North America Trauma Fixation Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.65 Billion

USD

12.38 Billion

2024

2032

USD

5.65 Billion

USD

12.38 Billion

2024

2032

| 2025 –2032 | |

| USD 5.65 Billion | |

| USD 12.38 Billion | |

|

|

|

|

Segmentación del mercado de fijación de traumatismos en Norteamérica , por tipo de producto (dispositivos de fijación interna y externa), material (implante metálico [acero, titanio y otros], fibra de carbono [ termoplástica ], implantes híbridos, bioabsorbibles, injertos y ortobiología), aplicación (hombro y codo, mano y muñeca, pelvis, cadera y fémur, tibia, craneomaxilofacial, rodilla, pie y tobillo, columna vertebral y otros), usuario final (hospitales, centros de cirugía ambulatoria, centros de traumatología y otros), canal de distribución (licitación directa, ventas minoristas y ventas en línea), tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de fijación de traumas en América del Norte

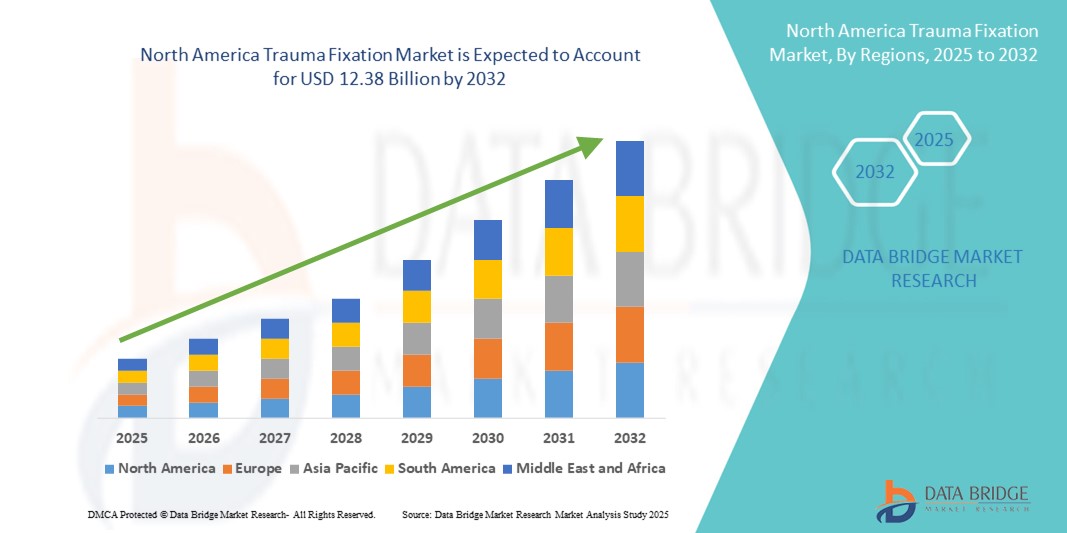

- El tamaño del mercado de fijación de traumas de América del Norte se valoró en USD 5.65 mil millones en 2024 y se espera que alcance los USD 12.38 mil millones para 2032 , con una CAGR del 10,3% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente incidencia de traumatismos por accidentes de tráfico, caídas y lesiones deportivas, una tendencia intensificada por la urbanización, el aumento del uso de vehículos y el envejecimiento de la población. Estos factores impulsan la demanda de dispositivos eficaces de fijación de traumatismos que estabilicen las fracturas y faciliten la recuperación.

- Además, la innovación tecnológica juega un papel crucial: avances como las técnicas quirúrgicas mínimamente invasivas, los materiales bioabsorbibles en fijadores internos, los implantes personalizados impresos en 3D y los recubrimientos de dispositivos inteligentes están mejorando la eficacia del dispositivo, reduciendo el tiempo de recuperación y mejorando los resultados de los pacientes.

Análisis del mercado de fijación de traumas en América del Norte

- Los dispositivos de fijación para traumatismos están experimentando una sólida adopción en Norteamérica, impulsada por la creciente incidencia de lesiones traumáticas, el crecimiento de la población geriátrica y el incremento de las cirugías ortopédicas. En 2024, Norteamérica representó aproximadamente el 41,5 % de los ingresos del mercado mundial de fijación para traumatismos, gracias a una infraestructura sanitaria avanzada, un alto conocimiento de las técnicas de fijación innovadoras y sólidos marcos de reembolso en toda la región.

- La creciente prevalencia de accidentes de tráfico, lesiones deportivas y trastornos óseos relacionados con la edad impulsa la demanda de dispositivos de fijación internos y externos fiables. Hospitales, centros de traumatología y centros de cirugía ambulatoria de Norteamérica invierten activamente en soluciones de fijación para traumatismos con el fin de mejorar los resultados de los pacientes, reducir el tiempo de recuperación y minimizar las complicaciones. El segmento hospitalario contribuyó con aproximadamente el 72,3 % de los ingresos totales del mercado de fijación de traumatismos en Norteamérica en 2024, lo que refleja la concentración de la atención de traumatismos complejos en entornos hospitalarios.

- Estados Unidos dominó el mercado de fijación de traumas en América del Norte, representando la mayor participación en los ingresos del 85,4 % en 2024. Esto se atribuye a la infraestructura de cirugía ortopédica bien establecida del país, los avances tecnológicos continuos en dispositivos de fijación y la presencia de actores clave del mercado con sede en los EE. UU. Las inversiones continuas en investigación sobre atención de traumas y la creciente cobertura de seguros refuerzan aún más el dominio del mercado.

- Se proyecta que Canadá será el país de más rápido crecimiento en el mercado norteamericano de fijación de traumatismos, con una tasa de crecimiento anual compuesta (TCAC) estimada del 10,9 % entre 2025 y 2032. El crecimiento en Canadá se ve impulsado por el aumento del gasto público en salud, la expansión de los centros de atención traumatológica y una mayor adopción de técnicas de fijación mínimamente invasivas en cirugía ortopédica. El crecimiento de la población geriátrica y la creciente concienciación sobre las opciones de fijación avanzada en las zonas rurales también respaldan esta tendencia.

- El segmento de dispositivos fijadores internos dominó el mercado de fijación de traumatismos de América del Norte con el 61,4 % de la participación en los ingresos del mercado en 2024, impulsado por su capacidad para proporcionar una fijación estable, permitir la movilización temprana y reducir los tiempos de recuperación para pacientes con fracturas complejas.

Alcance del informe y segmentación del mercado de fijación de traumas en América del Norte

|

Atributos |

Perspectivas clave del mercado de fijación de traumas en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de fijación de traumas en América del Norte

Aumento de las técnicas de fijación de traumas mínimamente invasivas y centradas en el paciente

- Una tendencia significativa y en auge en el mercado norteamericano de la fijación de traumatismos es la creciente adopción de procedimientos quirúrgicos mínimamente invasivos (CMI). Estos enfoques, como la fijación percutánea, el enclavado intramedular y los sistemas avanzados de placas, se están adoptando cada vez más porque reducen el traumatismo tisular, el riesgo de infección y acortan significativamente los tiempos de recuperación del paciente, lo que permite un alta más rápida y mejores resultados clínicos.

- Por ejemplo, DePuy Synthes ofrece el sistema de placas periprotésicas VA LCP, diseñado para aplicaciones MIS, que minimiza la exposición quirúrgica a la vez que mantiene una fijación rígida para fracturas complejas. De igual manera, el clavo intertrocantérico TRIGEN INTERTAN de Smith+Nephew permite la estabilización de fracturas mediante incisiones más pequeñas, lo que resulta en una menor pérdida de sangre y una movilización más rápida.

- Los sistemas de fijación híbridos, que combinan elementos de fijación interna y externa, también están ganando terreno, ya que ofrecen estrategias de estabilización personalizadas para fracturas complejas. Por ejemplo, Galaxy Fixation Gemini de Orthofix permite a los cirujanos cambiar de fijación externa a interna sin eliminar completamente la estabilización, lo que permite una adaptación a las necesidades específicas del paciente.

- Otro avance importante es el auge de los implantes específicos para cada paciente, producidos mediante imágenes de alta resolución y fabricación aditiva (impresión 3D). Por ejemplo, Materialise y Johnson & Johnson han colaborado para producir placas CMF personalizadas, adaptadas a la anatomía única de cada paciente, lo que mejora el ajuste del implante, el rendimiento biomecánico y la satisfacción del paciente.

- La adopción de biomateriales avanzados también está transformando el mercado. El titanio sigue siendo el estándar de oro en cuanto a resistencia y biocompatibilidad, mientras que los materiales bioabsorbibles como el PLA y el PGA están ganando popularidad, especialmente en casos pediátricos, eliminando la necesidad de una segunda cirugía para la extracción del implante. La espuma bioactiva Vitoss de Stryker es un ejemplo de biomaterial que promueve la regeneración ósea y es reabsorbible con el tiempo.

- El avance hacia dispositivos de fijación compatibles con centros de cirugía ambulatoria (CAA) también se está acelerando. Los productos diseñados para procedimientos ambulatorios, como el sistema de placa de bloqueo periarticular de Zimmer Biomet, favorecen una recuperación más rápida, reducen las estancias hospitalarias y el riesgo de infección, en consonancia con la creciente prioridad de los sistemas de salud en la rentabilidad y la comodidad del paciente.

Dinámica del mercado de fijación de traumas en América del Norte

Conductor

Necesidad creciente debido a la creciente incidencia de lesiones ortopédicas y los avances en los procedimientos quirúrgicos

- La creciente prevalencia de lesiones ortopédicas, fracturas y traumatismos causados por accidentes de tráfico, incidentes deportivos y la degeneración ósea relacionada con la edad es un factor importante que impulsa la demanda de dispositivos de fijación para traumatismos en Norteamérica. Tanto los países desarrollados como los países en desarrollo están experimentando un aumento en los casos que requieren intervención quirúrgica para la estabilización y alineación ósea.

- Por ejemplo, en mayo de 2024, un estudio propuso un marco de algoritmo genético automático para optimizar los planes quirúrgicos tridimensionales para osteotomías correctivas del antebrazo. Este marco utiliza modelos 3D específicos del paciente y optimización multiobjetivo para determinar la posición y orientación óptimas del plano de osteotomía y el material de fijación, con el objetivo de mejorar los resultados quirúrgicos.

- A medida que los profesionales de la salud buscan mejorar los tiempos de recuperación y reducir las complicaciones posquirúrgicas, los dispositivos de fijación de traumatismos (como placas, tornillos, varillas y fijadores externos) son cada vez más preferidos por su capacidad de proporcionar estabilidad ósea inmediata y facilitar la movilización temprana de los pacientes.

- Además, los continuos avances en cirugías ortopédicas mínimamente invasivas y el desarrollo de materiales de fijación biocompatibles hacen que las soluciones de fijación para traumatismos sean más eficaces y seguras. Estas innovaciones también contribuyen a reducir las estancias hospitalarias y a mejorar la calidad de vida de los pacientes.

- La creciente demanda de dispositivos de fijación personalizados, la disponibilidad de impresión 3D en la fabricación médica y un número cada vez mayor de unidades especializadas de atención de traumatismos ortopédicos están impulsando aún más la expansión del mercado de fijación de traumatismos tanto en clínicas residenciales como en entornos hospitalarios a gran escala.

Restricción/Desafío

Preocupaciones sobre los riesgos quirúrgicos y los altos costos iniciales

- A pesar del gran potencial de mercado, la adopción de la fijación de traumas enfrenta desafíos debido a riesgos quirúrgicos como infecciones, rechazo de implantes y la necesidad de cirugías de revisión. Estas complicaciones pueden afectar la confianza del paciente e influir en las recomendaciones de los cirujanos, especialmente en regiones con acceso limitado a cuidados postoperatorios avanzados.

- Por ejemplo, informes clínicos de alto perfil sobre complicaciones posquirúrgicas (como aflojamiento de implantes o fallas del hardware) han aumentado la conciencia sobre la importancia del control de calidad en la fabricación de fijación de traumatismos y la mejora de las habilidades quirúrgicas.

- Para abordar estos riesgos se requiere el uso de materiales biocompatibles de alta calidad, el cumplimiento de estrictos protocolos de esterilización y la capacitación continua de los cirujanos ortopédicos. Empresas como Stryker y Zimmer Biomet destacan sus sólidos esfuerzos en I+D para producir sistemas de fijación con mayor durabilidad, menor riesgo de infección y mayor compatibilidad con el paciente.

- Otra barrera importante es el costo inicial relativamente alto de los sistemas avanzados de fijación de traumatismos en comparación con los métodos tradicionales de reparación ortopédica. En regiones con precios sensibles, especialmente en países de ingresos bajos y medios, esto puede disuadir a hospitales y pacientes de adoptar soluciones de alta gama. Si bien los dispositivos de fijación básicos son cada vez más asequibles, los sistemas avanzados —integrados con herramientas de navegación o fabricados con aleaciones especializadas— siguen siendo caros.

- Para superar estos desafíos es necesario no solo hacer que los sistemas de fijación de traumas sean más rentables, sino también implementar políticas de salud pública que respalden la atención ortopédica subsidiada, ampliar la cobertura del seguro de salud y aumentar la conciencia de los pacientes sobre los beneficios a largo plazo de los dispositivos de fijación de traumas de alta calidad.

Alcance del mercado de fijación de traumas en América del Norte

El mercado está segmentado según el tipo de producto, material, aplicación, usuario final y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de fijación para traumatismos se segmenta en fijadores internos y externos. El segmento de fijadores internos representó el 61,4 % de los ingresos del mercado en 2024, gracias a su capacidad para proporcionar una fijación estable, facilitar la movilización temprana y reducir los tiempos de recuperación en pacientes con fracturas complejas. Dispositivos como placas, tornillos, varillas y clavos son ampliamente utilizados en cirugías ortopédicas, tanto electivas como de urgencia, gracias a sus resultados comprobados a largo plazo y su compatibilidad con técnicas mínimamente invasivas. Este segmento también se beneficia de la innovación continua en diseño, como placas con contornos anatómicos y sistemas de tornillos de bloqueo que mejoran la precisión quirúrgica.

Se prevé que el segmento de fijadores externos registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7,9 %, entre 2025 y 2032, gracias a su versatilidad para el tratamiento de fracturas expuestas, deformidades óseas complejas y casos de traumatismos graves donde la fijación interna no es viable. La creciente demanda de fijadores externos modulares y ligeros, junto con su mayor adopción en entornos de bajos recursos gracias a su reutilización, está impulsando aún más la expansión del mercado.

- Por material

En función del material, el mercado de la fijación de traumatismos se segmenta en implantes metálicos (acero, titanio y otros), fibra de carbono (termoplástica), implantes híbridos, materiales bioabsorbibles, injertos y productos ortobiológicos. El segmento de implantes metálicos representó el 54,8 % de la cuota de mercado en 2024, con el titanio como material dominante gracias a su biocompatibilidad, resistencia a la corrosión y capacidad de integración con el tejido óseo. El acero inoxidable sigue siendo una opción rentable, especialmente en las economías emergentes, para aplicaciones de alta resistencia y carga.

Se proyecta que el segmento de fibra de carbono (termoplástica) crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta, del 8,4 %, entre 2025 y 2032, gracias a su radiotransparencia (que permite imágenes nítidas sin interferencias) y a su ligereza, que mejora la comodidad del paciente. El desarrollo de implantes híbridos que combinan materiales metálicos y compuestos, así como la creciente adopción de implantes bioabsorbibles que eliminan la necesidad de cirugía de extracción, está transformando el panorama de los materiales en la fijación de traumatismos.

- Por aplicación

Según su aplicación, el mercado de fijación de traumatismos se segmenta en hombro y codo, mano y muñeca, pelvis, cadera y fémur, tibia, craneomaxilofacial, rodilla, pie y tobillo, columna vertebral, entre otros. El segmento de cadera y fémur registró la mayor participación en los ingresos, con un 28,3 %, en 2024, impulsado por la alta incidencia de fracturas en la población de edad avanzada y el creciente número de procedimientos de reemplazo total y parcial de cadera en todo el mundo. Estas lesiones suelen requerir sistemas de fijación robustos para restaurar la movilidad y reducir el riesgo de complicaciones.

Se espera que el segmento craneomaxilofacial registre la CAGR más rápida del 9,1 % entre 2025 y 2032, impulsada por los avances en la tecnología de impresión 3D para implantes específicos para pacientes y la creciente demanda de cirugías reconstructivas después de traumatismos o defectos congénitos.

- Por el usuario final

Según el usuario final, el mercado de fijación de traumatismos se segmenta en hospitales, centros de cirugía ambulatoria, centros de traumatología y otros. El segmento de hospitales dominó el mercado en 2024 con una participación del 66,5 %, gracias a su infraestructura avanzada, cirujanos ortopédicos cualificados y su capacidad para gestionar casos de traumatismos complejos que requieren atención multidisciplinaria. Los hospitales también lideran la adopción de nuevas tecnologías quirúrgicas y sistemas de fijación de alta gama mediante colaboraciones con fabricantes de dispositivos médicos.

Se espera que el segmento de centros quirúrgicos ambulatorios experimente la CAGR más rápida del 8,2 % entre 2025 y 2032, impulsada por el cambio hacia procedimientos ortopédicos ambulatorios, la rentabilidad y la reducción de los tiempos de espera de los pacientes.

- Por canal de distribución

Según el canal de distribución, el mercado de fijación de traumatismos se segmenta en licitación directa, venta minorista y venta en línea. El segmento de licitación directa representó el 72,8 % de los ingresos en 2024, gracias a las compras al por mayor por parte de hospitales e instituciones sanitarias públicas, lo que garantiza un suministro constante y ahorros de costos.

Se espera que el segmento de ventas en línea experimente la CAGR más rápida del 9,4 % entre 2025 y 2032, debido a la creciente aceptación de las plataformas de compras digitales, la mayor visibilidad de los productos y los precios competitivos.

Análisis regional del mercado de fijación de traumatismos en América del Norte

- El mercado norteamericano de fijación de traumatismos representó el 47 % de los ingresos del mercado global en 2024, impulsado por el creciente número de casos de traumatismos, el elevado gasto sanitario y los sólidos marcos de reembolso que respaldan las tecnologías de fijación avanzadas en hospitales, centros de traumatología y clínicas ortopédicas. Norteamérica se beneficia de una infraestructura sanitaria consolidada, la adopción generalizada de técnicas quirúrgicas mínimamente invasivas y la innovación continua en dispositivos para la atención de traumatismos.

- La creciente prevalencia de lesiones ortopédicas debido a accidentes de tránsito, traumatismos deportivos y fracturas asociadas a la edad está acelerando la adopción de sistemas de fijación interna y externa en la región. Las inversiones en innovación quirúrgica e iniciativas de recuperación de pacientes impulsan la demanda, especialmente en centros ortopédicos y hospitales de alto volumen. El segmento de dispositivos de fijación interna dominó los ingresos en 2024, lo que refleja la preferencia por soluciones de estabilización ósea estables y a largo plazo.

- Los avances tecnológicos en materiales y diseño de dispositivos, incluyendo sistemas de titanio y placas bloqueadas, implantes personalizables e instrumentación quirúrgica optimizada, impulsan aún más el crecimiento del mercado, especialmente en instituciones centradas en mejorar los resultados clínicos y reducir los tiempos de recuperación. El liderazgo de Norteamérica se ve reforzado por una sólida I+D, rápidas aprobaciones regulatorias y la colaboración entre fabricantes y profesionales sanitarios.

Perspectiva del mercado de la fijación del trauma en EE. UU.

El mercado estadounidense de fijación de traumas continúa dominando el mercado norteamericano, con la mayor participación en los ingresos, con aproximadamente el 85,4 % en 2024. Este liderazgo se sustenta en la infraestructura de cirugía ortopédica altamente desarrollada del país, que incluye una extensa red de centros especializados en traumas, instalaciones quirúrgicas avanzadas y un sólido ecosistema de rehabilitación posoperatoria. Estados Unidos también alberga a varios actores del mercado reconocidos mundialmente, como Johnson & Johnson (DePuy Synthes), Stryker y Zimmer Biomet, cuyas sedes y centros de I+D son fundamentales para impulsar la innovación en dispositivos de fijación de traumas. Los avances tecnológicos, como los implantes específicos para cada paciente, las placas de bloqueo de titanio, los tornillos biodegradables y la navegación quirúrgica asistida por computadora, han mejorado significativamente la precisión quirúrgica y los resultados de recuperación del paciente. Además, las continuas inversiones en investigación sobre atención traumatológica, junto con una amplia cobertura de seguros para procedimientos ortopédicos, permiten una mayor tasa de adopción de soluciones de fijación tanto tradicionales como de nueva generación. La alta incidencia de accidentes de tránsito, lesiones relacionadas con el deporte y casos de fracturas entre la población de edad avanzada del país sustenta aún más la demanda de dispositivos de fijación avanzados.

Perspectivas del mercado canadiense de fijación de traumas

El mercado canadiense de fijación de traumatismos se posiciona como el país de más rápido crecimiento en Norteamérica, con una proyección de crecimiento anual compuesto (TCAC) del 10,9 % entre 2025 y 2032. Esta sólida trayectoria de crecimiento se sustenta en el aumento del gasto público en salud, destinado a modernizar la infraestructura de atención traumatológica y garantizar la accesibilidad tanto en hospitales urbanos como en centros médicos remotos. La expansión de unidades especializadas de traumatología, junto con la integración de tecnologías quirúrgicas avanzadas, como técnicas de fijación mínimamente invasivas y sistemas híbridos de placas, está transformando la atención ortopédica en el país. Además, Canadá está experimentando un cambio demográfico marcado por el rápido crecimiento de la población geriátrica, que es más susceptible a fracturas relacionadas con la osteoporosis y otras lesiones esqueléticas. Las campañas de concienciación pública, especialmente en zonas rurales y marginadas, también fomentan el diagnóstico y el tratamiento tempranos, lo que lleva a una mayor adopción de soluciones de fijación avanzadas. El favorable sistema de reembolso y la colaboración entre hospitales canadienses y fabricantes internacionales de dispositivos ortopédicos están acelerando aún más la adopción de dispositivos de fijación de traumatismos de vanguardia.

Cuota de mercado de fijación de traumas en América del Norte

La industria de fijación de traumas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Grupo Weigao (China)

- Orthofix Medical Inc. (EE. UU.)

- Corporación CONMED (EE. UU.)

- Wright Medical Group NV (Países Bajos)

- OsteoMed (EE. UU.)

- Invibio Ltd. (Reino Unido)

- Medtronic (Irlanda)

- Smith + Nephew (Reino Unido)

- Zimmer Biomet (EE. UU.)

- B. Braun SE (Alemania)

- Stryker (EE. UU.)

- Implantate AG (Alemania)

- Johnson & Johnson y sus filiales (EE. UU.)

- Inion OY (Finlandia)

- Arthrex Inc. (EE. UU.)

- Jeil Medical Corporation (Corea del Sur)

- Bioretec Ltd. (Finlandia)

Últimos avances en el mercado de fijación de traumatismos en América del Norte

- En agosto de 2021, Zimmer Biomet Holdings Inc. anunció que la compañía había recibido la autorización de la FDA para el sistema ROSA Hip para el tratamiento de la artroplastia total de cadera. Este sistema robótico está diseñado para ayudar a los cirujanos en la evaluación y ejecución de su plan quirúrgico, midiendo la orientación del cotilo, la longitud de la pierna y el desplazamiento intraoperatorio.

- En marzo de 2024, Stryker Corporation lanzó SmartScrew Pro, un dispositivo avanzado de fijación para traumatismos con monitorización de la cicatrización ósea en tiempo real. Esta innovación busca mejorar los resultados de los pacientes al proporcionar a los cirujanos información inmediata sobre el proceso de cicatrización, mejorando así la precisión quirúrgica y los tiempos de recuperación.

- En enero de 2024, Zimmer Biomet presentó el sistema absorbible BioFIX, un sistema de placas bioabsorbibles diseñado principalmente para casos de trauma pediátrico. Los ensayos clínicos en la Unión Europea demostraron una reducción del 42 % en la necesidad de cirugías secundarias, lo que destaca el potencial del sistema para mejorar la recuperación del paciente y reducir los costos de atención médica.

- En septiembre de 2023, Orthofix anunció el lanzamiento comercial completo de su sistema de fijación Galaxy Gemini. Este sistema está diseñado para procedimientos ortopédicos de traumatología y ofrece mayor estabilidad y flexibilidad en el tratamiento de fracturas de miembros inferiores y superiores. Este lanzamiento demuestra el compromiso de Orthofix con el avance de la atención traumatológica mediante soluciones innovadoras.

- En octubre de 2024, un estudio presentó el sistema "StraightTrack", un sistema de navegación de realidad mixta diseñado para facilitar la colocación precisa de agujas de Kirschner (agujas de Kirschner) durante la cirugía percutánea de trauma pélvico. Este sistema proporciona visualización y guía 3D en tiempo real, lo que mejora la precisión de la colocación de las agujas y reduce las complicaciones asociadas a su colocación incorrecta.

- En mayo de 2024, un estudio propuso un marco de algoritmo genético automático para optimizar los planes quirúrgicos tridimensionales para osteotomías correctivas del antebrazo. Este marco utiliza modelos 3D específicos del paciente y optimización multiobjetivo para determinar la posición y orientación óptimas del plano de osteotomía y el material de fijación, con el objetivo de mejorar los resultados quirúrgicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.