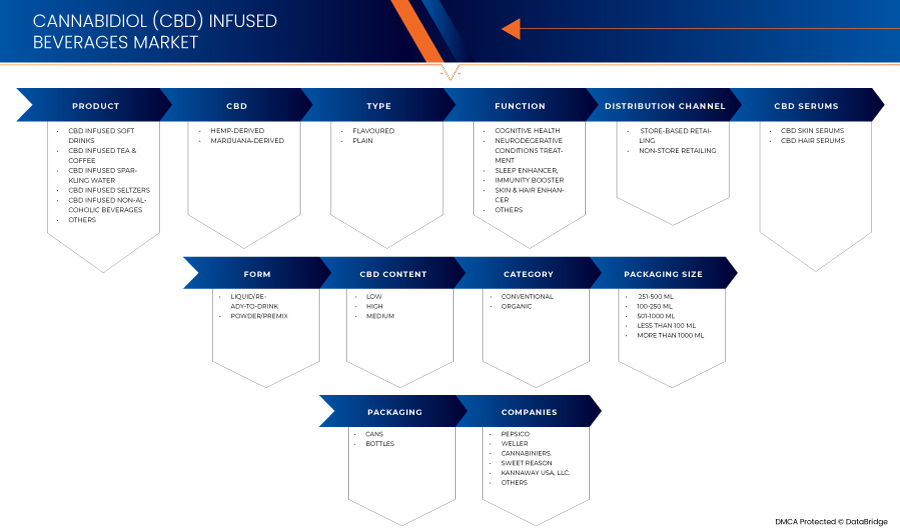

U.S. Cannabidiol (CBD) Infused Beverages Market, By Product (CBD Infused Soft Drinks, CBD Infused Tea & Coffee, CBD Infused Sparkling Water, CBD Infused Seltzers, CBD Infused Non-Alcoholic Beverages, and Others), CBD (Hemp-Derived and Marijuana-Derived), Type (Flavoured and Plain), Form (Liquid/Ready-to-Drink and Powder/Premix), CBD Content(Low, High, and Medium), Category (Conventional and Organic), Function (Cognitive Health, Neurodegerative Conditions Treatment, Sleep Enhancer, Immunity Booster, Skin & Hair Enhancer, and Others), Packaging (Cans and Bottles), Packaging Size (251-500 Ml, 100-250 Ml, 501-1000 Ml, Less Than 100 Ml, and More Than 1000 Ml), Distribution Channel (Store-Based Retailing and Non-Store Retailing), CBD Serums (CBD Skin Serums and CBD Hair Serums) - Industry Trends and Forecast to 2030.

U.S. Cannabidiol (CBD) Infused Beverages Market Analysis and Insights

CBD-infused beverages are widely used to treat insomnia, inflammation, chronic pain, depression, anxiety, and hyperemesis. Increasing consumer awareness regarding the health benefits of CBD is expected to drive market growth. In addition, rising demand for flavored CBD-infused beverages is further expected to drive market growth. Growing medical applications of CBD products are expected to provide market growth opportunities. However, side effects related to overconsumption or utilization of CBD products and government regulations are expected to challenge market growth.

Data Bridge Market Research analyses that the U.S. cannabidiol (CBD) infused beverages market is expected to reach the value of USD 501.93 million by 2030, at a CAGR of 14.7 during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Product (CBD Infused Soft Drinks, CBD Infused Tea & Coffee, CBD Infused Sparkling Water, CBD Infused Seltzers, CBD Infused Non-Alcoholic Beverages, and Others), CBD (Hemp-Derived and Marijuana-Derived), Type (Flavoured and Plain), Form (Liquid/Ready-to-Drink and Powder/Premix), CBD Content(Low, High, and Medium), Category (Conventional and Organic), Function (Cognitive Health, Neurodegerative Conditions Treatment, Sleep Enhancer, Immunity Booster, Skin & Hair Enhancer, and Others), Packaging (Cans and Bottles), Packaging Size (251-500 Ml, 100-250 Ml, 501-1000 Ml, Less Than 100 Ml, and More Than 1000 Ml), Distribution Channel (Store-Based Retailing and Non-Store Retailing), CBD Serums (CBD Skin Serums and CBD Hair Serums) |

|

Country Covered |

U.S. |

|

Market Players Covered |

PepsiCo, Weller, Cannabiniers., Sweet Reason, KANNAWAY USA, LLC., Kickback., Altitude., BellRock Brands Inc., A88CBD, CANN, Ablis, Wyld CBD, Harmony Craft Beverages., Daytrip Beverages., Recess, Neurogan, CBD Living., PURAVIDAORGANIC y ONE HUNDRED COCONUTS, LLC, entre otros. |

Definición de mercado

Bebidas con infusión de cannabidiol (CBD) que contienen fármacos cannabinoides derivados de la planta Cannabis Sativa. Estos medicamentos se clasifican principalmente como tetrahidrocannabinol (THC) y cannabidiol (CBD) (CBD). Las bebidas con infusión de CBD se utilizan ampliamente para tratar el insomnio, la inflamación, el dolor crónico, la depresión, la ansiedad y la hiperémesis, entre otros.

Dinámica del mercado de bebidas con infusión de cannabidiol (CBD) en EE. UU.

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumenta la conciencia de los consumidores sobre los beneficios del CBD para la salud

La demanda de productos de CBD ha ido en aumento, especialmente por parte de los consumidores, debido a la creciente conciencia de los beneficios para la salud del CBD. Esto ayudará a que el mercado del CBD en los EE. UU. experimente un rápido crecimiento con la creciente demanda.

Las bebidas con CBD se consideran un remedio natural para una variedad de problemas de salud. Se cree que las bebidas con infusión de CBD tratan una variedad de problemas de salud, incluidos el dolor, la ansiedad, las enfermedades del sistema nervioso central, la epilepsia y otros.

Por ejemplo,

- Según Harvard Health, la capacidad del CBD para tratar la epilepsia puede ser el indicio más claro de sus beneficios para la salud. Las bebidas con CBD ofrecen alivio a quienes padecen dolor crónico, artritis y acné. También ayuda a tratar el insomnio y los trastornos de salud mental, como la ansiedad y la depresión.

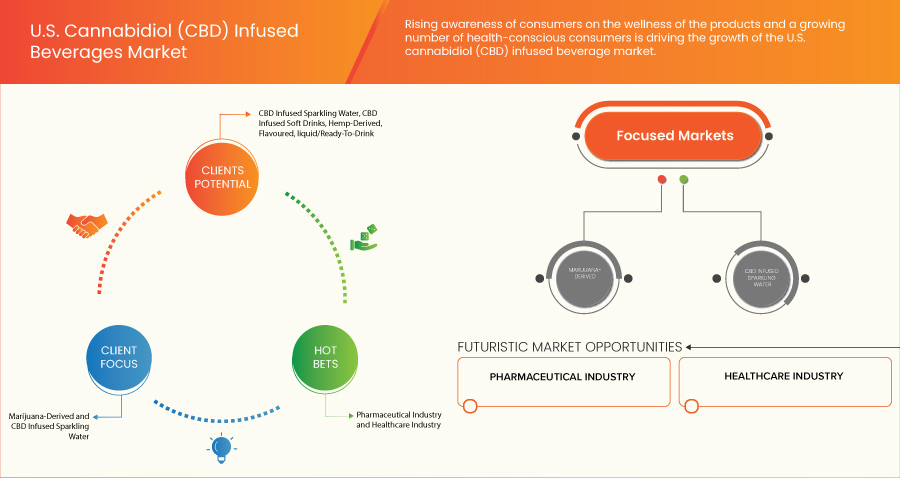

Además, la creciente disponibilidad de información procedente de fuentes fiables, como la investigación científica y los medios de comunicación, ha aumentado la concienciación de los consumidores, que están mejor preparados para tomar decisiones informadas e incorporar bebidas con infusión de CBD a sus regímenes de bienestar. Por tanto, la creciente concienciación de los consumidores sobre el bienestar de los productos y un número cada vez mayor de consumidores preocupados por la salud están impulsando el crecimiento del mercado de bebidas con infusión de cannabidiol (CBD).

- Demanda creciente de bebidas con sabor a CBD

Los consumidores buscan cada vez más bebidas que ofrezcan beneficios para la salud y una experiencia de sabor placentera. Las bebidas con sabor a CBD ofrecen una combinación de posibles propiedades para el bienestar y sabores agradables, lo que las hace atractivas para las personas preocupadas por su salud.

La creciente demanda de bebidas con sabor a CBD ha permitido a los fabricantes lanzar nuevos productos en los EE. UU. con una amplia gama de sabores disponibles. Los consumidores pueden elegir bebidas que se adapten a sus gustos y preferencias personales. Los sabores hacen que las bebidas con CBD se sientan más como una opción de bebida habitual, lo que contribuye a una mayor aceptación y al crecimiento del mercado.

Además, las bebidas con sabor a CBD tienen el potencial de atraer a nuevos consumidores que pueden sentirse intrigados por los sabores nuevos y exóticos. El lanzamiento de diferentes sabores puede ayudar a atraer a personas que prefieren las bebidas con CBD.

Por lo tanto, se espera que la amplia disponibilidad de varios sabores, como naranja, frambuesa, maracuyá y lima, entre otros, en el mercado y la fabricación, brindando muchas opciones a los consumidores con respecto a los sabores, impulse el crecimiento del mercado.

Restricciones/Desafíos

- Precios elevados de las bebidas con CBD en comparación con los productos convencionales

El CBD es una opción popular y holística para las personas que sufren dolor, inflamación y problemas de sueño. Dado que el CBD es un producto nuevo con menos investigación y desarrollo y que recientemente ha sido regulado y aprobado, el precio del CBD está sujeto a fluctuaciones. La producción de cáñamo se legalizó en 2018 en los EE. UU., lo que afectó los precios de los productos de CBD.

El alto precio de los productos de CBD se debe a varias razones, entre ellas su novedad y la dificultad de extracción. Las principales razones incluyen la dificultad y el tiempo que lleva cultivar y producir la materia prima y elaborar las bebidas, y la cantidad de tarifas que los cultivadores y distribuidores deben pagar para estandarizar y aprobar los productos antes de su lanzamiento.

Además, las bebidas con CBD suelen incorporar sabores naturales, edulcorantes o extractos de hierbas. Estos ingredientes satisfacen las demandas de los consumidores de opciones naturales y orgánicas y pueden tener un precio elevado, lo que contribuye aún más al costo general de las bebidas con CBD.

Por lo tanto, los altos precios en el procesamiento y producción de cannabidiol conducen a un aumento de los precios de las bebidas con infusión de CBD, lo que puede restringir el crecimiento del mercado estadounidense de bebidas con infusión de cannabidiol (CBD).

- Disponibilidad de sustitutos del CBD infundido en bebidas

Los adaptógenos son un grupo de hierbas o sustancias que se cree que ayudan al cuerpo a adaptarse y responder mejor al estrés. Han ganado popularidad en los últimos años por sus posibles beneficios para la salud. Si bien el CBD (cannabidiol) se ha utilizado comúnmente en bebidas infusionadas por sus posibles efectos relajantes y calmantes, algunos fabricantes optan por incorporar hierbas adaptógenas como alternativa.

Estas hierbas, como la ashwagandha , la rodiola, el ginseng, la albahaca sagrada y otras, ayudan a reforzar la respuesta del cuerpo al estrés, aumentan la energía y promueven el bienestar general. Los fabricantes tienen como objetivo proporcionar a los consumidores bebidas funcionales que ofrezcan posibles beneficios para el alivio del estrés y el bienestar mental mediante el uso de hierbas adaptogénicas en las bebidas.

Por ejemplo,

- En septiembre de 2022, según un artículo publicado en Beverage Industry, los sabores botánicos y los adaptógenos son muy utilizados en la industria de alimentos y bebidas debido a sus múltiples beneficios para la salud y sus cualidades para aliviar el estrés.

Además, se añaden otros sustitutos, como infusiones de hierbas y terpenos, a las bebidas infusionadas para proporcionar los beneficios necesarios para la salud sin estrictas regulaciones gubernamentales. Los sustitutos están fácilmente disponibles y ofrecen efectos similares a los del CBD. Por lo tanto, los fabricantes se centran en incluir sustitutos para proporcionar a los consumidores bebidas infusionadas.

La creciente tendencia a utilizar sustitutos del CBD en las bebidas estadounidenses puede frenar el crecimiento del mercado.

Oportunidad

- Aumentan las inversiones en el desarrollo de nuevos productos basados en CBD

Con la creciente tendencia de ofrecer productos innovadores y refinados en el mercado, los fabricantes están gastando grandes cantidades en investigación, desarrollo y adquisiciones para expandir su negocio y producir nuevos productos basados en CBD. Ha habido una gran demanda de diversas bebidas y sueros con infusión de CBD. Estas bebidas tan demandadas incluyen té, café, refrescos, agua con gas y soda.

La creciente demanda ha aumentado el número de ensayos para estudiar el impacto del CBD en ciertas condiciones de salud, lo que se espera que genere nuevos productos con infusión de CBD, lo que a su vez brindará una oportunidad para el aumento de la demanda en los próximos años. Además, los fabricantes están invirtiendo en el desarrollo de nuevos sabores y bebidas con infusión de CBD, lo que puede impulsar el crecimiento del mercado estadounidense de bebidas con infusión de cannabidiol (CBD).

Por ejemplo,

- En junio de 2021, The Valens Company completó la adquisición de Green Roads por aproximadamente USD 60 millones. Esta adquisición otorga a The Valens Company acceso al mercado estadounidense de CBD a través de una red bien desarrollada de Green Roads y aumenta su potencial de desarrollo de productos.

- En junio de 2021, Vertical Wellness, la empresa estadounidense de cannabidiol, se fusionó con la empresa canadiense CanaFarma Hemp Products Corp. Ahora ofrece múltiples productos y servicios relacionados con el cáñamo. Esta fusión ayudará a Vertical Wellness a transformarse en una entidad pública con un valor combinado de 50 millones de dólares y a desarrollar nuevos productos para el mercado según los requisitos de los clientes.

Por lo tanto, el desarrollo de nuevos productos, el aumento de las actividades de investigación y desarrollo y diversas decisiones estratégicas tomadas por fabricantes clave pueden ofrecer oportunidades lucrativas para el crecimiento del mercado estadounidense de bebidas con infusión de cannabidiol (CBD).

Acontecimientos recientes

- En junio de 2022, la marca de Pepsico, Rockstar Energy, anunció la asociación con la organización de juegos y entretenimiento NRG. Esta asociación ayudó a la marca a construir su reconocimiento en los EE. UU. a través de la comunidad de juegos que llevó al desarrollo de la empresa.

- En febrero de 2022, la marca Rockstar Energy de Pepsico anunció el lanzamiento de una nueva bebida energética llamada Rockstar Unplugged. Estas bebidas son bebidas con infusión de CBD que contienen extracto de semilla de cáñamo y vitamina B. Este lanzamiento ayudó a la empresa a atraer a una gran cantidad de consumidores, lo que ayudó al crecimiento de la empresa.

Alcance del mercado de bebidas con infusión de cannabidiol (CBD) en EE. UU.

El mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en once segmentos notables según el producto, el CBD, el tipo, la forma, el contenido de CBD, la categoría, la función, el empaque, el tamaño del empaque, el canal de distribución y los sueros de CBD.

Producto

- Refrescos con infusión de CBD

- Té y café con infusión de CBD

- Agua con gas infusionada con CBD

- Bebidas carbonatadas con infusión de CBD

- Bebidas no alcohólicas con infusión de CBD

- Otros

Sobre la base del producto, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en refrescos con infusión de CBD, té y café con infusión de CBD, agua con gas con infusión de CBD, seltzers con infusión de CBD, bebidas no alcohólicas con infusión de CBD y otros.

CDB

- Derivado de la marihuana

- Derivado del cáñamo

Sobre la base del CBD, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en derivados del cáñamo y derivados de la marihuana.

Tipo

- Plano

- Sazonado

Según el tipo, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) se segmenta en saborizadas y simples.

Forma

- Polvo/Premezcla

- Líquido/listo para beber

En función de la forma, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en líquido/listo para beber y polvo/premezcla.

Contenido de CBD

- Bajo

- Medio

- Alto

Sobre la base del contenido de CBD, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) se segmenta en bajo, alto y medio.

Categoría

- Convencional

- Orgánico

Según la categoría, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en convencional y orgánico.

Función

- Salud cognitiva

- Tratamiento de enfermedades neurodegenerativas

- Refuerzo de la inmunidad

- Potenciador del sueño

- Mejorador de piel y cabello

- Otros

Sobre la base de la función, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en salud cognitiva, tratamiento de afecciones neurodegenerativas, potenciadores del sueño, potenciadores de la inmunidad, potenciadores de la piel y el cabello, y otros.

Embalaje

- Latas

- Botellas

En función del embalaje, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en latas y botellas.

Tamaño del embalaje

- Menos de 100 ml

- 100-250 ml

- 251-500 ml

- 501-1000 ml

- Más de 1000 ml

Sobre la base del tamaño del envase, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en 251-500 ml, 100-250 ml, 501-1000 ml, menos de 100 ml y más de 1000 ml.

Canal de distribución

- Venta minorista en tiendas

- Venta minorista sin tiendas

Sobre la base del canal de distribución, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en venta minorista en tiendas y venta minorista fuera de tiendas.

Sueros de CBD

- Sueros para la piel con CBD

- Sueros para el cabello con CBD

Sobre la base de los sueros de CBD, el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) está segmentado en sueros de CBD para la piel y sueros de CBD para el cabello.

Análisis del panorama competitivo y de la cuota de mercado de bebidas con infusión de cannabidiol (CBD) en EE. UU.

El panorama competitivo del mercado de bebidas con infusión de cannabidiol (CBD) de EE. UU. proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en EE. UU., los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de las empresas en el mercado.

Algunos de los principales actores del mercado que operan en el mercado estadounidense de bebidas con infusión de cannabidiol (CBD) son PepsiCo, Weller, Cannabiniers., Sweet Reason, KANNAWAY USA, LLC., Kickback., Altitude., BellRock Brands Inc., A88CBD, CANN, Ablis, Wyld CBD, Harmony Craft Beverages., Daytrip Beverages., Recess, Neurogan, CBD Living., PURAVIDAORGANIC y ONE HUNDRED COCONUTS, LLC, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 BRAND COMPARITIVE ANALYSIS ON U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASE DECISION

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 NUMBER OF PRODUCT LAUNCHES

4.5.2 LINE EXTENSION

4.5.3 NEW PACKAGING

4.5.4 RE-LAUNCHED

4.5.5 NEW FORMULATION

4.6 SHOPPING BEHAVIOR AND DYNAMICS

4.6.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.6.2 RESEARCH

4.6.3 IMPULSIVE

4.6.4 ADVERTISEMENT

4.6.4.1 TELEVISION ADVERTISEMENT

4.6.4.2 ONLINE ADVERTISEMENT

4.6.4.3 IN-STORE ADVERTISEMENT

4.6.4.4 OUTDOOR ADVERTISEMENT

4.7 PRICING ANALYSIS

4.8 SUPPLY CHAIN OF U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING

4.8.3 WINTERIZATION

4.8.4 EMULSIFICATION

4.8.5 MARKETING AND DISTRIBUTION

4.8.6 THE STRATEGIES MANUFACTURERS USE FOR MARKETING ARE:

4.8.7 END USERS

4.9 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.1 PROMOTIONAL ACTIVITIES

4.11 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.11.1 OVERVIEW

4.11.2 SOCIAL FACTORS

4.11.3 CULTURAL FACTORS

4.11.4 PSYCHOLOGICAL FACTORS

4.11.5 PERSONAL FACTORS

4.11.6 ECONOMIC FACTORS

4.11.7 PRODUCT TRAITS

4.11.8 MARKET ATTRIBUTES

4.11.9 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.11.10 CONCLUSION

4.12 CONSUMER-LEVEL TRENDS

4.13 MEETING CONSUMER REQUIREMENT

4.14 PRIVATE LABEL VS BRAND LABEL

4.14.1 BRAND LABEL

4.14.2 PRIVATE LABEL

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 REGULATIONS IN THE U.S.

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING CONSUMER AWARENESS REGARDING HEALTH BENEFITS OF CBD

6.1.2 RISING DEMAND FOR FLAVORED CBD-INFUSED BEVERAGES

6.2 RESTRAINTS

6.2.1 HIGH PRICES OF CBD BEVERAGE AS COMPARED TO CONVENTIONAL PRODUCTS

6.2.2 AVAILABILITY OF SUBSTITUTES FOR CBD INFUSED IN BEVERAGES

6.3 OPPORTUNITIES

6.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD-BASED PRODUCTS

6.3.2 GROWING MEDICAL APPLICATIONS OF CBD PRODUCTS

6.4 CHALLENGES

6.4.1 SIDE EFFECTS RELATED TO OVERCONSUMPTION OR UTILIZATION OF CBD PRODUCTS

6.4.2 STRINGENT REGULATIONS BY GOVERNMENT BODIES IN VARIOUS STATES

7 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET

7.1 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET

7.2 U.S. CANNABIDIOL (CBD) SKIN SERUMS & HAIR SERUMS MARKET

8 COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: U.S.

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 PEPSICO

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 PRODUCT PORTFOLIO

10.1.4 RECENT DEVELOPMENTS

10.2 WELLER+

10.2.1 COMPANY SNAPSHOT

10.2.2 PRODUCT PORTFOLIO

10.2.3 RECENT DEVELOPMENTS

10.3 CANNABINIERS

10.3.1 COMPANY SNAPSHOT

10.3.2 PRODUCT PORTFOLIO

10.3.3 RECENT DEVELOPMENTS

10.4 SWEET REASON

10.4.1 COMPANY SNAPSHOT

10.4.2 PRODUCT PORTFOLIO

10.4.3 RECENT DEVELOPMENTS

10.5 KANNAWAY USA, LLC.

10.5.1 COMPANY SNAPSHOT

10.5.2 PRODUCT PORTFOLIO

10.5.3 RECENT DEVELOPMENTS

10.6 A88CBD

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 RECENT DEVELOPMENTS

10.7 ABLIS CBD

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 ALTITUDE

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 BELLROCK BRANDS

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENT

10.1 CANN

10.10.1 COMPANY SNAPSHOT

10.10.2 PRODUCT PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 CBD LIVING

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENT

10.12 DAYTRIP BEVERAGES

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCT PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 HARMONY CRAFT BEVERAGES

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCT PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 KICKBACK

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 NEUROGAN

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 ONE HUNDRED COCONUTS, LLC

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 PURAVIDAORGANIC

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENT

10.18 RECESS

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCT PORTFOLIO

10.18.3 RECENT DEVELOPMENTS

10.19 WYLD CBD

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Tablas

TABLE 1 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE SAME COMPANIES:

TABLE 2 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 3 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY CBD, 2021-2030 (USD MILLION)

TABLE 4 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 U.S. FLAVORED IN CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 6 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 7 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY CBD CONTENT, 2021-2030 (USD MILLION)

TABLE 8 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 9 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 10 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 11 U.S. BOTTLES IN CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 13 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 14 U.S. STORE-BASED RETAILING IN CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 15 U.S. NON-STORE RETAILING IN CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 16 U.S. CBD SKIN SERUMS & HAIR SERUMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: SEGMENTATION

FIGURE 2 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: DATA TRIANGULATION

FIGURE 3 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: DROC ANALYSIS

FIGURE 4 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: SEGMENTATION

FIGURE 9 RISING DEMAND FOR FLAVOURED CBD INFUSED BEVERAGES IS EXPECTED TO DRIVE THE U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 10 CBD INFUSED SPARKLING WATER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET IN 2023 AND 2030

FIGURE 11 SUPPLY CHAIN OF U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET

FIGURE 12 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET

FIGURE 14 U.S. CANNABIDIOL (CBD) INFUSED BEVERAGES MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.