North America Smart Medical Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

33.96 Billion

USD

143.03 Billion

2025

2033

USD

33.96 Billion

USD

143.03 Billion

2025

2033

| 2026 –2033 | |

| USD 33.96 Billion | |

| USD 143.03 Billion | |

|

|

|

|

Segmentación del mercado de dispositivos médicos inteligentes en Norteamérica, por tipo de producto (dispositivos de diagnóstico y monitorización, y dispositivos terapéuticos), tipo (sujeto al cuerpo (parche adhesivo), externo (clip para cinturón) y portátil), tecnología (basada en resorte, accionada por motor, bomba rotatoria, batería expansible, gas presurizado y otros), modalidad (usable y no usable), aplicación (oncología, diabetes, trastornos autoinmunes, enfermedades infecciosas, deportes y fitness, trastornos del sueño y otros), usuario final (hospitales, clínicas, atención domiciliaria, clubes deportivos y otros), canal de distribución (farmacias, canal online y otros): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado de dispositivos médicos inteligentes en América del Norte

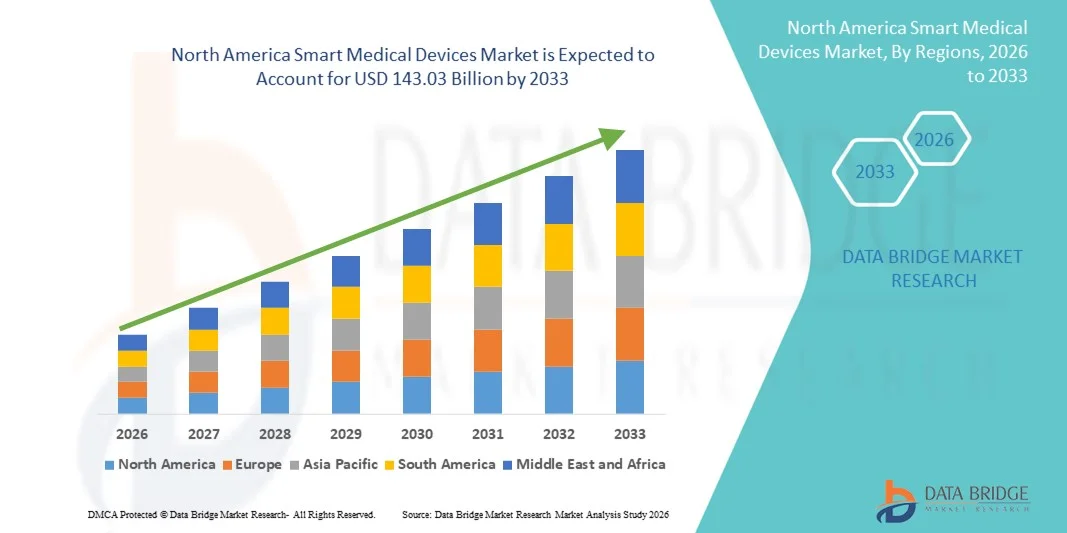

- El tamaño del mercado de dispositivos médicos inteligentes de América del Norte se valoró en USD 33,96 mil millones en 2025 y se espera que alcance los USD 143,03 mil millones para 2033 , con una CAGR del 19,69% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a los rápidos avances tecnológicos en tecnologías sanitarias conectadas e impulsadas por el IoT, la expansión del uso de dispositivos portátiles y de monitorización remota de pacientes, y la creciente digitalización de la atención sanitaria tanto en entornos clínicos como domiciliarios. El elevado gasto en atención sanitaria y la sólida adopción de tecnologías médicas avanzadas en EE. UU. y Canadá impulsan la continua expansión en la región.

- Además, la creciente demanda de seguimiento de la salud en tiempo real, plataformas de tratamiento personalizadas y soluciones inteligentes integradas para el manejo de enfermedades crónicas está consolidando los dispositivos médicos inteligentes como herramientas esenciales en la atención médica moderna. Estos factores convergentes están acelerando su adopción e impulsando significativamente la trayectoria de crecimiento de la industria durante el período de pronóstico.

Análisis del mercado de dispositivos médicos inteligentes en América del Norte

- Los dispositivos médicos inteligentes, incluidos los monitores portátiles, los diagnósticos habilitados para IoT y las soluciones de atención remota al paciente, son componentes cada vez más vitales de los sistemas de atención médica modernos, tanto en entornos clínicos como de atención domiciliaria, debido a su capacidad para brindar monitoreo de salud en tiempo real, tratamiento personalizado e integración perfecta con plataformas de salud digital.

- La creciente demanda de dispositivos médicos inteligentes se ve impulsada principalmente por la creciente adopción de tecnologías de atención médica conectadas, la creciente prevalencia de enfermedades crónicas y la mayor preferencia por la monitorización remota y las soluciones de telesalud entre pacientes y proveedores de atención médica.

- Estados Unidos dominó el mercado de dispositivos médicos inteligentes de América del Norte con la mayor participación en los ingresos del 78,9 % en 2025, caracterizado por la adopción temprana de tecnologías de atención médica avanzadas, un alto gasto en atención médica y una fuerte presencia de actores clave de la industria.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de dispositivos médicos inteligentes de América del Norte durante el período de pronóstico debido al aumento de las inversiones en infraestructura de atención médica, la creciente conciencia de los pacientes y la creciente adopción de tecnologías de salud digital.

- El segmento de dispositivos portátiles dominó el mercado de dispositivos médicos inteligentes de América del Norte con una participación de mercado del 42,5 % en 2025, impulsado por su eficacia demostrada en el monitoreo continuo de la salud, la conveniencia del paciente y la compatibilidad con las plataformas de salud digital existentes.

Alcance del informe y segmentación del mercado de dispositivos médicos inteligentes en América del Norte

|

Atributos |

Perspectivas clave del mercado de dispositivos médicos inteligentes en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de dispositivos médicos inteligentes en América del Norte

Mayor comodidad gracias a la IA y la monitorización remota

- Una tendencia significativa y en auge en el mercado norteamericano de dispositivos médicos inteligentes es la creciente integración de la inteligencia artificial (IA) y las plataformas de monitorización remota basadas en la nube. Esta fusión de tecnologías está mejorando la comodidad del paciente, la personalización del tratamiento y la toma de decisiones clínicas.

- Por ejemplo, el dispositivo portátil BioSticker monitoriza continuamente las constantes vitales del paciente y transmite datos a los profesionales sanitarios en tiempo real, lo que permite intervenciones proactivas. De igual forma, Fitbit Health Solutions integra algoritmos de IA para el análisis de tendencias y alertas de salud predictivas.

- La integración de IA en dispositivos médicos inteligentes permite funciones como diagnósticos predictivos, recomendaciones de tratamientos adaptativos y alertas inteligentes ante anomalías. Por ejemplo, algunos tensiómetros conectados de Omron utilizan IA para detectar latidos cardíacos irregulares y notificar a pacientes y médicos de inmediato.

- La integración perfecta de dispositivos médicos inteligentes con sistemas de registros médicos electrónicos (EHR) y plataformas de telesalud permite a los proveedores de atención médica administrar los datos de múltiples pacientes desde un panel centralizado, lo que mejora la eficiencia operativa y los resultados de los pacientes.

- Esta tendencia hacia dispositivos médicos más inteligentes, intuitivos e interconectados está transformando las expectativas de los pacientes respecto a la atención médica remota. Por ello, empresas como iRhythm están desarrollando wearables con IA que detectan irregularidades cardíacas y se integran con los sistemas de monitorización hospitalaria.

- La demanda de dispositivos médicos inteligentes que ofrecen información impulsada por IA y monitoreo remoto en tiempo real está creciendo rápidamente en hospitales, clínicas y atención domiciliaria, ya que tanto los pacientes como los proveedores priorizan cada vez más la conveniencia, la eficiencia y la atención médica proactiva.

- La creciente adopción por parte de los consumidores de aplicaciones de salud móviles y plataformas complementarias que se conectan con dispositivos inteligentes está impulsando la expansión del mercado al permitir a los pacientes realizar un seguimiento de las tendencias de salud, establecer recordatorios y compartir datos con los proveedores sin problemas.

- Las crecientes colaboraciones entre fabricantes de dispositivos, desarrolladores de software e instituciones de atención médica están acelerando la innovación, lo que permite el desarrollo de dispositivos médicos inteligentes más personalizados y multifuncionales.

Dinámica del mercado de dispositivos médicos inteligentes en América del Norte

Conductor

Creciente necesidad debido a las enfermedades crónicas y la adopción de la salud digital

- La creciente prevalencia de enfermedades crónicas, el envejecimiento de la población y la rápida adopción de soluciones de salud digital son impulsores importantes de una mayor demanda de dispositivos médicos inteligentes.

- Por ejemplo, en marzo de 2025, Dexcom anunció monitores continuos de glucosa con IA para el control de la diabetes, lo que mejora la atención en tiempo real y la adherencia del paciente. Se espera que estas estrategias de empresas líderes impulsen el crecimiento del mercado durante el período de pronóstico.

- A medida que los pacientes y los proveedores buscan un monitoreo continuo e intervenciones oportunas, los dispositivos médicos inteligentes ofrecen funciones avanzadas como transmisión de datos en tiempo real, alertas de lecturas anormales y análisis predictivos, lo que proporciona una mejora convincente sobre los métodos de monitoreo tradicionales.

- Además, la creciente adopción de la telesalud y la expansión del ecosistema de salud digital están haciendo que los dispositivos médicos inteligentes sean parte integral de la atención conectada, lo que permite una integración perfecta con aplicaciones móviles y plataformas de gestión clínica.

- La comodidad de la monitorización remota, la información personalizada sobre los datos y la generación de informes automatizados para los profesionales sanitarios son factores clave que impulsan la adopción de dispositivos médicos inteligentes. La tendencia hacia la monitorización domiciliaria y los diseños de dispositivos intuitivos contribuyen aún más al crecimiento del mercado.

- El aumento de las iniciativas gubernamentales y las políticas de reembolso en los EE. UU. que apoyan el monitoreo remoto de pacientes y la adopción de la salud digital están acelerando aún más la demanda del mercado.

- La expansión de la cobertura del seguro de salud y los incentivos para soluciones de monitoreo remoto están motivando tanto a los proveedores como a los pacientes a adoptar dispositivos médicos inteligentes para el manejo de enfermedades crónicas y la atención posoperatoria.

Restricción/Desafío

Preocupaciones sobre la seguridad de los datos y obstáculos para el cumplimiento normativo

- Las preocupaciones en torno a la seguridad, la privacidad y el cumplimiento normativo de los datos de los pacientes suponen un reto importante para una mayor penetración en el mercado. Dado que los dispositivos médicos inteligentes dependen de la conectividad de red, son vulnerables a las ciberamenazas, lo que genera inquietud sobre la integridad de los datos y la confidencialidad del paciente.

- Por ejemplo, los informes de alto perfil sobre vulnerabilidades en dispositivos de salud conectados han hecho que algunos hospitales y pacientes sean cautelosos a la hora de adoptar soluciones de monitoreo remoto, incluidos los dispositivos médicos inteligentes.

- Abordar las preocupaciones sobre ciberseguridad y cumplimiento normativo mediante cifrado, protocolos de autenticación seguros y el cumplimiento de las normas de la FDA o HIPAA es crucial para generar confianza. Empresas como Medtronic priorizan las funciones de seguridad avanzadas y las actualizaciones periódicas de software para tranquilizar a los usuarios.

- Además, el coste relativamente alto de los dispositivos avanzados con IA, en comparación con las herramientas de monitorización convencionales, puede limitar su adopción entre los profesionales sanitarios y los pacientes, que se preocupan por los costes. Si bien los dispositivos básicos de marcas como Withings son más asequibles, las funciones premium, como el ECG continuo o el análisis predictivo, tienen precios más elevados.

- Superar estos desafíos mediante una sólida seguridad de datos, el cumplimiento normativo, la educación del consumidor y el desarrollo de dispositivos rentables será vital para sostener el crecimiento del mercado en América del Norte.

- La rápida obsolescencia tecnológica y las frecuentes actualizaciones de software pueden plantear desafíos para los proveedores de atención médica y los pacientes, lo que requiere capacitación continua e inversión en sistemas compatibles.

- La variabilidad en las regulaciones a nivel estatal y los plazos de aprobación para dispositivos médicos conectados pueden retrasar el lanzamiento y la adopción de productos, en particular en sistemas de atención médica que abarcan varios estados.

Análisis del mercado de dispositivos médicos inteligentes en América del Norte

El mercado está segmentado en función del tipo de producto, tipo, tecnología, modalidad, aplicación, usuario final y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado norteamericano de dispositivos médicos inteligentes se segmenta en dispositivos de diagnóstico y monitorización, y dispositivos terapéuticos. El segmento de dispositivos de diagnóstico y monitorización dominó el mercado con la mayor cuota de ingresos, un 52,3%, en 2025. Este dominio se debe a la creciente adopción de soluciones de monitorización continua para enfermedades crónicas como la diabetes y los trastornos cardiovasculares. Los hospitales y las clínicas prefieren cada vez más los wearables de diagnóstico y las herramientas de monitorización remota para mejorar los resultados de los pacientes y reducir las tasas de readmisión. Los pacientes en casa también utilizan dispositivos como monitores de glucosa, ECG wearables y oxímetros de pulso para el seguimiento en tiempo real, lo que impulsa el crecimiento del segmento. La integración de la IA y la analítica basada en la nube mejora aún más el valor de los dispositivos de diagnóstico y monitorización al proporcionar información predictiva y capacidades de detección temprana. El creciente enfoque en la atención sanitaria preventiva y las iniciativas de telesalud está impulsando una demanda sostenida de este segmento.

Se prevé que el segmento de Dispositivos Terapéuticos experimente el crecimiento más rápido, con una tasa de crecimiento anual compuesta (TCAC) del 13,8 % entre 2026 y 2033. Este crecimiento se debe principalmente a las innovaciones en soluciones de terapia conectada, como bombas de insulina, dispositivos de neuroestimulación y robótica de rehabilitación. Por ejemplo, las bombas de infusión portátiles con IA permiten una dosificación precisa y la monitorización remota, lo que mejora la adherencia del paciente y los resultados del tratamiento. La expansión de la atención médica domiciliaria y la creciente prevalencia de enfermedades crónicas están acelerando la adopción de dispositivos terapéuticos. La integración con aplicaciones móviles y plataformas de salud digital mejora la participación del paciente y la personalización de la terapia. Además, el aumento de las políticas de reembolso y la cobertura de seguros para dispositivos terapéuticos de uso domiciliario está impulsando una rápida adopción en el mercado.

- Por tipo

Según el tipo, el mercado se segmenta en dispositivos corporales (parche adhesivo), externos (clip para cinturón) y portátiles. El segmento corporal (parche adhesivo) dominó el mercado con la mayor participación en ingresos, un 45,7 % en 2025. El liderazgo de este segmento se debe a la preferencia de los pacientes por la monitorización continua y no intrusiva, especialmente en el manejo de enfermedades crónicas. Los dispositivos de parche adhesivo proporcionan un seguimiento vital en tiempo real, que incluye ECG, niveles de glucosa y temperatura, lo cual resulta valioso para la atención remota. Los hospitales y los proveedores de atención médica domiciliaria están adoptando cada vez más dispositivos basados en parches para reducir las visitas al hospital. Su diseño compacto y ligero garantiza la comodidad, mejorando el cumplimiento terapéutico del paciente. La integración con aplicaciones móviles y paneles de control en la nube permite a los médicos monitorizar a los pacientes de forma remota y realizar intervenciones oportunas.

Se proyecta que el segmento de dispositivos portátiles experimentará el mayor crecimiento durante el período de pronóstico, impulsado por la creciente demanda de soluciones de diagnóstico portátiles y en el punto de atención. Dispositivos como ecógrafos portátiles, glucómetros portátiles y estetoscopios digitales permiten realizar pruebas rápidas tanto en entornos clínicos como domiciliarios. Por ejemplo, los dispositivos portátiles permiten al personal sanitario de campo monitorear a pacientes en zonas rurales con acceso limitado a hospitales. La comodidad de obtener resultados inmediatos y la conectividad inalámbrica para la transmisión de datos impulsan su adopción. Los dispositivos portátiles también se integran cada vez más con el soporte de decisiones basado en IA para una mayor precisión diagnóstica. La creciente concienciación sobre la atención médica preventiva y la necesidad de diagnósticos rápidos impulsan el sólido crecimiento de este segmento.

- Por tecnología

En función de la tecnología, el mercado se segmenta en bombas de resorte, accionadas por motor, rotativas, de batería expansible, de gas presurizado, entre otras. El segmento de bombas rotativas dominó el mercado con la mayor participación en ingresos, con un 41,5 % en 2025. Esto se debe principalmente a su amplia aplicación en sistemas de administración de fármacos, como bombas de insulina y dispositivos de infusión. La tecnología de bombas rotativas ofrece una dosificación precisa y consistente, fundamental para la eficacia terapéutica y la seguridad del paciente. Hospitales y clínicas confían en esta tecnología tanto para la atención hospitalaria como ambulatoria. Su durabilidad y fiabilidad a largo plazo impulsan su adopción también en la atención médica domiciliaria. La integración con la monitorización digital y las aplicaciones móviles mejora el control y el cumplimiento de la dosificación.

Se espera que el segmento de Baterías Expandibles experimente el mayor crecimiento durante el período de pronóstico, impulsado por dispositivos portátiles y wearables que requieren tiempos de funcionamiento más largos sin recargas frecuentes. Por ejemplo, los monitores cardíacos wearables y los monitores continuos de glucosa utilizan tecnología de baterías expandibles para garantizar una monitorización ininterrumpida. Esta tecnología facilita un diseño compacto del dispositivo y la comodidad del paciente, fundamental para la atención domiciliaria. La creciente demanda de monitorización remota de pacientes e integración de telesalud está acelerando su adopción. Esta tecnología de baterías permite la monitorización continua durante varios días, lo que reduce la necesidad de tiempo de inactividad del dispositivo y mejora los resultados de los pacientes. La creciente inversión en dispositivos sanitarios energéticamente eficientes impulsa aún más la expansión del segmento.

- Por modalidad

Según la modalidad, el mercado se segmenta en dispositivos wearables y no wearables. El segmento wearable dominó el mercado con la mayor cuota de mercado, con un 42,5% en 2025. Los dispositivos médicos wearables permiten la monitorización continua de parámetros de salud del paciente, como la frecuencia cardíaca, la glucosa y la presión arterial. Hospitales, clínicas y proveedores de atención médica domiciliaria adoptan cada vez más wearables para facilitar la atención remota, mejorar la adherencia al tratamiento y reducir los reingresos hospitalarios. Los wearables ofrecen una integración fluida con smartphones y plataformas de salud digital para la monitorización y las alertas en tiempo real. Su comodidad, precisión y movilidad contribuyen a una sólida adopción. El creciente enfoque en la atención preventiva y el tratamiento de enfermedades crónicas impulsa aún más la demanda.

Se proyecta que el segmento de dispositivos no portátiles experimente el mayor crecimiento entre 2026 y 2033, impulsado por dispositivos de punto de atención, monitores de cabecera y equipos terapéuticos estacionarios. Por ejemplo, los dispositivos no portátiles de monitorización respiratoria y diálisis en clínicas se están adoptando rápidamente. Esta tecnología se está optimizando con capacidades de IoT e IA para la monitorización remota y el análisis predictivo. La expansión de la atención ambulatoria y los programas de rehabilitación domiciliaria está impulsando la demanda. Los dispositivos no portátiles son preferidos en entornos clínicos por su alta precisión y su capacidad para realizar diagnósticos y tratamientos complejos. La integración con los sistemas de gestión hospitalaria impulsa aún más el crecimiento del mercado.

- Por aplicación

Según la aplicación, el mercado se segmenta en oncología, diabetes, trastornos autoinmunes, enfermedades infecciosas, deporte y fitness, trastornos del sueño, entre otros. El segmento de diabetes dominó el mercado con la mayor participación en ingresos, con un 49,2 % en 2025. Este predominio se atribuye a la alta prevalencia de la diabetes en EE. UU., la creciente demanda de dispositivos de monitorización continua de glucosa (MCG) y la integración con aplicaciones móviles para obtener datos en tiempo real y la dosificación de insulina. Los hospitales y los proveedores de atención domiciliaria adoptan ampliamente el MCG y las bombas de insulina conectadas para mejorar los resultados de los pacientes. La disponibilidad de análisis basados en IA mejora la atención predictiva y el tratamiento personalizado.

Se espera que el segmento de Deportes y Fitness experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción de monitores de actividad física portátiles, monitores de frecuencia cardíaca y dispositivos inteligentes de rehabilitación. Por ejemplo, los dispositivos que monitorizan la frecuencia cardíaca, la saturación de oxígeno y las métricas de rendimiento se utilizan cada vez más en gimnasios, clubes deportivos y por deportistas individuales. La creciente concienciación sobre la salud y la integración de la IA para recomendaciones personalizadas impulsan la adopción. El segmento se beneficia de la tendencia de los programas de fitness en casa y telerehabilitación. La integración con plataformas digitales y aplicaciones móviles para el seguimiento de datos y el entrenamiento acelera aún más el crecimiento.

- Por el usuario final

Según el usuario final, el mercado se segmenta en hospitales, clínicas, atención domiciliaria, clubes deportivos y otros. El segmento Hospitales dominó el mercado con la mayor participación en ingresos, un 44,5 % en 2025, gracias a la alta adopción de dispositivos médicos inteligentes para la monitorización de pacientes hospitalizados, cuidados intensivos y el manejo de enfermedades crónicas. Los hospitales implementan cada vez más dispositivos de diagnóstico y tratamiento basados en IA para mejorar la eficiencia operativa y los resultados de los pacientes. La adopción a gran escala está impulsada por la integración con sistemas de historiales clínicos electrónicos, plataformas de telesalud y redes de monitorización de pacientes.

Se prevé que el segmento de Cuidado Domicilio experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de monitorización remota, dispositivos wearables y soluciones terapéuticas para enfermedades crónicas. Por ejemplo, pacientes con diabetes, enfermedades cardiovasculares o trastornos del sueño utilizan dispositivos conectados en casa para la monitorización diaria y las consultas remotas. El creciente enfoque en la atención domiciliaria, el envejecimiento de la población y la creciente concienciación sobre las soluciones de salud digital impulsan su adopción. El reembolso de seguros para dispositivos de uso doméstico también impulsa el crecimiento. La conveniencia, la comodidad y la rentabilidad de las soluciones de cuidado domiciliario aceleran aún más su adopción.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en farmacias, canal en línea y otros. El segmento del canal en línea dominó el mercado con la mayor participación en ingresos, un 38,9 %, en 2025, impulsado por la creciente preferencia de los consumidores por las compras directas, la comodidad y la entrega a domicilio de dispositivos médicos inteligentes. Las plataformas en línea ofrecen información detallada sobre los productos, herramientas de comparación y servicios de gestión de dispositivos por suscripción, lo que impulsa su adopción.

Se espera que el segmento de Farmacias experimente el mayor crecimiento durante el período de pronóstico, gracias a la accesibilidad, la orientación profesional y el aumento de las colaboraciones con fabricantes de dispositivos médicos. Por ejemplo, los monitores de glucosa inteligentes y los tensiómetros se distribuyen cada vez más a través de farmacias minoristas, lo que permite a los clientes adquirirlos junto con sus medicamentos. Los farmacéuticos también ofrecen orientación sobre el uso, la calibración y la integración de los dispositivos con aplicaciones móviles. La creciente confianza en los servicios de salud basados en farmacias y la expansión de las cadenas de farmacias en zonas urbanas y semiurbanas impulsan un sólido crecimiento.

Análisis regional del mercado de dispositivos médicos inteligentes en América del Norte

- Estados Unidos dominó el mercado de dispositivos médicos inteligentes de América del Norte con la mayor participación en los ingresos del 78,9 % en 2025, caracterizado por la adopción temprana de tecnologías de atención médica avanzadas, un alto gasto en atención médica y una fuerte presencia de actores clave de la industria.

- Los proveedores de atención médica y los pacientes de la región valoran mucho la conveniencia, el monitoreo en tiempo real y los conocimientos predictivos que ofrecen los dispositivos médicos inteligentes, incluidas las herramientas de diagnóstico portátiles, las soluciones de monitoreo remoto y los dispositivos terapéuticos conectados.

- Esta adopción generalizada está respaldada además por una población conocedora de la tecnología, fuertes iniciativas gubernamentales que promueven el monitoreo remoto de pacientes y la presencia de fabricantes clave de dispositivos médicos, que establecen los dispositivos médicos inteligentes como herramientas esenciales tanto en entornos clínicos como de atención domiciliaria.

Análisis del mercado de dispositivos médicos inteligentes de EE. UU.

El mercado estadounidense de dispositivos médicos inteligentes captó la mayor participación en los ingresos, con un 78,9 %, en 2025 en Norteamérica, impulsado por la rápida adopción de tecnologías de atención médica conectada y la expansión de las iniciativas de telesalud. Pacientes y profesionales de la salud priorizan cada vez más la monitorización remota, el diagnóstico continuo y las soluciones de tratamiento personalizadas. La creciente tendencia a la atención domiciliaria, combinada con la sólida demanda de wearables con IA y la integración de aplicaciones móviles, impulsa aún más la industria de dispositivos médicos inteligentes. Además, la integración de dispositivos inteligentes con historias clínicas electrónicas (HCE) y plataformas de análisis predictivo contribuye significativamente a la expansión del mercado.

Análisis del mercado de dispositivos médicos inteligentes de Canadá

Se proyecta que el mercado canadiense de dispositivos médicos inteligentes crecerá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado por el aumento de las inversiones en infraestructura sanitaria y un fuerte enfoque en iniciativas de salud digital. La creciente concienciación de los pacientes, sumada a la adopción de soluciones de monitorización remota de pacientes y telemedicina, está impulsando la adopción de dispositivos médicos inteligentes. Los proveedores de atención médica canadienses están adoptando dispositivos conectados para el manejo de enfermedades crónicas, la monitorización hospitalaria y la atención preventiva. La integración con aplicaciones móviles de salud y análisis de IA también está impulsando la mejora de los resultados de los pacientes y la eficiencia operativa.

Análisis del mercado de dispositivos médicos inteligentes en México

Se prevé que el mercado mexicano de dispositivos médicos inteligentes crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la expansión de la cobertura sanitaria y la creciente adopción de tecnologías médicas avanzadas. La creciente urbanización, las mejoras en la infraestructura hospitalaria y las iniciativas gubernamentales para modernizar los servicios de salud están impulsando el crecimiento del mercado. La creciente preferencia en México por los dispositivos de monitorización domiciliaria y las terapias portátiles está contribuyendo a la demanda. Además, las alianzas entre fabricantes nacionales e internacionales de dispositivos médicos están facilitando el acceso a soluciones médicas inteligentes asequibles e innovadoras.

Cuota de mercado de dispositivos médicos inteligentes en América del Norte

La industria de dispositivos médicos inteligentes de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Medtronic (Irlanda)

- Abbott (EE. UU.)

- Dexcom, Inc. (EE. UU.)

- Boston Scientific Corporation (EE. UU.)

- BD (EE. UU.)

- Masimo Corporation (EE. UU.)

- ResMed Inc. (EE. UU.)

- iRhythm Technologies, Inc. (EE. UU.)

- AliveCor, Inc. (EE. UU.)

- Qardio, Inc. (EE. UU.)

- Sempulse Corporation (EE. UU.)

- Zephyr Technology Corporation (EE. UU.)

- Apple Inc. (EE. UU.)

- Fitbit LLC (EE. UU.)

- GE HealthCare (EE. UU.)

- Stryker (EE. UU.)

- Omron Healthcare, Inc. (EE. UU.)

- Welch Allyn, Inc. (EE. UU.)

- Hill-Rom Services, Inc. (EE. UU.)

- NeuroMetrix, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de dispositivos médicos inteligentes de América del Norte?

- En octubre de 2024, los dispositivos médicos portátiles EmeTerm Smart y HeadaTerm 2 recibieron las Licencias de Dispositivos Médicos (MDL) de Health Canada, lo que permitió que estos dispositivos se comercializaran en Canadá para el alivio del mareo por movimiento y la migraña, lo que ilustra el progreso regulatorio en América del Norte y la adopción ampliada de tecnologías terapéuticas portátiles más allá del marco de la FDA de EE. UU.

- En agosto de 2024, Masimo W1® Medical Watch recibió la autorización 510(k) de la FDA para su integración con el sistema de telemonitoreo Masimo SafetyNet®, lo que permite la transmisión continua de signos vitales desde la muñeca (por ejemplo, SpO₂, frecuencia del pulso) a cuidadores y médicos a través de una conectividad segura en la nube, un avance significativo en el monitoreo remoto de pacientes.

- En marzo de 2024, la FDA de EE. UU. autorizó el primer monitor continuo de glucosa de venta libre, el sistema de biosensor de glucosa Dexcom Stelo, ampliando el acceso al monitoreo de glucosa en tiempo real para adultos sin receta, lo que permite un autocontrol más amplio de la glucosa en sangre fuera de entornos clínicos.

- En enero de 2024, la plataforma portátil SimpleSense‑BP de Nanowear recibió la autorización 510(k) de la FDA para la monitorización continua de la presión arterial sin manguito habilitada con IA, lo que representa un paso adelante para el diagnóstico de hipertensión no invasivo en el hogar.

- En noviembre de 2023, el reloj médico W1™ de Masimo obtuvo la autorización 510(k) de la FDA para su uso con y sin receta, lo que permite la monitorización continua de la saturación de oxígeno y la frecuencia del pulso para adultos en entornos domésticos y clínicos, lo que indica la expansión de los diagnósticos portátiles en la atención médica convencional.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.