Mercado de diagnóstico de accidentes cerebrovasculares en América del Norte, por gravedad (moderada, grave, leve), tipo (tomografía computarizada (TC), angiografía por tomografía computarizada (ATC), imágenes por resonancia magnética (IRM), angiografía por resonancia magnética (ARM), ecografía Doppler transcraneal , prueba de impulso cefálico por video (VHIT), otros), aplicación (accidente cerebrovascular isquémico, accidente cerebrovascular hemorrágico, ataques isquémicos transitorios (TIAS)), usuario final (hospitales, clínicas, centros quirúrgicos ambulatorios, atención médica domiciliaria), canal de distribución (licitación directa, distribuidores externos, otros), etapa (preoperatoria, perioperatoria, posoperatoria), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de diagnóstico de accidentes cerebrovasculares en América del Norte

Análisis y perspectivas del mercado: mercado de diagnóstico de accidentes cerebrovasculares en América del Norte

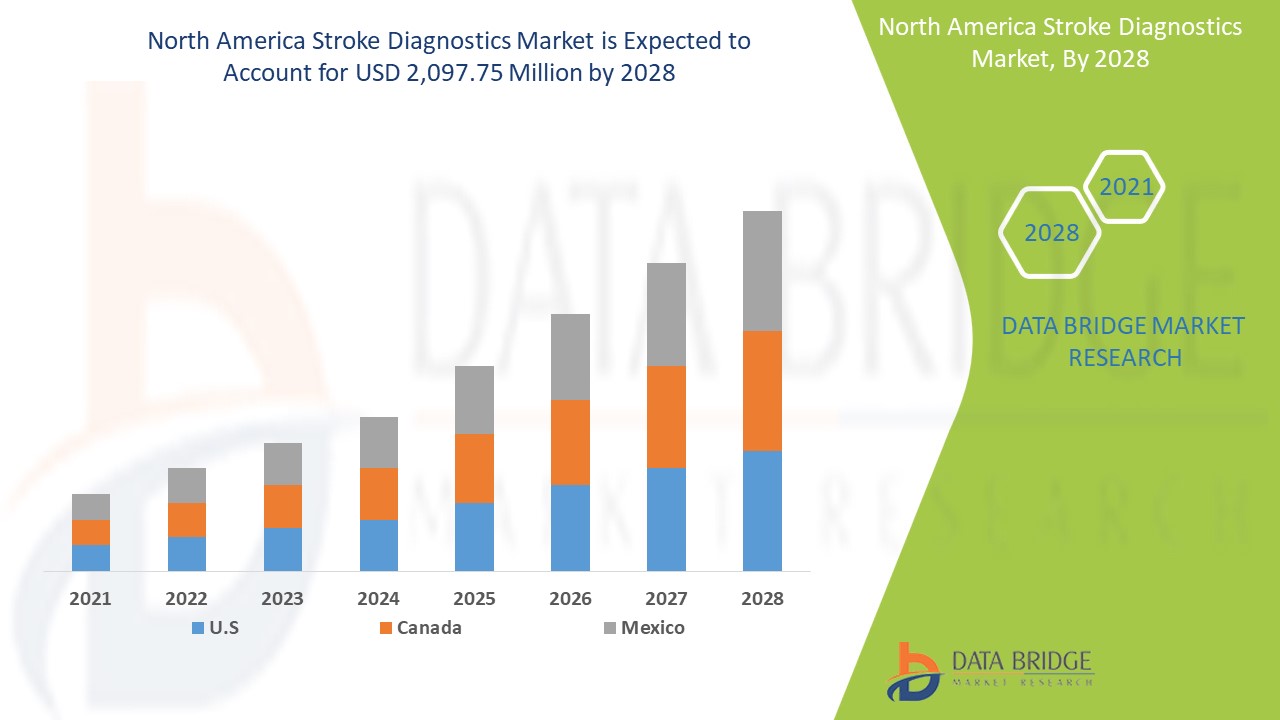

Se espera que el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,6% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 2097,75 millones para 2028. El crecimiento de la I+D en la industria de la salud y un aumento en el gasto en atención médica son los principales impulsores que se prevé que impulsen la demanda del mercado en el período de pronóstico. Por el contrario, las retiradas de productos están restringiendo el mercado.

Un accidente cerebrovascular se produce cuando el suministro de sangre al cerebro disminuye o se bloquea por completo, lo que impide que el tejido cerebral reciba oxígeno y nutrientes. Existen varios tipos de dispositivos de diagnóstico que se utilizan para detectar un accidente cerebrovascular y sus síntomas iniciales, por ejemplo, la tomografía computarizada (TC), la angiografía por tomografía computarizada (ATC), la resonancia magnética (RM), la angiografía por resonancia magnética (ARM), la ecografía Doppler transcraneal y otros.

La creciente incidencia de accidentes cerebrovasculares y enfermedades cardiovasculares y neurológicas ha aumentado la demanda de diagnósticos de accidentes cerebrovasculares en los países en desarrollo. Además, el aumento del gasto en atención médica está impulsando el crecimiento del mercado. Por otro lado, el alto costo del diagnóstico puede obstaculizar el crecimiento del mercado. La presencia de actores del mercado y los lanzamientos de nuevos productos brindan una oportunidad. Sin embargo, la falta de profesionales capacitados puede suponer un desafío para el mercado.

El informe de mercado de diagnóstico de accidentes cerebrovasculares proporciona detalles sobre la participación de mercado, los nuevos desarrollos, el impacto de los actores del mercado nacional y localizado, análisis de oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos , decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de diagnóstico de accidentes cerebrovasculares en América del Norte

Alcance y tamaño del mercado de diagnóstico de accidentes cerebrovasculares en América del Norte

El mercado de diagnóstico de accidentes cerebrovasculares de América del Norte está segmentado en función de la gravedad, el tipo, la aplicación, el usuario final, el canal de distribución y la etapa. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de la gravedad, el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte se segmenta en moderado, severo y leve. En 2021, se espera que el segmento moderado domine el mercado, con un aumento en las actividades de I+D.

- Según el tipo, el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte se segmenta en tomografía computarizada (TC), angiografía por tomografía computarizada (ATC), imágenes por resonancia magnética (IRM), angiografía por resonancia magnética (ARM), ecografía Doppler transcraneal, prueba de impulso cefálico por video (VHIT), otros. En 2021, se espera que el segmento de la tomografía computarizada (TC) domine el mercado con las crecientes iniciativas gubernamentales para proporcionar dispositivos más avanzados.

- En función de la aplicación, el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte se segmenta en accidentes cerebrovasculares isquémicos, accidentes cerebrovasculares hemorrágicos y ataques isquémicos transitorios (TIAS). En 2021, se espera que los accidentes cerebrovasculares isquémicos dominen el mercado con el creciente lanzamiento de productos por parte de los principales actores del mercado.

- En función de los usuarios finales, el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte está segmentado en hospitales, atención médica domiciliaria, centros quirúrgicos ambulatorios y clínicas. En 2021, se espera que el segmento hospitalario domine el mercado con la presencia de profesionales y personal capacitado.

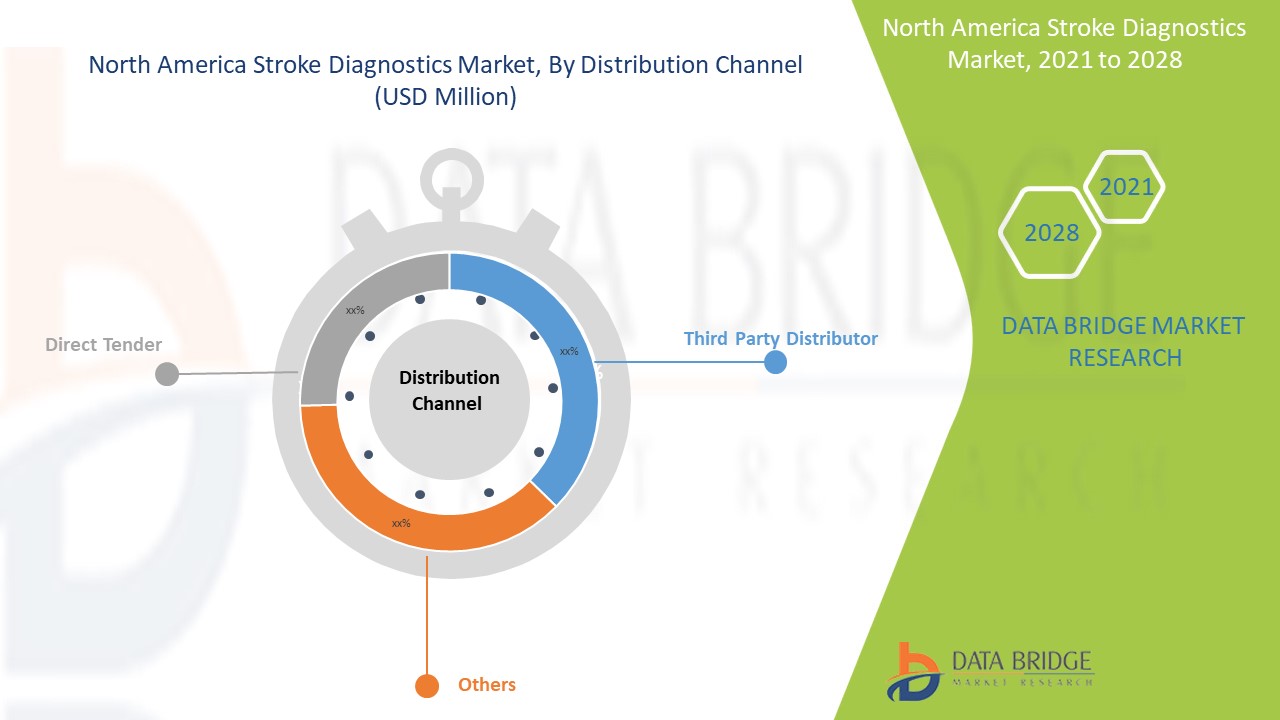

- En función del canal de distribución, el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte se segmenta en licitación directa, distribuidor externo y otros. En 2021, se espera que la licitación directa domine el mercado debido al creciente número de pacientes con accidentes cerebrovasculares.

- En función de la etapa, el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte se segmenta en preoperatorio, perioperatorio y posoperatorio. En 2021, se espera que el preoperatorio domine el mercado debido al creciente avance en el desarrollo de productos.

Análisis a nivel de país del mercado de diagnóstico de accidentes cerebrovasculares

Se analiza el mercado de diagnóstico de accidentes cerebrovasculares y se proporciona información sobre el tamaño del mercado en función de la gravedad, el tipo, la aplicación, los usuarios finales, el canal de distribución y la etapa.

Los países cubiertos en el informe del mercado de diagnóstico de accidentes cerebrovasculares de América del Norte son EE. UU., Canadá y México.

Se espera que el segmento de diagnóstico de accidentes cerebrovasculares en la región de América del Norte crezca a la tasa de crecimiento más alta en el período de pronóstico de 2021 a 2028 debido al aumento del desarrollo de la investigación para mejorar la calidad del producto. Se espera que EE. UU. lidere el crecimiento del mercado de diagnóstico de accidentes cerebrovasculares en América del Norte, y se anticipa que el segmento de licitación directa domine debido a la creciente incidencia de la enfermedad en el país.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El aumento de los avances y la tecnología para el desarrollo de nuevos productos está impulsando el crecimiento del mercado de diagnóstico de accidentes cerebrovasculares

El mercado de diagnóstico de accidentes cerebrovasculares también le ofrece un análisis detallado del mercado para el crecimiento de cada país en la industria de diagnóstico de accidentes cerebrovasculares con las ventas de medicamentos para el diagnóstico de accidentes cerebrovasculares, el impacto del avance en la tecnología de diagnóstico de accidentes cerebrovasculares y los cambios en los escenarios regulatorios con su apoyo al mercado de diagnóstico de accidentes cerebrovasculares. Los datos están disponibles para el período histórico de 2011 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de los diagnósticos de accidentes cerebrovasculares

El panorama competitivo del mercado de diagnóstico de accidentes cerebrovasculares proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de diagnóstico de accidentes cerebrovasculares.

Las principales empresas que operan en el mercado de diagnóstico de accidentes cerebrovasculares de América del Norte son Siemens, Koninklijke Philips NV, Stryker, Hologic, Inc., ESAOTE SPA, Medtron AG, Shenzhen Anke High-Tech CO., Ltd, Aspect Imaging Ltd, Siemens, FONAR Corp, FUJIFILM Holdings Corporation, General Electric Company, ALPINION MEDICAL SYSTEMS Co., Ltd., Ltd, TERASON DIVISION TERATECH CORPORATION, Analogic Corporation, Carestream Health, IMRIS, Deerfield Imaging Inc., Canon Inc., SAMSUNG, SternMed GmbH, entre otras.

Numerosos lanzamientos de productos y acuerdos son iniciados por empresas de todo el mundo, lo que también acelera el mercado del diagnóstico de accidentes cerebrovasculares.

Por ejemplo,

- En febrero de 2021, Koninklijke Philips NV anunció que había completado con éxito la adquisición de BioTelemetry, Inc., un proveedor líder con sede en EE. UU. de diagnóstico y monitoreo cardíaco remoto. La adquisición ha agregado los nuevos productos de detección portátiles tecnológicos a su cartera de productos

- En septiembre de 2021, SAMSUNG anunció que había completado la adquisición de la empresa HARMAN. La adquisición ha aumentado la cartera de productos y el avance tecnológico de la empresa.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando el mercado de la empresa en el mercado de diagnóstico de accidentes cerebrovasculares, lo que también proporciona el beneficio para que la organización mejore su oferta de diagnóstico de accidentes cerebrovasculares.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA STROKE DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 NORTH AMERICA STROKE DIAGNOSTICS MARKET: REGULATIONS

6.1 REGULATION IN THE U.S.

6.2 REGULATION IN EUROPE

6.3 REGULATION IN CHINA

6.4 REGULATION IN JAPAN

6.5 REGULATION IN SOUTH AFRICA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 TECHNOLOGICAL ADVANCEMENT

7.1.2 INCREASE IN THE INCIDENCE OF STROKE

7.1.3 INCREASE IN THE GERIATRIC POPULATION

7.1.4 INCREASE IN NUMBER OF PATIENTS WITH HYPERTENSION AND CORONARY HEART DISEASES

7.2 RESTRAINTS

7.2.1 HIGH COST OF DIAGNOSIS

7.2.2 INCREASE IN PRODUCT RECALL

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE SPENDING

7.3.2 INCREASE IN DIABETIC POPULATION AND OBESITY

7.3.3 INCREASE IN FDA APPROVAL AND PRODUCT LAUNCH

7.3.4 RISE IN AWARENESS REGARDING HEALTH AND STROKE

7.4 CHALLENGES

7.4.1 UNFAVORABLE REIMBURSEMENT SCENARIO

7.4.2 COMPLICATION RELATED TO DIAGNOSTIC DEVICES

8 IMPACT OF COVID-19 ON NORTH AMERICA STROKE DIAGNOSTICS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC INITIATIVES

8.5 CONCLUSION

9 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY

9.1 OVERVIEW

9.2 MODERATE

9.3 SEVERE

9.4 MILD

10 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE

10.1 OVERVIEW

10.2 COMPUTED TOMOGRAPHY (CT SCAN)

10.3 COMPUTED TOMOGRAPHY ANGIOGRAPHY (CTA)

10.4 MAGNETIC RESONANCE IMAGING (MRI)

10.5 MAGNETIC RESONANCE ANGIOGRAPHY (MRA)

10.6 TRANSCRANIAL DOPPLER ULTRASOUND

10.7 VIDEO HEAD IMPULSE TEST (VHIT)

10.8 OTHERS

10.8.1 CAROTID ULTRASOUND

10.8.2 CAROTID ANGIOGRAPHY

10.8.3 ELECTROCARDIOGRAPHY (EKG)

10.8.4 ECHOCARDIOGRAPHY

10.8.5 BLOOD TESTS

10.8.6 NUCLEAR NEUROIMAGING

10.8.7 OTHERS

11 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ISCHEMIC STROKE

11.2.1 THROMBOTIC STROKES

11.2.2 EMBOLIC STROKES

11.3 HEMORRHAGIC STROKE

11.3.1 INTRACEREBRAL HEMORRHAGE

11.3.2 SUBARACHNOID HEMORRHAGE

11.4 TRANSIENT ISCHEMIC ATTACKS (TIAS)

12 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 HOME HEALTHCARE

12.6 OTHERS

13 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE

14.1 OVERVIEW

14.2 PRE OPERATIVE

14.3 PERI OPERATIVE

14.4 POST OPERATIVE

15 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 STROKE DIAGNOSTICS MARKET COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SIEMENS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 KONINKLIJKE PHILIPS N.V.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GENERAL ELECTRIC COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 CANON INC

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ALPINION MEDICAL SYSTEMS CO., LTD

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 ANALOGIC CORPORATION

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ASPECT IMAGING LTD

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BPL MEDICAL TECHNOLOGIES

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 CARESTREAM HEALTH

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ESAOTE SPA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 FONAR CORP

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 FUJIFILM HOLDINGS CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 HOLOGIC, INC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 IMRIS, DEERFIELD IMAGING INC.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 MEDFIELD DIAGNOSTICS AB

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MEDTRON AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 NEUSOFT CORPORATION

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SAMSUNG

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 SHENXHEN ANKE HIGH-TECH CO., LTD.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SHIMADZU CORPORATION

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIUI

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 STERNMED GMBH

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 STRYKER

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 TERASON DIVISION TERATECH CORPORATION

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA MODERATE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA SEVERE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA MILD IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA COMPUTED TOMOGRAPHY (CT SCAN) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA COMPUTED TOMOGRAPHY ANGIOGRAPHY (CTA) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA MAGNETIC RESONANCE ANGIOGRAPHY (MRA) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSCRANIAL DOPPLER ULTRASOUND IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA VIDEO HEAD IMPULSE TEST (VHIT) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA ISCHEMIC STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA HEMORRHAGIC STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSIENT ISCHEMIC ATTACKS (TIAS) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA HOSPITAL IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA CLINICS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA HOME HEALTHCARE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA DIRECT TENDER IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA PRE OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA PERI OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA POST OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 44 U.S. STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 45 U.S. STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 U.S. OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 U.S. STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 48 U.S. ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 U.S. HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 U.S. STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 51 U.S. STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 52 U.S. STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 53 CANADA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 54 CANADA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 CANADA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 56 CANADA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 57 CANADA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 CANADA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 59 CANADA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 60 CANADA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 61 CANADA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 62 MEXICO STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 63 MEXICO STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 64 MEXICO OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 MEXICO STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 MEXICO ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 67 MEXICO HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 MEXICO STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 69 MEXICO STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 70 MEXICO STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STROKE DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STROKE DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STROKE DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA STROKE DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA STROKE DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR STROKE DIAGNOSTISIS EXPECTED TO DRIVE THE NORTH AMERICA STROKE DIAGNOSTICS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 MODERATE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA STROKE DIAGNOSTICS MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA STROKE DIAGNOSTICS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STROKE DIAGNOSTICS MARKET

FIGURE 15 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, 2020

FIGURE 16 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, 2020-2028 (USD MILLION)

FIGURE 17 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, CAGR (2021-2028)

FIGURE 18 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, LIFELINE CURVE

FIGURE 19 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, 2020

FIGURE 20 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, 2020-2028 (USD MILLION)

FIGURE 21 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 22 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, 2020

FIGURE 24 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, 2020-2028 (USD MILLION)

FIGURE 25 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 26 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, 2020

FIGURE 28 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, 2020-2028 (USD MILLION)

FIGURE 29 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, CAGR (2021-2028)

FIGURE 30 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 32 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

FIGURE 33 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 34 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, 2020

FIGURE 36 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, 2020-2028 (USD MILLION)

FIGURE 37 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, CAGR (2021-2028)

FIGURE 38 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, LIFELINE CURVE

FIGURE 39 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SNAPSHOT (2020)

FIGURE 40 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2020)

FIGURE 41 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 42 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 43 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY (2021-2028)

FIGURE 44 STROKE DIAGNOSTICS MARKET COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.