North America Torque Vectoring Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.15 Billion

USD

11.79 Billion

2024

2032

USD

3.15 Billion

USD

11.79 Billion

2024

2032

| 2025 –2032 | |

| USD 3.15 Billion | |

| USD 11.79 Billion | |

|

|

|

|

Segmentación del mercado de vectorización de par en Norteamérica por componente (hardware y servicios), tecnología (sistemas de vectorización de par activo [ATVS] y pasivo [PTVS]), tipo de accionamiento del embrague (eléctrico e hidráulico), tipo de rueda motriz (tracción trasera [RWD], tracción delantera [FWD] y tracción total/tracción en las cuatro ruedas [AWD/4WD]), tipo de vehículo (turismos, vehículos comerciales y todoterrenos), tipo de propulsión (diésel/gasolina/GNC y eléctrico): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de vectorización de par en América del Norte

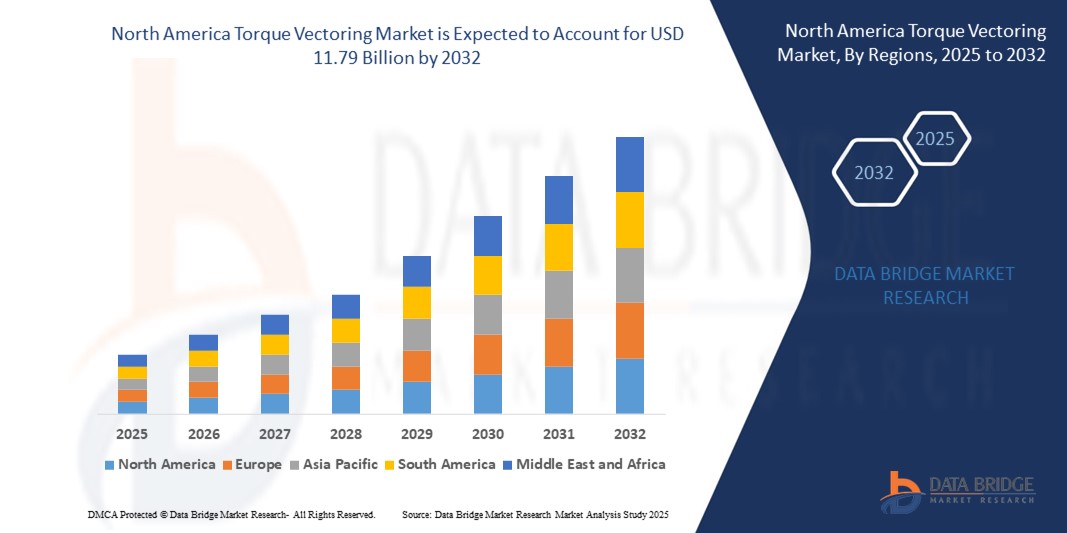

- El tamaño del mercado de vectorización de par de América del Norte se valoró en USD 3.150 millones en 2024 y se espera que alcance los USD 11.790 millones para 2032 , con una CAGR del 17,90 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de vehículos de alto rendimiento y de bajo consumo de combustible, junto con la creciente adopción de tecnologías de transmisión avanzadas en vehículos con motor eléctrico y de combustión interna.

- La creciente inclinación de los consumidores hacia una mayor seguridad y control del vehículo, especialmente en condiciones climáticas adversas, está impulsando aún más la demanda de sistemas de vectorización de par en toda la región.

Análisis del mercado de vectorización de par en América del Norte

- Los avances tecnológicos en seguridad automotriz y dinámica de manejo están impulsando a los fabricantes de automóviles a integrar sistemas de vectorización de par en una amplia gama de vehículos comerciales y de pasajeros.

- La presencia de importantes fabricantes de automóviles, junto con las crecientes inversiones en el desarrollo de vehículos eléctricos (VE), está acelerando la adopción de soluciones de vectorización de par en EE. UU. y Canadá.

- El mercado estadounidense de vectorización de par tuvo la mayor participación en los ingresos del 79,5 % en 2024 en América del Norte, impulsado por el liderazgo del país en avances tecnológicos de vehículos y sólidas ventas de automóviles.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de vectorización de torque de América del Norte debido a la creciente demanda de vehículos con tracción en las cuatro ruedas, los incentivos gubernamentales para la movilidad eléctrica y las crecientes colaboraciones entre los proveedores automotrices locales y los actores globales en la innovación del sistema de propulsión.

- El segmento de hardware dominó el mercado con la mayor participación en ingresos en 2024, gracias a la alta integración de unidades de control electrónico, sensores y actuadores en sistemas avanzados de tren motriz. Estos componentes son esenciales para la distribución del par en tiempo real y desempeñan un papel fundamental para garantizar la estabilidad del vehículo y la precisión en las curvas. La demanda de vehículos robustos y de alto rendimiento está acelerando la implementación de este tipo de hardware en vehículos premium y medianos.

Alcance del informe y segmentación del mercado de vectorización de par en América del Norte

|

Atributos |

Perspectivas clave del mercado de vectorización de par en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

• BorgWarner Inc. (EE. UU.) |

|

Oportunidades de mercado |

• Expansión de vehículos eléctricos e híbridos en el segmento de lujo |

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de vectorización de par en América del Norte

Integración creciente de la vectorización de par en vehículos eléctricos y con tracción total

- La creciente electrificación de los vehículos y la demanda de una mejor dinámica de manejo están acelerando la adopción de la tecnología de vectorización de par en Norteamérica. Dado que los vehículos eléctricos e híbridos suelen utilizar motores duales o múltiples, la vectorización de par se convierte en una función crucial para gestionar eficientemente la distribución de potencia, mejorando la tracción y la experiencia de conducción.

- La creciente popularidad de las configuraciones de tracción total (AWD) en SUV y vehículos de alto rendimiento también contribuye a esta tendencia. La vectorización del par permite ajustar la potencia en tiempo real a cada rueda, lo que garantiza una mejor estabilidad y un mejor agarre en las curvas en diversas condiciones de la carretera. Esto es especialmente valioso en regiones con climas variables, como Estados Unidos y Canadá.

- Los fabricantes de automóviles ahora integran sistemas de vectorización de par basados en software que permiten modos de conducción personalizables, ofreciendo a los conductores mayor control sobre la conducción y la capacidad de respuesta. Estos sistemas no solo aumentan la seguridad al volante, sino que también mejoran la interacción del usuario, convirtiéndolos en la opción preferida tanto en vehículos premium como de gama media.

- Por ejemplo, en 2023, un fabricante líder de vehículos eléctricos con sede en EE. UU. lanzó un nuevo modelo SUV equipado con vectorización de par asistida por IA, lo que permite una distribución superior del par y una optimización de la energía tanto para uso en carretera como fuera de ella.

- Si bien la transición hacia vehículos eléctricos y con tracción total impulsa la adopción de la vectorización del par, las mejoras continuas en las tecnologías de sensores y los algoritmos de control son esenciales para garantizar la precisión y la capacidad de respuesta del sistema. Los fabricantes deben invertir en la integración de hardware y software e interfaces intuitivas para aprovechar al máximo el potencial de estos sistemas.

Dinámica del mercado de vectorización de par en América del Norte

Conductor

Aumento de la demanda de vehículos orientados al rendimiento y de las regulaciones de seguridad

La demanda de vehículos de alto rendimiento con características mejoradas de seguridad y control está impulsando la adopción de sistemas avanzados de vectorización de par en el mercado norteamericano. Los consumidores buscan cada vez más vehículos que ofrezcan mejor aceleración, agarre en curvas y frenado, especialmente en vehículos utilitarios deportivos (SUV) y sedanes premium. La vectorización de par ofrece estas ventajas al ajustar dinámicamente el par en cada rueda.

Las agencias reguladoras de Norteamérica, como la Administración Nacional de Seguridad del Tráfico en las Carreteras (NHTSA), han reforzado sus requisitos de seguridad, incentivando a los fabricantes de automóviles a incorporar sistemas que mejoran la estabilidad del vehículo y el control de tracción. La vectorización del par complementa los sistemas de control electrónico de estabilidad y los sistemas de frenos antibloqueo, alineándose así con las normas de seguridad en constante evolución.

Los fabricantes de automóviles también están aprovechando la vectorización de par para cumplir con los objetivos de eficiencia de combustible y reducción de emisiones. Al distribuir el par de forma más eficaz, estos sistemas reducen la pérdida innecesaria de potencia y optimizan el rendimiento del motor. Esta doble ventaja, que combina rendimiento y eficiencia, resulta especialmente atractiva en un panorama automotriz cada vez más competitivo.

• Por ejemplo, en 2024, una empresa automotriz canadiense colaboró con un proveedor de tecnología de transmisión para desarrollar módulos de vectorización de par rentables para su integración en crossovers híbridos compactos, dirigidos tanto a consumidores conscientes de la seguridad como del medio ambiente.

A pesar de la creciente concienciación y el respaldo regulatorio, persiste la necesidad de una mayor educación y capacitación del consumidor entre los técnicos de servicio para promover su adopción generalizada. Los fabricantes deberían centrarse en simplificar los procesos de integración y ofrecer soporte posventa para asegurar un crecimiento sostenido del mercado.

Restricción/Desafío

Altos costos del sistema e integración compleja con los sistemas de transmisión existentes

Una de las principales limitaciones en el mercado norteamericano de vectorización de par es el alto costo asociado con los componentes y la integración del sistema. Las unidades de control electrónico, sensores, actuadores y paquetes de software avanzados aumentan significativamente el costo total de producción del vehículo, lo que limita su adopción en modelos de gama baja y media.

La modernización de sistemas de vectorización de par en transmisiones convencionales también presenta un desafío técnico. La mayoría de los vehículos tradicionales no están diseñados para incorporar estos sistemas dinámicos de gestión de potencia, lo que genera problemas de compatibilidad y costosas inversiones de ingeniería. Estos desafíos pueden retrasar la comercialización y reducir la escalabilidad.

La complejidad de la tecnología de vectorización de par también requiere técnicos cualificados para su instalación, diagnóstico y mantenimiento. La falta de formación generalizada en las redes de reparación de automóviles puede alargar los tiempos de servicio y aumentar la reticencia de los consumidores, especialmente en zonas rurales o desatendidas.

• Por ejemplo, en 2023, varios concesionarios estadounidenses informaron retrasos en la entrega de vehículos eléctricos recién lanzados con vectorización de par debido a problemas de integración con módulos de transmisión de terceros, lo que destaca la necesidad de procesos de fabricación más optimizados.

• A medida que los ecosistemas de software y hardware automotrices se vuelven más sofisticados, es fundamental que las empresas inviertan en estandarización, componentes modulares y colaboración con OEM y proveedores para reducir costos, garantizar una integración perfecta y respaldar la viabilidad del mercado a largo plazo.

Alcance del mercado de vectorización de par en América del Norte

El mercado está segmentado en función del componente, la tecnología, el tipo de accionamiento del embrague, el tipo de rueda motriz, el tipo de vehículo y el tipo de propulsión.

- Por componente

En función de los componentes, el mercado de vectorización de par se segmenta en hardware y servicios. El segmento de hardware dominó el mercado con la mayor cuota de mercado en 2024, gracias a la alta integración de unidades de control electrónico, sensores y actuadores en sistemas avanzados de tren motriz. Estos componentes son esenciales para la distribución del par en tiempo real y desempeñan un papel fundamental para garantizar la estabilidad del vehículo y la precisión en las curvas. La demanda de vehículos robustos y de alto rendimiento está acelerando la implementación de este tipo de hardware en vehículos premium y medianos.

Se prevé que el segmento de servicios experimente el mayor crecimiento entre 2025 y 2032, impulsado por las crecientes necesidades de mantenimiento de sistemas, calibración de software y diagnóstico en tiempo real. A medida que los vehículos se vuelven cada vez más complejos, los fabricantes de automóviles y los proveedores de servicios ofrecen servicios por suscripción y monitorización remota del rendimiento, lo que garantiza la eficiencia, la seguridad y el cumplimiento normativo del sistema durante toda la vida útil del vehículo.

- Por tecnología

En cuanto a la tecnología, el mercado se segmenta en Sistemas de Vectorización de Par Activo (ATVS) y Sistemas de Vectorización de Par Pasivo (PTVS). El segmento de los ATVS obtuvo la mayor participación en los ingresos en 2024, gracias a su avanzada funcionalidad para distribuir dinámicamente el par según las condiciones de conducción, el ángulo de dirección y los datos de tracción. Los ATVS se han adoptado ampliamente en vehículos eléctricos y con tracción total gracias a su mayor seguridad, agilidad y control.

Se prevé que el segmento PTVS experimente el mayor crecimiento entre 2025 y 2032, principalmente debido a su rentabilidad y su aplicación en vehículos de gama básica. Si bien presenta menor capacidad de respuesta que los sistemas activos, la vectorización pasiva del par mejora la estabilidad en curvas y la tracción sin un control electrónico complejo, lo que la hace ideal para segmentos con presupuestos ajustados.

- Por tipo de accionamiento del embrague

Según el tipo de accionamiento del embrague, el mercado se segmenta en eléctrico e hidráulico. El segmento hidráulico lideró el mercado en 2024 gracias a su amplio uso en vehículos con motor de combustión interna tradicional y su fiabilidad demostrada en aplicaciones de alto rendimiento. Los sistemas hidráulicos ofrecen una alta capacidad de fuerza, lo que los hace ideales para ajustes rápidos de par durante la conducción dinámica.

Se prevé que el segmento eléctrico experimente su mayor crecimiento entre 2025 y 2032, impulsado por el auge de los vehículos electrificados y la transición hacia sistemas más eficientes y con mayor capacidad de respuesta. El accionamiento eléctrico también permite un control de par más preciso y una integración más sencilla con los sistemas de gestión de vehículos basados en software, lo que mejora la experiencia del usuario y el rendimiento.

- Por tipo de rueda motriz

Según el tipo de tracción, el mercado se clasifica en tracción trasera (RWD), tracción delantera (FWD) y tracción total/tracción en las cuatro ruedas (AWD/4WD). El segmento AWD/4WD representó la mayor participación en 2024 debido a la creciente demanda de vehículos capaces de adaptarse a diversos terrenos y condiciones climáticas. La vectorización de par mejora significativamente la tracción y el control en estos sistemas, lo que aumenta su atractivo en las categorías de vehículos utilitarios, todoterreno y de lujo.

Se espera que el segmento FWD sea testigo de la tasa de crecimiento más rápida entre 2025 y 2032, especialmente en los automóviles de pasajeros compactos, donde los fabricantes están comenzando a implementar sistemas de vectorización de torque livianos y simplificados para mejorar el rendimiento y el agarre en las curvas sin incurrir en costos sustanciales.

- Por tipo de vehículo

Según el tipo de vehículo, el mercado se segmenta en turismos, vehículos comerciales y todoterrenos. El segmento de turismos dominó la cuota de mercado en 2024, gracias a la fuerte demanda de tecnologías de conducción avanzadas y seguridad vehicular. La vectorización del par se incorpora cada vez más en los modelos de vehículos medianos y premium para ofrecer una mejor calidad de conducción, eficiencia de combustible y dinámica de conducción.

Se prevé que el segmento de vehículos todoterreno experimente el mayor crecimiento entre 2025 y 2032, impulsado por el creciente interés en vehículos de aventura y recreativos. Estos vehículos requieren una gestión superior del par para afrontar terrenos difíciles, lo que convierte la vectorización del par en una característica crucial para el rendimiento y la seguridad.

- Por tipo de propulsión

Según el tipo de propulsión, el mercado se divide en vehículos diésel/gasolina/GNC y eléctricos. El segmento diésel/gasolina/GNC dominó en 2024 debido a su base de vehículos tradicionales y a su uso generalizado en el transporte comercial y personal en Norteamérica. Los sistemas de vectorización de par están consolidados en esta categoría, especialmente en vehículos deportivos y utilitarios.

Se prevé que el segmento de vehículos eléctricos experimente su mayor crecimiento entre 2025 y 2032, debido a la creciente transición hacia la electrificación y la compatibilidad natural de la vectorización de par con las transmisiones eléctricas. Las configuraciones de vehículos eléctricos con dos o más motores permiten una distribución de par precisa y controlada por software, lo que convierte la vectorización de par en un componente fundamental para la mejora del rendimiento y la optimización energética de la movilidad eléctrica.

Análisis regional del mercado de vectorización de par en América del Norte

- El mercado estadounidense de vectorización de par tuvo la mayor participación en los ingresos del 79,5 % en 2024 en América del Norte, impulsado por el liderazgo del país en avances tecnológicos de vehículos y sólidas ventas de automóviles.

- Los consumidores se sienten cada vez más atraídos por las características que mejoran el rendimiento, especialmente en los autos deportivos y SUV de lujo, donde el control preciso del torque contribuye a mejorar las curvas y la estabilidad.

- Además, la creciente demanda de vehículos eléctricos e híbridos equipados con sistemas de control dinámico está acelerando la integración de tecnologías de vectorización de par.

- El mercado también se beneficia de la presencia de importantes fabricantes de automóviles y proveedores de componentes que invierten activamente en soluciones de transmisión inteligente para satisfacer los estándares cambiantes de rendimiento y seguridad.

Perspectivas del mercado canadiense de vectorización de par

Se prevé que el mercado canadiense de vectorización de par registre su mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de vehículos eléctricos y tecnologías avanzadas de transmisión. El fuerte énfasis del gobierno canadiense en la movilidad sostenible, junto con los incentivos para la adopción de vehículos eléctricos e híbridos, está impulsando la implementación de sistemas inteligentes de distribución de par. Además, las difíciles condiciones climáticas y la variedad de terrenos del país aumentan la demanda de sistemas de tracción total y control de tracción mejorado, lo que convierte a los sistemas de vectorización de par en un componente valioso tanto para vehículos de pasajeros como comerciales.

Cuota de mercado de vectorización de par en América del Norte

La industria de vectorización de par de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• BorgWarner Inc. (EE. UU.)

• Dana Incorporated (EE. UU.)

• American Axle & Manufacturing, Inc. (EE. UU.)

• Eaton Corporation (EE. UU.)

• JTEKT North America Corporation (EE. UU.)

• Linamar Corporation (Canadá)

• Magna International Inc. (Canadá)

• Timken Company (EE. UU.)

Últimos avances en el mercado de vectorización de par en América del Norte

- En febrero de 2023, American Axle & Manufacturing Holdings, Inc. firmó acuerdos de colaboración con NIO y Mercedes para desarrollar sistemas híbridos-eléctricos de alto rendimiento y componentes para vehículos eléctricos. Con un diseño P3, con el motor eléctrico ubicado en el eje trasero, el sistema busca optimizar la distribución del peso y el par motor. Se espera que este avance mejore la eficiencia y el rendimiento del vehículo, consolidando la posición de la compañía en el cambiante mercado de los vehículos eléctricos.

- En octubre de 2022, Magna lanzó su transmisión híbrida de doble embrague de 48 voltios, integrada por primera vez en vehículos como el Jeep Renegade, el Compass e-Hybrid, el Tipo y el Fiat 500 X. Esta tecnología ofrece un mayor ahorro de combustible y un mejor rendimiento del vehículo. Su implementación en varios modelos refleja la dedicación de Magna a ampliar su oferta de movilidad sostenible y consolidar su presencia en el sector de la tecnología híbrida.

- En diciembre de 2021, Magna presentó su sistema EtelligentReach, que incluye controladores de dinámica del vehículo con función de desconexión y vectorización longitudinal del par. Esta innovación mejora la eficiencia y el rendimiento de conducción, a la vez que reduce las emisiones de CO2. Esto subraya la continua inversión de Magna en soluciones para vehículos sostenibles de nueva generación.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.