizaki Electric, Helmer Scientific Inc., MTL Cool, Zero Zone, Inc., Maxx Cold, Dukers Appliance Co., USA Ltd, Beverage–Air, Atosa USA, Saba Corp, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 BRAND ANALYSIS

4.4 PRODUCTION CAPACITY OVERVIEW

4.5 CONSUMER BUYING BEHAVIOUR

4.5.1 ENHANCED PRODUCT VISIBILITY:

4.5.2 IMPROVED PRODUCT PRESENTATION:

4.5.3 TEMPERATURE CONTROL:

4.5.4 ENERGY EFFICIENCY:

4.5.5 PRODUCT PROTECTION:

4.5.6 BRANDING AND MARKETING OPPORTUNITIES:

4.5.7 CONVENIENCE FOR CONSUMERS:

4.5.8 COMPLIANCE WITH HEALTH AND SAFETY REGULATIONS:

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.6.1 IMPACT ON PRICE

4.6.2 IMPACT ON SUPPLY CHAIN

4.6.3 IMPACT ON SHIPMENT

4.6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 POSITIVE OUTLOOK TOWARDS THE RETAIL SECTOR

5.1.2 RISING SPENDING TOWARD IMPROVED FACILITY MANAGEMENT IN THE HOSPITALITY SECTOR

5.1.3 FAVOURABLE SCENARIO REGARDING PREDOMINANT SPENDING ON KEEPING STORAGE OF DRUGS AND OTHER MEDICAL OFFERINGS

5.2 RESTRAINTS

5.2.1 EXTENSIVE INVOLVEMENT OF COST

5.3 OPPORTUNITIES

5.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARDS ECO-FRIENDLY AND ENERGY-EFFICIENT REFRIGERANTS

5.3.2 STRONG SPENDING ON ADVERTISING POTENTIAL WITH BRANDED DISPLAYS AND PRODUCT SHOWCASES

5.4 CHALLENGES

5.4.1 CHALLENGES FACED DURING THE MANUFACTURING PROCESS

6 U.S. GLASS DOOR MERCHANDISER MARKET, BY CONFIGURATION

6.1 OVERVIEW

6.2 ENDLESS SELF-CONTAINED GLASS DOOR

6.2.1 MORE THAN 1000 LITERS

6.2.2 500 LITERS - 1000 LITERS

6.2.3 UP TO 500 LITERS

6.3 ENDLESS REMOTE CONTROL GLASS DOOR

6.3.1 MORE THAN 1000 LITERS

6.3.2 500 LITERS - 1000 LITERS

6.3.3 UP TO 500 LITERS

7 U.S. GLASS DOOR MERCHANDISER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COOLERS

7.3 FREEZERS

8 U.S. GLASS DOOR MERCHANDISER MARKET, BY DESIGN

8.1 OVERVIEW

8.2 HINGED DOOR TYPE

8.2.1 MULTI DOOR

8.2.2 SINGLE DOOR

8.3 SLIDING DOOR TYPE

9 U.S. GLASS DOOR MERCHANDISER MARKET, BY END-USE

9.1 OVERVIEW

9.2 RETAIL OUTLETS

9.2.1 HYPERMARKET/SUPERMARKET

9.2.2 MULTI-BRAND STORES

9.2.3 SINGLE-BRAND STORES

9.3 COMMERCIAL COMPLEXES

9.3.1 SHOPPING MALL/ MULTIPLEX

9.3.2 CAFE & BAR

9.3.3 HOSPITALS

9.3.3.1 VACCINE STORAGE

9.3.3.2 PHARMACY REFRIGERATORS

9.3.3.3 BLOOD BANK REFRIGERATORS

9.3.3.4 LABORATORY REFRIGERATORS

9.3.4 RESTAURANT/HOTEL

9.3.5 OTHERS

9.4 AIRPORT AND STATIONS

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: U.S.

10.2 E-COMMERCE EXPANSION

10.3 BRAND LAUNCH

10.4 ACQUISITION

11 COMPANY PROFILES

11.1 HUSSMANN CORPORATION (A SUBSIDIARY OF PANASONIC HOLDINGS CORPORATION)

11.1.1 COMPANY SNAPSHOT

11.1.2 SWOT ANALYSIS

11.1.3 REVENUE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENT

11.2 DOVER CORPORATION

11.2.1 COMPANY SNAPSHOT

11.2.2 SWOT ANALYSIS

11.2.3 REVENUE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENT

11.3 BEVERAGE-AIR

11.3.1 COMPANY SNAPSHOT

11.3.2 PRODUCT PORTFOLIO

11.3.3 SWOT ANALYSIS

11.3.4 RECENT DEVELOPMENT

11.4 ILLINOIS TOOL WORKS INC.

11.4.1 COMPANY SNAPSHOT

11.4.2 SWOT ANALYSIS

11.4.3 REVENUE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENT

11.5 LIEBHERR

11.5.1 COMPANY SNAPSHOT

11.5.2 SWOT ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 ARNEG USA

11.6.1 COMPANY SNAPSHOT

11.6.2 SWOT ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 ATOSA USA

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 SWOT ANALYSIS

11.7.4 RECENT DEVELOPMENT

11.8 DUKERS APPLIANCE CO., USA LTD.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 SWOT ANALYSIS

11.8.4 RECENT DEVELOPMENT

11.9 EVEREST REFRIGERATION

11.9.1 COMPANY SNAPSHOT

11.9.2 SWOT ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 HELMER SCIENTIFIC INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 SWOT ANALYSIS

11.10.4 RECENT DEVELOPMENT

11.11 HOSHIZAKI CORPORATION

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 SWOT ANALYSIS

11.11.5 RECENT DEVELOPMENTS

11.12 MASTER-BILT PRODUCTS, LLC.

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 SWOT ANALYSIS

11.12.4 RECENT DEVELOPMENT

11.13 MAXX COLD

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 SWOT ANALYSIS

11.13.4 RECENT DEVELOPMENT

11.14 MIGALI

11.14.1 COMPANY SNAPSHOT

11.14.2 SWOT ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT DEVELOPMENT

11.15 MTL COOL

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 SWOT ANALYSIS

11.15.4 RECENT DEVELOPMENT

11.16 SABA CORP.

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 SWOT ANALYSIS

11.16.4 RECENT DEVELOPMENT

11.17 TRUE MANUFACTURING CO., INC.

11.17.1 COMPANY SNAPSHOT

11.17.2 SWOT ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT DEVELOPMENT

11.18 TURBO AIR INC.

11.18.1 COMPANY SNAPSHOT

11.18.2 SWOT ANALYSIS

11.18.3 PRODUCT PORTFOLIO

11.18.4 RECENT DEVELOPMENT

11.19 VORTEX REFRIGERATION COMPANY

11.19.1 COMPANY SNAPSHOT

11.19.2 SWOT ANALYSIS

11.19.3 PRODUCT PORTFOLIO

11.19.4 RECENT DEVELOPMENT

11.2 ZERO ZONE, INC.

11.20.1 COMPANY SNAPSHOT

11.20.2 PRODUCT PORTFOLIO

11.20.3 SWOT ANALYSIS

11.20.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tablas

TABLE 1 U.S. GLASS DOOR MERCHANDISER MARKET, BY CONFIGURATION, 2021-2030 (USD MILLION)

TABLE 2 U.S. GLASS DOOR MERCHANDISER MARKET, BY CONFIGURATION, 2021-2030 (THOUSAND UNITS)

TABLE 3 U.S. ENDLESS SELF-CONTAINED GLASS DOOR IN GLASS DOOR MERCHANDISER MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 4 U.S. ENDLESS REMOTE CONTROL GLASS DOOR IN GLASS DOOR MERCHANDISER MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 5 U.S. GLASS DOOR MERCHANDISER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 U.S. GLASS DOOR MERCHANDISER MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 7 U.S. HINGED DOOR TYPE IN GLASS DOOR MERCHANDISER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 U.S. GLASS DOOR MERCHANDISER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 9 U.S. RETAIL OUTLETS IN GLASS DOOR MERCHANDISER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.S. COMMERCIAL COMPLEXES IN GLASS DOOR MERCHANDISER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 U.S. HOSPITALS IN GLASS DOOR MERCHANDISER MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 U.S. GLASS DOOR MERCHANDISER MARKET

FIGURE 2 U.S. GLASS DOOR MERCHANDISER MARKET: DATA TRIANGULATION

FIGURE 3 U.S. GLASS DOOR MERCHANDISER MARKET: DROC ANALYSIS

FIGURE 4 U.S. GLASS DOOR MERCHANDISER MARKET: U.S. VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. GLASS DOOR MERCHANDISER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. GLASS DOOR MERCHANDISER MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 U.S. GLASS DOOR MERCHANDISER MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. GLASS DOOR MERCHANDISER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. GLASS DOOR MERCHANDISER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. GLASS DOOR MERCHANDISER MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 U.S. GLASS DOOR MERCHANDISER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. GLASS DOOR MERCHANDISER MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 U.S. GLASS DOOR MERCHANDISER MARKET: SEGMENTATION

FIGURE 14 A POSITIVE OUTLOOK TOWARDS THE RETAIL SECTOR IS EXPECTED TO DRIVE THE U.S. GLASS DOOR MERCHANDISER MARKET IN THE FORECAST PERIOD

FIGURE 15 THE ENDLESS SELF-CONTAINED CONTROL GLASS DOOR IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. GLASS DOOR MERCHANDISER MARKET IN 2023 AND 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE U.S. GLASS DOOR MERCHANDISER MARKET

FIGURE 18 U.S. GLASS DOOR MERCHANDISER MARKET: BY CONFIGURATION, 2022

FIGURE 19 U.S. GLASS DOOR MERCHANDISER MARKET: BY PRODUCT TYPE, 2022

FIGURE 20 U.S. GLASS DOOR MERCHANDISER MARKET: BY DESIGN, 2022

FIGURE 21 U.S. GLASS DOOR MERCHANDISER MARKET: BY END-USE, 2022

FIGURE 22 U.S. GLASS DOOR MERCHANDISER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.