North America Wearable Devices In Sports Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

12.28 Billion

USD

48.72 Billion

2025

2033

USD

12.28 Billion

USD

48.72 Billion

2025

2033

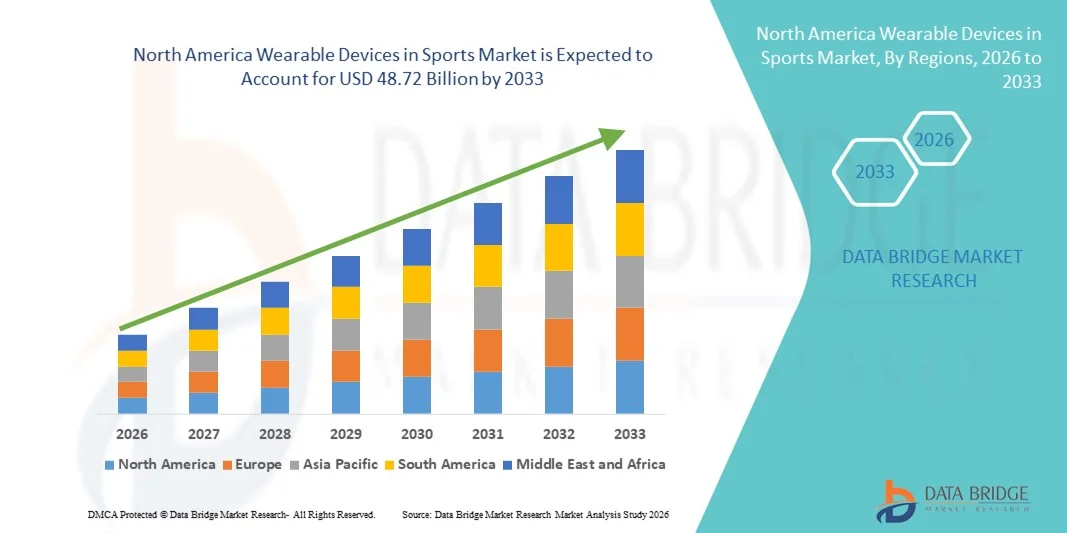

| 2026 –2033 | |

| USD 12.28 Billion | |

| USD 48.72 Billion | |

|

|

|

|

Segmentación del mercado de dispositivos portátiles deportivos en Norteamérica por componente (hardware y software), tipo de producto (podómetros, monitores de actividad física y frecuencia cardíaca, tejidos inteligentes, cámara inteligente, rastreadores de tiros y otros), ubicación (diadema, dispositivo portátil, de brazo y muñeca, clip, sensor de calzado y otros), aplicación (conteo de pasos, calorías quemadas, monitoreo de frecuencia cardíaca, seguimiento del sueño y otros), usuario final (centros deportivos, gimnasios, centros de atención domiciliaria y otros), canal de distribución (tienda minorista independiente, hipermercado/supermercado, tienda de marca y canal de venta en línea): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de dispositivos portátiles deportivos en América del Norte

- El tamaño del mercado de dispositivos portátiles deportivos de América del Norte se valoró en USD 12,28 mil millones en 2025 y se espera que alcance los USD 48,72 mil millones para 2033 , con una CAGR del 18,8% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción por parte de los consumidores de tecnologías deportivas portátiles, la creciente conciencia sobre la salud y el fitness y la integración de sensores y análisis avanzados en dispositivos deportivos.

- Además, la sólida infraestructura digital, los altos ingresos disponibles y la presencia de importantes innovadores tecnológicos impulsan la adopción de soluciones wearables intuitivas y basadas en datos, tanto para el fitness recreativo como para los deportes de competición. Los avances tecnológicos y la expansión de las áreas de aplicación siguen posicionando a los wearables como herramientas esenciales para el seguimiento del rendimiento y la salud, acelerando así significativamente el crecimiento del sector en toda la región.

Análisis del mercado de dispositivos portátiles deportivos en Norteamérica

- Los dispositivos portátiles en los deportes, incluidos los relojes inteligentes, los rastreadores de actividad física y los sensores de monitoreo del rendimiento, se están convirtiendo en herramientas esenciales tanto para los atletas aficionados como para los profesionales, ofreciendo seguimiento del rendimiento en tiempo real, monitoreo de la salud e integración perfecta con plataformas de análisis deportivo.

- La creciente demanda de wearables deportivos se debe principalmente a la creciente conciencia sobre la salud y el fitness, la creciente adopción de dispositivos conectados y una preferencia por soluciones de entrenamiento y prevención de lesiones basadas en datos entre los atletas y entusiastas del fitness.

- Estados Unidos dominó el mercado de dispositivos portátiles en el deporte con la mayor participación en los ingresos del 85,2 % en 2025, respaldado por la adopción temprana de tecnologías de acondicionamiento físico, altos ingresos disponibles y una fuerte presencia de actores clave en tecnología y equipamiento deportivo, con innovaciones en análisis de rendimiento habilitados por IA, monitoreo biométrico y soluciones de entrenamiento de equipos conectados que impulsan un crecimiento sustancial.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de dispositivos portátiles deportivos durante el período de pronóstico debido a la creciente participación en deportes, la creciente conciencia sobre la salud y las crecientes inversiones en infraestructura deportiva inteligente.

- El segmento de monitores de actividad física y frecuencia cardíaca dominó el mercado de dispositivos portátiles deportivos con una participación de mercado del 41,5 % en 2025, impulsado por su precisión, facilidad de uso y capacidad para brindar información detallada sobre el rendimiento, la resistencia y la salud general tanto para usuarios ocasionales como para atletas profesionales.

Alcance del informe y segmentación del mercado de dispositivos portátiles deportivos en América del Norte

|

Atributos |

Perspectivas clave del mercado de dispositivos portátiles deportivos en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de dispositivos portátiles deportivos en América del Norte

Monitoreo avanzado del rendimiento mediante inteligencia artificial e integración de sensores

- Una tendencia significativa y en auge en el mercado norteamericano de dispositivos wearables deportivos es la creciente integración de inteligencia artificial (IA) y sensores biométricos avanzados en dispositivos como relojes inteligentes, monitores de frecuencia cardíaca y pulseras de actividad. Esta combinación de tecnologías está mejorando el seguimiento del rendimiento en tiempo real y la información personalizada sobre el entrenamiento.

- Por ejemplo, la serie Forerunner de Garmin aprovecha el análisis basado en IA con sensores de frecuencia cardíaca y GPS para ofrecer recomendaciones de entrenamiento adaptativas e informes detallados de rendimiento para corredores y ciclistas. De igual forma, las correas Whoop monitorizan los datos de recuperación, sueño y esfuerzo para optimizar el rendimiento de los atletas.

- La integración de IA habilita funciones como alertas predictivas de lesiones, recomendaciones de entrenamiento adaptativas y análisis de rendimiento inteligente. Por ejemplo, algunos dispositivos Polar utilizan IA para identificar patrones anormales de frecuencia cardíaca y sugerir ajustes de descanso o entrenamiento. Además, los sensores avanzados permiten un control preciso del VO2 máximo, las calorías quemadas y la carga de entrenamiento para optimizar el rendimiento deportivo.

- La integración perfecta de los wearables con aplicaciones móviles y plataformas en la nube facilita el seguimiento centralizado de múltiples métricas de salud y rendimiento, lo que permite a los atletas y entrenadores analizar y gestionar el entrenamiento, la recuperación y el estado físico general en una única interfaz.

- Esta tendencia hacia dispositivos wearables más inteligentes, basados en datos e interconectados está transformando las expectativas de los usuarios respecto a la tecnología deportiva. Por ello, empresas como Fitbit están desarrollando dispositivos de fitness con IA, con funciones como reconocimiento automático de actividad, alertas de frecuencia cardíaca en tiempo real y sugerencias de entrenamiento personalizadas.

- La demanda de dispositivos portátiles que ofrecen información sobre el rendimiento basada en sensores e inteligencia artificial está creciendo rápidamente en los sectores deportivos tanto amateur como profesional, a medida que los consumidores priorizan cada vez más el entrenamiento respaldado por datos, la optimización de la recuperación y el rendimiento atlético general.

- Los wearables incorporan cada vez más funciones sociales y de gamificación, como desafíos virtuales y comparaciones de clasificaciones, que mejoran la participación del usuario y fomentan el uso constante entre los entusiastas del fitness y los atletas.

Dinámica del mercado de dispositivos portátiles deportivos en América del Norte

Conductor

Aumento de la conciencia sobre la salud y la adopción de tecnología deportiva

- El enfoque creciente en la salud, la aptitud física y el rendimiento atlético, combinado con la creciente adopción de dispositivos conectados, es un impulsor importante del mercado de dispositivos portátiles deportivos de América del Norte.

- Por ejemplo, en marzo de 2025, Apple introdujo un monitoreo avanzado de la frecuencia cardíaca en el Apple Watch Series 10, brindando a los usuarios métricas de ECG, VO2 máximo y recuperación, lo que reforzó la adopción de dispositivos portátiles para el seguimiento del rendimiento y la salud.

- A medida que los atletas y entusiastas del fitness buscan datos precisos para mejorar el rendimiento y prevenir lesiones, los dispositivos portátiles brindan funciones como monitoreo en tiempo real, registro de actividad y recomendaciones de entrenamiento personalizadas, lo que ofrece una ventaja sustancial sobre los métodos de fitness tradicionales.

- Además, la popularidad de los gimnasios inteligentes, las plataformas de entrenamiento virtual y los ecosistemas de fitness interconectados está posicionando a los dispositivos portátiles como herramientas esenciales para la gestión integrada del rendimiento.

- La comodidad del monitoreo continuo de la salud, la información del entrenamiento remoto y el seguimiento automatizado del rendimiento mediante dispositivos portátiles está impulsando su adopción tanto en el deporte recreativo como en el profesional. La disponibilidad de dispositivos fáciles de usar, adecuados para el entrenamiento individual, impulsa aún más el crecimiento del mercado.

- Las iniciativas gubernamentales y los programas de bienestar corporativo que promueven el monitoreo de la salud y el seguimiento de la actividad física están fomentando la adopción generalizada de dispositivos portátiles en lugares de trabajo, escuelas y academias deportivas.

- Los avances en la duración de la batería, el diseño liviano y la tecnología resistente al agua están mejorando la usabilidad del dispositivo, lo que permite a los atletas usar dispositivos continuamente durante el entrenamiento, las competencias y los períodos de recuperación.

Restricción/Desafío

Preocupaciones sobre la precisión y altos costos de los dispositivos

- Las preocupaciones sobre la precisión de las mediciones, la confiabilidad de los sensores y la privacidad de los datos de los dispositivos deportivos portátiles plantean un desafío importante para una adopción más amplia, ya que los atletas dependen de métricas de rendimiento precisas para las decisiones de entrenamiento.

- Por ejemplo, los informes de lecturas inconsistentes de frecuencia cardíaca en rastreadores de actividad física económicos han hecho que algunos consumidores duden en adoptar dispositivos portátiles para fines de entrenamiento profesional.

- Abordar estas preocupaciones mediante calibración avanzada, análisis mejorados con IA, cifrado seguro de datos y políticas de privacidad transparentes es crucial para generar confianza en el consumidor. Empresas como Garmin y Polar priorizan la precisión y el cifrado de los sensores para garantizar la seguridad de los usuarios. Además, el coste relativamente alto de los wearables premium en comparación con los monitores de actividad física básicos puede limitar su adopción entre los consumidores sensibles al precio, en particular los deportistas ocasionales o los entusiastas del fitness con presupuestos ajustados.

- Si bien los dispositivos de nivel básico son cada vez más asequibles, las funciones avanzadas como el monitoreo continuo de ECG, el análisis de recuperación y el rastreo GPS a menudo tienen un precio superior.

- Superar estos desafíos mediante una tecnología de sensores mejorada, la educación del consumidor sobre el uso de los dispositivos y el desarrollo de soluciones portátiles rentables será vital para el crecimiento sostenido del mercado.

- La interoperabilidad limitada entre diferentes marcas de wearables y aplicaciones deportivas puede restringir la experiencia del usuario y la consolidación de datos, creando barreras para los atletas que dependen de múltiples dispositivos y plataformas de análisis.

- Las preocupaciones sobre la durabilidad y el desgaste del dispositivo durante deportes de alta intensidad o actividades al aire libre pueden disuadir la adopción a largo plazo, en particular entre atletas profesionales que requieren soluciones robustas y reforzadas.

Alcance del mercado de dispositivos portátiles deportivos en América del Norte

El mercado está segmentado según el componente, el tipo de producto, el sitio, la aplicación, el usuario final y el canal de distribución.

- Por componente

En cuanto a sus componentes, el mercado norteamericano de dispositivos wearables deportivos se segmenta en hardware y software. El segmento de hardware dominó el mercado con la mayor cuota de ingresos, un 62,4%, en 2025, impulsado por la creciente demanda de monitores de actividad física y frecuencia cardíaca, relojes inteligentes y sensores wearables. Los atletas y entusiastas del fitness priorizan dispositivos fiables que ofrezcan un seguimiento preciso de los datos y una batería de larga duración. Los sensores avanzados en hardware permiten monitorizar en tiempo real la frecuencia cardíaca, las calorías quemadas, el VO2 máximo y los niveles de actividad. La integración con aplicaciones móviles y plataformas de análisis deportivo mejora la usabilidad y la comodidad. Los diseños duraderos, resistentes al agua y ligeros impulsan aún más su adopción. Empresas como Garmin, Polar y Fitbit siguen liderando gracias a la confianza en la marca y a sus sólidas líneas de productos.

Se prevé que el segmento de software experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 14,8 %, entre 2026 y 2033, impulsada por la creciente adopción de análisis basados en IA, monitorización en la nube y plataformas de entrenamiento personalizadas. El software permite a los atletas analizar datos de rendimiento, monitorizar su progreso y optimizar sus entrenamientos de forma eficiente. La integración con dispositivos móviles y la nube mejora la comodidad y la accesibilidad para los usuarios. El análisis predictivo y las recomendaciones de IA facilitan la prevención de lesiones y la optimización del entrenamiento. Los modelos basados en suscripción fomentan los ingresos recurrentes e impulsan la expansión del mercado. Las soluciones de software compatibles con múltiples dispositivos impulsan aún más su adopción entre usuarios profesionales y recreativos.

- Por tipo de producto

Según el tipo de producto, el mercado se segmenta en podómetros, monitores de actividad física y frecuencia cardíaca, tejidos inteligentes, cámaras inteligentes, rastreadores de tiro y otros. El segmento de monitores de actividad física y frecuencia cardíaca dominó el mercado con la mayor participación en los ingresos del 41,5 % en 2025, impulsado por la demanda continua de monitorización fisiológica, optimización del rendimiento y seguimiento de la salud. Los dispositivos proporcionan seguimiento de la frecuencia cardíaca, las calorías y la actividad en tiempo real, lo que ayuda a prevenir lesiones y a supervisar la recuperación. La integración con aplicaciones móviles y los análisis basados en IA mejora su valor tanto para atletas profesionales como para usuarios ocasionales. La compatibilidad con múltiples deportes y actividades de fitness aumenta la versatilidad. La alta precisión, la larga duración de la batería y la presencia de marca de confianza contribuyen a su adopción. Empresas líderes como Fitbit, Garmin y Polar han fortalecido su dominio del mercado mediante dispositivos con numerosas funciones.

Se prevé que el segmento de tejidos inteligentes experimente el mayor crecimiento entre 2026 y 2033, impulsado por su creciente uso en el deporte profesional, la fisioterapia y la rehabilitación. Los tejidos inteligentes con sensores integrados monitorizan la postura, la actividad muscular y el movimiento corporal sin restringir la movilidad. La ropa conectada permite la recopilación de datos en tiempo real para optimizar el rendimiento y prevenir lesiones. Los avances tecnológicos en tejidos conductores y sensores miniaturizados los hacen cómodos y fiables. La creciente colaboración entre empresas de ropa deportiva y tecnología acelera su adopción. Los atletas profesionales y los programas de entrenamiento de alto rendimiento impulsan la demanda de textiles vestibles innovadores.

- Por sitio

Según el sitio web, el mercado se segmenta en diademas, dispositivos portátiles, de brazo y muñeca, de clip, con sensor para calzado y otros. El segmento de brazo y muñeca dominó el mercado con la mayor participación en ingresos, un 44,7 % en 2025, impulsado por la popularidad de los relojes inteligentes, las pulseras de actividad física y los monitores de frecuencia cardíaca de muñeca. Los dispositivos ofrecen un seguimiento continuo de la frecuencia cardíaca, la actividad, el sueño y los datos de rendimiento del GPS. La integración con aplicaciones móviles permite un análisis exhaustivo del rendimiento. Su diseño ergonómico, la resistencia al agua y la larga duración de la batería mejoran la usabilidad. Los dispositivos de muñeca son adecuados para múltiples deportes y niveles de condición física. Marcas líderes como Garmin, Fitbit y Apple aumentan la credibilidad y la confianza del consumidor.

Se espera que el segmento de sensores de calzado experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsada por la demanda en el entrenamiento de running, baloncesto y fútbol. Los sensores de calzado proporcionan métricas precisas como la longitud de la zancada, la cadencia, la distribución de la presión y el tiempo de contacto con el suelo. La integración con aplicaciones permite a los entrenadores analizar el rendimiento y prevenir lesiones. Los sensores ligeros, duraderos y de alta precisión impulsan su adopción. Las ligas y academias deportivas profesionales impulsan el crecimiento del mercado. Las colaboraciones entre marcas de calzado y proveedores de tecnología aceleran aún más esta tendencia.

- Por aplicación

Según la aplicación, el mercado se segmenta en conteo de pasos, calorías quemadas, monitorización de la frecuencia cardíaca, seguimiento del sueño, entre otros. El segmento de monitorización de la frecuencia cardíaca dominó el mercado con la mayor cuota de ingresos, un 39,2 %, en 2025, gracias a su papel esencial en la optimización del entrenamiento, la prevención del sobreesfuerzo y el seguimiento de la recuperación. El seguimiento continuo de la frecuencia cardíaca proporciona información crucial tanto para atletas como para entusiastas del fitness. Las aplicaciones móviles y el entrenamiento basado en IA aumentan el valor. Los dispositivos permiten el seguimiento de calorías y la gestión del estrés. La compatibilidad con múltiples deportes aumenta la versatilidad. Las principales marcas de wearables continúan mejorando la precisión de los sensores y la integración del software, consolidando su dominio.

Se espera que el segmento de monitorización del sueño experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsada por la creciente concienciación sobre el papel de la recuperación y el descanso en el rendimiento. Los wearables monitorizan las fases, la duración y la calidad del sueño, ofreciendo recomendaciones basadas en IA. La integración con aplicaciones móviles permite correlacionar el sueño con las métricas de entrenamiento y salud. La creciente demanda de bienestar holístico impulsa su adopción. Los sensores avanzados y no intrusivos mejoran la experiencia del usuario. Los atletas profesionales y los entusiastas del fitness dependen cada vez más de los datos del sueño para optimizar su recuperación.

- Por el usuario final

Según el usuario final, el mercado se segmenta en centros deportivos, gimnasios, centros de atención domiciliaria y otros. El segmento de gimnasios dominó el mercado con la mayor participación en ingresos, un 36,8%, en 2025, impulsado por la adopción de dispositivos wearables para la monitorización de clientes, el coaching personalizado y los programas de entrenamiento grupal. Los wearables ayudan a los entrenadores a monitorizar el rendimiento de los socios, optimizar los entrenamientos y aumentar la participación. La integración con el software de gestión de gimnasios proporciona información basada en datos. Los dispositivos facilitan la gamificación, el seguimiento de objetivos y los retos de rendimiento. Los consumidores prefieren wearables compatibles con equipos de gimnasio y aplicaciones móviles. Las colaboraciones entre marcas y cadenas de fitness consolidan su dominio del mercado.

Se espera que el segmento de atención domiciliaria experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsada por la adopción de la monitorización remota de la salud, la rehabilitación y la orientación personalizada para el ejercicio. Los wearables permiten monitorizar la frecuencia cardíaca, la actividad y la recuperación en casa. La integración con aplicaciones móviles y la nube permite obtener información y analizar el rendimiento en tiempo real. La creciente concienciación sobre la salud y la popularidad del ejercicio en casa impulsan el crecimiento. Funciones como la prevención de lesiones basada en IA, la detección de caídas y el entrenamiento automatizado aumentan el valor. La demanda está creciendo tanto entre los usuarios mayores como entre los aficionados al ejercicio que buscan comodidad.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en tiendas minoristas independientes, hipermercados/supermercados, tiendas de marca y venta en línea. El segmento de venta en línea dominó el mercado con la mayor participación en ingresos, un 47,1%, en 2025, impulsado por la conveniencia, los precios competitivos, la variedad de productos y la entrega a domicilio. Los consumidores prefieren las compras en línea por la información detallada de los productos, las reseñas y las ofertas combinadas. Los servicios por suscripción y la integración de aplicaciones aumentan el atractivo. La comparación de marcas y características mejora las decisiones de compra. El comercio electrónico impulsa las ventas directas al consumidor de las principales marcas. El marketing y las promociones en línea impulsan un crecimiento significativo de los ingresos.

Se prevé que el segmento de tiendas de marca experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsada por la demanda de productos auténticos, asesoramiento experto y soporte posventa. La experiencia práctica permite a los consumidores probar dispositivos, consultar con especialistas y explorar sus funciones. La concienciación sobre las falsificaciones fomenta las compras en tienda. Las empresas utilizan las tiendas para demostraciones de productos, talleres y programas de fidelización. Los lanzamientos de productos exclusivos y las recomendaciones personalizadas fomentan la adopción. La expansión de tiendas insignia en las principales ciudades impulsa aún más el crecimiento.

Análisis regional del mercado de dispositivos portátiles deportivos en Norteamérica

- Estados Unidos dominó el mercado de dispositivos portátiles en el deporte con la mayor participación en los ingresos del 85,2 % en 2025, respaldado por la adopción temprana de tecnologías de fitness, altos ingresos disponibles y una fuerte presencia de actores clave en tecnología y equipamiento deportivo.

- Los consumidores de la región valoran cada vez más el seguimiento del rendimiento en tiempo real, la monitorización de la frecuencia cardíaca y las funciones de entrenamiento personalizado que ofrecen los dispositivos wearables. La integración con aplicaciones móviles, plataformas en la nube y análisis basados en IA mejora aún más la experiencia y la participación del usuario en diversas actividades deportivas y de fitness.

- Esta adopción generalizada se ve respaldada además por los altos ingresos disponibles, la infraestructura digital avanzada y una población con conocimientos tecnológicos. El creciente interés en los entrenamientos en casa, la optimización del rendimiento deportivo y los programas de entrenamiento basados en datos consolida los dispositivos wearables como herramientas esenciales tanto para atletas profesionales como para entusiastas del fitness en Estados Unidos.

Análisis del mercado estadounidense de dispositivos portátiles deportivos

Los dispositivos wearables deportivos estadounidenses captaron la mayor cuota de ingresos, con un 85,2 %, en 2025 en Norteamérica, impulsados por la rápida adopción de dispositivos de fitness conectados y el creciente interés en el rendimiento deportivo basado en datos. Los consumidores priorizan cada vez más el seguimiento del rendimiento en tiempo real, la monitorización de la frecuencia cardíaca y las funciones de entrenamiento personalizadas que ofrecen los relojes inteligentes, las pulseras de actividad y los monitores de frecuencia cardíaca. La creciente tendencia a los entrenamientos en casa, los programas de entrenamiento personalizados y la orientación física a distancia impulsa aún más el mercado. Además, la integración con análisis basados en IA, aplicaciones móviles y plataformas en la nube está mejorando significativamente la experiencia del usuario. La presencia de actores tecnológicos clave, como Apple, Garmin, Fitbit y Whoop, impulsa la innovación y acelera el crecimiento del mercado.

Análisis del mercado canadiense de dispositivos portátiles deportivos

Se espera que el mercado canadiense de dispositivos wearables deportivos crezca a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por una mayor concienciación sobre la salud y el fitness, así como por la creciente adopción de dispositivos deportivos conectados. El creciente número de gimnasios, academias deportivas y programas de bienestar corporativo está impulsando la demanda de dispositivos wearables. Los consumidores canadienses también valoran la comodidad, la monitorización precisa del rendimiento y la información personalizada sobre el entrenamiento que ofrecen los dispositivos con IA. La integración con aplicaciones móviles, plataformas en la nube y entrenamiento virtual está impulsando aún más su adopción. El mercado está experimentando un crecimiento en aplicaciones deportivas tanto profesionales como recreativas.

Análisis del mercado de dispositivos portátiles deportivos en México

Se prevé que el mercado mexicano de dispositivos wearables deportivos crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente popularidad del seguimiento de la actividad física, la monitorización deportiva y los dispositivos wearables de salud entre las poblaciones urbanas. Los consumidores se sienten atraídos por dispositivos que ofrecen monitorización de la frecuencia cardíaca, seguimiento de pasos y gestión de calorías. El mercado se sustenta en el aumento de la renta disponible, la penetración de los teléfonos inteligentes y la creciente concienciación sobre el análisis deportivo y la optimización del rendimiento. Los canales de venta en línea y las redes de distribución minorista facilitan aún más la accesibilidad. Se espera que la adopción de dispositivos wearables en gimnasios, centros deportivos y hogares continúe impulsando el crecimiento.

Cuota de mercado de dispositivos portátiles deportivos en América del Norte

La industria de dispositivos portátiles deportivos en América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- WHOOP, Inc. (EE. UU.)

- Oura Health Oy (Finlandia)

- Garmin Ltd. (EE. UU.)

- Fitbit, Inc. (EE. UU.)

- Coros Wearables (EE. UU.)

- Apple Inc. (EE. UU.)

- Polar Electro Oy (Finlandia)

- Suunto Oy (Finlandia)

- Samsung Electronics Co., Ltd. (Corea del Sur)

- Fitbit International Ltd. (Irlanda)

- Under Armour, Inc. (EE. UU.)

- Nike, Inc. (EE. UU.)

- Adidas AG (Alemania)

- Corporación Xiaomi (China)

- Google LLC (EE. UU.)

- Huawei Technologies Co., Ltd. (China)

- Oppo (China)

- Sony Corporation (Japón)

- Xsensio AG (Suiza)

¿Cuáles son los desarrollos recientes en el mercado de dispositivos portátiles deportivos en América del Norte?

- En septiembre de 2025, Polar lanzó Polar Loop, su nuevo rastreador de actividad física y sueño sin pantalla, haciendo que los wearables de fitness sean más accesibles al eliminar las tarifas de suscripción y enfocarse en un monitoreo discreto de la actividad, la frecuencia cardíaca y el sueño las 24 horas, los 7 días de la semana, dirigido a usuarios que prefieren wearables minimalistas sin costos continuos.

- En junio de 2025, Meta se asoció con la marca de gafas deportivas Oakley para lanzar gafas inteligentes impulsadas por IA para América del Norte y otras regiones, lo que marca un paso hacia la tecnología portátil orientada al deporte con cámaras de alta resolución, altavoces de oído abierto, resistencia al agua y funcionalidad de IA incorporada: una combinación de seguimiento del rendimiento y computación contextual.

- En mayo de 2025, WHOOP presentó sus wearables de nueva generación, WHOOP 5.0 y WHOOP MG, con funciones avanzadas de monitorización de la salud, como hasta 14 días de batería, ECG a demanda y análisis de la presión arterial, todo en un formato más elegante. Estos dispositivos también incluyen una experiencia de aplicación rediseñada para un seguimiento más profundo del rendimiento y la salud de los atletas y entusiastas del fitness.

- En febrero de 2025, la Liga Nacional de Hockey (NHL) anunció que los árbitros usarían relojes Apple con aplicaciones personalizadas para recibir información del juego en tiempo real, como el tiempo del reloj y de las penalizaciones, a través de alertas hápticas, lo que demuestra cómo la tecnología deportiva portátil se está integrando en las operaciones deportivas profesionales en vivo en América del Norte.

- En diciembre de 2021, la tecnología portátil fue nombrada oficialmente la principal tendencia de fitness para 2022 por la encuesta del Colegio Americano de Medicina Deportiva (ACSM) a 4500 profesionales del fitness, destacando el entusiasmo inicial de los consumidores y la confianza de la industria en los wearables de fitness mucho antes del período de 2025.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.