North America Spouted Pouches Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

993.36 Million

USD

1,950.47 Million

2024

2032

USD

993.36 Million

USD

1,950.47 Million

2024

2032

| 2025 –2032 | |

| USD 993.36 Million | |

| USD 1,950.47 Million | |

|

|

|

|

Segmentación del mercado de bolsas con boquilla en Norteamérica: por material (plástico, aluminio y papel), color (verde, rojo, negro, azul, plateado y dorado), componente (tapa, pajita y película), capa (cuatro, tres y dos), tamaño de la bolsa (menos de 200 ml, de 200 ml a 500 ml, de 500 ml a 1000 ml y más de 1000 ml), proceso de llenado (estándar, aséptico, autoclave y llenado en caliente), aplicación (alimentos, bebidas, cuidado personal y del hogar, automotriz, farmacéutica y otros): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de bolsas con boquilla en América del Norte

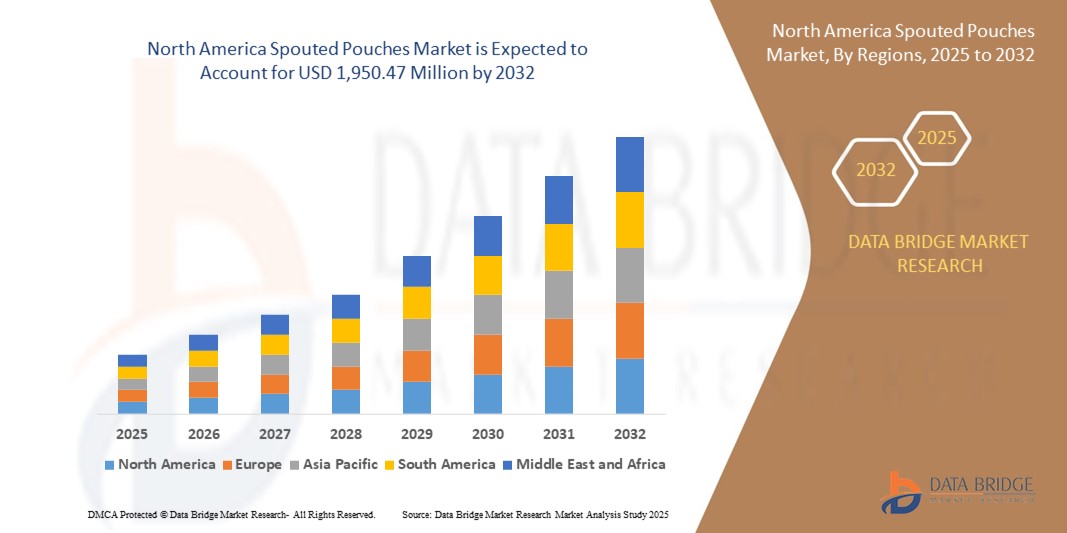

- El tamaño del mercado de bolsas con boquilla de América del Norte se valoró en USD 993,36 millones en 2024 y se espera que alcance los USD 1.950,47 millones para 2032 , con una CAGR del 8,80 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de formatos de envases ligeros, portátiles y resellables en los sectores de alimentos, bebidas y cuidado personal, junto con la creciente preferencia de los consumidores por soluciones de envases sostenibles y flexibles.

- Las crecientes inversiones en innovación de envases, como cierres a prueba de manipulaciones y tecnologías de películas de alta barrera, están acelerando aún más la expansión del mercado en toda la región.

Análisis del mercado de bolsas con boquilla en América del Norte

- El mercado en América del Norte está impulsado por un fuerte cambio de los consumidores hacia formatos de embalaje convenientes, una creciente adopción de materiales ecológicos y innovaciones en el diseño y la funcionalidad de las bolsas.

- Los fabricantes se centran cada vez más en la diferenciación de productos y la rentabilidad, con inversiones crecientes en materiales reciclables y de alta barrera para cumplir con las estrictas regulaciones ambientales.

- El mercado estadounidense de bolsas con boquilla representó la mayor participación en los ingresos, con un 79,4 %, en 2024 en América del Norte, impulsado por la alta demanda en los sectores de alimentos y bebidas y la adopción generalizada de soluciones de envasado flexible.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de bolsas con boquilla de América del Norte debido a la creciente demanda de soluciones de envasado sostenibles y livianas, el aumento de la inversión en innovaciones de procesamiento y envasado de alimentos y la creciente inclinación del consumidor hacia formatos de bolsas fáciles de usar y respetuosos con el medio ambiente en los sectores

- El segmento del plástico dominó el mercado con la mayor participación en ingresos en 2024, impulsado por su ligereza, durabilidad y altas propiedades de barrera contra la humedad y el oxígeno. Los materiales plásticos ofrecen excelente flexibilidad y compatibilidad con maquinaria de llenado de alta velocidad, lo que los hace adecuados para una amplia gama de aplicaciones en alimentos y bebidas. Además, los avances en películas plásticas reciclables y de origen biológico refuerzan aún más el dominio de este segmento.

Alcance del informe y segmentación del mercado de bolsas con boquilla en América del Norte

|

Atributos |

Perspectivas clave del mercado de bolsas con boquilla en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

• Creciente demanda de soluciones de embalaje sostenibles y reciclables • Creciente adopción de bolsas con boquilla en los segmentos emergentes de cuidado personal y alimentos para bebés |

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de bolsas con boquilla en América del Norte

Aumento del uso de bolsas con boquilla en alimentos para bebés y productos nutricionales

• La creciente adopción de bolsas con boquilla en alimentos para bebés y suplementos de salud está cambiando las estrategias de envasado entre los fabricantes, debido a su facilidad de uso, dispensación controlada y beneficios higiénicos que satisfacen tanto a los cuidadores como a los consumidores preocupados por la salud.

• Estas bolsas ofrecen una vida útil prolongada sin conservantes, reducen el peso del embalaje para fines logísticos y mejoran la seguridad del producto, todo lo cual es fundamental en segmentos que involucran a bebés y productos dietéticos.

• Por ejemplo, las empresas de los EE. UU. y Canadá han lanzado ampliamente purés de frutas orgánicos y mezclas de proteínas en bolsas con boquilla como parte de sus iniciativas de alimentos para bebés con etiqueta limpia, alineándose con la demanda de los consumidores de soluciones de alimentación más seguras y convenientes.

• En otro caso, las marcas de nutrición de alto rendimiento están cambiando los frascos y botellas por bolsas con boquilla para geles energéticos para llevar y batidos post-entrenamiento, respondiendo a las necesidades de los atletas de contar con envases portátiles y resellables.

• Este cambio está impulsando la innovación en la ciencia de los materiales, las tecnologías de llenado y la participación del consumidor, impulsando a las marcas hacia formatos de embalaje funcionales, sostenibles y aptos para niños que mejoran la confianza, la conveniencia y la diferenciación de la marca.

Dinámica del mercado de bolsas con boquilla en América del Norte

Conductor

Mayor preferencia por envases ligeros y sostenibles

• Las bolsas con boquilla están ganando terreno en América del Norte debido al creciente énfasis de los consumidores y los reguladores en la sostenibilidad, ya que utilizan mucho menos plástico y son más livianas en comparación con los contenedores rígidos, lo que genera menores emisiones de transporte y un menor impacto ambiental.

• Estas bolsas se alinean con las demandas del comercio minorista y el comercio electrónico al ofrecer un embalaje compacto y resistente a los daños que requiere menos espacio en los estantes y brinda una mejor eficiencia logística para fabricantes y distribuidores.

• Por ejemplo, los fabricantes de alimentos de EE. UU. están reemplazando cada vez más las voluminosas botellas de vidrio y los recipientes de plástico por bolsas con boquilla para productos como salsas, aderezos y condimentos, lo que resulta en menores costos de envío y una minimización de las roturas.

• De manera similar, las empresas de cuidado personal en Canadá están adoptando formatos de bolsas recargables para reducir los plásticos de un solo uso, lo que apoya tanto las preferencias de los consumidores como los objetivos nacionales de reducción de residuos de envases.

• Esta preferencia se ve reforzada aún más por los compromisos de la marca con la responsabilidad ambiental, los mandatos de reciclaje impulsados por el gobierno y una cadena de suministro de envases en evolución que se centra en mejorar la reciclabilidad y la eficiencia del ciclo de vida sin comprometer la integridad ni la facilidad de uso del producto.

Restricción/Desafío

Baja reciclabilidad de materiales flexibles multicapa

- La compleja estructura material de las bolsas con boquilla, a menudo compuestas de múltiples resinas plásticas y capas de lámina, plantea desafíos significativos para la reciclabilidad, ya que los sistemas de reciclaje municipales e industriales existentes en América del Norte no están equipados para procesar estos laminados híbridos de manera efectiva.

- Esto ha generado confusión y reacciones negativas entre los consumidores, en particular entre los compradores conscientes del medio ambiente que buscan soluciones de embalaje circulares, lo que presiona a las marcas para que justifiquen sus formatos de bolsas o inviertan en materiales alternativos.

- Por ejemplo, varias cadenas minoristas en los EE. UU. han enfrentado críticas por almacenar productos en bolsas no reciclables en pasillos con etiquetas de sostenibilidad, lo que provocó revisiones de políticas y auditorías de empaque para mejorar el cumplimiento de los materiales.

- En otro caso, grupos ecoactivistas de Canadá han hecho campaña contra el uso generalizado de envases flexibles de un solo uso, presionando a los municipios para que exijan un cumplimiento más estricto por parte de los fabricantes de productos envasados.

- Estas limitaciones están restringiendo una adopción más amplia a pesar de los beneficios funcionales de las bolsas con boquilla, lo que subraya la necesidad urgente de innovación en monomateriales, alternativas compostables y mejoras en la infraestructura de recuperación para alinear el crecimiento de la industria con los objetivos de sostenibilidad ambiental a largo plazo.

Alcance del mercado de bolsas con boquilla en América del Norte

El mercado está segmentado según el material, el color, el componente, la capa, el tamaño de la bolsa, el proceso de llenado y la aplicación.

- Por material

En cuanto a materiales, el mercado norteamericano de bolsas con boquilla se segmenta en plástico, aluminio y papel. El segmento de plástico dominó el mercado con la mayor participación en ingresos en 2024, gracias a su ligereza, durabilidad y alta barrera contra la humedad y el oxígeno. Los materiales plásticos ofrecen excelente flexibilidad y compatibilidad con maquinaria de llenado de alta velocidad, lo que los hace adecuados para una amplia gama de aplicaciones en alimentos y bebidas. Además, los avances en películas plásticas reciclables y de origen biológico refuerzan el dominio de este segmento.

Se prevé que el segmento del papel experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente preferencia de los consumidores por envases ecológicos y biodegradables. Las bolsas de papel con boquilla atraen a marcas y consumidores con conciencia ambiental que buscan reducir los residuos plásticos. Su creciente adopción en productos alimenticios orgánicos y artículos para el hogar sostenibles pone de manifiesto su creciente potencial de mercado.

- Por color

Según el color, el mercado se segmenta en verde, rojo, negro, azul, plateado y dorado. El segmento plateado obtuvo la mayor cuota de mercado en 2024, gracias a su aspecto premium, sus excelentes propiedades de barrera a la luz y su amplio uso en envases de alimentos, cuidado personal y productos farmacéuticos. Las bolsas plateadas suelen asociarse con la frescura y el alto valor del producto, lo que las convierte en la opción preferida de muchas marcas orientadas al consumidor.

Se prevé que el segmento ecológico experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente alineación de la marca con la conciencia ecológica y la sostenibilidad. Muchas líneas de productos orgánicos y naturales en Norteamérica están adoptando envases ecológicos para reforzar su posicionamiento ambiental.

- Por componente

Según el componente, el mercado se segmenta en tapa, pajita y película. El segmento de tapas dominó el mercado en 2024, ya que son esenciales para el resellado, la prevención de derrames y la comodidad del usuario. Las tapas mejoran la funcionalidad y la vida útil del producto, especialmente en alimentos para bebés, jugos y condimentos, donde el acceso repetido es frecuente.

Se prevé que el segmento de películas experimentará el mayor crecimiento entre 2025 y 2032, impulsado por los avances en películas multicapa que ofrecen mayor resistencia, resistencia al calor y protección del producto. Las innovaciones en películas también contribuyen a reducir el consumo total de material, en consonancia con los objetivos de ahorro de costes y sostenibilidad.

- Por capa

Según la capa, el mercado se segmenta en cuatro, tres y dos capas. El segmento de tres capas tuvo la mayor participación de mercado en 2024 gracias a su equilibrio entre costo, protección y rendimiento. Estas bolsas ofrecen propiedades de barrera adecuadas para la mayoría de los productos no perecederos sin el costo adicional de una cuarta capa.

Se espera que el segmento de dos capas experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la demanda de envases livianos y económicos para productos de corta duración, como jugos frescos, salsas y bebidas lácteas en los mercados locales y de pequeña escala.

- Por tamaño de bolsa

Según el tamaño de la bolsa, el mercado se segmenta en menos de 200 ml, de 200 ml a 500 ml, de 500 ml a 1000 ml y más de 1000 ml. El segmento de 200 ml a 500 ml dominó el mercado en 2024, gracias a su amplia aplicación en alimentos para bebés, bebidas deportivas y bebidas monodosis. Estos tamaños ofrecen un equilibrio ideal entre portabilidad y control de porciones para los consumidores que buscan un producto para llevar.

Se espera que el segmento de más de 1000 ML sea testigo de la tasa de crecimiento más rápida entre 2025 y 2032, a medida que los envases a granel se vuelven cada vez más comunes en los servicios de alimentos institucionales y los envases de recarga en los sectores de cuidado del hogar y cuidado personal.

- Por proceso de llenado

Según el proceso de llenado, el mercado se segmenta en estándar, aséptico, de retorta y llenado en caliente. El segmento de llenado en caliente representó la mayor cuota de mercado en 2024, ya que se utiliza ampliamente en el envasado de salsas, sopas, purés de frutas y bebidas, proporcionando una eficaz seguridad microbiana y una larga vida útil.

Se prevé que el segmento aséptico experimente el mayor crecimiento entre 2025 y 2032, debido a la creciente demanda de bebidas nutricionales listas para beber y sin conservantes. El llenado aséptico permite la seguridad del producto sin necesidad de refrigeración, atendiendo a la creciente base de consumidores de salud y bienestar.

- Por aplicación

En cuanto a su aplicación, el mercado norteamericano de bolsas con boquilla se segmenta en alimentos, bebidas, cuidado personal y del hogar, automoción, productos farmacéuticos y otros. El segmento alimentario dominó el mercado en 2024, impulsado por el aumento de la demanda de comidas preparadas, alimentos infantiles y condimentos. Las bolsas con boquilla para aplicaciones alimentarias ofrecen comodidad, capacidad de resellado y un control eficaz de las porciones, en línea con las preferencias del consumidor actual.

Se prevé que el segmento de cuidado personal y del hogar experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente tendencia de las bolsas rellenables para jabones líquidos, champús y detergentes. Las bolsas con boquilla en este segmento impulsan la sostenibilidad y las iniciativas de ahorro de costes mediante la reducción del material de embalaje y una mayor eficiencia en los envíos.

Análisis regional del mercado de bolsas con boquilla en América del Norte

- El mercado estadounidense de bolsas con boquilla representó la mayor participación en los ingresos, con un 79,4 %, en 2024 en América del Norte, impulsado por la alta demanda en los sectores de alimentos y bebidas y la adopción generalizada de soluciones de envasado flexible.

- La preferencia del consumidor está cambiando hacia formatos de envases ligeros, resellables y ecológicos, lo que impulsa el uso de bolsas con boquilla en alimentos para bebés, salsas y bebidas listas para beber.

- Además, los avances en la durabilidad del material de las bolsas, junto con una sólida infraestructura de comercio minorista y electrónico, están impulsando aún más el crecimiento del mercado.

- La presencia de fabricantes clave y las innovaciones en el diseño de boquillas y la impresión personalizada también contribuyen significativamente a la expansión del mercado.

Perspectiva del mercado de envases con boquilla en Canadá

Se prevé que Canadá experimente la tasa de crecimiento más rápida entre 2025 y 2032, debido a la creciente demanda de envases sostenibles y al aumento de las inversiones en los sectores de procesamiento de alimentos y cuidado personal. La creciente concienciación sobre la reducción de residuos de envases y la comodidad del consumidor está animando a los fabricantes a adoptar envases tipo bolsa. Además, el apoyo gubernamental a las iniciativas ambientales y la adopción de materiales reciclables para las bolsas están creando condiciones favorables para la expansión del mercado en la región.

Cuota de mercado de bolsas con boquilla en América del Norte

La industria de bolsas con boquilla de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen

- ProAmpac (EE. UU.)

- Berry Global Inc. (EE. UU.)

- Sonoco Products Company (EE. UU.)

- Sealed Air Corporation (EE. UU.)

- Glenroy, Inc. (EE. UU.)

- American Packaging Corporation (EE. UU.)

- WINPAK LTD. (Canadá)

- ProAmpac (EE. UU.)

- Glenroy, Inc. (EE. UU.)

- Sonoco Products Company (EE. UU.)

- Scholle IPN (Filial de SIG) (EE.UU.)

- Paquete de impresión. (EE. UU.)

- Paquete de porristas de Norteamérica (EE. UU.)

Últimos avances en el mercado de bolsas con boquilla en América del Norte

- En septiembre de 2021, Scholle IPN presentó una nueva solución de fijación con fijación para bolsas con boquilla como parte de su iniciativa de desarrollo de productos. Esta innovación busca mejorar la reciclabilidad y apoyar la transición hacia una economía circular, manteniendo el tapón unido a la bolsa, reduciendo así los residuos plásticos. Este desarrollo amplía la cartera de envases sostenibles de la compañía para envases flexibles de líquidos. Esta iniciativa no solo refuerza el compromiso de Scholle IPN con la responsabilidad ambiental, sino que también fortalece su posición competitiva ante la creciente demanda de soluciones de envasado ecológicas, contribuyendo positivamente a la transición del mercado hacia la sostenibilidad.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.