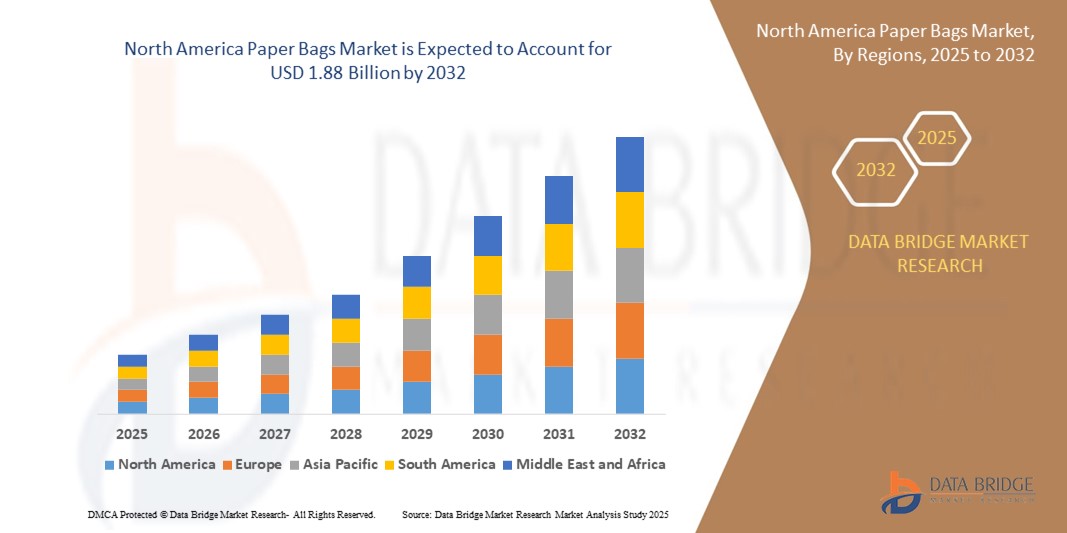

North America Paper Bags Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.23 Billion

USD

1.88 Billion

2024

2032

USD

1.23 Billion

USD

1.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.88 Billion | |

|

|

|

|

Segmentación del mercado de bolsas de papel en Norteamérica, por productos (bolsas de papel planas, sacos de papel multicapa, de boca abierta, con válvula de sellado, bolsas de papel con cierre, bolsas de autoapertura (SOS), bolsas stand-up y otras), uso (desechables y reutilizables), capacidad (menos de 1 kg, 1 kg-5 kg, 5 kg-10 kg y más de 10 kg), tamaño (pequeño, mediano, grande y extragrande), sellado y asa (sellado térmico, asa de mano, ziplock, asa retorcida, asa plana y otras), forma (rectangular, cuadrada, circular y otras), canal de distribución (tiendas de conveniencia, supermercados/hipermercados, tiendas especializadas, comercio electrónico y otros), usuario final (alimentos y bebidas, piensos, productos cosméticos, agricultura, construcción, productos farmacéuticos, productos químicos y otros) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de bolsas de papel

- El tamaño del mercado de bolsas de papel de América del Norte se valoró en USD 1.23 mil millones en 2024 y se espera que alcance los USD 1.88 mil millones para 2032 , con una CAGR del 5,5% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida al cambio hacia soluciones de embalaje sostenibles y a la creciente presión regulatoria para reducir el plástico de un solo uso, lo que lleva a una mayor adopción de bolsas de papel en los sectores minoristas, de servicios de alimentación e industriales.

- Además, la creciente concienciación de los consumidores sobre el impacto ambiental, sumada a la creciente demanda de alternativas biodegradables y reciclables, está posicionando las bolsas de papel como la opción preferida tanto por las marcas como por los consumidores. Estos factores convergentes están acelerando la transición del plástico al papel, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de bolsas de papel

- Las bolsas de papel son soluciones de embalaje ecológicas, fabricadas con papel kraft o reciclado, ampliamente utilizadas para transportar comestibles, alimentos, ropa y otros bienes de consumo. Están disponibles en diversos tipos, tamaños y formatos de sellado, ideales para los sectores minorista, de restauración, farmacéutico y de la construcción.

- La creciente demanda de bolsas de papel se debe principalmente a las prohibiciones gubernamentales sobre el plástico, los objetivos de sostenibilidad establecidos por las corporaciones y el uso creciente de bolsas de papel como herramienta de marca en entornos minoristas premium y con conciencia ecológica.

- Estados Unidos dominó el mercado de bolsas de papel con una participación del 83,10 % en 2024, debido al aumento de las restricciones regulatorias sobre el uso de plástico y a la creciente adopción de envases sostenibles en los sectores minorista, de servicios de alimentación y de alimentación. La creciente demanda de alternativas reciclables y biodegradables, y la mayor conciencia ambiental de los consumidores han posicionado a Estados Unidos como líder regional.

- Se espera que Canadá sea la región de más rápido crecimiento en el mercado de bolsas de papel durante el período de pronóstico debido a las políticas nacionales de reducción de plástico y un fuerte cambio del consumidor hacia envases ecológicos.

- El segmento de productos de un solo uso dominó el mercado con una cuota del 64,2 % en 2024, debido a los estrictos requisitos de higiene en las industrias farmacéutica y alimentaria. El énfasis regulatorio en el control de la contaminación y la facilidad de eliminación de los envases ha propiciado la adopción generalizada de las bolsas de papel de un solo uso. Además, son rentables para operaciones de gran volumen, especialmente en entornos dinámicos como el comercio minorista y el sector de alimentación y bebidas.

Alcance del informe y segmentación del mercado de bolsas de papel

|

Atributos |

Perspectivas clave del mercado de bolsas de papel |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de bolsas de papel

“Aumento de la adopción de materiales biodegradables”

- El mercado de bolsas de papel está experimentando un sólido crecimiento a medida que las empresas y los consumidores priorizan cada vez más los envases ecológicos, y la adopción de materiales biodegradables y reciclables se convierte en una tendencia definitoria.

- Por ejemplo, empresas como International Paper Company, Mondi Group, Smurfit Kappa y WestRock están introduciendo bolsas de papel innovadoras hechas de papel kraft de origen sostenible, bioplásticos y recubrimientos compostables para satisfacer la demanda regulatoria y de los consumidores de soluciones de embalaje sostenibles.

- El sector de alimentos y bebidas, junto con el comercio minorista y el comercio electrónico, está cambiando rápidamente a bolsas de papel para llevar, comprar alimentos y entregar a domicilio, impulsado por las prohibiciones de los plásticos de un solo uso y la necesidad de envases que se alineen con las iniciativas ecológicas.

- Los materiales avanzados, como el papel kraft más delgado y resistente y los recubrimientos resistentes a la humedad, están mejorando la durabilidad y versatilidad de las bolsas de papel, lo que respalda su uso en una gama más amplia de productos, incluidos los productos perecederos y a granel.

- El branding y la personalización están en aumento, y los minoristas y los restaurantes de servicio rápido aprovechan las bolsas de papel impresas a medida para promover la sostenibilidad y mejorar la experiencia del consumidor.

- En conclusión, la convergencia del crecimiento del comercio electrónico, la acción regulatoria y las iniciativas de sostenibilidad está posicionando a las bolsas de papel como un componente crítico en el futuro del embalaje y la logística de Asia Pacífico, con líderes del mercado invirtiendo en nuevas tecnologías y expandiendo líneas de productos ecológicos.

Dinámica del mercado de bolsas de papel

Conductor

“ Cambio hacia alternativas ecológicas al plástico ”

- El creciente movimiento mundial para reducir los residuos plásticos es el principal impulsor del mercado de bolsas de papel de Asia Pacífico, con prohibiciones legislativas y preferencias de los consumidores que aceleran el cambio hacia opciones biodegradables y reciclables.

- Por ejemplo, empresas como International Paper Company, Mondi Group, Smurfit Kappa y WestRock están aumentando la producción de bolsas de papel para los principales minoristas y proveedores de servicios de alimentos en China, India, Australia y el sudeste asiático, quienes están reemplazando las bolsas de plástico para cumplir con las regulaciones y alcanzar los objetivos de sostenibilidad.

- El auge del comercio electrónico y los envíos directos al consumidor está impulsando la demanda de bolsas de papel livianas, protectoras y rentables en una variedad de sectores.

- La conveniencia, la capacidad de impresión y los beneficios ambientales percibidos de las bolsas de papel las convierten en la opción preferida tanto para las grandes empresas como para las pequeñas empresas que buscan mejorar sus credenciales ecológicas.

- El aumento de la inversión en infraestructura de reciclaje y el desarrollo de papel de origen local con certificación FSC respaldan aún más el cambio hacia soluciones de embalaje basadas en papel.

Restricción/Desafío

“Altos costos de producción y limitaciones de materias primas”

- La producción de bolsas de papel es más cara que las alternativas de plástico debido a los mayores requisitos de materia prima, energía y agua, lo que puede limitar su adopción en mercados sensibles a los costos.

- Por ejemplo, el precio promedio de importación de bolsas y sacos de papel en Asia Pacífico alcanzó los 2.778 dólares por tonelada en 2018, y países como Japón pagaron hasta 3.754 dólares por tonelada, lo que pone de relieve una importante variabilidad de precios y presiones de costos en toda la región.

- Las bolsas de papel suelen ofrecer menor durabilidad, especialmente en condiciones de humedad o uso intensivo, lo que las hace menos adecuadas para transportar líquidos, productos congelados o artículos voluminosos. La fluctuación de los precios y el suministro de materias primas como la pulpa de madera y el papel reciclado, así como la necesidad de prácticas forestales sostenibles, pueden afectar la estabilidad de los costos y la fiabilidad de la cadena de suministro.

- La infraestructura de reciclaje limitada y los sistemas de recolección inconsistentes en algunas regiones de Asia Pacífico obstaculizan la circularidad de las bolsas de papel, en particular las que están hechas de materiales mixtos.

- Siguen existiendo preocupaciones ambientales relacionadas con la deforestación y la huella de carbono de la producción de papel, especialmente en regiones que carecen de reciclaje avanzado o gestión forestal sostenible.

Alcance del mercado de bolsas de papel

El mercado está segmentado según el tipo de producto, uso, capacidad, tamaño, sellado y manejo, forma, canal de distribución y usuario final.

- Por productos

En cuanto a los productos, el mercado de medicamentos antivirales se segmenta en bolsas de papel planas, sacos de papel multicapa, bolsas de boca abierta, bolsas con válvula de sellado, bolsas de papel con cierre, bolsas de autoapertura (SOS), bolsas stand-up y otras. El segmento de bolsas de papel planas dominó la mayor cuota de mercado en 2024, gracias a su perfil ecológico, asequibilidad y amplio uso en el envasado de productos ligeros como productos de panadería y farmacéuticos. Estas bolsas son especialmente preferidas para aplicaciones de un solo uso donde la biodegradabilidad y el mínimo impacto ambiental son factores de compra cruciales. Su fácil personalización y compatibilidad con las tecnologías de impresión mejoran aún más la imagen de marca y la visibilidad del producto para los usuarios finales.

Se proyecta que el segmento de bolsas stand-up registre el mayor crecimiento entre 2025 y 2032 debido a la creciente demanda de envases flexibles, resellables y que ahorren espacio. Estas bolsas ofrecen una mayor vida útil y protección contra la contaminación, lo que las hace ideales para productos farmacéuticos y cosméticos. Su atractivo estético, comodidad y adaptabilidad a contenidos secos y líquidos también están acelerando su adopción en los canales minoristas y de comercio electrónico.

- Por uso

En función del uso, el mercado se clasifica en bolsas de un solo uso y reutilizables. El segmento de un solo uso representó la mayor cuota de mercado, con un 64,2 %, en 2024, impulsado por los estrictos requisitos de higiene en las industrias farmacéutica y alimentaria. La importancia regulatoria para el control de la contaminación y la facilidad de eliminación de envases ha propiciado la adopción generalizada de bolsas de papel de un solo uso. Además, son rentables para operaciones de gran volumen, especialmente en entornos de alta actividad como el comercio minorista y el sector de alimentación y bebidas.

Se prevé que el segmento de productos reutilizables experimente su mayor crecimiento anual compuesto (CAGR) entre 2025 y 2032, impulsado por las crecientes iniciativas de sostenibilidad y la preferencia de los consumidores por soluciones de embalaje respetuosas con el medio ambiente. Estas bolsas son cada vez más utilizadas por marcas premium y supermercados para promover hábitos de consumo ecológicos, manteniendo su durabilidad y atractivo visual.

- Por capacidad

En función de la capacidad, el mercado se segmenta en menos de 1 kg, de 1 kg a 5 kg, de 5 kg a 10 kg y más de 10 kg. El segmento de 1 kg a 5 kg lideró el mercado en 2024, gracias a su versatilidad en una amplia gama de industrias de uso final, como la alimentaria, la farmacéutica y la de piensos. Este rango de capacidad es óptimo para manipular productos perecederos y no perecederos sin comprometer la comodidad ni la eficiencia de almacenamiento.

Se prevé que el segmento de más de 10 kg registre el mayor crecimiento durante el período de pronóstico, impulsado por el aumento de las aplicaciones industriales en agricultura, construcción y productos químicos. Estas bolsas ofrecen una robusta integridad estructural, rentabilidad para el transporte a granel y compatibilidad con sistemas automatizados de llenado y manipulación.

- Por tamaño

Según el tamaño, el mercado se segmenta en tamaño pequeño, mediano, grande y extragrande. El segmento mediano obtuvo la mayor cuota de mercado en 2024, gracias a su equilibrio ideal entre capacidad, portabilidad y comodidad de uso. Este segmento de tamaño tiene un gran auge en los sectores minorista, de restauración y farmacéutico, donde un embalaje compacto pero funcional es esencial.

Se proyecta que el segmento de tamaño extragrande crecerá a su ritmo más rápido entre 2025 y 2032, impulsado por el aumento de los requisitos de manipulación a granel y la demanda de alternativas sostenibles a las bolsas de plástico. Estas bolsas se utilizan cada vez más en los sectores de la construcción y la agricultura, donde se requieren embalajes de gran volumen, duraderos y resistentes a la intemperie.

- Mediante sellado y manipulación

En cuanto al sellado y el manejo, el mercado se segmenta en sellado térmico, asa de mano, cierre hermético, asa retorcida, asa plana y otros. El segmento de sellado térmico dominó el mercado en 2024 gracias a su superior resistencia de sellado, sus propiedades de precinto de seguridad y su amplia adopción en envases farmacéuticos y alimentarios. El sellado térmico garantiza la integridad del producto, prolongando su vida útil y minimizando las fugas y el deterioro.

Se prevé que el segmento Ziplock experimente el mayor crecimiento, ya que la funcionalidad resellable se convierte en una demanda clave de los consumidores por su comodidad y reutilización. La integración de las características de Ziplock con materiales biodegradables también está cobrando impulso, especialmente en envases para comercios urbanos y premium.

- Por forma

Según su forma, el mercado se divide en rectangular, cuadrado, circular y otros. El segmento rectangular captó la mayor participación en 2024, favorecido por sus prácticas ventajas de almacenamiento, apilamiento y facilidad de impresión y etiquetado. Las bolsas rectangulares se utilizan ampliamente en sectores como el farmacéutico y el cosmético, donde la presencia en los estantes y la eficiencia operativa son cruciales.

Se prevé que el segmento Circular registre el mayor crecimiento durante el período de pronóstico debido a la creciente demanda de envases innovadores y diferenciados en categorías de productos premium y de nicho. Las bolsas circulares ofrecen una estética única y suelen ser adoptadas por marcas que buscan la distinción entre el consumidor.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en tiendas de conveniencia, supermercados/hipermercados, tiendas especializadas, comercio electrónico y otros. El segmento de supermercados/hipermercados dominó la cuota de mercado en 2024, impulsado por las tendencias de compra a granel y la visibilidad directa de los productos envasados. Estas tiendas sirven como puntos clave de compra de bolsas de papel reutilizables y de marca, especialmente en los centros urbanos.

Se prevé que el comercio electrónico experimente su mayor crecimiento entre 2025 y 2032 debido al auge de las compras en línea y los modelos de entrega a domicilio. A medida que el embalaje se convierte en un punto de contacto clave para las marcas, los minoristas electrónicos optan cada vez más por soluciones basadas en papel por su respeto al medio ambiente y su atractivo estético.

- Por el usuario final

Según el usuario final, el mercado se segmenta en alimentos y bebidas, piensos, productos cosméticos, agricultura, construcción, productos farmacéuticos, productos químicos y otros. El segmento de alimentos y bebidas lideró el mercado en 2024 gracias al alto volumen de consumo, los estándares de higiene y la rápida transición hacia envases biodegradables. Estas bolsas garantizan un almacenamiento seguro, estabilidad térmica y un etiquetado claro del producto.

Se proyecta que el segmento farmacéutico crecerá a su ritmo más rápido entre 2025 y 2032 debido a las crecientes exigencias regulatorias para el envasado secundario sostenible, la protección estéril y la trazabilidad. La creciente demanda de bolsas de papel con propiedades de barrera mejoradas y características de seguridad impulsa aún más la expansión del segmento.

Análisis regional del mercado de bolsas de papel

- EE. UU. dominó el mercado de bolsas de papel con la mayor participación en los ingresos, con un 83,10 % en 2024, impulsado por el aumento de las restricciones regulatorias sobre el uso de plástico y la creciente adopción de envases sostenibles en los sectores minorista, de servicios de alimentación y de alimentación. La creciente demanda de alternativas reciclables y biodegradables, y la mayor conciencia ambiental de los consumidores han posicionado a EE. UU. como líder regional.

- La amplia presencia de los principales fabricantes de bolsas de papel, combinada con una sólida infraestructura minorista y las iniciativas de sostenibilidad corporativa, sigue impulsando la demanda de productos. Además, el apoyo a las prohibiciones locales y federales sobre los plásticos de un solo uso está acelerando la transición a soluciones de embalaje basadas en papel.

- El mercado estadounidense también se beneficia de la creciente innovación en el diseño, la resistencia y la reutilización de las bolsas de papel, lo que consolida aún más su dominio en el panorama de los envases sostenibles de América del Norte.

Perspectiva del mercado de bolsas de papel de Canadá

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado norteamericano de bolsas de papel entre 2025 y 2032, impulsada por las políticas nacionales de reducción del plástico y una fuerte tendencia de los consumidores hacia envases ecológicos. La creciente preferencia por bolsas de papel reutilizables y de primera calidad, especialmente en la restauración y el comercio minorista, está impulsando la demanda. El apoyo gubernamental a las alternativas de envases ecológicos y la creciente inversión en capacidad de producción nacional impulsan aún más el mercado.

Perspectiva del mercado de bolsas de papel en México

Se prevé que el mercado mexicano de bolsas de papel experimente un crecimiento sostenido entre 2025 y 2032, impulsado por el crecimiento del sector minorista, la expansión de las operaciones de servicios de alimentación y una mayor presión para reducir los residuos plásticos. La creciente conciencia ambiental, junto con los avances regulatorios y los vínculos comerciales regionales, anima a los fabricantes locales a aumentar la producción de bolsas de papel para satisfacer la demanda nacional y la exportación.

Cuota de mercado de las bolsas de papel

La industria de las bolsas de papel está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- WestRock Company (EE. UU.)

- Smurfit Kappa (Irlanda)

- International Paper (EE. UU.)

- Grupo Inteplast (EE. UU.)

- PAPIER-METTLER KG (Alemania)

- PackagingPro (Australia)

- JINAN XINSHUNYUAN PACKING CO., LTD (China)

- Mondi (Reino Unido)

- Thai Showa Paxxs Co., Ltd. (Tailandia)

- Conitex Sonoco (EE. UU.)

Últimos avances en el mercado de bolsas de papel de América del Norte

- En julio de 2025, EP Group lanzó una campaña dirigida a los minoristas de moda para que actualizaran su oferta de bolsas de papel, lo que indica un impulso hacia soluciones de embalaje de mayor calidad y más sostenibles en el sector textil. Se espera que esta iniciativa influya en los estándares de embalaje para minoristas e impulse la demanda de bolsas de papel premium y alineadas con las marcas.

- En junio de 2025, Mondi presentó su re/cycle PaperPlus Bag Advanced, una solución de alto rendimiento diseñada para productos sensibles a la humedad, con un contenido reducido de plástico. Esta innovación refuerza la tendencia hacia los envases híbridos de papel y fortalece la posición de Mondi en los segmentos de envases industriales y de comercio electrónico, priorizando tanto la funcionalidad como la sostenibilidad.

- En junio de 2024, el lanzamiento de la SolmixBag por parte de Mondi en España, en colaboración con Cemex, marcó un avance significativo en el envasado de materiales de construcción. Al crear una bolsa que se disuelve durante el proceso de mezcla del cemento, Mondi contribuye a la eficiencia operativa y la sostenibilidad en el sector de la construcción, fomentando la adopción de soluciones ecológicas y que reducen los residuos en la industria.

- En octubre de 2024, Coles presentó una bolsa de papel lavable con un precio de 15 USD, capaz de soportar hasta 20 kg y lavable a máquina. Esta innovación refleja la creciente preferencia del consumidor por envases duraderos y reutilizables, lo que refuerza la tendencia del sector minorista a abandonar los plásticos de un solo uso y amplía las oportunidades para los fabricantes de bolsas de papel de larga duración.

- En noviembre de 2024, Primark lanzó bolsas de papel para envolver regalos con un diseño de rayas rojas que permiten reutilizarlas como papel de regalo. Este enfoque creativo para el embalaje de doble uso mejora la interacción con el cliente y también contribuye a los objetivos de sostenibilidad, consolidando las bolsas de papel como una solución versátil y respetuosa con el medio ambiente para el comercio minorista.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.