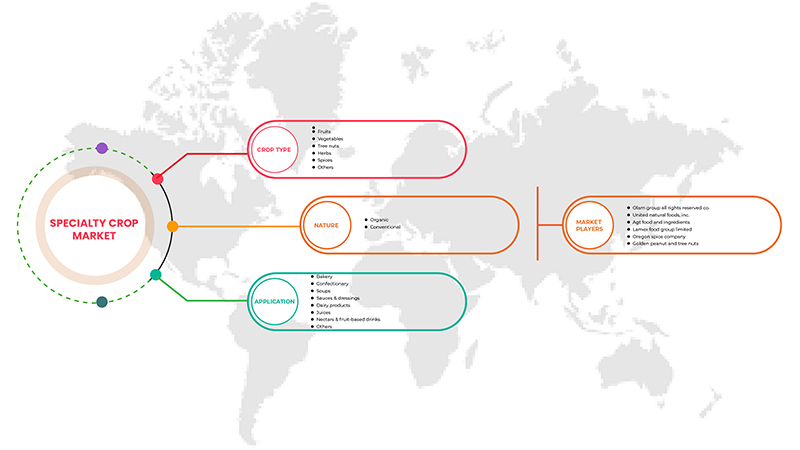

Mercado de cultivos especializados de América del Norte , por tipo de cultivo ( frutas , verduras, frutos secos , hierbas, especias y otros), naturaleza (orgánica y convencional), aplicación (productos lácteos, panadería, jugos, néctares y bebidas a base de frutas, confitería, sopas, salsas y aderezos y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de cultivos especiales de América del Norte

Las frutas y verduras, los frutos secos, las frutas deshidratadas, la horticultura y los cultivos de vivero son ejemplos de cultivos especializados (incluida la floricultura). También incluyen plantas exóticas cultivadas en una zona determinada debido a sus características topográficas y climáticas. Se ha documentado un cambio de paradigma en los hábitos alimentarios de los consumidores debido al crecimiento de la población y al aumento del ingreso disponible per cápita, lo que afecta directamente a la demanda de alimentos saludables. Otros factores que impulsan el mercado de cultivos especializados incluyen el aumento de la urbanización, la diversidad étnica, las preocupaciones sanitarias y los cambios en las características demográficas. Los principales impulsores de la industria de cultivos especializados incluyen la ampliación de la gama de aplicaciones de los cultivos especializados, el fomento de iniciativas gubernamentales y las políticas de libre comercio. Sin embargo, la expansión se ve limitada por las restricciones comerciales y ambientales.

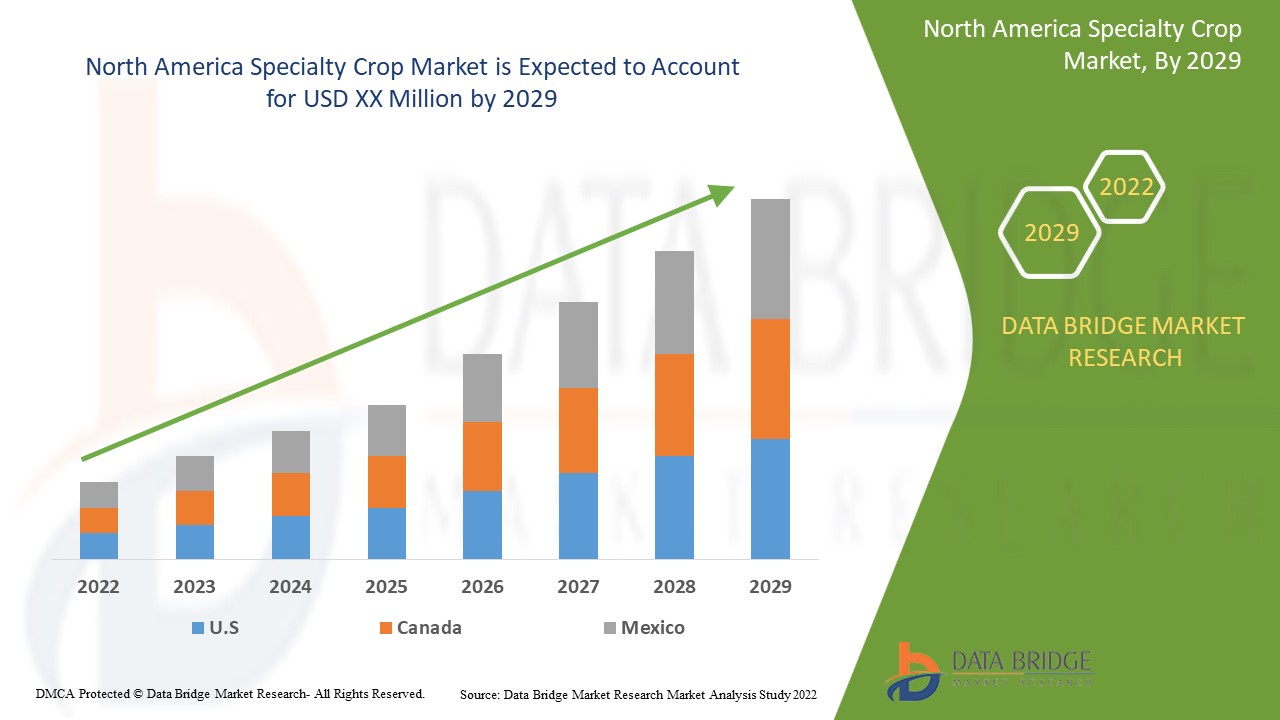

Data Bridge Market Research analiza que el mercado de cultivos especiales de América del Norte crecerá a una CAGR del 4,5 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en millones de unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de cultivo ( frutas , verduras, frutos secos , hierbas, especias y otros), naturaleza (orgánica y convencional), aplicación (productos lácteos, panadería, jugos, néctares y bebidas a base de frutas, confitería, sopas, salsas y aderezos y otros) |

|

Regiones cubiertas |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Banabay, Rice Fruit Company, Fisher Nut Company, SVZ Industrial Fruit & Vegetable Ingredients, United Natural Foods, Inc., Lamex Food Group Limited, Herbs N Spices International, Harbor Spice Co., Inc., Olam Group, Oregon Spice Company, Speciality Crop Company., INC., NUTSCO, AGT Food and Ingredients, Natural Specialty Crops, ULC, Golden Peanut and Tree Nuts, FARMER DIRECT ORGANIC y Barnes Williams, entre otros. |

Definición de mercado

Las frutas y verduras, los frutos secos, las frutas deshidratadas, la horticultura y los cultivos de vivero son ejemplos de cultivos especializados (incluida la floricultura). También incluyen plantas exóticas cultivadas en una zona determinada debido a sus características topográficas y climáticas. Se ha documentado un cambio de paradigma en los hábitos alimentarios de los consumidores debido al crecimiento de la población y al aumento del ingreso disponible per cápita, lo que afecta directamente a la demanda de alimentos saludables. Otros factores que impulsan el mercado de cultivos especializados incluyen el aumento de la urbanización, la diversidad étnica, los problemas de salud y los cambios en las características demográficas.

Dinámica del mercado de cultivos especiales en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores:

- Creciente inclinación de los consumidores hacia la comida vegana, natural y saludable

Como consumidor consciente, es una forma de vida particularmente beneficiosa porque hacerse vegano le aislaría por completo de los antibióticos peligrosos, las hormonas y la adulteración, que es una cultura muy extendida para asegurar una mayor vida útil de la mayoría de los productos animales. A medida que aumentan las exportaciones y el mundo se encoge, se utilizan más conservantes y composiciones químicas para garantizar que los alimentos sobrevivan el viaje. El veganismo también es una opción de estilo de vida no violento. La mayor conciencia de la gente sobre la salud la lleva a incluir más alimentos saludables en sus dietas, como hierbas medicinales, especias y frutos secos.

Por lo tanto, se espera que la creciente inclinación hacia los alimentos veganos y saludables debido al aumento de la conciencia de los beneficios nutricionales y medicinales sea un motor para el crecimiento del mercado de cultivos especiales.

- El creciente interés de los consumidores por una vida sana

El mercado norteamericano de cultivos especiales está siendo impulsado por un creciente deseo de un estilo de vida saludable entre las personas. La creciente preferencia de los consumidores por estilos de vida saludables se ha convertido en un motor para la creación de demanda de cultivos especiales. Independientemente de la industria, muchos pioneros han tenido en cuenta este motor y están invirtiendo activamente en empresas basadas en cultivos especiales. Un aspecto importante de llevar un estilo de vida saludable es comer alimentos saludables, como alimentos elaborados con cultivos especializados. Una dieta nutritiva es fundamental para una salud y nutrición óptimas. Protege contra una amplia gama de enfermedades crónicas, incluidas las enfermedades cardíacas, la diabetes y el cáncer. Una dieta saludable incluye comer una variedad de alimentos y consumir menos sal, azúcar, grasas saturadas y grasas trans generadas industrialmente. Además, un mayor conocimiento de las ventajas de un estilo de vida saludable hace que los consumidores seleccionen los mejores productos alimenticios saludables, que incluyen alimentos elaborados con cultivos especiales como nueces, especias, hierbas, etc.

Por lo tanto, la creciente conciencia y el conocimiento de las ventajas de un estilo de vida saludable hacen que los consumidores seleccionen los mejores productos alimenticios saludables, como los productos de cultivos especiales, convirtiéndose eventualmente en una fuerza impulsora importante para el crecimiento del mercado de cultivos especiales.

Restricciones

- Normas estrictas para los productos alimenticios

Por diversas razones, los cultivos especializados son particularmente vulnerables a la prevalencia de enfermedades transmitidas por los alimentos. Puede resultar complicado limpiar o desinfectar por completo los cultivos especializados porque, con frecuencia, se consumen crudos o con poca preparación, según la fruta o verdura en particular. A medida que avanza la tecnología, cuestiones como la responsabilidad y las leyes se vuelven más cruciales. Para reducir los peligros de las enfermedades transmitidas por los alimentos tanto como sea posible, los productores de cultivos especializados deben conocer las normas que pueden afectar a su negocio. Por estas razones, los organismos reguladores de alimentos, como la Administración de Alimentos y Medicamentos ("FDA") y el Servicio de Inocuidad e Inspección de Alimentos ("FSIS"), mantienen normas y regulaciones estrictas para la producción de estos cultivos.

Por lo tanto, estas regulaciones crearán una barrera para que muchos empresarios inicien y continúen en el mercado de cultivos especiales, lo que puede actuar como un importante freno para el crecimiento del mercado.

- Instalaciones limitadas para el cultivo de cultivos especiales

Los productores de cultivos especiales dependen en gran medida de insumos de mano de obra estacional. El suministro de alimentos de un país, especialmente su suministro de frutas y verduras frescas, puede estar en peligro si no hay suficiente mano de obra para satisfacer las demandas agrícolas y ganaderas. Los agricultores se ven obligados a vender sus productos a precios bajos a prestamistas locales debido a un transporte inadecuado. Los agricultores no pueden conservar sus alimentos cuando los precios son bajos porque no hay suficientes almacenes disponibles. Por lo tanto, estos factores explican en gran medida la baja producción de cultivos especiales. Esta falta de instalaciones desde la producción hasta la comercialización se convierte en una barrera importante para el crecimiento del mercado.

Por lo tanto, la falta de diversas instalaciones para el cultivo de cultivos, como riego, semillas, fertilizantes, transporte y otras funciones, puede actuar como una restricción al crecimiento del mercado.

Oportunidad

- Iniciativas gubernamentales y políticas de libre comercio

Las medidas gubernamentales positivas, como las iniciativas de ventas y marketing, la prevención de plagas y enfermedades de las plantas y la investigación y el desarrollo, contribuyen a la expansión de los cultivos especializados. El acceso a los mercados internacionales ayuda a que el negocio de los cultivos especializados crezca, al mismo tiempo que apoya los medios de vida de quienes trabajan en granjas y en industrias relacionadas. El Servicio de Comercialización Agrícola (AMS) administra iniciativas para abrir mercados nacionales e internacionales para los productores estadounidenses de alimentos, fibras y cultivos especializados. Para garantizar la disponibilidad y la calidad de alimentos saludables para los clientes de todo el país, el gobierno ha tomado varias iniciativas. El gobierno también proporcionó un programa de asistencia alimentaria para ayudar a los productores de cultivos especializados. Esta ayuda se proporcionó para alentar el desarrollo de cultivos especializados, como la horticultura, los frutos secos, las frutas, las verduras y el índigo.

Desafíos

- Alergias asociadas a los cultivos de frutos secos

Los frutos secos son una de las principales causas de alergia alimentaria. Parece que existen diferencias en la frecuencia de la alergia a los frutos secos entre países debido a otros hábitos alimentarios y procedimientos de cocción. Las reacciones alérgicas a los frutos secos pueden ser graves, a veces incluso mortales. La alergia alimentaria y los problemas bucales se diagnostican debido a la presencia de alérgenos en los frutos secos. Las personas son alérgicas a los frutos secos, especialmente los niños y los adultos, y esta población aumenta día a día. El crecimiento de las ventas ha ido disminuyendo desde que la gente es más consciente de su salud.

Además, las alergias a los frutos secos pueden ser mortales, y los frutos secos y las semillas son algunos de los alimentos que más desencadenan reacciones alérgicas graves que pueden poner en peligro la vida. En la región de América del Norte, las alergias a los frutos secos son comunes, siendo la alergia a las avellanas la más frecuente. Los anacardos son el segundo fruto seco más alérgico y un problema de salud importante en la región de América del Norte. No existe ningún tratamiento para las alergias a los frutos secos, salvo evitarlos y los alimentos que los contengan. Como resultado, esto ha tenido un impacto significativo en la reciente expansión de la industria de los frutos secos y se prevé que continúe en el futuro.

Por lo tanto, el crecimiento del mercado se ve obstaculizado debido a las alergias que provocan los frutos secos. Ahora, las personas son más conscientes de su salud y tienen cuidado de evitar las alergias que provocan los frutos secos y sus productos. Esto puede suponer un reto para el crecimiento del mercado de cultivos especiales de Norteamérica.

Impacto posterior a la COVID-19 en el mercado de cultivos especializados de América del Norte

Después de la pandemia, la demanda de cultivos especiales ha aumentado, ya que no habrá restricciones de movimiento; por lo tanto, el suministro de productos será fácil. La persistencia de COVID-19 durante un período más largo ha afectado a la cadena de suministro, ya que se vio interrumpida y se volvió difícil suministrar productos alimenticios a los consumidores, lo que inicialmente aumentó la demanda de productos. Sin embargo, después de COVID, la demanda de cultivos especiales ha aumentado significativamente debido al buen contenido de proteínas y otros nutrientes disponibles.

Acontecimientos recientes

- En julio de 2022, SVZ Industrial Fruit & Vegetable Ingredients anunció un plan de inversión para su planta de procesamiento belga en Rijkevorsel. Esta expansión ayudará a la empresa a satisfacer la creciente demanda de productos de frutas y verduras por parte de los consumidores al aumentar la capacidad de las instalaciones.

- En septiembre de 2020, The Fisher Nut Company presentó una nueva línea de envasado en cajas debido al aumento de la demanda de productos durante la COVID-19

Alcance del mercado de cultivos especiales de América del Norte

El mercado de cultivos especializados de América del Norte está segmentado en función del tipo de cultivo, la naturaleza y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de cultivo

- Verduras

- Frutas

- Frutos secos

- Hierbas

- Especias

- Otros

Según el tipo de cultivo, el mercado de cultivos especiales de América del Norte está segmentado en frutas, verduras, frutos secos, hierbas, especias y otros.

Naturaleza

- Convencional

- Orgánico

Según el tipo de producto, el mercado de cultivos especiales de América del Norte se segmenta en orgánico y convencional.

Solicitud

- Productos lácteos

- Panadería

- Jugos

- Néctares y bebidas a base de frutas

- Confitería

- Sopas

- Salsas y Aderezos

- Otros

Sobre la base del usuario final, el mercado de cultivos especiales de América del Norte está segmentado en productos lácteos, panadería, jugos, néctares y bebidas a base de frutas, confitería, sopas, salsas y aderezos, y otros.

Análisis y perspectivas regionales del mercado de cultivos especiales de América del Norte

Se analiza el mercado de cultivos especiales de América del Norte y se proporcionan información y tendencias del tamaño del mercado según el tipo de cultivo, la naturaleza y la aplicación, como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de cultivos especiales de América del Norte son Estados Unidos, Canadá y México.

En 2022, se espera que Estados Unidos domine el mercado de cultivos especiales de América del Norte en términos de participación de mercado e ingresos. Se estima que mantendrá su dominio durante el período de pronóstico debido a la creciente demanda de agricultura, y el consumo de alimentos es la principal razón del crecimiento de los cultivos especiales en la región de América del Norte.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de cultivos especializados en América del Norte

El competitivo mercado de cultivos especiales de América del Norte proporciona detalles sobre los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de cultivos especiales de América del Norte.

Algunos de los principales actores que operan en el mercado de cultivos especiales de América del Norte son Banabay, Rice Fruit Company, Fisher Nut Company, SVZ Industrial Fruit & Vegetable Ingredients, United Natural Foods, Inc., Lamex Food Group Limited, Herbs N Spices International, Harbor Spice Co., Inc., Olam Group, Oregon Spice Company, Speciality Crop Company., INC., NUTSCO, AGT Food and Ingredients, Natural Specialty Crops, ULC, Golden Peanut and Tree Nuts, FARMER DIRECT ORGANIC y Barnes Williams, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, América del Norte frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA SPECIALTY CROP MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION OF THE NORTH AMERICA SPECIALTY CROP MARKET

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF NORTH AMERICA SPECIALTY CROP MARKET

4.3.1 COMPANIES PROVIDING MORE OPTIONS IN SPECIALTY CROP PRODUCTS DUE TO THE RISING HEALTHY LIFESTYLE TREND

4.3.2 COMPANIES PROVIDING ONLINE AND DOORSTEP DELIVERY SERVICES DUE TO THE TREND OF CONVENIENCE IN PURCHASING PRODUCTS

4.4 TECHNOLOGICAL TRENDS

4.5 SUPPLY CHAIN OF NORTH AMERICA SPECIALTY CROPS MARKET

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 PROCESSING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 VALUE CHAIN ANALYSIS: NORTH AMERICA SPECIALTY CROP MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING INCLINATION OF THE CONSUMERS TOWARD VEGAN FOOD, NATURAL AND HEALTHY FOODS

5.1.2 THE INCREASED FOCUS OF CONSUMERS ON HEALTHY LIVING

5.1.3 INCREASING PUBLIC KNOWLEDGE OF THE HEALTH BENEFITS OF SPECIALTY CROPS

5.2 RESTRAINTS

5.2.1 STRICT REGULATIONS FOR FOOD PRODUCTS

5.2.2 LIMITED CROP GROWING FACILITIES FOR SPECIALTY CROPS

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES AND FREE TRADE POLICIES

5.3.2 ADVANCEMENTS IN AGRICULTURAL TECHNOLOGY

5.4 CHALLENGES

5.4.1 ADVERSE CLIMATIC CONDITION

5.4.2 ALLERGIES ASSOCIATED WITH TREE NUTS CROPS

6 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE

6.1 OVERVIEW

6.2 CONVENTIONAL

6.3 ORGANIC

7 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DAIRY PRODUCTS

7.2.1 ICE CREAM

7.2.2 CHEESE

7.2.3 MILK-POWDER

7.2.4 SPREADS

7.2.5 OTHERS

7.3 BAKERY

7.3.1 BREADS

7.3.2 CAKES & PASTRIES

7.3.3 BISCUIT & COOKIES

7.3.4 MUFFINS

7.3.5 OTHERS

7.4 JUICES

7.4.1 PINEAPPLE

7.4.2 ORANGE

7.4.3 MOSAMBI

7.4.4 GUAVA

7.4.5 APPLE

7.4.6 STRAWBERRY

7.4.7 OTHERS

7.5 NECTARS & FRUIT-BASED DRINKS

7.6 CONFECTIONERY

7.6.1 CHOCOLATE

7.6.2 CREAM FEELINGS

7.6.3 HARD & SOFT CANDY

7.6.4 GUMS & JELLY

7.6.5 OTHERS

7.7 SOUPS

7.8 SAUCES & DRESSINGS

7.9 OTHERS

8 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE

8.1 OVERVIEW

8.2 FRUIT

8.2.1 COFFEE

8.2.2 BANANA

8.2.3 MANGO

8.2.4 APPLE

8.2.5 CITRUS

8.2.6 GRAPE

8.2.7 GUAVA

8.2.8 STRAWBERRY

8.2.9 LITCHI

8.2.10 COCONUT

8.2.11 AVOCADO

8.2.12 KIWI

8.2.13 GOOSEBERRY

8.2.14 CHERRY

8.2.15 BLACKBERRY

8.2.16 BLUEBERRY

8.2.17 CRANBERRY

8.2.18 CURRANT

8.2.19 CHOKEBERRY

8.2.20 DATE

8.2.21 FIG

8.2.22 OLIVE

8.2.23 BREADFRUIT

8.2.24 CACAO

8.2.25 CHERIMOYA

8.2.26 MACADAMIA

8.2.27 FEIJOA FRUIT

8.2.28 NECTARINE

8.3 VEGETABLES

8.3.1 LENTILS

8.3.2 TOMATOES

8.3.3 CUCUMBER

8.3.4 GARLIC

8.3.5 GARLIC

8.3.6 EGGPLANTS

8.3.7 CARROT

8.3.8 PEPPERS

8.3.9 CAULIFLOWER

8.3.10 PEA (GARDEN, DRY, EDIBLE)

8.3.11 BEET

8.3.12 BROCCOLI

8.3.13 LETTUCE

8.3.14 ASPARAGUS

8.3.15 CELERY

8.3.16 CHIVE

8.3.17 COLLARDS

8.3.18 ARTICHOKE

8.3.19 CELERIAC

8.3.20 EDAMAME

8.3.21 ENDIVE

8.3.22 HORSERADISH

8.3.23 KOHLRABI

8.3.24 LEEK

8.4 TREE NUT

8.4.1 ALMONDS

8.4.2 CASHEWS

8.4.3 HAZELNUTS

8.4.4 MACADAMIA NUTS

8.4.5 PINE NUTS

8.4.6 CHESTNUTS

8.4.7 HICKORY NUTS

8.4.8 BRAZIL NUTS

8.4.9 PECANS

8.4.10 ACORNS

8.5 HERBS

8.5.1 CORIANDER

8.5.2 MINT

8.5.3 BASIL

8.5.4 ALOE VERA

8.5.5 PARSLEY

8.5.6 LAVENDER

8.5.7 ROSEMARY

8.5.8 THYME

8.5.9 DILL

8.5.10 JASMINE

8.5.11 CHIVES

8.5.12 CATNIP

8.5.13 OTHERS

8.6 SPICES

8.6.1 CRUSHED RED PEPPER

8.6.2 GARLIC

8.6.3 GINGER

8.6.4 TURMERIC

8.6.5 CORIANDER SEEDS

8.6.6 CUMIN

8.6.7 BLACK PEPPER

8.6.8 CARDAMOM

8.6.9 CLOVE

8.6.10 FENUGREEK

8.6.11 MUSTARD SEEDS

8.6.12 CURRY POWDER

8.6.13 NUTMEG

8.6.14 CELERY SEEDS

8.6.15 CASSIA BARK

8.6.16 MACE

8.6.17 OTHERS

8.7 OTHERS

9 NORTH AMERICA SPECIALTY CROP MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 OLAM GROUP ALL RIGHTS RESERVED CO.

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 UNITED NATURAL FOODS, INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 AGT FOOD AND INGREDIENTS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 LAMEX FOOD GROUP LIMITED

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 GOLDEN PEANUT AND TREE NUTS

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 OREGON SPICE COMPANY

12.6.1 COMPANY SNAPSHOT

12.6.2 COMPANY SHARE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BANABAY

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 BARNES WILLIAMS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 FARMER DIRECT ORGANIC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 FISHER NUT COMPANY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 FRUIT+ VEG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 HARBOR SPICE CO., INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 HERBS N SPICES INTERNATIONAL

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NATURAL SPECIALTY CROPS, ULC

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 NUTSCO

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 RICE FRUIT COMPANY

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 SIMPED FOODS PTY LTD.

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 SPECIALTY CROP COMPANY. INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 SVZ INDUSTRIAL FRUIT & VEGETABLE INGREDIENTS

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 3 NORTH AMERICA CONVENTIONAL IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CONVENTIONAL IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 5 NORTH AMERICA ORGANIC IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ORGANIC IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 9 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 13 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 19 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 21 NORTH AMERICA NECTARS & FRUIT-BASED DRINKS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA NECTARS & FRUIT-BASED DRINKS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 23 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 27 NORTH AMERICA SOUPS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SOUPS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 NORTH AMERICA SAUCES & DRESSINGS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SAUCES & DRESSINGS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 35 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 37 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 41 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 43 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 45 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 NORTH AMERICA SPECIALTY CROP MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SPECIALTY CROP MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 49 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 51 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 53 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 55 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 57 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 59 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 61 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 63 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 65 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 67 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 69 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 U.S. SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 75 U.S. FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 76 U.S. FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 77 U.S. VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 78 U.S. VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 79 U.S. TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 80 U.S. TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 81 U.S. HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 82 U.S. HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 83 U.S. SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 84 U.S. SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 85 U.S. SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 86 U.S. SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 87 U.S. SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 89 U.S. BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 U.S. CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 U.S. DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 U.S. JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 CANADA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 99 CANADA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 100 CANADA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 101 CANADA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 102 CANADA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 103 CANADA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 104 CANADA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 105 CANADA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 106 CANADA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 107 CANADA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 108 CANADA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 109 CANADA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 110 CANADA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 111 CANADA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 CANADA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 113 CANADA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 CANADA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 117 CANADA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 119 CANADA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 MEXICO SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 123 MEXICO FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 124 MEXICO FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 125 MEXICO VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 126 MEXICO VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 127 MEXICO TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 128 MEXICO TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 129 MEXICO HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 130 MEXICO HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 131 MEXICO SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 132 MEXICO SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 133 MEXICO SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 135 MEXICO SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 137 MEXICO BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 139 MEXICO CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 MEXICO DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 143 MEXICO JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 NORTH AMERICA SPECIALTY CROP MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPECIALTY CROP MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPECIALTY CROP MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPECIALTY CROP MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA SPECIALTY CROP MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPECIALTY CROP MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SPECIALTY CROP MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA SPECIALTY CROP MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SPECIALTY CROP MARKET: SEGMENTATION

FIGURE 10 THE RISING TREND OF EXOTIC FLAVOURS AMONG MILLENNIALS IS EXPECTED TO DRIVE THE NORTH AMERICA SPECIALTY CROP MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE VEGETABLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPECIALTY CROP MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF INDIA FOOD INGREDIENTS

FIGURE 13 VALUE CHAIN OF SPECIALTY CROP

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPECIALTY CROP MARKET

FIGURE 15 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2021

FIGURE 16 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2021

FIGURE 17 NORTH AMERICA SPECIALITY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA SPECIALTY CROP MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA SPECIALTY CROP MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA SPECIALTY CROP MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA SPECIALTY CROP MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA SPECIALTY CROP MARKET: BY TYPE (2022-2029)

FIGURE 23 NORTH AMERICA SPECIALTY CROPS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.