North America Pet Equine Care E Commerce Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

936.76 Million

USD

2,948.35 Million

2025

2033

USD

936.76 Million

USD

2,948.35 Million

2025

2033

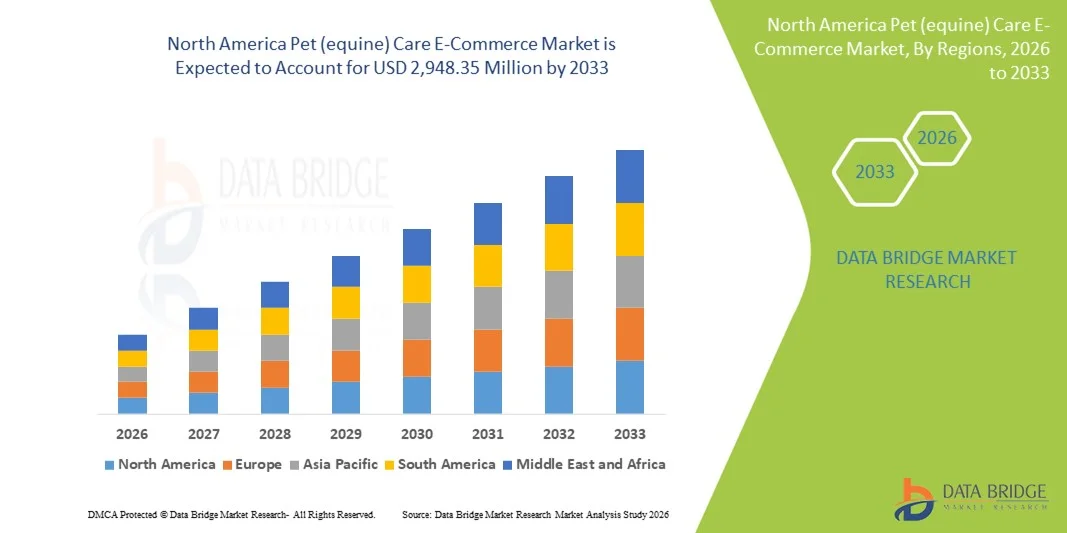

| 2026 –2033 | |

| USD 936.76 Million | |

| USD 2,948.35 Million | |

|

|

|

|

Segmentación del mercado de comercio electrónico de cuidado de mascotas (equinos) en Norteamérica, por tipo (alimentos y golosinas para mascotas, medicamentos para mascotas, productos de aseo para mascotas, accesorios para mascotas y otros), tipo de equino (caballos/ponis, burros, mulas/burdéganos y otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de comercio electrónico de cuidado de mascotas (equinos) en América del Norte

- El tamaño del mercado de comercio electrónico de cuidado de mascotas (equinos) de América del Norte se valoró en USD 936,76 millones en 2025 y se espera que alcance los USD 2.948,35 millones para 2033 , con una CAGR del 15,41 % durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente adopción de plataformas digitales para la compra de productos para el cuidado de mascotas y equinos, el aumento de la propiedad de mascotas y la creciente conciencia sobre la salud y el bienestar de los equinos.

- La conveniencia que ofrecen las plataformas en línea, que incluyen entrega a domicilio, servicios de suscripción y acceso a una amplia gama de productos, está impulsando la preferencia de los consumidores por los canales de comercio electrónico.

Análisis del mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

- La creciente penetración digital y la accesibilidad a Internet están transformando la forma en que se compran productos para el cuidado de equinos en la región.

- Las plataformas de comercio electrónico colaboran cada vez más con veterinarios, entrenadores y tiendas especializadas para ampliar la oferta de productos y brindar orientación experta a los consumidores.

- Estados Unidos dominó el mercado de comercio electrónico de cuidado de mascotas (equinos) en América del Norte con la mayor participación en los ingresos del 40,12 % en 2025, impulsado por la creciente adopción de compras en línea de productos para mascotas y una mayor conciencia sobre la salud y el bienestar equino.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de comercio electrónico de cuidado de mascotas (equinos) de América del Norte debido al aumento de la propiedad de mascotas, la creciente conciencia de la salud y el bienestar equinos y la expansión de las plataformas digitales que ofrecen opciones convenientes de compra en línea.

- El segmento de Alimentos y Golosinas para Mascotas registró la mayor participación en ingresos del mercado en 2025, impulsado por la creciente demanda de nutrición especializada, la comodidad de la entrega a domicilio y los servicios por suscripción. Las plataformas en línea que ofrecen una amplia variedad de opciones de alimentos premium, orgánicos y terapéuticos han fortalecido su adopción entre los propietarios de equinos.

Alcance del informe y segmentación del mercado de comercio electrónico de cuidado de mascotas (equinos) en América del Norte

|

Atributos |

Perspectivas clave del mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

Creciente demanda de productos online para el cuidado de mascotas y equinos

- El creciente enfoque en la comodidad y la accesibilidad está transformando significativamente el mercado de comercio electrónico para el cuidado de mascotas (equinos) en Norteamérica, ya que los consumidores prefieren cada vez más comprar productos en línea en lugar de visitar tiendas físicas. Las plataformas de comercio electrónico ofrecen una amplia gama de productos, entregas puntuales y la facilidad de los servicios de suscripción, lo que fortalece su adopción en las categorías de nutrición, aseo y cuidado equino.

- La creciente conciencia sobre la salud, el bienestar y la atención preventiva de los equinos ha acelerado la demanda de productos especializados como suplementos, suministros veterinarios y herramientas de aseo. Los propietarios de equinos preocupados por su salud buscan activamente plataformas en línea confiables que ofrezcan productos certificados y de alta calidad, lo que impulsa a los mercados a ampliar su oferta y mejorar la logística.

- Las tendencias digitales y las recomendaciones personalizadas influyen en el comportamiento de compra, y los minoristas priorizan interfaces intuitivas, aplicaciones móviles y promociones específicas. Estos factores ayudan a las plataformas a diferenciarse en un mercado competitivo, a aumentar la confianza del consumidor y a impulsar la repetición de compras.

- Por ejemplo, en 2024, las principales plataformas online de cuidado de mascotas en EE. UU. ampliaron su gama de productos equinos e introdujeron modelos de suscripción para piensos, suplementos y productos de aseo, respondiendo a la creciente demanda de una entrega cómoda y continua. Estas iniciativas han mejorado la fidelización de los clientes y acelerado la penetración en el mercado.

- Si bien el crecimiento del mercado es prometedor, la expansión sostenida depende de la inversión continua en infraestructura, logística y tecnología de comercio electrónico para mejorar la experiencia del consumidor y gestionar la eficiencia de las entregas. Los minoristas también se centran en la escalabilidad, la colaboración con profesionales del sector equino y la adopción de herramientas digitales avanzadas para un servicio personalizado.

Dinámica del mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

Conductor

Creciente preferencia por productos especializados y en línea para el cuidado equino

- La creciente adopción de canales digitales y compras en línea por parte de los consumidores es un factor clave para el mercado de comercio electrónico de cuidado de mascotas (equinos) en Norteamérica. Las plataformas de comercio electrónico ofrecen comodidad, una mayor selección de productos, precios competitivos y acceso a asesoramiento experto, aspectos muy valorados por los propietarios de equinos.

- El creciente enfoque en la salud equina, la atención preventiva y los productos de nutrición premium está impulsando el crecimiento del mercado. Los propietarios están dispuestos a invertir en productos certificados de alta calidad disponibles a través de plataformas en línea, lo que impulsa las ventas en las categorías de suplementos, cuidado personal y cuidado de la salud.

- Los minoristas están aprovechando activamente las aplicaciones móviles, las recomendaciones personalizadas y los modelos de suscripción para promocionar productos de cuidado equino y mejorar la experiencia del cliente. Esta tendencia también fomenta la colaboración entre veterinarios, entrenadores y plataformas de comercio electrónico para garantizar la credibilidad de los productos y mejorar la calidad del servicio.

- Por ejemplo, en 2023, los principales minoristas equinos en línea de Norteamérica informaron un aumento en los pedidos de alimentos y suplementos por suscripción, impulsado por la conveniencia y la disponibilidad constante de productos. Las estrategias de marketing enfatizaron la calidad del producto, los beneficios para la salud y la entrega confiable, lo que fortaleció la confianza en la marca y las compras recurrentes.

- Si bien la adopción digital impulsa el crecimiento, una mayor penetración en el mercado depende de la inversión tecnológica, una gestión eficaz de la cadena de suministro y unas interfaces intuitivas. La innovación continua en logística, las recomendaciones basadas en IA y la atención al cliente serán fundamentales para impulsar el crecimiento a largo plazo.

Restricción/Desafío

Costos de envío elevados y escaso conocimiento de los productos equinos especializados en línea

- El costo relativamente más alto del envío de productos equinos voluminosos, como alimento y cama, sigue siendo un desafío clave, lo que limita su adopción entre los consumidores preocupados por los costos. La logística para la entrega oportuna de productos perecederos también agrega complejidad operativa y aumenta los costos generales.

- El conocimiento y la confianza en los productos de cuidado equino en línea siguen siendo desiguales, especialmente entre quienes compran por primera vez o entre propietarios en zonas rurales. El escaso conocimiento de los beneficios del producto y la fiabilidad de la plataforma puede limitar la adopción del comercio electrónico.

- Los desafíos de la cadena de suministro y el cumplimiento, incluyendo las condiciones de almacenamiento, el embalaje y los requisitos de la cadena de frío para ciertos suplementos, impactan aún más el crecimiento del mercado. Los operadores de comercio electrónico deben invertir en sistemas robustos de logística y manipulación para garantizar la calidad del producto y la entrega puntual.

- Por ejemplo, en 2024, algunos distribuidores norteamericanos de productos para el cuidado de equinos informaron de una menor aceptación de las suscripciones en línea a piensos y suplementos debido al aumento de los costes de envío y al desconocimiento de las opciones de compra digital. Los problemas operativos también provocaron retrasos en las entregas en zonas remotas, lo que afectó la satisfacción del cliente.

- Superar estos desafíos requerirá una logística mejorada, modelos de entrega rentables y campañas educativas para concienciar a los propietarios de equinos. Las alianzas estratégicas con proveedores locales, la inversión en plataformas digitales y las iniciativas de atención al cliente son fundamentales para impulsar el potencial de crecimiento a largo plazo en el mercado de comercio electrónico para el cuidado de mascotas (equinos) en Norteamérica.

Alcance del mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

El mercado de comercio electrónico de cuidado de mascotas (equinos) de América del Norte está segmentado en función del tipo y del tipo de equino.

- Por tipo

Según el tipo, el mercado se segmenta en alimentos y golosinas para mascotas, medicamentos para mascotas, productos de aseo para mascotas, accesorios para mascotas y otros. El segmento de alimentos y golosinas para mascotas obtuvo la mayor participación en los ingresos del mercado en 2025, impulsado por la creciente demanda de nutrición especializada, la comodidad de la entrega a domicilio y los servicios por suscripción. Las plataformas en línea que ofrecen una amplia variedad de opciones de alimentos premium, orgánicos y terapéuticos han fortalecido su adopción entre los propietarios de equinos.

Se prevé que el segmento de medicamentos para mascotas experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente concienciación sobre la salud equina, la atención preventiva y la necesidad de acceder rápidamente a medicamentos aprobados por veterinarios. Las plataformas de comercio electrónico son cada vez más populares por su facilidad para realizar pedidos, la entrega a domicilio y el acceso a productos certificados, lo que garantiza un cuidado y una gestión adecuados de la salud equina.

- Por tipo de equino

Según el tipo de equino, el mercado se segmenta en caballos/ponis, burros, mulas/burdéganos y otros. El segmento de caballos/ponis mantuvo la mayor cuota de mercado en 2025 debido al alto número de propietarios y uso recreativo de caballos en Norteamérica, así como a la creciente inversión en competiciones y deportes equinos.

Se prevé que el segmento de burros y mulos/burdéganos experimente el mayor crecimiento entre 2026 y 2033, impulsado por el creciente interés en la agricultura a pequeña escala, los programas de terapia asistida por equinos y las actividades recreativas. Las plataformas de comercio electrónico que ofrecen productos a medida para estos animales, como piensos especializados, herramientas de aseo y suplementos para la salud, están impulsando la adopción del segmento.

Análisis regional del mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

- Estados Unidos dominó el mercado de comercio electrónico de cuidado de mascotas (equinos) en América del Norte con la mayor participación en los ingresos del 40,12 % en 2025, impulsado por la creciente adopción de compras en línea de productos para mascotas y una mayor conciencia sobre la salud y el bienestar equinos.

- Los consumidores del país valoran mucho la comodidad, la amplia variedad de productos y la entrega a domicilio que ofrecen las plataformas de comercio electrónico, junto con el acceso a productos especializados para el cuidado equino.

- Esta adopción generalizada se ve respaldada además por el aumento de los ingresos disponibles, una población con conocimientos digitales y la creciente preferencia por soluciones personalizadas para el cuidado de las mascotas, lo que establece el comercio electrónico como un canal favorito tanto para productos equinos minoristas como profesionales.

Perspectivas del mercado de comercio electrónico para el cuidado de mascotas (equinos) en Canadá

Se prevé que el mercado canadiense de comercio electrónico para el cuidado de mascotas (equinos) experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente preferencia de los consumidores por las compras en línea por comodidad y seguridad. Los consumidores priorizan el acceso rápido a alimentos, medicamentos y productos de aseo para mascotas de alta calidad, así como a artículos específicos para equinos. La expansión de las plataformas en línea, la mejora de la logística y las campañas promocionales de los principales minoristas de comercio electrónico impulsan aún más el crecimiento del mercado. Además, la adopción de aplicaciones móviles y servicios de suscripción para las necesidades recurrentes del cuidado equino contribuye significativamente a la rápida expansión del mercado.

Cuota de mercado del comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

La industria del comercio electrónico de cuidado de mascotas (equinos) en América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Chewy Inc (EE. UU.)

- Petco Health and Wellness Company Inc (EE. UU.)

- PetSmart Inc (EE. UU.)

- Zoetis Inc (EE. UU.)

- Manna Pro Products Inc (EE. UU.)

- Valley Vet Supply (EE. UU.)

- Talabartería Dover (EE. UU.)

- SmartPak Equine (EE. UU.)

- Jeffers Pet (EE. UU.)

- Absorbine Inc (EE. UU.)

- Cavalor Norteamérica (EE.UU.)

- Tiendas TSC (Canadá)

- Las mascotas de Ren (Canadá)

- Global Pet Foods (Canadá)

- Topline Equine (Canadá)

Últimos avances en el mercado de comercio electrónico para el cuidado de mascotas (equinos) en América del Norte

- En julio de 2021, Purina firmó una alianza estratégica con Natures Crops para desarrollar suplementos equinos de origen vegetal. Esta colaboración se centra en la creación de soluciones innovadoras y naturales de suplementos para caballos, con el objetivo de mejorar la salud y la nutrición equinas en general. La iniciativa aprovecha la experiencia de Purina en nutrición animal y las fórmulas vegetales de Natures Crops para ofrecer alternativas más seguras y sostenibles. Se espera que el lanzamiento de estos suplementos satisfaga la creciente demanda de productos naturales para el cuidado equino, aumente la confianza de los clientes e impulse el crecimiento del mercado de comercio electrónico de productos para el cuidado de mascotas (equinos) en Norteamérica.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.