Mercado de polioles de América del Norte, por tipo (polioles de poliéter y polioles de poliéster), aplicación (espuma de poliuretano flexible, espuma de poliuretano rígida, recubrimientos, adhesivos y selladores, elastómeros y otros), usuario final (construcción, muebles, transporte, embalaje, respaldo de alfombras y otros), tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de polioles en América del Norte

Los polioles son compuestos orgánicos. Este compuesto orgánico es un compuesto que contiene carbono unido covalentemente a otros átomos, especialmente carbono-carbono y carbono-hidrógeno. Una clase de polioles llamados alcoholes de azúcar incluye aquellos que se derivan de azúcares. Pueden ocurrir de forma natural o producirse industrialmente. La creciente demanda de espumas de poliuretano, la creciente demanda en el sector de la construcción y la infraestructura y el creciente enfoque en materiales de aislamiento energéticamente eficientes y productos sostenibles son los principales factores que actúan como un factor impulsor para el mercado de polioles de América del Norte. Sin embargo, las regulaciones ambientales y las preocupaciones de sostenibilidad, los altos costos asociados con los polioles están actuando como factores restrictivos para el crecimiento del mercado de polioles de América del Norte. Se estima que la creciente demanda de polioles para materiales de embalaje, el uso de polioles en aplicaciones de aislamiento y la creciente demanda de productos de base biológica brindarán oportunidades para el crecimiento del mercado de polioles de América del Norte. Sin embargo, las fluctuaciones en los precios de las materias primas y las limitaciones tecnológicas y los requisitos de rendimiento están creando un entorno desafiante para el crecimiento del mercado de polioles de América del Norte.

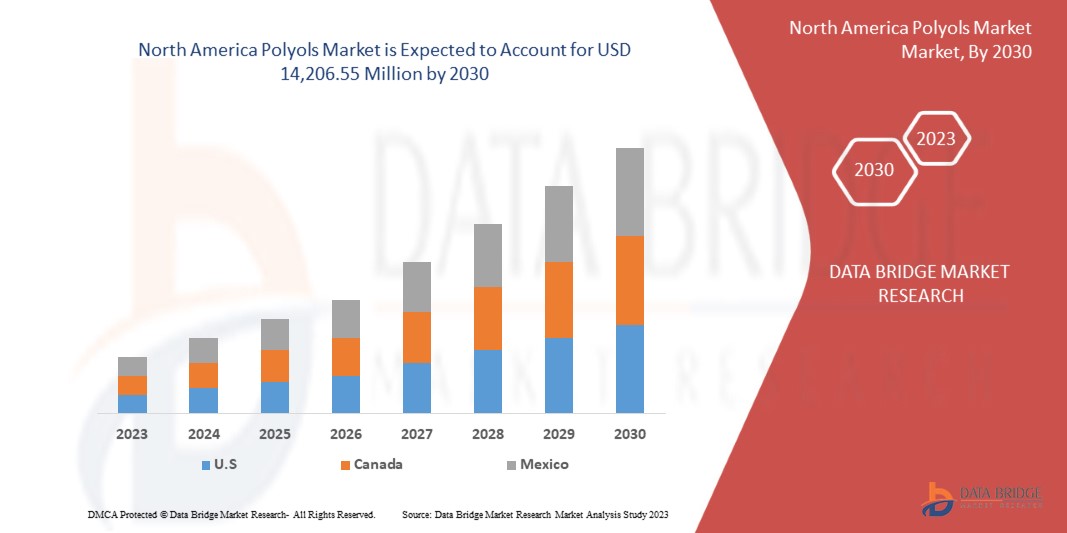

Data Bridge Market Research analiza que se espera que el mercado de polioles de América del Norte alcance un valor de USD 14.206,55 millones para 2030, con una CAGR del 5,7 % durante el período de pronóstico. El informe del mercado de polioles de América del Norte también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Tipo (polioles de poliéter y polioles de poliéster), aplicación (espuma de poliuretano flexible, espuma de poliuretano rígida, revestimientos, adhesivos y selladores, elastómeros y otros), usuario final (construcción, muebles, transporte, embalaje, base de alfombras y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Huntsman International LLC, Repsol, Biesterfeld AG, DIC CORPORATION, Tosoh Corporation, Arkema, BASF SE, Dow, Cargill, Incorporated, LANXESS, Shell plc, Mitsubishi Chemical Corporation, Vertellus, Wanhua, Stepan Company, Gulshan Polyols Ltd, Perstorp Holding AB (subsidiaria de PETRONAS Chemicals Group), Emery Oleochemicals LLC, Covestro AG, Coim Group y Shakun Industries, entre otras. |

Definición de mercado

Los polioles son alcoholes con más de un grupo hidroxilo y constituyen una de las principales materias primas para la fabricación de poliuretano. Se utilizan comúnmente como materias primas clave en la fabricación de varios productos, como espumas de poliuretano , revestimientos, adhesivos, selladores, elastómeros y más. Los polioles se derivan principalmente de fuentes petroquímicas o recursos renovables como aceites vegetales y derivados del azúcar. Se pueden clasificar en diferentes tipos según su estructura química, incluidos polioles de poliéter y polioles de poliéster. Cada tipo posee propiedades específicas y es adecuado para diferentes aplicaciones. Los diferentes tipos de polioles son polioles de poliéter y polioles de poliéster. Los polioles se utilizan en diferentes aplicaciones en diferentes formas, como espuma de poliuretano flexible, espuma de poliuretano rígida, revestimientos, adhesivos y selladores, elastómeros y otros. Los poliuretanos son versátiles, modernos y seguros. Tienen una amplia gama de aplicaciones para crear todo tipo de productos industriales y básicos de consumo para hacer nuestra vida más práctica, cómoda y respetuosa con el medio ambiente. El poliuretano está compuesto de material plástico y se presenta en varias formas. Se puede utilizar en varias formas, como rígido o flexible, y se prefiere en función del material en una amplia gama de aplicaciones. Uno de estos polioles es Repsol, que ofrece una cartera de polioles de poliéter desarrollados con tecnología propia con una amplia gama de alternativas.

Dinámica del mercado de polioles en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de espumas de poliuretano

Los polioles son uno de los dos componentes principales que se utilizan en la producción de espumas de poliuretano, siendo el otro componente los isocianatos. Los polioles son compuestos poliméricos que contienen múltiples grupos funcionales hidroxilo (-OH). Pueden derivarse de varias fuentes, como petróleo, aceites vegetales o poliésteres. En el proceso de fabricación de espuma de poliuretano, los polioles reaccionan con isocianatos para formar una red de polímeros. Se espera que la creciente demanda de espumas de poliuretano impulse el mercado de polioles de América del Norte. Las espumas de poliuretano son materiales versátiles que se utilizan en diversas industrias, como la construcción, la automoción, el mobiliario y el embalaje, debido a sus excelentes propiedades de aislamiento, amortiguación y durabilidad.

Oportunidad

- Demanda creciente de polioles para materiales de embalaje

Los materiales de embalaje se utilizan para encerrar, proteger y contener productos para su almacenamiento, distribución y venta. El embalaje cumple varias funciones, entre ellas preservar la calidad e integridad de los productos, garantizar su seguridad durante el transporte, proporcionar información a los consumidores y facilitar la manipulación y el almacenamiento. Los materiales de embalaje pueden estar hechos de una amplia gama de materiales, incluidos plásticos, papel y cartón, vidrio, metales y materiales compuestos. Los materiales de embalaje desempeñan un papel fundamental a la hora de garantizar la seguridad, la conservación y la presentación de los productos. Contribuyen a la experiencia general del consumidor y proporcionan información esencial sobre el producto, como los ingredientes, los valores nutricionales y las instrucciones de uso. Los materiales de embalaje eficaces ayudan a proteger los productos de los daños, prolongan su vida útil y mejoran su comercialización.

Restricciones/Desafíos

- Altos costos asociados con los polioles

El costo de los polioles depende de diversos factores, como las materias primas, el proceso de fabricación y la demanda del mercado. Los precios de las materias primas utilizadas para la producción de polioles, como el óxido de propileno y el óxido de etileno, son volátiles y pueden fluctuar con frecuencia, lo que lleva a un aumento en el costo de producción de los polioles. Además, el proceso de producción de polioles es complejo y requiere equipo y experiencia especializados, lo que genera mayores costos de capital y operativos.

- Fluctuación de los precios de las materias primas

Las materias primas para la producción de poliol pueden variar dependiendo del tipo de poliol que se esté produciendo, como polioles de poliéter y polioles de poliéster.

Acontecimientos recientes

- En septiembre de 2022, Covestro AG anunció el lanzamiento de polioles de poliéter basados en materias primas biocirculares. La empresa podrá ofrecer prepolímeros selectivos para diversas aplicaciones adhesivas y su base de clientes. Los componentes principales de los poliuretanos se basarán en materias primas alternativas. Este paso ayuda a la empresa a ofrecer sustitutos a diversas industrias y mejorar su imagen de marca en el mercado.

- En septiembre de 2022, Wanhua anunció el lanzamiento de un nuevo producto químico que ha desarrollado un poliol de origen biológico para reducir su huella de carbono. Los nuevos bioproductos se han lanzado para contribuir a un medio ambiente sostenible y aumentar la eficiencia de la producción. Esto ayudará a la empresa a mejorar su cartera de productos.

Alcance del mercado de polioles en América del Norte

El mercado de polioles de América del Norte está segmentado en tres segmentos importantes según el tipo, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Polioles de poliéter

- Polioles de poliéster

Según el tipo, el mercado de polioles de América del Norte está segmentado en polioles de poliéter y polioles de poliéster.

Solicitud

- Espuma de poliuretano flexible

- Espuma de poliuretano rígida

- Recubrimientos

- Adhesivos y selladores

- Elastómeros

- Otros

Sobre la base de la aplicación, el mercado de polioles de América del Norte está segmentado en espuma de poliuretano flexible, espuma de poliuretano rígida, revestimientos, adhesivos y selladores, elastómeros y otros.

Usuario final

- Construcción

- Muebles

- Transporte

- Embalaje

- Respaldo de alfombra

- Otros

Sobre la base del usuario final, el mercado de polioles de América del Norte está segmentado en construcción, muebles, transporte, embalaje, respaldo de alfombras y otros.

Análisis y perspectivas regionales del mercado de polioles de América del Norte

Se analiza el mercado de polioles de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de polioles de América del Norte son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado de polioles de América del Norte, ya que posee una infraestructura de fabricación sólida y avanzada, que incluye instalaciones y tecnologías de última generación. Esto permite procesos de producción eficientes y garantiza productos de polioles de alta calidad. La disponibilidad de mano de obra calificada y experiencia técnica fortalece aún más el sector manufacturero estadounidense.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos de la región.

Análisis del panorama competitivo y de la cuota de mercado de los polioles en América del Norte

El panorama competitivo del mercado de polioles de América del Norte proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de polioles de América del Norte.

Algunos de los principales actores que operan en el mercado de polioles de América del Norte son Huntsman International LLC, Repsol, Biesterfeld AG, DIC CORPORATION, Tosoh Corporation, Arkema, BASF SE, Dow, Cargill, Incorporated, LANXESS, Shell plc, Mitsubishi Chemical Corporation, Vertellus, Wanhua, Stepan Company, Gulshan Polyols Ltd, Perstorp Holding AB (subsidiaria de PETRONAS Chemicals Group), Emery Oleochemicals LLC, Covestro AG, Coim Group y Shakun Industries, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA POLYOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT DATA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR POLYURETHANE FOAMS

5.1.2 INCREASING DEMAND IN THE CONSTRUCTION AND INFRASTRUCTURE SECTOR

5.1.3 ADVANCEMENTS IN POLYOLS TECHNOLOGY

5.1.4 GROWING DEMAND IN THE AUTOMOTIVE INDUSTRY

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY CONCERNS

5.2.2 HIGH COST ASSOCIATED WITH POLYOLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR POLYOLS FOR PACKAGING MATERIALS

5.3.2 USE OF POLYOLS IN INSULATION APPLICATIONS

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 HIGH DEMAND FOR BIO-BASED AND SUSTAINABLE POLYOLS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 TECHNOLOGICAL LIMITATIONS AND PERFORMANCE REQUIREMENTS

6 NORTH AMERICA POLYOLS MARKET, BY TYPE

6.1 OVERVIEW

6.2 POLYETHER POLYOLS

6.3 POLYESTER POLYOLS

7 NORTH AMERICA POLYOLS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FLEXIBLE POLYURETHANE FOAM

7.3 RIGID POLYURETHANE FOAM

7.4 COATINGS

7.5 ADHESIVES & SEALANTS

7.6 ELASTOMERS

7.7 OTHERS

8 NORTH AMERICA POLYOLS MARKET, BY END USER

8.1 OVERVIEW

8.2 CONSTRUCTION

8.2.1 POLYETHER POLYOLS

8.2.2 POLYESTER POLYOLS

8.3 FURNITURE

8.3.1 POLYETHER POLYOLS

8.3.2 POLYESTER POLYOLS

8.4 TRANSPORT

8.4.1 POLYETHER POLYOLS

8.4.2 POLYESTER POLYOLS

8.5 PACKAGING

8.5.1 POLYETHER POLYOLS

8.5.2 POLYESTER POLYOLS

8.6 CARPET BACKING

8.6.1 POLYETHER POLYOLS

8.6.2 POLYESTER POLYOLS

8.7 OTHERS

8.7.1 POLYETHER POLYOLS

8.7.2 POLYESTER POLYOLS

9 NORTH AMERICA POLYOLS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA POLYOLS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILINGS

12.1 SHELL PLC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 COVESTRO AG

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 WANHUA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 LANXESS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT AND SOLUTION PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 HUNTSMAN INTERNATIONAL LLC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ARKEMA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BASF SE

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 BIESTERFELD AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CARGILL, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT AND SERVICE PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 COIM GROUP

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 DOW

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 DIC CORPORATION

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 EMERY OLEOCHEMICALS LLC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 GULSHAN POLYOLS LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 MITSUBISHI CHEMICAL CORPORATION

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

12.16 PERSTORP HOLDING AB (SUBSIDIARY OF PETRONAS CHEMICALS GROUP)

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 REPSOL

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENTS

12.18 SHAKUN INDUSTRIES

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 STEPAN COMPANY

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENTS

12.2 TOSOH CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 VERTELLUS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 3 NORTH AMERICA POLYETHER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA POLYETHER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (MT)

TABLE 5 NORTH AMERICA POLYESTER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA POLYESTER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (MT)

TABLE 7 NORTH AMERICA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FLEXIBLE POLYURETHANE FOAM IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA RIGID POLYURETHANE FOAM IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA COATINGS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA ADHESIVES & SEALANTS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA ELASTOMERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CONSTRUCTION IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA FURNITURE IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSPORT IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA PACKAGING IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CARPET BACKING IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA POLYOLS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA POLYOLS MARKET, BY COUNTRY, 2021-2030 (MT)

TABLE 29 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 31 NORTH AMERICA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 41 U.S. POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.S. POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 U.S. CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 51 CANADA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 CANADA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 53 CANADA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 CANADA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CANADA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 61 MEXICO POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 MEXICO POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 63 MEXICO CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 MEXICO TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA POLYOLS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA POLYOLS MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA POLYOLS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POLYOLS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POLYOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POLYOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA POLYOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA POLYOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA POLYOLS MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA POLYOLS MARKET: TYPE CURVE

FIGURE 11 NORTH AMERICA POLYOLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA POLYOLS MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND IN THE CONSTRUCTION AND INFRASTRUCTURE SECTOR IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA POLYOLS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 POLYETHER POLYOLS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYOLS MARKET FROM 2023 TO 2030

FIGURE 15 GRAPH 1: EXPORT DATA OF COUNTRIES ACROSS THE GLOBE (FROM JANUARY TO MAY 2023)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POLYOLS MARKET

FIGURE 17 NORTH AMERICA POLYOLS MARKET: BY TYPE, 2022

FIGURE 18 NORTH AMERICA POLYOLS MARKET: BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA POLYOLS MARKET: BY END USER, 2022

FIGURE 20 NORTH AMERICA POLYOLS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA POLYOLS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA POLYOLS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA POLYOLS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA POLYOLS MARKET: BY TYPE (2023-2030)

FIGURE 25 NORTH AMERICA POLYOLS MARKET: COMPANY SHARE 2022(%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.