Mercado de desinfección de sondas de ultrasonido de América del Norte, por productos y servicios ( instrumentos , consumibles y servicios), nivel de desinfección (desinfección de bajo nivel, desinfección de nivel intermedio y desinfección de alto nivel), tipo de sonda ( dispositivos críticos , dispositivos no críticos y dispositivos semicríticos), usuario final (hospitales y centros de diagnóstico por imágenes, centros de atención ambulatoria , centros de maternidad , institutos académicos y de investigación y otros), canal de distribución (licitación directa, distribuidores externos y otros), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de desinfección con sondas ultrasónicas en América del Norte

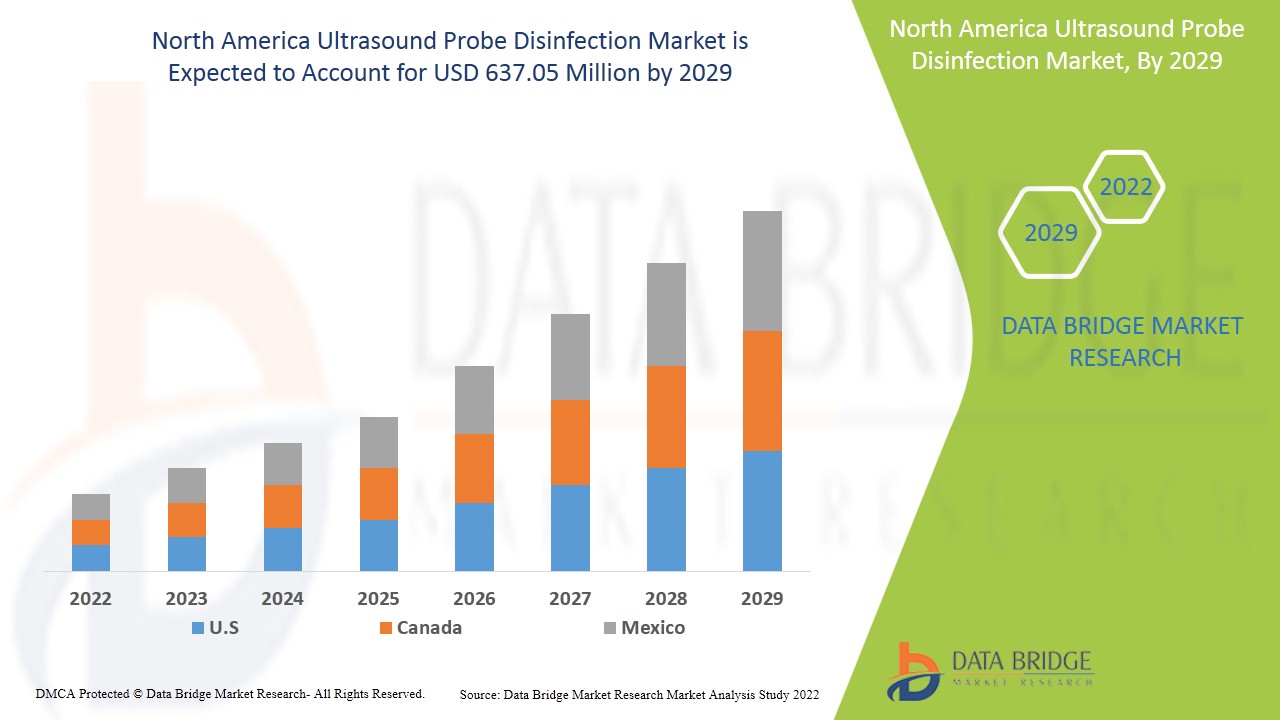

Se espera que el mercado de desinfección de sondas ultrasónicas de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 17,2% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 637,05 millones para 2029 desde USD 185,57 millones en 2021. La alta prevalencia de infecciones adquiridas en el hospital y el aumento de la conciencia sobre el uso de equipos reprocesados es el principal impulsor que se prevé que impulse el mercado en el período de pronóstico.

La desinfección se refiere a la destrucción térmica o química de microorganismos patógenos y de otro tipo. El proceso es menos letal que la esterilización, ya que la desinfección destruye los microorganismos patógenos más reconocidos. Según el Instituto Americano de Ultrasonido en Medicina (AIUM), "el control de infecciones es una parte integral del uso seguro y eficaz del ultrasonido en medicina".

Existen diferentes tipos y categorías de desinfectantes, como los desinfectantes de bajo nivel, que destruyen la mayoría de las bacterias, excepto los bacilos tuberculosos, algunos hongos y algunos virus; los desinfectantes de nivel intermedio, que destruyen las bacterias vegetativas, incluidos los bacilos tuberculosos y muchos virus, pero no las esporas bacterianas; y los desinfectantes de alto nivel, que eliminan las esporas bacterianas cuando se utilizan en concentraciones adecuadas y en condiciones apropiadas. La desinfección de la sonda de ultrasonidos sumergiéndola manualmente en la solución antiséptica es un procedimiento estándar que se mantiene en los centros de atención médica.

Se prevé que la creciente prevalencia mundial de enfermedades infecciosas, el aumento del número de infecciones adquiridas en hospitales y la creciente necesidad de procedimientos tecnológicamente avanzados que ofrecen métodos rápidos, sencillos y rentables impulsen el crecimiento del mercado. Sin embargo, el efecto secundario del uso de toallitas desinfectantes puede frenar el crecimiento del mercado. Además, se espera que el crecimiento de la tasa de natalidad y del número de embarazos brinde oportunidades lucrativas a los actores del mercado. Sin embargo, el alto costo de los reprocesadores de sondas automatizados puede suponer un desafío para el crecimiento del mercado de desinfección de sondas por ultrasonidos.

El informe de mercado de desinfección por sonda de ultrasonido de América del Norte proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos , expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de desinfección con sondas de ultrasonidos en América del Norte

El mercado de desinfección con sonda ultrasónica de América del Norte se clasifica en cinco segmentos notables que se basan en el producto y los servicios, el nivel de desinfección, el tipo de sonda, el usuario final y el canal de distribución.

- En función de los productos y servicios, el mercado de desinfección de sondas ultrasónicas de América del Norte se segmenta además en instrumentos, consumibles y servicios. En 2022, se espera que el segmento de instrumentos domine el mercado debido a las iniciativas adoptadas por los actores del mercado, como el lanzamiento de varios dispositivos desinfectantes de sondas ultrasónicas.

- En función del nivel de desinfección, el mercado de desinfección con sondas ultrasónicas de América del Norte se segmenta en desinfección de bajo nivel, desinfección de nivel intermedio y desinfección de alto nivel. En 2022, se espera que la desinfección de alto nivel domine el mercado, ya que brinda seguridad frente a las infecciones. Se prevé que estos parámetros afirmativos impulsen el crecimiento del mercado en el período de pronóstico.

- Según el tipo de sonda, el mercado de desinfección de sondas ultrasónicas de América del Norte se segmenta en dispositivos críticos, dispositivos no críticos y dispositivos semicríticos. En 2022, se espera que el segmento de dispositivos críticos domine el mercado, ya que necesitan un gran nivel de desinfección.

- En función del usuario final, el mercado de desinfección de sondas de ultrasonido de América del Norte se segmenta en hospitales y centros de diagnóstico por imágenes, centros de atención ambulatoria, centros de maternidad, institutos académicos y de investigación, entre otros. En 2022, se espera que el segmento de hospitales y centros de diagnóstico por imágenes domine el mercado a medida que aumentan las infecciones adquiridas en el hospital.

- En función del canal de distribución, el mercado de desinfección de sondas ultrasónicas de América del Norte se segmenta en licitación directa, distribuidores externos y otros. En 2022, se espera que el segmento de licitación directa domine el mercado porque ya existe una gran conciencia entre los consumidores.

Análisis a nivel de país del mercado de desinfección con sondas de ultrasonido de América del Norte

Se analiza el mercado de desinfección con sonda ultrasónica de América del Norte y se proporciona información sobre el tamaño del mercado por producto y servicios, nivel de desinfección, tipo de sonda, usuario final y canal de distribución.

Los países cubiertos en el informe del mercado de desinfección con sonda ultrasónica de América del Norte son EE. UU., Canadá y México.

Se espera que América del Norte domine el mercado debido a la alta prevalencia de infecciones adquiridas en hospitales. Se espera que Estados Unidos domine el mercado de América del Norte debido al aumento de eventos epidémicos y pandémicos y la presencia de una infraestructura de atención médica sofisticada.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El aumento de la tasa de natalidad y el aumento del uso de sistemas de desinfección de alto nivel en el mercado de desinfección con sondas de ultrasonido están creando nuevas oportunidades para los actores en el mercado de desinfección con sondas de ultrasonido

El mercado de desinfección por ultrasonidos de América del Norte también le proporciona un análisis detallado del mercado para el crecimiento de cada país en una industria en particular con las ventas de dispositivos de desinfección por ultrasonidos, el impacto del avance en la desinfección por ultrasonidos y los cambios en los escenarios regulatorios con su apoyo al mercado de dispositivos de desinfección por ultrasonidos. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de desinfección con sondas ultrasónicas en América del Norte

El panorama competitivo del mercado de desinfección por ultrasonidos de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de desinfección por ultrasonidos.

Algunas de las principales empresas que operan en el mercado de desinfección de sondas ultrasónicas de América del Norte son General Electric Company, STERIS, CS Medical LLC, Nanosonics, Ecolab, VIROX TECHNOLOGIES, INC., ASP, Schülke & Mayr GmbH, Parker Laboratories, Inc., Metrex Research, LLC, Siemens Healthcare GmbH, API 2000, BODE Chemie GmbH, LANXESS, PDI, Inc., Pharmaceutical Innovations, Inc., CIVCO Medical Solutions, AUS TULSA, entre otros actores nacionales y de Asia-Pacífico. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos lanzamientos de productos y acuerdos son también iniciados por empresas de todo el mundo, lo que también está acelerando el mercado de desinfección con sondas ultrasónicas.

Por ejemplo,

- En mayo de 2021, las toallitas desinfectantes Disinfectant 1 Wipe y Disinfectant 1 Spray de Ecolab recibieron la aprobación para su uso en entornos sanitarios, incluidos los centros de vacunación y pruebas de COVID-19. La aprobación ha ayudado a la empresa a ampliar su cartera de productos.

La colaboración, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando el mercado de la empresa en el mercado de desinfección de sondas ultrasónicas, lo que también proporciona el beneficio para que la organización mejore su oferta de desinfección de sondas ultrasónicas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS & SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAI'S)

6.1.2 RISE IN AWARENESS REGARDING USE OF REPROCESSED EQUIPMENT

6.1.3 INCREASE IN CHRONIC AND CONTAGIOUS DISEASES

6.1.4 TECHNOLOGICAL ADVANCEMENTS

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS OF USING DISINFECTANT WIPES

6.2.2 RELUCTANCE TOWARDS SHIFT FROM MANUAL DISINFECTION METHODS TO AUTOMATED PROBE RE-PROCESSORS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN BIRTH RATES/NUMBER OF PREGNANCIES

6.3.2 INCREASE IN USE OF HIGH-LEVEL DISINFECTION SYSTEMS

6.4 CHALLENGES

6.4.1 LESS STORAGE FOR ULTRASOUND PROBE CABINETS

6.4.2 HIGH COST OF AUTOMATED PROBE RE-PROCESSORS

7 IMPACT OF COVID-19 ON THE NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 REPROCESSORS

8.2.1.1 AUTOMATED REPROCESSORS

8.2.1.2 MANUAL REPROCESSORS

8.2.2 ULTRASOUND TRANSDUCER STORAGE CABINETS

8.2.3 UV-C DISINFECTORS

8.2.4 OTHERS

8.3 CONSUMABLES

8.3.1 DISINFECTANTS

8.3.1.1 DISINFECTANTS WIPES

8.3.1.2 DISINFECTANTS LIQUID

8.3.1.3 DISINFECTANTS SPRAYS

8.3.1.4 HIGH-LEVEL DISINFECTANTS

8.3.1.5 INTERMEDIATE LEVEL DISINFECTION

8.3.1.6 LOW-LEVEL DISINFECTANTS

8.3.2 DETERGENTS

8.3.2.1 ENZYMATIC

8.3.2.2 NON-ENZYMATIC

8.4 SERVICES

9 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION

9.1 OVERVIEW

9.2 HIGH-LEVEL DISINFECTANTS

9.3 INTERMEDIATE LEVEL DISINFECTION

9.4 LOW-LEVEL DISINFECTANTS

10 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE

10.1 OVERVIEW

10.2 CRITICAL DEVICES

10.2.1 INTRACARDIAC ULTRASOUND PROBES

10.2.2 OTHERS

10.3 NONCRITICAL DEVICES

10.3.1 LINEAR TRANSDUCERS

10.3.2 CONVEX TRANSDUCERS

10.3.3 PHASED ARRAY TRANSDUCERS

10.4 SEMICRITICAL DEVICES

10.4.1 ENDOCAVITARY TRANSDUCERS

10.4.2 TRANSESOPHAGEAL PROBES

11 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DIAGNOSTIC IMAGING CENTERS

11.3 AMBULATORY CARE CENTERS

11.4 MATERNITY CENTERS

11.5 ACADEMIC & RESEARCH INSTITUTES

11.6 OTHERS

12 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

5.1 DIRECT TENDER

12.2 THIRD PARTY DISTRIBUTORS

12.3 OTHERS

13 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ECOLAB

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 NANOSONICS

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 ASP

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 SCHULKE & MAYR GMBH

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GENERAL ELECTRIC COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 CIVCO MEDICAL SOLUTIONS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 API 2000

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AUS TULSA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BODE CHEMIE GMBH

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BORER CHEMIE AG

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CS MEDICAL LLC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FUJIFILM HEALTHCARE EUROPE (A SUBSIDIARY OF FUJIFILM CORPORATION)

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 GERMITEC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 IMA-X

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 LANXESS

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 MEDEVICE HEALTHTECH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MEDISOUND

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MH HEALTHCARE CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 METREX RESEARCH, LLC

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 PARKER LABORATORIES, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PDI, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 PHARMACEUTICAL INNOVATIONS, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SIEMENS HEALTHCARE GMBH

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 SOLUSCOPE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 STERIS

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 TRISTEL PLC

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 VIROX TECHNOLOGIES INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 WHITELEY

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA INSTRUMENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA INSTRUMENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA REPROCESSORS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CONSUMABLES IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CONSUMABLES IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA DETERGENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SERVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA HIGH-LEVEL DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA INTERMEDIATE LEVEL DISINFECTANTION IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LOW-LEVEL DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA NONCRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA NONCRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEMICRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SEMICRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS & DIAGNOSTIC IMAGING CENTERS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA AMBULATORY CARE CENTERS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MATERNITY CENTERS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ACADEMIC & RESEARCH INSTITUTES IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA DIRECT TENDER IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN ULTRASOUND PROBE DISINFECTION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INSTRUMENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA REPROCESSORS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CONSUMABLES IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA DETERGENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA NONCRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SEMICRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 U.S. ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 U.S. INSTRUMENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 49 U.S. REPROCESSORS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 50 U.S. CONSUMABLES IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 51 U.S. DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 53 U.S. DETERGENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 U.S. ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 55 U.S. ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 56 U.S. CRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 57 U.S. NONCRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 58 U.S. SEMICRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 59 U.S. ULTRASOUND PROBE DISINFECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 U.S. ULTRASOUND PROBE DISINFECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 CANADA ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 62 CANADA INSTRUMENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 CANADA REPROCESSORS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 CANADA CONSUMABLES IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 CANADA DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 67 CANADA DETERGENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 CANADA ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 69 CANADA ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 70 CANADA CRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 71 CANADA NONCRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 72 CANADA SEMICRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 73 CANADA ULTRASOUND PROBE DISINFECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 CANADA ULTRASOUND PROBE DISINFECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 MEXICO ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 76 MEXICO INSTRUMENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 77 MEXICO REPROCESSORS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 MEXICO CONSUMABLES IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 79 MEXICO DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 80 MEXICO DISINFECTANTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO DETERGENTS IN ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 82 MEXICO ULTRASOUND PROBE DISINFECTION MARKET, BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO CRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO NONCRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO SEMICRITICAL DEVICES IN ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO ULTRASOUND PROBE DISINFECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 MEXICO ULTRASOUND PROBE DISINFECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: SEGMENTATION

FIGURE 11 THE HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET

FIGURE 14 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY PRODUCTS & SERVICES, 2021

FIGURE 15 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY PRODUCTS & SERVICES, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY PRODUCTS & SERVICES, LIFELINE CURVE

FIGURE 18 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY LEVEL OF DISINFECTION, 2021

FIGURE 19 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY LEVEL OF DISINFECTION, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY LEVEL OF DISINFECTION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY LEVEL OF DISINFECTION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY TYPE OF PROBE, 2021

FIGURE 23 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY TYPE OF PROBE, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY TYPE OF PROBE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY TYPE OF PROBE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: BY PRODUCTS & SERVICES (2022-2029)

FIGURE 39 NORTH AMERICA ULTRASOUND PROBE DISINFECTION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.