Mercado de papel marrón de EE. UU., por tipo de papel (papel para impresión, papel para fotocopiadora , papel encerado, papel para tarjetas de felicitación, papel bond, papel de calco, papel de seda, papel de inyección de tinta y papel para liar tabaco), uso final (embalaje, papelería, cuidado del hogar y cuidado personal, construcción y otros), canal de distribución (venta directa/B2B, tiendas especializadas, comercio electrónico y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de papel marrón en EE. UU.

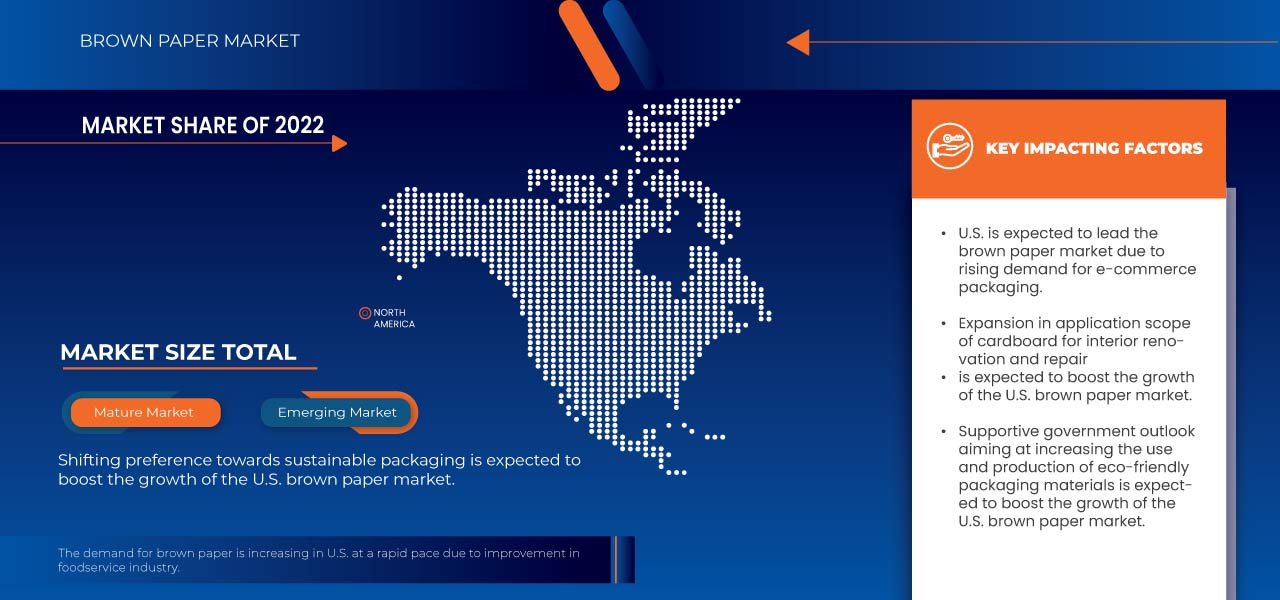

El cambio de preferencia hacia envases sostenibles y la mejora en la industria de servicios de alimentación es un factor importante para el mercado de papel marrón de EE. UU. Algunos de los factores que impulsan el crecimiento del mercado son la creciente demanda de envases para el comercio electrónico, la expansión del ámbito de aplicación del cartón para la renovación y reparación de interiores y la creciente demanda de componentes electrónicos blandos. Sin embargo, se espera que las limitaciones de suministro debido al uso de pulpa de papel en otras aplicaciones y el acceso limitado a materias primas de alta calidad obstaculicen el crecimiento del mercado.

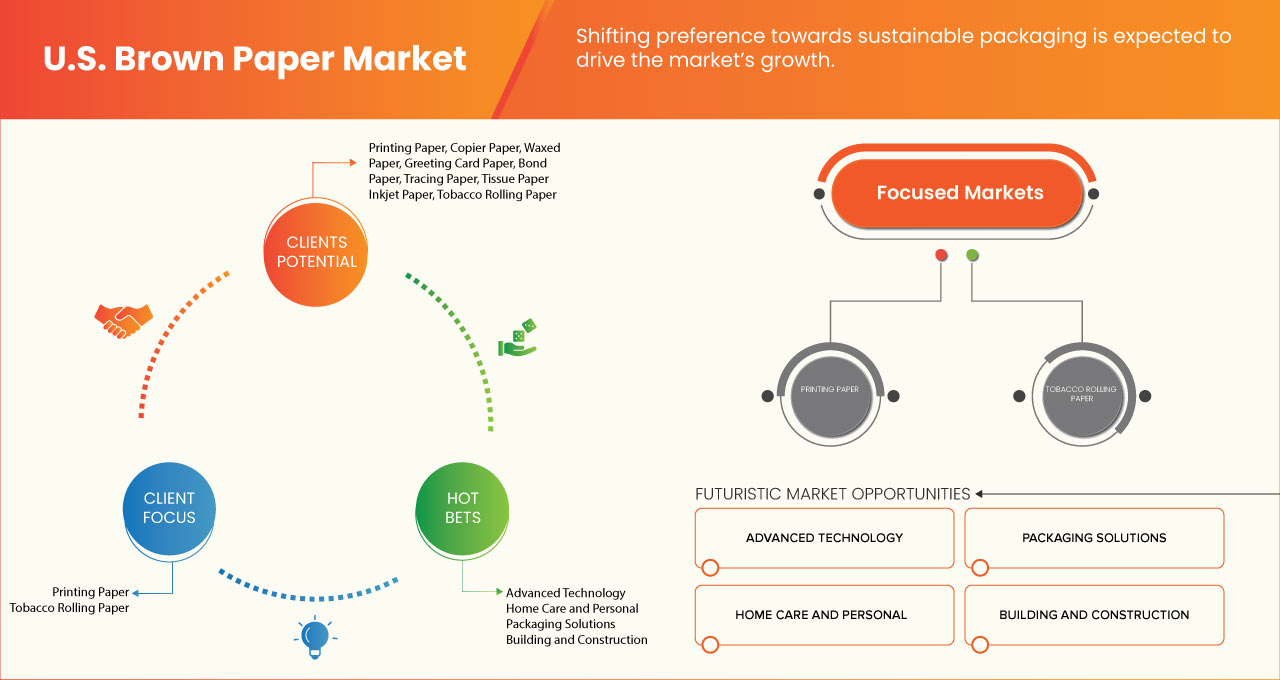

Data Bridge Market Research analiza que se espera que el mercado de papel marrón de EE. UU. alcance un valor de USD 7258,59 millones para 2030, con una CAGR del 3,5 % durante el período de pronóstico. El papel para impresión representa el segmento de tipo de papel más grande en el mercado de papel marrón de EE. UU. debido a las crecientes aplicaciones del papel marrón como papel para impresión. El informe del mercado de papel marrón de EE. UU. también cubre análisis de precios, análisis de patentes y avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones, volúmenes en kilotoneladas, precios en USD |

|

Segmentos cubiertos |

Tipo de papel (papel para impresión, papel para fotocopiadora, papel encerado, papel para tarjetas de felicitación, papel bond, papel de calco, papel tisú , papel para inyección de tinta y papel para liar tabaco), uso final (embalaje, papelería, cuidado del hogar y cuidado personal, construcción y otros), canal de distribución (venta directa/B2B, tiendas especializadas, comercio electrónico y otros) |

|

País cubierto |

A NOSOTROS |

|

Actores del mercado cubiertos |

Richerpaper.com, Primo Tedesco SA, Georgia-Pacific, Graphic Packaging International, LLC, WestRock Company, Oji Holdings Corporation, Nordic Paper y Smurfit Kappa, entre otros. |

Definición de mercado

El papel marrón es un papel con una gran resistencia al desgarro y una gran fuerza. Se utiliza principalmente en la industria del embalaje, entre muchos otros usuarios. Se añaden productos químicos a la pulpa de madera y a los materiales reciclados para aumentar la resistencia, el grosor y la durabilidad de la fibra, manteniendo al mismo tiempo el peso ligero del papel. El papel marrón es el más resistente de los papeles de embalaje comunes y se utiliza cuando se requiere la máxima resistencia en aplicaciones como bolsas industriales, bolsas de supermercado, capas internas de sacos multicapa o papel de envolver normal. El papel marrón también se utiliza para producir el revestimiento del cartón ondulado.

Dinámica del mercado de papel marrón en EE.UU.

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Cambio de preferencia hacia envases sostenibles

El uso de materiales de embalaje compostables y sostenibles está aumentando entre los consumidores debido a la creciente concienciación sobre el impacto perjudicial del plástico y otras variantes y opciones de embalaje no biodegradables. Las soluciones de embalaje de papel marrón son biodegradables, duraderas y fáciles de usar. Por lo tanto, su demanda aumenta constantemente en diversas industrias de uso final, como la de alimentos y bebidas, la electrónica y los productos eléctricos, la farmacéutica y la construcción, entre otras.

Además, el cambio en las compras de los consumidores, con más consumidores dispuestos a pagar más por productos respetuosos con el medio ambiente, está reforzando la necesidad de que las empresas aumenten su compromiso con las prácticas comerciales responsables y utilicen soluciones de embalaje sostenibles, lo que impulsará aún más la demanda de papel marrón en la industria del embalaje.

- Creciente demanda de embalajes para comercio electrónico

El embalaje para el comercio electrónico es el proceso de envolver bienes y productos para su entrega segura a una ubicación designada. Con el aumento de las compras por comercio electrónico, los servicios relacionados con este último han surgido como mercados importantes. Las cajas de envío están ganando terreno junto con el sector del comercio electrónico, que está creciendo rápidamente.

Además, la creciente popularidad del comercio electrónico y los avances relacionados han llevado a la premiumización de los envases kraft. Esto incluye la demanda de material de papel marrón que pueda soportar gráficos de alta calidad en tiradas cortas. Además, los actores clave que operan en el mercado han iniciado muchas innovaciones que han mejorado y acelerado la producción de papel kraft marrón para sacos y bolsas de papel y han mejorado la protección del producto.

Oportunidades

- Aumento del gasto en avances tecnológicos de nuevas soluciones de embalaje de papel marrón

Las organizaciones de la industria de bienes de consumo de rápido movimiento (FMCG) están tomando medidas para volverse más sostenibles mediante la introducción de soluciones de embalaje más sostenibles. Los actores clave del mercado, así como varias empresas emergentes en el mercado del papel, están desarrollando nuevas soluciones de embalaje de papel kraft o papel marrón, como bolsas fáciles de usar, bolsas verticales y bolsas con cierre hermético.

Las empresas que fabrican soluciones de embalaje de papel marrón también tienen en cuenta diversos aspectos del embalaje inteligente. El embalaje inteligente incluye embalaje activo, atmósfera modificada, control de humedad, captadores de gases, etiquetas inteligentes e indicadores de tiempo y temperatura, especialmente para los embalajes que entran en contacto directo con los alimentos.

- Perspectiva gubernamental favorable que apunta a aumentar el uso y la producción de materiales de embalaje ecológicos

La tendencia hacia materiales de embalaje ecológicos, que sean modernos y al mismo tiempo atractivos visualmente, tengan una identidad de marca y una larga vida útil, ha aumentado. La principal ventaja del papel marrón es que se puede mezclar con una variedad de fibras. Esto mejora las características del papel y amplía la gama de sus aplicaciones. Estos papeles marrones son respetuosos con el medio ambiente, tienen propiedades de embalaje mejoradas y son fáciles de apilar y reciclar.

Las autoridades reguladoras están prestando más atención a la introducción de prácticas de reciclaje de papel. Debido a las propiedades de envasado de diversos alimentos, como sándwiches, pizzas y hamburguesas, la industria ha experimentado un aumento significativo en la demanda de papel marrón por parte de la industria de alimentos y bebidas debido al cambio en el enfoque del consumidor hacia la mejora de la apariencia de los productos para el usuario final.

Restricciones

- Amenaza creíble de sustitutos externos, como los plásticos

Los envases de plástico tienen muchas formas que pueden variar según las distintas aplicaciones, desde los flexibles y adaptables hasta los resistentes y duraderos, como los contenedores de plástico. Además, existe la posibilidad de utilizar bioplásticos, que se fabrican a partir de fuentes biodegradables, como verduras, arroz y otros compuestos orgánicos y de origen vegetal.

Además, las bolsas de plástico son más duraderas que las bolsas de papel marrón. Son menos propensas a romperse, más fáciles de transportar y también se pueden usar en condiciones climáticas adversas. Las bolsas de plástico son reutilizables, como bolsas para basura y como bolsas de almacenamiento. Las bolsas de plástico duran más y se pueden reutilizar, a diferencia de las bolsas de papel. La baja densidad, la resistencia, los diseños fáciles de usar, las capacidades de fabricación, la vida útil prolongada, el bajo peso y el bajo costo son características que han contribuido al rápido aumento del plástico. Se espera que esto frene el crecimiento del mercado.

- Aparición de otros homólogos en papel

En vista del aumento del costo de la pulpa de madera y de la constante deforestación en la agenda ambiental, varias empresas están buscando otras materias primas y métodos para crear productos de papel ecológicos que puedan actuar como sustituto del papel marrón. Estas empresas están considerando esto y están adoptando un enfoque creativo en cuanto a los materiales utilizados para producir papel, con el fin de producir diferentes tipos y calidades de papel. Muchos de estos tipos de papel son reciclables y sostenibles por naturaleza, lo que los convierte en la opción preferida en diversas aplicaciones.

Desafíos

- Acceso limitado a materias primas de alta calidad

La disponibilidad de materias primas es muy importante para el funcionamiento eficaz de cualquier tipo de industria. Los residuos agrícolas se han convertido en uno de los recursos sustitutos más importantes debido al aumento de la demanda de materias primas fibrosas, la escasez de árboles en muchos países y la creciente conciencia de la sostenibilidad. Existe una escasez de recursos madereros a pesar de que el mundo cuenta con suficiente suelo forestal para proporcionar madera.

Otros factores, como las fuertes tormentas meteorológicas en Estados Unidos, han provocado una escasez temporal de determinados materiales durante la pandemia. Toda la industria papelera, incluidos fabricantes, mayoristas, impresores y empresas de marketing, está experimentando dificultades para conseguir la cantidad necesaria de materiales y productos.

- Restricciones de suministro como consecuencia del uso de pulpa de papel en otras aplicaciones

La principal fuente de fibra celulósica utilizada para la producción de pulpa y papel proviene de la madera, mientras que las fibras no leñosas se utilizan en menor medida. La necesidad de pulpa y papel está aumentando significativamente debido al crecimiento exponencial de la población, la industrialización y la urbanización. La mayoría de las industrias de fabricación de papel utilizan fibras de madera para satisfacer las necesidades de pulpa y papel. La escasez de recursos de madera fibrosa y el aumento de la deforestación están vinculados a la dependencia excesiva de la madera para la producción de pulpa y papel.

La mayor parte de las fibras celulósicas utilizadas proceden de especies de madera, principalmente maderas duras y blandas. Sin embargo, en los últimos años se ha producido un aumento de la concienciación de los consumidores respecto a la necesidad de preservar el medio ambiente.

Acontecimientos recientes

- En febrero de 2023, Smurfit Kappa fue reconocida como una de las empresas con mejor desempeño ESG por la empresa líder en investigación y análisis Morningstar Sustainalytics. La calificación de riesgo ESG de 2022 de la empresa ha mejorado, y la empresa que cotiza en el índice FTSE 100 se ha posicionado en la lista de empresas mejor calificadas de Sustainalytics tanto en la categoría de la industria como en la regional. La insignia ESG Industry Top Rated que recibió Smurfit Kappa es un punto de referencia global y reafirma la calificación de riesgo ESG de Smurfit Kappa como de "riesgo bajo".

- En febrero de 2021, Graphic Packaging International lanzó ProducePack, una gama de soluciones de embalaje de cartón sostenible para productos frescos. El lanzamiento del producto dio lugar a nuevas relaciones comerciales y asociaciones. Además, atrajo mucha atención de clientes más grandes de todo el mundo.

Alcance del mercado de papel marrón en EE.UU.

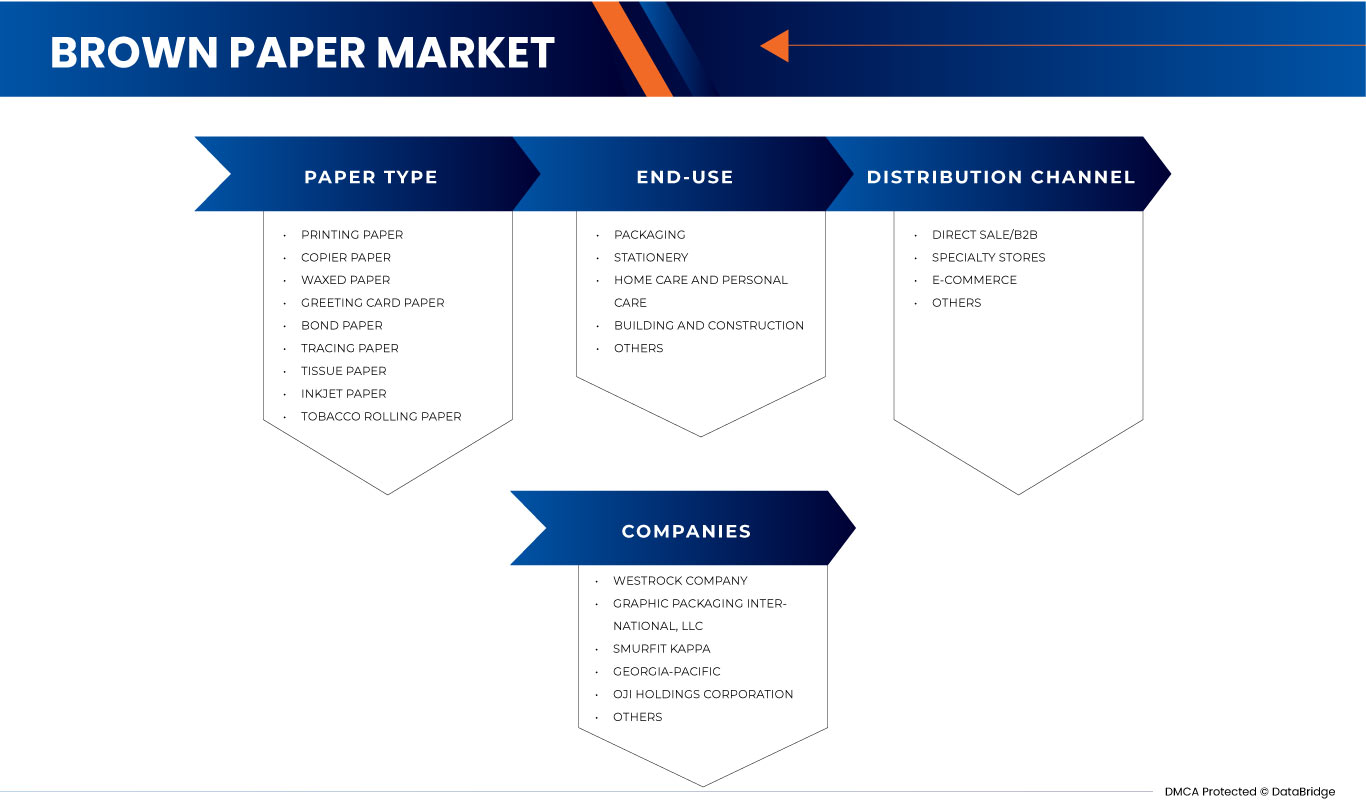

El mercado estadounidense de papel marrón está segmentado en función del tipo de papel, el uso final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de papel

- Papel de impresión

- Papel para fotocopiadora

- Papel encerado

- Papel para tarjetas de felicitación

- Papel bond

- Papel de calco

- Papel de seda

- Papel para inyección de tinta

- Papel de liar tabaco

Según el tipo de papel, el mercado estadounidense de papel marrón se segmenta en papel de impresión, papel para fotocopiadora, papel encerado, papel para tarjetas de felicitación, papel bond, papel de calco, papel de seda, papel de inyección de tinta y papel para liar tabaco.

Uso final

- Embalaje

- Papelería

- Cuidado del hogar y cuidado personal

- Construcción y edificación

- Otros

Sobre la base del uso final, el mercado estadounidense de papel marrón se ha segmentado en embalajes, artículos de papelería, cuidado del hogar y cuidado personal, construcción y edificación, y otros.

Canal de distribución

- Venta directa/B2B

- Tiendas especializadas

- Comercio electrónico

- Otros

Sobre la base del canal de distribución, el mercado estadounidense de papel marrón se ha segmentado en venta directa/B2B, tiendas especializadas, comercio electrónico y otros.

Análisis del panorama competitivo y de la cuota de mercado del papel marrón en EE.UU.

El panorama competitivo del mercado de papel marrón de EE. UU. proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de papel marrón de EE. UU.

Algunos de los principales actores que operan en el mercado estadounidense de papel marrón son Richerpaper.com, Primo Tedesco SA, Georgia-Pacific, Graphic Packaging International, LLC, WestRock Company, Oji Holdings Corporation, Nordic Paper y Smurfit Kappa, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. BROWN PAPER

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PAPER TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 LIST OF KEY PATENTS LAUNCHED

4.5 SUPPLY CHAIN ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFTING PREFERENCE TOWARD SUSTAINABLE PACKAGING

5.1.2 IMPROVEMENT IN THE FOOD SERVICE INDUSTRY

5.1.3 RISING DEMAND FOR E-COMMERCE PACKAGING

5.1.4 EXPANSION IN APPLICATION SCOPE OF CARDBOARD FOR INTERIOR RENOVATION AND REPAIR

5.2 RESTRAINTS

5.2.1 CREDIBLE THREAT FROM EXTERNAL SUBSTITUTES, SUCH AS PLASTICS

5.2.2 EMERGENCE OF OTHER PAPER COUNTERPARTS

5.3 OPPORTUNITIES

5.3.1 RISING SPENDING ON TECHNOLOGICAL ADVANCEMENTS OF NEW BROWN PAPER PACKAGING SOLUTIONS

5.3.2 SUPPORTIVE GOVERNMENT OUTLOOK AIMING AT INCREASING THE USE AND PRODUCTION OF ECO-FRIENDLY PACKAGING MATERIALS

5.4 CHALLENGES

5.4.1 LIMITED ACCESS TO HIGH-QUALITY RAW MATERIALS

5.4.2 SUPPLY CONSTRAINTS AS A RESULT OF THE USE OF PAPER PULP IN OTHER APPLICATIONS

6 U.S. BROWN PAPER MARKET, BY PAPER TYPE

6.1 OVERVIEW

6.2 PRINTING PAPER

6.2.1 BAGS & POUCHES

6.2.2 CORRUGATED SHEETS

6.2.3 COMPOSITE CANS

6.2.4 CARTONS

6.2.5 SACKS

6.2.6 ENVELOPES

6.2.7 OTHERS

6.3 COPIER PAPER

6.4 WAXED PAPER

6.5 GREETING CARD PAPER

6.6 BOND PAPER

6.7 TRACING PAPER

6.8 TISSUE PAPER

6.9 INKJET PAPER

6.1 TOBACCO ROLLING PAPER

7 U.S. BROWN PAPER MARKET, BY END-USE

7.1 OVERVIEW

7.2 PACKAGING

7.2.1 PRINTING PAPER

7.2.2 WAXED PAPER

7.3 STATIONERY

7.3.1 COPIER PAPER

7.3.2 GREETING CARD PAPER

7.3.3 BOND PAPER

7.3.4 PRINTING PAPER

7.3.5 INKJET PAPER

7.3.6 TRACING PAPER

7.4 HOME CARE AND PERSONAL CARE

7.4.1 TISSUE PAPER

7.4.2 TRACING PAPER

7.4.3 WAXED PAPER

7.5 BUILDING AND CONSTRUCTION

7.5.1 PRINTING PAPER

7.6 OTHERS

7.6.1 PRINTING PAPER

7.6.2 TOBACCO ROLLING PAPER

8 U.S. BROWN PAPER MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT SALE/B2B

8.3 SPECIALTY STORES

8.4 E-COMMERCE

8.5 OTHERS

9 U.S. BROWN PAPER MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: U.S.

9.2 ACQUISITION

9.3 NEW PRODUCT LAUNCH

9.4 CERTIFICATION

9.5 AWARDS

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 WESTROCK COMPANY

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENTS

11.2 GRAPHIC PACKAGING INTERNATIONAL, LLC

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENTS

11.3 SMURFIT KAPPA

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENTS

11.4 GEORGIA-PACIFIC

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENTS

11.5 NORDIC PAPER

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 OJI HOLDINGS CORPORATION

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 PRIMO TEDESCO SA

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 RICHERPAPER.COM

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF UNCOATED KRAFT PAPER AND PAPERBOARD IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE – 4804 (USD THOUSAND)

TABLE 2 EXPORT DATA OF UNCOATED KRAFT PAPER AND PAPERBOARD IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE – 4804 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 U.S. BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 5 U.S. BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (KILO TONS)

TABLE 6 U.S. PRINTING PAPER IN BROWN PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 7 U.S. BROWN PAPER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 8 U.S. PACKAGING IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.S. STATIONERY IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.S. HOME CARE AND PERSONAL CARE IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 11 U.S. BUILDING AND CONSTRUCTION IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 12 U.S. OTHERS IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 13 U.S. BROWN PAPER MARKET, BDISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 U.S. BROWN PAPER MARKET

FIGURE 2 U.S. BROWN PAPER MARKET: DATA TRIANGULATION

FIGURE 3 U.S. BROWN PAPER MARKET: DROC ANALYSIS

FIGURE 4 U.S. BROWN PAPER MARKET: U.S. MARKET ANALYSIS

FIGURE 5 U.S. BROWN PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. BROWN PAPER MARKET: THE PAPER TYPE LIFE LINE CURVE

FIGURE 7 U.S. BROWN PAPER MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. BROWN PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. BROWN PAPER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. BROWN PAPER MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 U.S. BROWN PAPER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. BROWN PAPER MARKET: SEGMENTATION

FIGURE 13 SHIFTING PREFERENCE TOWARD SUSTAINABLE PACKAGING IS EXPECTED TO DRIVE U.S. BROWN PAPER MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 14 PRINTING PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. BROWN PAPER MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S. BROWN PAPER MARKET

FIGURE 16 U.S. BROWN PAPER MARKET: BY PAPER TYPE, 2022

FIGURE 17 U.S. BROWN PAPER MARKET: BY END-USE, 2022

FIGURE 18 U.S. BROWN PAPER MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 19 U.S. BROWN PAPER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.