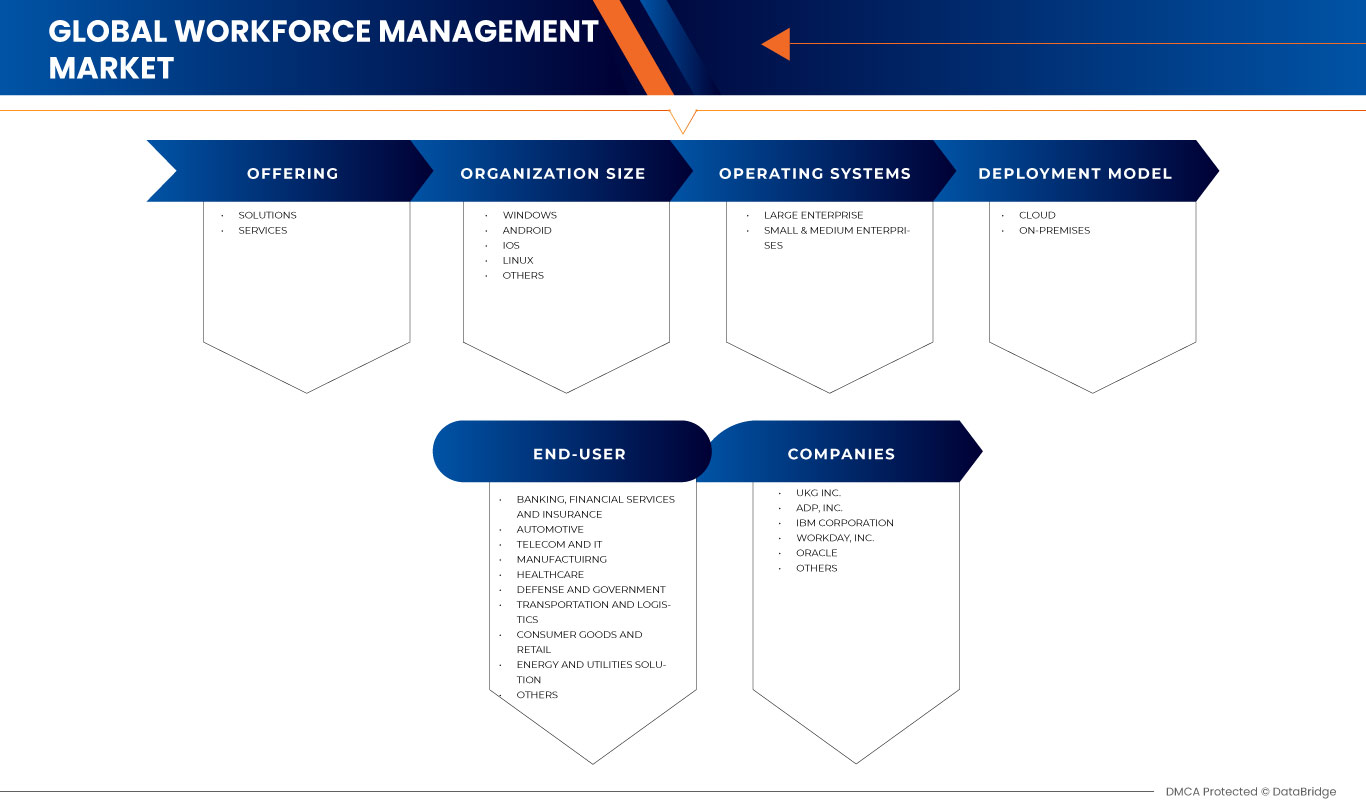

Mercado de gestión de la fuerza laboral de América del Norte, por oferta (soluciones y servicios), tamaño de la organización (grandes empresas y pequeñas y medianas empresas), sistemas operativos (Windows, Android, iOS, LINUX y otros), modelo de implementación (nube y local), usuario final ( banca, servicios financieros y seguros , automoción, telecomunicaciones y TI, fabricación, atención médica, defensa y gobierno, transporte y logística, bienes de consumo y venta minorista, soluciones de energía y servicios públicos, y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de gestión de la fuerza laboral en América del Norte

La gestión de la fuerza laboral se refiere a los procesos y herramientas que utilizan las organizaciones para optimizar la productividad y la eficiencia de sus empleados. El mercado de la gestión de la fuerza laboral está creciendo rápidamente, impulsado por la creciente adopción de soluciones basadas en la nube y la necesidad de que las empresas mejoren su eficiencia operativa. Sin embargo, este mercado también enfrenta varias limitaciones, como la escasez de mano de obra calificada y la creciente complejidad de las leyes y regulaciones laborales. En este contexto, es importante comprender las tendencias y los factores actuales que configuran el mercado de la gestión de la fuerza laboral y los desafíos que enfrentan las organizaciones en este campo.

Data Bridge Market Research analiza que se espera que el mercado de gestión de la fuerza laboral de América del Norte alcance los 3.574.810,79 mil dólares en 2030, con una CAGR del 10,1 % durante el período de pronóstico. El informe del mercado de gestión de la fuerza laboral de América del Norte también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Oferta (soluciones y servicios), tamaño de la organización (grandes empresas y pequeñas y medianas empresas), sistemas operativos (Windows, Android, iOS, LINUX y otros), modelo de implementación (nube y en instalaciones locales), usuario final (banca, servicios financieros y seguros, automoción, telecomunicaciones y TI, fabricación, atención médica, defensa y gobierno, transporte y logística, bienes de consumo y venta minorista, soluciones de energía y servicios públicos y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México. |

|

Actores del mercado cubiertos |

UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity, Paycom Payroll LLC, Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG, Oracle |

Definición de mercado

La gestión de la fuerza laboral optimiza la productividad de los empleados, garantizando que todos los recursos trabajen en el momento y lugar adecuados. La gestión de la fuerza laboral generalmente comprende la previsión, la programación, la gestión de habilidades, la gestión intradía, el control del tiempo y la asistencia. El software de gestión de la fuerza laboral a menudo se incorpora con aplicaciones de RR.HH. de empresas de terceros y tecnologías clave de RR.HH. que actúan como repositorios clave para la información de empleo. Esto ayuda a RR.HH. a gestionar de manera eficiente a los empleados para mejorar la productividad de la organización. La gestión de la fuerza laboral (WFM) cumple de manera efectiva con los requisitos laborales y establece y administra los horarios de los empleados para realizar una tarea específica a diario y hora a hora. La gestión de la fuerza laboral introduce tecnologías de IoT e IA para ofrecer soluciones mejoradas para la gestión de recursos humanos. El segmento de la nube está en auge en el mercado de gestión de la fuerza laboral de Asia-Pacífico debido a ventajas como la escalabilidad ilimitada, el control y varias aplicaciones.

Dinámica del mercado de gestión de la fuerza laboral en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

CONDUCTORES

- Creciente adopción de Internet de las cosas (IoT) y soluciones de gestión de la fuerza laboral basadas en la nube

El Internet de las cosas es una de las tecnologías potenciales que pueden brindar soluciones modernas para los lugares de trabajo modernos, con el fin de impulsar la cultura laboral y optimizar el uso de los recursos. El uso del Internet de las cosas y la tecnología basada en la nube en la gestión de la fuerza laboral permite una mejor conectividad, habilidades para la toma de decisiones y una interoperabilidad perfecta, y desarrolla una cultura de trabajo inteligente.

- Creciente penetración de soluciones analíticas y aplicaciones de dispositivos conectados

La analítica de la fuerza laboral combina software y metodología que aplica modelos estadísticos a datos relacionados con el trabajo y permite a las organizaciones optimizar los recursos humanos. Esta tecnología y esta analítica han crecido a lo largo de los años y evolucionan a diario con el aumento de la demanda en el mercado.

- Necesidad de reducción de gastos relacionados con recursos humanos

En el mundo empresarial actual, las empresas se esfuerzan por mejorar sus beneficios y ampliar sus negocios en este mercado hipercompetitivo, que ejerce una presión constante para reducir los costes y mejorar la rentabilidad. La reducción de los costes relacionados con los recursos humanos desempeña un papel fundamental en el aumento de la rentabilidad de las empresas.

OPORTUNIDAD

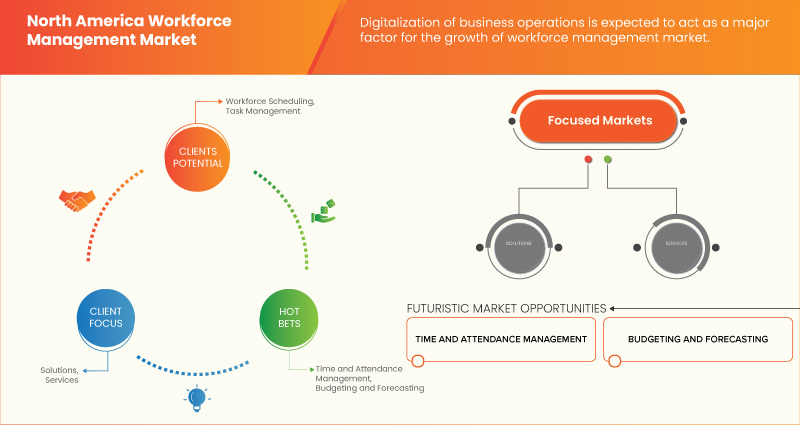

- Digitalización de las operaciones comerciales

Los avances tecnológicos están impulsando la revolución industrial con la potencial transformación de las industrias de América del Norte y un impacto social, económico y ambiental significativo que representa un enorme potencial de crecimiento. La mayor oportunidad es la transformación de todas las industrias y empresas mediante la mejora de los procesos de producción y de negocios, lo que potencia la inversión en la región.

RESTRICCIONES/DESAFÍOS

- Falta de conocimiento sobre las herramientas de gestión de la fuerza laboral

El mundo está evolucionando en torno a la tecnología digital y diversas industrias están adoptando avances tecnológicos para su desarrollo y transformación. El avance tecnológico en cualquier industria ha simplificado las operaciones comerciales. De manera similar, la incorporación de software y tecnologías avanzadas en todas las industrias ha influido en su productividad y eficiencia .

- Altos costos asociados con la compra e implementación de soluciones de gestión de la fuerza laboral

La gestión de la fuerza laboral es un término general que engloba diversos instrumentos y sistemas utilizados por las organizaciones para gestionar su fuerza laboral, desde la creación de listas, la elaboración de horarios de trabajo y los movimientos para las organizaciones basadas en turnos hasta el seguimiento de las horas de trabajo y la obtención de pruebas de trabajo para los trabajadores remotos o de campo. Esta clasificación de programación a menudo combina las finanzas, la contabilidad y otras soluciones de RR.HH. para garantizar una gestión más eficaz de los empleados. Hay muchos elementos y dispositivos en un sistema de gestión de la fuerza laboral que a menudo se cruzan con la programación de RR.HH.

Impacto posterior a la COVID-19 en el mercado de gestión de la fuerza laboral de América del Norte

La pandemia de COVID-19 ha impactado significativamente el mercado de gestión de la fuerza laboral, acelerando varias tendencias existentes y creando nuevos desafíos para las organizaciones. Con el cambio repentino al trabajo remoto y la necesidad de mantener la continuidad del negocio, las empresas han adaptado rápidamente sus estrategias y herramientas de gestión de la fuerza laboral. Esto ha llevado a una creciente demanda de soluciones basadas en la nube que permitan el trabajo remoto y de tecnologías como videoconferencias, herramientas de colaboración y plataformas de capacitación virtual. Al mismo tiempo, la pandemia también ha puesto de relieve la importancia de la gestión de la fuerza laboral para mantener la productividad y garantizar el compromiso de los empleados en tiempos de crisis. A medida que el mundo avanza hacia una era pospandémica, se espera que el mercado de gestión de la fuerza laboral continúe evolucionando, impulsado por la necesidad de una mayor agilidad y flexibilidad ante la incertidumbre.

Acontecimientos recientes

- En marzo de 2022, Ceridian HCM Inc. anunció que Center Parcs UK & Ireland había seleccionado a Dayforce para optimizar su fuerza laboral, impulsar el compromiso de los empleados y fortalecer el cumplimiento normativo. Esta colaboración ayudará a la empresa a fortalecer sus posiciones de mercado en seis ubicaciones en el Reino Unido e Irlanda.

- En noviembre de 2021, Visier, Inc. anunció el desarrollo de una nueva plataforma como servicio (PaaS) Alpine Visier. Estos nuevos servicios ayudan a la empresa a diversificar las ofertas para los clientes y brindar una solución sólida que atraiga nuevos clientes para acelerar el crecimiento de los ingresos.

Alcance del mercado de gestión de la fuerza laboral en América del Norte

El mercado de gestión de personal de América del Norte está segmentado en función de la oferta, el tamaño de la organización, los sistemas operativos, el modelo de implementación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Soluciones

- Servicios

Sobre la base de la oferta, el mercado de gestión de fuerza laboral de América del Norte está segmentado en soluciones y servicios.

Modelo de implementación

- Nube

- En las instalaciones

Sobre la base del modelo de implementación, el mercado de gestión de fuerza laboral de América del Norte está segmentado en local y en la nube.

Tamaño de la organización

- Gran empresa

- Pequeñas y medianas empresas

Sobre la base del tamaño de la organización, el mercado de gestión de fuerza laboral de América del Norte está segmentado en grandes empresas y pequeñas y medianas empresas.

Sistemas operativos

- Ventanas

- Androide

- iOS

- Linux

- Otros

Sobre la base de los sistemas operativos, el mercado de gestión de fuerza laboral de América del Norte está segmentado en Windows, Android, iOS, Linux y otros.

Usuario final

- Banca, servicios financieros y seguros

- Automotor

- Telecomunicaciones y TI

- Fabricación

- Cuidado de la salud

- Defensa y Gobierno

- Transporte y Logística

- Bienes de consumo y venta minorista

- Soluciones de energía y servicios públicos

- Otros

Sobre la base del usuario final, el mercado de gestión de fuerza laboral de América del Norte está segmentado en banca, servicios financieros y seguros, automotriz, telecomunicaciones y TI, manufactura, atención médica, defensa y gobierno, transporte y logística, bienes de consumo y venta minorista, soluciones de energía y servicios públicos, y otros.

Análisis y perspectivas regionales del mercado de gestión de la fuerza laboral en América del Norte

Se analiza el mercado de gestión de la fuerza laboral de América del Norte y se proporcionan información y tendencias del tamaño del mercado por región, oferta, tamaño de la organización, sistemas operativos, modelo de implementación y usuario final, como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de gestión de la fuerza laboral de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine la región de América del Norte, ya que tiene la economía más grande del mundo y una fuerza laboral altamente diversificada que incluye trabajadores de una amplia gama de industrias. Esto ha creado una demanda significativa de soluciones de gestión de la fuerza laboral, ya que las empresas buscan gestionar a sus empleados de manera más eficaz y eficiente.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos de la región.

Análisis del panorama competitivo y la cuota de mercado de la gestión de la fuerza laboral en América del Norte

El panorama competitivo del mercado de gestión de personal de América del Norte proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de las empresas en el mercado de gestión de personal de América del Norte.

Algunos de los principales actores que operan en el mercado de gestión de la fuerza laboral de América del Norte son UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG y Oracle.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S ANALYSIS

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGICAL TRENDS

4.4 PATENT ANALYSIS

4.5 CASE STUDY

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.7.1 UKG INC.:

4.7.2 SAP SE:

4.7.3 WORKDAY, INC.:

4.7.4 ADP, INC.:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF THE INTERNET OF THINGS (IOT) AND CLOUD-BASED WORKFORCE MANAGEMENT SOLUTIONS

5.1.2 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONS

5.1.3 NEED FOR REDUCTION OF EXPENSES RELATED TO HUMAN RESOURCE

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT WORKFORCE MANAGEMENT TOOLS

5.2.2 COMPLEXITIES IN THE INTEGRATION OF DIFFERENT WORKFORCE MANAGEMENT TOOLS

5.3 OPPORTUNITIES

5.3.1 DIGITALIZATION OF BUSINESS OPERATIONS

5.3.2 INCREASE IN DEMAND FOR FLEXIBLE MANAGEMENT RESOURCES

5.3.3 UPSURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE IN BUSINESS OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH COST ASSOCIATED WITH THE PURCHASE AND DEPLOYMENT OF WORKFORCE MANAGEMENT SOLUTIONS

5.4.2 RISING NEED FOR REGULAR DATA MONITORING AND DATA INPUT SYSTEMS IN THE WORKFORCE

6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 TIME AND ATTENDANCE MANAGEMENT

6.2.2 LEAVE AND ABSENCE MANAGEMENT

6.2.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

6.2.4 WORKFORCE SCHEDULING

6.2.5 WORKFORCE ANALYTICS

6.2.6 BUDGETING AND FORECASTING

6.2.7 TASK MANAGEMENT

6.2.8 FATIGUE MANAGEMENT

6.2.9 OTHERS

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 IMPLEMENTATION

6.3.3 TRAINING, SUPPORT AND MAINTENANCE

7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISE

7.3 SMALL & MEDIUM ENTERPRISES

8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS

8.1 OVERVIEW

8.2 WINDOWS

8.3 ANDROID

8.4 IOS

8.5 LINUX

8.6 OTHERS

9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER

10.1 OVERVIEW

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE

10.2.1 SOLUTIONS

10.2.1.1 TIME AND ATTENDANCE MANAGEMENT

10.2.1.2 LEAVE AND ABSENCE MANAGEMENT

10.2.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.2.1.4 WORKFORCE SCHEDULING

10.2.1.5 WORKFORCE ANALYTICS

10.2.1.6 BUDGETING AND FORECASTING

10.2.1.7 TASK MANAGEMENT

10.2.1.8 FATIGUE MANAGEMENT

10.2.1.9 OTHERS

10.2.2 SERVICES

10.2.2.1 CONSULTING

10.2.2.2 IMPLEMENTATION

10.2.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.3 AUTOMOTIVE

10.3.1 SOLUTIONS

10.3.1.1 TIME AND ATTENDANCE MANAGEMENT

10.3.1.2 LEAVE AND ABSENCE MANAGEMENT

10.3.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.3.1.4 WORKFORCE SCHEDULING

10.3.1.5 WORKFORCE ANALYTICS

10.3.1.6 BUDGETING AND FORECASTING

10.3.1.7 TASK MANAGEMENT

10.3.1.8 FATIGUE MANAGEMENT

10.3.1.9 OTHERS

10.3.2 SERVICES

10.3.2.1 CONSULTING

10.3.2.2 IMPLEMENTATION

10.3.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.4 TELECOM AND IT

10.4.1 SOLUTIONS

10.4.1.1 TIME AND ATTENDANCE MANAGEMENT

10.4.1.2 LEAVE AND ABSENCE MANAGEMENT

10.4.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.4.1.4 WORKFORCE SCHEDULING

10.4.1.5 WORKFORCE ANALYTICS

10.4.1.6 BUDGETING AND FORECASTING

10.4.1.7 TASK MANAGEMENT

10.4.1.8 FATIGUE MANAGEMENT

10.4.1.9 OTHERS

10.4.2 SERVICES

10.4.2.1 CONSULTING

10.4.2.2 IMPLEMENTATION

10.4.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.5 MANUFACTURING

10.5.1 SOLUTIONS

10.5.1.1 TIME AND ATTENDANCE MANAGEMENT

10.5.1.2 LEAVE AND ABSENCE MANAGEMENT

10.5.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.5.1.4 WORKFORCE SCHEDULING

10.5.1.5 WORKFORCE ANALYTICS

10.5.1.6 BUDGETING AND FORECASTING

10.5.1.7 TASK MANAGEMENT

10.5.1.8 FATIGUE MANAGEMENT

10.5.1.9 OTHERS

10.5.2 SERVICES

10.5.2.1 CONSULTING

10.5.2.2 IMPLEMENTATION

10.5.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.6 HEALTHCARE

10.6.1 SOLUTIONS

10.6.1.1 TIME AND ATTENDANCE MANAGEMENT

10.6.1.2 LEAVE AND ABSENCE MANAGEMENT

10.6.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.6.1.4 WORKFORCE SCHEDULING

10.6.1.5 WORKFORCE ANALYTICS

10.6.1.6 BUDGETING AND FORECASTING

10.6.1.7 TASK MANAGEMENT

10.6.1.8 FATIGUE MANAGEMENT

10.6.1.9 OTHERS

10.6.2 SERVICES

10.6.2.1 CONSULTING

10.6.2.2 IMPLEMENTATION

10.6.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.7 DEFENSE AND GOVERNMENT

10.7.1 SOLUTIONS

10.7.1.1 TIME AND ATTENDANCE MANAGEMENT

10.7.1.2 LEAVE AND ABSENCE MANAGEMENT

10.7.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.7.1.4 WORKFORCE SCHEDULING

10.7.1.5 WORKFORCE ANALYTICS

10.7.1.6 BUDGETING AND FORECASTING

10.7.1.7 TASK MANAGEMENT

10.7.1.8 FATIGUE MANAGEMENT

10.7.1.9 OTHERS

10.7.2 SERVICES

10.7.2.1 CONSULTING

10.7.2.2 IMPLEMENTATION

10.7.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.8 TRANSPORTATION AND LOGISTICS

10.8.1 SOLUTIONS

10.8.1.1 TIME AND ATTENDANCE MANAGEMENT

10.8.1.2 LEAVE AND ABSENCE MANAGEMENT

10.8.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.8.1.4 WORKFORCE SCHEDULING

10.8.1.5 WORKFORCE ANALYTICS

10.8.1.6 BUDGETING AND FORECASTING

10.8.1.7 TASK MANAGEMENT

10.8.1.8 FATIGUE MANAGEMENT

10.8.1.9 OTHERS

10.8.2 SERVICES

10.8.2.1 CONSULTING

10.8.2.2 IMPLEMENTATION

10.8.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.9 CONSUMER GOODS AND RETAIL

10.9.1 SOLUTIONS

10.9.1.1 TIME AND ATTENDANCE MANAGEMENT

10.9.1.2 LEAVE AND ABSENCE MANAGEMENT

10.9.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.9.1.4 WORKFORCE SCHEDULING

10.9.1.5 WORKFORCE ANALYTICS

10.9.1.6 BUDGETING AND FORECASTING

10.9.1.7 TASK MANAGEMENT

10.9.1.8 FATIGUE MANAGEMENT

10.9.1.9 OTHERS

10.9.2 SERVICES

10.9.2.1 CONSULTING

10.9.2.2 IMPLEMENTATION

10.9.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.1 ENERGY AND UTILITIES SOLUTIONS

10.10.1 SOLUTIONS

10.10.1.1 TIME AND ATTENDANCE MANAGEMENT

10.10.1.2 LEAVE AND ABSENCE MANAGEMENT

10.10.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.10.1.4 WORKFORCE SCHEDULING

10.10.1.5 WORKFORCE ANALYTICS

10.10.1.6 BUDGETING AND FORECASTING

10.10.1.7 TASK MANAGEMENT

10.10.1.8 FATIGUE MANAGEMENT

10.10.1.9 OTHERS

10.10.2 SERVICES

10.10.2.1 CONSULTING

10.10.2.2 IMPLEMENTATION

10.10.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.11 OTHERS

11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 UKG INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 SOLUTION PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ADP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 IBM CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 WORKDAY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 ORACLE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SOLUTION PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATOSS SOFTWARE AG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICES PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CEGID META4

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CERIDIAN HCM, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SOLUTION PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 INFOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 INFORM SOFTWARE

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INVISION AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NICE

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 PAYCOM PAYROLL LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SOLUTION PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 PAYLOCITY

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SOLUTION PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 QUINYX AB

14.15.1 COMPANY SNAPSHOT

14.15.2 SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 RAMCO SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 REFLEXIS SYSTEMS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICE PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 REPLICON

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SAP SE

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 COMPANY SHARE ANALYSIS

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 SUMTOTAL SYSTEMS, LLC

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 VERINT SYSTEMS INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 VISIER, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE ENTERPRISE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SMALL & MEDIUM ENTERPRISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA WINDOWS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANDROID IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA IOS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA LINUX IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA CLOUD IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ON-PREMISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA ENERGY AND UTILITIES SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 96 U.S. WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 97 U.S. WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 100 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 101 U.S. AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 125 CANADA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 126 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 127 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 128 CANADA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 129 CANADA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 130 CANADA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 159 MEXICO WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 160 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 162 MEXICO WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 163 MEXICO WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 164 MEXICO WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 165 MEXICO WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 166 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 171 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 172 MEXICO TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MULTIVARIATE MODELLING

FIGURE 11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONSARE EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 14 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET FROM 2023 TO 2030

FIGURE 15 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA WORKFORCE MANAGEMENT MARKET

FIGURE 17 ENTERPRISES USING IOT, 2021

FIGURE 18 EMPLOYMENT FOR THE AGE 20 TO 64

FIGURE 19 AI ADOPTION RATE AROUND THE WORLD

FIGURE 20 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 21 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OPERATING SYSTEMS, 2022

FIGURE 23 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 24 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 25 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 26 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 27 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2023-2030)

FIGURE 28 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022-2030)

FIGURE 29 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING (2023-2030)

FIGURE 30 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.