Mercado de sensores táctiles de América del Norte , por tipo (resistivo, capacitivo, onda acústica de superficie (SAW), infrarrojo, óptico), flexibilidad (convencional, flexible, otros), canal (multicanal, canal único), aplicación (electrónica de consumo, electrodomésticos, dispositivos médicos, sistemas biométricos, automoción, cajeros automáticos (ATM) y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

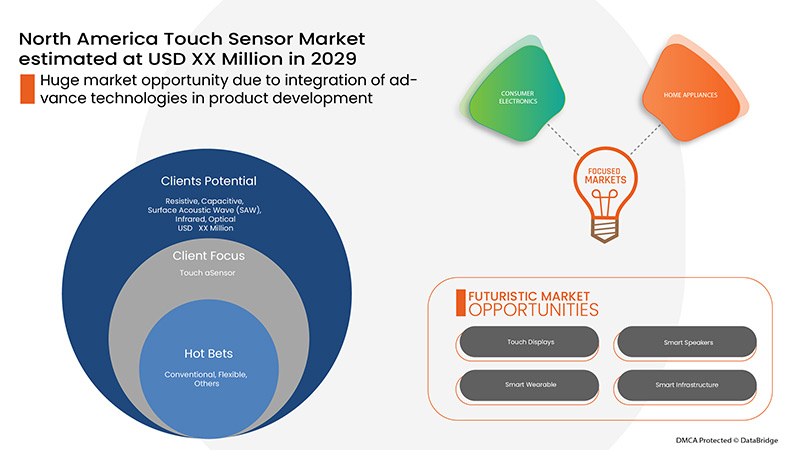

La creciente integración de sensores debido al aumento de la cantidad de pantallas y dispositivos táctiles puede aumentar el crecimiento del mercado de sensores táctiles en América del Norte. La creciente demanda de productos electrónicos de consumo, como televisores inteligentes, altavoces y sistemas de automatización del hogar, está complementando el crecimiento del mercado.

La creciente demanda de señalización digital interactiva en tiendas minoristas y centros comerciales impulsa la demanda de estos sensores táctiles. Además, la creciente demanda de señalización digital interactiva en tiendas minoristas y centros comerciales, que reduce el trabajo manual y actúa como autoayuda para los consumidores, acelera aún más el crecimiento del mercado. La rápida progresión de la tecnología de sensores táctiles y el uso creciente de pantallas táctiles en el sector educativo y corporativo para aumentar la interactividad impulsan el crecimiento del mercado. El segmento automotriz tiene un potencial enorme para liderar la demanda de sensores táctiles debido a la rápida integración de paneles táctiles en los vehículos.

Los actores del mercado de sensores táctiles de América del Norte están más centrados en el desarrollo de nuevos productos, asociaciones y otras estrategias para aumentar la cuota de mercado de sensores táctiles de América del Norte.

Los principales factores que se espera que impulsen el crecimiento del mercado de sensores táctiles en América del Norte son la creciente adopción de pantallas táctiles, la creciente demanda de productos electrónicos de consumo, el uso cada vez mayor de pantallas táctiles en la industria automotriz y las iniciativas gubernamentales para la digitalización. Sin embargo, la disminución de la demanda de PC todo en uno puede frenar el crecimiento del mercado.

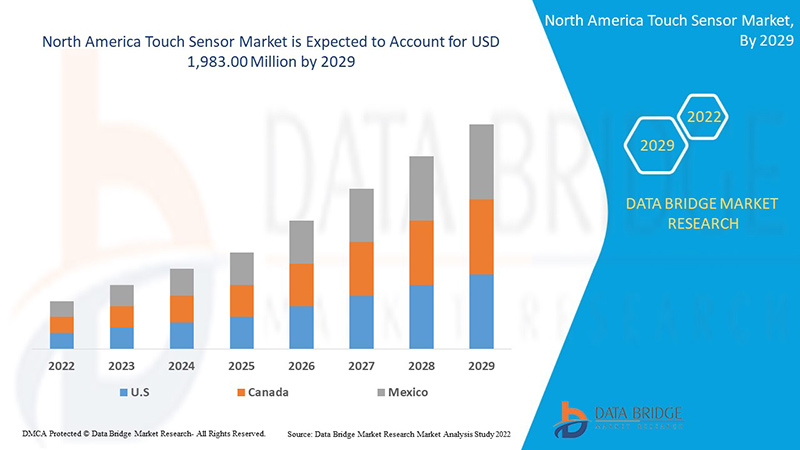

Data Bridge Market Research analiza que se espera que el mercado de sensores táctiles alcance un valor de USD 1.983,00 millones para el año 2029, con una CAGR del 12,6% durante el período de pronóstico. El segmento de tipo "resistivo" representa el más destacado en el mercado respectivo, ya que el sensor táctil resistivo no depende de la propiedad eléctrica de la capacitancia. El informe de mercado elaborado por el equipo de Data Bridge Market Research incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Tipo (resistivo, capacitivo, onda acústica de superficie (SAW), infrarrojo, óptico), flexibilidad (convencional, flexible, otros), canal (multicanal, canal único), aplicación (electrónica de consumo, electrodomésticos, dispositivos médicos, sistemas biométricos, automoción, cajeros automáticos (ATM), otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Neonode Inc., Renesas Electronics Corporation., SCHURTER, Semtech Corporation, Silicon Laboratories, Texas Instruments Incorporated, TSItouch, Zytronic PLC, Apex Material Technology Corporation, Xymox Technologies, Inc., CIRQUE CORPORATION, Futaba Corporation, Synaptics Incorporated, Infineon Technologies AG, Japan Display Inc., Nissha Co., Ltd., Azoteq (PTY) Ltd, CAPTRON, DMC CO., LTD., Elo Touch Solutions, Inc., Microchip Technology Inc., entre otros. |

Definición de mercado

Un sensor táctil se define como un sensor electrónico que se utiliza para detectar y registrar el tacto físico. Se consideran alternativas económicas de tamaño miniatura a los interruptores mecánicos tradicionales . El sensor generalmente funciona cuando se aplica un contacto o presión sobre la superficie, lo que permite que la corriente fluya a través del circuito . Son de varios tipos, incluidos los capacitivos, resistivos, infrarrojos y de ondas acústicas de superficie (SAW).

Se utilizan en diversas aplicaciones, entre ellas la electrónica de consumo , los dispositivos médicos y la automoción, debido a sus numerosas ventajas. Los dispositivos electrónicos de consumo abarcan desde sistemas de entretenimiento como altavoces hasta dispositivos de comunicación como móviles, pasando por hogares inteligentes y domótica.

La dinámica del mercado de sensores táctiles de América del Norte incluye:

- Creciente adopción de pantallas táctiles

La región de América del Norte ha experimentado un rápido crecimiento de las tecnologías digitales, lo que ha aumentado la adopción de pantallas táctiles. Por ejemplo, en el caso de las computadoras personales y portátiles, el ratón y el teclado han sido sustituidos por una interfaz de usuario sencilla que responde muy bien y se puede utilizar fácilmente para navegar. También son muy duraderas y resistentes, por lo que tienen una vida útil más larga. Por tanto, la rápida incorporación de dispositivos táctiles y de pantalla táctil en sectores que van desde restaurantes hasta empresas manufactureras y servicios financieros es un factor que puede impulsar el crecimiento del mercado de América del Norte.

- Creciente demanda de productos electrónicos de consumo

La tendencia ascendente en la demanda de productos electrónicos de consumo impulsada por la fuerte demanda de dispositivos con mejores características es un factor importante que se prevé que impulse el crecimiento del mercado de sensores táctiles de América del Norte.

- Aumento del uso de sensores táctiles en la industria automotriz

América del Norte tiene una enorme oportunidad de crecimiento en el mercado de la industria automotriz. Empresas como Tesla, que han lanzado pantallas táctiles de 16 pulgadas en sus vehículos, han impulsado aún más la demanda de sensores táctiles. La industria automotriz se ha convertido en uno de los principales usuarios de pantallas táctiles y se espera que impulse el crecimiento del mercado de sensores táctiles en América del Norte.

- Iniciativas gubernamentales para la digitalización

América del Norte ha mostrado una gran inclinación hacia la digitalización y el gobierno está tomando medidas continuamente para lograr una transformación digital. La digitalización ha transformado radicalmente nuestras vidas y la llegada de esta pandemia ha puesto todo esto patas arriba. Ha obligado a las economías de todo el mundo a repensar sus estrategias y mantener el país en marcha. Ha puesto de relieve sus deficiencias en términos de transformación. El impulso del gobierno hacia la digitalización a través de iniciativas e inversiones extranjeras es un factor importante que se prevé que impulse el crecimiento del mercado.

- Creciente demanda de señalización digital interactiva

Las pantallas para locales comerciales se introdujeron por primera vez en la década de 1970, cuando se utilizaban televisores CRT de gran tamaño como pantallas para la gestión de contenidos. En 1980, ya se utilizaban ampliamente en espacios comerciales. Sin embargo, en 2000, la señalización basada en software se disparó y se hizo muy popular. Una década después, las pantallas flexibles y curvas entraron en escena y allanaron el camino para la interacción máquina-máquina y hombre-máquina, dando lugar a la señalización digital interactiva. El progreso tecnológico y la conectividad de alta velocidad han abierto una nueva puerta de posibilidades.

Restricciones y desafíos que enfrenta el mercado de sensores táctiles de América del Norte

- Demanda en descenso de ordenadores todo en uno

En América del Norte, los usuarios se inclinan más por utilizar teléfonos inteligentes y tabletas en lugar de optar por PC todo en uno. Hoy en día, las PC se utilizan ampliamente en todas las empresas para su trabajo. Una computadora normal viene con una CPU, un monitor y otros componentes separados, mientras que en una PC todo en uno (AIO), todos los componentes están integrados en el monitor. Apple iMac se considera uno de los AIO más exitosos en general. En general, AIO es muy atractivo y cuenta con un monitor de pantalla táctil. A medida que más empresas brindan computadoras portátiles a sus empleados para trabajar desde casa en lugar de una PC todo en uno, se espera que esto frene el crecimiento del mercado.

- Escasez de suministro de chips

Los líderes y ejecutivos de las corporaciones multinacionales de Asia-Pacífico están preocupados por la escasez de semiconductores, que ha afectado la producción y las ventas en numerosos países y no se vislumbra una solución inmediata. Esto plantea un desafío importante para el crecimiento del mercado.

Este informe sobre el mercado de sensores táctiles de América del Norte proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de sensores táctiles, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Desarrollo reciente

- En noviembre de 2020, Microchip Technology Inc. anunció que había lanzado la primera familia de controladores de pantalla táctil capacitiva del mundo, MXT336UD-MAUHA1, precertificada para seguridad. Esta familia incluye tres controladores, MXT112UD-MAUHA1, MXT228UD-MAUHA1 y MXT336UD-MAUHA1, diseñados según distintos requisitos. Esto ayudará a la empresa a aumentar su participación de mercado y a entrar en este campo, lo que generará mayores ingresos en el futuro.

Alcance del mercado de sensores táctiles en América del Norte

El mercado de sensores táctiles de América del Norte está segmentado en función del tipo, la flexibilidad, el canal y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Resistador

- Capacitivo

- Onda acústica de superficie (SAW)

- Infrarrojo

- Óptico

Según el tipo, el mercado de sensores táctiles de América del Norte está segmentado en resistivo, capacitivo, de ondas acústicas de superficie (sierra), infrarrojo y óptico.

Flexibilidad

- Convencional

- Flexible

- Otros

Sobre la base de la flexibilidad, el mercado de sensores táctiles de América del Norte está segmentado en convencional, flexible y otros.

Canal

- Monocanal

- Multicanal

Sobre la base del canal, el mercado de sensores táctiles de América del Norte está segmentado en canal único y multicanal.

Solicitud

- Electrónica de consumo

- Electrodomésticos

- Dispositivos médicos

- Cajeros automáticos (ATM)

- Sistemas biométricos

- Automotor

- Otros

Sobre la base de la aplicación, el mercado de sensores táctiles de América del Norte está segmentado en electrónica de consumo, electrodomésticos, dispositivos médicos, cajeros automáticos (ATM), sistemas biométricos, automoción y otros.

Análisis y perspectivas regionales del mercado de sensores táctiles de América del Norte

Se analiza el mercado de sensores táctiles de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo, flexibilidad, canal y aplicación como se menciona anteriormente.

Algunos de los países cubiertos en el informe del mercado de sensores táctiles de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de sensores táctiles de América del Norte, ya que la región cuenta con muchos actores locales. Estados Unidos ha sido el centro de algunas de las principales empresas líderes en la industria de semiconductores.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de sensores táctiles en América del Norte

El panorama competitivo del mercado de sensores táctiles de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de sensores táctiles de América del Norte.

Algunos de los principales actores que operan en el mercado de sensores táctiles de América del Norte son Neonode Inc., Renesas Electronics Corporation., SCHURTER, Semtech Corporation, Silicon Laboratories, Texas Instruments Incorporated, TSItouch, Zytronic PLC, Apex Material Technology Corporation, Xymox Technologies, Inc., CIRQUE CORPORATION, Futaba Corporation, Synaptics Incorporated, Infineon Technologies AG, Japan Display Inc., Nissha Co., Ltd., Azoteq (PTY) Ltd, CAPTRON, DMC CO., LTD., Elo Touch Solutions, Inc., Microchip Technology Inc., entre otros.

Metodología de investigación: mercado de sensores táctiles en América del Norte

La recopilación de datos y el análisis del año base se realizan mediante módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman mediante modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíenos su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (por parte de expertos de la industria). Además de esto, los modelos de datos incluyen una cuadrícula de posicionamiento de proveedores, un análisis de la línea de tiempo del mercado, una descripción general y una guía del mercado, un análisis de expertos, un análisis de importación y exportación, un análisis de precios, un análisis de producción y consumo, un escenario de la cadena climática, una cuadrícula de posicionamiento de la empresa, un análisis de la participación de mercado de la empresa, estándares de medición, análisis global versus regional y de la participación de los proveedores. Para saber más sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TOUCH SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PREMIUM INSIGHTS

5.1 TOUCH SENSOR PRICING ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF TOUCH-BASED DISPLAYS

6.1.2 RISING DEMAND FOR CONSUMER ELECTRONICS

6.1.3 INCREASING USE OF TOUCH SCREENS IN THE AUTOMOTIVE INDUSTRY

6.1.4 GOVERNMENT INITIATIVES FOR DIGITALIZATION

6.1.5 RISING DEMAND FOR INTERACTIVE DIGITAL SIGNAGE

6.2 RESTRAINTS

6.2.1 DECLINING DEMAND FOR ALL-IN-ONE PC

6.2.2 SHORTAGE OF SKILLED LABOUR

6.2.3 SHORT SUPPLY OF INDIUM

6.3 OPPORTUNITIES

6.3.1 SURGE IN INDUSTRIAL APPLICATIONS OF TOUCH-BASED PANELS AND EQUIPMENT

6.3.2 DEVELOPMENTS IN MULTI-TOUCH TECHNOLOGY

6.3.3 RISE IN INVESTMENTS FOR R&D OF TOUCH SENSORS

6.4 CHALLENGES

6.4.1 CHIP SUPPLY SHORTAGE

6.4.2 ACCIDENTAL TOUCHES DUE TO HIGH SENSITIVITY

7 COVID-19 IMPACT ON THE NORTH AMERICA TOUCH SENSOR MARKET

7.1 ANALYSIS OF IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON PRICE

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 NORTH AMERICA TOUCH SENSOR MARKET, BY TYPE

8.1 OVERVIEW

8.2 RESISTIVE

8.2.1 5 –WIRE

8.2.2 8 –WIRE

8.2.3 4 –WIRE

8.3 CAPACITIVE

8.3.1 BY TECHNOLOGY

8.3.1.1 PROJECTED CAPACITANCE

8.3.1.2 SURFACE CAPACITANCE

8.3.2 BY SURFACE TYPE

8.3.2.1 GLASS

8.3.2.2 NON-GLASS

8.3.2.2.1 PLASTIC/POLYMER

8.3.2.2.1.1 PET & PETG

8.3.2.2.1.2 POLYCARBONATES

8.3.2.2.1.3 PMMA

8.3.2.2.1.4 OTHERS

8.3.2.2.2 SAPPHIRE

8.4 SURFACE ACOUSTIC WAVE (SAW)

8.5 INFRARED

8.6 OPTICAL

9 NORTH AMERICA TOUCH SENSOR MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 FLEXIBLE

9.4 OTHERS

10 NORTH AMERICA TOUCH SENSOR MARKET, BY CHANNEL

10.1 OVERVIEW

10.2 MULTI-CHANNEL

10.3 SINGLE CHANNEL

11 NORTH AMERICA TOUCH SENSOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 LAPTOPS

11.2.2 MONITORS

11.2.3 WEARABLE

11.2.4 ALL-IN-ONE (AIO) PCS

11.2.5 OTHERS

11.3 HOME APPLIANCES

11.3.1 WASHING MACHINES

11.3.2 OVEN

11.3.3 REFRIGERATOR

11.3.4 OTHERS

11.4 MEDICAL DEVICES

11.5 BIOMETRIC SYSTEMS

11.6 AUTOMOTIVE

11.7 AUTOMATED TELLER MACHINES (ATM)

11.8 OTHERS

12 NORTH AMERICA TOUCH SENSOR MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TOUCH SENSOR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROCHIP TECHNOLOGY INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 INFINEON TECHNOLOGIES AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 JAPAN DISPLAY INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TEXAS INSTRUMENTS INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 NISSHA CO. LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 RENESAS ELECTRONICS CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APEX MATERIAL TECHNOLOGY CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 AZOTEQ (PTY) LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CAPTRON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CIRQUE CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DMC CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 ELO TOUCH SOLUTIONS INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FUTABA CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 NEONODE INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 SCHURTER

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SEMTECH CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 SILICON LABORATORIES

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 SYNAPTICS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TSITOUCH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 XYMOX TECHNOLOGIES, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ZYTRONIC PLC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA RESISTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CAPACITIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SURFACE ACOUSTIC WAVE (SAW) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA INFRARED IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OPTICAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CONVENTIONAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA FLEXIBLE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA MULTI-CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SINGLE CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONSUMER ELECTRONICS IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOME APPLIANCES IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MEDICAL DEVICES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BIOMETRIC SYSTEMS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA AUTOMOTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA AUTOMATED TELLER MACHINES (ATM) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TOUCH SENSOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 U.S. CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 48 U.S. TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 U.S. TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 U.S. CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 CANADA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 59 CANADA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 CANADA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 MEXICO CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 70 MEXICO TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 MEXICO TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TOUCH SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TOUCH SENSOR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TOUCH SENSOR MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TOUCH SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TOUCH SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TOUCH SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TOUCH SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TOUCH SENSOR MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TOUCH SENSOR MARKET: CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 12 GROWING INTEGRATION OF SENSORS IN TOUCH-ENABLED DEVICES IS EXPECTED TO DRIVE NORTH AMERICA TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 13 RESISTIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA TOUCH SENSOR MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN NORTH AMERICA TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TOUCH SENSOR MARKET

FIGURE 16 NORTH AMERICA TOUCH SENSOR MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA TOUCH SENSOR MARKET: BY FLEXIBILITY, 2021

FIGURE 18 NORTH AMERICA TOUCH SENSOR MARKET: BY CHANNEL, 2021

FIGURE 19 NORTH AMERICA TOUCH SENSOR MARKET: BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA TOUCH SENSOR MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA TOUCH SENSOR MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA TOUCH SENSOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA TOUCH SENSOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA TOUCH SENSOR MARKET: BY TYPE (2022-2029)

FIGURE 25 NORTH AMERICA TOUCH SENSOR MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.