North America Smoking Cessation And Nicotine De Addictions Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

74.27 Billion

USD

425.98 Billion

2024

2032

USD

74.27 Billion

USD

425.98 Billion

2024

2032

| 2025 –2032 | |

| USD 74.27 Billion | |

| USD 425.98 Billion | |

|

|

|

Segmentación del mercado de cesación del tabaquismo y desintoxicación de la nicotina en América del Norte, por tipo de producto (con nicotina y sin nicotina), tipo de tratamiento (farmacológico, terapias y otros), canal de distribución (en línea, fuera de línea), usuario final (generación Z, millennials, generación X y generación silenciosa): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de la deshabituación tabáquica y la desintoxicación de la nicotina

El número de fumadores está aumentando rápidamente en todo el mundo. Este subgrupo de la población está formado principalmente por adolescentes y trabajadores. La tasa de mortalidad por tabaquismo es extremadamente alta. El creciente deseo de dejar de fumar y los numerosos riesgos para la salud asociados con el hábito de fumar son un fuerte incentivo para que las empresas desarrollen nuevos productos para dejar de fumar.

Tamaño del mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina

El tamaño del mercado de abandono del hábito de fumar y desintoxicación de la nicotina en América del Norte se valoró en 74,27 mil millones de dólares en 2024 y se proyecta que alcance los 425,98 mil millones de dólares en 2032, con una CAGR del 1,5 % durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Dejar de fumar y eliminar la adicción a la nicotina: perspectivas clave del mercado |

|

Segmentación |

|

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores clave del mercado |

Imperial Brands (Reino Unido), 22nd Century Group, Inc (Estados Unidos), Pfizer Inc. (Estados Unidos), Dr. Reddy's Laboratories Ltd (India), Glaxosmithkline Plc. (Reino Unido), British American Tobacco (Reino Unido), Cambrex Corporation (Estados Unidos), Cipla Inc. (Estados Unidos), Fertin Pharma (Dinamarca), Johnson & Johnson Private Limited (Estados Unidos), Perrigo Company Plc (Irlanda) |

|

Oportunidades de mercado |

|

Definición del mercado de la deshabituación tabáquica y la desintoxicación de la nicotina

La abstinencia del tabaco forma parte del proceso de dejar de fumar o de la desintoxicación por nicotina. El tabaco contiene nicotina, que se sabe que causa adicción al liberar neurotransmisores como la dopamina, el ácido gamma-aminobutírico (GABA) y el glutamato. Dejar de fumar ayuda en el tratamiento de los adictos al cigarrillo y al tabaco.

Dinámica del mercado de la deshabituación tabáquica y la desintoxicación de la nicotina

Conductores

- Aumenta el número de personas que intentan dejar de fumar en todo el mundo

Uno de los principales factores que impulsan el crecimiento del mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina es el aumento de la cantidad de personas que intentan dejar de fumar en todo el mundo. Debido a los efectos tóxicos de la nicotina y la adicción al cigarrillo en los sistemas cardíaco y respiratorio, el gobierno hace hincapié en la aplicación de estrictas regulaciones para controlar la adicción a la nicotina y al cigarrillo, y los altos impuestos sobre los productos de tabaco aceleran el crecimiento del mercado. Además, la elevada adopción de opciones de estilo de vida poco saludables, la rápida urbanización y el aumento de la renta disponible benefician al mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina.

- El gobierno ha establecido normas estrictas para controlar la adicción a la nicotina y al cigarrillo

El gobierno está poniendo énfasis en la aplicación de normas estrictas para controlar la adicción a la nicotina y al tabaco debido a sus efectos tóxicos sobre los sistemas cardíaco y respiratorio. Entre las políticas gubernamentales para dejar de fumar se encuentran la prohibición de fumar en lugares públicos, los altos impuestos a los productos de tabaco y el apoyo financiero a las terapias para dejar de fumar. Como resultado, se espera que durante el período previsto el mercado mundial de productos para dejar de fumar y desintoxicarse de la nicotina crezca rápidamente.

Oportunidades

Se espera que la introducción de productos de terapia de reemplazo de nicotina mejorados e innovadores sea una fuerza impulsora importante en el crecimiento del mercado de la deshabituación tabáquica y la desintoxicación de la nicotina. Se espera que la creciente prevalencia de enfermedades objetivo como la enfermedad pulmonar obstructiva crónica (EPOC) , el asma, las enfermedades cardíacas y el cáncer de pulmón, así como la creciente conciencia pública sobre los peligros del tabaquismo, impulsen el crecimiento del mercado. Una institución educativa continúa participando activamente en la organización de diversas campañas y programas para difundir información sobre los efectos y consecuencias nocivos del tabaquismo con el fin de aumentar la conciencia de la población joven.

Restricciones

Por otra parte, se espera que la renuencia a aceptar el tratamiento obstaculice el crecimiento del mercado. Se espera que el mercado de la cesación del tabaquismo y la desintoxicación de la nicotina enfrente desafíos debido a la falta de concienciación en el período de pronóstico.

Este informe de mercado sobre el abandono del hábito de fumar y la eliminación de la adicción a la nicotina proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de abandono del hábito de fumar y eliminación de la adicción a la nicotina, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Ámbito de aplicación del mercado de la deshabituación tabáquica y la desintoxicación de la nicotina

El mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina está segmentado en función del tipo de producto, el tipo de tratamiento, el canal de distribución y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Con nicotina

- Sin nicotina

Tipo de tratamiento

- Farmacológico

- Terapias

- Otros

Canales de distribución

- En línea

- Desconectado

Usuario final

- Generación Z

- Millennials

- Generación X

- Generación silenciosa

Análisis regional del mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina

Se analiza el mercado de dejar de fumar y desintoxicarse de la nicotina y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo de producto, tipo de tratamiento, canal de distribución y usuario final como se menciona anteriormente.

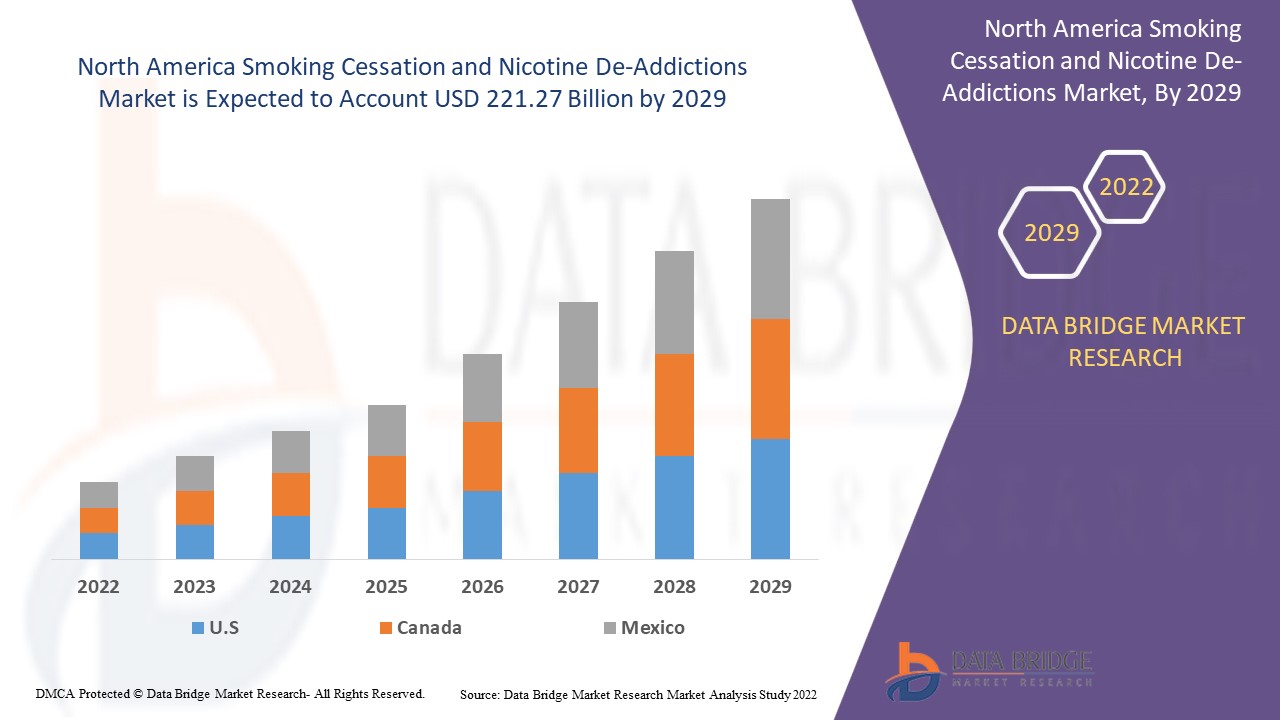

Los países cubiertos en el informe sobre el mercado de abandono del hábito de fumar y desintoxicación de la nicotina son Estados Unidos, Canadá y México.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de la deshabituación tabáquica y la desintoxicación de la nicotina

El panorama competitivo del mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de la deshabituación tabáquica y la eliminación de la adicción a la nicotina.

Los líderes del mercado de la deshabituación tabáquica y la desintoxicación de la nicotina que operan en el mercado son:

- Marcas Imperiales (Reino Unido)

- 22nd Century Group, Inc. (Estados Unidos)

- Pfizer Inc. (Estados Unidos)

- Laboratorios Dr. Reddy's Ltd (India)

- Glaxosmithkline Plc. (Reino Unido)

- British American Tobacco (Reino Unido)

- Corporación Cambrex (Estados Unidos)

- Cipla Inc. (Estados Unidos)

- Fertin Pharma (Dinamarca)

- Johnson & Johnson Private Limited (Estados Unidos)

- Perrigo Company Plc (Irlanda)

Últimos avances en el mercado de la deshabituación tabáquica y la desintoxicación de la nicotina

- JB Chemicals & Pharmaceuticals lanzará pastillas de nicotina medicinales en mayo de 2021 para ayudar a reducir el deseo de consumir o fumar tabaco.

- NFL Biosciences SA, una empresa biofarmacéutica que desarrolla medicamentos botánicos para el tratamiento de adicciones, comenzará su ensayo clínico CESTO II Fase II/III en diciembre de 2021 para evaluar la eficacia y seguridad de su tratamiento para dejar de fumar NFL-101

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.