North America Pterygium Drug Market, By Disease Type (Progressive Pterygium and Atrophic Pterygium), Stages (Stage 2, Stage 3, Stage 1), Treatment (Artificial Tears/Topical Lubricants and Steroid Eye Drops), Formulation (Eye Drops, Eye Ointments, Others), Mode of Purchase (Prescription and Over the Counter (OTC)), Population Type (Geriatric and Adults), End-User (Hospitals, Specialty Clinics, Home Healthcare, Others), Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Others), Country (U.S., Canada, Mexico) – Industry Trends and Forecast to 2029.

North America Pterygium Drug Market Analysis and Insights

Pterygium is a common ocular surface lesion that begins in the limbal conjunctiva within the palpebral fissure and progresses to the cornea. It is named after the Greek word pterygos, which means "wing". The lesion occurs more frequently at the nasal limbus than the temporal with a characteristic wing-like appearance. UV exposure is strongly linked to the occurrence of pterygia. Individuals having a history of elevated UV exposure and those living closer to the equator have a higher incidence (outdoor work). According to certain research, males have a somewhat higher incidence than females, which could be due to a higher rate of UV exposure.

It can cause redness, inflammation, and a change in the look of the eye; it can create astigmatism, which can cause blurry vision; and it can cause a whitish or pinkish growth covering the front of the eye. It could affect one or both eyes.

Pterygium is diagnosed using a microscope to examine the front components of the eye during a full eye examination and based on the appearance of tissue growth on the cornea from the white area of the eye.

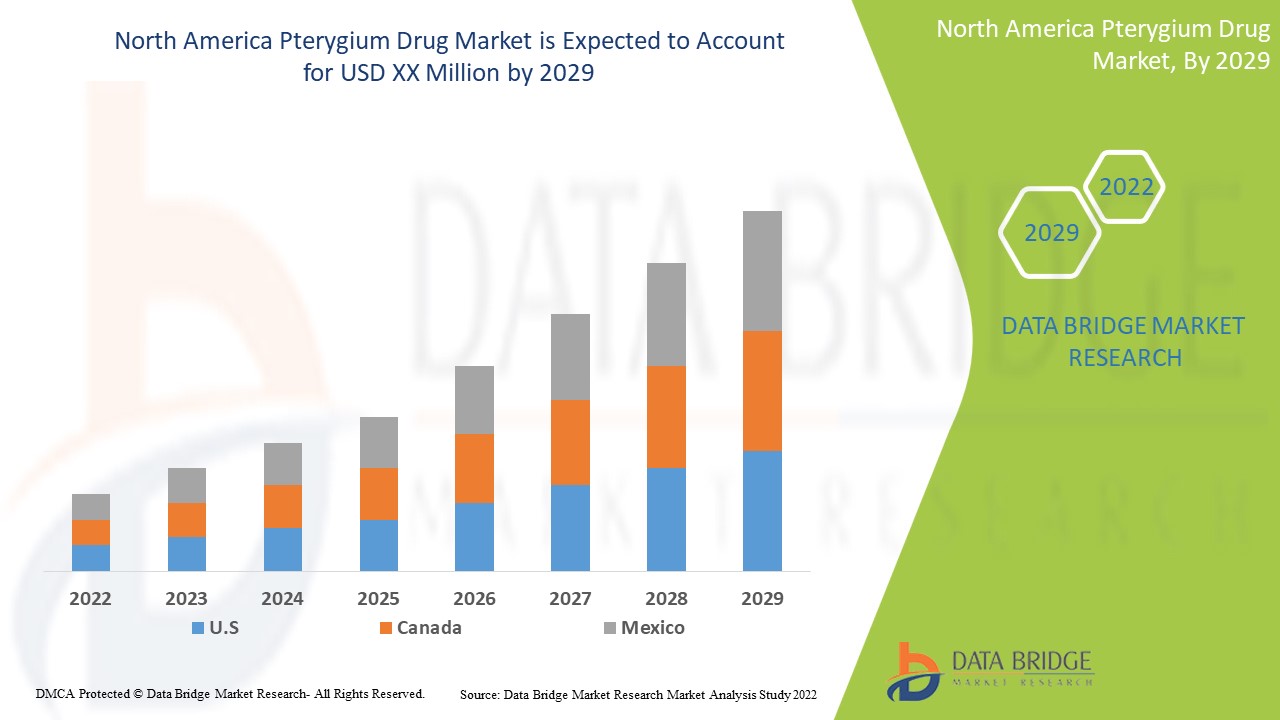

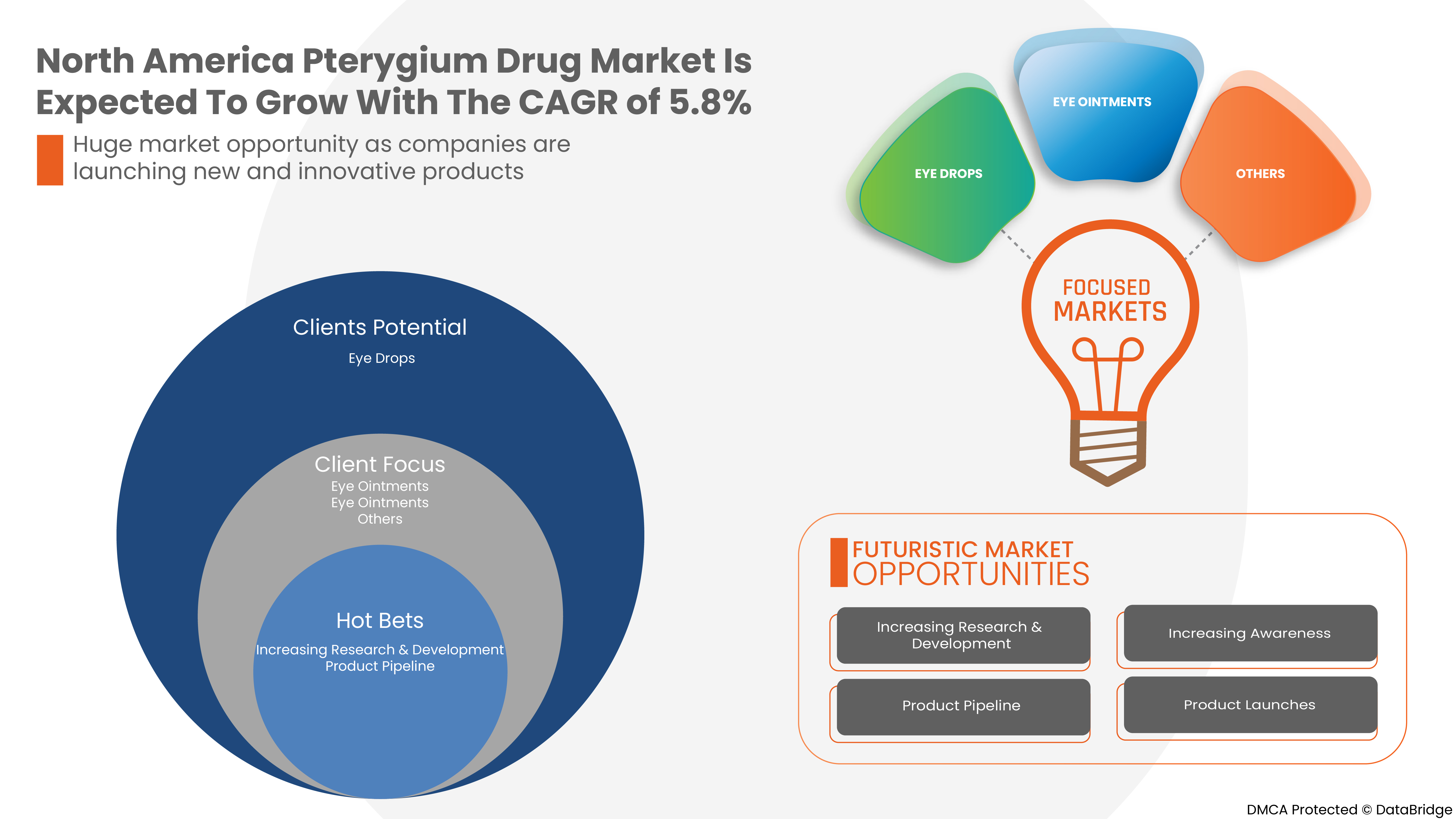

Data Bridge Market Research analyses that the North America pterygium drug market will grow at a CAGR of 5.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Disease Type (Progressive Pterygium and Atrophic Pterygium), Stages (Stage 2, Stage 3, Stage 1, Stage 4), Treatment (Artificial Tears/Topical Lubricants and Steroid Eye Drops.), Formulation (Eye Drops, Eye Ointments, Others), Mode of Purchase (Prescription and Over the Counter (OTC)), Population Type (Geriatric and Adults), End-User (Hospitals, Specialty Clinics, Home Healthcare, Others), Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Johnson & Johnson Services, Inc. (EE. UU.), Novartis AG (Suiza), Akorn Operating Company LLC (EE. UU.), Bausch & Lomb Incorporated (Canadá), AbbVie Inc. (EE. UU.), Prestige Consumer Healthcare Inc. (EE. UU.), Théa Laboratories (Francia), Wellona Pharma (India), Bayer AG (Alemania), Zydus Group, Amneal Pharmaceuticals LLC (India), OASIS Medical (EE. UU.), Alcon (Suiza) y Santen Pharmaceutical Co., Ltd. (Japón) |

Dinámica del mercado de medicamentos para el pterigión en América del Norte

Conductores

- Aumento de la incidencia y prevalencia de trastornos oftálmicos

Según datos publicados en la Biblioteca Nacional de Medicina (Centro Nacional de Información Biotecnológica) en 2021, las tasas de prevalencia varían en diferentes lugares. Es más abundante en el "cinturón de pterigión" de Cameron, que se extiende entre los 37° de latitud norte y sur del ecuador.

Las causas más comunes del pterigión incluyen la exposición prolongada a la luz ultravioleta (UV) del sol (la causa más común) y la irritación ocular causada por el clima cálido y seco, el viento y el polvo. Los factores afirmativos indican que este es el principal impulsor del mercado de medicamentos para el pterigión en América del Norte.

- Aumento de la población geriátrica

Con el aumento de la población geriátrica en todo el mundo, también aumenta la prevalencia de enfermedades oftálmicas con dolor ocular intenso. Según los datos proporcionados y publicados en "Global Prevalence of Blindness and Distance and Near Vision Impairment in 2020: progress toward the Vision 2020 targets and what the future returns" de la "Asociación para la Investigación en Visión y Oftalmología" (ARVO), se estima que 41,9 millones de personas son ciegas.

Con el aumento de la población, la presión sobre el sistema de atención sanitaria está aumentando. La demanda de atención y servicios está aumentando para tratar el problema de los trastornos oftalmológicos, incluido el pterigión. Por lo tanto, el aumento de la población geriátrica es una gran oportunidad para el mercado de medicamentos para el pterigión en América del Norte.

Oportunidades

-

Programas e iniciativas para reducir la carga de enfermedades oculares

La agencia internacional para prevenir la ceguera ha lanzado varios programas e iniciativas con ONG y empresas de gran reputación para difundir la conciencia y reducir la carga de las enfermedades oculares.

Por ejemplo,

-

Agencia Internacional respalda nuestra Visión Infantil y una iniciativa cofundada por el Brien Holden Vision Institute y el fondo Vision For Life (creado por Essilor) para la Prevención de la Ceguera (IAPB)

Restricciones/Desafíos

- Alto costo del tratamiento y la medicación para los ojos

La creciente prevalencia de diversos trastornos oftálmicos también ha aumentado la necesidad de tratamientos oportunos. Sin embargo, los tratamientos y la medicación adecuada para los trastornos oftálmicos no son muy baratos. Estudios recientes muestran que el precio de los esteroides tópicos ha aumentado en los últimos años. Aunque algunos esteroides oftálmicos tópicos como la prednisolona son ligeramente baratos, otros medicamentos avanzados y gotas para los ojos siguen siendo caros.

El informe del mercado de medicamentos para el pterigión de América del Norte proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de medicamentos para el pterigión, comuníquese con Data Bridge Market Research para obtener un resumen de analistas. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Análisis de la epidemiología de los pacientes

La prevalencia de trastornos oftálmicos sigue aumentando debido al aumento de las industrias químicas y la contaminación en todo el mundo. Las quemaduras químicas y las quemaduras por calor provocan un dolor ocular importante y severo debido a las irritaciones en la superficie ocular.

Según datos publicados en la Biblioteca Nacional de Medicina (Centro Nacional de Información Biotecnológica) en 2021, las tasas de prevalencia varían en diferentes lugares. Es más abundante en el "cinturón de pterigión" de Cameron, que se extiende entre los 37° de latitud norte y sur del ecuador. Se ha informado que la prevalencia del pterigión varía entre el 0,3 y el 29% en todo el mundo.

El mercado de medicamentos para el pterigión de América del Norte también proporciona un análisis detallado del mercado para el análisis de pacientes, el pronóstico y las curas. La prevalencia, la incidencia, la mortalidad y la adherencia son algunas de las variables de datos disponibles en el informe. Se analiza el impacto directo o indirecto de la epidemiología en el crecimiento del mercado para crear un modelo estadístico multivariado más sólido y co-hot para pronosticar el mercado en el período de crecimiento.

Impacto posterior a la COVID-19 en el mercado de medicamentos para el pterigión en América del Norte

La COVID-19 ha afectado negativamente al mercado. Los confinamientos y aislamientos durante las pandemias complican el manejo de las enfermedades y la adherencia a la medicación. La falta de acceso a centros sanitarios para el tratamiento rutinario y la administración de medicamentos afectará aún más al mercado.

Desarrollo reciente

- En enero de 2022, Alcon anunció el lanzamiento de las gotas oftálmicas lubricantes completas sin conservantes Systane en Europa. El producto actúa para proporcionar un alivio integral del ojo seco con una sola gota al hidratar las capas de la película lagrimal. Esto ha ayudado a la empresa a aumentar su cartera de productos.

Alcance del mercado de medicamentos para el pterigión en América del Norte

El mercado de medicamentos para el pterigión en América del Norte se clasifica en ocho segmentos notables según el tipo de enfermedad, las etapas, el tratamiento y la formulación, el modo de compra, el tipo de población, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de enfermedad

- Pterigión progresivo

- Pterigión atrófico

Según la enfermedad, el mercado de medicamentos para el pterigión en América del Norte está segmentado en pterigión progresivo y pterigión atrófico.

Etapas

- Etapa 1

- Etapa 2

- Etapa 3

Según las etapas, el mercado de medicamentos para el pterigión de América del Norte se segmenta en etapa 1, etapa 2, etapa 3,

Tratamiento

- Lágrimas artificiales/lubricantes tópicos

- Gotas oftálmicas con esteroides

Según el tratamiento, el mercado de medicamentos para el pterigión en América del Norte está segmentado en lágrimas artificiales/lubricantes tópicos y gotas oftálmicas con esteroides.

Formulación

- Gotas para los ojos

- Ungüentos para los ojos

- Otros

Según la formulación, el mercado de medicamentos para el pterigión en América del Norte está segmentado en gotas para los ojos, ungüentos para los ojos y otros.

Modo de compra

- Prescripción

- Medicamentos de venta libre (OTC)

Según el modo de compra, el mercado de medicamentos para el pterigión en América del Norte está segmentado en medicamentos con receta y de venta libre (OTC).

Tipo de población

- Geriátrico

- Adultos

Según el tipo de población, el mercado de medicamentos para el pterigión en América del Norte está segmentado en geriátrico y adultos.

Usuario final

- Hospitales

- Clínicas de especialidades

- Atención médica domiciliaria

- Otros

Según el usuario final, el mercado de medicamentos para el pterigión en América del Norte está segmentado en hospitales, clínicas especializadas, atención médica domiciliaria y otros.

Canal de distribución

- Farmacias minoristas

- Farmacias hospitalarias

- Farmacias en línea

- Otros

Según los canales de distribución, el mercado de medicamentos para el pterigión en América del Norte está segmentado en farmacias minoristas, farmacias hospitalarias y farmacias en línea.

Análisis y perspectivas regionales del mercado de medicamentos para el pterigión en América del Norte

Se analiza el mercado de medicamentos para el pterigión de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo de enfermedad, etapas, tratamiento y formulación, modo de compra, tipo de población, usuario final y canal de distribución como se mencionó anteriormente.

Los países cubiertos en el informe sobre el mercado de medicamentos para el pterigión en América del Norte son EE. UU., Canadá y México.

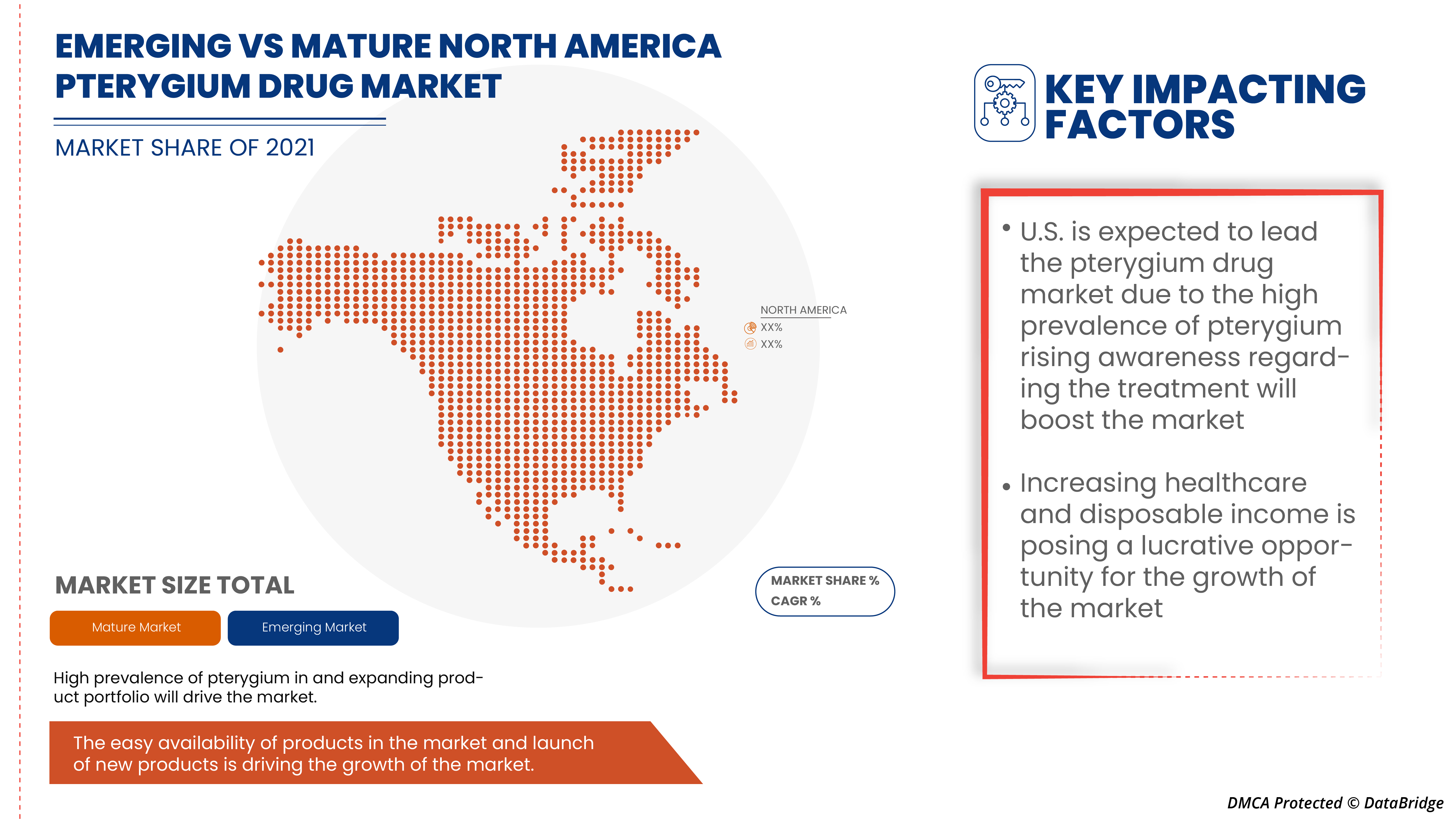

Se espera que el mercado de medicamentos para el pterigión en América del Norte crezca debido a la presencia de grandes actores del mercado en la región y un sistema de atención médica establecido. Se espera que Estados Unidos domine el mercado de medicamentos para el pterigión en América del Norte en términos de participación de mercado e ingresos de mercado. Seguirá aumentando su dominio durante el período de pronóstico. Esto se debe a la alta prevalencia de la enfermedad en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de medicamentos para el pterigión en América del Norte

El panorama competitivo del mercado de medicamentos para el pterigión en América del Norte proporciona detalles sobre los competidores. Los detalles incluyen una descripción general de la empresa, sus finanzas, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia europea, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de medicamentos para el pterigión.

Algunos de los principales actores que operan en el mercado de medicamentos para el pterigión en América del Norte son Johnson & Johnson Services, Inc., Novartis AG, Akorn Operating Company LLC, Bausch & Lomb Incorporated, AbbVie Inc., Prestige Consumer Healthcare Inc., Théa Laboratories, Wellona Pharma, Bayer AG, Zydus Group, Amneal Pharmaceuticals LLC, OASIS Medical, Alcon y Santen Pharmaceutical Co., Ltd., entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, América del Norte frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PTERYGIUM DRUG MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA PTERYGIUM DRUG MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 CLASS SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S 5 FORCES

4.3 EPIDEMIOLOGY

4.4 NORTH-AMERICA PTERYGIUM DRUG MARKET: NUMBER OF SURGERIES

5 PIPELINE ANALYSIS

6 NORTH-AMERICA PTERYGIUM DRUG MARKET: REGULATIONS

6.1 REGULATION IN THE NORTH-AMERICA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN INCIDENCES AND PREVALENCE OF OPHTHALMIC DISORDERS

7.1.2 RISE IN GERIATRIC POPULATION

7.1.3 INCREASE IN HEALTHCARE AWARENESS TO REDUCE THE RISK OF EYE ILLNESSES

7.2 RESTRAINTS

7.2.1 HIGH COST OF EYE TREATMENT AND MEDICATION

7.2.2 SIDE EFFECTS OF STEROIDS EYE DROPS

7.3 OPPORTUNITIES

7.3.1 PROGRAMS AND INITIATIVES TO REDUCE THE BURDEN OF EYE DISEASES

7.3.2 RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

7.3.3 INCREASE IN RESEARCH AND DEVELOPMENT ACTIVITIES

7.4 CHALLENGES

7.4.1 STRINGENT RULES & REGULATIONS

7.4.2 EXPOSURE TO ULTRAVIOLET RADIATIONS

8 NORTH AMERICA PTERYGIUM DRUG MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 PROGRESSIVE PTERYGIUM

8.3 ATROPHIC PTERYGIUM

9 NORTH AMERICA PTERYGIUM DRUG MARKET, BY STAGES

9.1 OVERVIEW

9.2 STAGE 2

9.3 STAGE 3

9.4 STAGE 1

10 NORTH AMERICA PTERYGIUM DRUG MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 ARTIFICIAL TEARS/TOPICAL LUBRICANTS

10.2.1 DEMULCENT

10.2.2 EMOLLIENTS

10.3 STEROID EYE DROPS

10.3.1 KETONE STEROIDS

10.3.1.1 PREDNOSOLONE

10.3.1.2 DEXAMETHASONE

10.3.1.3 FLUROMETHOLONE

10.3.1.4 OTHERS

10.3.2 ESTER STEROID (LOTERPREDNOL)

11 NORTH AMERICA PTERYGIUM DRUG MARKET, BY FORMULATION

11.1 OVERVIEW

11.2 EYE DROPS

11.2.1 EYE DROPS WITH PRESERVATIVES

11.2.2 PRESERVATIVE-FREE EYE DROPS

11.3 EYE OINTMENTS

11.4 OTHERS

12 NORTH AMERICA PTERYGIUM DRUG MARKET, BY MODE OF PURCHASE

12.1 OVERVIEW

12.2 PRESCRIPTION

12.3 OVER THE COUNTER (OTC)

13 NORTH AMERICA PTERYGIUM DRUG MARKET, BY POPULATION TYPE

13.1 OVERVIEW

13.2 GERIATRIC

13.3 ADULTS

14 NORTH AMERICA PTERYGIUM DRUG MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 SPECIALTY CLINICS

14.4 HOME HEALTHCARE

14.5 OTHERS

15 NORTH AMERICA PTERYGIUM DRUG MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL PHARMACIES

15.3 HOSPITAL PHARMACIES

15.4 ONLINE PHARMACIES

15.5 OTHERS

16 NORTH AMERICA PTERYGIUM DRUG MARKET, BY COUNTRY

16.1 U.S.

16.2 MEXICO

16.3 CANADA

17 NORTH AMERICA PTERYGIUM DRUG MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 ALCON

19.1.1 COMPANY SNAPSHOT

19.1.2 RECENT FINANCIALS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 ABBVIE INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 BAUSCH & LOMB INCORPORATED

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 JOHNSON & JOHNSON SERVICES, INC.

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENTS

19.5 BAYER AG

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 AKORN OPERATING COMPANY LLC

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 AMNEAL PHARMACEUTICALS LLC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 NOVARTIS AG

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 OASIS MEDICAL

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 PRESTIGE CONSUMER HEALTHCARE INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 SANTEN PHARMACEUTICAL CO., LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 RECENT FINANCIALS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 SIMILASAN CORPORATION

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 THÉA LABORATORIES

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 WELLONA PHARMA

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 ZYDUS GROUP

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH-AMERICA PTERYGIUM DRUG MARKET, PIPELINE ANALYSIS

TABLE 2 NORTH AMERICA PTERYGIUM DRUG MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA PTERYGIUM DRUG MARKET, BY STAGES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PTERYGIUM DRUG MARKET, BY TREATMENT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ARTIFICIAL TEARS/TOPICAL LUBRICANTS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA STEROID EYE DROPS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA KETONE STEROIDS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA EYE DROPS IN PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PTERYGIUM DRUG MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PTERYGIUM DRUG MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PTERYGIUM DRUG MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PTERYGIUM DRUG MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PTERYGIUM DRUG MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 15 U.S. PTERYGIUM DRUG MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. PTERYGIUM DRUG MARKET, BY STAGES, 2020-2029 (USD MILLION)

TABLE 17 U.S. PTERYGIUM DRUG MARKET, BY TREATMENT, 2020-2029 (USD MILLION)

TABLE 18 U.S. ARTIFICIAL TEARS/TOPICAL LUBRICANTS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. STEROIDS EYE DROPS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. KETONE STEROIDS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.S. PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 22 U.S. EYE DROPS IN PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 23 U.S. PTERYGIUM DRUG MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 24 U.S. PTERYGIUM DRUG MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. PTERYGIUM DRUG MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 U.S. PTERYGIUM DRUG MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 MEXICO PTERYGIUM DRUG MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 28 MEXICO PTERYGIUM DRUG MARKET, BY STAGES, 2020-2029 (USD MILLION)

TABLE 29 MEXICO PTERYGIUM DRUG MARKET, BY TREATMENT, 2020-2029 (USD MILLION)

TABLE 30 MEXICO ARTIFICIAL TEARS/TOPICAL LUBRICANTS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MEXICO STEROIDS EYE DROPS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MEXICO KETONE STEROIDS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MEXICO PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 34 MEXICO EYE DROPS IN PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 35 MEXICO PTERYGIUM DRUG MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 36 MEXICO PTERYGIUM DRUG MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO PTERYGIUM DRUG MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 MEXICO PTERYGIUM DRUG MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 39 CANADA PTERYGIUM DRUG MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 40 CANADA PTERYGIUM DRUG MARKET, BY STAGES, 2020-2029 (USD MILLION)

TABLE 41 CANADA PTERYGIUM DRUG MARKET, BY TREATMENT, 2020-2029 (USD MILLION)

TABLE 42 CANADA ARTIFICIAL TEARS/TOPICAL LUBRICANTS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 CANADA STEROIDS EYE DROPS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CANADA KETONE STEROIDS IN PTERYGIUM DRUG MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 CANADA PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 46 CANADA EYE DROPS IN PTERYGIUM DRUG MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 47 CANADA PTERYGIUM DRUG MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 48 CANADA PTERYGIUM DRUG MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA PTERYGIUM DRUG MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA PTERYGIUM DRUG MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA PTERYGIUM DRUG MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PTERYGIUM DRUG MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PTERYGIUM DRUG MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PTERYGIUM DRUG MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PTERYGIUM DRUG MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PTERYGIUM DRUG MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PTERYGIUM DRUG MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA PTERYGIUM DRUG MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PTERYGIUM DRUG MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA PTERYGIUM DRUG MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF OPHTHALMIC DISORDERS AND RISE IN GERIATRIC POPULATION ARE EXPECTED TO DRIVE THE NORTH AMERICA PTERYGIUM DRUG MARKET FROM 2022 TO 2029

FIGURE 12 PROGRESSIVE PTERYGIUM IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA PTERYGIUM DRUG MARKET FROM 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH-AMERICA PTERYGIUM DRUG MARKET

FIGURE 14 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISEASE TYPE, 2021

FIGURE 15 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISEASE TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISEASE TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA PTERYGIUM DRUG MARKET: BY STAGES, 2021

FIGURE 19 NORTH AMERICA PTERYGIUM DRUG MARKET: BY STAGES, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA PTERYGIUM DRUG MARKET: BY STAGES, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA PTERYGIUM DRUG MARKET: BY STAGES, LIFELINE CURVE

FIGURE 22 NORTH AMERICA PTERYGIUM DRUG MARKET: BY TREATMENT, 2021

FIGURE 23 NORTH AMERICA PTERYGIUM DRUG MARKET: BY TREATMENT, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA PTERYGIUM DRUG MARKET: BY TREATMENT, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA PTERYGIUM DRUG MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 26 NORTH AMERICA PTERYGIUM DRUG MARKET: BY FORMULATION, 2021

FIGURE 27 NORTH AMERICA PTERYGIUM DRUG MARKET: BY FORMULATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA PTERYGIUM DRUG MARKET: BY FORMULATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA PTERYGIUM DRUG MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA PTERYGIUM DRUG MARKET: BY MODE OF PURCHASE, 2021

FIGURE 31 NORTH AMERICA PTERYGIUM DRUG MARKET: BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA PTERYGIUM DRUG MARKET: BY MODE OF PURCHASE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA PTERYGIUM DRUG MARKET: BY MODE OF PURCHASE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA PTERYGIUM DRUG MARKET: BY POPULATION TYPE, 2021

FIGURE 35 NORTH AMERICA PTERYGIUM DRUG MARKET: BY POPULATION TYPE, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA PTERYGIUM DRUG MARKET: BY POPULATION TYPE, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA PTERYGIUM DRUG MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA PTERYGIUM DRUG MARKET: BY END USER, 2021

FIGURE 39 NORTH AMERICA PTERYGIUM DRUG MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA PTERYGIUM DRUG MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA PTERYGIUM DRUG MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 43 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA PTERYGIUM DRUG MARKET: SNAPSHOT (2021)

FIGURE 47 NORTH AMERICA PTERYGIUM DRUG MARKET: BY COUNTRY (2021)

FIGURE 48 NORTH AMERICA PTERYGIUM DRUG MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 NORTH AMERICA PTERYGIUM DRUG MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 NORTH AMERICA PTERYGIUM DRUG MARKET: BY DISEASE TYPE (2022-2029)

FIGURE 51 NORTH AMERICA PTERYGIUM DRUG MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.