North America Premium Wine Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

14,009.64 Million

USD

22,029.88 Million

2021

2029

USD

14,009.64 Million

USD

22,029.88 Million

2021

2029

| 2022 –2029 | |

| USD 14,009.64 Million | |

| USD 22,029.88 Million | |

|

|

|

|

Mercado de vinos premium de América del Norte, por color de vino ( vino tinto , vino blanco, vino rosado y otros), tipo de producto ( vino tranquilo , vino fortificado, vino espumoso, vino de postre), categoría de producto (vino alcohólico y vino sin alcohol), sabor (original y aromatizado), años de envejecimiento (1-17 años, 18-24 años, 25-44 años, 45-64 años y 65+ años), tipo de barrica de envejecimiento (roble, arce, cedro, nogal y otros), rango de precios (premium y superpremium), canal de distribución (minoristas en tiendas y minoristas en línea) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de vinos premium de América del Norte

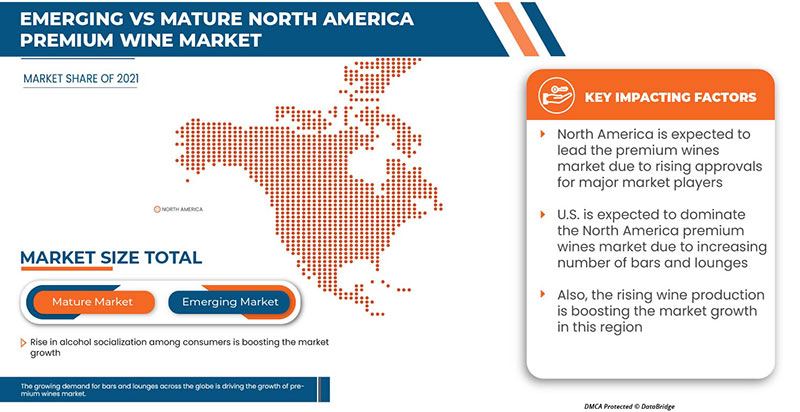

La creciente demanda de vino debido a sus diferentes beneficios para la salud está contribuyendo a impulsar el crecimiento general del mercado. El auge del comercio electrónico, la mensajería y los servicios de entrega de vino también están contribuyendo al crecimiento del mercado. Los principales actores del mercado están muy centrados en varios lanzamientos de nuevos vinos. Además, el aumento de la socialización del alcohol entre los consumidores también contribuye al aumento de la demanda del mercado.

El mercado de vinos premium de América del Norte está creciendo en el año de pronóstico debido al aumento de los actores del mercado y la disponibilidad de varias marcas de vinos premium en el mercado. Junto con esto, los fabricantes se dedican a producir diferentes vinos en el mercado. El aumento de bares y restaurantes está impulsando aún más el crecimiento del mercado. Sin embargo, el alto costo de producción del vino y el cambio gradual de los consumidores hacia otras bebidas alcohólicas podrían obstaculizar el crecimiento del mercado de vinos premium de América del Norte en el período de pronóstico.

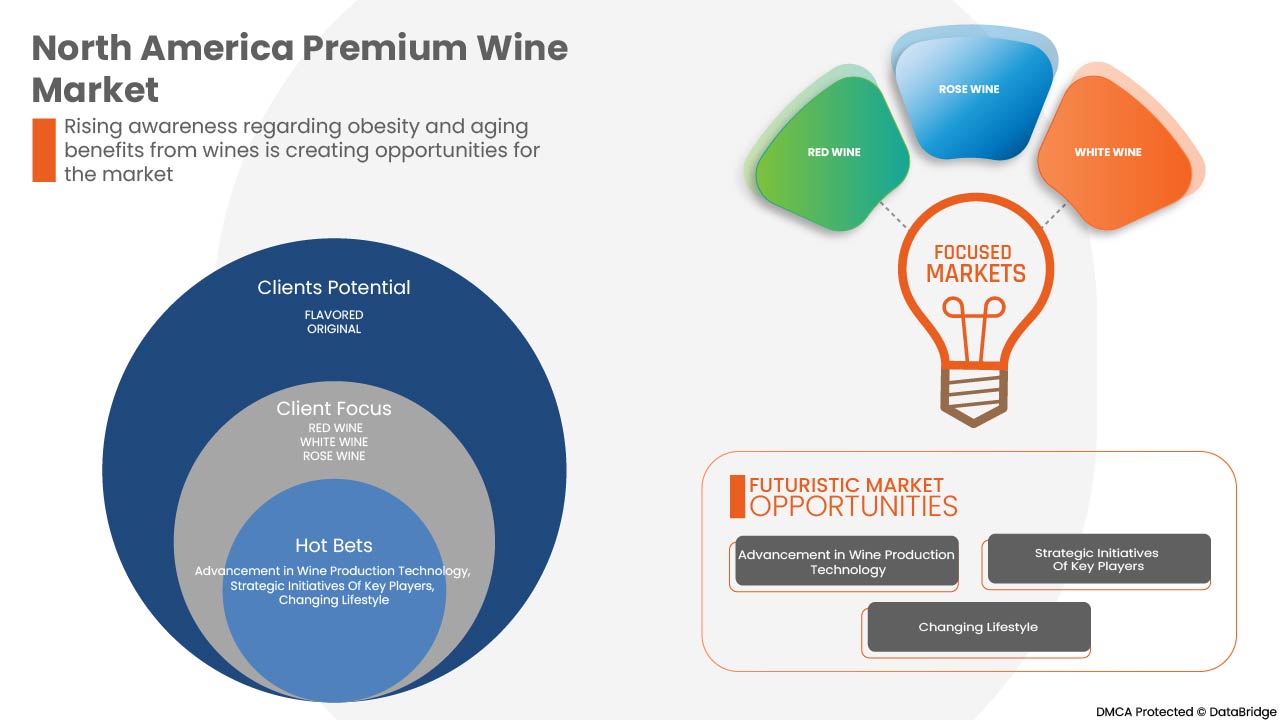

Los diversos beneficios para la salud, los cambios en el estilo de vida y las iniciativas estratégicas de los actores del mercado están brindando oportunidades al mercado. Sin embargo, el consumo excesivo de vino, que obstaculiza la aparición de diversas enfermedades graves, la escasez de agua y las complicaciones para satisfacer la demanda de los consumidores, son desafíos clave para el crecimiento del mercado.

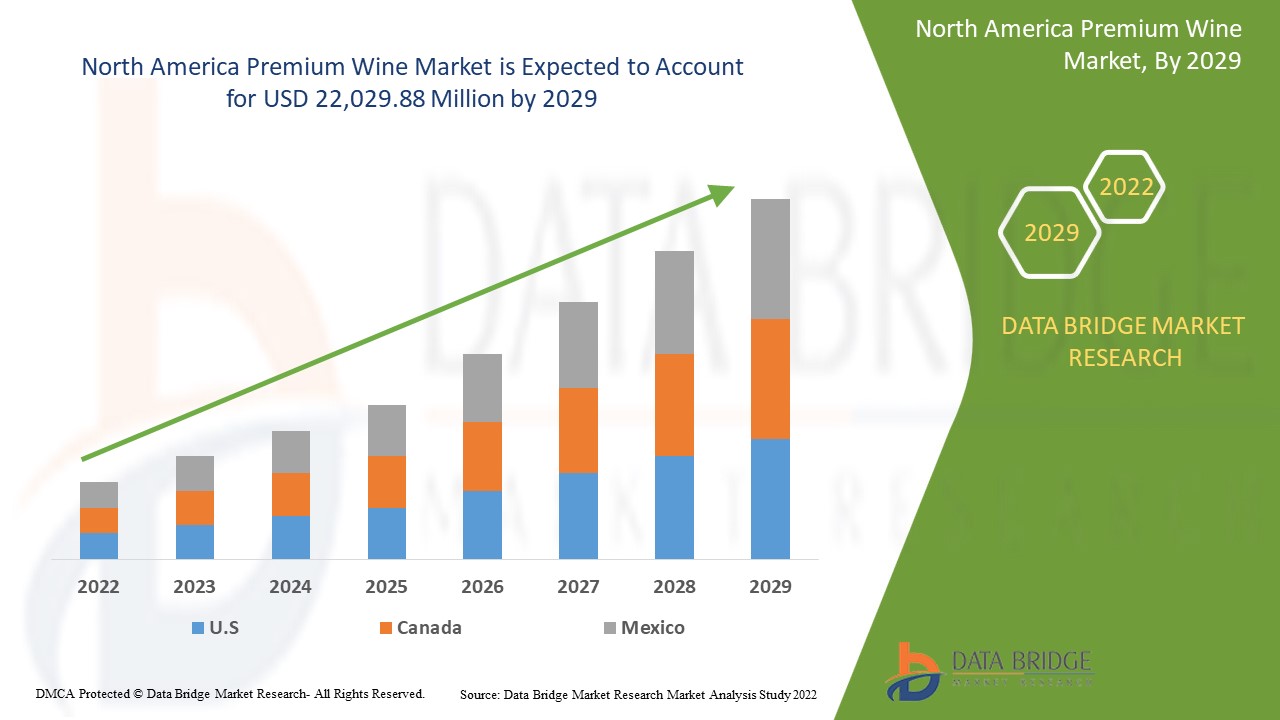

Se espera que el mercado de vinos premium de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 22.029,88 millones para 2029 desde USD 14.009,64 millones en 2021.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por color de vino ( vino tinto , vino blanco, vino rosado y otros), tipo de producto ( vino tranquilo , vino generoso, vino espumoso, vino de postre), categoría de producto (vino alcohólico y vino sin alcohol), sabor (original y aromatizado), años de envejecimiento (1-17 años, 18-24 años, 25-44 años, 45-64 años y 65+ años), tipo de barrica de envejecimiento (roble, arce, cedro, nogal y otros), rango de precios (premium y superpremium), canal de distribución (minoristas en tiendas y minoristas en línea) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Las principales empresas que operan en el mercado son Viña Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres SA, Fetzer, GRUPO PENFLOR y entre otras. |

Definición del mercado de vinos premium

El vino es una bebida alcohólica en la que el alcohol se produce de forma natural mediante la fermentación. La fermentación es el primer paso del proceso, que se lleva a cabo por las bacterias que se encuentran en la piel de las uvas. Después, se añade una cepa específica de levadura al producto fermentado principal para obtener el resultado deseado. El azúcar de las uvas se convierte en dióxido de carbono y etanol por acción de las levaduras o bacterias del vino. Los vinos con mucho azúcar tienen un sabor diferente, y el vino de postre es uno de ellos. El estrujado, la fermentación alcohólica, la fermentación maloláctica, el desfangado del vino, la estabilización y el envejecimiento, y el afinamiento en botella son los seis procesos fundamentales que intervienen en la producción de vino.

Dinámica del mercado de vinos premium

Conductores

- Creciente demanda de vino por sus diferentes beneficios para la salud

El consumo de vino ha aumentado en los últimos años debido a la mayor concienciación sobre sus diferentes beneficios para la salud. Según los investigadores, el consumo moderado de vino, que tiene un contenido de alcohol del 12% al 15% diario, ayuda a prevenir varias enfermedades. A continuación, se enumeran algunos de los beneficios del vino para la salud:

El vino tiene propiedades antioxidantes. Los antioxidantes son compuestos que previenen el daño celular causado por la inflamación y el estrés oxidativo. Las uvas tienen altos niveles de polifenoles y antioxidantes que han demostrado reducir el estrés oxidativo y la inflamación.

- Aumento del comercio electrónico, la mensajería y los servicios de entrega de vino

La industria del comercio electrónico está en constante cambio y desempeña un papel fundamental en nuestra vida diaria. El comercio electrónico ofrece una plataforma para que las personas compren o vendan lo que quieran, cuando quieran. Los comerciantes crean y mejoran continuamente las estrategias y los enfoques de sus negocios de comercio electrónico para satisfacer la demanda cambiante de los consumidores.

El comercio electrónico ha transformado la forma de hacer negocios en todo el mundo. Gran parte del crecimiento de la industria se ha debido al aumento de la penetración de Internet y los teléfonos inteligentes. Además, los avances tecnológicos y el crecimiento de los mercados disponibles han facilitado la compra y venta de productos a través de portales en línea. Los comerciantes y los servicios de entrega siguen la demanda de los consumidores en las plataformas en línea y acuden al comercio electrónico en cantidades récord.

- Aumento de la socialización del alcohol entre los consumidores

La producción y el consumo de vino han crecido rápidamente en las últimas décadas, lo que ha aumentado el consumo. Hoy en día, los compromisos sociales, la modernización y la creciente adopción de la cultura occidental son algunos de los elementos que animan a los consumidores a socializar con el alcohol, lo que acelerará aún más el crecimiento del mercado.

El consumo de alcohol se está convirtiendo en un signo de estatus social, lo que respalda el crecimiento del mercado de bebidas de bajo contenido alcohólico. También está ganando una enorme popularidad entre los millennials y los jóvenes, debido a su atractivo refrescante y a su bajo contenido de alcohol por volumen. Se asocia principalmente a diversas ocasiones y se sirve como bebida de mesa con las comidas habituales en los países en desarrollo.

La creciente demanda alienta aún más a los fabricantes a lanzar e introducir productos innovadores, lo que también se espera que impulse el crecimiento del mercado en los próximos años.

Oportunidades

-

Cambiar el estilo de vida

La gente prefiere el vino de calidad por su sabor auténtico. Los vinos se han convertido en un elemento social y genérico para fiestas y diversas ocasiones a pesar de sus componentes saludables y nocivos. Los estudios epidemiológicos de numerosas poblaciones dispares revelan que las personas con el hábito de un consumo moderado diario de vino disfrutan de reducciones significativas en la mortalidad por todas las causas y, en particular, la mortalidad cardiovascular en comparación con las personas que se abstienen o beben alcohol en exceso.

-

Aumento del número de bares y salones

La demanda de vino de primera calidad está aumentando debido al aumento de restaurantes, bares y vinotecas especiales en todo el mundo. Como estos vinos de primera calidad están fácilmente disponibles en bares y salones, la demanda de vinotecas específicas también está aumentando. Los bares y salones de vino que ofrecen la suscripción anual de vinos premium auténticos están haciendo que la gente se sienta más complacida.

Restricciones/Desafíos

- Aumento del coste de producción del vino

En todo el mundo, los costes de producción del vino han aumentado. Las industrias del vino se enfrentan a varios retos, como el coste de los productos y su envío debido al aumento de los precios del gas. La botella de vino real es cada vez más difícil de conseguir, especialmente con los retos en la cadena de suministro y el aumento de los precios del gas. Debido a la COVID, el aumento de los precios del gas y la inflación, no es fácil conseguir botellas de vino. La industria del vino experimentó un aumento del 30 por ciento en los costes en el año 2022. Por tanto, el aumento del coste de la producción de vino está obstaculizando el crecimiento del mercado.

- Cambio gradual de los consumidores hacia otras bebidas alcohólicas

La creciente modernización y el aumento del consumo de alcohol son tendencias en curso en todo el mundo, que han impulsado a los productores de alcohol a lanzar variantes innovadoras y audaces en bebidas alcohólicas. Los consumidores están cambiando gradualmente sus preferencias hacia diversas bebidas alcohólicas, como licores, bebidas espirituosas, cerveza y otras, debido a su disponibilidad a precios económicos.

Impacto del COVID-19 en el mercado de vinos premium

El COVID-19 ha afectado negativamente al mercado. Los confinamientos y el aislamiento durante la pandemia provocaron el cierre de la mayoría de bares y restaurantes y, por lo tanto, afectaron a la venta de vino. La compra de vino en línea aumentó en comparación con la compra a vendedores. Por lo tanto, el COVID-19 afectó negativamente al mercado del vino premium.

Acontecimientos recientes

- En junio de 2022, Pernod Ricard anunció el lanzamiento de un sistema de etiquetado digital para informar mejor a los consumidores sobre los productos que compran, así como sobre el consumo responsable. Esta iniciativa tiene como objetivo ofrecer a los consumidores una solución eficaz a su deseo de una mayor transparencia en el contenido de los productos y la información sobre la salud. En julio de 2022 se puso en marcha un programa piloto europeo, que se implementará a nivel mundial en todas las marcas del portafolio del Grupo en 2024. Esto ha ayudado a la empresa a ofrecer mejores servicios a los consumidores a través de este tipo de innovaciones en la organización.

Panorama del mercado de vinos premium de América del Norte

El mercado de vinos premium de América del Norte está segmentado por color de vino, tipo de producto, categoría de producto, tipo de barrica de añejamiento, rango de precio y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Color del vino

- Vino tinto

- Vino blanco

- Vino rosado

- Otros

Según el color del vino, el mercado de vinos premium de América del Norte se segmenta en vino tinto, vino blanco, vino rosado y otros.

Tipo de producto

- Vino tranquilo

- Vino espumoso

- Vino Fortificado y

- Vino de postre

Según el tipo de producto, el mercado de vinos premium de América del Norte está segmentado en vino tranquilo, vino espumoso, vino fortificado y vino de postre.

Categoría de producto

- Vino alcohólico

- Vino sin alcohol

Según la categoría de producto, el mercado de vinos premium de América del Norte está segmentado en vino con alcohol y vino sin alcohol.

Sabor

- Original

- Sazonado

Según el sabor, el mercado de vinos premium de América del Norte se segmenta en original y aromatizado.

Años de envejecimiento

- 1-7 años

- 18-24 años

- 25-44 años

- 45-64 años

- 65+ años

Según los años de envejecimiento, el mercado de vinos premium de América del Norte se segmenta en 1 a 7 años, 18 a 24 años, 25 a 44 años, 45 a 64 años y 65 años o más.

Tipo de barrica de envejecimiento

- Roble

- Arce

- Cedro

- Nuez dura

- Otros

Según el tipo de barrica, el mercado de vinos premium de América del Norte está segmentado en roble, arce, cedro, nogal y otros.

Por rango de precio

- De primera calidad

- Súper Premium

Según el rango de precios, el mercado de vinos premium de América del Norte se segmenta en premium y súper premium.

Canal de distribución

- Minoristas con sede en tiendas

- Minoristas en línea

Según el canal de distribución, el mercado de vinos premium de América del Norte está segmentado en minoristas en tiendas físicas y minoristas en línea.

Análisis y perspectivas regionales del mercado de vinos premium

Se analiza el mercado del vino premium y se proporcionan información y tendencias del tamaño del mercado por país, color del vino, tipo de producto, categoría de producto, tipo de barrica de envejecimiento, rango de precio y canal de distribución.

Los países del mercado del vino premium son Estados Unidos, Canadá y México.

Estados Unidos domina el mercado del vino premium en términos de participación de mercado e ingresos de mercado y continuará fortaleciendo su dominio durante el período de pronóstico.

Se espera que el mercado estadounidense de vinos premium crezca debido a un aumento en el consumo de vino con las comidas, el consumo de vino premium en reuniones sociales y celebraciones, un aumento en la preferencia de los consumidores por los vinos premium, y un aumento en las opciones para personalizar el sabor, el color y el empaque del vino premium que se espera que impulsen el mercado regional en el período previsto.

Los rápidos avances tecnológicos y la perfección en el arte tradicional de la elaboración del vino están aumentando la demanda de vino de primera calidad. La creciente población de adultos que consumen alcohol está impulsando aún más el crecimiento del mercado. Además, las diferentes opciones de envasado del vino de primera calidad, junto con su personalización, disponibilidad en línea, presencia de importantes actores del mercado en la región y altos niveles de vida, también están impulsando el crecimiento del mercado.

Análisis del panorama competitivo y de la cuota de mercado de los vinos premium

El panorama competitivo del mercado de vinos premium ofrece información detallada de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de vinos premium.

Algunos de los principales actores que operan en el mercado de vinos premium son Viña Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres SA, Fetzer, GRUPO PENFLOR y entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, América del Norte frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PREMIUM WINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 WINE COLOUR LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET WINE COLOUR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 REGULATORY FRAMEWORK AND GUIDELINES

4.3.1 ADVERTISING & PROMOTIONS –

4.4 TAXATION AND DUTY LEVIES

4.5 COMPARATIVE ANALYSIS OF TYPES OF WINE

4.6 DEMOGRAPHIC PREFERENCES

4.7 BRAND COMPETITIVE ANALYSIS

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 NORTH AMERICA PREMIUM WINE MARKET: REGULATIONS

8 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK –

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW –

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING DEMAND FOR WINE OWING TO DIFFERENT HEALTH BENEFITS

10.1.2 RISING E-COMMERCE, COURIER, AND WINE DELIVERY SERVICES

10.1.3 RISE IN ALCOHOL SOCIALIZATION AMONG CONSUMERS

10.2 RESTRAINTS

10.2.1 INCREASED COST OF WINE PRODUCTION

10.2.2 GRADUAL SHIFT OF CONSUMERS TOWARD OTHER ALCOHOLIC BEVERAGES

10.3 OPPORTUNITIES

10.3.1 CHANGING LIFESTYLE

10.3.2 INCREASING NUMBER OF BARS AND LOUNGES

10.3.3 RISING AWARENESS REGARDING OBESITY AND AGING BENEFITS FROM WINES

10.4 CHALLENGES

10.4.1 HIGH CONSUMPTION LEADING SEVERE HEALTH PROBLEMS

10.4.2 LABOUR-INTENSIVE AND TIME-CONSUMING

11 NORTH AMERICA PREMIUM WINE MARKET, BY WINE COLOR

11.1 OVERVIEW

11.2 RED WINE

11.2.1 FULL-BODIED

11.2.2 MEDIUM-BODIED

11.2.3 LIGHT-BODIED

11.3 WHITE WINE

11.4 ROSE WINE

11.5 OTHERS

12 NORTH AMERICA PREMIUM WINE MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 STILL WINE

12.3 SPARKLING WINE

12.4 FORTIFIED WINE

12.5 DESSERT WINE

12.5.1 LIGHT SWEET

12.5.2 RICHLY SWEET

12.5.3 SWEET RED WINE

13 NORTH AMERICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 ALCOHOLIC

13.3 NON-ALCOHOLIC

13.3.1 0.5% ABV

13.3.2 MORE THAN 0.05% ABV

13.3.3 0.05% ABV

13.3.4 LESS THAN 0.05% ABV

14 NORTH AMERICA PREMIUM WINE MARKET, BY FLAVOR

14.1 OVERVIEW

14.2 FLAVORED

14.2.1 FRUITS

14.2.1.1 CHERRY

14.2.1.2 PEACH

14.2.1.3 LEMON

14.2.1.4 GREEN APPLE

14.2.1.5 ORANGE

14.2.1.6 POMOGRANATE

14.2.1.7 MELON

14.2.1.8 FIG

14.2.1.9 MANGO

14.2.1.10 PINEAPPLE

14.2.1.11 OTHERS

14.2.2 BERRY

14.2.2.1 CRANBERRIES

14.2.2.2 BLUEBERRY

14.2.2.3 RASPBERRY

14.2.2.4 STRAWBERRY

14.2.2.5 OTHERS

14.2.3 FLORAL

14.2.3.1 ROSE

14.2.3.2 HIBISCUS

14.2.3.3 OTHERS

14.2.4 HERBAL

14.2.4.1 SMOKED TOBACCO

14.2.4.2 TRUFFLE

14.2.4.3 OTHERS

14.2.5 SPICES

14.2.5.1 CINNAMON

14.2.5.2 NUTMEG

14.2.5.3 PEPPER

14.2.5.4 GINGER

14.2.5.5 CLOVES

14.2.5.6 OTHERS

14.2.6 CHOCOLATE

14.2.7 MAPLE

14.2.8 HONEY

14.2.9 VANILLA

14.2.10 CARAMEL

14.3 ORIGINAL

15 NORTH AMERICA PREMIUM WINE MARKET, BY AGEING YEARS

15.1 OVERVIEW

15.2 1-17 YEARS

15.3 18-24 YEARS

15.4 25-44 YEARS

15.5 45-64 YEARS

15.6 65+ YEARS

16 NORTH AMERICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE

16.1 OVERVIEW

16.2 OAK

16.3 HICKORY

16.4 MAPLE

16.5 CEDAR

16.6 OTHERS

17 NORTH AMERICA PREMIUM WINE MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 PREMIUM

17.3 SUPER PREMIUM

18 NORTH AMERICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 STORE BASED RETAILERS

18.2.1 LIQUOR STORES

18.2.2 CONVENIENCE STORE

18.2.3 SUPERMARKETS/HYPERMARKETS

18.2.4 WHOLESALERS

18.2.5 SPECIALITY STORES

18.2.6 GROCERY STORES

18.2.7 OTHERS

18.3 ONLINE RETAILERS

19 NORTH AMERICA PREMIUM WINE MARKET, BY REGION

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

20 COMPANY LANDSCAPE

20.1 NORTH AMERICA PREMIUM WINE MARKET: COMPANY LANDSCAPE

20.1.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 PERNOD RICARD

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 E. & J. GALLO WINERY

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 CONSTELLATION BRANDS, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 TREASURY WINE ESTATES

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 CASTEL FRÈRES

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ACCOLADE WINES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 BASS PHILLIP WINES

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CASELLA

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 CHANGYU

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUS ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.1 CHATEAU CHEVAL BLANC

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 CULLEN WINES

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 FETZER

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 GIACONDA MARKETING PTY. LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 GRUPO PEÑAFLOR

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 HENSCHKE

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 LEEUWIN ESTATE

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 MIGUEL TORRES S.A

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOSS WOOD

22.18.1 COMANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOUNT MARY VINEYARD

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

22.2 ROCKFORD

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 SULA VINEYARDS PVT. LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 THE WINE GROUP

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 VINA CONCHA Y TORO

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT DEVELOPMENT

22.24 VINS GRAND CRUS

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tablas

TABLE 1 BELOW ARE THE MOST COMMON RED WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 2 BELOW ARE THE MOST COMMON WHITE WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 3 BELOW IS THE TABULAR REPRESENTATION OF THE OVERALL TOTAL CONSUMPTION OF WINE IN DIFFERENT COUNTRIES :

TABLE 4 THE PRICES OF THESE WINES VARY FROM REGION TO REGION. BELOW ARE THE PRICES OF SOME OF THE MOST POPULAR RED WINES ACROSS THE GLOBE.

TABLE 5 BELOW ARE THE PRICES OF SOME OF THE WORLD’S BEST WHITE WINES ACROSS THE GLOBE.

TABLE 6 NORTH AMERICA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA RED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA RED WINE IN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA WHITE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ROSE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA STILL WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SPARKLING WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA FORTIFIED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DESSERT WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY ABV %, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FLAVORED IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FRUITS IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ORIGINAL IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PREMIUM WINE MARKET, BY AGEING, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA 1-17 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA 18-24 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA 25-44 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA 45-64 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA 65+ YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OAK IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HICKORY IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA MAPLE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CEDAR IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SUPER PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA ONLINE RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PREMIUM WINE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 U.S. PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 69 U.S. RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 U.S. NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 74 U.S. PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 75 U.S. FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 76 U.S. FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 77 U.S. BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 78 U.S. FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 U.S. HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 U.S. SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 U.S. PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 82 U.S. PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.S. PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 84 U.S. PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 U.S. STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 CANADA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 87 CANADA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 CANADA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 92 CANADA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 CANADA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 CANADA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 CANADA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 96 CANADA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 97 CANADA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 98 CANADA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 CANADA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 100 CANADA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 101 CANADA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 CANADA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 CANADA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 105 MEXICO RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 MEXICO NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 110 MEXICO PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 111 MEXICO FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 112 MEXICO FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 113 MEXICO BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 MEXICO FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 MEXICO HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 MEXICO SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 MEXICO PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 118 MEXICO PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA PREMIUM WINE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PREMIUM WINE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PREMIUM WINE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PREMIUM WINE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PREMIUM WINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PREMIUM WINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PREMIUM WINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PREMIUM WINE MARKET: MARKET WINE COLOUR COVERAGE GRID

FIGURE 9 NORTH AMERICA PREMIUM WINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PREMIUM WINE MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND OF WINE OWING TO DIFFERENT HEALTH BENEFITS AND RISING E-COMMERCE, COURIER AND WINE DELIVERY SERVICES ARE EXPECTED TO DRIVE THE NORTH AMERICA PREMIUM WINE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RED WINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PREMIUM WINE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PREMIUM WINE MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN THE CONSUMPTION OF WINE IN THE U.S.

FIGURE 15 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 16 NORTH AMERICA PREMIUM WINE MARKET: BY WINE COLOR, 2021

FIGURE 17 NORTH AMERICA PREMIUM WINE MARKET: BY WINE COLOR, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA PREMIUM WINE MARKET: BY WINE COLOR, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA PREMIUM WINE MARKET: BY WINE COLOR, LIFELINE CURVE

FIGURE 20 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 25 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, LIFELINE CURVE

FIGURE 28 NORTH AMERICA PREMIUM WINE MARKET: BY FLAVOR, 2021

FIGURE 29 NORTH AMERICA PREMIUM WINE MARKET: BY FLAVOR, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA PREMIUM WINE MARKET: BY FLAVOR, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA PREMIUM WINE MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 32 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING YEARS, 2021

FIGURE 33 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING YEARS, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING YEARS, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING YEARS, LIFELINE CURVE

FIGURE 36 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2021

FIGURE 37 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, LIFELINE CURVE

FIGURE 40 NORTH AMERICA PREMIUM WINE MARKET: BY PRICE RANGE, 2021

FIGURE 41 NORTH AMERICA PREMIUM WINE MARKET: BY PRICE RANGE, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA PREMIUM WINE MARKET: BY PRICE RANGE, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA PREMIUM WINE MARKET: BY PRICE RANGE, LIFELINE

FIGURE 44 NORTH AMERICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 NORTH AMERICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 NORTH AMERICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 NORTH AMERICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE

FIGURE 48 NORTH AMERICA PREMIUM WINE MARKET: SNAPSHOT (2021)

FIGURE 49 NORTH AMERICA PREMIUM WINE MARKET: BY COUNTRY (2021)

FIGURE 50 NORTH AMERICA PREMIUM WINE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 NORTH AMERICA PREMIUM WINE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 NORTH AMERICA PREMIUM WINE MARKET: WINE COLOR (2022-2029)

FIGURE 53 NORTH AMERICA PREMIUM WINE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.