North America Sports Flooring Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4,869.15 Billion

USD

7,042.96 Billion

2022

2030

USD

4,869.15 Billion

USD

7,042.96 Billion

2022

2030

| 2023 –2030 | |

| USD 4,869.15 Billion | |

| USD 7,042.96 Billion | |

|

|

|

North America Sports Flooring Market, By Type (Rubber Flooring, PVC Flooring, Wood Flooring, Artificial Turf Flooring, Polyurethane Flooring, and Polypropylene Flooring), Application (Indoor and Outdoor), Sports (Gym, Basketball, Badminton, Tennis, Football, Dance and Aerobic Studio, Track and Field, Volleyball, and Others), End-Use (Commercial and Residential), Construction Type (Renovate/Maintained and New Construction), Sales Channel (Direct Sales and Sports Outlet) - Industry Trends and Forecast to 2030.

North America Sports Flooring Market Analysis and Size

Sports flooring involves specialized flooring solutions made for athletic and sporting events. There are many types of sports flooring, including rubber, hardwood, and synthetic materials. Basketball courts frequently have hardwood sports flooring installed because it provides great ball bounce and player traction and is frequently made of maple or oak. PVC or vinyl synthetic sports flooring is adaptable and can be tailored to different sports activities. Popular for indoor tracks, weightlifting areas, and aerobic studios is rubber sports flooring, which is known for its shock-absorbing qualities.

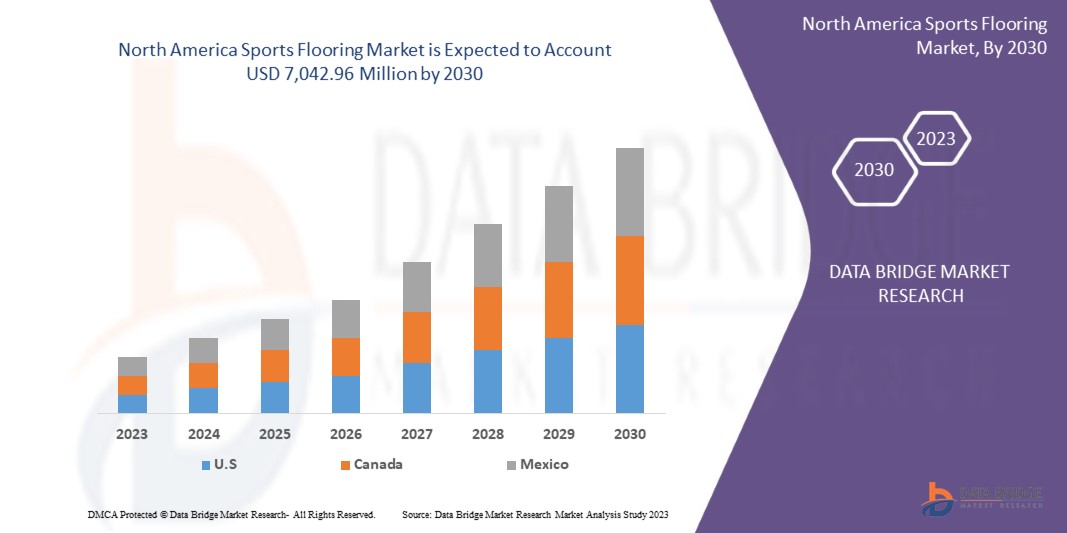

Data Bridge Market Research analyzes that the market is expected to reach USD 7,042.96 million by 2030 from USD 4,869.15 million in 2022, growing at a CAGR of 4.9% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Rubber Flooring, PVC Flooring, Wood Flooring, Artificial Turf Flooring, Polyurethane Flooring, and Polypropylene Flooring), Application (Indoor and Outdoor), Sports (Gym, Basketball, Badminton, Tennis, Football, Dance and Aerobic Studio, Track and Field, Volleyball, and Others), End-Use (Commercial and Residential), Construction Type (Renovate/Maintained and New Construction), Sales Channel (Direct Sales and Sports Outlet) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Rephouse Ltd, CONICA AG, Junckers Industrier A/S, FAB FLOORINGS INDIA, FLEXCOURT, Sika AG, Tarkett, Gerflor, Forbo Flooring Systems, Horner Sports Flooring., Asian Flooring India Private Limited, INDIANA SPORTS INFRA, SnapSports, LX Hausys, Abacus Sports, Hamberger Industriewerke GmbH, KTL SPORTS FLOORING, and Ecore International, among others |

Market Definition

Sports flooring involves specialized flooring solutions made for athletic and sporting events. These flooring options take into account elements such as shock absorption, traction, and ball bounce as they are engineered to offer safety, performance, durability, and comfort for athletes. Indoor sports facilities such as gyms, arenas, multipurpose halls, and fitness centers frequently have sports flooring installed.

Dinámica del mercado de suelos deportivos en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

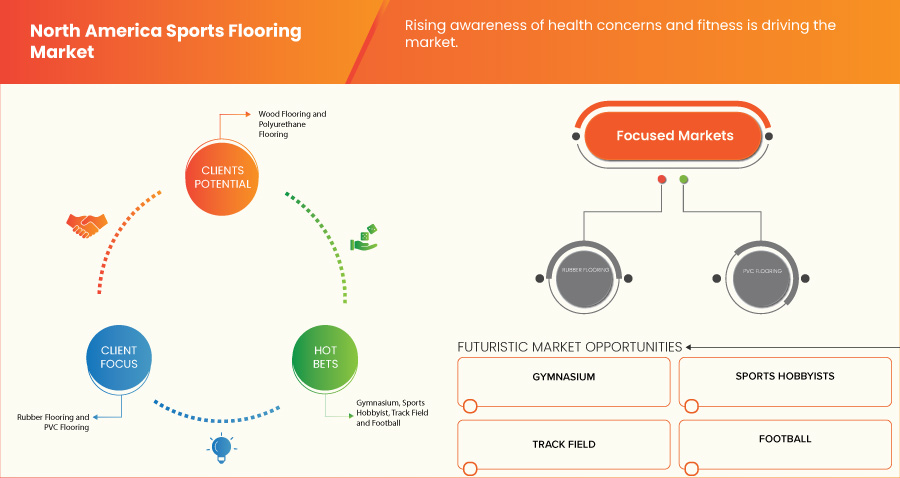

- Conciencia creciente sobre los problemas de salud y la aptitud física

La población en general está tomando conciencia de manera notable sobre los problemas de salud y la condición física. Las personas están buscando activamente formas de mejorar su bienestar general a medida que se vuelven más conscientes de los efectos negativos de un estilo de vida sedentario. Las personas están priorizando la actividad física regular y adoptando estilos de vida más saludables como resultado de esta creciente conciencia, que ha provocado un cambio significativo en el comportamiento del consumidor. El desarrollo del mercado de pisos deportivos en América del Norte está impulsado significativamente por la creciente conciencia de las personas sobre los problemas de salud y la condición física. Existe una creciente necesidad de opciones de pisos deportivos adecuadas a medida que las personas se vuelven más conscientes del valor de vivir un estilo de vida activo y participar en actividades físicas regulares.

La creciente prevalencia de enfermedades crónicas relacionadas con la inactividad y la mala condición física ha aumentado aún más la urgencia de que las personas tomen medidas proactivas para mantener su salud.

- Creciente participación de mujeres en diversas actividades deportivas

El mercado de suelos deportivos de América del Norte está creciendo como resultado del creciente número de mujeres que participan en diferentes actividades deportivas, como bádminton y baloncesto, entre otras. Ahora las mujeres participan mucho más activamente que nunca en los deportes y participan en todo tipo de actividades, desde deportes amateurs hasta competiciones conocidas. Este aumento de la participación de las mujeres en los deportes ha creado una demanda de soluciones especializadas de suelos deportivos que satisfagan sus necesidades y requisitos específicos.

El crecimiento de los deportes femeninos se ha visto favorecido por la aparición de nuevas ligas y competiciones, así como por la atención de los medios de comunicación y las oportunidades de patrocinio. Ahora, las mujeres de todas las edades se sienten más alentadas a participar en deportes y a dar alta prioridad a su condición física como resultado de esta mayor visibilidad y reconocimiento.

Las empresas del sector de suelos deportivos tienen la oportunidad de beneficiarse de la creciente popularidad de los deportes femeninos ofreciendo productos de suelos de alta calidad adaptados a sus necesidades particulares.

- Creciente preocupación por la seguridad y el rendimiento de los atletas

Cada vez se hace más hincapié en proporcionar entornos seguros y propicios para que los atletas maximicen su rendimiento y minimicen el riesgo de lesiones. Los atletas, entrenadores y administradores de instalaciones deportivas buscan activamente soluciones de vanguardia para reducir estos riesgos debido a la creciente conciencia de los posibles efectos a largo plazo de las lesiones relacionadas con el deporte en la salud. Los suelos deportivos son esenciales para proporcionar una superficie que anime y proteja a los atletas, ayudando a desviar el impacto, ofrecer tracción y reducir la posibilidad de tropiezos, resbalones y caídas.

Los organismos reguladores y las organizaciones encargadas de la reglamentación y los estándares deportivos también reconocen la importancia del rendimiento y la seguridad de los deportistas, lo que ha llevado a la inclusión de directrices específicas para los suelos deportivos en sus normas. Esto aumenta la necesidad de soluciones para suelos deportivos que cumplan con las normas.

Oportunidades

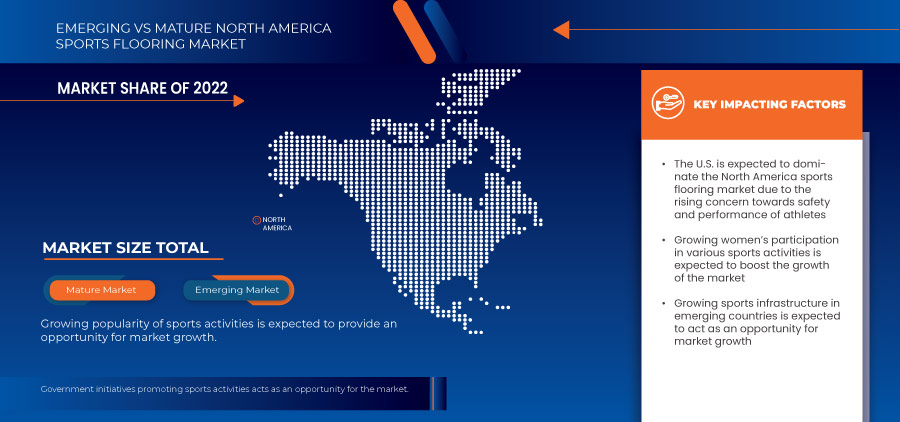

- Creciente infraestructura deportiva en la región

Uno de los requisitos clave para las instalaciones deportivas es contar con suelos deportivos de alta calidad que ofrezcan rendimiento, seguridad y durabilidad. Esto crea un entorno favorable para el crecimiento del mercado de suelos deportivos en América del Norte.

Además, la construcción de instalaciones deportivas multiusos en países emergentes aumenta las oportunidades de mercado. Estas instalaciones atienden una variedad de actividades deportivas y recreativas, como baloncesto, voleibol, tenis y fútbol sala. Los sistemas de pisos deportivos versátiles que pueden adaptarse a múltiples deportes se vuelven cruciales para estos lugares, lo que impulsa la demanda de materiales de pisos deportivos adaptables y duraderos.

La creciente demanda de instalaciones deportivas, eventos regionales e internacionales, ligas deportivas profesionales, recintos multiusos y promoción de la salud contribuyen a la creciente necesidad de soluciones de suelos deportivos de alta calidad. Por lo tanto, se crean amplias oportunidades para el crecimiento del mercado de suelos deportivos de América del Norte en el futuro cercano.

- Gobierno toma iniciativas para promover las actividades deportivas

Los gobiernos de las economías en desarrollo están tomando iniciativas y realizando inversiones para desarrollar infraestructura deportiva con el fin de promover el deporte y los estilos de vida saludables. Estas iniciativas impulsan la demanda de soluciones para suelos deportivos y crean oportunidades para que los actores del mercado ofrezcan sus productos y servicios.

Cuando los gobiernos priorizan e invierten en el desarrollo deportivo, crean un entorno favorable para el crecimiento de la infraestructura deportiva, lo que genera una mayor demanda de soluciones de pisos deportivos.

Por lo tanto, la financiación y los subsidios gubernamentales para clubes deportivos, academias e instituciones educativas pueden impulsar el mercado de los pisos deportivos. El apoyo financiero permite a estas organizaciones mejorar sus instalaciones, incluida la inversión en pisos deportivos de calidad. Los fabricantes y proveedores pueden colaborar con estas instituciones para proporcionar soluciones de pisos a medida que cumplan con sus requisitos específicos, lo que genera mayores oportunidades comerciales.

Restricciones/Desafíos

- Dependencia de mano de obra calificada y disponibilidad limitada de mano de obra

La instalación de suelos deportivos requiere conocimientos y habilidades especializadas. Es fundamental contar con profesionales capacitados que comprendan las complejidades de las técnicas de instalación adecuadas, la preparación de la superficie y la aplicación del adhesivo. Sin embargo, puede haber escasez de mano de obra calificada con experiencia en la instalación de suelos deportivos, lo que puede dificultar la finalización oportuna y eficiente de los proyectos.

La mano de obra calificada desempeña un papel fundamental para garantizar que el piso se instale correctamente, lo que incluye una nivelación adecuada, marcas de línea y acabados sin juntas. La disponibilidad limitada de trabajadores calificados puede dar lugar a un compromiso en el control de calidad, lo que puede dar como resultado instalaciones deficientes e insatisfacción del cliente.

- Altos costos de instalación y compra

El costo de compra e instalación es una barrera importante para el mercado de pisos deportivos de América del Norte. Las empresas de esta industria enfrentan obstáculos difíciles como resultado de los costos relacionados con la compra e instalación de sistemas de pisos deportivos. Los materiales y equipos de pisos deportivos de alta calidad pueden ser costosos al principio, y la instalación por parte de expertos también puede ser bastante costosa.

Además, los suelos deportivos suelen ser más caros que los suelos convencionales debido a su naturaleza especializada, que debe cumplir con estrictos estándares de seguridad y rendimiento. Los costes más elevados son resultado de la necesidad de materiales, ingeniería y métodos de fabricación de vanguardia para garantizar una absorción de impactos, tracción y durabilidad ideales. Por lo tanto, los altos costes de instalación y compra son una limitación del mercado para los suelos deportivos.

Acontecimientos recientes

- En julio de 2023, Tarkett lanzó PureGrain, un avance que está destinado a cambiar por completo el panorama de los campos deportivos. Este producto innovador, elaborado a partir de mazorcas de maíz, no solo representa un gran paso hacia un futuro más ecológico, sino que también ofrece un gran rendimiento para atletas de todos los niveles. Este tipo de lanzamiento de productos ha ayudado a la empresa a ampliar su cartera de productos y ganar una nueva base de consumidores.

- En abril de 2023, la empresa anunció el lanzamiento de seis nuevos diseños de arce. Estos diseños de Taraflex son increíblemente realistas y replican nuestras tiras de arce Connor al tiempo que simulan el piso más prestigioso de la NBA. Este tipo de lanzamiento de productos ayudará a la empresa a obtener una ventaja competitiva en el mercado.

- En septiembre de 2021, el fabricante de materiales de construcción y diseño de interiores LX Hausys se unió a una oferta para adquirir una participación en la empresa de muebles Hanssem. LX Hausys informó que planea invertir 300 mil millones de wones (USD 259 millones) en una empresa de propósito especial formada por IMM Private Equity (PE). Hanssem fabrica pisos, puertas y ventanas. Con esta adquisición, se espera que LX Hausys fortalezca su presencia en el mercado local del diseño de interiores utilizando la sinergia entre las dos empresas.

- En 2021, el organismo rector internacional del baloncesto, la FIBA, y Junckers Industier A/s firmaron un acuerdo a largo plazo en virtud del cual Junckers proporcionará suelos de madera a nivel mundial para el año 2024. Este acuerdo está ayudando a la empresa a generar una facturación estable y ganar una nueva base de consumidores mediante la promoción de su imagen de marca.

Alcance del mercado de suelos deportivos en América del Norte

El mercado de suelos deportivos de América del Norte se divide en seis segmentos importantes según el tipo, la aplicación, el deporte, el uso final, el tipo de construcción y el canal de venta. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento de las industrias y proporcionará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Tipo

- Pisos de caucho

- Suelos de PVC

- Pisos de madera

- Pavimento de césped artificial

- Pisos de poliuretano

- Pisos de polipropileno

Según el tipo, el mercado está segmentado en pisos de caucho, pisos de PVC, pisos de madera, pisos de césped artificial, pisos de poliuretano y pisos de polipropileno.

Solicitud

- Interior

- Exterior

Según la aplicación, el mercado está segmentado en interior y exterior.

Deportes

- Gimnasia

- Baloncesto

- Bádminton

- Tenis

- Fútbol americano

- Estudio de danza y aeróbic

- Atletismo

- Voleibol

- Otros

En función de los deportes, el mercado está segmentado en gimnasio, baloncesto, bádminton, tenis, fútbol, estudio de danza y aeróbic, atletismo, voleibol y otros.

Uso final

- Comercial

- Residencial

En función del uso final, el mercado se segmenta en comercial y residencial.

Tipo de construcción

- Renovar/Mantener

- Nueva construcción

En función del tipo de construcción, el mercado se segmenta en renovación/mantenimiento y nueva construcción.

Canal de venta

- Ventas directas

- Outlet de deportes

Sobre la base del canal de ventas, el mercado está segmentado en venta directa y puntos de venta deportivos.

Análisis y perspectivas regionales del mercado de suelos deportivos de América del Norte

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación, deportes, uso final, tipo de construcción y canal de ventas como se menciona anteriormente.

Los países del mercado de pisos deportivos de América del Norte son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado de suelos deportivos de América del Norte debido a la creciente concienciación sobre las preocupaciones relacionadas con la salud y la forma física. La creciente preocupación por la seguridad y el rendimiento de los atletas también contribuye al crecimiento del mercado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas regionales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de suelos deportivos en América del Norte

El panorama competitivo del mercado de suelos deportivos de América del Norte proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de suelos deportivos de América del Norte.

Algunos de los participantes destacados que operan en el mercado de pisos deportivos de América del Norte son Rephouse Ltd, CONICA AG, Junckers Industrier A/S, FAB FLOORINGS INDIA, FLEXCOURT, Sika AG, Tarkett, Gerflor, Forbo Flooring Systems, Horner Sports Flooring., Asian Flooring India Private Limited, INDIANA SPORTS INFRA, SnapSports, LX Hausys, Abacus Sports, Hamberger Industriewerke GmbH, KTL SPORTS FLOORING y Ecore International, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES: NORTH AMERICA SPORTS FLOORING MARKET

4.3 VENDOR SELECTION CRITERIA

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTICS COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 RAW MATERIAL COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF SPORTS ACTIVITIES

5.1.2 RISING AWARENESS OF HEALTH CONCERNS AND FITNESS

5.1.3 GROWING WOMEN’S PARTICIPATION IN VARIOUS SPORTS ACTIVITIES

5.1.4 RISING CONCERN TOWARDS SAFETY AND PERFORMANCE OF ATHLETES

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION AND PURCHASE COSTS

5.2.2 VARIETY IN CONSUMER PREFERENCE

5.3 OPPORTUNITIES

5.3.1 GROWING SPORTS INFRASTRUCTURE IN THE REGION

5.3.2 GOVERNMENT INITIATIVES PROMOTING SPORTS ACTIVITIES

5.4 CHALLENGES

5.4.1 DEPENDENCY ON SKILLED LABOR AND LIMITED AVAILABILITY OF WORKFORCE

5.4.2 STRINGENT REGULATIONS REGARDING INSTALLATION

6 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE

6.1 OVERVIEW

6.2 RUBBER FLOORING

6.2.1 RECYCLED RUBBER FLOORING

6.2.2 VULCANIZED RUBBER FLOORING

6.3 PVC FLOORING

6.4 WOOD FLOORING

6.4.1 STANDARD

6.4.2 HIGH-END

6.5 ARTIFICIAL TURF FLOORING

6.6 POLYURETHANE FLOORING

6.7 POLYPROPYLENE FLOORING

7 NORTH AMERICA SPORTS FLOORING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INDOOR

7.2.1 RUBBER FLOORING

7.2.2 PVC FLOORING

7.2.3 WOOD FLOORING

7.2.4 POLYURETHANE FLOORING

7.2.5 POLYPROPYLENE FLOORING

7.2.6 ARTIFICIAL TURF FLOORING

7.3 OUTDOOR

7.3.1 ARTIFICIAL TURF FLOORING

7.3.2 PVC FLOORING

7.3.3 POLYURETHANE FLOORING

7.3.4 POLYPROPYLENE FLOORING

7.3.5 RUBBER FLOORING

8 NORTH AMERICA SPORTS FLOORING MARKET, BY SPORTS

8.1 OVERVIEW

8.2 GYM

8.3 BASKETBALL

8.4 BADMINTON

8.5 TENNIS

8.6 FOOTBALL

8.7 DANCE AND AEROBIC STUDIO

8.8 TRACK AND FIELD

8.9 VOLLEYBALL

8.1 OTHERS

9 NORTH AMERICA SPORTS FLOORING MARKET, BY END-USE

9.1 OVERVIEW

9.2 COMMERCIAL

9.3 RESIDENTIAL

10 NORTH AMERICA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE

10.1 OVERVIEW

10.2 RENOVATE/MAINTAINED

10.3 NEW CONSTRUCTION

11 NORTH AMERICA SPORTS FLOORING MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 SPORTS OUTLET

12 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TARKETT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 GERFLOR

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.3 LX HAUSYS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SIKA AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 HAMBERGER INDUSTRIEWERKE GMBH

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ABACUS SPORTS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ASIAN FLOORING INDIA PRIVATE LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CONICA AG

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ECORE INTERNATIONAL

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FAB FLOORINGS INDIA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FLEXCOURT

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 FORBO GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 HORNER SPORTS FLOORING.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 INDIANA SPORTS INFRA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 JUNCKERS INDUSTRIER A/S

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 KTL SPORTS FLOORING

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 REPHOUSE LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SNAPSPORTS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 3 NORTH AMERICA RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY, 2021-2030 (MILLION SQUARE FEET)

TABLE 14 U.S. SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 16 U.S. RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 U.S. INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.S. SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 22 U.S. SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 23 U.S. SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 25 CANADA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CANADA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 27 CANADA RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 CANADA INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 CANADA OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 CANADA SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 33 CANADA SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 34 CANADA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 35 CANADA SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 36 MEXICO SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 38 MEXICO RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 MEXICO INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MEXICO OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 44 MEXICO SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 45 MEXICO SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPORTS FLOORING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPORTS FLOORING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPORTS FLOORING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPORTS FLOORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SPORTS FLOORING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SPORTS FLOORING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SPORTS FLOORING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 NORTH AMERICA SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 11 GROWING POPULARITY OF SPORTS ACTIVITIES IS DRIVING THE GROWTH OF THE NORTH AMERICA SPORTS FLOORING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 RUBBER FLOORING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPORTS FLOORING MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPORTS FLOORING MARKET

FIGURE 15 NORTH AMERICA SPORTS FLOORING MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA SPORTS FLOORING MARKET: BY APPLICATION, 2022

FIGURE 17 NORTH AMERICA SPORTS FLOORING MARKET: BY SPORTS, 2022

FIGURE 18 NORTH AMERICA SPORTS FLOORING MARKET: BY END-USE, 2022

FIGURE 19 NORTH AMERICA SPORTS FLOORING MARKET: BY CONSTRUCTION TYPE, 2022

FIGURE 20 NORTH AMERICA SPORTS FLOORING MARKET: BY SALES CHANNEL, 2022

FIGURE 21 NORTH AMERICA SPORTS FLOORING MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.