Mercado de películas de vinilo autoadhesivas imprimibles de América del Norte, por proceso de fabricación (películas calandradas y películas fundidas ), espesor (delgado (2-3 milésimas de pulgada) y grueso (más de 3 milésimas de pulgada)), tipo (opaco, transparente y translúcido), sustrato (piso, plásticos, vidrio y otros), aplicación (gráficos de flotas, gráficos de embarcaciones, envoltura de automóviles, gráficos de piso, etiquetas y calcomanías, gráficos de ventanas, paneles de exhibición, publicidad exterior, decoración de muebles, revestimiento de paredes y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de películas de vinilo autoadhesivas imprimibles en América del Norte

Las películas de vinilo autoadhesivas imprimibles ofrecen claridad óptica y facilidad de remoción. Estas películas se utilizan como calcomanías promocionales y gráficos para ventanas. Estas películas se colocan en las ventanas de restaurantes, tiendas, oficinas y otros establecimientos comerciales para brindar privacidad o publicidad. Estas películas son versátiles y flexibles, y están hechas de adhesivos de vinilo como acrílico. Se utilizan para crear logotipos, letreros y campañas publicitarias para promocionar empresas y difundir información a grandes audiencias.

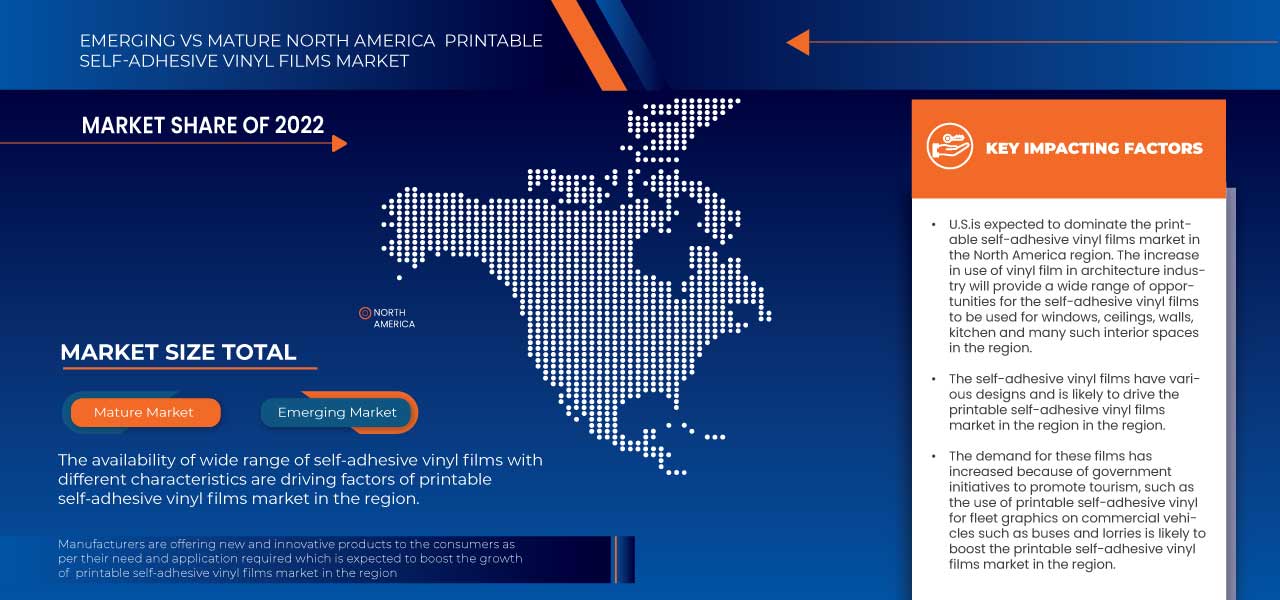

Las películas de vinilo autoadhesivas imprimibles se fabrican principalmente utilizando numerosos polímeros de vinilo que utilizan monómeros como ésteres de vinilo o acetato de vinilo. Se espera que la creciente demanda de películas de vinilo autoadhesivas imprimibles en aplicaciones de construcción y arquitectura impulse el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte. Además, existe una amplia gama de películas de vinilo autoadhesivas con diferentes características. Sin embargo, los nuevos desarrollos estratégicos e iniciativas de los fabricantes pueden representar una oportunidad para el mercado de América del Norte. Mientras tanto, las crecientes preocupaciones ambientales y las regulaciones gubernamentales pueden representar un serio desafío para el crecimiento del mercado de películas de vinilo autoadhesivas imprimibles de América del Norte.

La demanda de películas de vinilo autoadhesivas imprimibles está aumentando, por lo que los fabricantes ahora están más concentrados y participan en el lanzamiento de nuevos productos, la promoción, los premios, la certificación y la participación en eventos del mercado. Estas decisiones, en última instancia, están mejorando el crecimiento del mercado.

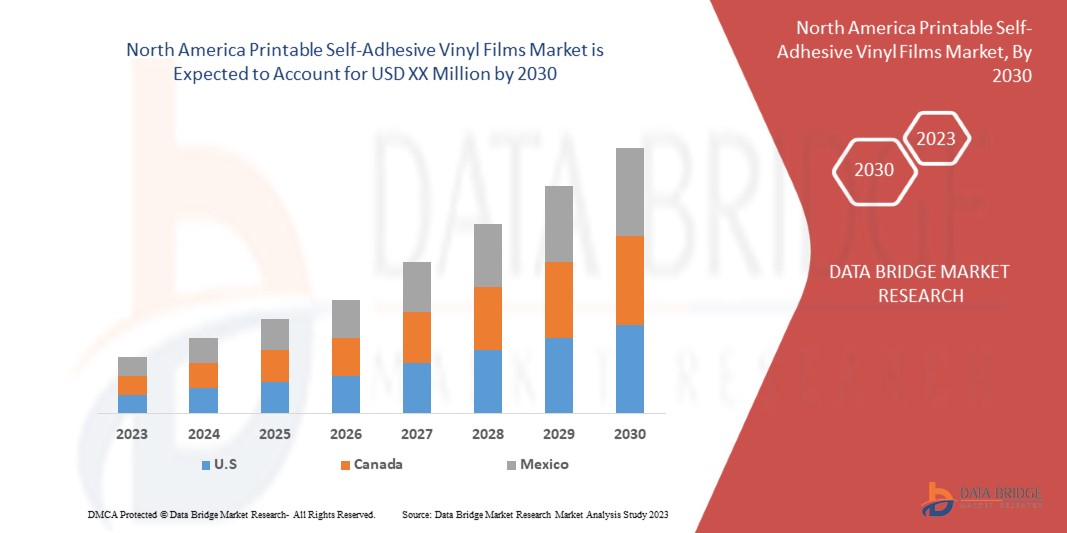

Data Bridge Market Research analiza que el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte crecerá a una CAGR del 4,1 % entre 2023 y 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por proceso de fabricación (películas calandradas y películas fundidas), espesor (fino (2-3 milésimas de pulgada) y grueso (más de 3 milésimas de pulgada)), tipo (opaco, transparente y translúcido), sustrato (piso, plástico, vidrio y otros), aplicación (gráficos para flotas, gráficos para embarcaciones, revestimiento de automóviles, gráficos para pisos, etiquetas y calcomanías, gráficos para ventanas, paneles para exhibiciones, publicidad exterior, decoración de muebles, revestimiento de paredes y otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Brite Coatings Private Limited, Item Plastic Corp., 3M, AVERY DENNISON CORPORATION, Arlon Graphics, LLC., HEXIS SAS, Metamark, DRYTAC, FLEXcon Company, Inc., TEKRA LLC, LX Hausys, LINTEC Corporation, Stahls' International, POLI-TAPE Group, Innovia Films, Henkel Adhesives Technologies India Private Limited, Responsive Industries Ltd., ACHILLIES CORPORATION, ORAFOL Europe GmbH, Shubh Plastics |

Definición de mercado

Las películas de vinilo autoadhesivas imprimibles ofrecen claridad óptica y facilidad de remoción. Estas películas se utilizan como calcomanías promocionales y gráficos para ventanas. Estas películas se colocan en las ventanas de restaurantes, tiendas, oficinas y otros establecimientos comerciales para brindar privacidad o publicidad. Estas películas son versátiles, flexibles y están hechas de adhesivos de vinilo como acrílico. Se utilizan para crear logotipos, letreros y campañas publicitarias para promocionar empresas y difundir información a grandes audiencias.

Dinámica del mercado de películas de vinilo autoadhesivas imprimibles en América del Norte

Conductores

-

Creciente demanda de películas de vinilo autoadhesivas imprimibles en aplicaciones de construcción y arquitectura

El uso cada vez mayor de películas de vinilo autoadhesivas en una variedad de aplicaciones arquitectónicas, como revestimientos de suelos, revestimientos de paredes, cubiertas y revestimientos de plataformas, está influyendo positivamente en la demanda del mercado de películas de vinilo autoadhesivas. La película autoadhesiva es un material resistente y duradero que se puede utilizar para proteger una variedad de superficies. Estas películas se utilizan ampliamente para proteger superficies de arañazos, abrasiones, vandalismo, roturas, daños por rayos UV y decoloración. Además, las películas de vinilo autoadhesivas tienen varios diseños que se utilizan para revestimiento de paredes.

Las películas de vinilo autoadhesivas imprimibles están diseñadas para usarse en superficies lisas para mejorar la textura y el color de la superficie propuesta. Debido a sus diseños actualizados y su durabilidad, las películas se están volviendo populares como la mejor solución para renovaciones comerciales y proyectos de nueva construcción. Además, varios fabricantes clave están entregando películas de vinilo autoadhesivas para aplicaciones arquitectónicas, lo que se espera que impulse el crecimiento del mercado de películas de vinilo autoadhesivas en América del Norte.

Por ejemplo,

- DRYTAC ofrece un rollo de película de vinilo autoadhesivo llamado TimeTech Wall Protector. La película se puede utilizar para empapelar la cocina, los armarios, cubrir las paredes y también los muebles.

- Avery Dennison Corporation ofrece a sus usuarios finales una colección de diseños de interiores. Las películas de la serie MPI 8000 están disponibles en varios diseños. Estas películas se pueden aplicar sin necesidad de imprimación y su excelente opacidad garantiza que la pared subyacente quede completamente oculta.

Por lo tanto, se espera que la creciente demanda de películas de vinilo autoadhesivas imprimibles para aplicaciones arquitectónicas y de construcción impulse el crecimiento del mercado. Además, se espera que los fabricantes que ofrecen películas nuevas e innovadoras para estas aplicaciones impulsen el crecimiento del mercado a nivel mundial.

-

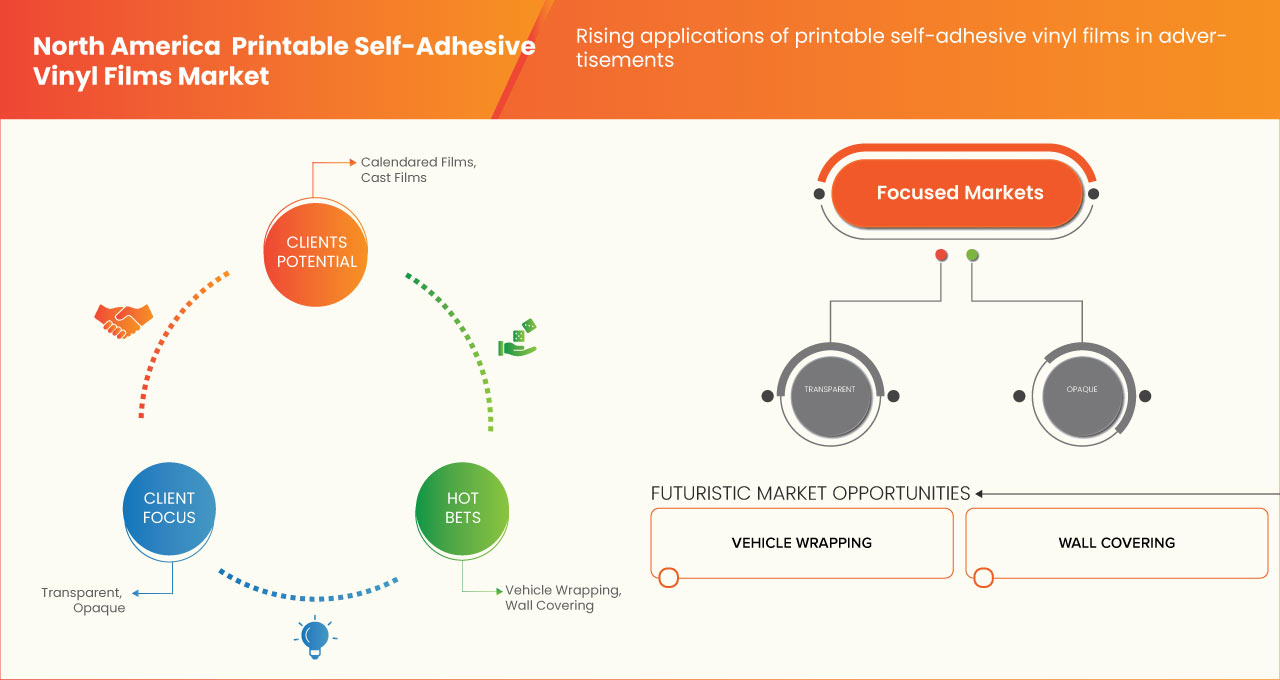

Aumento del uso de películas de vinilo autoadhesivas imprimibles en publicidad

Las películas de vinilo autoadhesivas imprimibles se utilizan ampliamente en publicidad, especialmente en publicidad exterior. Estas películas se han utilizado generalmente en anuncios exteriores para aumentar el conocimiento y la visibilidad de la marca. Debido a su capacidad, esto proporciona a las empresas un lienzo creativo en el que transmitir el mensaje de su marca, así como la facilidad con la que se puede modificar.

La demanda de estas películas para fines publicitarios y de marca se ve impulsada por características estéticas como un mayor brillo, que atrae a viajeros y otros clientes importantes. Además, la demanda de estas películas ha aumentado como resultado de las iniciativas gubernamentales para promover el turismo, como el uso de vinilo autoadhesivo imprimible para gráficos de flotas en vehículos comerciales como autobuses y camiones. Además, los fabricantes están entregando productos especialmente diseñados para anuncios, lo que está impulsando el crecimiento del mercado.

Por ejemplo,

Avery Dennison Corporation ofrece una amplia gama de películas gráficas sensibles a la presión en una variedad de tonos y acabados, así como películas de imágenes digitales de última generación que pueden convertir prácticamente cualquier superficie, desde paredes hasta ventanas, pisos y muebles, en un lienzo funcional para promociones llamativas.

Por lo tanto, debido a la alta calidad y resolución de las imágenes y anuncios, las películas de vinilo autoadhesivas imprimibles se utilizan mucho para anuncios publicitarios. Además, se espera que los fabricantes que ofrecen películas para publicidad también impulsen el crecimiento del mercado.

Oportunidades

-

Nuevos desarrollos estratégicos e iniciativas de los principales fabricantes

La amplia gama de aplicaciones de películas de vinilo autoadhesivas imprimibles en diversas industrias ha aumentado significativamente su demanda en el mercado. Por lo tanto, los principales fabricantes de películas de vinilo autoadhesivas están lanzando productos nuevos e innovadores para generar buenos ingresos y satisfacer la demanda de los usuarios finales. Además, están realizando nuevas adquisiciones y fusiones que se espera que creen una inmensa oportunidad en el mercado.

Por ejemplo,

-

En diciembre de 2022, LX International acordó adquirir una participación del 100 % en HanGlas. El objetivo principal de la adquisición era ampliar el tamaño del negocio de ventanas y vidrios revestidos de su filial LX Hausys.

Por lo tanto, se espera que los nuevos desarrollos estratégicos e iniciativas de los fabricantes clave creen oportunidades en el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte.

Restricciones/Desafíos

- Disponibilidad de varios sustitutos

Las películas de vinilo autoadhesivas imprimibles tienen una serie de aplicaciones, como etiquetas, letreros, gráficos para pisos, revestimientos de paredes, etc., y se utilizan ampliamente en todo el mundo. Sin embargo, hay muchos sustitutos disponibles para las películas de vinilo autoadhesivas imprimibles, como papeles, telas, películas biodegradables y películas sin PVC. El papel se puede utilizar para imprimir etiquetas, calcomanías y calcomanías. Es biodegradable y también está presente en una variedad de acabados y texturas. Además, las películas biodegradables son una alternativa ecológica a las películas de vinilo tradicionales. Están hechas de materiales como ácido poliláctico (PLA) o celulosa y están diseñadas para degradarse con el tiempo. Hay varios sustitutos que están presentes en el mercado, que pueden obstaculizar el crecimiento del mercado.

Por ejemplo,

- Next Day Flyers ofrece etiquetas de papel, como etiquetas BOPP blancas y etiquetas BOPP transparentes, laminadas con brillo, transparentes y resistentes al agua, al aceite y a la refrigeración. El papel se puede utilizar en lugar de películas de vinilo autoadhesivas.

Impacto posterior al COVID-19 en el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte

El COVID-19 ha afectado al mercado en cierta medida. Debido al confinamiento, el comercio de materias primas y películas de vinilo autoadhesivas imprimibles en todo el mundo se vio gravemente afectado por las medidas de cuarentena, lo que influyó en el mercado. Debido al cambio en muchos mandatos y regulaciones, los fabricantes pueden diseñar y lanzar nuevos productos al mercado, lo que ayudará al crecimiento del mercado.

Acontecimientos recientes

- En febrero de 2022, Stahls lanzó las transferencias directas a película (DTF) UltraColor Max como una nueva opción de servicio de transferencia térmica personalizada. El servicio ofrece colores ilimitados y detalles extremadamente finos sin contorno blanco ni transparente. Ampliará la cartera de productos de la empresa.

- En octubre de 2019, el Grupo POLI-TAPE adquirió Aslan, un desarrollador, fabricante y comercializador líder de películas autoadhesivas especializadas.

Alcance del mercado de películas de vinilo autoadhesivas imprimibles en América del Norte

El mercado de películas de vinilo autoadhesivas imprimibles de América del Norte está segmentado en cinco segmentos notables según el proceso de fabricación, el grosor, el tipo, el sustrato y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Proceso de fabricación

- Películas calendarizadas

- Películas del reparto

Sobre la base del proceso de fabricación, el mercado de películas de vinilo autoadhesivas imprimibles se segmenta en películas calandradas y películas fundidas.

Espesor

- Grueso (2-3 milésimas de pulgada)

- Delgado (más de 3 milésimas de pulgada)

En función del grosor, el mercado de películas de vinilo autoadhesivas imprimibles se segmenta en delgadas (2-3 milésimas de pulgada) y gruesas (más de 3 milésimas de pulgada).

Tipo

- Transparente

- Translúcido

- Opaco

Según el tipo, el mercado de películas de vinilo autoadhesivas imprimibles se segmenta en transparente, translúcida y opaca.

Solicitud

- Gráficos de flotas

- Gráficos de embarcaciones

- Envoltura de vehículos

- Gráficos de suelo

- Etiquetas y pegatinas

- Gráficos de ventana

- Paneles de exposición

- Publicidad exterior

- Decoración de muebles

- Revestimiento de paredes

- Otros

Sobre la base de la aplicación, el mercado de películas de vinilo autoadhesivas imprimibles se segmenta en gráficos de flotas, gráficos para embarcaciones, envoltura de automóviles, gráficos de piso, etiquetas y calcomanías, gráficos de ventanas, paneles de exhibición, publicidad exterior, decoración de muebles, revestimiento de paredes y otros.

Análisis y perspectivas regionales del mercado de películas de vinilo autoadhesivas imprimibles de América del Norte

Se analiza el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado según lo mencionado anteriormente.

Los países cubiertos en el informe del mercado de películas de vinilo autoadhesivas imprimibles de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte en términos de participación de mercado e ingresos. Se estima que mantendrá su dominio durante el período de pronóstico debido al aumento creciente de películas de vinilo autoadhesivas imprimibles en varias industrias. Además, la disponibilidad de múltiples tipos de películas de vinilo autoadhesivas imprimibles permite a los fabricantes elegir el tipo de películas de vinilo requerido según sus necesidades.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de películas de vinilo autoadhesivas imprimibles en América del Norte

El panorama competitivo del mercado de películas de vinilo autoadhesivas imprimibles de América del Norte proporciona detalles sobre los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con las empresas que se centran en el mercado de películas de vinilo autoadhesivas imprimibles de América del Norte.

Algunos de los principales actores que operan en el mercado son Brite Coatings Private Limited, Item Plastic Corp., 3M, AVERY DENNISON CORPORATION y Arlon Graphics, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS:

4.2.2 BARGAINING POWER OF SUPPLIERS:

4.2.3 THE THREAT OF NEW ENTRANTS:

4.2.4 THREAT OF SUBSTITUTES:

4.2.5 RIVALRY AMONG EXISTING COMPETITORS:

4.3 LIST OF KEY BUYERS

4.3.1 NORTH AMERICA

4.4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILM MARKET: PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 TRADE ANALYSIS

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS

6.1.2 RISING APPLICATIONS OF PRINTABLE SELF-ADHESIVE VINYL FILMS IN ADVERTISEMENTS

6.1.3 AVAILABILITY OF A WIDE RANGE OF SELF-ADHESIVE VINYL FILMS WITH DIFFERENT CHARACTERISTICS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF VARIOUS SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 NEW STRATEGIC DEVELOPMENTS AND INITIATIVES BY KEY MANUFACTURERS

6.3.2 RISING DEMAND FOR VEHICLE WRAPS

6.3.3 COMPANIES OFFERING SUSTAINABLE PRINTABLE SELF-ADHESIVE VINYL FILMS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG KEY MANUFACTURERS

6.4.2 INCREASING ENVIRONMENTAL CONCERNS AND GOVERNMENT REGULATIONS

7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 CALENDERED FILMS

7.3 CAST FILMS

8 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 THIN (2-3 MILS)

8.3 THICK (MORE THAN 3 MILS)

9 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE

9.1 OVERVIEW

9.2 OPAQUE

9.3 TRANSPARENT

9.4 TRANSLUCENT

10 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 PLASTIC

10.3 FLOOR

10.4 GLASS

10.5 OTHERS

11 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CAR WRAPPING

11.3 FLEET GRAPHICS

11.4 WATERCRAFT GRAPHICS

11.5 FLOOR GRAPHICS

11.6 WINDOW GRPAHICS

11.7 OUTDOOR ADVERTISING

11.8 LABLES& STICKERS

11.9 FURNITURE DECORATION

11.1 WALLCOVERING

11.11 EXHIBITION PANELS

11.12 OTHERS

12 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILE

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SWOT

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 AVERY DENNISON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SWOT

14.2.5 PRODUCT PORTFOLIO

14.2.6 RECENT DEVELOPMENTS

14.3 ORAFOL EUROPE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 SWOT

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HENKEL ADHESIVES TECHNOLOGIES INDIA PRIVATE LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SWOT

14.4.5 PRODUCT PORTFOLIO

14.4.6 RECENT DEVELOPMENTS

14.5 LX HAUSYS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SWOT

14.5.5 PRODUCT PORTFOLIO

14.5.6 RECENT DEVELOPMENT

14.6 ACHILLIES CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SWOT

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 ARLON GRAPHICS, LLC.

14.7.1 COMPANY SNAPSHOT

14.7.2 SWOT

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BRITE COATINGS PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 SWOT

14.8.4 RECENT DEVELOPMENT

14.9 DRYTAC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT

14.9.4 RECENT DEVELOPMENT

14.1 FLEXCON COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 SWOT

14.10.4 RECENT DEVELOPMENTS

14.11 HEXIS S.A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 INNOVIA FILMS

14.12.1 COMPANY SNAPSHOT

14.12.2 SWOT

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 ITEM PLASTIC CORP.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 SWOT

14.13.4 RECENT DEVELOPMENTS

14.14 LINTEC CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SWOT

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 METAMARK

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 SWOT

14.15.4 RECENT DEVELOPMENTS

14.16 POLI-TAPE GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RESPONSIVE INDUSTRIES LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENT

14.18 SHUBH PLASTICS

14.18.1 COMPANY SNAPSHOT

14.18.2 SWOT

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 STAHLS’ INTERNATIONAL

14.19.1 COMPANY SNAPSHOT

14.19.2 SWOT

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TEKRA, LLC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 SWOT

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES, OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 2 EXPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 3 LIST OF MAJOR RAW MATERIAL SUPPLIERS

TABLE 4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CALENDERED FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CAST FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA THIN (2-3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA THICK (MORE THAN 3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPAQUE IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA TRANSPARENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TRANSLUCENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLOOR IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GLASS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CAR WRAPPING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FLEET GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA WATERCRAFT GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLOOR GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA WINDOW GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OUTDOOR ADVERTISING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA LABELS & STICKERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FURNITURE DECORATION IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA WALLCOVERING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA EXHIBITION PANELS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 38 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 39 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 41 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 43 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 44 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 46 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 48 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 49 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 11 CALENDERED FILM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

FIGURE 13 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS, 2022

FIGURE 14 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY THICKNESS, 2022

FIGURE 15 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY SUBSTRATE, 2022

FIGURE 17 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS (2023-2030)

FIGURE 23 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.