North America Sleep Apnea Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

6.50 Billion

USD

24.40 Billion

2024

2032

USD

6.50 Billion

USD

24.40 Billion

2024

2032

| 2025 –2032 | |

| USD 6.50 Billion | |

| USD 24.40 Billion | |

|

|

|

|

North America Sleep Apnea Devices Market Segmentation, By Diseases type (Obstructive Sleep Apnea Syndrome, Central Sleep Apnea Syndrome, Complex Sleep Apnea Syndrome), Type (Devices, Therapy), Patient Demographics (Pediatric, Adult, Geriatric), End User (Hospital/ Clinics, Diagnostic Centers, Ambulatory Care Centers, Specialty Care Centers, Home Healthcare), Distribution Channel (Direct Tender, Retail Sales) - Industry Trends and Forecast to 2032

Sleep Apnea Devices Market Size

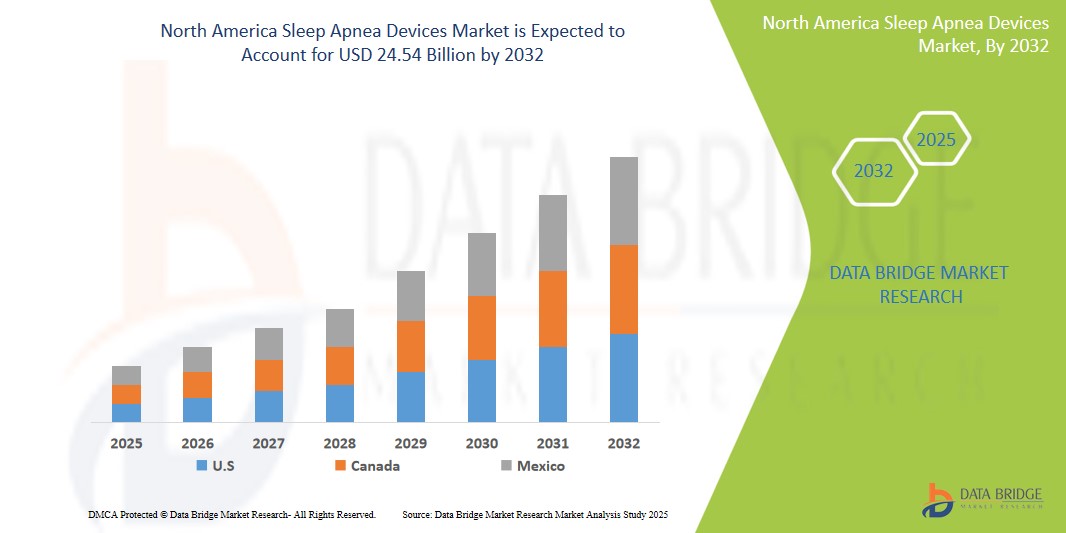

- The North America Sleep Apnea Devices Market was valued atUSD6.5 Billion in 2024 and is expected to reachUSD24.54 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 7.1%primarily driven by the anticipated launch of therapies

- The drivers of the Sleep Apnea Devices Market are rising prevalence of obstructive sleep apnea (OSA) due to increasing obesity and aging populations, growing awareness about the health risks associated with untreated sleep disorders, advancements in sleep apnea diagnostic and therapeutic technologies, and the increasing adoption of home-based sleep testing and therapy solutions. Additionally, supportive reimbursement policies and initiatives by healthcare organizations to promote early diagnosis and treatment of sleep apnea are further propelling market growth.

North America Sleep Apnea Devices Market Analysis

- Sleep apnea devices play a pivotal role in diagnosing and treating sleep-related breathing disorders, primarily obstructive sleep apnea (OSA). These devices—including continuous positive airway pressure (CPAP) machines, bilevel positive airway pressure (BiPAP) machines, adaptive servo-ventilation (ASV) devices, and oral appliances—are essential for maintaining airway patency during sleep and improving patient outcomes. They are widely used across sleep clinics, hospitals, and home care settings.

- The demand for sleep apnea devices in North America is primarily driven by the increasing prevalence of sleep apnea, particularly linked to rising obesity rates, sedentary lifestyles, and aging populations. Growing awareness of the health risks associated with untreated sleep apnea—such as cardiovascular disease, stroke, and diabetes—is further fueling the adoption of diagnostic and therapeutic devices.

- North America is a leading region in the global sleep apnea devices market, supported by a well-established healthcare infrastructure, high rates of diagnosis, and significant investment in medical device innovation. The United States holds a dominant share, owing to advanced sleep medicine programs, a large base of sleep disorder patients, and expanding reimbursement coverage for sleep apnea treatments.

- For instance, the U.S. has experienced increased use of CPAP and home sleep testing devices, driven by a shift towards remote monitoring, telehealth integration, and patient preference for non-invasive treatment options.

- The North American sleep apnea devices market is also shaped by regulatory support, such as FDA approvals for new and user-friendly technologies, as well as rising public and private healthcare expenditures. Technological advancements—including miniaturized, quieter, and more comfortable devices—combined with a surge in at-home sleep tests, are contributing to wider patient acceptance. Furthermore, the growing burden of comorbidities and the trend towards personalized therapy are fostering the adoption of tailored sleep apnea solutions

Report ScopeSleep Apnea DevicesMarket Segmentation

|

Attributes |

Sleep Apnea DevicesKey Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sleep Apnea Devices Market Trends

“Increasing Integration of Smart and Connected Devices”

- The integration of smart technology into sleep apnea devices is a prominent trend in the North American market. Devices such as CPAP (Continuous Positive Airway Pressure) machines, BiPAP (Bilevel Positive Airway Pressure), and adaptive servo-ventilation (ASV) devices now feature connectivity options that allow patients and healthcare providers to monitor treatment progress remotely. Real-time data transmission via mobile apps and cloud platforms is helping healthcare professionals personalize care and improve patient compliance.

- There is a growing trend toward the development and adoption of portable and compact sleep apnea devices that allow for in-home use. These devices are becoming more user-friendly and effective, with features such as noise reduction, improved comfort, and portability. The rise in home healthcare demand, fueled by the need for cost-effective, convenient care, is driving the adoption of these at-home devices, making it easier for patients to manage their condition outside of hospital settings.

Sleep Apnea Devices Market Dynamics

Driver

“Increasing Awareness and Access to Sleep Apnea Treatment”

- Rising awareness about the risks of untreated sleep apnea, such as cardiovascular diseases, stroke, and daytime fatigue, is driving the demand for sleep apnea devices in North America.

- Public health campaigns and education on the importance of early diagnosis and treatment of sleep apnea are encouraging individuals to seek medical advice and invest in devices like CPAP machines, BiPAP machines, and portable monitoring systems.

- Increased accessibility to healthcare services and insurance coverage, particularly through government programs like Medicare and Medicaid in the U.S., has improved access to treatment for sleep apnea, contributing to the market growth.

- The expansion of e-commerce platforms and retail channels has made sleep apnea devices more accessible to a broader range of consumers, including those who prefer at-home diagnosis and treatment solutions.

- For instance, In January 2024, the U.S. FDA approved a new portable sleep apnea device, "SnoozeTrack," which combines diagnostic and therapeutic functions in a single device. This device is designed for at-home use and offers both continuous positive airway pressure (CPAP) therapy and sleep monitoring, making it a convenient option for patients who have trouble visiting clinics regularly. The introduction of such innovative devices reflects the growing market demand for accessible, effective, and user-friendly sleep apnea treatments

- In line with these trends, companies are increasingly introducing innovative, user-friendly devices, including wireless monitoring devices and wearable technology, which are further accelerating market adoption.

- Additionally, advancements in telemedicine and remote monitoring for sleep apnea care are boosting treatment adherence and expanding the patient base, especially in remote or underserved areas.

Opportunity

“Integration of Sleep Apnea Devices into Home-Based and Telemedicine Platforms”

- The growing trend toward home-based healthcare and telemedicine is creating significant opportunities for the integration of sleep apnea devices into remote monitoring and at-home treatment solutions in North America.

- As patients and healthcare providers increasingly embrace digital health solutions, there is a rising demand for sleep apnea devices that offer continuous monitoring, data sharing, and remote physician consultations, particularly in rural and underserved areas.

- The shift towards telemedicine and virtual consultations is encouraging the development of connected sleep apnea devices, allowing patients to manage their condition more effectively from the comfort of their homes while keeping their healthcare providers updated in real-time.

- For instance, In February 2024, the company ResMed launched a cloud-connected CPAP machine, the "AirSense 11," which integrates with mobile apps to provide patients and healthcare providers with real-time data on treatment adherence, sleep quality, and therapy effectiveness. This innovation allows patients to manage their sleep apnea treatment at home while benefiting from remote monitoring and virtual follow-up consultations with their healthcare providers, reflecting the growing opportunity in home-based and telemedicine-driven sleep apnea care

- This trend is also driving the need for more compact, user-friendly, and non-intrusive devices that can easily integrate into patients' daily lives without disrupting their routines.

Restraint/Challenge

“High Equipment Costs and Complex Regulatory Approval Processes”

- Advanced sleep apnea devices, such as CPAP and BiPAP machines with integrated monitoring systems and smart technology, often come with high procurement, maintenance, and operational costs. These expenses can be a significant barrier for smaller healthcare providers, clinics, and homecare agencies, especially in rural or underserved areas across North America.

- The complex and lengthy regulatory approval processes imposed by agencies like the U.S. FDA and Health Canada also create hurdles for manufacturers looking to launch or upgrade sleep apnea devices. These regulations, while necessary for patient safety, contribute to delayed market entry, higher development costs, and the need for extensive clinical trials.

- For instance, In March 2024, a report from the U.S. FDA highlighted the challenges faced by small sleep apnea device manufacturers in obtaining FDA clearance for new technologies. The report noted that innovative sleep apnea devices with advanced features, such as wireless data transmission and artificial intelligence-driven therapy adjustment, faced delays in approval due to rigorous testing requirements. These delays hindered the ability of smaller companies to compete with larger, more established players in the market, limiting their reach and growth opportunities

Sleep Apnea Devices Market Scope

The market is segmented on the basis, disease type, type, patient demographics, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Disease Type |

|

|

By Type |

|

|

By Patient Demographics |

|

|

By End User

|

|

|

By Distribution Channel |

|

In 2025, the Devices is projected to dominate the market with a largest share in type segment

The Positive Airway Pressure (PAP) devices segment is expected to dominate the North America Sleep Apnea Devices Market in 2025, primarily due to its proven effectiveness in treating obstructive sleep apnea (OSA), the most common form of sleep apnea. PAP devices—including CPAP, BiPAP, and APAP—are widely regarded as the first-line therapy for moderate to severe cases. Their ability to maintain airway patency during sleep significantly reduces apnea episodes and improves sleep quality. Increasing awareness among patients and healthcare professionals, combined with a growing prevalence of sleep-related disorders, is fueling demand for these devices. Furthermore, advancements in device design—such as quieter operation, portable form factors, and smart connectivity features—are enhancing patient compliance and driving segment growth.

The o Hospital/ Clinics is expected to account for the largest share during the forecast period in end user market

In 2025, hospitals and sleep clinics are projected to account for the largest share of the North America Sleep Apnea Devices Market by end user. This dominance is attributed to the increasing number of sleep studies conducted in clinical settings, the availability of comprehensive diagnostic and therapeutic services, and the presence of skilled healthcare professionals for effective patient management. Hospitals and accredited sleep centers are often the first point of diagnosis and treatment, particularly for patients with complex or severe sleep apnea cases. Additionally, supportive reimbursement policies, integration of telehealth services, and ongoing investments in sleep disorder programs across North America further reinforce the segment's leading position.

Sleep Apnea Devices Market Regional Analysis

“U.S. is the Dominant Country in the Sleep Apnea Devices Market”

- The United States leads the North America Sleep Apnea Devices Market, driven by a high prevalence of sleep apnea, robust diagnostic infrastructure, and strong presence of key market players such as ResMed, Philips Respironics, and Fisher & Paykel Healthcare.

- The country’s advanced healthcare system, widespread awareness campaigns, and growing emphasis on sleep health have significantly boosted the diagnosis and treatment rates of sleep apnea.

- Supportive reimbursement policies, integration of sleep studies in routine healthcare, and increasing adoption of telemedicine platforms have further accelerated the uptake of CPAP, BiPAP, and home sleep testing devices.

- Technological advancements such as cloud-connected PAP machines, wearable monitoring systems, and AI-enabled therapy management solutions continue to position the U.S. as a hub for innovation and market growth.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to register the fastest growth in the North America Sleep Apnea Devices Market, supported by increasing awareness of sleep-related disorders, expansion of healthcare services, and a rising aging population.

- Government initiatives aimed at improving access to diagnostic services, particularly in rural and underserved regions, are contributing to the growing demand for home-based sleep testing and therapy devices.

- Provinces like Ontario, British Columbia, and Quebec are witnessing greater adoption of PAP therapy and diagnostic tools, driven by expanding sleep clinics, improved insurance coverage, and educational efforts promoting early diagnosis and treatment.

- The increasing availability of digital health solutions, telehealth consultations, and mobile monitoring technologies is making sleep apnea management more accessible and efficient—further accelerating market penetration across Canada

Sleep Apnea Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ResMed Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare (New Zealand)

- Compumedics Limited (Australia)

- Itamar Medical Ltd. (Israel)

- Nihon Kohden Corporation (Japan)

- Drive DeVilbiss Healthcare (U.S.)

Latest Developments in Global Sleep Apnea Devices Market

- In November 2023, Vivos Therapeutics obtained FDA 510(k) Clearance for its CARE (Complete Airway Repositioning and/or Expansion) oral devices tailored for adults with severe obstructive sleep apnea (OSA). This clearance covers the company's prominent DNA, mRNA, and mmRNA oral appliances.

- In October 2023, ResMed and Bittium Biosignals Ltd, a Bittium Corporation subsidiary, entered an agreement where ResMed becomes a distributor of Bittium Respiro, an advanced Home Sleep Apnea Test and Analysis Solution. The comprehensive solution includes the Bittium Respiro measuring device, its accessories, and the Bittium Respiro Analyst software analysis tool and service platform. The non-exclusive agreement covers Norway, the United Kingdom (UK), Switzerland, the Republic of Ireland, Finland, and Sweden

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.