Mercado de buques pesqueros congeladores en Sudamérica, por sistema (congelación por aire comprimido, congelación en placa, salmuera, IQF (congelación rápida individual)), tipo ( buques pesqueros comerciales , buques pesqueros artesanales y buques pesqueros recreativos), longitud del buque (menos de 20 m, 21 m-30 m, más de 40 m y 31 m-40 m), capacidad de congelación (50 toneladas a 150 toneladas, 150 toneladas a 300 toneladas, menos de 50 toneladas y más de 300 toneladas) – Tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

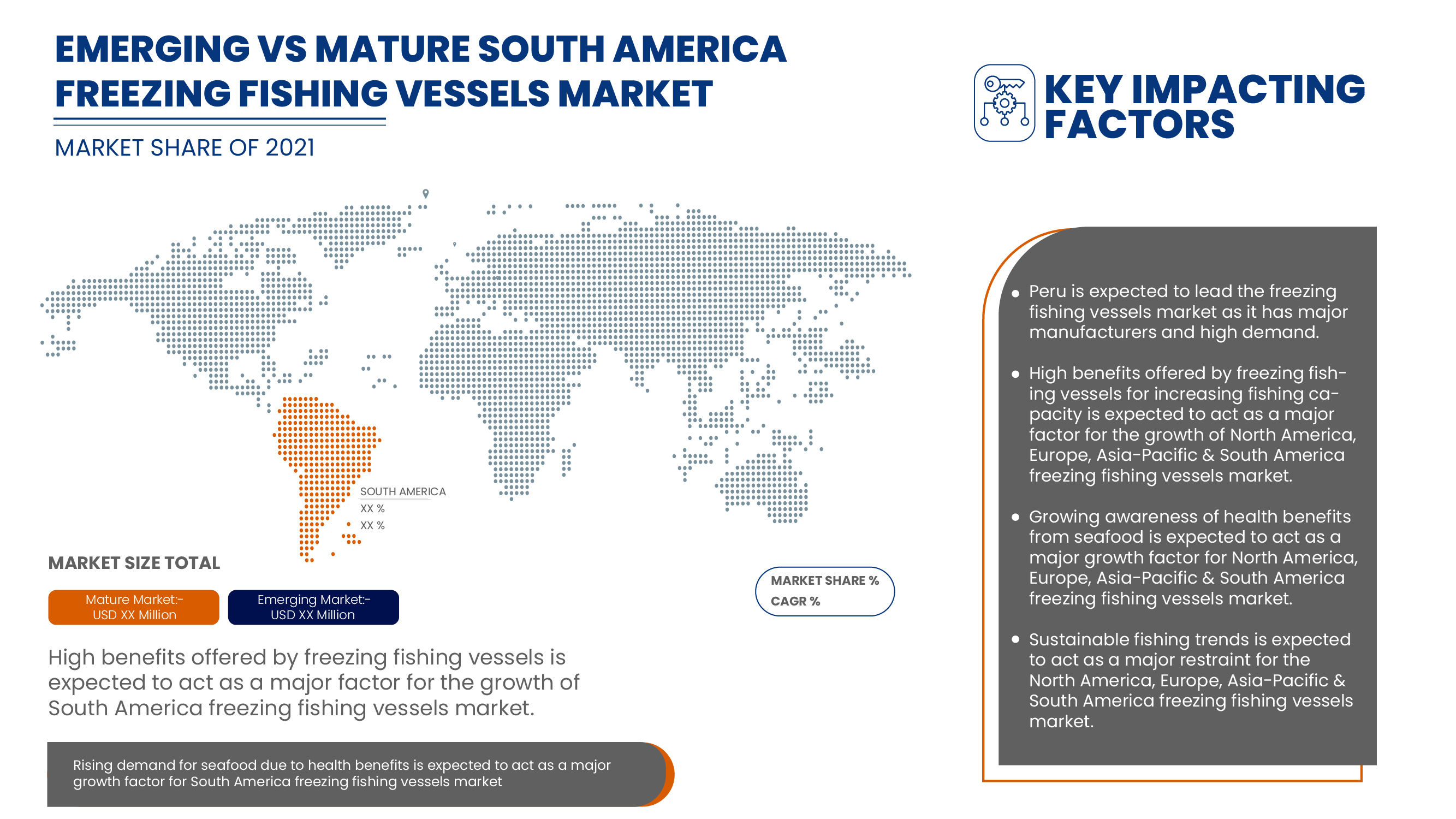

Un barco pesquero es un pontón o barco que se utiliza para pescar en el océano, en un lago o en un arroyo. Se utiliza una amplia gama de barcos pesqueros en la pesca comercial, recreativa y artesanal. La recolección de recursos acuáticos y la producción se realizan en la naturaleza o en situaciones controladas en la acuicultura. La creciente demanda de productos del mar está aumentando la demanda de soluciones de barcos pesqueros congeladores en el mercado. El mercado de barcos pesqueros congeladores de América del Sur está creciendo rápidamente debido a los beneficios para la salud de los mariscos y la demanda de productos de mayor calidad. Las empresas incluso están lanzando nuevos productos para ganar una mayor participación de mercado.

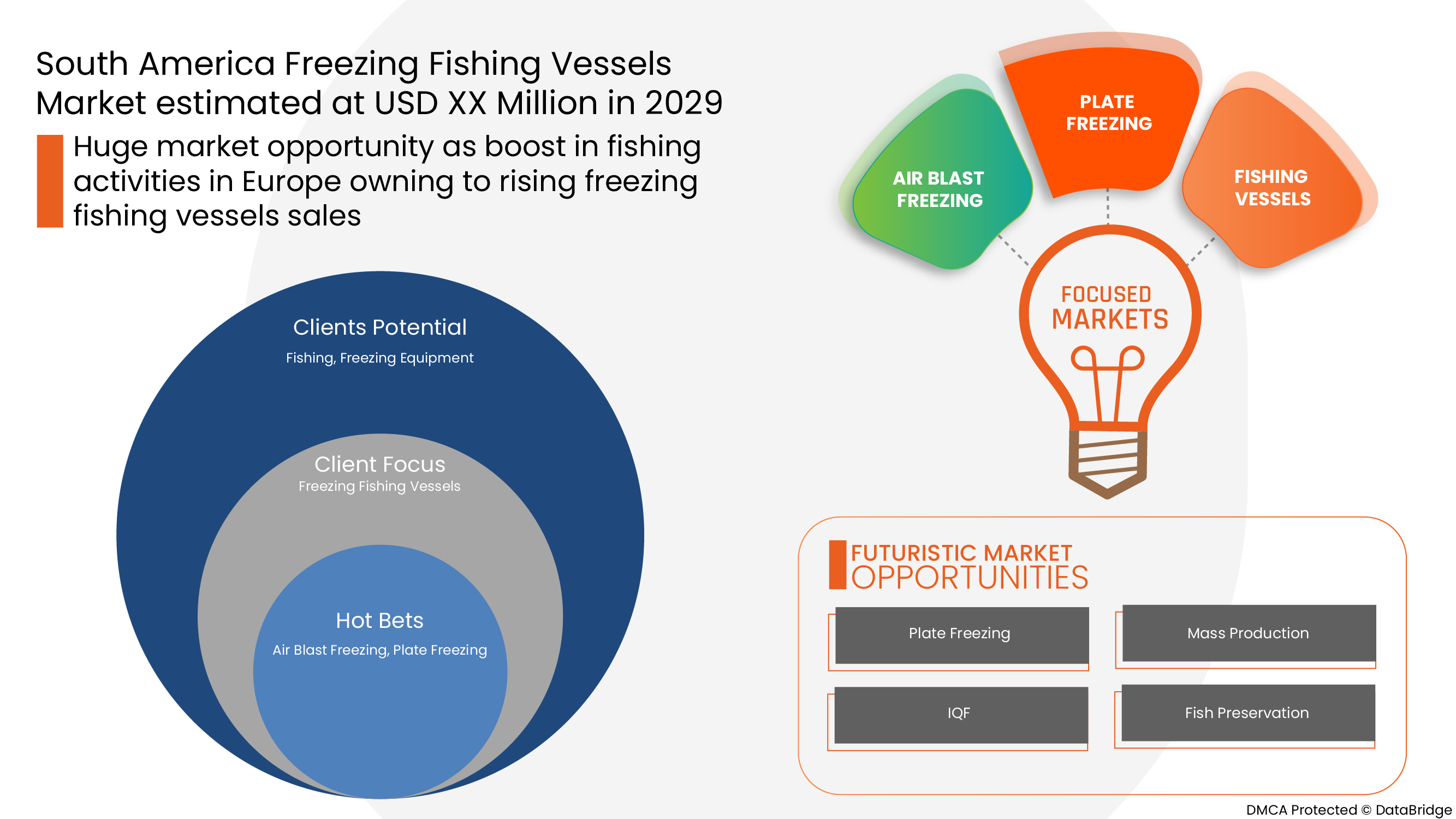

Data Bridge Market Research analiza que se espera que el mercado de buques pesqueros congeladores de América del Sur alcance un valor de USD 3.013,81 millones para 2029, con una CAGR del 3,9% durante el período de pronóstico. La "congelación por soplado de aire" representa el segmento de sistemas más grande en el mercado de buques pesqueros congeladores. El informe del mercado de buques pesqueros congeladores también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Millones de dólares |

|

Segmentos cubiertos |

Por sistema (congelación por soplado de aire, congelación en placa, salmuera, IQF (congelación rápida individual)), por tipo (embarcaciones de pesca comercial, embarcaciones de pesca artesanal y embarcaciones de pesca recreativa), por eslora de la embarcación (menos de 20 m, 21 m-30 m, más de 40 m y 31 m-40 m), por capacidad de congelación (50 toneladas a 150 toneladas, 150 toneladas a 300 toneladas, menos de 50 toneladas y más de 300 toneladas) |

|

Países cubiertos |

Perú, Chile, Ecuador y resto de Sudamérica |

|

Actores del mercado cubiertos |

Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol BV, Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Astillero Aresa, entre otros. |

Definición de mercado

Un barco pesquero es un pontón o barco utilizado para capturar peces en el océano, en un lago o en un arroyo. Se utiliza una amplia gama de tipos de barcos pesqueros en la pesca comercial, recreativa y artesanal. La recolección de recursos acuáticos y la producción se realizan en la naturaleza o en situaciones controladas en la acuicultura. Ambos utilizan una tremenda combinación de innovaciones, desde distintivas hasta altamente industriales, que incorporan embarcaciones y equipos, así como aparatos y métodos de pesca. Para la pesca de captura y la acuicultura , el uso de tecnologías innovadoras como los barcos pesqueros y el uso de filamentos diseñados, equipos hidráulicos y manipulación de peces está en las tendencias actuales del mercado de barcos pesqueros. Además, la recolección de peces en barcos pesqueros también incorpora dispositivos para la localización de peces, tecnología basada en satélites para rutas y comunicaciones, conservación instalada y uso ampliado de motores desmontables. Se estima que la creciente demanda de equipos de pesca en la tecnología pesquera impulsará el mercado de barcos pesqueros en todo el mundo.

Dinámica del mercado de buques pesqueros congeladores en América del Sur

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Aumento de la popularidad de las actividades recreativas

En todo el mundo se ha producido un aumento de las actividades recreativas, como la pesca y la navegación, lo que ha generado un aumento de la demanda de barcos pesqueros. Las características avanzadas que ofrecen los barcos pesqueros, como una larga vida útil, durabilidad, personalización y respeto por el medio ambiente, atraen aún más a los clientes. Por lo tanto, se prevé que la demanda de barcos pesqueros aumente aún más durante el período de pronóstico.

- Aumento de la conciencia sobre los beneficios para la salud asociados con los productos del mar

El aumento de la demanda de pesca a nivel mundial y la mayor conciencia sobre los beneficios para la salud asociados con los productos del mar, como el atún, los peces de fondo y el salmón, generan una mayor demanda de este producto. La participación en actividades al aire libre, junto con la demanda de productos del mar, ha impulsado enormemente el mercado de barcos pesqueros y se prevé que siga creciendo durante el período de pronóstico.

- Demanda de desarrollo sostenible

Un obstáculo para el crecimiento de este mercado podría ser la creciente demanda de desarrollo sostenible. Los barcos pesqueros suelen extraer más de los cuerpos de agua de lo que pueden reponer en un corto período de tiempo, eliminando rápidamente las reservas de pescado. Pero este efecto se puede amortiguar mediante la aplicación de estrictas regulaciones pesqueras y marítimas a nivel mundial que garanticen un suministro constante de pescado.

- Alto costo inicial de inversión

El mercado de los buques pesqueros congeladores ofrece varios factores beneficiosos, como beneficios para la salud y mayor capacidad, pero todo esto conlleva un alto costo de inversión. La industria de la construcción naval es un asunto de alto costo y el proyecto puede durar varios años. Esto puede frenar el crecimiento del mercado de los buques pesqueros congeladores.

Impacto posterior al COVID-19 en el mercado de congelación de buques pesqueros

La COVID-19 ha tenido un gran impacto en el mercado de los buques pesqueros congeladores, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de los buques pesqueros congeladores está aumentando debido a las políticas gubernamentales para impulsar el comercio internacional después de la COVID-19. Además, los beneficios que ofrece el mercado de los buques pesqueros congeladores para el mercado pesquero y la demanda de mariscos están aumentando la demanda del mercado de los buques pesqueros congeladores en el mercado. Sin embargo, factores como la congestión asociada a las rutas comerciales y las restricciones comerciales entre algunas naciones están restringiendo el crecimiento del mercado. El cierre de las instalaciones de producción durante la situación de pandemia ha tenido un impacto significativo en el mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el mercado de los buques pesqueros congeladores. Con esto, las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar el comercio internacional han llevado al crecimiento del mercado.

Acontecimientos recientes

- En agosto de 2021, Wärtsilä ofreció soluciones de propulsión para buques pesqueros a los astilleros Karstensens Shipyard. La característica principal de este sistema de propulsión fue el sistema de reducción de emisiones NOx Reducer, el reductor, la hélice de paso controlable y el sistema de control remoto de propulsión ProTouch. El lanzamiento de esta solución ayudó a la empresa a expandir su mercado.

- En junio de 2019, Rolls-Royce plc recibió el contrato para la construcción de un arrastrero de popa de 70 metros de largo para Engenes fiskeriselskap AS. La empresa ofreció el diseño del barco y una amplia gama de equipos, como sistemas de propulsión y potencia, maquinaria de cubierta, sistemas eléctricos y de automatización. De esta forma, la empresa amplió su mercado y su presencia global.

Alcance del mercado de buques pesqueros congeladores en América del Sur

El mercado de buques pesqueros congeladores de América del Sur está segmentado en función del sistema, el tipo, la longitud del buque y la capacidad de congelación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por sistema

- Congelación por aire comprimido

- Congelación de placas

- Salmuera

- IQF (congelación rápida individual)

Sobre la base del sistema, el mercado de buques pesqueros congeladores de América del Norte, Europa, Asia-Pacífico y América del Sur está segmentado en congelación por chorro de aire, congelación en placas, salmuera e IQF (congelación rápida individual).

Por tipo

- Buques de pesca comercial

- Embarcaciones pesqueras artesanales

- Embarcaciones de pesca recreativa

Sobre la base del tipo, el mercado de buques pesqueros congeladores de América del Norte, Europa, Asia-Pacífico y América del Sur se ha segmentado en buques pesqueros comerciales, buques pesqueros artesanales y buques pesqueros recreativos.

Por longitud del buque

- Menos de 20 M

- 21M-30M

- Por encima de 40 M

- 31M-40M

Sobre la base de la longitud de los buques, el mercado de buques pesqueros congeladores de América del Norte, Europa, Asia-Pacífico y América del Sur se ha segmentado en menos de 20 M, 21 M-30 M, más de 40 M y 31 M-40 M.

Por capacidad de congelación

- 50 toneladas a 150 toneladas

- 150 toneladas a 300 toneladas

- Menos de 50 toneladas

- Más de 300 toneladas

Sobre la base de la capacidad de congelación, el mercado de buques pesqueros congeladores de América del Norte, Europa, Asia-Pacífico y América del Sur se ha segmentado en 50 toneladas a 150 toneladas, 150 toneladas a 300 toneladas, menos de 50 toneladas y más de 300 toneladas.

Análisis y perspectivas regionales del mercado de buques pesqueros congeladores

Se analiza el mercado de buques pesqueros congeladores de América del Sur y se proporcionan información y tendencias sobre el tamaño del mercado por país, sistema, tipo, longitud del buque y capacidad de congelación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de buques pesqueros congeladores son Perú, Chile, Ecuador y el resto de América del Sur.

Perú domina el mercado de buques pesqueros congeladores de América del Sur. Es probable que Perú sea el mercado de buques pesqueros congeladores de América del Sur de más rápido crecimiento. El creciente desarrollo de infraestructura, comercial e industrial en países emergentes como Perú, Chile y Ecuador se atribuye al dominio del mercado. Perú domina la región de América del Sur debido a las iniciativas gubernamentales y las actividades pesqueras de atún.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Sur y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los buques de pesca congeladores

El panorama competitivo del mercado de buques pesqueros congeladores de América del Sur proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Sur, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de buques pesqueros congeladores.

Algunos de los principales actores que operan en el mercado de buques pesqueros congeladores son:

Entre los más destacados se encuentran: Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol BV, Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Astillero Aresa, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SOUTH AMERICA FREEZING FISHING VESSELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 PREMIUM INSIGHTS:

2.1 FISHING VESSEL CONSTRUCTION

2.2 OTHER DETAILS REGARDING FISHING VESSEL

2.2.1 FISHING VESSEL AVERAGE OPERATIONAL YEARS

2.2.2 TOTAL NUMBER OF FISHING VESSEL

3 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM

3.1 OVERVIEW

3.2 AIR BLAST FREEZING

3.3 PLATE FREEZING

3.3.1 VERTICAL PLATE FREEZING

3.3.2 HORIZONTAL PLATE FREEZING

3.4 BRINE

3.5 IQF (INDIVIDUAL QUICK FROZEN)

4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE

4.1 OVERVIEW

4.2 COMMERCIAL FISHING VESSELS

4.3 ARTISANAL FISHING VESSELS

4.4 RECREATIONAL FISHING VESSELS

5 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH

5.1 OVERVIEW

5.2 LESS THAN 20 M

5.3 21 M-30 M

5.4 ABOVE 40 M

5.5 31 M-40 M

6 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY

6.1 OVERVIEW

6.2 50 TONS TO 150 TONS

6.3 150 TONS TO 300 TONS

6.4 LESS THAN 50 TONS

6.5 MORE THAN 300 TONS

7 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY REGION

7.1 SOUTH AMERICA

7.1.1 PERU

7.1.2 CHILE

7.1.3 ECUADOR

7.1.4 REST OF SOUTH AMERICA

8 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: SOUTH AMERICA

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ROLLS-ROYCE PLC

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCTS PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 WÄRTSILÄ

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SAHRE ANALYSIS

10.2.4 PRODUCTS PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 DAMEN SHIPYARDS GROUP

10.3.1 COMPANY SNAPSHOT

10.3.2 COMPANY SHARE ANALYSIS

10.3.3 PRODUCTS PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 ULSTEIN GROUP ASA

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCTS PORTFOLIO

10.4.4 RECENT DEVELOPMENTS

10.5 KONGSBERG GRUPPEN ASA

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCTS PORTFOLIO

10.5.5 RECENT DEVELOPMENTS

10.6 ARESA SHIPYARD

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCTS PORTFOLIO

10.6.3 RECENT DEVELOPMENTS

10.7 ASTILLEROS ARMON

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCTS PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 CHANTIER DE CONSTRUCTIONS NAVALES MARTINEZ

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCTS PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 ELLIOTT BAY DESIGN GROUP

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCTS PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 GREEN YARD KLEVEN

10.10.1 COMPANY SNAPSHOT

10.10.2 SERVICES PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HEINEN & HOPMAN

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCTS PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 INTEGRATED MARINE SYSTEMS, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCTS PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 KARSTENSENS SKIBSVÆRFT A/S

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCTS PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 LERØY HAVFISK

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCTS PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 MAREFSOL B.V.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCTS PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 MASTER BOAT BUILDERS, INC.

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCTS PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 MAURICE

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCTS PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 MMC FIRST PROCESS AS.

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCTS PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 NICHOLS BROS BOAT BUILDERS

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCTS PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 NORDIC WILDFISH

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCTS PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

10.21 TEKNOTHERM

10.21.1 COMPANY SNAPSHOT

10.21.2 PRODUCTS PORTFOLIO

10.21.3 RECENT DEVELOPMENTS

10.22 THOMA-SEA SHIP BUILDERS, LLC

10.22.1 COMPANY SNAPSHOT

10.22.2 PRODUCTS PORTFOLIO

10.22.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Tablas

TABLE 1 FISHING VESSEL CONSTRUCTION DETAILS

TABLE 2 FISHING VESSEL AVERAGE OPERATIONAL YEARS WITH RESPECT TO THE TYPE

TABLE 3 FISHING VESSEL OWNERS REQUIRING FREEZING SYSTEMS

TABLE 4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 5 SOUTH AMERICA AIR BLAST FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 SOUTH AMERICA BRINE IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 SOUTH AMERICA IQF (INDIVIDUAL QUICK FROZEN) IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 SOUTH AMERICA COMMERCIAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 SOUTH AMERICA ARTISANAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 SOUTH AMERICA RECREATIONAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 15 SOUTH AMERICA LESS THAN 20 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 SOUTH AMERICA 21 M-30 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 SOUTH AMERICA ABOVE 40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 SOUTH AMERICA 31 M-40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 20 SOUTH AMERICA 50 TONS TO 150 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 SOUTH AMERICA 150 TONS TO 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AMERICA LESS THAN 50 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AMERICA MORE THAN 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 26 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 29 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 PERU FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 31 PERU PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 PERU FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 PERU FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 34 PERU FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 35 CHILE FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 36 CHILE PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 CHILE FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHILE FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 39 CHILE FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 40 ECUADOR FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 41 ECUADOR PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ECUADOR FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ECUADOR FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 44 ECUADOR FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 45 REST OF SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY SYSTEM, 2021

FIGURE 2 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY TYPE, 2021

FIGURE 3 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY VESSEL LENGTH, 2021

FIGURE 4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY FREEZING CAPACITY, 2021

FIGURE 5 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: SNAPSHOT (2021)

FIGURE 6 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021)

FIGURE 7 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 8 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 9 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY SYSTEM (2022-2029)

FIGURE 10 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.