Mercado de sistemas de cables submarinos de América del Norte, por producto (productos de planta húmeda y productos de planta seca), voltaje (voltaje medio y alto , voltaje extra alto), oferta (instalación y puesta en servicio, reparación y mantenimiento y actualizaciones), clase de fibra (sin repetición y con repetición), tipo de cables (cables de tubo holgado, cables de cinta y otros), tipo de armadura (armadura liviana, armadura simple, armadura doble y armadura de roca), profundidad (0 a 500 m, 500 m a 1000 m, 1000 m a 5000 m y otros), aplicación ( cables de alimentación y cables de comunicación ): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de sistemas de cable submarino en América del Norte

Un cable submarino es un cable tendido en el lecho marino entre estaciones terrestres para transportar señales de telecomunicaciones a través de tramos de mar y océano. El aumento de las suscripciones a telecomunicaciones y las elevadas inversiones en parques eólicos marinos han influido directamente en el crecimiento del mercado de cables submarinos. Además, las crecientes inversiones de los proveedores de contenido y servicios en la nube están impulsando el crecimiento del mercado de cables submarinos. Asimismo, el aumento del tráfico de Internet en las regiones emergentes repercute positivamente en el crecimiento del mercado. Además, la creciente demanda de ancho de banda también está actuando como un motor de crecimiento activo para el crecimiento del mercado de cables submarinos. Además, el creciente número de parques eólicos marinos y la creciente demanda de conexiones eléctricas entre países e islas están creando una enorme demanda de cables submarinos y elevando el crecimiento del mercado de cables submarinos.

Sin embargo, los procedimientos regulatorios, ambientales y de autorización intrincados que conducen a demoras y el complejo procedimiento de reparación para los enlaces de cables eléctricos en aguas profundas son las principales restricciones al crecimiento del cable submarino en el período previsto mencionado anteriormente. Por el contrario, el creciente entusiasmo en torno a las constelaciones de comunicaciones por Internet basadas en el espacio puede suponer un desafío para el crecimiento del mercado de cables submarinos.

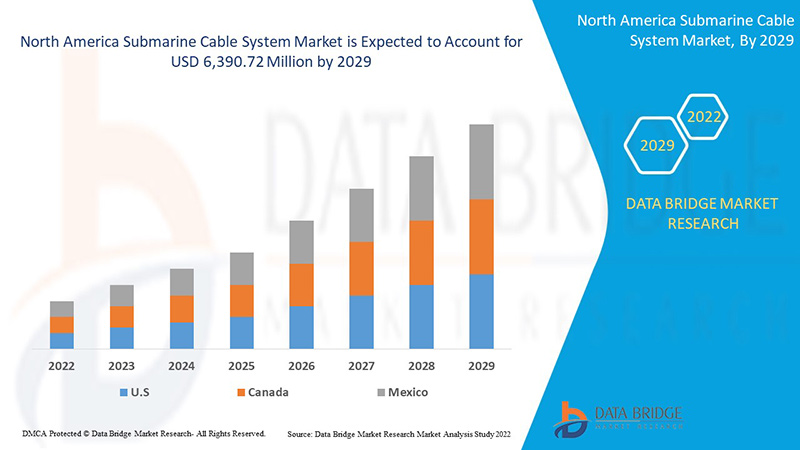

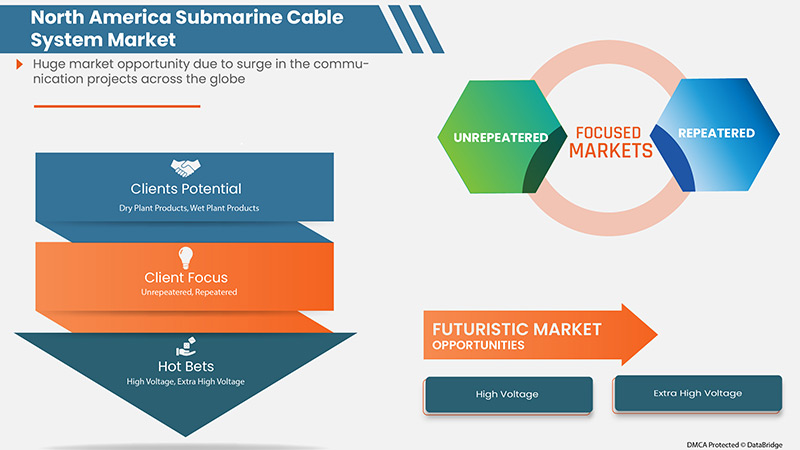

Data Bridge Market Research analiza que se espera que el mercado de sistemas de cables submarinos de América del Norte alcance los USD 6.390,72 millones para 2029, con una CAGR del 7,2 % durante el período de pronóstico. Los "productos de plantas secas" representan el segmento tecnológico más destacado. Este tipo de tecnología tiene demanda porque ofrece la máxima eficiencia de trabajo al evitar la instalación de cables en áreas críticas. El informe de mercado de sistemas de cables submarinos también cubre de manera integral los precios, las patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Segmentos cubiertos |

Por producto (productos de planta húmeda y productos de planta seca), voltaje (voltaje medio y alto , voltaje extra alto), oferta (instalación y puesta en servicio, reparación y mantenimiento y actualizaciones), clase de fibra (sin repetición y con repetición), tipo de cable (cables de tubo holgado, cables de cinta y otros), tipo de armadura (armadura liviana, armadura simple, armadura doble y armadura de roca), profundidad (0 a 500 m, 500 m a 1000 m, 1000 m a 5000 m y otros), aplicación ( cables de alimentación y cables de comunicación ) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

HENGTONG GROUP CO., LTD, TE Connectivity, Saudi Ericsson, APAR, NEC Corporation, NXT A/S, Norddeutsche Seekabelwerke GmbH (una subsidiaria de Prysmian Group), JDR Cable Systems Ltd, ZTT, Hexatronic Group, Alcatel Submarine Networks, Corning Incorporated, The Okonite Company, AFL (una subsidiaria de Fujikura Ltd.), LEONI, NEXANS, Ocean Specialists, Inc. (una subsidiaria de Continental Shelf Associates, Inc.), TFKable, Sumitomo Electric Industries, Ltd., Tratos, Hellenic Cables SA y HESFIBEL SUBSEA CABLES, entre otros. |

Definición de mercado

Un sistema de cable submarino se refiere a las estructuras de cables conectados a una estación terrestre que ayuda a transmitir las señales a través del océano y los cuerpos de agua marinos. La combinación de conectividad a largas distancias combina la comunicación y la transmisión de electricidad a través de los sistemas de cables colocados bajo el agua.

La demanda y el despliegue del sistema de cable submarino dependen completamente del aumento de las suscripciones a telecomunicaciones e Internet en América del Norte. Se espera que se amplíen los sistemas submarinos en áreas inexploradas. Además, el transporte marítimo y el GPS desempeñan un papel importante en el desarrollo de cables submarinos en todos los países y regiones del mundo moderno. Esto requiere la aplicación de regulaciones gubernamentales adecuadas y únicas para desarrollar un procedimiento estándar y conectividad. Por lo tanto, incluye varios conjuntos de reglas y regulaciones que ayudan a impulsar el mercado.

Dinámica del mercado de sistemas de cable submarino

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Impulsores/Oportunidades

- Aumento de la tendencia de generación de energía eólica marina

Los cables submarinos existen desde mediados del siglo XIX, pero durante gran parte de su historia se utilizaron fundamentalmente para enviar energía desde fuentes convencionales, como las centrales de carbón, ya sea entre países o hacia islas o yacimientos petrolíferos. La industria de los cables submarinos sufrió un declive durante el siglo XIX, pero eso cambió durante la década de 2000, cuando el aumento de los costos de la energía y las preocupaciones por el cambio ambiental avivaron el interés en el crecimiento de la energía eólica marina y en redes eléctricas transnacionales más eficientes.

La generación de energía eólica es una fuente de energía limpia que no requiere combustible y la generación de energía en alta mar tiene vientos fuertes, lo que atrae proyectos de desarrollo de generación de energía eólica marina en todo el mundo.

- Aumento de la adopción de servicios basados en la nube

El desarrollo de la transmisión por aire mediante el uso de nuevos grupos de satélites y la creciente afición por acceder a contenidos a través de organizaciones portátiles mediante transmisiones inalámbricas remotas. Estas transmisiones remotas están conectadas a través de infraestructuras de centros de datos . Están interconectadas a través de cables tendidos en un submarino para desarrollar conexiones entre diferentes centros de datos en diferentes países y regiones. Esto implica una necesidad de cables submarinos que ayuden a conectar centros de datos y mejoren directamente la conectividad basada en la nube para todo tipo de organizaciones. Por lo tanto, se espera que la adopción de servicios y soluciones basados en la nube sea un importante impulsor del crecimiento del mercado de sistemas de cables submarinos.

- Despliegue de diversas tecnologías en sistemas de cables submarinos

La alimentación de energía a los sistemas de cable submarino es una práctica establecida desde hace mucho tiempo, desde los sistemas submarinos coaxiales hasta los sistemas de amplificadores ópticos actuales. Los principios fundamentales de la alimentación eléctrica a los sistemas de cable submarino, como se analiza en este capítulo, son el equipo de alimentación de energía (PFE) instalado en las estaciones terminales, el camino de retorno a través de tierra y mar, y el PFE que alimenta una corriente constante para estabilizar las características del repetidor y el rendimiento de la transmisión.

Restricción/Desafíos

- Las elevadas inversiones iniciales actúan como barrera de entrada para las PYME

La conexión a través de cables submarinos es larga y, por lo tanto, el costo depende directamente de la longitud de los sistemas de cable utilizados, lo que directamente influye. Por lo tanto, se ha observado que, por lo general, los principales actores del mercado se involucran en el negocio de servicios de cable submarino, ya que implica enormes inversiones que las PYME no pueden ofrecer. Esto restringirá la entrada de más actores al mercado y promoverá el dominio, lo que se espera que restrinja el crecimiento del mercado.

- Procedimientos de reparación complejos

Los barcos cableros se cargan con suficiente cable para reparaciones, quizás 5-10 km, que se pueden cargar en unas pocas horas. Para hacer la reparación, es necesario agregar cable, ya que no hay suficiente holgura para sacarlo y cortar un trozo. Una vez que el cable se recupera y se encuentra a bordo, en una sala de reparaciones que parece un laboratorio, los ingenieros lo reparan.

Impacto posterior al COVID-19 en el mercado de sistemas de cables submarinos

La COVID-19 afectó significativamente al mercado de sistemas de cables submarinos, ya que casi todos los países optaron por cerrar todas las instalaciones de producción, excepto las que producen bienes esenciales. El gobierno ha tomado medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más, para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de sistemas de cables submarinos está aumentando debido a la digitalización del proceso de producción y las cadenas de suministro en las empresas eléctricas, mineras, petroleras y de gas, y de transporte. Además, las averías en los cables ocurren con frecuencia en todo el mundo y una flota de buques especializados las repara lo más rápido posible. Para reparar un cable es necesario recibir permisos gubernamentales para acceder a los puertos y para que los barcos realicen reparaciones en aguas territoriales. Las demoras en los permisos ya eran un problema al que se enfrentaba la industria en algunos países antes del COVID-19. Ahora que la conectividad está en su punto más alto, es más vital que nunca que los gobiernos agilicen los permisos para garantizar reparaciones rápidas.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología en el mercado de sistemas de cables submarinos. Las empresas aportarán soluciones avanzadas y precisas al mercado.

Desarrollo reciente

- En noviembre de 2021, LEONI anunció su participación en el proyecto ADOPD, que desarrolla unidades computacionales ultrarrápidas de fibra óptica basadas en dendritas ópticas adaptativas. Este proyecto ayudará a la empresa a comprender los distintos procesos e interacciones y dará como resultado el desarrollo de mejores tecnologías de productos en varios segmentos, especialmente en sistemas de cable.

- En julio de 2022, NEXANS anunció la adjudicación del nuevo proyecto de EuroAsia Interconnector Limited para desarrollar la interconexión eléctrica europea que unirá las redes nacionales de Israel, Chipre y Grecia (Creta). Este proyecto ayudará a la empresa a proporcionar tecnología para cables eléctricos submarinos en aguas profundas utilizando los desarrollos a largo plazo de NEXANS para aguas ultraprofundas de 3000 m junto con las capacidades de instalación que serán reconocidas en el mercado.

Alcance del mercado de sistemas de cable submarino en América del Norte

El mercado de sistemas de cables submarinos está segmentado por producto, voltaje, oferta, clase de fibra, tipo de cable, tipo de armadura, profundidad y aplicación. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por producto

- Productos de planta húmeda

- Productos vegetales secos

Sobre la base del producto, el mercado de sistemas de cables submarinos está segmentado en productos de planta húmeda y productos de planta seca.

Por voltaje

- Media tensión

- Alto voltaje

- Voltaje extra alto

En función del voltaje, el mercado de sistemas de cables submarinos se segmenta en medio voltaje, alto voltaje y extra alto voltaje.

Al ofrecer

- Mantenimiento

- Actualizaciones

- Instalación y puesta en servicio

Sobre la base de la oferta, el mercado de sistemas de cables submarinos se segmenta en mantenimiento, actualizaciones e instalación y puesta en servicio .

Por clase de fibra

- Sin repetición

- Repetido

Sobre la base de la clase de fibra, el mercado de sistemas de cable submarino se segmenta en sin repetidores y con repetidores.

Por tipo de cable

- Cables de tubo suelto

- Cables de cinta

- Otros

Según el tipo de cable, el mercado de sistemas de cables submarinos se segmenta en cables de tubo suelto, cables de cinta y otros.

Por tipo de armadura

- Armadura ligera

- Armadura simple

- Doble armadura

- Armadura de roca

Sobre la base del tipo de armadura, el mercado de sistemas de cables submarinos se segmenta en armadura liviana, armadura simple, armadura doble y armadura de roca.

Por profundidad

- 0 a 500 M

- 500M-1000M

- 1000M-5000M

- Otros

En función de la profundidad, el mercado de sistemas de cable submarino se segmenta en 0 a 500 m, 500 m a 1000 m, 1000 m a 5000 m y otros.

Por aplicación

- Cables de alimentación

- Cables de comunicación

Sobre la base de la aplicación, el mercado de sistemas de cables submarinos se segmenta en cables de alimentación y cables de comunicación.

Análisis y perspectivas regionales del mercado de sistemas de cable submarino

Se analiza el mercado del sistema de cable submarino y se proporcionan información y tendencias del tamaño del mercado por producto, voltaje, oferta, fibra de vidrio, tipo de cable, tipo de armadura, profundidad y aplicación como se menciona anteriormente.

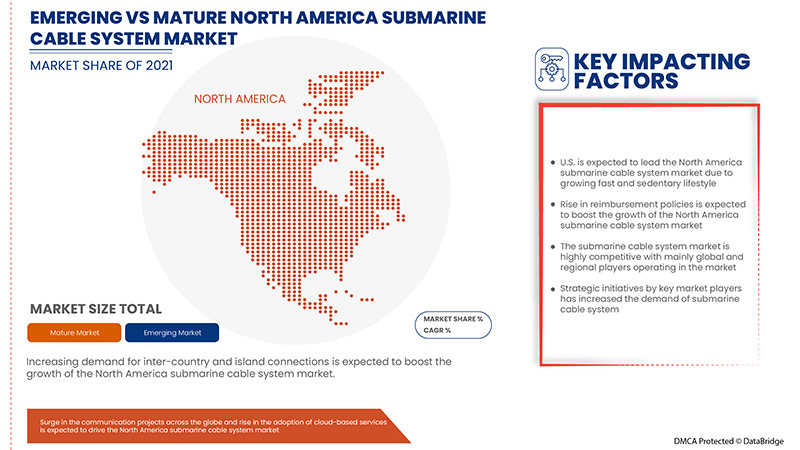

Los países cubiertos en el informe del mercado del sistema de cable submarino son Estados Unidos, Canadá y México.

Estados Unidos domina el mercado de sistemas de cables submarinos de América del Norte. Es probable que Estados Unidos sea el mercado de sistemas de cables submarinos de más rápido crecimiento. El creciente uso de sensores y tecnología de inteligencia artificial en las industrias se atribuye al dominio del mercado. Con el creciente desarrollo de la tecnología de automatización, se está incrementando la demanda de productos de sistemas de cables submarinos en la región de América del Norte.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de cable submarino

El panorama competitivo del mercado de sistemas de cable submarino proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de sistemas de cable submarino.

Algunos de los principales actores que operan en el mercado de sistemas de cable submarino son HENGTONG GROUP CO., LTD, TE Connectivity, Saudi Ericsson, APAR, NEC Corporation, NXT A/S, Norddeutsche Seekabelwerke GmbH (una subsidiaria de Prysmian Group), JDR Cable Systems Ltd, ZTT, Hexatronic Group, Alcatel Submarine Networks, Corning Incorporated, The Okonite Company, AFL (una subsidiaria de Fujikura Ltd.), LEONI, NEXANS, Ocean Specialists, Inc. (una subsidiaria de Continental Shelf Associates, Inc.), TFKable, Sumitomo Electric Industries, Ltd., Tratos, Hellenic Cables SA y HESFIBEL SUBSEA CABLES, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN THE COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE

5.1.2 RISE IN THE TREND OF OFFSHORE WIND POWER GENERATION

5.1.3 GROWING DEMAND FOR HIGH BANDWIDTH, LOW-LATENCY, AND HIGH REDUNDANCY OWING TO THE EMERGENCE OF 5G

5.1.4 RISE IN THE ADOPTION OF CLOUD-BASED SERVICES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS ACT AS ENTRY BARRIER FOR SMES

5.2.2 HIGH PROBABILITY OF DAMAGE DUE TO VULNERABLE CONDITIONS

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF SUBMARINE CABLE OWING TO THE INCREASING INTERNET TRAFFIC ACROSS THE REGION

5.3.2 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS FOR CABLE SYSTEMS

5.3.3 RISING INVESTMENTS BY OTT PROVIDERS TO CREATE ABUNDANT OPPORTUNITIES FOR SALES OF SUBMARINE CABLES

5.3.4 DEPLOYMENT OF VARIED TECHNOLOGIES IN SUBMARINE CABLE SYSTEMS

5.4 CHALLENGES

5.4.1 ALTERNATIVE MODES OF INTERNET SERVICE PROVISIONING

5.4.2 COMPLEX REPAIRING PROCEDURES

6 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DRY PLANT PRODUCTS

6.2.1 POWER FEEDING EQUIPMENT (PFE)

6.2.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

6.2.3 SUBMARINE LINE MONITOR (SLM)

6.2.4 OTHERS

6.3 WET PLANT PRODUCTS

6.3.1 CABLES

6.3.2 REPEATER

6.3.3 BRANCHING UNIT (BU)

6.3.4 OTHERS

7 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE

7.1 OVERVIEW

7.2 HIGH VOLTAGE

7.3 EXTRA HIGH VOLTAGE

7.4 MEDIUM VOLTAGE

8 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 INSTALLATION AND COMMISSIONING

8.3 REPAIR AND MAINTENANCE

8.4 UPGRADES

9 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS

9.1 OVERVIEW

9.2 UNREPEATERED

9.3 REPEATERED

10 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE

10.1 OVERVIEW

10.2 LOOSE TUBE CABLES

10.3 RIBBON CABLES

10.4 OTHERS

11 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE

11.1 OVERVIEW

11.2 SINGLE ARMOR

11.3 DOUBLE ARMOR

11.4 LIGHT WEIGHT ARMOR

11.5 ROCK ARMOR

12 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH

12.1 OVERVIEW

12.2 1000M-5000M

12.3 5000M-1000M

12.4 0M-500M

12.5 0THERS

13 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 COMMUNICATION CABLES

13.2.1 DRY PLANT PRODUCTS

13.2.1.1 POWER FEEDING EQUIPMENT (PFE)

13.2.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.2.1.3 SUBMARINE LINE MONITOR (SLM)

13.2.1.4 OTHERS

13.2.2 WET PLANT PRODUCTS

13.2.2.1 CABLES

13.2.2.2 REPEATER

13.2.2.3 BRANCHING UNIT (BU)

13.2.2.4 OTHERS

13.3 POWER CABLES

13.3.1 DRY PLANT PRODUCTS

13.3.1.1 POWER FEEDING EQUIPMENT (PFE)

13.3.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.3.1.3 SUBMARINE LINE MONITOR (SLM)

13.3.1.4 OTHERS

13.3.2 WET PLANT PRODUCTS

13.3.2.1 CABLES

13.3.2.2 REPEATER

13.3.2.3 BRANCHING UNIT (BU)

13.3.2.4 OTHERS

14 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ZTT

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HENGTONG GROUP CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT CATEGORIES

17.2.4 RECENT DEVELOPMENT

17.3 NKT A/S

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 CORNING INCORPORATED

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NEXANS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 HELLENIC CABLES S.A.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ALCATEL SUBMARINE NETWORKS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AFL (A SUBSIDIAIRY OF FUJIKURA LTD.)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APAR

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HESFIBEL SUBSEA CABLES

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HEXATRONIC GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 JDR CABLE SYSTEMS LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 LEONI

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NEC CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NORDDEUTSCHE SEEKABELWERKE GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 OCEAN SPECIALISTS, INC. (A SUBSIDIARY OF CONTINENTAL SHELF ASSOCIATES, INC.)

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SAUDI ERICSSON

17.17.1 COMPANY SNAPSHOT

17.17.2 SOLUTION PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SUMITOMO ELECTRIC INDUSTRIES, LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 TE CONNECTIVITY

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 SOLUTION PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TFKABLE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 THE OKONITE COMPANY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 TRATOS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA EXTRA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDIUM VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INSTALLATION AND COMMISSIONING IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA REPAIR AND MAINTENANCE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA UPGRADES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA UNREPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA REPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LOOSE TUBE CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA RIBBON CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SINGLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA DOUBLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA LIGHT WEIGHT ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ROCK ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA 1000M-5000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA 500M-1000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA 0M-500M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA COMMUNICATION CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA POWER CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 U.S. DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 61 U.S. SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 U.S. SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 63 U.S. SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 66 U.S. SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.S. COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 CANADA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 77 CANADA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 CANADA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 79 CANADA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 82 CANADA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 CANADA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 MEXICO DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 95 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 98 MEXICO SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 MEXICO COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 MEXICO WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 11 SURGE IN COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 DRY PLANT PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET FROM 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET

FIGURE 14 FDI PROJECTS FOR COMMUNICATIONS AND MEDIA (2019-2020)

FIGURE 15 OFFSHORE WIND ELECTRICITY GENERATION

FIGURE 16 NET ANNUAL WIND CAPACITY EXPANSIONS, 2018-2020

FIGURE 17 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2021

FIGURE 18 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2021

FIGURE 19 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2021

FIGURE 20 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2021

FIGURE 21 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2021

FIGURE 22 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2021

FIGURE 23 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2021

FIGURE 24 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: BY PRODUCT (2022-2029)

FIGURE 30 NORTH AMERICA SUBMARINE CABLE SYSTEM MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.