North America Residential Energy Management Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.63 Billion

USD

84.06 Billion

2025

2033

USD

8.63 Billion

USD

84.06 Billion

2025

2033

| 2026 –2033 | |

| USD 8.63 Billion | |

| USD 84.06 Billion | |

|

|

|

|

Mercado de gestión de energía residencial (REM) en América del Norte, por aplicación de interfaz de usuario (medidores inteligentes, termostatos inteligentes, pantallas internas (IHD) y electrodomésticos inteligentes), plataforma (plataforma de gestión de energía (EMP), plataforma de análisis de energía y participación del cliente (CEP)), componente (hardware y software), tecnología de comunicación (ZigBee, Z-Wave, Wi-Fi, Homeplug, Wireless M-Bus y Thread), usuario final (casas y departamentos independientes), país (EE. UU., Canadá y México) Tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de gestión de energía residencial (REM) en América del Norte

Análisis y perspectivas del mercado: mercado de gestión de energía residencial (REM) en América del Norte

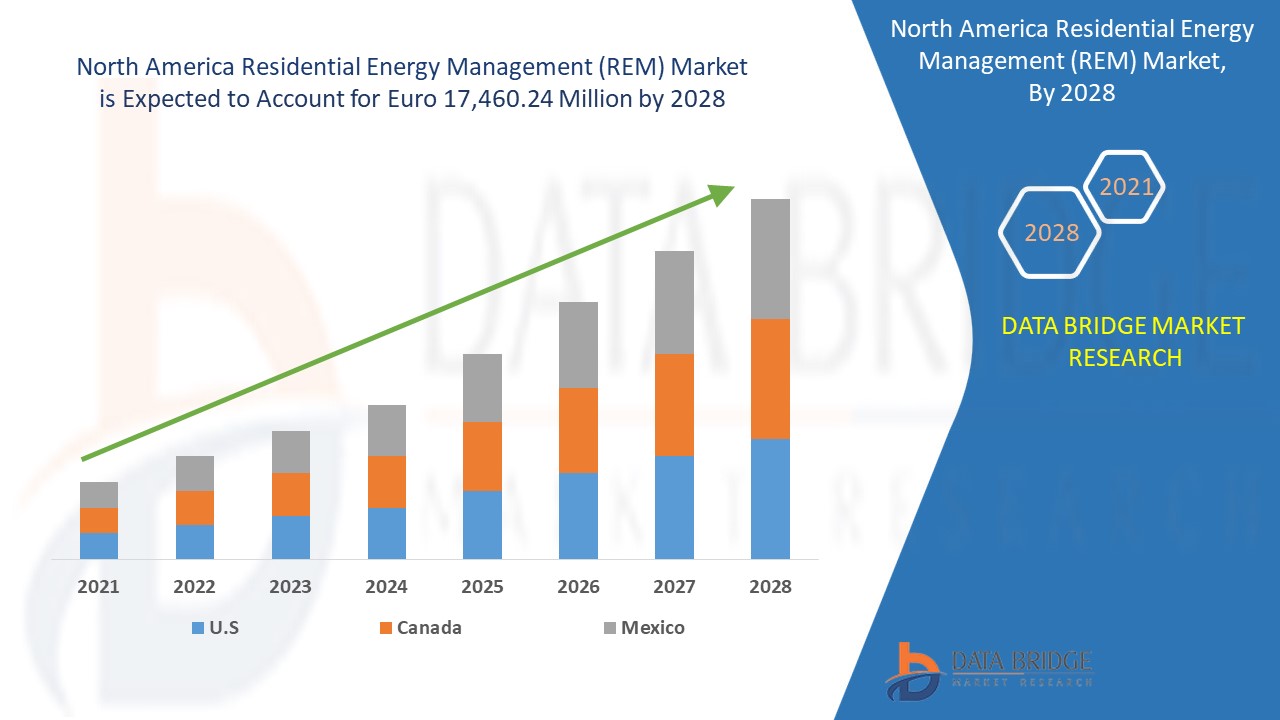

Se espera que el mercado de gestión de energía residencial (REM) gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 32,9% en el período de pronóstico de 2021 a 2028 y se espera que alcance los 17.460,24 millones de euros para 2028. La conciencia del consumidor hacia el sistema de gestión de energía eficiente y la implementación de una infraestructura de medición avanzada (AMI) son algunos de los factores que impulsan el crecimiento del mercado de gestión de energía residencial (REM).

Un sistema de gestión de energía doméstica es una plataforma tecnológica de hardware y software que permite al usuario supervisar el uso y la producción de energía y controlar manualmente o automatizar el uso de energía dentro de un hogar. En los sistemas de producción, transmisión y distribución de redes de sistemas eléctricos, la gestión de energía residencial (REM) tiene aplicaciones difíciles. La gestión de la demanda es importante entre las aplicaciones y la fijación de precios en tiempo real (RTP) son dos técnicas comunes de gestión de la demanda (DSM) diseñadas por proveedores de energía especiales con características del sistema de gestión de energía.

La creciente necesidad de mejorar la eficiencia del sector de servicios públicos está impulsando el crecimiento del mercado de gestión de energía residencial (REM). La falta de concienciación y orientación estandarizada está restringiendo el crecimiento de este mercado. Las casas inteligentes que impulsan a los sectores privado y gubernamental a invertir están generando diversas oportunidades para el mercado de gestión de energía residencial (REM). El problema que surge a través de la conectividad con dispositivos habilitados para IoT, como los teléfonos inteligentes, es la cuestión de la privacidad, que plantea un desafío para el mercado de gestión de energía residencial (REM).

Este informe de mercado de gestión de energía residencial (REM) proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado local y nacional, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de gestión de energía residencial (REM), comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de gestión de energía residencial (REM)

Alcance y tamaño del mercado de gestión de energía residencial (REM)

El mercado de gestión de energía residencial (REM) está segmentado en función de la plataforma, la aplicación de interfaz de usuario, el componente, la tecnología de comunicación y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

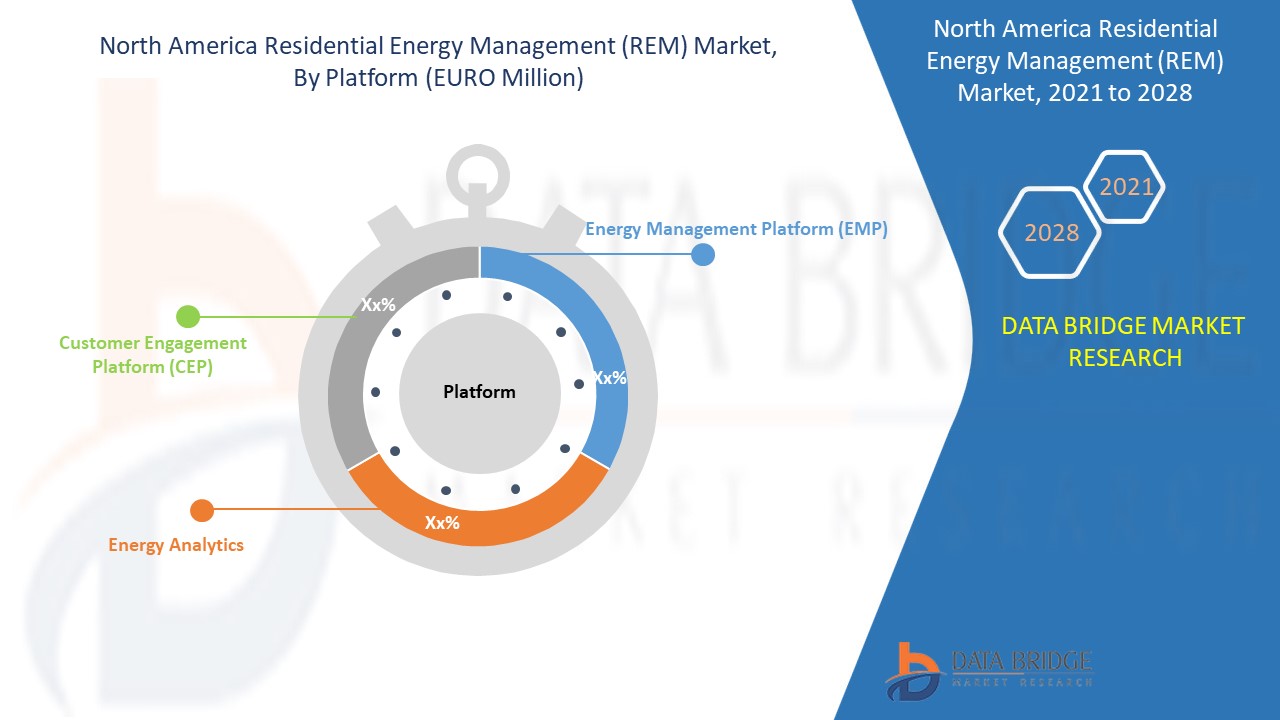

- En función de la plataforma, el mercado de gestión de energía residencial (REM) se segmenta en plataforma de gestión de energía (EMP), análisis de energía y plataforma de interacción con el cliente (CEP). En 2021, el segmento de la plataforma de gestión de energía (EMP) está dominando debido a la creciente adopción de medidores inteligentes, las estrictas regulaciones gubernamentales para conservar la energía, los desarrollos tecnológicos que ayudan a recopilar y monitorear el uso de datos, el aumento del ahorro de energía y la simplificación de los informes de energía son algunos de los factores que ayudan a impulsar el mercado de gestión de energía residencial (REM).

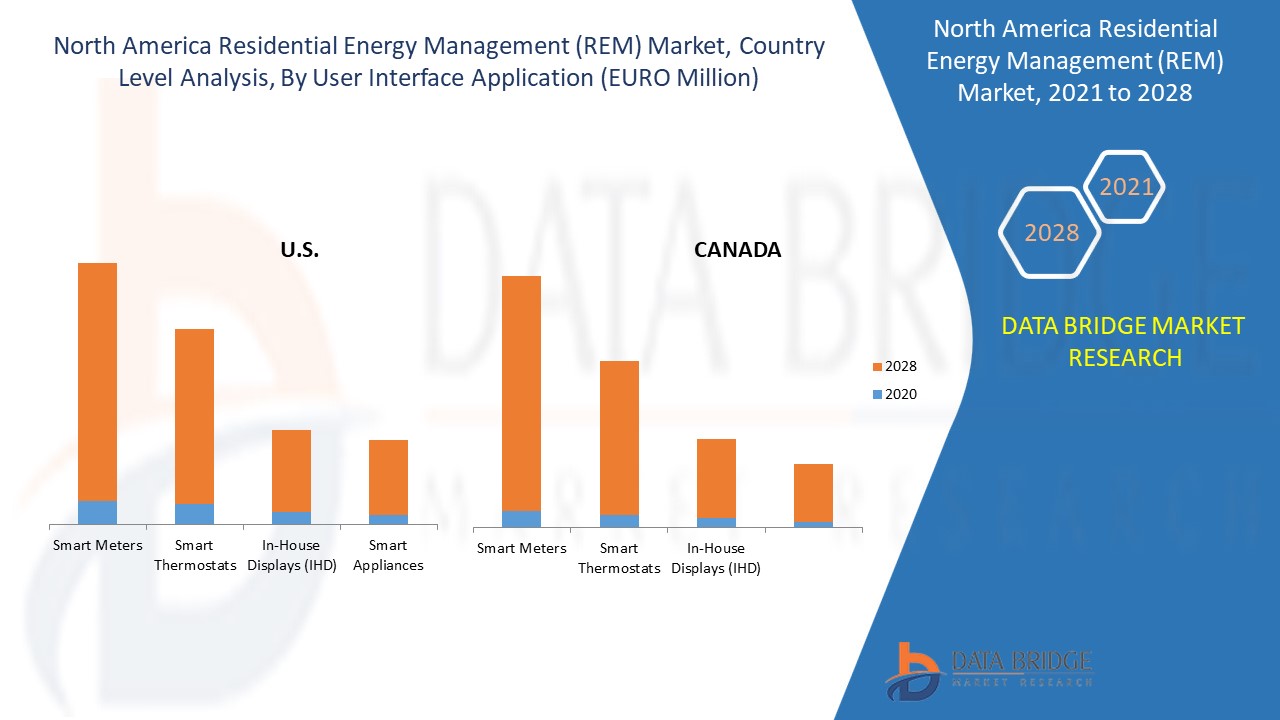

- Sobre la base de la aplicación de la interfaz de usuario, el mercado de gestión de energía residencial (REM) se segmenta en medidores inteligentes, termostatos inteligentes, pantallas internas (IHD) y electrodomésticos inteligentes. En 2021, el segmento de medidores inteligentes tiene la mayor participación de mercado debido al bajo costo operativo, el ahorro de tiempo para los consumidores al informar la lectura del medidor a los proveedores de energía, una mayor precisión en las facturas, un consumo real informado de energía y una mejor supervisión y gestión del uso de energía con una visualización de datos en tiempo real son algunos de los factores que ayudan al segmento a dominar el mercado de gestión de energía residencial (REM).

- En función de los componentes, el mercado de gestión de energía residencial (REM) se segmenta en hardware y software . En 2021, el segmento de hardware tiene la mayor participación de mercado debido al creciente desarrollo de componentes como HVAC, dispositivos de respuesta a la demanda y puertas de enlace. Además, el análisis en línea con solución de monitoreo en tiempo real creó la mayor demanda de componentes avanzados, que también es uno de los factores que impulsan el crecimiento del segmento en el mercado de gestión de energía residencial (REM).

- Sobre la base de la tecnología de comunicación, el mercado de gestión de energía residencial (REM) se segmenta en Zigbee, Z-Wave, Wi-Fi, HomePlug, Wireless M-Bus y Thread . En 2021, el segmento Zigbee tiene la mayor participación de mercado, ya que Zigbee se ha convertido en el estándar dominante para las redes de automatización inalámbrica.

- En función del usuario final, el mercado de gestión de energía residencial (REM) se segmenta en viviendas y apartamentos independientes. En 2021, el segmento de viviendas independientes ha sido el que ha acaparado la mayor cuota de mercado, ya que ofrece funciones más avanzadas para permitir la transformación de estructuras tradicionales en viviendas inteligentes.

Análisis a nivel de país del mercado de gestión de energía residencial (REM) en América del Norte

Análisis a nivel de país del mercado de gestión de energía residencial (REM) en América del Norte

Se analiza el mercado de gestión de energía residencial (REM) de América del Norte y se proporciona información sobre el tamaño del mercado por país, plataforma, aplicación de interfaz de usuario, componente, tecnología de comunicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de gestión de energía residencial (REM) de América del Norte son EE. UU., Canadá y México.

Estados Unidos ha sido responsable de la mayor participación en el mercado de gestión de energía residencial (REM) en América del Norte debido a la creciente penetración de hogares inteligentes junto con medidores inteligentes, termostatos inteligentes, pantallas internas (IHD) y electrodomésticos inteligentes y la creciente demanda de tecnologías de ahorro de energía y costos en el país. Mientras tanto, Canadá domina con la segunda participación más alta debido al hecho de que el país tiene un gran número de actores destacados junto con la automatización inteligente para medidores inteligentes para proporcionar una estructura respetuosa con el medio ambiente para la gestión de energía residencial (REM) confiable.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Necesidad creciente de mejorar la eficiencia del sector de servicios públicos en el mercado de gestión de energía residencial (REM)

El mercado de gestión de energía residencial (REM) también le proporciona un análisis detallado del mercado para cada país, el crecimiento de la industria con ventas, ventas de componentes, impacto del desarrollo tecnológico en la gestión de energía residencial (REM) y cambios en los escenarios regulatorios con su apoyo al mercado de gestión de energía residencial (REM). Los datos están disponibles para el período histórico de 2011 a 2019.

Análisis del panorama competitivo y la cuota de mercado de la gestión de energía residencial (REM)

El panorama competitivo del mercado de gestión de energía residencial (REM) proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de gestión de energía residencial (REM) de América del Norte.

Los principales actores cubiertos en el informe del mercado de gestión de energía residencial (REM) de América del Norte son Lutron Electronics Co., Inc., SAVANT TECHNOLOGIES LLC (una subsidiaria de GENERAL ELECTRIC COMPANY), Schneider Electric, Elster Solutions (una subsidiaria de Honeywell International Inc.), ABB, Siemens, Aclara Technologies LLC, ecobee, Uplight, Inc., e-peas, Cisco, LG Electronics, Itron Inc., SAMSUNG SDI CO.,LTD. (una subsidiaria de SAMSUNG ELECTRONICS CO., LTD.), EcoFactor, GridPoint, Landis+Gyr, Panasonic Corporation, COMCAST entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Muchas empresas de todo el mundo también están iniciando desarrollos de productos que también están acelerando el crecimiento del mercado de gestión de energía residencial (REM).

Por ejemplo,

- En noviembre de 2020, Itron Inc. se asoció con la Asociación de Asistencia Energética Residencial (REAP) de CPS Energy, que se encarga de administrar las facturas de energía. La contribución implementa CPS Energy para mejorar la alfabetización energética y hídrica con el fin de inspirar. La empresa mejoró sus resultados comerciales mediante la ampliación de su cartera de productos a partir de la asociación, lo que atrajo a más clientes.

La colaboración, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando el mercado empresarial en el mercado de gestión de energía residencial (REM), lo que también proporciona el beneficio para que las organizaciones mejoren su oferta de gestión de energía residencial (REM).

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.