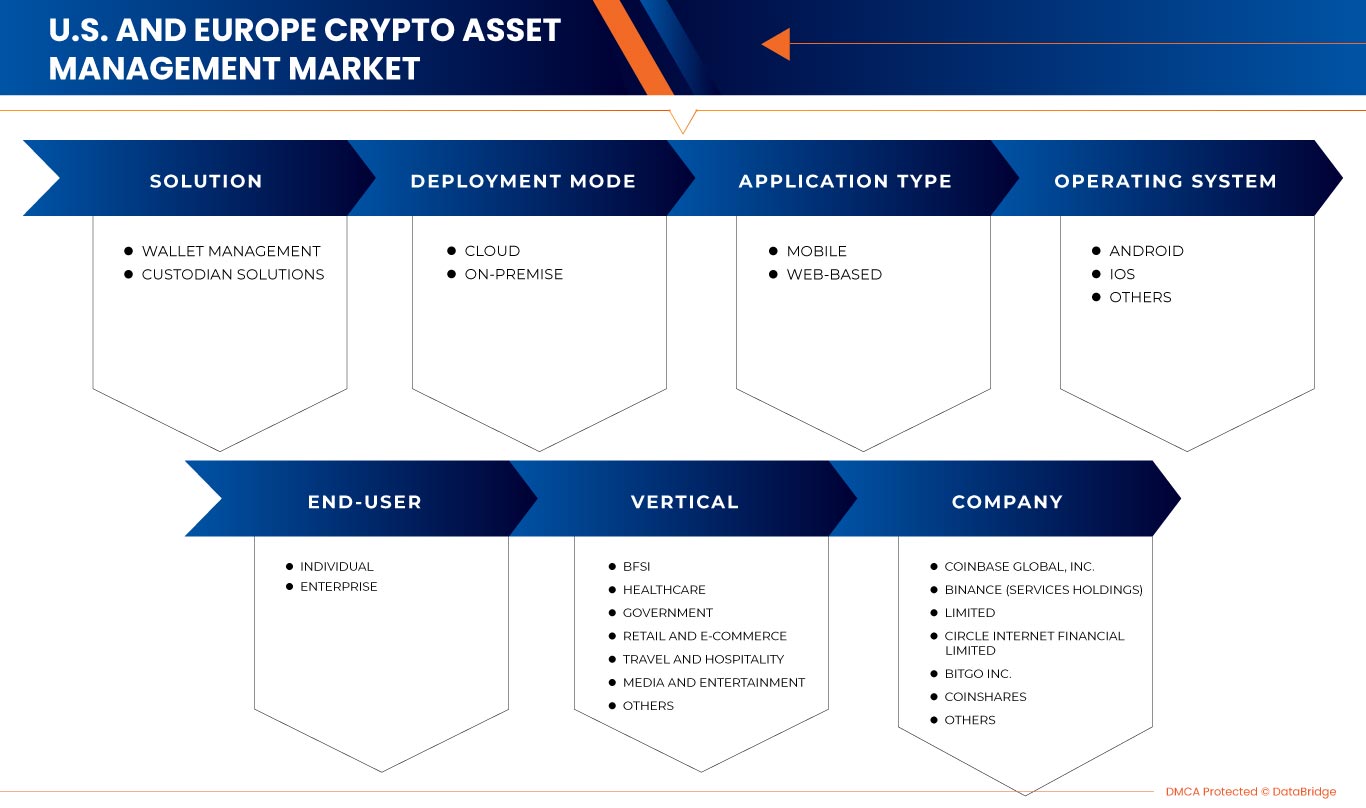

Mercado de gestión de activos criptográficos de EE. UU. y Europa, por solución (gestión de billeteras, soluciones de custodia), modo de implementación (nube, local), tipo de aplicación (móvil, basada en web), sistema operativo (Android, IOS y otros), usuario final (individual, empresarial), vertical (BFSI, atención médica, gobierno, comercio minorista y electrónico, viajes y hotelería, medios y entretenimiento, y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de gestión de activos criptográficos de EE. UU. y Europa

Ahora es más fácil adquirir y vender criptomonedas y otros activos que en el pasado. Para comprar o vender criptoactivos, debe abrir una cuenta en el exchange de su elección y seleccionar una billetera que admita.

Debido a la facilidad con la que se pueden obtener criptoactivos, es fundamental contar con un método para gestionarlos, similar a cómo se gestionan las inversiones tradicionales en una cartera. Muchas personas y empresas se dieron cuenta de esta necesidad y desarrollaron herramientas y aplicaciones que ahora son estándar en los mercados financieros más tradicionales: aplicaciones y servicios de gestión de activos.

En lugar de administrar varias cuentas y billeteras de diferentes intercambios mientras se hacen malabarismos con los activos tradicionales, los sistemas de gestión de activos criptográficos simplifican el proceso al ayudar a los usuarios a consolidar sus diversas tenencias y al mismo tiempo brindar capacidades superiores de gestión de cartera.

Data Bridge Market Research analiza que el mercado de gestión de activos criptográficos de EE. UU. y Europa crecerá a una CAGR del 30,7 % entre 2023 y 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por solución (gestión de billeteras, soluciones de custodia), modo de implementación (nube, local), tipo de aplicación (móvil, basada en la web), sistema operativo (Android, IOS y otros), usuario final (individual, empresarial), vertical (BFSI, atención médica, gobierno, comercio minorista y electrónico, viajes y hotelería, medios y entretenimiento, y otros) |

|

Regiones cubiertas |

EE. UU., Reino Unido, Alemania, Francia, España, Italia, Países Bajos, Suiza, Rusia, Bélgica, Turquía y el resto de Europa. |

|

Actores del mercado cubiertos |

Coinbase Global, Inc., Gemini Trust Company, LLC., Crypto Finance Group, Genesis Global Trading, Inc., Bakkt Holdings, Inc., BitGo Inc., Ledger SAS., Xapo Holdings Limited, Paxos Trust Company, LLC, Blockdaemon, Binance (Services Holdings) Limited, CoinStats Inc, Fireblocks, Bankex, copper.co y CYBAVO Pte. Ltd, entre otros. |

Definición de mercado

La gestión de activos criptográficos es la actividad de compra y venta de activos digitales para su uso como inversiones mientras se gestiona una cartera para lograr un crecimiento general del valor. Una solución de software y sistema conocida como DAM puede almacenar, organizar, gestionar, recuperar y difundir de manera eficiente los activos digitales de una organización. Al utilizar las funciones de DAM, muchas empresas pueden crear un área centralizada donde pueden acceder a sus activos digitales. La gestión de activos criptográficos es la versión de criptomonedas de la gestión de activos digitales. Los inversores pueden obtener acceso a la cadena de bloques o a los activos de criptomonedas a través de una variedad de canales con la ayuda de la gestión de activos criptográficos, que con frecuencia se ofrece como una solución de servicios total o parcial. Estos servicios pueden ser proporcionados directamente por organizaciones de gestión de activos criptográficos o a través de un proveedor de servicios externo. Estas organizaciones se encargan de seleccionar los mejores activos criptográficos para las carteras de sus clientes, supervisar y analizar el rendimiento de esos activos, ayudar a los inversores principiantes a través del mercado de criptomonedas y proporcionar apoyo integral según sea necesario.

Dinámica del mercado de gestión de activos criptográficos en EE. UU. y Europa

Conductor

- La creciente adopción de criptomonedas en el mercado financiero

Las criptomonedas y el negocio de la cadena de bloques han ganado mucha popularidad en los últimos años. Los inversores cada vez pueden obtener más servicios de custodia de nivel institucional a medida que se construye la infraestructura financiera más necesaria. Los inversores profesionales e individuales están obteniendo gradualmente acceso a las herramientas y máquinas que necesitan para administrar y proteger sus tenencias de criptomonedas.

Oportunidad

- Aumento de diversas decisiones estratégicas como asociaciones y adquisiciones

Las asociaciones y adquisiciones estratégicas ayudan a las empresas a trabajar para alcanzar el objetivo deseado. A medida que el mercado cambia y evoluciona, los clientes buscan constantemente productos nuevos y avanzados que puedan ayudarlos a gestionar de manera eficiente los activos criptográficos en el mercado de EE. UU. y Europa. Además, buscan plataformas que puedan ayudarlos a recibir diferentes servicios relacionados con el mercado.

Restricción/Desafío

- Altas tarifas de transacción

Las altas tarifas de transacción de las criptomonedas en el mercado de gestión de activos criptográficos de EE. UU. están afectando en gran medida el crecimiento del mercado. Las transacciones de Bitcoin comenzaron a fluctuar significativamente a medida que más personas se interesaron en las criptomonedas. Las tarifas de transacción se refieren al dinero que se paga a los mineros de Bitcoin para que se aprueben las transacciones, y los costos pueden aumentar a medida que aumenta el número de usuarios. Debido a que la cadena de bloques tiene una cantidad finita de espacio para procesar todas las transacciones, se congestiona. Las crecientes tarifas de transacción representan tanto la cantidad de transacciones de Bitcoin en una cola para ser procesadas como un incentivo para que los mineros manejen las transacciones particularmente grandes, que son más rentables para ellos.

Desarrollo reciente

- En enero de 2023, Copper.co anunció su asociación estratégica con Bybit, la tercera plataforma de intercambio de criptomonedas más visitada del mundo. La empresa está fortaleciendo sus soluciones de custodia y comercialización de activos digitales institucionales para los clientes institucionales de Bybit a través del servicio líder en el mercado ClearLoop de Copper. Esto ayudó a la empresa a aumentar su presencia en el mercado.

Alcance del mercado de gestión de activos criptográficos en EE. UU. y Europa

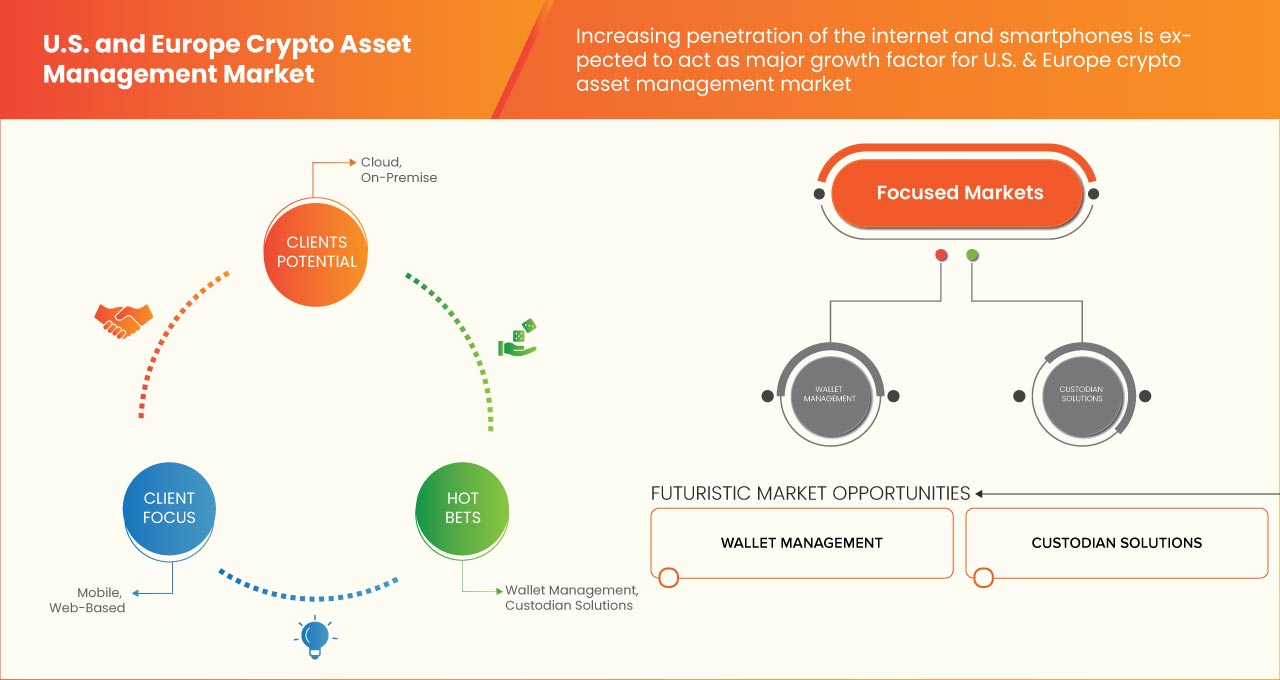

El mercado de gestión de criptoactivos de EE. UU. y Europa está segmentado por solución, implementación, tipo de aplicación, sistema operativo y usuario final, vertical. El crecimiento entre estos segmentos lo ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Solución

- Gestión de billetera

- Soluciones de custodia

Sobre la base de la solución, el mercado de gestión de activos criptográficos de EE. UU. y Europa está segmentado en gestión de billeteras y soluciones de custodia.

Modo de implementación

- Nube

- En las instalaciones

Sobre la base del modo de implementación, el mercado de gestión de activos criptográficos de EE. UU. y Europa está segmentado en nube y local.

Tipo de aplicación

- Móvil

- Basado en la web

Según el tipo de aplicación, el mercado de gestión de activos criptográficos de EE. UU. y Europa está segmentado en móvil y basado en la web.

Sistema operativo

- Androide

- iOS

- Otros

Sobre la base del sistema operativo, el mercado de gestión de activos criptográficos de EE. UU. y Europa está segmentado en Android, iOS y otros.

Usuario final

- Individual

- Empresa

Sobre la base del usuario final, el mercado de gestión de activos criptográficos de EE. UU. y Europa está segmentado en individual y empresarial.

Vertical

- BFSI

- Cuidado de la salud

- Gobierno

- Comercio minorista y comercio electrónico

- Viajes y Hostelería

- Medios y entretenimiento

- Otros

Sobre la base vertical, el mercado de gestión de activos criptográficos de EE. UU. y Europa está segmentado en bfsi, atención médica, gobierno, comercio minorista y electrónico, viajes y hotelería, medios y entretenimiento, y otros.

Análisis y perspectivas regionales del mercado de gestión de activos criptográficos de EE. UU. y Europa

Se analiza el mercado de gestión de activos criptográficos y se proporcionan información y tendencias del tamaño del mercado según la solución, la implementación, el tipo de aplicación, el sistema operativo, el usuario final, la vertical y los países mencionados anteriormente.

El mercado de EE. UU. y Europa está formado por los países de EE. UU., Reino Unido, Alemania, Francia, España, Italia, Países Bajos, Suiza, Rusia, Bélgica, Turquía y el resto de Europa.

Se espera que Alemania domine el mercado de gestión de activos criptográficos de EE. UU. y Europa, ya que Alemania es líder regional en la adopción de aplicaciones de gestión de activos.

La sección de países del informe del mercado de gestión de activos criptográficos también proporciona factores de impacto individuales en el mercado y cambios en las regulaciones en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, epidemiología de enfermedades y aranceles de importación y exportación son algunos de los indicadores importantes que se utilizan para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de gestión de activos criptográficos en EE. UU. y Europa

El panorama competitivo del mercado de gestión de activos criptográficos de EE. UU. y Europa detalla a los competidores. Los detalles incluyen descripción general de la empresa, finanzas de la empresa, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, sitios e instalaciones de producción, capacidades de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, amplitud y amplitud del producto y dominio de la aplicación. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de gestión de activos criptográficos de EE. UU. y Europa.

Algunos de los fabricantes que operan en el mercado son Coinbase Global, Inc., Gemini Trust Company, LLC., Crypto Finance Group, Genesis Global Trading, Inc., Bakkt Holdings, Inc., BitGo Inc., Ledger SAS., Xapo Holdings Limited, Paxos Trust Company, LLC, Blockdaemon, Binance (Services Holdings) Limited, CoinStats Inc, Fireblocks, Bankex, copper.co y CYBAVO Pte. Ltd, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE TIMELINE CURVE

2.7 MARKET APPLICATION COVERAGE GRID

2.8 MULTIVARIATE MODELING

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 VENDOR SHARE ANALYSIS

2.12 HE MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULARITY OF U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET TOOLS

5.1.2 INCREASING ADOPTION OF CRYPTOCURRENCY IN THE FINANCIAL MARKET

5.1.3 INCREASING DEMAND FOR CRYPTOCURRENCY-SPECIFIC SOFTWARE

5.1.4 INCREASING PENETRATION OF THE INTERNET AND SMARTPHONES

5.2 RESTRAINTS

5.2.1 HIGH TRANSACTION FEES

5.2.2 HIGH IT INFRASTRUCTURE COST FOR CRYPTO ASSET MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 DEVELOPMENTS IN THE HARDWARE AND SOFTWARE

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL IMPACT OF CRYPTOCURRENCY

5.4.2 MISUSE OF VIRTUAL CURRENCY AND SECURITY ATTACK

6 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 WALLET MANAGEMENT

6.3 CUSTODIAN SOLUTIONS

7 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE

8.1 OVERVIEW

8.2 MOBILE

8.3 WEB-BASED

9 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM

9.1 OVERVIEW

9.2 ANDROID

9.3 IOS

9.4 OTHERS

10 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY END USER

10.1 OVERVIEW

10.2 INDIVIDUAL

10.3 ENTERPRISE

11 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BFSI

11.3 HEALTHCARE

11.4 GOVERNMENT

11.5 RETAIL AND E-COMMERCE

11.6 TRAVEL AND HOSPITALITY

11.7 MEDIA AND ENTERTAINMENT

11.8 OTHERS

12 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY COUNTRY

12.1 GERMANY

12.2 U.K.

12.3 FRANCE

12.4 ITALY

12.5 SPAIN

12.6 TURKEY

12.7 RUSSIA

12.8 NETHERLANDS

12.9 BELGIUM

12.1 SWITZERLAND

12.11 REST OF EUROPE

13 U.S. AND EUROPE CRYPTO ASSET MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.2 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 COINBASE GLOBAL, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 BINANCE (SERVICES HOLDINGS) LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 BITGO INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 CIRCLE INTERNET FINANCIAL LIMITED

15.4.1 COMPANY SNAPSHOT

15.4.2 SOLUTION PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 COINSHARES

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 BLOCKDAEMON

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BOSONIC, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BAKKT HOLDINGS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SOLUTION PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BITCOIN SUISSE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BLOCKCHAIN.COM, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 BANKEX

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 COINSTATS INC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 COPPER.CO

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CYBAVO PTE. LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CRYPTO FINANCE GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 EXODUS MOVEMENT, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 FIREBLOCKS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 GEMINI TRUST COMPANY, LLC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 GENESIS GLOBAL TRADING, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 ICONOMI

15.20.1 COMPANY SNAPSHOT

15.20.2 PLATFORM PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 LEDGER SAS.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 METACO SA.

15.22.1 COMPANY SNAPSHOT

15.22.2 PLATFORM PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NYDIG.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PAXOS TRUST COMPANY, LLC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SYGNUM

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 XAPO BANK LIMITED

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 2 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 3 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 5 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 7 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 8 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 9 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 10 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 11 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 12 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 13 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 14 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 15 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 16 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 17 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 18 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 19 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 20 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 21 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 22 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 24 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 25 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 26 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 27 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 28 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 29 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 30 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 32 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 33 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 34 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 35 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 36 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 38 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 39 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 40 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 41 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 42 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 44 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 45 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 46 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 47 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 49 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 50 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 51 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 52 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 53 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 54 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 55 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 56 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 57 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 58 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 59 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 60 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 62 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 63 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 64 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 65 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 66 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 67 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 68 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 69 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 70 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 71 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 72 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 73 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 74 REST OF EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: SOLUTION TIMELINE CURVE

FIGURE 7 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 8 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: MULTIVARIATE MODELLING

FIGURE 9 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 11 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CRYPTOCURRENCY SPECIFIC SOFTWARE IS DRIVING THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 WEALTH MANAGEMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT

FIGURE 16 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY SOLUTION, 2022

FIGURE 17 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY SOLUTION, 2022

FIGURE 18 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2022

FIGURE 19 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2022

FIGURE 20 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY APPLICATION TYPE, 2022

FIGURE 21 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY APPLICATION TYPE, 2022

FIGURE 22 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY OPERATING SYSTEM, 2022

FIGURE 23 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY OPERATING SYSTEM, 2022

FIGURE 24 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 25 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 26 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY VERTICAL, 2022

FIGURE 27 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY VERTICAL, 2022

FIGURE 28 EUROPE CRYPTO ASSET MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 29 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 30 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 32 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY SOLUTION (2023-2030)

FIGURE 33 U.S. CRYPTO ASSET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 34 EUROPE CRYPTO ASSET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.