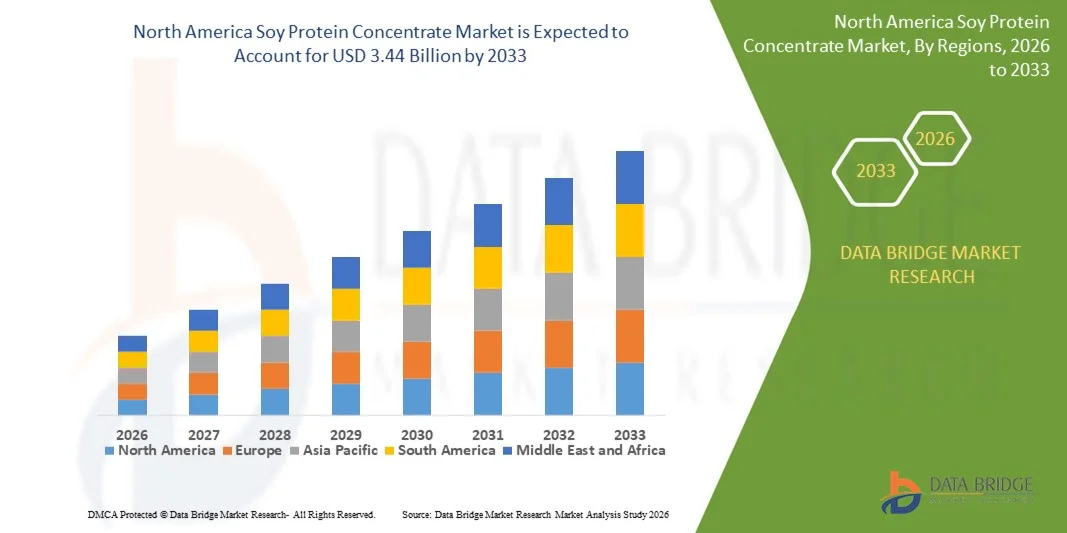

North America Soy Protein Concentrate Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.26 Billion

USD

3.44 Billion

2025

2033

USD

1.26 Billion

USD

3.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.26 Billion | |

| USD 3.44 Billion | |

|

|

|

|

Segmentación del mercado de concentrado de proteína de soya en Norteamérica por categoría (compuesto único y compuesto fortificado), proceso de extracción (lavado con alcohol acuoso, lavado con ácido y lavado con agua con desnaturalización térmica), tipo de modificación (modificación térmica, modificación química y modificación enzimática), concentración de proteína (70 % de proteína), forma (seca y líquida), naturaleza (orgánica y convencional), función (solubilidad, gelificación, emulsificación, fijación de agua, espuma, texturizante, estabilizador, espesante y otros), aplicación (alimentos, bebidas, nutracéuticos y suplementos dietéticos, cosméticos y cuidado personal, piensos, productos farmacéuticos y otros): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de concentrado de proteína de soja en América del Norte

- El tamaño del mercado de concentrado de proteína de soja de América del Norte se valoró en USD 1.26 mil millones en 2025 y se espera que alcance los USD 3.44 mil millones para 2033 , con una CAGR del 13,3% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de ingredientes alimentarios de origen vegetal y con alto contenido proteico, respaldada por un mayor enfoque de los consumidores en la salud, la nutrición y las opciones dietéticas sostenibles en las economías desarrolladas y emergentes.

- Además, la creciente adopción de concentrado de proteína de soja por parte de los fabricantes de alimentos para enriquecer las proteínas, mejorar la textura y la rentabilidad de los alimentos procesados y las alternativas a la carne está acelerando la penetración en el mercado, lo que apoya significativamente la expansión general del mercado.

Análisis del mercado de concentrado de proteína de soja en América del Norte

- El concentrado de proteína de soja es un ingrediente proteico derivado de plantas que se produce eliminando carbohidratos solubles de la harina de soja desgrasada, lo que da como resultado un producto con alto contenido proteico que se utiliza para mejorar el valor nutricional, la textura y el rendimiento funcional en alimentos, piensos y aplicaciones nutracéuticas.

- La creciente demanda de concentrado de proteína de soja se debe principalmente al cambio hacia dietas basadas en plantas, el aumento del uso en productos alimenticios funcionales y fortificados y la expansión de la aplicación en la nutrición animal debido a su perfil equilibrado de aminoácidos y su versatilidad funcional.

- Estados Unidos dominó el mercado de concentrado de proteína de soja en 2025, debido al alto consumo de productos alimenticios enriquecidos con proteínas, la fuerte demanda de alternativas de carne de origen vegetal y las industrias de procesamiento de alimentos y nutracéuticos bien establecidas.

- Se espera que Canadá sea la región de más rápido crecimiento en el mercado de concentrado de proteína de soja durante el período de pronóstico debido a la creciente demanda de proteínas de origen vegetal, productos alimenticios de etiqueta limpia y soluciones de nutrición sostenible.

- El segmento convencional dominó el mercado con una participación del 74,6 % en 2025, gracias a las cadenas de suministro consolidadas y las ventajas de costos. El concentrado de proteína de soja convencional satisface la gran demanda de las industrias de alimentos y piensos. La disponibilidad estable y los precios competitivos mantienen su liderazgo.

Alcance del informe y segmentación del mercado de concentrado de proteína de soja

|

Atributos |

Información clave del mercado del concentrado de proteína de soja |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de concentrado de proteína de soja en América del Norte

Uso creciente en la alimentación animal

- El mercado del concentrado de proteína de soja se está expandiendo rápidamente a medida que los fabricantes y productores ganaderos reconocen su valor como un ingrediente rentable y de alto contenido proteico en la alimentación animal, en particular para los sectores avícola, porcino y acuícola.

- Por ejemplo, grandes empresas como Bunge han fortalecido su posición mediante la adquisición de fabricantes especializados en concentrado de proteína de soja como CJ Selecta, lo que les permite ofrecer soluciones de alimentación personalizadas y respaldar la creciente demanda de nutrición ganadera sostenible y rica en proteínas.

- La adopción de concentrado de proteína de soja en la alimentación animal está impulsada por su perfil superior de aminoácidos, digestibilidad y capacidad para mejorar las tasas de crecimiento y la eficiencia alimentaria, lo que lo hace muy atractivo para las granjas comerciales a gran escala.

- Las crecientes preocupaciones sobre el uso de antibióticos y la necesidad de optimizar la salud animal están impulsando a los formuladores de alimentos a incorporar concentrado de proteína de soja como ingrediente funcional para mejorar la salud intestinal y la respuesta inmune en el ganado.

- Los avances tecnológicos en el procesamiento están llevando al desarrollo de concentrados de proteína de soya no modificados genéticamente, con bajo contenido de oligosacáridos y altamente digestibles, diseñados específicamente para la industria de alimentos balanceados, ampliando el atractivo para productores con necesidades variadas.

- El abastecimiento sostenible, una menor huella ambiental en comparación con los alimentos proteicos de origen animal y un mayor enfoque en la transparencia de la cadena alimentaria están impulsando aún más su creciente adopción en la industria alimentaria.

Dinámica del mercado de concentrado de proteína de soja en América del Norte

Conductor

Creciente demanda de proteínas de origen vegetal

- El aumento de consumidores preocupados por la salud, junto con la creciente popularidad de las dietas vegetarianas, veganas y flexitarianas, está impulsando significativamente la demanda mundial de proteínas de origen vegetal en los sectores de alimentos y bebidas.

- Por ejemplo, actores líderes como DuPont y Solae han colaborado para crear concentrados de proteína de soja con sabor y textura mejorados, haciéndolos más adecuados para alternativas de carne de origen vegetal y alimentos funcionales.

- La versatilidad del concentrado de proteína de soja, como ingrediente principal en sustitutos de carne, barras de proteína, alternativas lácteas y suplementos para la salud, está apuntalando su crecimiento en el mercado entre los productores de alimentos tradicionales y especializados.

- La asequibilidad y los perfiles equilibrados de aminoácidos posicionan a los concentrados de proteína de soja como una alternativa atractiva a las proteínas animales, especialmente en regiones con acceso limitado a las fuentes de proteínas tradicionales.

- El enfoque creciente en ingredientes proteínicos de etiqueta limpia, no transgénicos y producidos de manera sustentable está impulsando a las empresas de alimentos a integrar concentrado de proteína de soja en sus carteras, alineándose con las preferencias cambiantes de los consumidores por la transparencia y la nutrición ecológica.

Restricción/Desafío

Reacciones alérgicas a la soja

- La soja es uno de los ocho principales alérgenos alimentarios a nivel mundial, y el riesgo de reacciones alérgicas representa una barrera importante para la adopción más amplia del concentrado de proteína de soja en las industrias de alimentos y piensos.

- Por ejemplo, Nestlé ha implementado estrictos protocolos de etiquetado y segregación de alérgenos en todas sus líneas de productos a base de soja para cumplir con las regulaciones en América del Norte y Europa y mitigar los riesgos de seguridad del consumidor.

- La búsqueda de formulaciones hipoalergénicas y el surgimiento de proteínas vegetales alternativas (como las proteínas de guisante, arroz y avena) están intensificando las presiones competitivas e impulsando la innovación para abordar el problema de los alérgenos.

- La percepción del consumidor sobre la soja, a veces influenciada por mitos sobre la modificación genética o problemas de salud, puede afectar las decisiones de compra y requerir educación adicional o inversión en marketing por parte de las marcas.

- Las diferencias regulatorias entre regiones con respecto al etiquetado, los niveles permitidos de proteínas alergénicas y las afirmaciones permitidas complican aún más la expansión del mercado y requieren estrategias de cumplimiento sólidas por parte de los fabricantes.

Alcance del mercado de concentrado de proteína de soja en América del Norte

El mercado está segmentado según la categoría, el proceso de extracción, el tipo de modificación, la concentración de proteínas, la forma, la naturaleza, la función y la aplicación.

- Por categoría

Según la categoría, el mercado de concentrado de proteína de soya se segmenta en concentrados monocomponentes y compuestos fortificados. El segmento de compuestos monocomponentes dominó la mayor cuota de mercado en 2025, gracias a su amplio uso como fuente de proteína rentable en el procesamiento de alimentos y la nutrición animal. Los fabricantes prefieren el concentrado de proteína de soya monocomponente debido a su perfil proteico uniforme y su fácil formulación en múltiples aplicaciones. Su funcionalidad neutra favorece una textura estable y una mejora nutricional sin alterar las características del producto final. La fuerte demanda de los grandes procesadores de alimentos consolidó aún más su liderazgo.

Se prevé que el segmento de compuestos fortificados experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de perfiles nutricionales mejorados en alimentos funcionales y suplementos dietéticos. Las variantes fortificadas permiten la inclusión de vitaminas, minerales y aminoácidos, lo que mejora el posicionamiento en el sector de la salud. La creciente concienciación de los consumidores sobre la calidad de las proteínas y la nutrición específica impulsa su adopción. El posicionamiento premium de los productos y los mayores márgenes también incentivan a los fabricantes a ampliar su oferta de fortificados.

- Por proceso de extracción

Según el proceso de extracción, el mercado se segmenta en lavado con alcohol acuoso, lavado con ácido y lavado con agua con desnaturalización térmica. El segmento de lavado con alcohol acuoso dominó la cuota de mercado en 2025 gracias a su eficacia para reducir los factores antinutricionales, preservando al mismo tiempo la funcionalidad de las proteínas. Este proceso produce concentrados de alta pureza con sabor y color mejorados, lo que lo hace ideal para aplicaciones en alimentación humana. Su calidad constante respalda su adopción industrial a gran escala.

Se prevé que el segmento de procesos de lavado con agua y desnaturalización por calor registre el mayor crecimiento durante el período de pronóstico, impulsado por la creciente preferencia por métodos de procesamiento más limpios. Este proceso se alinea con las tendencias de etiquetado limpio al minimizar el uso de productos químicos. La mejor digestibilidad de las proteínas y su rendimiento funcional aumentan su atractivo en aplicaciones alimentarias y nutracéuticas. La presión regulatoria y de los consumidores hacia el procesamiento natural acelera aún más el crecimiento.

- Por tipo de modificación

Según el tipo de modificación, el mercado del concentrado de proteína de soja se segmenta en modificación térmica, modificación química y modificación enzimática. La modificación térmica dominó el mercado en 2025 gracias a su amplia aceptación y escalabilidad rentable. Este método mejora la funcionalidad de la proteína, incluyendo la absorción de agua y la textura, sin necesidad de procesos complejos. Su compatibilidad con la infraestructura de fabricación existente facilita su uso generalizado.

Se proyecta que la modificación enzimática experimentará el mayor crecimiento entre 2026 y 2033 gracias a su precisión en la adaptación de las propiedades funcionales. Los procesos enzimáticos mejoran la solubilidad y la digestibilidad, lo que favorece las formulaciones alimentarias avanzadas. La creciente demanda de proteínas vegetales de alto rendimiento en la nutrición especializada impulsa su adopción. La innovación en tecnologías enzimáticas fortalece aún más las perspectivas de crecimiento.

- Por concentración de proteínas

Según la concentración de proteína, el mercado se segmenta en <20% de proteína, 20%-70% de proteína y >70% de proteína. El segmento de 20%-70% de proteína dominó la cuota de mercado en 2025, gracias a su perfil nutricional equilibrado y versatilidad funcional. Esta gama se utiliza ampliamente en productos alimenticios, piensos y nutracéuticos gracias a su favorable relación coste-proteína. Su amplia aplicabilidad garantiza una demanda sostenida en todos los sectores.

Se espera que el segmento de proteínas superiores al 70 % crezca al ritmo más rápido durante el período de pronóstico, impulsado por la creciente demanda de formulaciones ricas en proteínas. Los fabricantes de nutrición deportiva y suplementos dietéticos prefieren cada vez más concentrados con mayor contenido proteico. La atención del consumidor a la salud muscular y el enriquecimiento proteico respalda esta tendencia. El posicionamiento premium impulsa aún más la expansión del mercado.

- Por formulario

Según su presentación, el mercado del concentrado de proteína de soya se segmenta en seco y líquido. El segmento seco dominó el mercado en 2025 gracias a su mayor vida útil y facilidad de transporte. El concentrado de proteína de soya seco ofrece flexibilidad de formulación y rentabilidad a los fabricantes. Su uso generalizado en panadería, snacks y alternativas a la carne refuerza su dominio.

Se prevé que el segmento de presentaciones líquidas experimente el mayor crecimiento entre 2026 y 2033, impulsado por su creciente uso en bebidas y formulaciones listas para usar. Los concentrados líquidos permiten un procesamiento más rápido y una mezcla uniforme. La creciente demanda de bebidas enriquecidas con proteínas y productos emulsionados impulsa su adopción. La comodidad en las aplicaciones industriales acelera el crecimiento.

- Por naturaleza

En función de la naturaleza, el mercado se segmenta en orgánico y convencional. El segmento convencional representó la mayor cuota de mercado en ingresos, con un 74,6 % en 2025, gracias a cadenas de suministro consolidadas y ventajas de costos. El concentrado de proteína de soja convencional satisface la gran demanda de las industrias de alimentos y piensos. Su disponibilidad estable y precios competitivos sustentan su liderazgo.

Se espera que el segmento orgánico registre el mayor crecimiento durante el período de pronóstico, impulsado por la creciente preferencia de los consumidores por productos orgánicos y sin OGM. La certificación orgánica refuerza la credibilidad de los productos en los mercados orientados a la salud. El crecimiento del consumo de alimentos sostenibles y de etiqueta limpia impulsa la expansión. Los precios premium incentivan aún más la participación de los productores.

- Por función

Según su función, el mercado se segmenta en solubilidad, gelificación, emulsificación, retención de agua, espumación, texturización, estabilización, espesamiento, entre otros. El segmento de emulsificación dominó el mercado en 2025 debido a su papel crucial en la estabilidad de los alimentos procesados. El concentrado de proteína de soya se utiliza ampliamente para mejorar la textura y la consistencia en alternativas a la carne y sustitutos lácteos. La fuerte demanda de los fabricantes de alimentos mantiene su dominio.

Se proyecta que el segmento de agentes texturizantes experimentará el mayor crecimiento entre 2026 y 2033, impulsado por el creciente consumo de carne de origen vegetal. La función texturizante mejora la textura en boca y la integridad estructural de las proteínas alternativas. La innovación en formulaciones de análogos de la carne impulsa la creciente demanda. La transición del consumidor hacia dietas de origen vegetal acelera el crecimiento.

- Por aplicación

Según su aplicación, el mercado del concentrado de proteína de soya se segmenta en productos alimenticios, bebidas, nutracéuticos y suplementos dietéticos, cosméticos y cuidado personal, alimentos para animales, productos farmacéuticos, entre otros. El segmento de productos alimenticios dominó la cuota de mercado en 2025, impulsado por su amplio uso en panadería, alternativas a la carne y alimentos procesados. El enriquecimiento proteico y sus beneficios funcionales respaldan su adopción generalizada. El alto consumo mantiene el liderazgo en el segmento.

Se prevé que el segmento de nutracéuticos y suplementos dietéticos experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente concienciación sobre la salud y las tendencias en la suplementación proteica. El concentrado de proteína de soja ofrece nutrición vegetal de alta digestibilidad. La demanda de las poblaciones envejecidas y los consumidores que se preocupan por su bienestar físico impulsa el crecimiento. La innovación de productos y las formulaciones específicas impulsan aún más la expansión.

Análisis regional del mercado de concentrado de proteína de soja en América del Norte

- Estados Unidos dominó el mercado de concentrado de proteína de soja con la mayor participación en los ingresos en 2025, impulsado por el alto consumo de productos alimenticios enriquecidos con proteínas, la fuerte demanda de alternativas de carne de origen vegetal y las industrias de procesamiento de alimentos y nutracéuticos bien establecidas.

- El uso generalizado de concentrado de proteína de soja en los segmentos de panadería, alimentos procesados, suplementos dietéticos y alimentos para animales, respaldado por capacidades avanzadas de fabricación de alimentos y una fuerte conciencia de los consumidores sobre la nutrición basada en plantas, continúa sustentando una sólida demanda en las industrias de uso final.

- La sólida presencia de importantes actores del mercado como ADM, Cargill Incorporated y DuPont, junto con la continua innovación de productos, la expansión de la capacidad y las inversiones en ingredientes de soja de etiqueta limpia y sin OMG, refuerzan el liderazgo de EE. UU. Se espera que el crecimiento continuo del consumo de alimentos de origen vegetal y productos de nutrición funcional mantenga el dominio del país durante el período de pronóstico.

Análisis del mercado canadiense de concentrado de proteína de soja

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado norteamericano de concentrado de proteína de soya entre 2026 y 2033, impulsada por la creciente demanda de proteínas vegetales, productos alimenticios de etiqueta limpia y soluciones nutricionales sostenibles. Por ejemplo, los fabricantes canadienses de alimentos incorporan cada vez más concentrado de proteína de soya en alternativas a la carne, nutrición deportiva y productos alimenticios fortificados para satisfacer la creciente demanda de dietas ricas en proteínas y basadas en plantas. La expansión de las inversiones en innovación alimentaria, la mayor concienciación sobre la salud y los marcos regulatorios favorables están acelerando el crecimiento del mercado, posicionando a Canadá como el país de más rápido crecimiento en la región.

Análisis del mercado del concentrado de proteína de soya en México

Se prevé un crecimiento sostenido en México entre 2026 y 2033, impulsado por el creciente uso de concentrado de proteína de soya en alimentos procesados, piensos y formulaciones asequibles de alimentos ricos en proteínas. La creciente urbanización, la creciente demanda de ingredientes nutricionales rentables y la expansión del sector local de procesamiento de alimentos respaldan una demanda constante del mercado. La mejor integración de la cadena de suministro con los productores norteamericanos y la adopción gradual de ingredientes proteicos de origen vegetal están fortaleciendo la penetración en el mercado. El crecimiento continuo en la fabricación de alimentos y las aplicaciones de nutrición ganadera contribuye a un crecimiento estable del mercado de concentrado de proteína de soya durante el período de pronóstico.

Cuota de mercado del concentrado de proteína de soja en América del Norte

La industria del concentrado de proteína de soja está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Cargill Incorporated (EE. UU.)

- DuPont (EE. UU.)

- ADM (EE. UU.)

- LA CORPORACIÓN VINCENT (EE. UU.)

- Wilmar International Ltd (Singapur)

- Batory Foods (EE. UU.)

- Nordic Soya Oy (Finlandia)

- Aminola (EE. UU.)

- Compañía Crown Soya Protein Group (China)

- Solbar Ningbo Protein Technology Co., Ltd (China)

- Grupo Victoria (Serbia)

- Yuwang (China)

- Shandong Yuxin Biotechnology Co., Ltd (China)

- Grupo de Biotecnología Gushen Co., Ltd. (China)

- Arshine Pharmaceutical Co., Limited (China)

- Tianwei Biotech Group Co., Ltd. (China)

- Corporación Internacional Foodchem (China)

Últimos avances en el mercado de concentrado de proteína de soja en América del Norte

- En mayo de 2025, Bunge presentó una nueva línea de concentrados de proteína de soya en la IFFA, cuyo lanzamiento está previsto para otoño. Estos concentrados están diseñados para abordar los principales desafíos de formulación en el sector de las proteínas vegetales, ofreciendo un sabor limpio, un color neutro y una excelente relación calidad-precio. Se espera que esta expansión estratégica de productos fortalezca la presencia de Bunge en el mercado e impulse una mayor adopción del concentrado de proteína de soya entre los fabricantes de alimentos que buscan ingredientes escalables y de alto rendimiento.

- En febrero de 2024, Amfora anunció el lanzamiento comercial de sus productos de primera generación con un contenido ultraalto de proteína vegetal. Esta entrada al mercado fortalece el panorama competitivo y respalda la creciente demanda de ingredientes sostenibles y ricos en nutrientes. Es probable que la innovación de Amfora acelere el crecimiento del uso de concentrado de proteína de soja en las categorías de alimentos funcionales y fortificados.

- En junio de 2023, Nutra Ingredients lanzó un nuevo concentrado de proteína de soya enriquecido con aminoácidos esenciales, dirigido al mercado de la nutrición deportiva. Este innovador producto promete beneficios mejorados para la recuperación y el crecimiento muscular, ampliando las aplicaciones de los concentrados de proteína de soya en la industria de la nutrición deportiva.

- En febrero de 2022, Benson Hill lanzó su portafolio de ingredientes de proteína de soya TruVail, con ventajas distintivas de sostenibilidad adaptadas a diversas aplicaciones alimentarias. Este lanzamiento marcó un avance significativo hacia la integración de la gestión ambiental con la innovación alimentaria. Este enfoque centrado en la sostenibilidad está contribuyendo a un mayor interés del mercado en soluciones de proteína de soya de etiqueta limpia y respetuosas con el medio ambiente, reforzando la adhesión de consumidores y fabricantes a las prácticas de abastecimiento responsable.

- En julio de 2020, DuPont amplió su cartera de productos Danisco Planit con el lanzamiento de nuevos productos como los concentrados de proteína de soja texturizada Response y los concentrados de proteína de soja Alpha Functional, que atienden diversas aplicaciones y mejoran su oferta de concentrados de proteína de soja.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.