North America Pharmaceutical Solvent Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.89 Billion

USD

2.71 Billion

2024

2032

USD

1.89 Billion

USD

2.71 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.71 Billion | |

|

|

|

|

Segmentación del mercado de disolventes farmacéuticos en Norteamérica, por tipo de disolvente (alcoholes, ésteres, éteres, cetonas, hidrocarburos aromáticos y alifáticos), aplicación (síntesis de ingredientes farmacéuticos activos [API], fabricación de excipientes, desarrollo de formulaciones, análisis analíticos), usuario final (empresas farmacéuticas, fabricantes de medicamentos genéricos, empresas de biotecnología, CRO y CMO): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de disolventes farmacéuticos de América del Norte

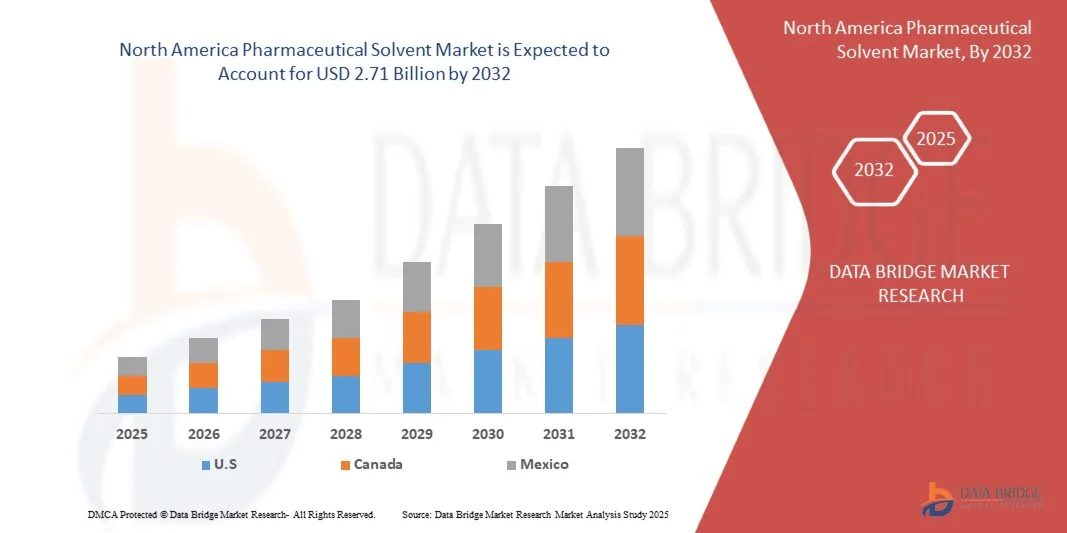

- El tamaño del mercado de solventes farmacéuticos de América del Norte se valoró en USD 1.890 millones en 2024 y se proyecta que alcance los USD 2.710 millones para 2032, creciendo a una CAGR del 4,60 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente demanda de solventes de alta pureza en la fabricación farmacéutica, particularmente en los procesos de formulación, síntesis y purificación de medicamentos.

- Además, las crecientes inversiones en I+D, la expansión de las capacidades de producción farmacéutica y los estándares regulatorios más estrictos para la calidad de los medicamentos están impulsando aún más la demanda de solventes de grado farmacéutico, lo que alimenta la expansión general del mercado.

Análisis del mercado de disolventes farmacéuticos en América del Norte

- Los solventes farmacéuticos, esenciales para la formulación, síntesis y purificación de medicamentos, desempeñan un papel fundamental en la fabricación farmacéutica al garantizar la eficacia, la estabilidad y el cumplimiento normativo del producto en las distintas etapas del desarrollo de medicamentos.

- La creciente demanda de solventes farmacéuticos en América del Norte está impulsada principalmente por el aumento de la producción farmacéutica, las crecientes inversiones en I+D y la creciente prevalencia de enfermedades crónicas que requieren terapias farmacológicas complejas.

- Estados Unidos dominó el mercado de solventes farmacéuticos de América del Norte con una participación dominante en los ingresos del 40,6 % en 2024, atribuida a una industria farmacéutica sólida, inversiones significativas en investigación biofarmacéutica y un marco regulatorio bien establecido que respalda la innovación y la ampliación de la producción.

- Se proyecta que Canadá será testigo de un crecimiento sostenido durante el período de pronóstico debido a las iniciativas gubernamentales que promueven la producción farmacéutica nacional y la creciente demanda de solventes limpios y de alta pureza en procesos avanzados de desarrollo de medicamentos.

- El segmento de alcoholes dominó el mercado en 2024, representando la mayor participación en los ingresos del 36,5%, debido a su uso generalizado tanto en los procesos de formulación como de síntesis de fármacos.

Alcance del informe y segmentación del mercado de solventes farmacéuticos en América del Norte

|

Atributos |

Perspectivas clave del mercado de disolventes farmacéuticos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de disolventes farmacéuticos en América del Norte

Avances en química verde y optimización de procesos impulsada por IA

- Una tendencia significativa y en auge en el mercado norteamericano de solventes farmacéuticos es la integración de principios de química verde e inteligencia artificial (IA) para optimizar el uso de solventes en la fabricación de medicamentos. Este cambio se debe a la creciente preocupación por el medio ambiente, marcos regulatorios más estrictos y la necesidad de procesos de producción más eficientes y sostenibles.

- Por ejemplo, las compañías farmacéuticas adoptan cada vez más disolventes de origen biológico y reciclables, como el etanol y el lactato de etilo, que ofrecen un menor impacto ambiental sin comprometer el rendimiento. BASF y Merck KGaA han introducido opciones de disolventes ecológicos que se ajustan a los objetivos globales de sostenibilidad y cumplen con los estrictos requisitos de pureza para uso farmacéutico.

- Las tecnologías de IA y aprendizaje automático se utilizan para modelar las interacciones de disolventes, predecir las mezclas óptimas de disolventes y mejorar la eficiencia de la purificación. Las empresas aprovechan estas herramientas para reducir el ensayo y error en la formulación, minimizar el desperdicio y acelerar el tiempo de comercialización. Por ejemplo, las plataformas basadas en IA pueden analizar grandes conjuntos de datos para identificar sistemas de disolventes ideales que maximicen el rendimiento y garanticen el cumplimiento de las directrices de la FDA y la EMA.

- El uso de IA en la gestión de disolventes también facilita el mantenimiento predictivo de los sistemas de recuperación de disolventes, garantizando la continuidad operativa y reduciendo costes. Al supervisar la degradación de los disolventes y el rendimiento del reciclaje, las empresas farmacéuticas pueden mantener altos estándares de calidad en sus procesos y optimizar la gestión del ciclo de vida de los disolventes.

- Estas innovaciones facilitan la transición hacia sistemas de solventes de circuito cerrado que reducen las emisiones y mejoran los indicadores de sostenibilidad. Empresas líderes como DuPont y Dow invierten en I+D para desarrollar tecnologías de solventes avanzadas que se ajusten a los objetivos ambientales y de rendimiento.

- La demanda de solventes farmacéuticos optimizados por IA y respetuosos con el medio ambiente está ganando impulso en el mercado norteamericano, a medida que las empresas se esfuerzan por cumplir con los requisitos regulatorios y las expectativas de los consumidores de procesos de producción de medicamentos más ecológicos y seguros.

Dinámica del mercado de solventes farmacéuticos en América del Norte

Conductor

La creciente demanda impulsada por la expansión de la producción farmacéutica y las actividades de I+D

- La creciente demanda de disolventes farmacéuticos en Norteamérica se debe en gran medida a la creciente escala de la fabricación de fármacos y a las actividades de investigación y desarrollo (I+D) en la región. Ante la creciente prevalencia de enfermedades crónicas, el envejecimiento de la población y el continuo desarrollo de formulaciones farmacológicas complejas, las compañías farmacéuticas están intensificando sus esfuerzos de producción, lo que incrementa directamente el consumo de disolventes de alta pureza.

- Por ejemplo, importantes empresas como Pfizer y Johnson & Johnson han ampliado significativamente su capacidad de fabricación en Norteamérica, a la vez que invierten considerablemente en I+D. Estos avances requieren grandes volúmenes de disolventes especializados para aplicaciones como síntesis, cristalización, extracción y purificación.

- Además, el creciente enfoque en productos biológicos y terapias avanzadas, incluyendo fármacos basados en ARNm y terapias celulares y génicas, exige disolventes de ultraalta pureza que cumplan con estrictos requisitos regulatorios. Esto impulsa el crecimiento de la innovación y la personalización de disolventes.

- La infraestructura farmacéutica avanzada de América del Norte, la presencia de CDMO (Organizaciones de Desarrollo y Fabricación por Contrato) líderes y un entorno regulatorio favorable también contribuyen a un mayor consumo de solventes.

- Además, la tendencia hacia la fabricación continua y la automatización en la producción farmacéutica está fomentando la adopción de disolventes compatibles con sistemas de control de calidad de alto rendimiento y en tiempo real, lo que impulsa aún más el impulso del mercado.

Restricción/Desafío

Preocupaciones ambientales y presión regulatoria sobre el uso de solventes tradicionales

- La creciente preocupación ambiental por la toxicidad, la volatilidad y la eliminación de los disolventes farmacéuticos convencionales supone un reto importante para el mercado. Agencias reguladoras como la Agencia de Protección Ambiental de los Estados Unidos (EPA) y la Administración de Alimentos y Medicamentos (FDA) están endureciendo las normas en materia de emisiones, disolventes residuales y eliminación de residuos.

- Por ejemplo, disolventes como el cloroformo, el diclorometano y el tolueno enfrentan restricciones de uso debido a su peligrosidad e impacto ambiental. El cumplimiento de estas regulaciones exige a las empresas invertir en alternativas más seguras y sistemas de recuperación de disolventes, lo que puede incrementar los costos operativos.

- Además, existe una creciente presión sobre los fabricantes farmacéuticos para que adopten disolventes más ecológicos y de origen biológico. Si bien estas alternativas son más sostenibles, es posible que no siempre ofrezcan el mismo rendimiento ni la misma compatibilidad con los sistemas de producción existentes, lo que limita su adopción en algunas formulaciones.

- La necesidad de una gran inversión en infraestructura de reciclaje de solventes, rediseño de procesos e I+D para identificar sustitutos ecológicos adecuados aumenta la complejidad y el costo del cumplimiento.

- Para abordar estos desafíos será necesaria una fuerte colaboración de la industria, innovación en química verde y marcos de políticas de apoyo que incentiven la adopción de solventes sustentables sin comprometer la eficacia ni la seguridad del producto.

Alcance del mercado de disolventes farmacéuticos en América del Norte

El mercado está segmentado según el tipo de disolvente, la aplicación y el usuario final.

Por tipo de disolvente

Según el tipo de disolvente, el mercado de disolventes farmacéuticos se segmenta en alcoholes, ésteres, éteres, cetonas, hidrocarburos aromáticos e hidrocarburos alifáticos. El segmento de alcoholes dominó el mercado en 2024, representando la mayor cuota de mercado (36,5 %), gracias a su amplio uso tanto en la formulación como en los procesos de síntesis de fármacos. Los alcoholes, como el etanol y el isopropanol, se utilizan habitualmente como disolventes debido a su alta solvencia, baja toxicidad y aceptación regulatoria en aplicaciones farmacéuticas. Su compatibilidad con una amplia gama de principios activos farmacéuticos (API) y excipientes, junto con su fácil disponibilidad y rentabilidad, contribuyen a su significativa cuota de mercado.

Se proyecta que el segmento de ésteres experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por su creciente uso en formulaciones de liberación controlada de fármacos y su capacidad para mejorar la solubilidad de los fármacos. Los ésteres también tienen una creciente demanda en sistemas de administración tópica y transdérmica de fármacos, ampliando su presencia en los procesos de desarrollo de formulaciones.

• Por aplicación

Según la aplicación, el mercado se segmenta en síntesis de ingredientes farmacéuticos activos (API), fabricación de excipientes, desarrollo de formulaciones y pruebas analíticas. El segmento de síntesis de API dominó el mercado con la mayor participación en ingresos, un 42,8 %, en 2024, debido al papel crucial que desempeñan los disolventes en los procesos de reacción, purificación y cristalización de la fabricación de API. Ante el aumento de la demanda mundial de medicamentos innovadores y genéricos, los fabricantes invierten cada vez más en sistemas de disolventes que garantizan alta pureza, rendimiento y cumplimiento normativo.

Se prevé que el segmento de desarrollo de formulaciones presente la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por los avances en las tecnologías de administración de fármacos y la medicina personalizada. Los disolventes en este segmento son esenciales para solubilizar los API, optimizar la biodisponibilidad y permitir nuevas formas farmacéuticas. El auge de formulaciones complejas, como los sistemas inyectables, inhalables y transdérmicos, acelera aún más la demanda de disolventes en esta área de aplicación.

• Por el usuario final

Según el usuario final, el mercado de disolventes farmacéuticos se segmenta en compañías farmacéuticas, fabricantes de medicamentos genéricos, empresas biotecnológicas y CRO y CMO. El segmento de compañías farmacéuticas representó la mayor cuota de mercado en ingresos, con un 38,6 % en 2024, gracias a su amplia participación en I+D y producción a gran escala de nuevas entidades químicas (NCE) y fármacos de marca. Estas organizaciones dependen en gran medida de disolventes de alta pureza para la síntesis, el control de calidad y la formulación, cumpliendo con estrictas normas regulatorias.

Se prevé que el segmento de las CRO y las CMO registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, a medida que las tendencias de externalización siguen creciendo en toda la cadena de valor farmacéutica. Los proveedores de servicios por contrato invierten cada vez más en instalaciones de fabricación flexibles y sistemas de disolventes especializados para satisfacer las diversas necesidades de los clientes, lo que los convierte en contribuyentes clave a la demanda de disolventes. Su capacidad para escalar la producción y gestionar múltiples carteras de fármacos impulsa un rápido crecimiento en este segmento.

Análisis regional del mercado de disolventes farmacéuticos de América del Norte

- Estados Unidos dominó el mercado de solventes farmacéuticos con la mayor participación en los ingresos, un 40,6 % en 2024, impulsado por un sector farmacéutico bien establecido, sólidas inversiones en I+D y la creciente demanda de solventes de alta pureza en el desarrollo y la fabricación de medicamentos.

- Las empresas de la región priorizan cada vez más la calidad de los solventes, el cumplimiento normativo y la eficiencia del proceso, lo que impulsa la adopción de solventes especializados en las etapas de síntesis, formulación y prueba de la producción farmacéutica.

- Este crecimiento del mercado está respaldado además por una fuerte presencia de importantes empresas farmacéuticas y biotecnológicas, iniciativas de atención médica respaldadas por el gobierno y una infraestructura madura para la investigación de medicamentos, lo que convierte a América del Norte en un centro clave para el consumo de solventes farmacéuticos.

Perspectivas del mercado canadiense de disolventes farmacéuticos

Se espera que el mercado canadiense de disolventes farmacéuticos crezca a una tasa de crecimiento anual compuesta (TCAC) constante durante el período de pronóstico, impulsado por las crecientes iniciativas gubernamentales para fortalecer la cadena de suministro farmacéutica nacional y mejorar la capacidad de fabricación de medicamentos. El aumento de la inversión en I+D, especialmente en genéricos y biosimilares, impulsa la demanda de sistemas de disolventes fiables y eficientes. El enfoque de Canadá en la sostenibilidad y la química verde también fomenta la adopción de disolventes ecológicos, mientras que su creciente red de CMO y CRO impulsa aún más la expansión del mercado.

Perspectiva del mercado de solventes farmacéuticos en México

Se proyecta que el mercado mexicano de solventes farmacéuticos experimente un crecimiento moderado, impulsado por la expansión de la producción farmacéutica y el aumento de las exportaciones a Estados Unidos y Latinoamérica. El apoyo del gobierno para mejorar la infraestructura sanitaria y fomentar la fabricación nacional de medicamentos está impulsando la demanda de solventes de grado farmacéutico. Además, el creciente papel de México como destino de nearshoring para las compañías farmacéuticas globales está incrementando la necesidad de procesos de fabricación con uso intensivo de solventes. A medida que los marcos regulatorios se alinean con los estándares internacionales, se espera que el mercado atraiga mayor inversión extranjera e innovación.

Cuota de mercado de disolventes farmacéuticos en América del Norte

La industria de disolventes farmacéuticos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DuPont (EE. UU.)

- Mitsui Chemicals (Japón)

- DOW (EE.UU.)

- Brenntag SE (Alemania)

- Merck KGaA (Alemania)

- Royal Dutch Shell Plc (Países Bajos/Reino Unido)

- BASF SE (Alemania)

- Exxon Mobil Corporation (EE. UU.)

- Clariant (Suiza)

- Eastman Chemical Company (EE. UU.)

- LyondellBasell Industries Holdings BV (Países Bajos)

- Corporación Olin (EE. UU.)

- SK geo centric Co., Ltd. (Corea del Sur)

- Avantor, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de solventes farmacéuticos de América del Norte?

- En abril de 2023, DuPont (EE. UU.), líder mundial en productos químicos especializados, lanzó una línea avanzada de disolventes farmacéuticos ecológicos, cuyo objetivo es reducir el impacto ambiental y mantener los altos estándares de pureza exigidos por los fabricantes de medicamentos. Esta iniciativa pone de manifiesto el compromiso de DuPont con la sostenibilidad y la innovación, respondiendo a la creciente presión regulatoria para encontrar alternativas a disolventes más ecológicos en Norteamérica. Al aprovechar tecnología de vanguardia y una amplia experiencia en el sector, DuPont consolida su posición en el creciente mercado de disolventes farmacéuticos de la región.

- En marzo de 2023, Brenntag SE (Alemania), un importante distribuidor de productos químicos con operaciones en Norteamérica, amplió su cartera de disolventes farmacéuticos al asociarse con fabricantes locales para mejorar la eficiencia de la cadena de suministro y la disponibilidad de disolventes para las compañías farmacéuticas. Esta estrategia fortalece la capacidad de Brenntag para satisfacer la creciente demanda de disolventes de alta calidad utilizados en la formulación y síntesis de fármacos, lo que demuestra la dedicación de la compañía a satisfacer las necesidades cambiantes de la industria farmacéutica.

- En marzo de 2023, Merck KGaA (Alemania) implementó con éxito un sistema de recuperación de disolventes a gran escala en su planta de fabricación de EE. UU., con el objetivo de mejorar la eficiencia de los recursos y reducir el desperdicio de disolventes. Este proyecto ejemplifica el compromiso de Merck con las prácticas sostenibles de fabricación farmacéutica, contribuyendo al ahorro de costes y a la conservación del medio ambiente, a la vez que cumple con las estrictas normas regulatorias.

- En febrero de 2023, Eastman Chemical Company (EE. UU.) anunció una colaboración con compañías farmacéuticas para desarrollar mezclas de disolventes a medida, diseñadas para optimizar los procesos de fabricación de fármacos. Esta iniciativa se centra en mejorar la eficiencia de los procesos, la seguridad y la calidad de los productos, lo que refleja la dedicación de Eastman a la innovación y a las soluciones centradas en el cliente en el mercado de disolventes farmacéuticos.

- En enero de 2023, Exxon Mobil Corporation (EE. UU.) presentó una nueva línea de disolventes de hidrocarburos de alta pureza diseñados específicamente para la industria farmacéutica norteamericana. Estos disolventes están diseñados para cumplir con los estrictos requisitos regulatorios y ofrecer un rendimiento superior en la síntesis de ingredientes farmacéuticos activos (API). La introducción de esta línea de productos por parte de ExxonMobil subraya su compromiso de satisfacer las necesidades específicas de los fabricantes farmacéuticos, a la vez que impulsa el crecimiento del mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.