Mercado de medidores de potencia óptica de América del Norte, por tipo (detectores térmicos y detectores fotográficos), tipo de instrumento/producto (medidor de sobremesa, medidor portátil, medidores virtuales, longitud de onda óptica, medidor de mano y otros), tipo de detector (InGaAs (arseniuro de indio y galio), germanio, silicio y otros), rango de potencia (alto, medio y bajo), longitud de onda (850 nm a 1650 nm y 400 nm a 1100 nm), fuente de luz (láser y LED), aplicación (instalación y mantenimiento, pruebas, fabricación, investigación y desarrollo, y otros), usuario final (industria de telecomunicaciones, industria eléctrica y electrónica, industria automotriz, industria militar y aeroespacial, industria de energía y servicios públicos, y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de medidores de potencia óptica en América del Norte

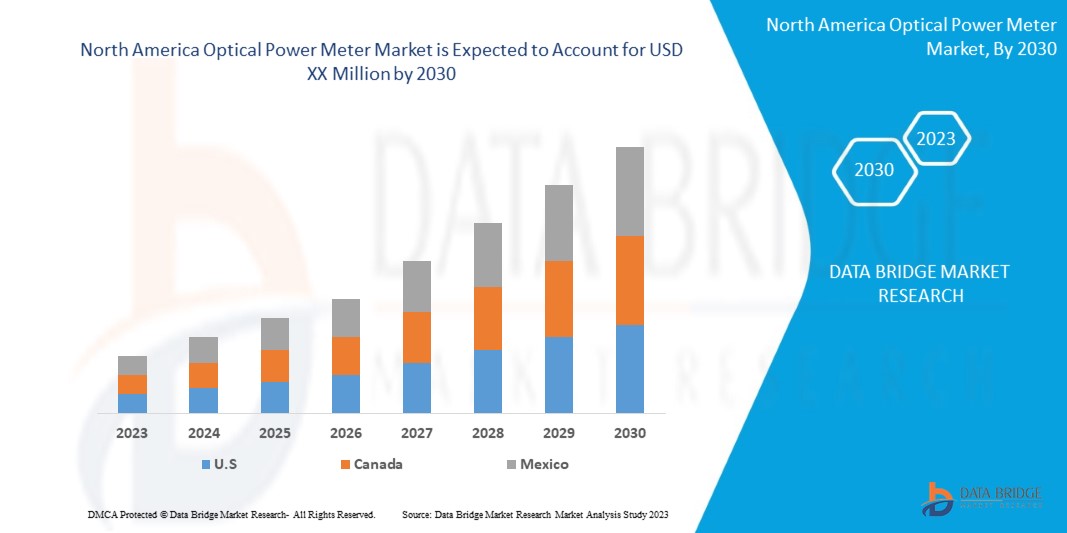

Se espera que el mercado de medidores de potencia óptica de América del Norte gane crecimiento en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,6%. La creciente demanda de actividades de investigación y desarrollo está actuando como un factor importante para el crecimiento del mercado.

Este informe de mercado de medidores de potencia óptica proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas y nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en miles, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo (detectores térmicos y detectores fotográficos), tipo de instrumento/producto (medidor de sobremesa, medidor portátil, medidores virtuales, longitud de onda óptica, medidor portátil y otros), tipo de detector (InGaAs (arseniuro de indio y galio), germanio, silicio y otros), rango de potencia (alto, medio y bajo), longitud de onda (850 nm a 1650 nm y 400 nm a 1100 nm), fuente de luz (láser y LED), aplicación (instalación y mantenimiento, pruebas, fabricación, investigación y desarrollo y otros), usuario final (industria de telecomunicaciones, industria eléctrica y electrónica, industria automotriz, industria militar y aeroespacial, industria de energía y servicios públicos y otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México. |

|

Actores del mercado cubiertos |

Thorlabs (EE. UU.), Inc., Kingfisher International (Australia), GAO Tek & GAO Group Inc. (EE. UU.), VIAVI Solutions Inc. (EE. UU.), Fluke Corporation (EE. UU.), EXFO Inc. (Canadá), AFL (EE. UU.), Newport Corporation (una subsidiaria de MKS Instruments) (EE. UU.), Stanlay (India), Keysight Technologies (EE. UU.), Anritsu (Japón), Tech Optics Ltd. (Inglaterra), JOINWIT (China), Artifex Engineering GmbH & Co KG. (Alemania), HIOKI EE CORPORATION (Japón), Edmund Optics Inc. (EE. UU.), BIOPTIC CO., LTD (Corea del Sur), ComSonics (EE. UU.), ADC CORPORATION (Japón), Deviser Instruments (EE. UU.), Incorporated, PDR World (India), Jonard Tools (EE. UU.), OZ Optics Ltd. (Canadá), APEX Technologies (Francia), Ophir Optronics Solutions Ltd (Israel), Santec Corporation (Japón) y Yokogawa Test & Measurement Corporation (Japón), entre otros. |

Definición de mercado

Un medidor de potencia óptica es un dispositivo que mide la electricidad y la potencia en una señal óptica. Los medidores de potencia óptica se utilizaban para probar la cantidad promedio de potencia en redes y sistemas de fibra óptica. Un medidor de potencia es una combinación e integración de un sensor calibrado, una pantalla y un amplificador de medición y pantalla, que mide y monitorea el rango de longitudes de onda y niveles de potencia. El sensor calibrado está integrado con un fotodiodo que se utiliza para medir las longitudes de onda y los niveles de potencia en el sistema. Los sensores están compuestos de semiconductores basados en silicio, germanio o InGaAs. Los diferentes tipos de sensores utilizados en los medidores de potencia óptica tienen diferentes características. Se utiliza un amplificador de medición para verificar la precisión y entregar datos e información. La unidad de visualización proporciona la lectura de potencia óptica monitoreada y medida y la longitud de onda establecida. Un medidor de potencia óptica también ayuda a determinar la pérdida de potencia incurrida por la señal óptica al pasar por el medio óptico.

Dinámica del mercado de medidores de potencia óptica en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- CRECIENTE DEMANDA DE MEDIDORES DE POTENCIA ÓPTICA

Un medidor de potencia óptica es un dispositivo que mide la electricidad y la potencia en una señal óptica. Los medidores de potencia óptica se utilizaban para comprobar la cantidad media de potencia en redes y sistemas de fibra óptica. Un medidor de potencia es una combinación e integración de un sensor calibrado, una pantalla y un amplificador de medición, que mide y controla el rango de longitudes de onda y niveles de potencia. Un medidor de potencia óptica también ayuda a determinar la pérdida de potencia que sufre la señal óptica al pasar por el medio óptico.

Se espera que el mercado de medidores de potencia óptica de América del Norte experimente un crecimiento significativo en los próximos años debido a la creciente demanda de medidores de potencia óptica. Los medidores de potencia óptica se utilizan ampliamente en la industria de las telecomunicaciones, ya que proporcionan mediciones precisas de la potencia óptica de un cable o sistema de fibra óptica.

- AUMENTO DE LOS REQUISITOS DE EVALUACIÓN DE LA CALIDAD DE LA TRANSMISIÓN

La red de transmisión es un factor importante en la red de comunicaciones para brindar mejores servicios al consumidor. Para la evaluación y el monitoreo de la calidad de la red de transmisión, no existe un estándar general. Uno de los principales objetivos en los que se centra la industria de las telecomunicaciones es transmitir señales a través de cables con la menor interrupción, la máxima capacidad, el menor ruido, el bajo consumo de energía y una calidad de transmisión óptima.

Hoy en día, diferentes servicios que consumen tráfico, como videos ultra HD, televisores 3D, comercio en línea, computación en la nube y otros, aumentan la demanda de tráfico IP por parte de los consumidores de Internet.

Estas aplicaciones de acceso han dado lugar al uso de antenas de redes inalámbricas fijas, seguridad de claves, estaciones base de redes móviles y estructuras de monitorización y medición, que exigen un mayor rendimiento de la información y los datos. En consecuencia, el aumento de la capacidad de transporte de las redes de acceso se vuelve crucial para los proveedores de servicios de Internet.

Los cables de transmisión están expuestos a condiciones externas y muchos factores pueden provocar una calibración incorrecta. Por lo tanto, es importante evaluar periódicamente la calidad de la transmisión, incluida la evaluación de la potencia dentro de los cables mediante medidores de potencia óptica.

Oportunidades

- AUMENTO DE LOS PROBLEMAS EN LA RED ELÉCTRICA

Una red eléctrica, también llamada red eléctrica, es una estructura de red interconectada que sirve para suministrar electricidad y energía desde los productores a los consumidores para su uso diario. La red eléctrica consta de tres etapas: generación, transmisión y distribución.

Las centrales eléctricas convierten la energía mecánica en energía eléctrica mediante un generador. La transmisión eléctrica se lleva a cabo mediante líneas eléctricas. El proceso de distribución conecta subestaciones desde grandes edificios industriales hasta pequeñas viviendas para suministrarles electricidad.

Restricciones/Desafíos

- FALTA DE CONOCIMIENTOS TÉCNICOS

Los crecientes avances tecnológicos, las innovaciones y la digitalización de los procesos comerciales dificultan que los trabajadores, empleados y personal adapten sus conjuntos de habilidades a las necesidades de operaciones en crecimiento y tecnológicamente actualizadas.

Esto genera una brecha de habilidades entre el personal y la empresa. Hay una escasez de personal técnico calificado con las calificaciones y conocimientos pertinentes, ya que la tecnología se actualiza día a día.

A medida que las computadoras se actualizan con soluciones más inteligentes e innovadoras, se vuelven más capaces de realizar tareas que antes realizaban humanos, por lo que los empleados y el personal necesitarán desarrollar y actualizar su conjunto de habilidades que les brindará la ventaja sobre las máquinas informáticas, como el pensamiento crítico, las innovaciones y la creatividad.

Los medidores de potencia óptica pertenecen a los semiconductores y requieren un gran conocimiento técnico en cuanto a unidades, conversiones y otros, lo que dificulta que el personal normal pueda operar los medidores de potencia.

Impacto posterior al COVID-19 en el mercado de medidores de potencia óptica de América del Norte

La COVID-19 ha tenido un impacto significativo en la economía de América del Norte y el mercado de medidores de potencia óptica no es una excepción. La pandemia ha provocado interrupciones en las cadenas de suministro y la producción, por lo que la demanda de medidores de potencia óptica puede haberse visto afectada.

Sin embargo, el uso cada vez mayor de medidores de potencia óptica en la industria de las telecomunicaciones, los centros de datos y otras aplicaciones ha mantenido la demanda relativamente estable. La necesidad de redes de comunicación fiables y de alta velocidad no ha hecho más que aumentar durante la pandemia debido al cambio hacia el trabajo remoto y el aprendizaje en línea.

Además, con la creciente adopción de la tecnología 5G y la expansión de las redes de fibra óptica, es probable que la demanda de medidores de potencia óptica siga creciendo en los próximos años.

En general, si bien el COVID-19 puede haber causado algunas interrupciones en el mercado de medidores de potencia óptica, se espera que la creciente demanda de redes de comunicación confiables y de alta velocidad impulse el crecimiento a largo plazo.

Acontecimientos recientes

- En septiembre de 2020, EXFO Inc. adquirió InOpticals Inc., que ofrece instrumentos de prueba de ultraalta velocidad para los mercados de laboratorio y fabricación. Con esta adquisición, la oferta de pruebas ópticas de la empresa se combinará con las soluciones de InOpticals. De esta manera, la empresa podrá mejorar su cartera de productos, aprovechar las innovadoras soluciones de prueba de InOpticals y crecer en el mercado.

- En mayo de 2020, Kingfisher International amplió su capacidad para calibrar medidores de potencia de fibra óptica en el espectro visible y UV-A. Gracias a esto, la empresa calibró con precisión medidores de potencia óptica de semiconductores de 350 a 1650 nm a intervalos de 5 nm. Esto ha ayudado a la empresa a satisfacer mejor las necesidades de los clientes.

Alcance del mercado de medidores de potencia óptica en América del Norte

El mercado de medidores de potencia óptica de América del Norte está segmentado en función del componente, tipo, tipo de instrumento o producto, tipo de detector, rango de potencia, longitud de onda, fuente de luz, aplicación y usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

TIPO

- DETECTORES TÉRMICOS

- DETECTORES DE FOTOS

Según el tipo, el mercado de medidores de potencia óptica de América del Norte está segmentado en detectores térmicos y detectores fotográficos.

TIPO DE INSTRUMENTO/PRODUCTO

- MEDIDOR DE SOBREMESA

- MEDIDOR PORTÁTIL

- MEDIDORES VIRTUALES

- LONGITUD DE ONDA ÓPTICA

- MEDIDOR PORTÁTIL

- OTROS

Sobre la base del tipo de instrumento/producto, el mercado de medidores de potencia óptica de América del Norte se ha segmentado en medidores de sobremesa, medidores portátiles, medidores virtuales, medidores de longitud de onda óptica, medidores portátiles y otros.

TIPO DE DETECTOR

- INGAAS (ARSENURO DE GALIO INDIO)

- GERMANIO

- SILICIO

- OTROS

Sobre la base del tipo de detector, el mercado de medidores de potencia óptica de América del Norte se ha segmentado en InGaAs (arseniuro de indio y galio), germanio, silicio y otros.

RANGO DE POTENCIA

- ALTO

- MEDIO

- BAJO

On the basis of power range, the optical power meter market has been segmented into the high, medium, and low.

WAVELENGTH

- 850NM TO 1650NM

- 400NM TO 1100NM

On the basis of wavelength, the North America optical power meter market has been segmented into 850NM to 1650NM and 400NM to 1100NM.

LIGHT SOURCE

- LASER

- LED

On the basis of the light source, the North America optical power meter market has been segmented into laser and led.

APPLICATION

- INSTALLATION & MAINTENANCE

- TESTING

- MANUFACTURING

- RESEARCH & DEVELOPMENT

- OTHERS

On the basis of application, the North America optical power meter market has been segmented into installation & maintenance, testing, manufacturing, research & development, and others.

END-USER

- TELECOMMUNICATION INDUSTRY

- ELECTRICAL & ELECTRONICS INDUSTRY

- AUTOMOTIVE INDUSTRY

- MILITARY & AEROSPACE INDUSTRY

- ENERGY & UTILITIES INDUSTRY

- OTHERS

On the basis of end-user, the North America optical power meter market has been segmented into the telecommunication industry, electrical & electronics industry, automotive industry, military & aerospace industry, energy & utilities industry, and others.

North America Optical Power Meter Market Regional Analysis/Insights

North America optical power meter market is analysed, and market size information is provided by country, component, type, instrument\product type, detector type, power range, wavelength, light source, application and end-user.

U.S. is dominating the North America region for North America optical power meter market due to the huge presence of optical power meter providers in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Optical Power Meter Market Share Analysis

North America optical power meter market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the North America optical power meter market.

Algunos de los principales actores que operan en el mercado de medidores de potencia óptica de América del Norte son Keysight Technologies, Anritsu, Newport Corporation (una subsidiaria de MKS Instruments), Yokogawa Test & Measurement Corporation, HIOKI EE CORPORATION, AFL, EXFO Inc., Fluke Corporation, APEX Technologies, PDR World, Thorlabs, Inc, VIAVI Solutions Inc., JOINWIT, ComSonics, BIOPTIC CO., LTD, OZ Optics Ltd, Santec Corporation, Jonard Tools., ADC CORPORATION, Ophir Optronics Solutions Ltd, Deviser Instruments, Incorporated, Edmund Optics, Kingfisher International, Artifex Engineering GmbH & Co KG., GAO Tek & GAO Group Inc., Tech Optics Ltd. y Stanlay.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPTICAL POWER METER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL TRENDS

4.4 PATENT ANALYSIS

4.5 VALUE CHAIN ANALYSIS

4.6 COMPANY COMPARATIVE ANALYSIS

4.6.1 YOKOGAWA ELECTRIC CORPORATION:

4.6.2 VIAVI SOLUTIONS INC.:

4.6.3 KEYSIGHT TECHNOLOGIES, INC.:

4.7 CASE STUDY

4.7.1 FAULT CAUSED BY ABNORMAL LIGHT-WAVE EMISSION FROM UNCONTROLLED ONU

4.7.2 FATAL DAMAGE TO THE OPTICAL FIBER END SURFACE OF THE CONNECTOR

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR OPTICAL POWER METERS

6.1.2 RISE IN REQUISITE OF TRANSMISSION QUALITY EVALUATION

6.1.3 GROWING NEED FOR REAL TIME ANALYSIS

6.1.4 INCREASE IN DEMAND FOR HIGH BANDWIDTH COMMUNICATION

6.1.5 ADVANCED FEATURES PROVIDED BY OPTICAL POWER METERS

6.2 RESTRAINTS

6.2.1 HIGH MANUFACTURING COST

6.2.2 COMPLICATED AND INFLEXIBLE OPERATION OF FIBER OPTIC POWER METERS

6.2.3 ISSUES WITH O-E AND E-O CONVERSIONS

6.3 OPPORTUNITIES

6.3.1 RISING POWER GRID PROBLEMS

6.3.2 INCREASING USE OF AUTOMATION

6.3.3 NEED FOR TECHNOLOGICAL ADVANCEMENTS

6.3.4 GROWING REQUIREMENT FOR LOW ATTENUATION APPLICATIONS

6.3.5 INTRODUCTION OF 5G NETWORK

6.4 CHALLENGES

6.4.1 LACK OF TECHNICAL KNOWLEDGE

6.4.2 DIFFICULTY IN MAINTAINING DYNAMIC RANGE

7 NORTH AMERICA OPTICAL POWER METER MARKET, BY TYPE

7.1 OVERVIEW

7.2 PHOTO DETECTORS

7.3 THERMAL DETECTORS

8 NORTH AMERICA OPTICAL POWER METER MARKET, BY INSTRUMENT/PRODUCT TYPE

8.1 OVERVIEW

8.2 HAND-HELD METER

8.2.1 MULTI MODE

8.2.2 SINGLE MODE

8.3 PORTABLE METER

8.4 BENCHTOP METER

8.5 OPTICAL WAVELENGTH

8.6 VIRTUAL METERS

8.7 OTHERS

9 NORTH AMERICA OPTICAL POWER METER MARKET, BY DETECTOR TYPE

9.1 OVERVIEW

9.2 GERMANIUM

9.3 SILICON

9.4 INGAAS (INDIUM GALLIUM ARSENIDE)

9.5 OTHERS

10 NORTH AMERICA OPTICAL POWER METER MARKET, BY POWER RANGE

10.1 OVERVIEW

10.2 MEDIUM

10.3 HIGH

10.4 LOW

11 NORTH AMERICA OPTICAL POWER METER MARKET, BY WAVELENGTH

11.1 OVERVIEW

11.2 850NM TO 1650NM

11.3 400NM TO 1100NM

12 NORTH AMERICA OPTICAL POWER METER MARKET, BY LIGHT SOURCE

12.1 OVERVIEW

12.2 LASER

12.3 LED

13 NORTH AMERICA OPTICAL POWER METER MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 TESTING

13.3 INSTALLATION & MAINTENANCE

13.4 MANUFACTURING

13.5 RESEARCH & DEVELOPMENT

13.6 OTHERS

14 NORTH AMERICA OPTICAL POWER METER MARKET, BY END-USER

14.1 OVERVIEW

14.2 TELECOMMUNICATION INDUSTRY

14.2.1 PHOTON DETECTORS

14.2.2 THERMAL DETECTORS

14.3 AUTOMOTIVE INDUSTRY

14.3.1 PHOTON DETECTORS

14.3.2 THERMAL DETECTORS

14.4 MILITARY & AEROSPACE INDUSTRY

14.4.1 PHOTON DETECTORS

14.4.2 THERMAL DETECTORS

14.5 ENERGY & UTILITIES INDUSTRY

14.5.1 PHOTON DETECTORS

14.5.2 THERMAL DETECTORS

14.6 ELECTRICAL & ELECTRONICS INDUSTRY

14.6.1 PHOTON DETECTORS

14.6.2 THERMAL DETECTORS

14.7 OTHERS

15 NORTH AMERICA OPTICAL POWER METER MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA OPTICAL POWER METER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILINGS

18.1 KEYSIGHT TECHNOLOGIES

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ANRITSU

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 NEWPORT CORPORATION (A SUBSIDIARY OF MKS INSTRUMENTS)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 YOKOGAWA TEST & MEASUREMENT CORPORATION (A SUBSIDIARY OF YOKOGAWA ELECTRIC CORPORATION)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HIOKI E.E. CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ADC CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AFL (SUBSIDIARY OF FUJIKURA, LTD.)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 APEX TECHNOLOGIES

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 ARTIFEX ENGINEERING GMBH & CO KG.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 BIOPTIC CO., LTD

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 COMSONICS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 DEVISER INSTRUMENTS

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 EDMUND OPTICS INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 EXFO INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 FLUKE CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 GAO TEK & GAO GROUP INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 JOINWIT

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 JONARD TOOLS

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 KINGFISHER INTERNATIONAL

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 OPHIR OPTRONICS SOLUTIONS LTD

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 OZ OPTICS LTD.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 PDR WORLD

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SANTEC CORPORATION

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 STANLAY

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 TECH OPTICS LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 THORLABS, INC.

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 VIAVI SOLUTIONS INC.

18.27.1 COMPANY SNAPSHOT

18.27.2 REVENUE ANALYSIS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA PHOTO DETECTORS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA THERMAL DETECTORS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA OPTICAL POWER METER MARKET, BY INSTRUMENT/PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA HAND-HELD METER IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA HAND-HELD METER IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA PORTABLE METER IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA BENCHTOP METER IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA OPTICAL WAVELENGTH IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA VIRTUAL METERS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA OTHERS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA OPTICAL POWER METER MARKET, BY DETECTOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA GERMANIUM IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA SILICON IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA INGAAS (INDIUM GALLIUM ARSENIDE) IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA OPTICAL POWER METER MARKET, BY POWER RANGE, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MEDIUM IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA HIGH IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA LOW IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA OPTICAL POWER METER MARKET, BY WAVELENGTH, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA 850NM TO 1650NM IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA 400NM TO 1100NM IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA OPTICAL POWER METER MARKET, BY LIGHT SOURCE, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA LASER IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA LED IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA OPTICAL POWER METER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TESTING IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA INSTALLATION & MAINTENANCE IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA MANUFACTURING IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA RESEARCH & DEVELOPMENT IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA OPTICAL POWER METER MARKET, BY END-USER 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA TELECOMMUNICATION INDUSTRY IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA TELECOMMUNICATION INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA AUTOMOTIVE INDUSTRY IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMOTIVE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA MILITARY & AEROSPACE INDUSTRY IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA MILITARY & AEROSPACE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA ENERGY & UTILITIES INDUSTRY IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA ENERGY & UTILITIES INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA ELECTRICAL & ELECTRONICS INDUSTRY IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRICAL & ELECTRONICS INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN OPTICAL POWER METER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA OPTICAL POWER METER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA OPTICAL POWER METER MARKET, BY INSTRUMENT/PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA HAND-HELD METER IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA OPTICAL POWER METER MARKET, BY DETECTOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA OPTICAL POWER METER MARKET, BY POWER RANGE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA OPTICAL POWER METER MARKET, BY WAVELENGTH, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA OPTICAL POWER METER MARKET, BY LIGHT SOURCE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA OPTICAL POWER METER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA OPTICAL POWER METER MARKET, BY END-USER 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA TELECOMMUNICATION INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA AUTOMOTIVE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA MILITARY & AEROSPACE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA ENERGY & UTILITIES INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA ELECTRICAL & ELECTRONICS INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. OPTICAL POWER METER MARKET, BY INSTRUMENT/PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. HAND-HELD METER IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. OPTICAL POWER METER MARKET, BY DETECTOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. OPTICAL POWER METER MARKET, BY POWER RANGE, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. OPTICAL POWER METER MARKET, BY WAVELENGTH, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. OPTICAL POWER METER MARKET, BY LIGHT SOURCE, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. OPTICAL POWER METER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. OPTICAL POWER METER MARKET, BY END-USER 2021-2030 (USD THOUSAND)

TABLE 69 U.S. TELECOMMUNICATION INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 U.S. AUTOMOTIVE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 U.S. MILITARY & AEROSPACE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. ENERGY & UTILITIES INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. ELECTRICAL & ELECTRONICS INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 CANADA OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 CANADA OPTICAL POWER METER MARKET, BY INSTRUMENT/PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 CANADA HAND-HELD METER IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA OPTICAL POWER METER MARKET, BY DETECTOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA OPTICAL POWER METER MARKET, BY POWER RANGE, 2021-2030 (USD THOUSAND)

TABLE 79 CANADA OPTICAL POWER METER MARKET, BY WAVELENGTH, 2021-2030 (USD THOUSAND)

TABLE 80 CANADA OPTICAL POWER METER MARKET, BY LIGHT SOURCE, 2021-2030 (USD THOUSAND)

TABLE 81 CANADA OPTICAL POWER METER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 82 CANADA OPTICAL POWER METER MARKET, BY END-USER 2021-2030 (USD THOUSAND)

TABLE 83 CANADA TELECOMMUNICATION INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 CANADA AUTOMOTIVE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 CANADA MILITARY & AEROSPACE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 CANADA ENERGY & UTILITIES INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 CANADA ELECTRICAL & ELECTRONICS INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 MEXICO OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 MEXICO OPTICAL POWER METER MARKET, BY INSTRUMENT/PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 MEXICO HAND-HELD METER IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 MEXICO OPTICAL POWER METER MARKET, BY DETECTOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 MEXICO OPTICAL POWER METER MARKET, BY POWER RANGE, 2021-2030 (USD THOUSAND)

TABLE 93 MEXICO OPTICAL POWER METER MARKET, BY WAVELENGTH, 2021-2030 (USD THOUSAND)

TABLE 94 MEXICO OPTICAL POWER METER MARKET, BY LIGHT SOURCE, 2021-2030 (USD THOUSAND)

TABLE 95 MEXICO OPTICAL POWER METER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 MEXICO OPTICAL POWER METER MARKET, BY END-USER 2021-2030 (USD THOUSAND)

TABLE 97 MEXICO TELECOMMUNICATION INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 MEXICO AUTOMOTIVE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 MEXICO MILITARY & AEROSPACE INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MEXICO ENERGY & UTILITIES INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MEXICO ELECTRICAL & ELECTRONICS INDUSTRY IN OPTICAL POWER METER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA OPTICAL POWER METER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPTICAL POWER METER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPTICAL POWER METER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPTICAL POWER METER MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPTICAL POWER METER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPTICAL POWER METER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPTICAL POWER METER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA OPTICAL POWER METER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA OPTICAL POWER METER MARKET: TYPE LIFE LINE CURVE

FIGURE 10 NORTH AMERICA OPTICAL POWER METER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA OPTICAL POWER METER MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR OPTICAL POWER METERS IN THE TELECOMMUNICATION INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA OPTICAL POWER METER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OPTICAL POWER METER MARKET IN 2023 AND 2030

FIGURE 14 VALUE CHAIN ANALYSIS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA OPTICAL POWER METER MARKET

FIGURE 16 NORTH AMERICA OPTICAL POWER METER MARKET: BY TYPE, 2022

FIGURE 17 NORTH AMERICA OPTICAL POWER METER MARKET: BY INSTRUMENT/PRODUCT TYPE, 2022

FIGURE 18 NORTH AMERICA OPTICAL POWER METER MARKET, BY DETECTOR TYPE, 2022

FIGURE 19 NORTH AMERICA OPTICAL POWER METER MARKET: BY POWER RANGE, 2022

FIGURE 20 NORTH AMERICA OPTICAL POWER METER MARKET: BY WAVELENGTH, 2022

FIGURE 21 NORTH AMERICA OPTICAL POWER METER MARKET, BY LIGHT SOURCE, 2022

FIGURE 22 NORTH AMERICA OPTICAL POWER METER MARKET, BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA OPTICAL POWER METER MARKET, BY END-USER, 2022

FIGURE 24 NORTH AMERICA OPTICAL POWER METER MARKET: SNAPSHOT (2022)

FIGURE 25 NORTH AMERICA OPTICAL POWER METER MARKET: BY COUNTRY (2022)

FIGURE 26 NORTH AMERICA OPTICAL POWER METER MARKET: BY COUNTRY (2023-2030)

FIGURE 27 NORTH AMERICA OPTICAL POWER METER MARKET: BY COUNTRY (2022-2030)

FIGURE 28 NORTH AMERICA OPTICAL POWER METER MARKET: BY TYPE (2023-2030)

FIGURE 29 NORTH AMERICA OPTICAL POWER METER MARKET: COMPANY SHARE 2022(%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.