Mercado de toallas de papel de América del Norte, por tipo de producto (toallas enrolladas, toallas dobladas, servilletas y toallas de lujo, toallas en caja), uso final (cuidado personal, cuidado del hogar, atención médica, hotelería, comercial, otros), canal de distribución (venta directa, comercio electrónico, tiendas minoristas, otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

Es probable que el mercado mundial de toallas de papel crezca significativamente en el futuro cercano debido a una mayor conciencia sobre la salud y la higiene. Se estima que el mercado de toallas de papel se desarrollará debido a un aumento en el número de trastornos congénitos, condiciones climáticas cambiantes y una mayor urbanización. En consecuencia, el crecimiento del mercado florecerá en gran medida durante el período previsto.

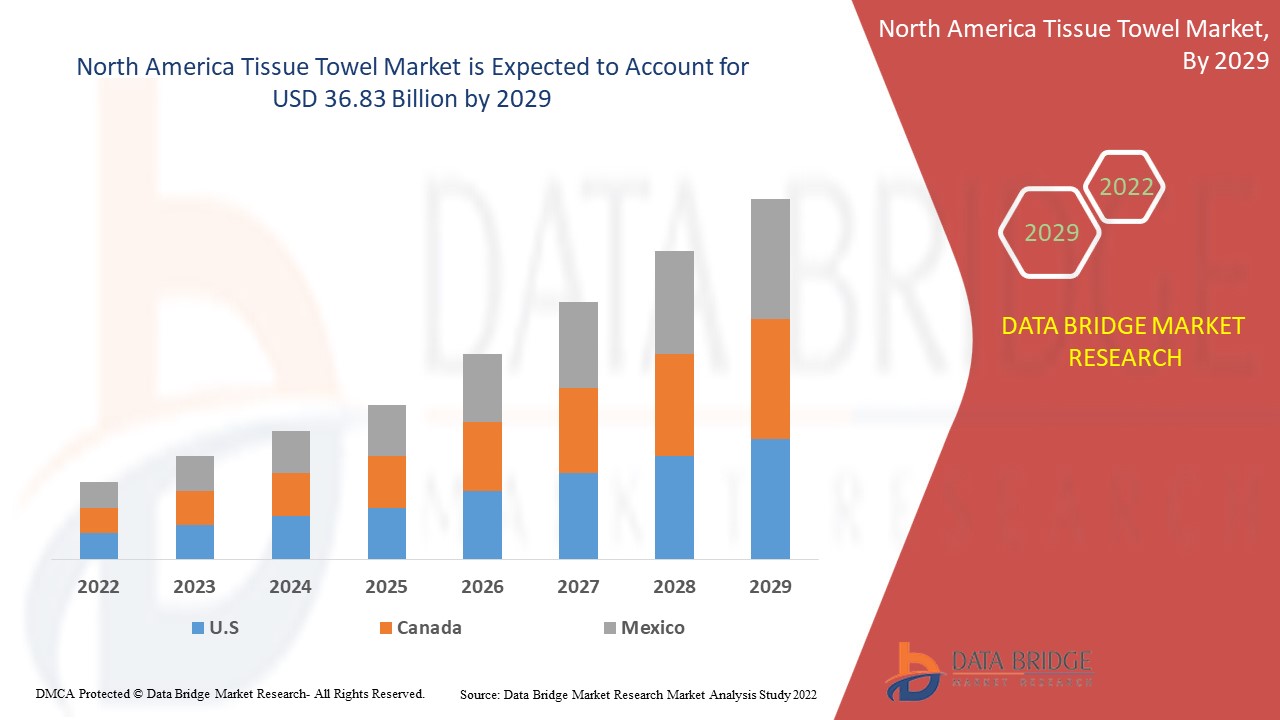

El mercado de toallas de papel de América del Norte se valoró en 25 mil millones de dólares en 2021 y se espera que alcance los 36.83 mil millones de dólares en 2029, registrando una CAGR del 4,40 % en 2022-2029. El informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

Definición de mercado

Las toallas de papel son toallas de papel que se utilizan para limpiar superficies como pisos, ventanas y otras superficies, así como para secar las manos de las personas. Debido a su tecnología de rápida absorción, estos artículos brindan beneficios como la prevención y la limpieza con el reciclaje de estas toallas. También se conocen como toallas de papel desechables porque se supone que solo se deben usar una vez y luego se desechan.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

KALSINT (EE. UU.), Queenex (EAU), American waste & Textiles, LLC (EE. UU.), Riverside Paper Co. lnc. (EE. UU.), National Wiper Alliance lnc. (EE. UU.), Larsen Packaging products, lnc. (EE. UU.), Ovasco Industries (EE. UU.), Carl Hubenthal GmbH & Co. KG. (Alemania), Georgia-Pacific (EE. UU.), METSÄ TISSUE (Finlandia), Procter & Gamble (EE. UU.), KCWW (EE. UU.), CARE Ratings Limited (India), HengAn (China), SHP Group (Eslovaquia), Grigeo (Lituania), Essity Aktiebolag (publ) (Suecia) |

|

Oportunidades de mercado |

|

Dinámica del mercado de las toallas de papel

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la demanda de toallas de papel

El mercado de las toallas de papel está creciendo debido a las condiciones climáticas cambiantes, la creciente demanda en otras industrias como la construcción y el cambio climático. El aumento influye en el mercado de las toallas de papel debido a la demanda de toallas de papel en sectores emergentes como las actividades al aire libre y las nuevas regiones, la expansión en los hogares como resultado de las condiciones climáticas cambiantes y el aumento de los casos de gripe y resfriado común, lo que aumenta la demanda de toallas de papel.

Factores como los diversos beneficios asociados con el uso de toallas de papel, incluida la prevención de la transmisión de infecciones, el aumento de la industria del turismo y la hospitalidad y el creciente número de mujeres trabajadoras impulsarán aún más la tasa de crecimiento del mercado de toallas de papel. Además, el aumento de la conciencia de la salud entre la población, el alto uso de estas toallas de papel debido a su relación costo-beneficio y el cambio generalizado en el estilo de vida del consumidor combinado con la rápida urbanización también impulsarán el crecimiento del valor de mercado. Se proyecta que la expansión de la industria hotelera y el aumento de los ingresos disponibles de las personas impulsarán el crecimiento del mercado.

Oportunidades

- Pañuelos de papel ecológicos y asequibles

Además, el desarrollo de pañuelos desechables biodegradables y ecológicos amplía las oportunidades rentables para los actores del mercado en el período de pronóstico de 2022 a 2029. Además, el desarrollo de pañuelos de papel asequibles para los países en desarrollo ampliará aún más el crecimiento futuro del mercado de toallas de papel.

Restricciones/Desafíos

- Preocupaciones por el medio ambiente

Se prevé que las crecientes preocupaciones sobre la producción de estas toallas, que incluyen muchos aspectos que causan contaminación y dañan el medio ambiente, como la eliminación de residuos peligrosos y la deforestación, obstaculicen la expansión del mercado de toallas de papel.

- Regulaciones estrictas

Además, también se espera que el fortalecimiento de las regulaciones contra la deforestación obstaculice el crecimiento del mercado mundial de toallas de papel.

- Precios de las materias primas

Además, se prevé que la fluctuación de los precios de las materias primas, que afecta a los resultados de los fabricantes, sea un factor negativo para el mercado de las toallas de papel. Por lo tanto, esto supondrá un desafío para la tasa de crecimiento del mercado de las toallas de papel.

Este informe de mercado de toallas de papel proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de toallas de papel, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de toallas de papel

El reciente brote de coronavirus tuvo un impacto positivo en el mercado de las toallas de papel, ya que hubo una gran demanda de ellas. El aumento de la demanda de toallas de papel se puede atribuir a una mayor conciencia de los consumidores sobre la necesidad de limpieza y desinfección, que se puede lograr utilizando toallas de papel. Se utilizaban principalmente para limpiar y secar rápidamente las manos y limpiar áreas que estaban potencialmente contaminadas o que eran manipuladas regularmente por varias personas, como manijas de puertas y tazas. Este producto se convirtió en un artículo imprescindible en la lista de los consumidores debido a su facilidad de uso, alta tasa de absorción y uso único. Además, varios usuarios que usaban la misma toalla de tela aumentaban el riesgo de contaminación por virus, lo que hacía que la toalla de papel fuera una alternativa mejor y más segura.

Alcance del mercado de toallas de papel en América del Norte

El mercado de las toallas de papel se segmenta en función del tipo de producto, el uso final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Toallas enrolladas

- Toallas dobladas

- Servilletas y toallas de lujo

- Toallas en caja

Uso final

- Cuidado personal

- Cuidados en el hogar

- Cuidado de la salud

- Hospitalidad

- Comercial

- Otros

Canal de distribución

- Ventas directas

- Comercio electrónico

- Tiendas minoristas

- Otros

Análisis y perspectivas regionales del mercado de toallas de papel

Se analiza el mercado de toallas de papel y se proporcionan información y tendencias del tamaño del mercado por país, tipo, tipo de producto, uso final y canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de toallas de papel son EE. UU., Canadá y México en América del Norte.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las toallas de papel

El panorama competitivo del mercado de las toallas de papel proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de las toallas de papel.

Algunos de los principales actores que operan en el mercado de toallas de papel son

- KALSINT (EE.UU.)

- Queenex (Emiratos Árabes Unidos)

- American Waste & Textiles, LLC (Estados Unidos)

- Riverside Paper Company Inc. (Estados Unidos)

- Alianza Nacional de Limpiaparabrisas (Estados Unidos)

- Productos de embalaje Larsen, Inc. (Estados Unidos)

- Industrias Ovasco (Estados Unidos)

- Carl Hubenthal GmbH & Co. KG. (Alemania)

- Georgia-Pacífico (Estados Unidos)

- TEJIDOS METSÄ (Finlandia)

- Procter & Gamble (Estados Unidos)

- KCWW (Estados Unidos)

- Calificaciones CARE Limited (India)

- Heng An (China)

- Grupo SHP (Eslovaquia)

- Grigeo (Lituania)

- Essity Aktiebolag (publ) (Suecia)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TISSUE TOWEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS

5.1.2 PAPER TOWEL IS MORE ENVIRONMENTALLY EFFICIENT AS COMPARED TO ELECTRIC AIR DRYERS

5.1.3 INCREASING HEALTH AWARENESS AND PREVENTION FROM CROSS-CONTAMINATION

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL DEGRADATION CAUSED DUE TO TISSUE INDUSTRIES

5.2.2 ENVIRONMENTAL CONCERNS DUE TO CUTTING DOWN OF TREES IMPACTING URBAN ECOSYSTEM

5.2.3 STRENGTHENING OF REGULATIONS TOWARDS DEFORESTATION

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF ECO-FRIENDLY BIODEGRADABLE DISPOSABLE TISSUES

5.3.2 DEVELOPMENT OF AFFORDABLE TABLET TISSUES FOR DEVELOPING COUNTRIES

5.4 CHALLENGE

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES IMPACTING BOTTOM LINE OF MANUFACTURERS

6 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA TISSUE TOWEL MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ROLLED TOWELS

7.2.1 STANDARD ROLLS

7.2.2 CENTER PULL ROLLS

7.3 FOLDED TOWELS

7.3.1 CENTREFOLD

7.3.2 MULTI-FOLD

7.4 BOXED TOWELS

7.5 NAPKINS AND LUXURY TOWELS

8 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE

8.1 OVERVIEW

8.2 HOME CARE

8.3 COMMERCIAL

8.3.1 OFFICE

8.3.2 RESTAURANTS

8.4 PERSONAL CARE

8.5 HEALTH CARE

8.6 HOSPITALITY

8.7 OTHERS

8.7.1 EDUCATION & RESEARCH INSTITUTES

8.7.2 PUBLIC WASHROOMS

9 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL STORES

9.2.1 HYPERMARKETS

9.2.2 SUPERMARKETS

9.2.3 WHOLESALE STORE

9.2.4 SPECIALTY STORES

9.2.5 OTHERS

9.3 E-COMMERCE

9.4 DIRECT SALES

9.5 OTHERS

10 NORTH AMERICA TISSUE TOWEL MARKET BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA TISSUE TOWEL MARKET, COMPANY LANDSCAPE

11.1 MERGERS & ACQUISITIONS

11.2 EXPANSIONS

11.3 NEW PRODUCT DEVELOPMENTS

11.4 PARTNERSHIP

12 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

12.1 SWOT ANALYSIS

12.1.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

12.1.2 WEAKNESS: - VOLATILE INPUT PRICES

12.1.3 OPPORTUNITY: - STRATEGIC ACQUISITIONS

12.1.4 THREAT: - AVAILABLITY OF SUBSTITUTES

12.2 DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

13 COMPANY PROFILE

13.1 GEORGIA-PACIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 PROCTER & GAMBLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 KCWW

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 KP TISSUE INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 METSÄ TISSUE (A SUBSIDIARY OF METSÄ GROUP)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 CASCADES INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATE

13.7 IRVING CONSUMER PRODUCTS LIMITED.

13.7.1 COMPANY SNAPSHOT

13.7.2 BRAND PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ASALEO CARE LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 BRAND PORTFOLIO

13.8.4 RECENT UPDATE

13.9 BLUE RIDGE TISSUE CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 ESSITY AKTIEBOLAG (PUBL).

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 BRAND PORTFOLIO

13.10.4 RECENT UPDATES

13.11 FLOWER CITY TISSUE MILLS CO

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 GLOBAL TISSUE GROUP, INC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 GORHAM PAPER & TISSUE.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 NOVA TISSUE

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 WEPA HYGIENEPRODUKTE GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 3 SUMMARY OF PRIMARY OR ESSENTIAL PROPERTIES OF AWAY FROM HOME (AFH) TISSUE PRODUCTS IN THE U.S. MARKET (2005)

TABLE 4 RANK ORDER 0F ENVIRONMEMNTAL IMPACT OF THE PRODUCTS

TABLE 5 NORTH AMERICA TREE GRADES CONSUMPTION, BY TISSUE TOWEL TYPE (2019)

TABLE 6 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 8 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 9 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 10 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 11 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 12 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 13 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 14 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 15 NORTH AMERICA FOLDED TOWEL IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 17 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 18 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 19 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 20 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 21 NORTH AMERICA HOME CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 22 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 23 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COMMERCIAL TYPE, 2019-2027 (USD MILLION)

TABLE 24 NORTH AMERICA PEESONAL CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 25 NORTH AMERICA HEALTH CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 29 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLIO N)

TABLE 32 NORTH AMERICA E-COMMERCE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 33 NORTH AMERICA DIRECT SALES IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 35 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 36 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 37 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 38 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 39 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 40 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 41 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027, 2019-2027 (THOUSAND TONS)

TABLE 42 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 43 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 44 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 45 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 46 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 47 NORTH AMERICA RETAIL STORE TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 48 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 49 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 50 U.S. ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 51 U.S ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 52 U.S. FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 53 U.S FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 54 U.S. TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 55 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 56 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 57 U.S. TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 58 U.S. RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 59 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 60 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 61 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 62 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 63 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 64 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 65 CANADA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 66 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 67 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 68 CANADA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 69 CANADA RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORES DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 70 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 71 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 72 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 73 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 74 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 75 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 76 MEXICO TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 77 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 78 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 79 MEXICO TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 80 MEXICO RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TISSUE TOWEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TISSUE TOWEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TISSUE TOWEL MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TISSUE TOWEL MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TISSUE TOWEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TISSUE TOWEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TISSUE TOWEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 NORTH AMERICA TISSUE TOWEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 12 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS IS DRIVING THE NORTH AMERICA TISSUE TOWEL MARKET IN THE FORECAST PERIOD OF 2021 TO 2027

FIGURE 13 ROLLED TOWELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TISSUE TOWEL MARKET IN 2021 & 2027

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA TISSUE TOWEL MARKET

FIGURE 15 GLOBAL PER CAPITA TOILET PAPER ROLLS CONSUMPTION, BY COUNTRY (2019)

FIGURE 16 GLOBAL FOREST COVER LOSS, SQ. KM (2000-2005)

FIGURE 17 GLOBAL PER CAPITA CONSUMPTION OF TISSUE, BY REGIONS, 2017 (KG)

FIGURE 18 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE, 2020

FIGURE 19 NORTH AMERICA TISSUE TOWEL MARKET: BY END-USE, 2020

FIGURE 20 NORTH AMERICA TISSUE TOWEL MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 21 NORTH AMERICA TISSUE TOWEL MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2021 & 2027)

FIGURE 24 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 26 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.