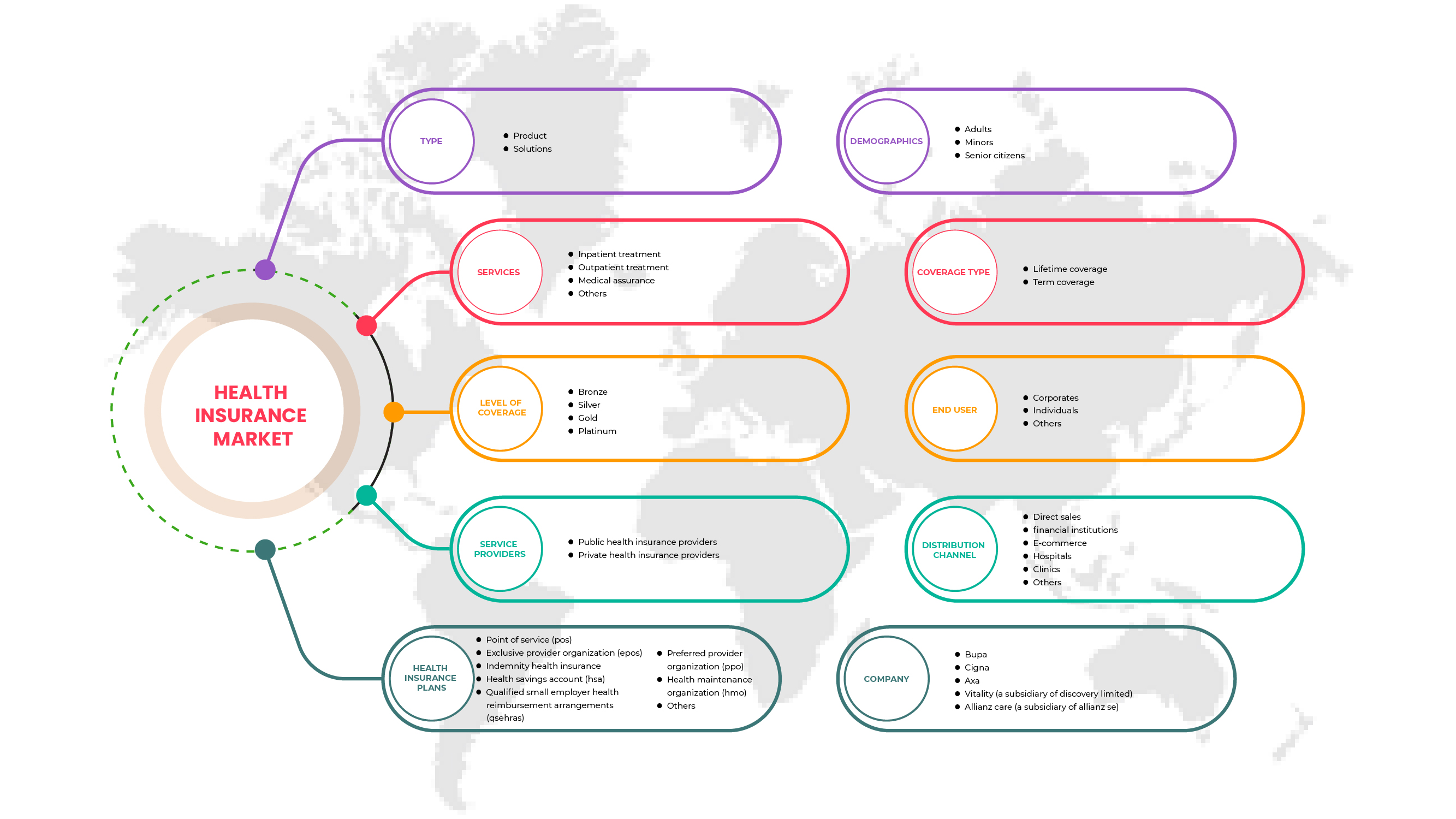

Mercado de seguros de salud del Reino Unido, por tipo (producto y soluciones), servicios (tratamiento hospitalario, tratamiento ambulatorio, seguro médico y otros), nivel de cobertura (bronce, plata, oro y platino), proveedores de servicios (proveedores de seguros de salud públicos, proveedores de seguros de salud privados), planes de seguro de salud (punto de servicio (POS), organización de proveedores exclusivos (EPOS), seguro de salud de indemnización , cuenta de ahorros para gastos médicos (HSA), acuerdos de reembolso de gastos médicos para pequeños empleadores calificados (QSEHRAS), organización de proveedores preferidos (PPO), organización de mantenimiento de la salud (HMO) y otros), datos demográficos (adultos, menores y personas mayores), tipo de cobertura (cobertura de por vida, cobertura a término), usuario final (empresas, particulares y otros), canal de distribución (ventas directas, instituciones financieras, comercio electrónico, hospitales, clínicas y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de seguros de salud en el Reino Unido

La póliza de seguro de salud consta de varios tipos de características y beneficios. Proporciona cobertura financiera a los asegurados contra determinados tratamientos. La póliza de seguro de salud ofrece ventajas que incluyen hospitalización sin efectivo, cobertura de pre y post hospitalización, reembolso y varios complementos. El informe del mercado de seguros de salud del Reino Unido proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado.

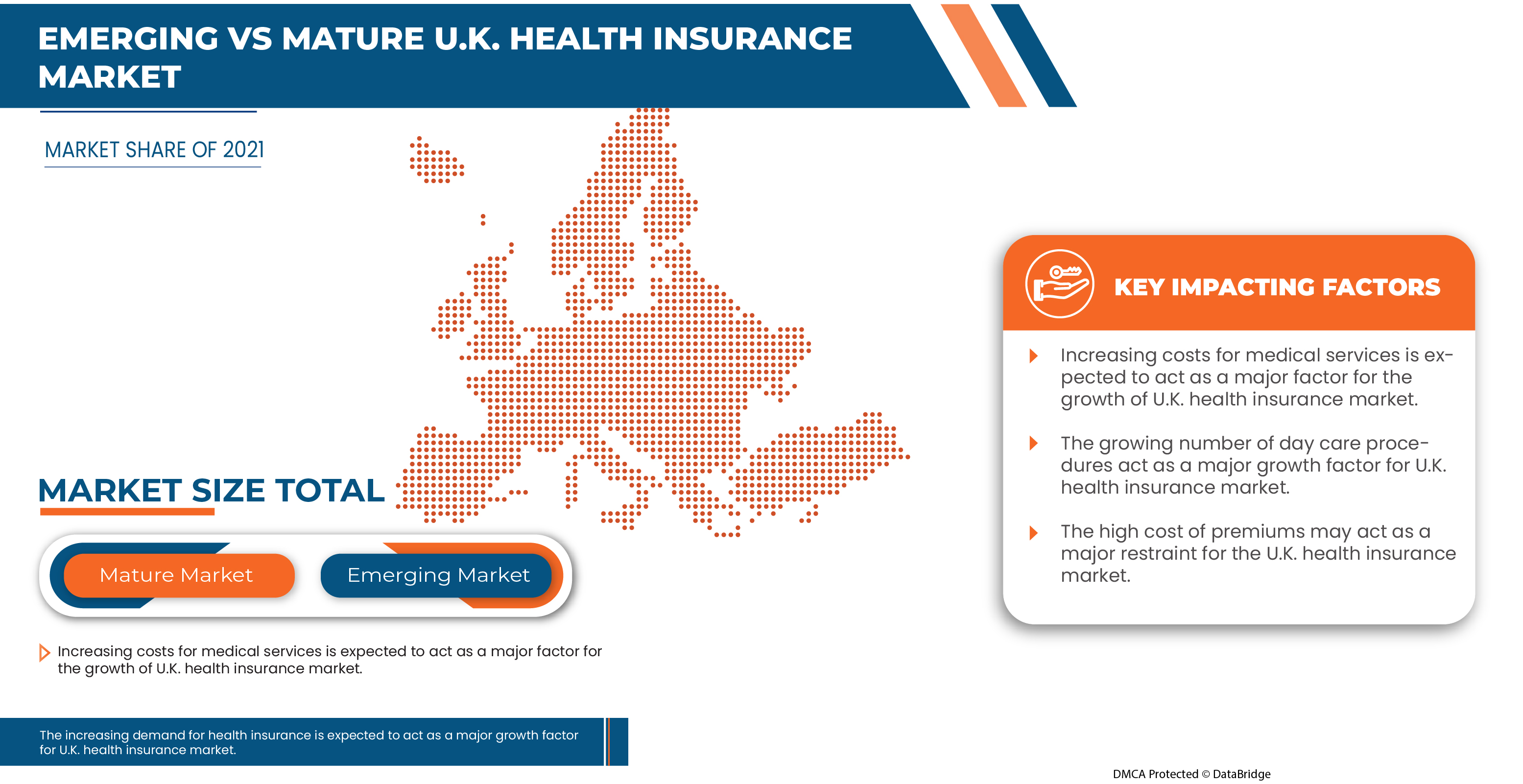

Data Bridge Market Research analiza que se espera que el mercado de seguros de salud del Reino Unido alcance un valor de USD 134.376,64 millones para 2029, con una CAGR del 4,7 % durante el período de pronóstico. El segmento de productos representa el segmento de oferta más grande en el mercado de seguros de salud del Reino Unido. El informe del mercado de seguros de salud del Reino Unido también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo (producto y soluciones), servicios (tratamiento para pacientes hospitalizados, tratamiento ambulatorio, seguro médico y otros), nivel de cobertura (bronce, plata, oro y platino), proveedores de servicios (proveedores de seguros de salud públicos, proveedores de seguros de salud privados), planes de seguro de salud (punto de servicio (POS), organización de proveedores exclusivos (EPOS), seguro de salud de indemnización , cuenta de ahorros para gastos médicos (HSA), acuerdos de reembolso de gastos médicos para pequeños empleadores calificados (QSEHRAS), organización de proveedores preferidos (PPO), organización para el mantenimiento de la salud (HMO) y otros), datos demográficos (adultos, menores y adultos mayores), tipo de cobertura (cobertura de por vida, cobertura a término), usuario final (empresas, particulares y otros), canal de distribución (ventas directas, instituciones financieras, comercio electrónico, hospitales, clínicas y otros). |

|

País cubierto |

Reino Unido |

|

Actores del mercado cubiertos |

Bupa, Cigna, AXA, Vitality (una subsidiaria de Discovery Limited), Allianz Care (una subsidiaria de Allianz SE), Aviva, AIA Group Limited, Saga, Exeter Friendly Society Limited, Pru Life UK, Freedom Health Insurance, General and Medical Finance Ltd y American International Group, Inc. |

Definición de mercado

El seguro de salud es un tipo de seguro que brinda cobertura para todo tipo de gastos quirúrgicos, así como para tratamientos médicos derivados de una enfermedad o lesión. Se aplica a una gama integral o limitada de servicios médicos que brinda cobertura total o parcial de los costos de servicios específicos. Proporciona apoyo financiero al asegurado, ya que cubre todos los gastos médicos cuando el asegurado está hospitalizado para recibir tratamiento. También cubre los gastos previos y posteriores a la hospitalización.

En el plan de seguro médico, hay varios tipos de cobertura disponibles, que son sin efectivo o con solicitud de reembolso. El beneficio sin efectivo está disponible cuando el asegurado recibe tratamiento en los hospitales de la red de la compañía de seguros. Si el asegurado recibe tratamiento en hospitales que no están en la red de la lista, en ese caso, el asegurado cubre todos los gastos médicos y luego solicita el reembolso a la compañía de seguros presentando todas las facturas médicas.

Dinámica del mercado de seguros de salud en el Reino Unido

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

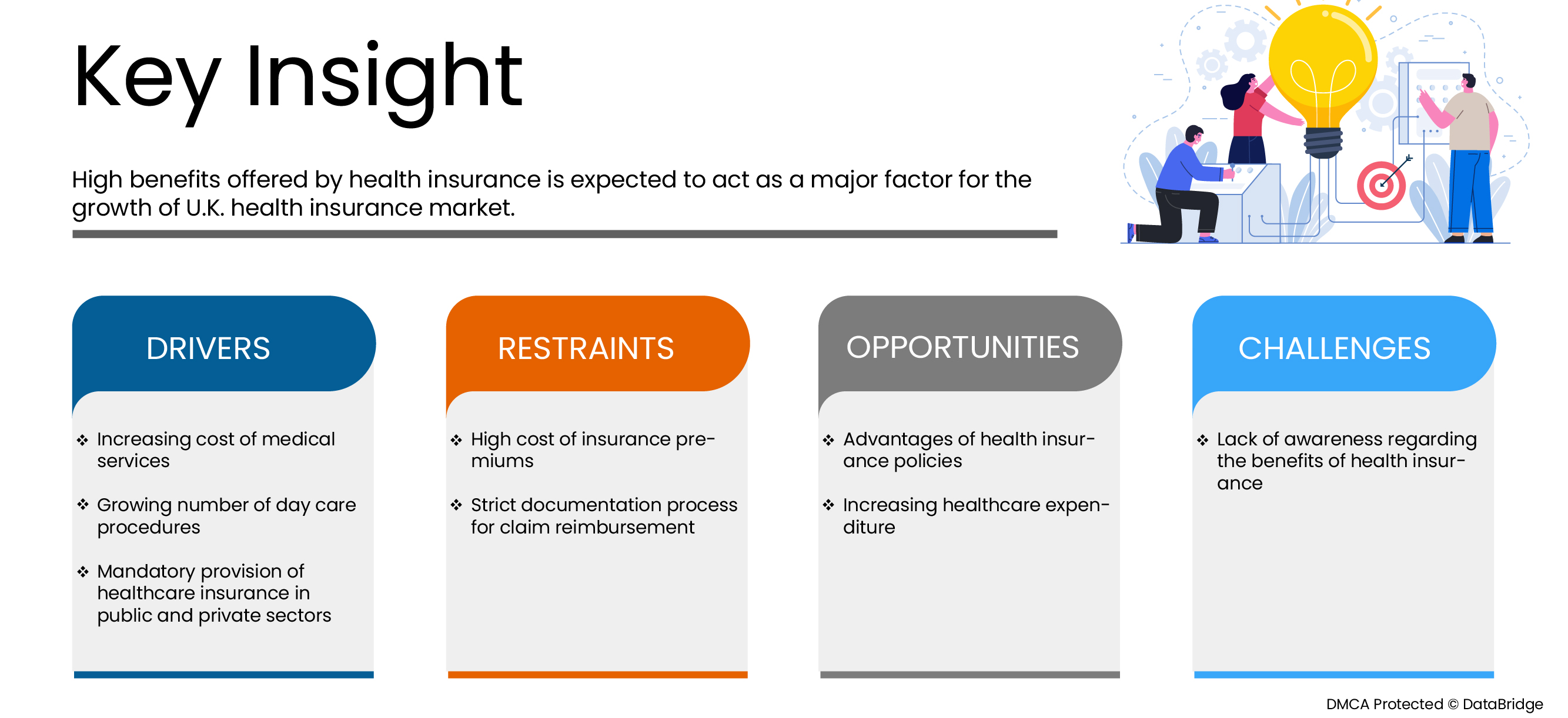

Conductores

-

Aumento del coste de los servicios médicos

Se espera que el aumento del coste de los servicios médicos en todo el mundo y en el Reino Unido actúe como un factor impulsor del mercado de seguros de salud del Reino Unido. Esto permite que muchos consumidores contraten un seguro de vida para cubrir los gastos médicos en caso de que surjan necesidades médicas para su salud o la de su familia.

-

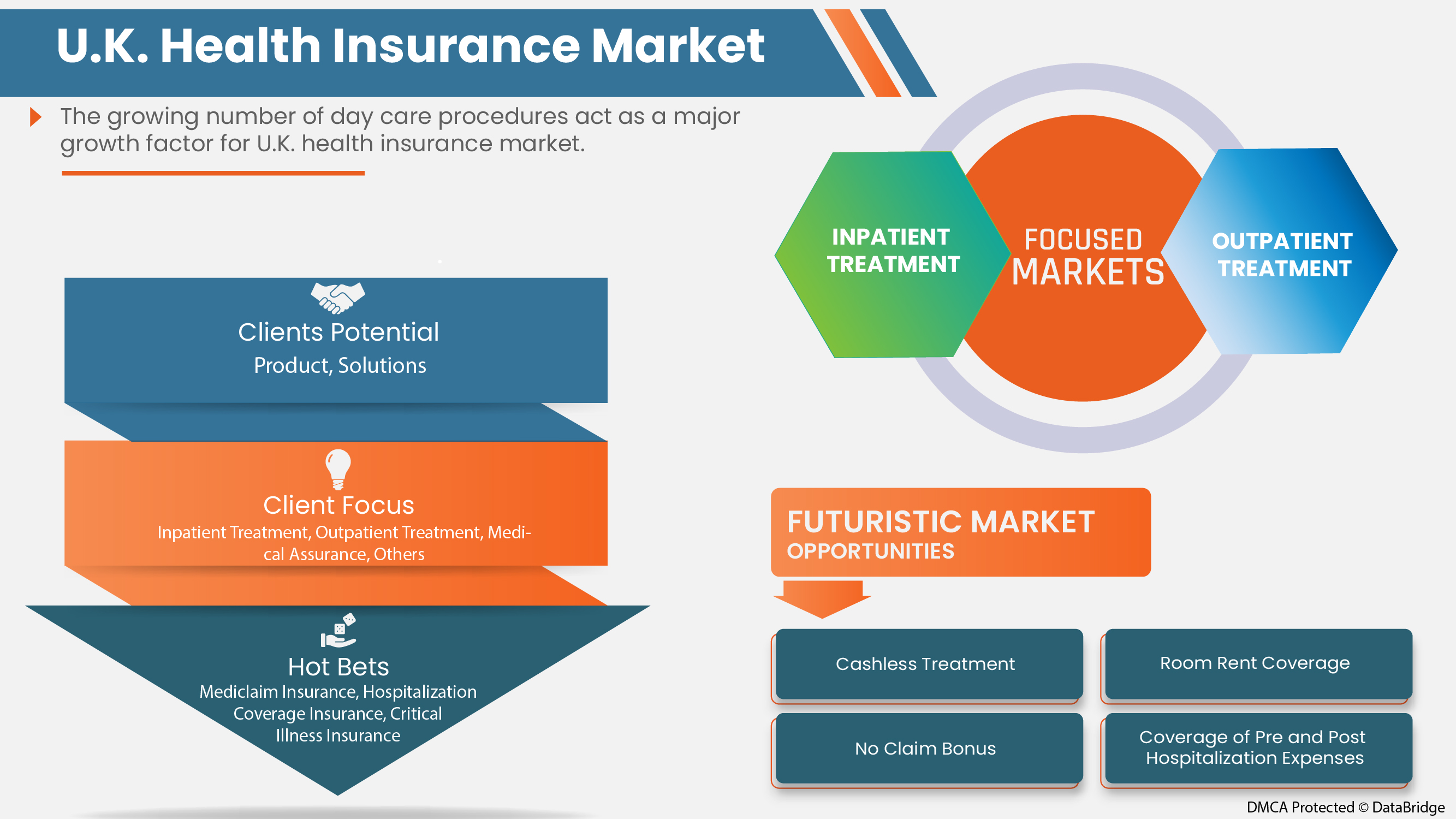

Creciente número de procedimientos de guardería

La mayoría de las compañías de seguros médicos cubren actualmente los procedimientos de atención ambulatoria en sus planes de seguro. Para solicitar este tipo de cirugía, no es obligatorio pasar 24 horas en el hospital, que es el tiempo mínimo de permanencia en el hospital para poder solicitar el seguro. Esto ha permitido que el creciente número de procedimientos de atención ambulatoria impulse el crecimiento del mercado de seguros médicos del Reino Unido.

Oportunidad

-

Ventajas de las pólizas de seguro de salud

En los planes de seguro de salud, el asegurado recibe un reembolso por sus gastos médicos, como hospitalización, cirugías y tratamientos derivados de las lesiones. Una póliza de seguro de salud es un tipo de acuerdo entre el asegurado y la compañía de seguros, en el que la compañía de seguros se compromete a garantizar el pago de los costos del tratamiento en caso de futuros problemas médicos, y el asegurado se compromete a pagar el monto de la prima de acuerdo con el plan de seguro. Por lo tanto, se espera que las crecientes ventajas de las pólizas de seguro de salud actúen como una oportunidad para el crecimiento del mercado.

Restricción/Desafío

- Alto costo de las primas de seguros

El seguro médico cubre todo tipo de costes de tratamiento médico. Proporciona apoyo financiero al asegurado, ya que cubre todos los gastos médicos cuando el asegurado está hospitalizado para recibir tratamiento. El seguro médico también cubre los gastos previos y posteriores a la hospitalización. Para adquirir un seguro médico, el asegurado debe pagar primas de seguro regularmente para mantener activa la póliza de seguro médico. El coste de las primas de seguro es elevado en la mayoría de los casos según el plan de seguro, lo que puede obstaculizar el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de seguros de salud del Reino Unido

El COVID-19 afectó significativamente a varias industrias, ya que casi todos los países optaron por el cierre de todas las instalaciones, excepto las que se dedicaban al segmento de bienes esenciales. El gobierno tomó algunas medidas estrictas, como el cierre de instalaciones y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación del COVID-19. Esto impulsó el mercado de seguros de salud del Reino Unido, ya que los consumidores estaban haciendo uso de seguros para evitar grandes pagos de capital en los hospitales en caso de necesidades médicas. Por lo tanto, el COVID-19 impactó positivamente en el mercado de seguros de salud del Reino Unido.

Acontecimientos recientes

- En agosto de 2020, International Medical Group, Inc. (IMG) mejoró su oferta de productos para ayudar a las organizaciones con la planificación y la investigación necesarias para realizar viajes internacionales seguros. Los nuevos y exclusivos servicios de asistencia de la empresa se diseñaron para ayudar a los clientes a hacer planes para 2020 y más allá. Este desarrollo ayudó a la empresa a mantenerse y prosperar en medio de una pandemia.

- En febrero de 2019, Now Health International anunció que había lanzado sus planes SimpleCare en el mercado internacional. Los nuevos planes de SimpleCare están diseñados para brindar un seguro médico internacional asequible para las personas que se preocupan por los costos. Con el lanzamiento de un nuevo producto, la empresa mejoró su negocio en el mercado internacional, como el mercado del Reino Unido, y generó más ingresos.

Alcance del mercado de seguros de salud en el Reino Unido

El mercado de seguros de salud del Reino Unido está segmentado en función del tipo, los servicios, el nivel de cobertura, los proveedores de servicios, los planes de seguros de salud, la demografía, el tipo de cobertura, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Mercado de seguros de salud del Reino Unido, por tipo

- Producto

- Soluciones

Según el tipo, el mercado se segmenta en productos y soluciones.

Mercado de seguros de salud en el Reino Unido, por servicios

- Tratamiento hospitalario

- Tratamiento ambulatorio

- Seguro médico

- Otros

En función de los servicios, el mercado está segmentado en tratamiento hospitalario, tratamiento ambulatorio, seguro médico y otros.

Mercado de seguros de salud en el Reino Unido, por nivel de cobertura

- Bronce

- Plata

- Oro

- Platino

Según el nivel de cobertura, el mercado está segmentado en bronce, plata, oro y platino.

Mercado de seguros de salud en el Reino Unido, por proveedores de servicios

- Proveedores de seguros de salud privados

- Proveedores de seguros de salud públicos

Sobre la base de los proveedores de servicios, el mercado está segmentado en proveedores de seguros de salud privados y proveedores de seguros de salud públicos.

Mercado de seguros de salud en el Reino Unido, por planes de seguros de salud

- Punto de servicio (POS)

- Organización de proveedores exclusivos (EPOS)

- Seguro médico de indemnización

- Cuenta de ahorros para gastos médicos (HSA)

- Acuerdos de reembolso de gastos médicos para pequeños empleadores calificados (QSEHRAS)

- Organización de proveedores preferidos (PPO)

- Organización para el mantenimiento de la salud (HMO)

- Otros

Sobre la base de los planes de seguro de salud, el mercado está segmentado en punto de servicio (POS), organización de proveedores exclusivos (EPOS), seguro de salud de indemnización, cuenta de ahorros para salud (HSA), acuerdos de reembolso de salud para pequeños empleadores calificados (QSEHRAS), organización de proveedores preferidos (PPO), organización de mantenimiento de la salud (HMO) y otros.

Por demografía

- Adultos

- Menores de edad

- Personas mayores

Sobre la base de la demografía, el mercado de seguros de salud del Reino Unido está segmentado en adultos, menores y personas mayores.

Por tipo de cobertura

- Cobertura de por vida

- Cobertura a término

Según el tipo de cobertura, el mercado de seguros de salud del Reino Unido está segmentado en cobertura de por vida y cobertura a término.

Por el usuario final

- Corporaciones

- Individuos

- Otros

En función del usuario final, el mercado de seguros de salud del Reino Unido está segmentado en empresas, individuos y otros.

Por canal de distribución

- Ventas directas

- Instituciones financieras

- Comercio electrónico

- Hospitales

- Clínicas

- Otros

Sobre la base del canal de distribución, el mercado de seguros de salud del Reino Unido está segmentado en ventas directas, instituciones financieras, comercio electrónico, hospitales, clínicas y otros.

Análisis y perspectivas regionales del mercado de seguros de salud del Reino Unido

El mercado de seguros de salud del Reino Unido en función del tipo, los servicios, el nivel de cobertura, los proveedores de servicios, los planes de seguro de salud, la demografía, el tipo de cobertura, el usuario final y el canal de distribución, como se mencionó anteriormente.

En 2022, se espera que el mercado de seguros de salud del Reino Unido crezca debido a factores como las ventajas de las pólizas de seguro de salud y el aumento del gasto sanitario.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas del Reino Unido y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los seguros de salud en el Reino Unido

El panorama competitivo del mercado de servicios de laboratorio analítico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en el Reino Unido, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de seguros de salud del Reino Unido.

Algunas de las principales compañías que ofrecen servicios de seguros en el mercado de seguros de salud del Reino Unido son Bupa, Cigna, AXA, Vitality (una subsidiaria de Discovery Limited), Allianz Care (una subsidiaria de Allianz SE), Aviva, AIA Group Limited, Saga, Exeter Friendly Society Limited, Pru Life UK, Freedom Health Insurance, general and medical finance ltd, American International Group, Inc., entre otras.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.K. HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USER COVERAGE GRID

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 TYPE LIFE LINE CURVE

2.11 MULTIVARIATE MODELING

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 U.K. HEALTH INSURANCE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 MEDICLAIM INSURANCE

6.2.2 INDIVIDUAL COVERAGE INSURANCE

6.2.3 FAMILY FLOATER COVERAGE INSURANCE

6.2.4 HOSPITALIZATION COVERAGE INSURANCE

6.2.5 SENIOR CITIZEN COVERAGE INSURANCE

6.2.6 CRITICAL ILLNESS INSURANCE

6.2.7 UNIT LINKED HEALTH PLANS

6.2.8 PERMANENT HEALTH INSURANCE

6.3 SOLUTIONS

6.3.1 LEAD GENERATIONS SOLUTIONS

6.3.2 REVENUE MANAGEMENT & BILLING SOLUTIONS

6.3.3 ROBOTIC PROCESS AUTOMATION

6.3.4 INSURANCE CLOUD SOLUTIONS

6.3.5 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

6.3.6 VALUE-BASED PAYMENTS SOLUTIONS

6.3.7 ARTIFICIAL INTELLIGENCE & BLOCK CHAIN SOLUTIONS

6.3.8 INTELLIGENT CASE MANAGEMENT SOLUTIONS

6.3.9 OTHERS

7 U.K. HEALTH INSURANCE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INPATIENT TREATMENT

7.3 OUTPATIENT TREATMENT

7.4 MEDICAL ASSURANCE

7.5 OTHERS

8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

8.1 OVERVIEW

8.2 BRONZE

8.3 SILVER

8.4 GOLD

8.5 PLATINUM

9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 PUBLIC HEALTH INSURANCE PROVIDERS

9.3 PRIVATE HEALTH INSURANCE PROVIDERS

10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICE (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIOR CITIZENS

12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 U.K. HEALTH INSURANCE MARKET, BY END-USER

13.1 OVERVIEW

13.2 CORPORATES

13.3 INDIVIDUALS

13.4 OTHERS

14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 U.K. HEALTH INSURANCE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: U.K.

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CIGNA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATE

17.2 AVIVA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATE

17.4 AXA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 BUPA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 AMERICAN INTERNATIONAL GROUP, INC. (2021)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 EXETER FRIENDLY SOCIETY LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 FREEDOM HEALTH INSURANCE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GENERAL AND MEDICAL FINANCE LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 PRU LIFE UK

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 SAGA (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAYCARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 U.K. HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.K. PRODUCT IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.K. SOLUTIONS IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.K. HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.K. HEALTH INSURANCE MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 U.K. HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 U.K. HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 U.K. HEALTH INSURANCE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 9 U.K. HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 10 U.K. HEALTH INSURANCE MARKET: TYPE LIFE LINE CURVE

FIGURE 11 U.K. HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 12 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 INCREASING COST OF MEDICAL SERVICES IS EXPECTED TO DRIVE THE U.K. HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.K. HEALTH INSURANCE MARKET

FIGURE 16 HEALTH INSURANCE COVERAGE

FIGURE 17 U.K. HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 18 U.K. HEALTH INSURANCE MARKET: BY SERVICES, 2021

FIGURE 19 U.K. HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2021

FIGURE 20 U.K. HEALTH INSURANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 21 U.K. HEALTH INSURANCE MARKET: BY HEALTH INSURANCE PLANS, 2021

FIGURE 22 U.K. HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2021

FIGURE 23 U.K. HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2021

FIGURE 24 U.K. HEALTH INSURANCE MARKET: BY END-USER, 2021

FIGURE 25 U.K. HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 U.K. HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.