North America Polybutylene Succinate Pbs Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

44.59 Million

USD

80.13 Million

2025

2033

USD

44.59 Million

USD

80.13 Million

2025

2033

| 2026 –2033 | |

| USD 44.59 Million | |

| USD 80.13 Million | |

|

|

|

|

Segmentación del mercado de succinato de polibutileno (PBS) en Norteamérica, por producto (succinato de polibutileno (PBS) convencional y succinato de polibutileno (PBS) de origen biológico), proceso (transesterificación y esterificación directa), aplicación (bolsas, películas de mantillo, películas de embalaje, productos de higiene desechables, redes de pesca, cápsulas de café, compuestos de madera y plástico, entre otros), uso (desechables y reutilizables), capas de embalaje (embalaje primario, secundario y terciario), uso final (embalaje, agricultura, textil, bienes de consumo, electricidad y electrónica, automoción, entre otros): tendencias de la industria y pronóstico hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de succinato de polibutileno (PBS) de América del Norte?

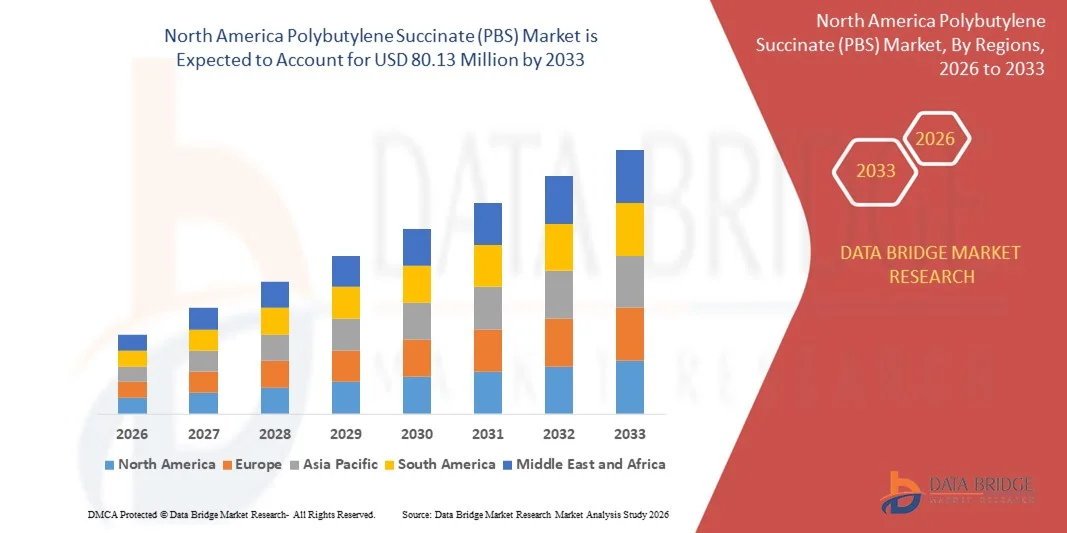

- El tamaño del mercado de succinato de polibutileno (PBS) de América del Norte se valoró en USD 44,59 millones en 2025 y se espera que alcance los USD 80,13 millones para 2033 , con una CAGR del 7,6 % durante el período de pronóstico.

- El succinato de polibutileno se combina frecuentemente con fibras naturales como el pasto varilla (SG). Estos innovadores materiales compuestos se emplean ampliamente en el sector automotriz, ya que se promocionan como alternativas viables de origen biológico a los polímeros convencionales derivados del petróleo.

- Según OICA, la producción de vehículos comerciales ligeros en Francia aumentó un 6,5 por ciento, pasando de 4.95.123 en 2018 a 5.27.262 en 2019, mientras que en España aumentó un 5,6 por ciento, pasando de 4.96.671 en 2018 a 5.24.504 en 2019. Como resultado del aumento de la producción automotriz, la demanda de succinato de polibutileno aumentará gradualmente, actuando como un impulsor del mercado.

¿Cuáles son las principales conclusiones del mercado de succinato de polibutileno (PBS)?

- El succinato de polibutileno se utiliza cada vez más en aplicaciones agrícolas, como las películas de acolchado. Estas películas se utilizan comúnmente para modificar la temperatura del suelo, controlar el desarrollo de malezas, reducir la pérdida de humedad y aumentar el rendimiento y la precocidad de los cultivos.

- Los gobiernos también están invirtiendo ampliamente en proyectos e inversiones agrícolas porque es una de las formas más efectivas de mejorar la sostenibilidad ambiental.

- Estados Unidos dominó el mercado de succinato de polibutileno (PBS) de América del Norte con la mayor participación en los ingresos del 36,9 % en 2024, impulsado por la creciente demanda de envases biodegradables, productos de servicio de alimentos compostables y películas agrícolas sostenibles.

- El mercado canadiense de succinato de polibutileno (PBS) está experimentando un crecimiento constante a una CAGR del 9,6 %, respaldado por la creciente adopción de películas de embalaje biodegradables, productos de higiene desechables y bienes de consumo ecológicos.

- El segmento PBS convencional dominó el mercado con una participación en los ingresos del 58,6 % en 2024, impulsado por su base de fabricación establecida, competitividad de costos y uso generalizado en películas de embalaje, productos agrícolas y bienes de consumo.

Alcance del informe y segmentación del mercado de succinato de polibutileno (PBS)

|

Atributos |

Perspectivas clave del mercado del succinato de polibutileno (PBS) |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de succinato de polibutileno (PBS)?

Creciente adopción de materiales de origen biológico y compostables para envases sostenibles y aplicaciones de consumo

- Una tendencia importante y en auge en el mercado del succinato de polibutileno (PBS) es la creciente transición hacia polímeros de origen biológico, biodegradables y compostables como alternativas a los plásticos convencionales derivados del petróleo. Esta transición se ve impulsada por la creciente preocupación por el medio ambiente, la presión regulatoria sobre los plásticos de un solo uso y la creciente demanda de materiales sostenibles por parte de los consumidores en aplicaciones de envasado, agricultura y bienes de consumo.

- Por ejemplo, los principales productores de materiales como BASF SE, Indorama Ventures, Mitsubishi Chemical y Far Eastern New Century están expandiendo la producción de PBS de base biológica y desarrollando grados de alto rendimiento adecuados para películas, productos moldeados y mezclas con PLA y PBAT.

- El uso creciente de PBS en películas de embalaje, bolsas compostables, cubiertos desechables y materiales en contacto con alimentos permite a los fabricantes cumplir objetivos de sostenibilidad manteniendo al mismo tiempo una flexibilidad, resistencia al calor y procesabilidad comparables a los plásticos convencionales.

- Los avances en la producción de ácido biosuccínico, las tecnologías de mezcla de polímeros y la optimización de costos están mejorando aún más la viabilidad comercial del PBS en aplicaciones a gran escala.

- La creciente adopción de principios de economía circular, estándares de envases compostables y programas de certificación biodegradables está reforzando la importancia del PBS como material central en las alternativas plásticas sostenibles.

- A medida que las expectativas de sostenibilidad continúan aumentando a nivel mundial, el succinato de polibutileno se está convirtiendo en un material fundamental para permitir el diseño de productos ambientalmente responsables sin comprometer el rendimiento funcional.

¿Cuáles son los impulsores clave del mercado de succinato de polibutileno (PBS)?

- Un factor clave del crecimiento del mercado de succinato de polibutileno (PBS) es la creciente implementación de políticas de reducción de plástico y prohibiciones de plásticos de un solo uso en los sectores de envasado, servicios de alimentos y agricultura.

- Por ejemplo, durante 2024-2025, los gobiernos de Europa y América del Norte reforzaron las regulaciones que promueven los materiales compostables, impulsando una mayor adopción de PBS en películas de embalaje, productos desechables y aplicaciones de mantillo agrícola.

- La creciente demanda de envases de alimentos sostenibles, bienes de consumo compostables e insumos agrícolas biodegradables está acelerando el consumo de PBS en las industrias de uso final.

- Los avances tecnológicos en materias primas de origen biológico, procesos de fermentación y modificación de polímeros están mejorando la resistencia mecánica, la estabilidad térmica y la competitividad de costos del PBS.

- Los crecientes compromisos de las marcas con la neutralidad de carbono, el etiquetado ecológico y las transiciones hacia envases sostenibles están animando a los fabricantes a integrar PBS en sus carteras de productos.

- Con el respaldo de las regulaciones ambientales, los objetivos de sostenibilidad corporativa y la creciente conciencia de los consumidores, se espera que el mercado de succinato de polibutileno (PBS) sea testigo de un sólido crecimiento a largo plazo en los mercados globales.

¿Qué factor está obstaculizando el crecimiento del mercado de succinato de polibutileno (PBS)?

- Los materiales básicos para el succinato de polibutileno, en particular el ácido succínico y los 1, 4-butanodioles, se derivan de materias primas derivadas del petróleo.

- Como resultado, las fluctuaciones del precio del petróleo crudo afectan el precio de las materias primas de succinato de polibutileno. El precio del succinato de polibutileno también aumenta debido a la incertidumbre en los precios del petróleo crudo.

- Como resultado, los creadores de mercado del succinato de polibutileno probablemente se enfrentarán a fuertes fluctuaciones en los precios del petróleo crudo. Se prevé que este factor dificulte el crecimiento del mercado global del succinato de polibutileno (PBS).

¿Cómo está segmentado el mercado de succinato de polibutileno (PBS)?

El mercado está segmentado en función del producto, el proceso, la aplicación, el uso, la capa de embalaje y el uso final .

- Por producto

En función del producto, el mercado del succinato de polibutileno (PBS) se segmenta en succinato de polibutileno (PBS) convencional y succinato de polibutileno (PBS) de origen biológico. El segmento de PBS convencional dominó el mercado con una participación del 58,6 % en los ingresos en 2024, gracias a su sólida base de fabricación, su competitividad en costes y su amplio uso en películas de embalaje, productos agrícolas y bienes de consumo. El PBS convencional ofrece resistencia mecánica, flexibilidad y estabilidad térmica fiables, lo que lo hace ideal para aplicaciones comerciales a gran escala.

Se prevé que el segmento de PBS de origen biológico experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, gracias al aumento de las regulaciones ambientales, la creciente demanda de plásticos compostables y la creciente disponibilidad de ácido succínico de origen biológico. Los compromisos de sostenibilidad de las marcas y los avances en el procesamiento de materias primas biológicas están acelerando aún más su adopción.

- Por proceso

Según el proceso, el mercado se segmenta en transesterificación y esterificación directa. El segmento de esterificación directa tuvo la mayor participación de mercado, con un 54,2 %, en 2024, gracias a su flujo de proceso simplificado, menores costos de producción y su idoneidad para la fabricación de PBS a gran escala. Este método es ampliamente adoptado por los principales productores para mejorar la eficiencia del rendimiento y reducir la complejidad operativa.

Se proyecta que el segmento de transesterificación crecerá a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2025 y 2032, impulsado por su capacidad para producir polímeros de mayor peso molecular y una mejor consistencia del material. El aumento de las inversiones en tecnologías avanzadas de polimerización está impulsando su adopción en grados de PBS de alto rendimiento y especiales.

- Por aplicación

Según su aplicación, el mercado del succinato de polibutileno (PBS) se segmenta en bolsas, películas de acolchado, películas de embalaje, productos de higiene desechables, redes de pesca, cápsulas de café, compuestos de madera y plástico, entre otros. El segmento de películas de embalaje dominó el mercado con una participación del 31,4 % en 2024, impulsado por la creciente demanda de envases alimentarios biodegradables, películas compostables y alternativas sostenibles a los plásticos convencionales.

Se espera que el segmento de películas de mantillo registre la CAGR más rápida entre 2025 y 2032, respaldado por la creciente adopción de insumos agrícolas biodegradables e iniciativas gubernamentales que promueven prácticas agrícolas sostenibles.

- Por uso

Según el uso, el mercado se segmenta en aplicaciones de un solo uso y reutilizables. El segmento de un solo uso representó la mayor cuota de ingresos, con un 62,7 %, en 2024, impulsado por su uso generalizado en envases desechables, productos de higiene y películas agrícolas. El PBS está sustituyendo cada vez más a los plásticos convencionales en aplicaciones de corta duración gracias a su compostabilidad y al cumplimiento normativo.

Se proyecta que el segmento reutilizable crecerá a la CAGR más rápida durante el período de pronóstico, respaldado por mejoras de materiales que mejoran la durabilidad, la resistencia mecánica y la resistencia al uso repetido, particularmente en bienes de consumo y aplicaciones de embalaje.

- Por capa de embalaje

Según la capa de envasado, el mercado se segmenta en Envases Primarios, Envases Secundarios y Envases Terciarios. El segmento de Envases Primarios dominó el mercado con una participación del 46,9 % en los ingresos en 2024, impulsado por aplicaciones de contacto directo con alimentos, como películas, bolsas y contenedores.

Se espera que el segmento de embalaje secundario sea testigo de la tasa de crecimiento más rápida entre 2025 y 2032, respaldado por el aumento del uso de materiales biodegradables para envolver, agrupar y proteger embalajes en las cadenas de suministro logísticas y minoristas.

- Por uso final

Por uso final, el mercado del succinato de polibutileno (PBS) se segmenta en envases, agricultura, textiles, bienes de consumo, electricidad y electrónica, automoción y otros. El segmento de envases tuvo la mayor cuota de mercado, con un 38,5 %, en 2024, impulsado por la creciente demanda de envases alimentarios sostenibles y productos de consumo compostables.

Se prevé que el segmento agrícola crezca a la CAGR más rápida durante 2025-2032, impulsado por el aumento del uso de películas de acolchado biodegradables y el apoyo gubernamental a soluciones agrícolas ecológicas.

¿Qué región posee la mayor participación en el mercado de succinato de polibutileno (PBS)?

- Estados Unidos dominó el mercado norteamericano de succinato de polibutileno (PBS), con la mayor cuota de mercado, un 36,9 % en 2024, impulsado por la creciente demanda de envases biodegradables, productos compostables para servicios de alimentación y películas agrícolas sostenibles. La sólida capacidad de producción nacional y la creciente concienciación de los consumidores sobre los materiales ecológicos están acelerando la adopción del PBS en múltiples industrias.

- El liderazgo del país en la investigación de bioplásticos, el apoyo regulatorio para la reducción de plásticos de un solo uso y las inversiones en infraestructura de polímeros de origen biológico están impulsando la integración a gran escala del succinato de polibutileno (PBS) en aplicaciones de envasado, agricultura y bienes de consumo. Las colaboraciones estratégicas con fabricantes globales de PBS y proveedores de tecnología están consolidando a EE. UU. como el principal centro del mercado norteamericano de PBS, lo que demuestra que EE. UU. es fundamental para el crecimiento regional y la adopción de la sostenibilidad.

Perspectivas del mercado canadiense de succinato de polibutileno (PBS)

El mercado canadiense de succinato de polibutileno (PBS) experimenta un crecimiento constante con una tasa de crecimiento anual compuesta (TCAC) del 9,6 %, impulsado por la creciente adopción de películas de embalaje biodegradables, productos de higiene desechables y bienes de consumo ecológicos. Los fabricantes canadienses se centran en grados de PBS de alto rendimiento, formulaciones de materiales compostables y tecnologías de procesamiento de polímeros sostenibles para cumplir con las estrictas normativas ambientales. Los incentivos gubernamentales, la creciente I+D en polímeros de origen biológico y las alianzas estratégicas con proveedores norteamericanos refuerzan la posición de Canadá como un factor clave en la innovación y el crecimiento del mercado de PBS en la región, lo que demuestra que el país desempeña un papel vital en el avance de soluciones de materiales sostenibles.

Perspectiva del mercado del succinato de polibutileno (PBS) en México

El mercado mexicano del succinato de polibutileno (PBS) se encuentra en constante expansión, impulsado por la creciente demanda de envases biodegradables, películas agrícolas y productos de consumo sostenibles. La creciente conciencia sobre la sostenibilidad ambiental, las políticas gubernamentales que apoyan los polímeros de origen biológico y la creciente producción e importación de materiales de PBS impulsan el crecimiento del mercado. Las inversiones en procesos de fabricación escalables, la mejora del rendimiento de los materiales y el desarrollo de productos ecológicos están posicionando a México como un importante centro de fabricación y crecimiento dentro del mercado norteamericano del succinato de polibutileno (PBS), lo que demuestra que el país contribuye de forma clave a la adopción regional de soluciones de polímeros sostenibles.

¿Cuáles son las principales empresas en el mercado de succinato de polibutileno (PBS)?

La industria del succinato de polibutileno (PBS) está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Indorama Ventures Public Company Limited (Tailandia)

- Alpek SAB de CV (México)

- Jiangsu Sanfangxiang Group Co., Ltd. (China)

- Corporación del Nuevo Siglo del Lejano Oriente (Taiwán)

- DAK Américas (EE. UU.)

- BASF SE (Alemania)

- Zhejiang Biodegradable Advanced Material Co. Ltd. (China)

- Xinhaibio (China)

- Lubrilog (Francia)

- ECCO Gleittechnik GmbH (Alemania)

- Corporación HUSK-ITT (EE. UU.)

- Setral Chemie GmbH (Alemania)

- IKV Tribology Ltd (Alemania)

- Hangzhou Ruijiang Chemical Co. (China)

- WILLEAP (Corea del Sur)

¿Cuáles son los desarrollos recientes en el mercado global de succinato de polibutileno (PBS)?

- En septiembre de 2022, Technip Energies, empresa francesa de ingeniería y tecnología, reforzó su cartera de productos químicos sostenibles con la adquisición de la tecnología de biosuccinio de DSM, lo que le permitió obtener derechos de licencia exclusivos para la producción de ácido succínico de origen biológico, una materia prima clave para el succinato de polibutileno (PBS). La adquisición incluye múltiples familias de patentes y cepas de levadura patentadas, validadas a escala comercial, lo que concluye que esta operación refuerza significativamente el liderazgo y el posicionamiento a largo plazo de Technip Energies en las cadenas de valor de polímeros de origen biológico.

- En abril de 2021, Mitsubishi Chemical Corporation desarrolló un grado de BioPBS biodegradable en el ámbito marino como parte de sus esfuerzos por impulsar el desarrollo de productos de succinato de polibutileno (PBS) de origen vegetal y ampliar su potencial de aplicación. Este desarrollo impulsa la diversificación de la cartera y el crecimiento de los ingresos, a la vez que cumple con los requisitos de sostenibilidad ambiental. Se concluye que esta innovación refuerza la ventaja competitiva de la empresa en los mercados de polímeros biodegradables y ecológicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.