Mercado de tecnología de conferencias portátiles de América del Norte, por oferta (hardware, software y servicios), tipo de conferencia ( audioconferencia y videoconferencia ), modo de implementación (local y en la nube ), tamaño de la organización (pequeña y mediana organización y gran organización), aplicación (consumidor y empresa), uso final (corporativo, educación, atención médica, gobierno y defensa, banca, servicios financieros y seguros (BSFI), medios y entretenimiento y otros), país (EE. UU., Canadá y México), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado de tecnología de conferencias portátil en América del Norte

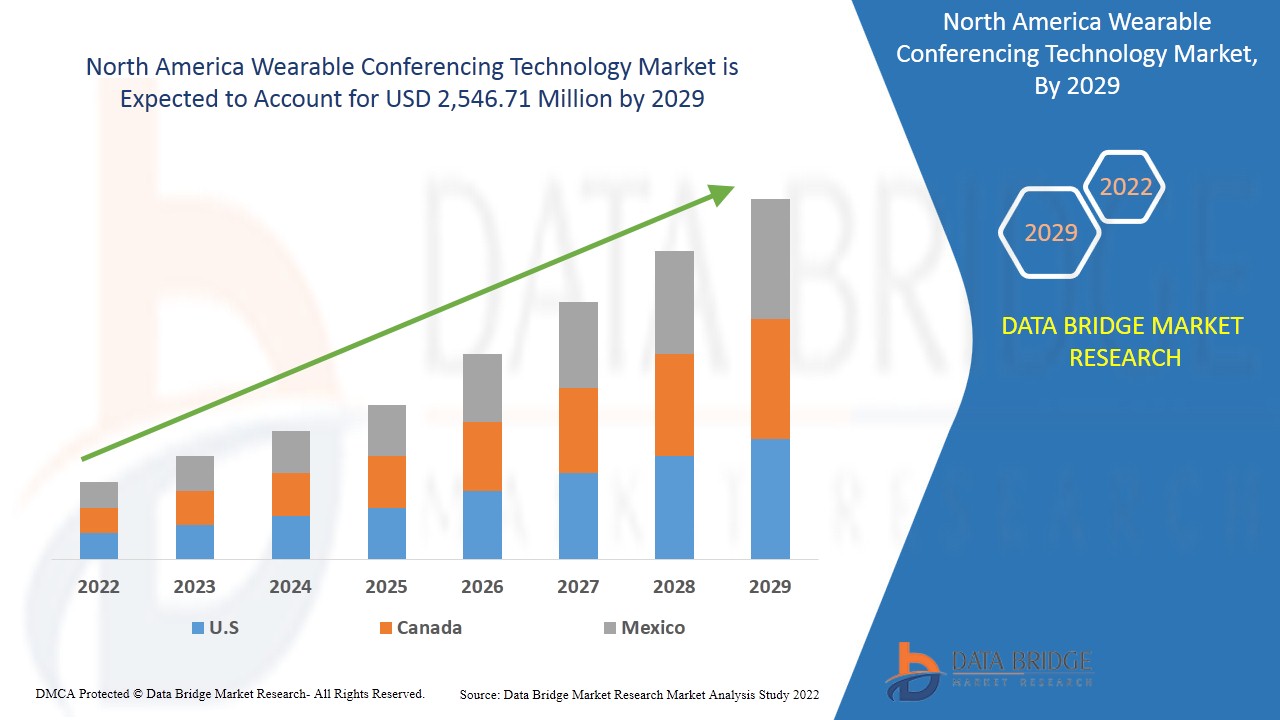

Se espera que el mercado de tecnología de conferencias portátiles de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 13,6% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2546,71 millones para 2029. El creciente enfoque y la adopción de la cultura del trabajo remoto están impulsando el mercado de tecnología de conferencias portátiles de América del Norte.

La tecnología portátil, a menudo conocida como "wearables", es una clase de dispositivos electrónicos que se pueden llevar sobre el cuerpo. Los gadgets son dispositivos de manos libres con aplicaciones prácticas que funcionan con microprocesadores y tienen la capacidad de enviar y recibir datos a través de Internet. La cooperación en tiempo real entre varios dispositivos es posible con las soluciones de conferencias. Los participantes pueden unirse a un único lugar digital utilizando sus dispositivos móviles, portátiles o computadoras personales (PC) mediante una plataforma de conferencias. Los usuarios pueden utilizar una conexión a Internet para acceder a tecnologías de conferencias que se suministran como software como servicio (SaaS). Una plataforma de conferencias web también se puede suministrar localmente, utilizando las capacidades del centro de datos de una organización. Por lo tanto, es una tecnología que se utiliza en dispositivos como Google Glasses o Microsoft HoloLens para la aplicación de conferencias y colaboración a través de medios de audio o vídeo. Actualmente, este mercado tiene amplias aplicaciones en el mundo corporativo para colaboraciones profesionales y en los sectores educativos y de formación.

El creciente interés y la adopción de una cultura de trabajo remoto actúan como un factor impulsor del mercado de tecnología de conferencias portátiles de América del Norte. La naturaleza intermitente de la energía eólica ha demostrado ser un desafío. Sin embargo, se espera que el aumento de diversas decisiones estratégicas, como las asociaciones, brinde oportunidades para el mercado de tecnología de conferencias portátiles de América del Norte. El alto costo de la infraestructura para conferencias puede resultar un obstáculo para el mercado.

El informe del mercado de tecnología de conferencias portátil de América del Norte proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de tecnología de conferencias portátil de América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de tecnología de conferencias portátil en América del Norte

El mercado de tecnología de conferencias portátil de América del Norte está segmentado en función de la oferta, el tipo de conferencia, el modo de implementación, el tamaño de la organización, la aplicación y el uso final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según la oferta, el mercado de tecnología de conferencias portátil de América del Norte se segmenta en hardware, software y servicios. El hardware se subdivide en cámaras, micrófonos y otros. Además, los servicios se subdividen en servicios gestionados y servicios profesionales. En 2022, se espera que el hardware domine el mercado de tecnología de conferencias portátil de América del Norte, ya que genera más ingresos y más investigación y desarrollo en hardware por parte de grandes organizaciones.

- Según el tipo de conferencia, el mercado de tecnología de conferencias portátiles de América del Norte se segmenta en audioconferencias y videoconferencias . En 2022, se espera que el segmento de las videoconferencias domine, ya que facilita las reuniones virtuales y la colaboración en documentos digitales y presentaciones compartidas conectando a las personas en tiempo real.

- Según el modo de implementación, el mercado de tecnología de conferencias portátil de América del Norte se segmenta en local y en la nube. En 2022, se prevé que el segmento local domine el mercado, ya que ayuda a brindar seguridad y privacidad a la infraestructura, ya que está ubicada localmente. La implementación de este tipo es más económica en comparación con la nube.

- Según el tamaño de la organización, el mercado de tecnología de conferencias portátil de América del Norte se segmenta en organizaciones pequeñas y medianas y organizaciones grandes. En 2022, se prevé que el segmento de las grandes organizaciones domine el mercado, ya que la solución requiere una mayor inversión de capital y el costo se justifica por la mayor generación de ingresos de las empresas mediante la implementación de esta tecnología.

- Según la aplicación, el mercado de tecnología de conferencias portátil de América del Norte se segmenta en consumidores y empresas. En 2022, se prevé que el segmento empresarial domine el mercado, ya que la solución ayuda a los empleados a trabajar de forma remota con facilidad y eficiencia.

- Según el uso final, el mercado de tecnología de conferencias portátil de América del Norte está segmentado en empresas, educación, atención médica , gobierno y defensa, banca, servicios financieros y seguros (BSFI), medios y entretenimiento, entre otros. En 2022, se prevé que el segmento corporativo domine el mercado, ya que las soluciones de conferencias ayudan a los empleados a colaborar y trabajar en documentos compartidos en tiempo real o mediante el uso compartido de la pantalla.

Análisis a nivel de país del mercado de tecnología de conferencias portátil en América del Norte

Se analiza el mercado de tecnología de conferencias portátiles de América del Norte y la oferta del tamaño del mercado, el tipo de conferencia, el modo de implementación, el tamaño de la organización, la aplicación y el uso final como se mencionó anteriormente.

Los países incluidos en el informe sobre el mercado de tecnología de conferencias portátiles en América del Norte son Estados Unidos, Canadá y México. Estados Unidos domina el mercado de tecnología de conferencias portátiles en América del Norte debido a la presencia de actores clave en el sector de los dispositivos portátiles y de los proveedores de software de conferencias. Canadá ocupa el segundo puesto, ya que el país está experimentando un desarrollo en el mercado de AR y MR con instalaciones de investigación de pequeñas empresas y demanda de la industria de la salud.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

La creciente penetración de dispositivos inteligentes y servicios de Internet está impulsando el crecimiento del mercado de tecnología de conferencias portátil en América del Norte

El mercado de tecnología de conferencias portátil de América del Norte también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y la cuota de mercado de la tecnología de conferencias portátil en América del Norte

El panorama competitivo del mercado de tecnología de conferencias portátil de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con el mercado de tecnología de conferencias portátil de América del Norte.

Las principales empresas que se dedican a la tecnología de conferencias portátil en América del Norte son Logitech, Vuzix Corporation, Vidyo, Inc., Ricoh, Zoom Video Communications, Inc., Microsoft, LogMeIn, Inc., RealWear, Inc., DIALPAD, INC., Google (una subsidiaria de Alphabet Inc.), Chironix, Seiko Epson Corporation, Iristick, Robert Bosch GmbH, ezTalks, HTC Corporation, Sony Corporation, Lenovo, EON Reality, TeamViewer, entre otras empresas nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos son iniciados también por empresas de todo el mundo, lo que acelera el mercado de tecnología de conferencias portátiles en América del Norte.

Por ejemplo,

- En octubre de 2021, LogMeIn, Inc. lanzó GoToConnect Legal, una nueva versión de su plataforma de comunicaciones unificadas como servicio (UCaaS). La plataforma está diseñada para satisfacer las demandas de los profesionales del derecho al facilitar la colaboración con clientes y colegas con el fin de maximizar las horas facturables. La solución permitirá minimizar el tiempo no facturado, maximizar los ingresos, gestionar las regulaciones de los organismos gubernamentales y mantener una alta seguridad en su práctica. De esta forma, la empresa ayudará a brindar servicios de alta calidad y fácilmente facturables a sus clientes.

- En diciembre de 2021, Vidyo, Inc. presentó nuevas interfaces de VidyoRoom Solutions, incluidas tres nuevas experiencias de videoconferencia en la oficina diseñadas para brindar el mejor entorno de colaboración para equipos híbridos. Las nuevas interfaces para salas de reuniones pequeñas, salas de reuniones y salas de juntas, que incluyen controles de conferencias y soporte para experiencias inmersivas, serán cada vez más vitales a medida que los empleados intenten regresar a la oficina después de la pandemia, mientras que otros continúan trabajando de forma remota. Con esto, la empresa podrá brindar una experiencia fácil de usar a sus clientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.2 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.3 RISE IN ADOPTION OF CONFERENCING TECHNOLOGY BY EDUCATIONAL INSTITUTES

5.2 RESTRAINTS

5.2.1 HIGH COST OF CONFERENCING INFRASTRUCTURE

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 RISE IN INITIATIVES BY GOVERNMENT

5.4 CHALLENGES

5.4.1 NORTH AMERICA ECONOMIC SLOWDOWN LIMITS

5.4.2 ELECTRONIC COMPONENTS ARE PUSHING SMART GLASSES BOUNDARIES

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AND GOVERNMENT INITIATIVES AFTER COVID-19

6.3 IMPACT ON DEMAND

6.4 PRICE IMPACT

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 CAMERA

7.2.2 MICROPHONE

7.2.3 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 MANAGED SERVICES

7.4.2 PROFESSIONAL SERVICES

8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE

8.1 OVERVIEW

8.2 VIDEO CONFERENCING

8.3 AUDIO CONFERENCING

9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 ON-PREMISE

9.3 CLOUD

10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ORGANIZATION

10.3 SMALL & MEDIUM ORGANIZATION

11 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ENTERPRISE

11.3 CONSUMER

12 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE

12.1 OVERVIEW

12.2 CORPORATE

12.2.1 MARKET BY DEPLOYMENT MODE

12.2.1.1 ON-PREMISE

12.2.1.2 CLOUD

12.2.2 MARKET BY ORGANIZATION SIZE

12.2.2.1 LARGE ORGANIZATION

12.2.2.2 SMALL & MEDIUM ORGANIZATION

12.3 EDUCATION

12.3.1 MARKET BY DEPLOYMENT MODE

12.3.1.1 ON-PREMISE

12.3.1.2 CLOUD

12.3.2 MARKET BY ORGANIZATION SIZE

12.3.2.1 LARGE ORGANIZATION

12.3.2.2 SMALL & MEDIUM ORGANIZATION

12.4 HEALTHCARE

12.4.1 MARKET BY DEPLOYMENT MODE

12.4.1.1 ON-PREMISE

12.4.1.2 CLOUD

12.4.2 MARKET BY ORGANIZATION SIZE

12.4.2.1 LARGE ORGANIZATION

12.4.2.2 SMALL & MEDIUM ORGANIZATION

12.5 GOVERNMENT AND DEFENSE

12.5.1 MARKET BY DEPLOYMENT MODE

12.5.1.1 ON-PREMISE

12.5.1.2 CLOUD

12.5.2 MARKET BY ORGANIZATION SIZE

12.5.2.1 LARGE ORGANIZATION

12.5.2.2 SMALL & MEDIUM ORGANIZATION

12.6 MEDIA AND ENTERTAINMENT

12.6.1 MARKET BY DEPLOYMENT MODE

12.6.1.1 ON-PREMISE

12.6.1.2 CLOUD

12.6.2 MARKET BY ORGANIZATION SIZE

12.6.2.1 LARGE ORGANIZATION

12.6.2.2 SMALL & MEDIUM ORGANIZATION

12.7 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

12.7.1 MARKET BY DEPLOYMENT MODE

12.7.1.1 ON-PREMISE

12.7.1.2 CLOUD

12.7.2 MARKET BY ORGANIZATION SIZE

12.7.2.1 LARGE ORGANIZATION

12.7.2.2 SMALL & MEDIUM ORGANIZATION

12.8 OTHER

12.8.1 MARKET BY DEPLOYMENT MODE

12.8.1.1 ON-PREMISE

12.8.1.2 CLOUD

12.8.2 MARKET BY ORGANIZATION SIZE

12.8.2.1 LARGE ORGANIZATION

12.8.2.2 SMALL & MEDIUM ORGANIZATION

13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MICROSOFT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 LENEVO

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 RICOH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SEIKO EPSON CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHIRONIX

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DIALPAD, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 EON REALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EZTALKS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HTC CORPORATION

16.10.1 COMPANY PROFILE

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 IRISTICK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 LOGITECH

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 LOGMEIN, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 REALWEAR, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ROBERT BOSCH GMBH

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 SONY CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 TEAMVIEWER

16.17.1 COMPANY SNAPSHOT

16.17.2 REVNUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 VIDYO, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 VUZIX CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 ZOOM VIDEO COMMUNICATIONS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 COMPANY SHARE ANALYSIS

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA VIDEO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUDIO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CLOUD IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LARGE ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SMALL & MEDIUM ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENTERPRISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CONSUMER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 64 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 65 U.S. HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 75 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 76 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 77 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 78 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 79 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 83 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 84 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 85 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 CANADA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 91 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 92 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 94 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 95 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 97 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 98 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 100 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 101 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 103 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 105 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 106 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 107 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 109 MEXICO HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 RISING PREFERENCE FOR REMOTE WORKING IS EXPECTED TO DRIVE NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

FIGURE 14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING, 2021

FIGURE 15 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY CONFERENCING TYPE, 2021

FIGURE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 17 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY END USE, 2021

FIGURE 20 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING (2022-2029)

FIGURE 25 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.