North America Rett Syndrome Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.00 Billion

USD

4.04 Billion

2024

2032

USD

2.00 Billion

USD

4.04 Billion

2024

2032

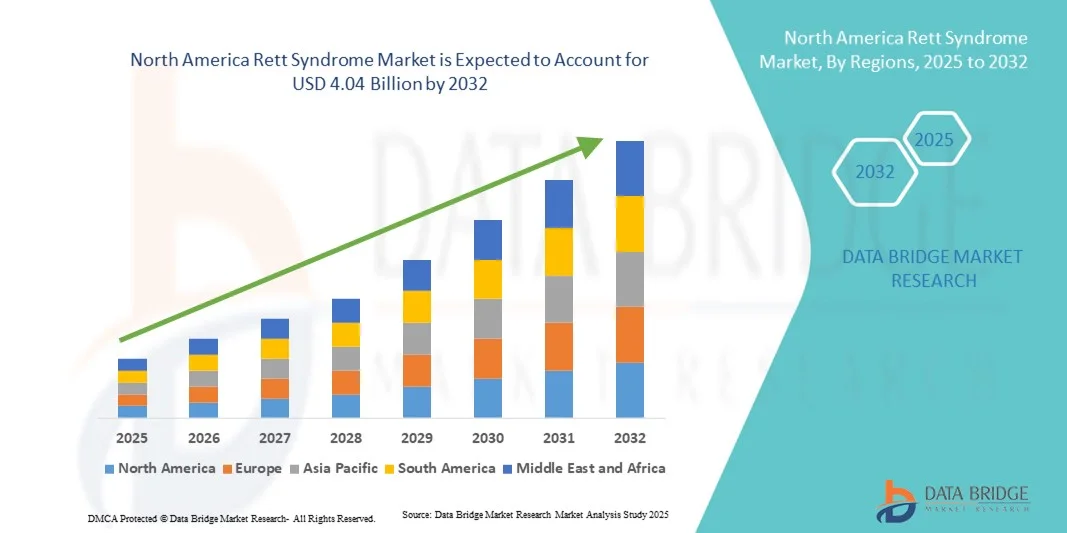

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 4.04 Billion | |

|

|

|

|

Segmentación del mercado del síndrome de Rett en Norteamérica por tipo (síndrome de Rett clásico y síndrome de Rett atípico), estadio (estadio IV: deterioro motor tardío; estadio III: meseta; estadio II: destrucción rápida; estadio I: inicio temprano), tipo de tratamiento (clase de fármaco, tipo de terapia y otros), tipo de fármaco (de marca y genéricos), vía de administración (oral, parenteral y otras), usuario final (hospitales, clínicas especializadas, organizaciones de investigación y otros) y canal de distribución (farmacia hospitalaria, farmacia en línea, farmacia minorista y otros): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado del síndrome de Rett en Norteamérica

- El tamaño del mercado del síndrome de Rett en América del Norte se valoró en 2.000 millones de dólares en 2024 y se espera que alcance los 4.040 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 9,2% durante el período de pronóstico.

- El crecimiento del mercado se debe principalmente a la creciente prevalencia del síndrome de Rett en Estados Unidos y Canadá, junto con una mayor concienciación y mejores capacidades de diagnóstico para trastornos neurológicos raros.

- Además, los avances continuos en la investigación genética, junto con la expansión de los ensayos clínicos para terapias dirigidas y tratamientos basados en genes, están acelerando la innovación en la región. Estos factores están fomentando una mayor inversión en terapias para el síndrome de Rett y en la infraestructura de atención al paciente, impulsando así la expansión general del mercado.

Análisis del mercado del síndrome de Rett en Norteamérica

- El síndrome de Rett, un trastorno neurodesarrollativo poco frecuente causado por mutaciones en el gen MECP2, está recibiendo cada vez más atención médica y de investigación en toda Norteamérica, impulsada por los avances en el diagnóstico genético, los programas de intervención temprana y la ampliación de los registros de pacientes que respaldan el desarrollo de terapias dirigidas.

- El crecimiento del mercado se debe principalmente al aumento de la incidencia de diagnósticos del síndrome de Rett, al creciente énfasis en la medicina personalizada y a las colaboraciones en curso entre empresas de biotecnología, instituciones académicas y organizaciones sanitarias para el desarrollo de tratamientos innovadores.

- Estados Unidos dominó el mercado norteamericano del síndrome de Rett con la mayor cuota de ingresos (68,9%) en 2024, gracias a una sólida infraestructura de I+D, políticas de reembolso favorables y la presencia de importantes empresas biofarmacéuticas centradas en terapias génicas y neuroregenerativas.

- Se prevé que Canadá registre el crecimiento más rápido durante el período de pronóstico, impulsado por un mejor acceso a la atención médica, una mayor concienciación entre los médicos y la participación activa en consorcios multinacionales de investigación del síndrome de Rett.

- El segmento del síndrome de Rett clásico dominó el mercado con la mayor cuota de mercado, un 61,7%, en 2024, debido a su mayor prevalencia en comparación con las variantes atípicas y al creciente número de ensayos clínicos específicos centrados en este tipo.

Alcance del informe y segmentación del mercado del síndrome de Rett en Norteamérica

|

Atributos |

Información clave del mercado del síndrome de Rett en Norteamérica |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis exhaustivos de expertos, epidemiología de pacientes, análisis de proyectos en desarrollo, análisis de precios y marco regulatorio. |

Tendencias del mercado del síndrome de Rett en América del Norte

Avances en terapia génica y enfoques de tratamiento personalizados

- Una tendencia significativa y en auge en el mercado norteamericano del síndrome de Rett es el creciente interés en la terapia génica y la medicina de precisión, cuyo objetivo es abordar la causa raíz de las mutaciones del gen MECP2. Este cambio de paradigma está potenciando la posibilidad de modificar la enfermedad a largo plazo, en lugar de limitarse al tratamiento sintomático.

- Por ejemplo, en marzo de 2024, Taysha Gene Therapies anunció datos alentadores de sus ensayos clínicos en curso de terapia génica TSHA-102 en pacientes con síndrome de Rett, lo que representa un paso crucial hacia el desarrollo de tratamientos transformadores de una sola administración. De manera similar, Neurogene Inc. está avanzando con su programa NGN-401, diseñado para restaurar la función de MECP2 mediante un sistema de vectores AAV9.

- La integración de herramientas genómicas avanzadas permite a los investigadores comprender mejor las variaciones genéticas específicas de cada paciente, lo que facilita el desarrollo de intervenciones terapéuticas más personalizadas. Por ejemplo, se están investigando la edición genética y las tecnologías basadas en ARNm para ajustar con precisión la expresión de MECP2 y minimizar los posibles efectos secundarios. Además, los modelos de células madre derivadas de pacientes se utilizan cada vez más para predecir la respuesta al tratamiento y acelerar el descubrimiento de fármacos.

- La colaboración entre instituciones académicas, empresas de biotecnología y organizaciones sin fines de lucro está fortaleciendo la investigación traslacional y facilitando la transición de los descubrimientos de laboratorio a la aplicación clínica. Gracias a estas alianzas, Norteamérica sigue liderando la innovación en enfermedades raras y la obtención de aprobaciones regulatorias para terapias dirigidas a genes.

- Este creciente cambio hacia la terapia personalizada y dirigida a genes está redefiniendo el panorama del tratamiento del síndrome de Rett. En consecuencia, empresas como Taysha Gene Therapies y Neurogene están liderando avances en tecnologías de reemplazo génico único y regulación de la expresión para lograr resultados terapéuticos duraderos.

- La demanda de terapias modificadoras de la enfermedad y planes de tratamiento individualizados está aumentando rápidamente en Estados Unidos y Canadá, a medida que los pacientes y sus cuidadores buscan cada vez más soluciones que ofrezcan mejores resultados neurológicos y una mayor calidad de vida.

Dinámica del mercado del síndrome de Rett en Norteamérica

Conductor

Aumento de la financiación para la investigación y avances en el diagnóstico genético

- La creciente inversión en investigación de enfermedades raras, junto con los avances tecnológicos en diagnósticos genéticos, es un factor clave en la expansión del mercado del síndrome de Rett en Norteamérica.

- Por ejemplo, en febrero de 2024, los Institutos Nacionales de Salud (NIH) de EE. UU. ampliaron su financiación en el marco de la Red de Investigación Clínica de Enfermedades Raras para incluir múltiples estudios centrados en el síndrome de Rett destinados a mejorar el diagnóstico precoz y el desarrollo de tratamientos.

- A medida que aumenta el conocimiento sobre el síndrome de Rett, la adopción de pruebas genéticas se acelera, lo que permite un diagnóstico más temprano y preciso, facilitando así la intervención terapéutica oportuna y la participación en ensayos clínicos.

- Además, la introducción de la secuenciación de próxima generación (NGS) y los programas de cribado neonatal en los principales estados de EE. UU. está mejorando las tasas de detección, mientras que las iniciativas que promueven los registros de enfermedades raras están enriqueciendo los datos clínicos y contribuyendo a la optimización de las terapias. La mayor colaboración entre instituciones de investigación, proveedores de atención médica y compañías farmacéuticas está impulsando la innovación y agilizando el proceso de aprobación regulatoria de las terapias para el síndrome de Rett en toda Norteamérica.

- El creciente número de ensayos clínicos que exploran terapias modificadoras de la enfermedad, incluyendo la reactivación genética y los agentes neuroprotectores, está generando un fuerte impulso para nuevas opciones de tratamiento.

- La ampliación de las colaboraciones entre empresas biotecnológicas y centros académicos está facilitando la traslación de los hallazgos preclínicos a estudios en humanos, acelerando la comercialización de fármacos de próxima generación para el síndrome de Rett.

Restricción/Desafío

Costes de tratamiento elevados y disponibilidad comercial limitada

- El elevado coste asociado a la terapia génica avanzada y a la atención neurológica especializada supone un importante obstáculo para un acceso más amplio en el mercado del síndrome de Rett en Norteamérica.

- Por ejemplo, se prevé que las terapias génicas emergentes, como la TSHA-102, tengan precios multimillonarios tras su aprobación, lo que plantea preocupaciones sobre la asequibilidad y el reembolso tanto para los pacientes como para los sistemas de salud.

- La limitada disponibilidad comercial de fármacos específicos para el síndrome de Rett y la reducida población de pacientes dificultan que las empresas farmacéuticas mantengan modelos de producción y distribución a gran escala.

- Además, los largos y complejos procesos regulatorios para las terapias genéticas raras a menudo retrasan los plazos de comercialización y aumentan los costos generales de desarrollo para los fabricantes.

- Para superar estos desafíos, ampliar la cobertura de los seguros, implementar iniciativas de financiación para enfermedades raras y fomentar las alianzas público-privadas serán esenciales para mejorar el acceso al tratamiento y la sostenibilidad del mercado a largo plazo.

- La escasez de neurólogos especializados y el conocimiento limitado entre los proveedores de atención primaria contribuyen al retraso en el diagnóstico y la subnotificación de casos del síndrome de Rett en toda América del Norte.

- Las preocupaciones éticas en torno a la edición genética y los requisitos de seguimiento de seguridad a largo plazo para las terapias génicas podrían ralentizar su adopción clínica y su aceptación regulatoria, a pesar de los importantes avances en la investigación.

Alcance del mercado del síndrome de Rett en América del Norte

El mercado está segmentado en función del tipo, la etapa, el tipo de tratamiento, el tipo de fármaco, la vía de administración, el usuario final y el canal de distribución.

- Por tipo

Según su tipo, el mercado del síndrome de Rett en Norteamérica se divide en síndrome de Rett clásico y síndrome de Rett atípico. El segmento del síndrome de Rett clásico dominó el mercado con la mayor cuota de ingresos (61,7 %) en 2024, principalmente debido a su mayor prevalencia y criterios diagnósticos específicos. Esta forma del síndrome de Rett es la más reconocida y representa la mayoría de los casos diagnosticados en Norteamérica. El aumento de la concienciación entre los profesionales clínicos, las iniciativas de defensa de los pacientes y los ensayos clínicos de terapia génica en curso dirigidos a las mutaciones del gen MECP2 han impulsado significativamente el crecimiento de este segmento. Las compañías farmacéuticas están priorizando las terapias dirigidas a mitigar la regresión motora, las convulsiones y el deterioro cognitivo que prevalecen en los casos de síndrome de Rett clásico. Además, las mayores tasas de diagnóstico y su inclusión en la mayoría de los estudios clínicos refuerzan aún más su dominio en el panorama general del mercado.

Se prevé que el segmento del síndrome de Rett atípico experimente el crecimiento más rápido durante el período de pronóstico, impulsado por los avances en la secuenciación de próxima generación (NGS) y el diagnóstico molecular, que mejoran la identificación de las variantes. Una mejor comprensión de subtipos como la variante con preservación del habla y la variante de convulsiones tempranas permite una diferenciación más precisa de otros trastornos neurológicos. El creciente interés clínico y el desarrollo de terapias personalizadas y dirigidas están ampliando las opciones de tratamiento para las presentaciones atípicas. Además, los esfuerzos de investigación respaldados por organizaciones de enfermedades raras están aumentando la concientización, la detección temprana y el acceso a la atención especializada para los casos atípicos.

- Por etapas

Según las etapas, el mercado se segmenta en Etapa I (Inicio Temprano), Etapa II (Destrucción Rápida), Etapa III (Meseta) y Etapa IV (Deterioro Motor Tardío). La Etapa II (Destrucción Rápida) dominó el mercado en 2024, ya que la mayoría de los diagnósticos se producen durante esta fase crítica de progresión, caracterizada por la pérdida de la función manual adquirida, las habilidades comunicativas y la movilidad. Esta etapa concentra la mayoría de las intervenciones médicas, incluidos los tratamientos farmacológicos y la terapia conductual, dirigidos a ralentizar la regresión neurológica. La fortaleza de este segmento también radica en la concentración de ensayos clínicos que buscan detener o revertir el deterioro rápido mediante nuevos agentes terapéuticos. La creciente concienciación entre los neurólogos pediátricos y los padres sobre el reconocimiento precoz de los síntomas mejora aún más las tasas de diagnóstico y tratamiento en esta etapa. Los hospitales y centros especializados están haciendo hincapié en las intervenciones terapéuticas tempranas para mitigar las complicaciones a largo plazo, lo que impulsa aún más el crecimiento del segmento.

Se prevé que el segmento de la Etapa III (Meseta) registre el crecimiento más rápido entre 2025 y 2032, gracias a los avances en cuidados paliativos y manejo terapéutico que prolongan la supervivencia de los pacientes y mejoran los resultados funcionales. Esta fase suele asociarse con la estabilización de los síntomas, lo que hace que los pacientes respondan mejor a la rehabilitación y las terapias de asistencia. La creciente disponibilidad de herramientas de comunicación adaptativa y programas de fisioterapia contribuye a una demanda sostenida del mercado. Además, en esta etapa se está incrementando la investigación sobre el mantenimiento de la función neurológica y la prevención del deterioro en etapas avanzadas. Los programas de capacitación para cuidadores y las iniciativas de apoyo multidisciplinario también impulsan el crecimiento dentro de este segmento.

- Por tipo de tratamiento

Según el tipo de tratamiento, el mercado se clasifica en clase de fármaco, tipo de terapia y otros. El segmento de Clase de Fármaco dominó el mercado en 2024 con una importante cuota de ingresos, impulsado por la creciente adopción de medicamentos que controlan síntomas como las convulsiones, la ansiedad y los trastornos del sueño. La aprobación en EE. UU. de fármacos dirigidos como DAYBUE™ (trofinetida) ha acelerado el crecimiento del mercado al ofrecer el primer tratamiento específico para el síndrome de Rett. El aumento de las inversiones en I+D por parte de empresas de biotecnología centradas en fármacos moduladores de MECP2 y agentes neuroprotectores también refuerza el dominio de este segmento. Además, los incentivos para medicamentos huérfanos y la financiación de programas para enfermedades raras siguen atrayendo la innovación en este campo. La expansión de los ensayos clínicos que exploran combinaciones de fármacos respalda aún más el potencial de crecimiento a largo plazo de este segmento.

Se prevé que el segmento de Tipos de Terapias experimente el crecimiento más rápido durante el período de pronóstico, debido a la creciente concienciación sobre la importancia de las intervenciones no farmacológicas. Las terapias físicas, ocupacionales y del habla son cada vez más reconocidas por su papel en la mejora de la movilidad, la comunicación y la interacción social. Los centros de rehabilitación y las clínicas especializadas están ampliando su oferta de servicios para incluir programas de terapia multidisciplinarios adaptados a pacientes con síndrome de Rett. Además, la integración de herramientas digitales de rehabilitación basadas en inteligencia artificial y plataformas de teleterapia está transformando el acceso a la terapia en toda Norteamérica. El auge de los programas de educación para padres que hacen hincapié en la intervención temprana está impulsando aún más la demanda del segmento.

- Por tipo de medicamento

Según el tipo de fármaco, el mercado se divide en medicamentos de marca y genéricos. El segmento de marca dominó el mercado norteamericano del síndrome de Rett en 2024, impulsado por las sólidas ventas de tratamientos recientemente aprobados y las continuas innovaciones en terapia génica. Los medicamentos de marca se benefician de la validación clínica, una eficacia superior y un sólido respaldo de marketing por parte de las principales compañías biofarmacéuticas. Los derechos de exclusividad y los precios elevados asociados a los medicamentos huérfanos incrementan aún más la rentabilidad del segmento. La creciente preferencia de los pacientes por medicamentos aprobados y clínicamente probados contribuye al dominio continuo de los productos de marca en hospitales y clínicas especializadas. Además, las colaboraciones entre compañías farmacéuticas e instituciones de investigación están reforzando la presencia del segmento de marca en el mercado.

Se prevé que el segmento de genéricos experimente el crecimiento más rápido entre 2025 y 2032, impulsado por la expiración de patentes clave y las iniciativas que promueven el acceso asequible a medicamentos para enfermedades raras. El papel cada vez más importante de los genéricos en el manejo de síntomas como las convulsiones y la disfunción motora está ampliando el acceso al tratamiento para pacientes de bajos ingresos. Los sistemas de reembolso gubernamentales que apoyan opciones de medicamentos rentables están impulsando aún más el crecimiento del segmento. Además, a medida que más medicamentos para el síndrome de Rett finalizan su exclusividad, se espera que la fabricación y distribución de genéricos se expandan por toda Norteamérica.

- Por vía administrativa

Según la vía de administración, el mercado se segmenta en oral, parenteral y otras. El segmento oral dominó el mercado con la mayor cuota de ingresos en 2024 debido a su conveniencia, facilidad de administración e idoneidad para el tratamiento terapéutico a largo plazo. Los medicamentos orales, como la trofinetida y los fármacos de apoyo para la ansiedad y la epilepsia, se prescriben ampliamente para el tratamiento domiciliario. Este segmento se beneficia de una mayor adherencia al tratamiento y menores costos sanitarios en comparación con las vías parenterales. El aumento de la inversión en I+D para el desarrollo de compuestos neuroprotectores con biodisponibilidad oral está reforzando aún más su dominio. Además, los avances en los sistemas de administración oral de fármacos, destinados a mejorar la penetración de la barrera hematoencefálica, están optimizando la eficacia del tratamiento.

Se prevé que el segmento parenteral experimente el crecimiento más rápido entre 2025 y 2032, impulsado por el auge de las terapias génicas y celulares inyectables que requieren una administración especializada. Los métodos de administración intravenosa y subcutánea se utilizan cada vez más en ensayos clínicos con productos biológicos y tratamientos con vectores virales. Los hospitales y clínicas especializadas se están equipando con infraestructura avanzada para respaldar dichas terapias. Además, el creciente énfasis en la administración sistémica rápida de fármacos y la dosificación precisa contribuye a la expansión de este segmento. Las alianzas entre hospitales y empresas biofarmacéuticas para la administración de nuevas terapias parenterales impulsan aún más el crecimiento.

- Por usuario final

Según el usuario final, el mercado se segmenta en hospitales, clínicas especializadas, organizaciones de investigación y otros. El segmento de hospitales ostentó la mayor cuota de mercado en 2024, dado que funcionan como centros primarios para el diagnóstico, las pruebas genéticas y el tratamiento del síndrome de Rett. La presencia de instalaciones avanzadas para pruebas neurogenéticas y unidades de atención multidisciplinarias garantiza una gestión integral del paciente. Los hospitales también son fundamentales para la administración de terapias parenterales, tratamientos génicos y ensayos clínicos en curso. La sólida integración de los seguros médicos y la financiación gubernamental para el manejo de enfermedades raras fortalecen aún más este segmento. Además, la adopción de servicios de telemedicina en las redes hospitalarias está mejorando el acceso para los pacientes de zonas rurales.

Se prevé que el segmento de Organizaciones de Investigación experimente el crecimiento más rápido durante el período de pronóstico, impulsado por el creciente número de colaboraciones académicas y privadas en el campo de la terapia génica y la investigación del neurodesarrollo. El aumento de la financiación pública y privada para estudios de enfermedades raras en Estados Unidos y Canadá está fomentando la creación de nuevos programas de investigación. La infraestructura de laboratorio avanzada y el acceso a registros de pacientes permiten a las organizaciones acelerar los estudios traslacionales. Además, las alianzas entre universidades, empresas de biotecnología y fundaciones de pacientes facilitan el intercambio de conocimientos y la transferencia de tecnología.

- Por canal de distribución

Según el canal de distribución, el mercado se clasifica en farmacia hospitalaria, farmacia en línea, farmacia minorista y otros. El segmento de farmacia hospitalaria dominó el mercado norteamericano del síndrome de Rett en 2024, con la mayor cuota de ingresos gracias al control centralizado de la distribución de terapias especializadas y génicas. Los hospitales garantizan la manipulación y administración seguras de medicamentos sensibles que requieren logística de cadena de frío y supervisión clínica. La presencia de unidades farmacéuticas especializadas en enfermedades raras refuerza aún más este dominio. Además, la mayor integración de los sistemas de receta electrónica está mejorando la eficiencia en la dispensación de medicamentos y la gestión de registros. La creciente demanda de programas de seguimiento y adherencia al tratamiento en hospitales también impulsa el crecimiento del segmento.

Se prevé que el segmento de farmacias en línea experimente el crecimiento más rápido entre 2025 y 2032, impulsado por la creciente adopción de plataformas de comercio electrónico para el manejo de enfermedades crónicas. Las farmacias en línea ofrecen comodidad a los pacientes que requieren la renovación periódica de sus recetas y la entrega a domicilio. El crecimiento de los servicios de telemedicina y las consultas digitales en Norteamérica complementa esta tendencia, mejorando el acceso para los profesionales de la salud. Además, las regulaciones favorables para las farmacias electrónicas autorizadas y los descuentos en recetas para tratamientos de larga duración están atrayendo a más consumidores. El segmento también se beneficia de las alianzas con proveedores de atención médica, lo que garantiza la autenticidad y la confiabilidad de los medicamentos dispensados en línea.

Análisis regional del mercado del síndrome de Rett en Norteamérica

- Estados Unidos dominó el mercado norteamericano del síndrome de Rett con la mayor cuota de ingresos (68,9%) en 2024, gracias a una sólida infraestructura de I+D, políticas de reembolso favorables y la presencia de importantes empresas biofarmacéuticas centradas en terapias génicas y neuroregenerativas.

- El alto nivel de conocimiento diagnóstico del país y la presencia de centros especializados en neurología y pediatría permiten la detección oportuna y el manejo eficaz de los casos de síndrome de Rett.

- Las principales compañías farmacéuticas y biotecnológicas estadounidenses participan activamente en el desarrollo de nuevas terapias dirigidas a las mutaciones del gen MECP2, con el apoyo de una financiación sustancial de organizaciones como los Institutos Nacionales de Salud (NIH).

Perspectiva del mercado del síndrome de Rett en EE. UU.

En 2024, el mercado estadounidense del síndrome de Rett representó el 68,9 % de los ingresos en Norteamérica, impulsado por la investigación clínica avanzada y la sólida presencia de empresas biotecnológicas y farmacéuticas líderes especializadas en enfermedades neurológicas raras. El país se beneficia de una amplia financiación de los NIH, una sólida colaboración entre institutos de investigación y grupos de defensa, y políticas favorables de la FDA que promueven el desarrollo de medicamentos huérfanos y la aprobación acelerada de los mismos. Por ejemplo, varias empresas estadounidenses están desarrollando terapias génicas dirigidas al gen MECP2 mediante ensayos clínicos, lo que refleja el liderazgo del país en innovación. El elevado gasto sanitario y una red consolidada de clínicas especializadas mejoran aún más el acceso al tratamiento. En conjunto, estos factores consolidan a Estados Unidos como la potencia dominante en el mercado norteamericano del síndrome de Rett.

Información sobre el mercado del síndrome de Rett en Canadá

Se prevé que el mercado canadiense del síndrome de Rett experimente un crecimiento sustancial durante el período de pronóstico, impulsado por una mayor concientización, la expansión de las colaboraciones en investigación y el creciente enfoque del gobierno en el manejo de enfermedades raras. El sistema de salud universal del país y su avanzada infraestructura de pruebas genéticas permiten una detección más temprana y mejores resultados para los pacientes. Por ejemplo, las instituciones de investigación canadienses se han asociado con empresas biotecnológicas internacionales para explorar la terapia génica y los tratamientos basados en ARN. El apoyo de organizaciones como la Asociación Canadiense del Síndrome de Rett (CRSA) desempeña un papel fundamental en la financiación de la investigación y la mejora de la educación pública. El aumento de las iniciativas federales para ampliar los registros de enfermedades raras y la financiación de la atención especializada están acelerando aún más el crecimiento del mercado en todo el país.

Perspectiva del mercado del síndrome de Rett en México

Se prevé que el mercado mexicano del síndrome de Rett experimente un crecimiento sostenido durante el período de pronóstico, impulsado por una mayor concienciación sobre el diagnóstico y las mejoras graduales en la infraestructura sanitaria del país. Si bien las tasas de diagnóstico y tratamiento siguen siendo relativamente bajas en comparación con Estados Unidos y Canadá, los esfuerzos gubernamentales en curso para integrar programas de cribado genético están mejorando la identificación temprana. Por ejemplo, la colaboración con organizaciones sin ánimo de lucro y empresas farmacéuticas internacionales está ampliando el acceso a la investigación y la atención clínica de los trastornos del neurodesarrollo. Además, el aumento de la inversión privada en el sector sanitario y la expansión de los servicios de neurología pediátrica están mejorando la capacidad de atención al paciente. A medida que la concienciación y los recursos médicos continúan aumentando, México se está consolidando como un mercado clave en desarrollo dentro de Norteamérica para el diagnóstico y los avances terapéuticos del síndrome de Rett.

Cuota de mercado del síndrome de Rett en América del Norte

La industria del síndrome de Rett en Norteamérica está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Acadia Pharmaceuticals Inc. (EE. UU.)

- Neuren Pharmaceuticals (Australia)

- Taysha GTx (EE. UU.)

- Neurogene Inc. (EE. UU.)

- ProQR Therapeutics (Países Bajos)

- Terapéutica de haces (EE. UU.)

- Alcyone Therapeutics (EE. UU.)

- ShapeTX (EE. UU.)

- Vico Therapeutics (Países Bajos)

- Unravel Biosciences, Inc. (EE. UU.)

- Anavex Life Sciences Corp. (EE. UU.)

- Palena Therapeutics, Inc. (EE. UU.)

- Prilenia Therapeutics BV (Países Bajos)

- Axonis Therapeutics (EE. UU.)

- Wave Life Sciences (EE. UU.)

¿Cuáles son los últimos avances en el mercado del síndrome de Rett en Norteamérica?

- En octubre de 2025, la FDA otorgó la designación de Terapia Innovadora a TSHA-102, una terapia génica de vanguardia desarrollada por Taysha Gene Therapies, tras los resultados positivos de la Parte A de su ensayo clínico de fase 1/2 REVEAL. La terapia demostró mejoras significativas en las funciones motoras y de comunicación en pacientes adultos con síndrome de Rett tratados con una sola dosis.

- En noviembre de 2024, Neurogene Inc. informó del fallecimiento de un paciente inscrito en su ensayo de terapia génica de fase 1/2 (NGN-401) para el síndrome de Rett tras un evento adverso grave. El ensayo, diseñado para probar la seguridad y la eficacia de la terapia génica de dosis única en pacientes pediátricos, estaba siendo supervisado de cerca por la FDA y comités de seguridad independientes.

- En julio de 2024, investigadores del Instituto Wyss de Ingeniería Inspirada Biológicamente de la Universidad de Harvard identificaron el vorinostat como un prometedor candidato terapéutico para el síndrome de Rett mediante una plataforma de descubrimiento de fármacos basada en inteligencia artificial. El estudio demostró con éxito que el vorinostat podía restaurar la función neurológica en modelos preclínicos al actuar sobre las vías celulares alteradas asociadas a mutaciones en el gen MECP2.

- En enero de 2024, el Centro Médico de la Universidad de Vanderbilt (VUMC) obtuvo una subvención de 13 millones de dólares del Departamento de Defensa de EE. UU. para dirigir un ensayo clínico multicéntrico que investiga posibles tratamientos para el síndrome de Rett mediante el uso de fármacos reutilizados y aprobados por la FDA, como la ketamina, el vorinostat y el donepezilo. El objetivo es evaluar su eficacia para mejorar la función neurológica y los resultados conductuales en los pacientes afectados.

- En marzo de 2023, la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) aprobó la trofinetida (DAYBUE) como el primer tratamiento aprobado para el síndrome de Rett en adultos y niños mayores de 2 años. Desarrollada por Acadia Pharmaceuticals, esta aprobación representó un hito histórico para la comunidad del síndrome de Rett, al ofrecer una terapia clínicamente probada que ayuda a mejorar la funcionalidad diaria y a reducir los síntomas relacionados con este síndrome.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.