North America Ophthalmology Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

31.77 Billion

USD

52.37 Billion

2024

2032

USD

31.77 Billion

USD

52.37 Billion

2024

2032

| 2025 –2032 | |

| USD 31.77 Billion | |

| USD 52.37 Billion | |

|

|

|

Segmentación del mercado de oftalmología en América del Norte, por productos (dispositivos, medicamentos y otros), enfermedades (cataratas, trastornos refractivos, glaucoma, degeneración macular relacionada con la edad, enfermedades inflamatorias y otras), examen ocular integral (refracción, prueba de agudeza visual, presión intraocular, segmento anterior y examen pupilar, prueba de campos visuales, prueba de visión del color y otras), usuario final (clínicas, hospitales, atención médica domiciliaria y otros), canal de distribución (ventas minoristas, licitación directa y otros) - Tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de oftalmología en América del Norte

El mercado de la oftalmología en América del Norte ha evolucionado significativamente a lo largo de los siglos, comenzando con los tratamientos antiguos para las enfermedades oculares en Egipto y Grecia. El campo comenzó a tomar forma en los siglos XVII y XVIII, con el desarrollo de técnicas y herramientas quirúrgicas más avanzadas. En el siglo XIX, innovaciones como el oftalmoscopio transformaron las capacidades de diagnóstico. El siglo XX fue testigo de avances como la cirugía de cataratas y la invención de las lentes intraoculares, junto con la llegada de la cirugía LASIK en la década de 1990. El siglo XXI trajo consigo un crecimiento continuo impulsado por el envejecimiento de la población, los avances tecnológicos y el desarrollo de dispositivos quirúrgicos y de diagnóstico especializados, incluida la tomografía de coherencia óptica (OCT) y los sistemas de imágenes de retina. Las tendencias recientes se centran en el uso creciente de la inteligencia artificial, la telemedicina y las terapias biológicas, como la terapia génica y los tratamientos con células madre, lo que ha dado forma aún más al crecimiento del mercado. Hoy en día, el mercado de la oftalmología continúa expandiéndose debido a la creciente prevalencia de enfermedades oculares, las nuevas tecnologías y la evolución de las opciones de tratamiento.

Tamaño del mercado de oftalmología en América del Norte

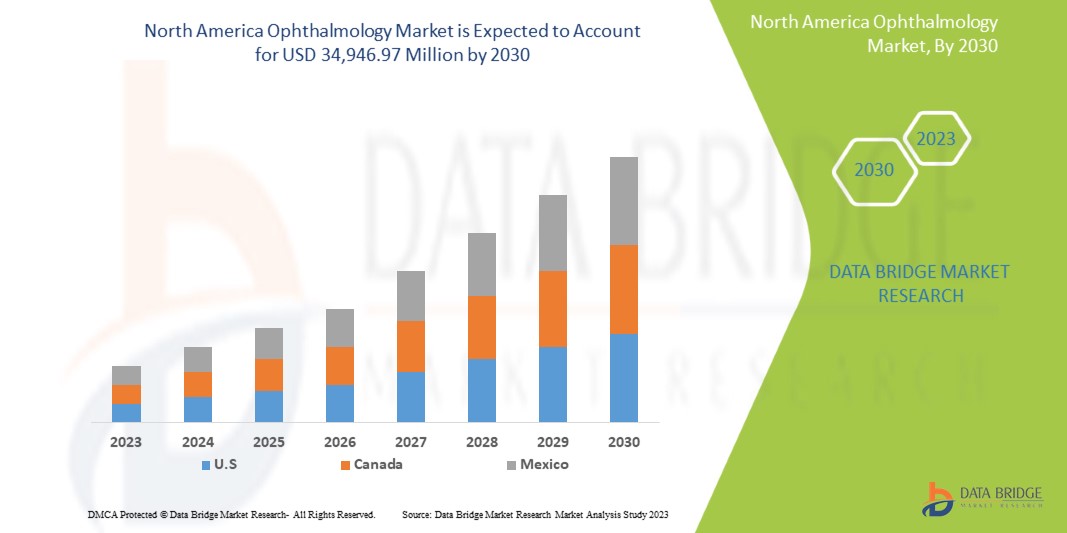

Se espera que el mercado de oftalmología de América del Norte alcance los USD 52,37 mil millones para 2032 desde USD 31,77 mil millones en 2024, creciendo a una CAGR del 6,5% en el período de pronóstico de 2025 a 2032.

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado de oftalmología en América del Norte

“La creciente adopción de la telemedicina y de herramientas de diagnóstico basadas en inteligencia artificial”

El mercado de oftalmología de América del Norte está adoptando cada vez más la telemedicina y las herramientas de diagnóstico impulsadas por IA. Estas innovaciones están transformando la forma en que se brinda atención oftalmológica al permitir consultas y exámenes a distancia, lo que aumenta la accesibilidad, especialmente en áreas rurales y desatendidas. Las tecnologías de IA, incluidos los algoritmos de aprendizaje automático, se están utilizando para analizar imágenes de la retina, detectar signos tempranos de afecciones como la retinopatía diabética, el glaucoma y la degeneración macular, y proporcionar diagnósticos más rápidos y precisos. Las plataformas de telemedicina permiten a los pacientes conectarse con oftalmólogos para consultas de seguimiento, lo que reduce la necesidad de visitas en persona y hace que la atención oftalmológica sea más conveniente y eficiente. Esta tendencia no solo está mejorando el acceso de los pacientes a tratamientos oportunos, sino que también mejora la eficiencia general de los sistemas de atención médica, lo que la convierte en un impulsor clave del crecimiento del mercado en el sector de la oftalmología. Como resultado, se espera que la integración de estas tecnologías continúe expandiéndose, particularmente en los mercados emergentes, donde la infraestructura de atención médica aún está en desarrollo.

Alcance del informe y segmentación del mercado de oftalmología en América del Norte

|

Atributos |

Perspectivas del mercado de oftalmología en América del Norte |

|

Segmentos cubiertos |

Productos secundarios : dispositivos, medicamentos y otros Por enfermedades : cataratas, trastornos refractivos, glaucoma, degeneración macular relacionada con la edad, enfermedades inflamatorias y otras Mediante examen ocular completo : refracción, prueba de agudeza visual, presión intraocular, examen del segmento anterior y pupilar, prueba de campos visuales, prueba de visión del color y otros Por usuario final : clínicas, hospitales, atención médica domiciliaria y otros Por canal de distribución : Ventas minoristas, licitación directa y otros |

|

Región cubierta |

Estados Unidos, Canadá y México |

|

Actores clave del mercado |

Alcon (Suiza), Bausch + Lomb (Canadá), Carl Zeiss Meditec (Alemania), Hoya Corporation (Japón), Johnson & Johnson Services, Inc. (EE. UU.), Essilor International (Francia), Topcon Corporation (Japón), Glaukos Corporation (EE. UU.), Haag-Streit Group (Suiza), Nidek Co., Ltd (EE. UU.), Staar Surgical (California), Ziemer Ophthalmic Systems Ag (Suiza), Cooper Companies (EE. UU.), Lumenis Be Ltd. (Israel), Reichert Inc. (Nueva York), Bayer Ag (Alemania), Novartis Ag (Suiza), Abbvie Inc. (EE. UU.), F. Hoffmann-La Roche Ltd. (Suiza), Dompé (Italia), Santen Pharmaceutical Co. (Japón), Ltd entre otros. |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de oftalmología en América del Norte

La oftalmología es una rama de la medicina y la cirugía que se centra en el diagnóstico, el tratamiento y la prevención de los trastornos y enfermedades oculares. Incluye la atención médica y quirúrgica de las afecciones que afectan a los ojos y al sistema visual, como las cataratas, el glaucoma, la degeneración macular y la retinopatía diabética.

Dinámica de definición del mercado de oftalmología en América del Norte

Conductores

- Aumento de la prevalencia de enfermedades oculares

La creciente prevalencia de enfermedades oculares, como cataratas, degeneración macular y retinopatía diabética, es un factor importante que impulsa el mercado de la oftalmología en América del Norte. A medida que la población de América del Norte envejece, aumenta la incidencia de estas enfermedades. Las cataratas, que provocan visión borrosa y ceguera, exigen un mercado en expansión para cirugías y tratamientos correctivos. De manera similar, la degeneración macular y la retinopatía diabética contribuyen a la necesidad de herramientas de diagnóstico avanzadas y terapias especializadas. El creciente número de personas afectadas asegura una demanda sostenida de servicios de atención oftalmológica, incluidas cirugías, medicamentos y tecnologías de diagnóstico innovadoras. Este aumento de las enfermedades oculares impulsa directamente la expansión del mercado, ya que los proveedores de atención médica y los fabricantes se esfuerzan por satisfacer la creciente necesidad de tratamientos y soluciones eficaces.

Por ejemplo,

- En julio de 2022, según el artículo publicado por NCBI, la prevalencia de ceguera aumenta con la edad, pasando del 0,45 % en las personas de 50 a 59 años al 11,62 % en las personas de 80 años o más. Las mujeres (2,31 %) y los residentes rurales (2,14 %) experimentan tasas más altas. La discapacidad visual también afecta al 26,68 % de los participantes, mostrando tendencias similares. Esta creciente carga de enfermedades oculares, especialmente entre los ancianos, impulsa la demanda de tratamientos y tecnologías oftálmicas, impulsando el mercado de la oftalmología.

- En agosto de 2023, según el artículo publicado por la OMS, América del Norte, más de 2200 millones de personas padecen problemas de visión, y casi 1000 millones de casos son prevenibles o no se tratan. Esta creciente prevalencia de problemas de visión pone de relieve la creciente demanda de servicios, tratamientos y soluciones correctivas para el cuidado de los ojos. A medida que más personas buscan atención médica para afecciones prevenibles o no resueltas, la creciente carga de enfermedades oculares actúa como un importante impulsor del mercado de la oftalmología.

La creciente prevalencia de enfermedades oculares relacionadas con la edad, como cataratas, degeneración macular y retinopatía diabética, está impulsando el mercado de la oftalmología en América del Norte. A medida que la población envejece, estas enfermedades se vuelven más comunes, lo que aumenta la demanda de tratamientos, cirugías y herramientas de diagnóstico. La necesidad de tecnologías y terapias avanzadas aumenta a medida que más personas requieren atención. Este aumento de las enfermedades oculares impulsa el crecimiento del mercado, ya que los proveedores de atención médica y los fabricantes apuntan a satisfacer la creciente demanda de soluciones efectivas.

- Centrarse en el cuidado preventivo de los ojos

Cada vez se hace más hincapié en la atención preventiva de los ojos y en la detección temprana de problemas relacionados con la visión, lo que desempeña un papel importante en el impulso del mercado de la oftalmología en América del Norte. A medida que aumenta la conciencia sobre la importancia de la salud ocular, más personas buscan controles oculares de rutina para detectar afecciones como el glaucoma, la retinopatía diabética y las cataratas en sus primeras etapas. El diagnóstico temprano permite intervenciones oportunas, lo que reduce el riesgo de pérdida de visión y mejora la salud ocular general. Este enfoque proactivo no solo mejora los resultados de los pacientes, sino que también impulsa la demanda de servicios oftálmicos, herramientas de diagnóstico y tratamientos correctivos. El enfoque creciente en la atención preventiva está generando un aumento de las inversiones en tecnologías para el cuidado de los ojos, dispositivos y servicios oftálmicos, lo que contribuye a la expansión del mercado. Esta tendencia actúa fuertemente como un motor de crecimiento en el sector de la oftalmología.

Por ejemplo,

- En octubre de 2022, según el artículo publicado por el Instituto Nacional del Ojo, el Programa Nacional de Educación sobre la Salud Ocular (NEHEP, por sus siglas en inglés) colabora con los profesionales de la salud para promover la concienciación sobre la detección temprana, el tratamiento de las enfermedades oculares y los beneficios de la rehabilitación de la visión. También se dirige a las poblaciones con alto riesgo de sufrir enfermedades oculares y pérdida de la visión. Este enfoque en la atención preventiva anima a las personas a buscar controles y tratamientos oculares oportunos, lo que impulsa la demanda de servicios oftálmicos, herramientas de diagnóstico y productos, impulsando así el mercado de la oftalmología.

- En octubre de 2024, según el artículo publicado por la Dirección General de Servicios de Salud, el Programa Nacional para el Control de la Ceguera y la Deficiencia Visual (NPCB&VI) tiene como objetivo reducir la prevalencia de la ceguera mediante la identificación y el tratamiento de la ceguera curable en todos los niveles de atención médica. Al centrarse en la detección temprana y abordar la ceguera evitable, el programa destaca la importancia de la atención preventiva. Esta iniciativa impulsa la demanda de servicios de atención oftalmológica, herramientas de diagnóstico y tratamientos, lo que contribuye significativamente al crecimiento del mercado de oftalmología en América del Norte.

El creciente enfoque en el cuidado preventivo de los ojos y la detección temprana está impulsando significativamente el mercado de la oftalmología en América del Norte. A medida que aumenta la conciencia sobre la salud ocular, más personas optan por exámenes oculares de rutina para identificar afecciones como el glaucoma y las cataratas de manera temprana. La detección temprana permite tratamientos efectivos que previenen una mayor pérdida de visión. Este enfoque proactivo está impulsando la demanda de herramientas de diagnóstico, servicios oftálmicos y tratamientos correctivos. La creciente importancia de la atención preventiva está impulsando la inversión en tecnologías avanzadas para el cuidado de los ojos, lo que contribuye al crecimiento general del mercado de la oftalmología y garantiza su expansión continua.

Oportunidades

- Aumento de la población que envejece

El aumento de la población que envejece presenta una oportunidad significativa para el mercado de oftalmología de América del Norte, ya que las personas mayores son más susceptibles a diversos trastornos y enfermedades oculares. Afecciones como cataratas, degeneración macular relacionada con la edad (DMRE), retinopatía diabética y glaucoma son frecuentes entre los ancianos, lo que genera una demanda sustancial de atención y tratamientos oftálmicos. Como resultado, los sistemas de atención médica y los proveedores de servicios oftálmicos están preparados para expandir sus servicios, mejorar las opciones diagnósticas y terapéuticas y atender las necesidades únicas de este grupo demográfico. Esta creciente base de pacientes requiere una variedad de soluciones, desde intervenciones quirúrgicas y terapias farmacológicas avanzadas hasta productos para la corrección de la visión, lo que garantiza una demanda constante y creciente de procedimientos y productos oftálmicos.

Por ejemplo,

- En marzo de 2023, según un artículo publicado en la Biblioteca Nacional de Medicina, las cataratas son una de las principales causas de discapacidad visual en la vejez. La opacificación del cristalino está notoriamente asociada con varias afecciones geriátricas, como la fragilidad, el riesgo de caídas, la depresión y el deterioro cognitivo. Además, según la misma fuente, en 2020, las principales causas mundiales de ceguera en pacientes de 50 años o más fueron las cataratas, seguidas del glaucoma, el error refractivo subcorregido, la degeneración macular relacionada con la edad y la retinopatía diabética.

- En agosto de 2022, según un artículo publicado en la Academia Estadounidense de Oftalmología, la DMAE es una enfermedad ocular común, que generalmente se encuentra en adultos mayores de 50 años. Además, se afirma que la mitad de los estadounidenses mayores de 75 años desarrollan cataratas.

Además, abordar las necesidades de salud ocular de la población que envejece puede estimular más inversiones en investigación y desarrollo dentro del sector de la oftalmología. Las compañías farmacéuticas y los fabricantes de dispositivos médicos se centran en crear soluciones innovadoras diseñadas específicamente para las afecciones relacionadas con la edad, lo que podría conducir a avances en los protocolos de tratamiento y la atención al paciente. La integración de nuevas tecnologías, como la teleoftalmología y las técnicas de diagnóstico por imagen avanzadas, facilitan una mejor gestión de la salud ocular en los adultos mayores, lo que hace que sea más fácil controlar y tratar las afecciones de forma remota. En general, el envejecimiento de la población amplifica la necesidad de los servicios oftálmicos existentes y presenta un terreno fértil para la innovación y el crecimiento dentro del mercado de oftalmología de América del Norte.

- Aumento de las plataformas de venta minorista en línea y de salud electrónica

El auge de las plataformas de venta minorista en línea y de salud electrónica ofrece una oportunidad significativa para el mercado de oftalmología de América del Norte, ya que ofrece a los consumidores un acceso más fácil a una amplia gama de productos y servicios para el cuidado de los ojos. Con la creciente adopción del comercio electrónico, los pacientes pueden comprar cómodamente artículos como anteojos recetados, lentes de contacto y productos de venta libre para el cuidado de los ojos desde la comodidad de sus hogares. Esta tendencia es especialmente atractiva para los consumidores más jóvenes y expertos en tecnología, y para aquellos que viven en áreas remotas con acceso limitado a las tiendas de óptica tradicionales. La capacidad de comparar precios, leer reseñas y acceder a una gama más amplia de productos en línea mejora la satisfacción del cliente y fomenta el uso, impulsando así el crecimiento en el segmento de productos oftálmicos.

Por ejemplo,

- En septiembre de 2023, según un artículo de The Times of India, el brote de "conjuntivitis" provocó un aumento en las ventas de medicamentos oftalmológicos. Las ventas aumentaron casi un 30% interanual por segundo mes consecutivo en agosto, superando al mercado general en casi cinco veces. El aumento refleja la incidencia masiva de conjuntivitis y complicaciones oculares en los últimos meses en todo el país.

- En abril de 2020, según un artículo, 'Opiniones de los pacientes sobre la compra online de gafas', la compra online de lentes de contacto está en aumento: entre el 10% y el 20% de los usuarios de lentes de contacto en Australia, EE. UU. y el Reino Unido han considerado o investigado la posibilidad de comprar por Internet.

Además de las oportunidades de venta minorista, las plataformas de salud electrónica facilitan servicios de telesalud que permiten a los pacientes consultar con profesionales de la salud ocular de forma remota. Las consultas virtuales para exámenes oculares de rutina, seguimientos y triaje para afecciones más graves pueden mejorar significativamente el acceso a la atención, en particular para adultos mayores o personas con problemas de movilidad. Estas plataformas mejoran la participación de los pacientes y la adherencia a las recomendaciones de salud ocular y permiten a los oftalmólogos llegar a una base de pacientes más amplia sin las limitaciones de los límites geográficos. Además, la integración de herramientas de salud digital, como aplicaciones móviles para monitorear la salud ocular o controlar enfermedades crónicas, puede crear una experiencia fluida para el paciente y fomentar la atención ocular proactiva, impulsando aún más el crecimiento en el mercado de la oftalmología.

Restricciones/Desafíos

- Efectos secundarios y complicaciones relacionadas con las cirugías oculares

A pesar de los avances significativos en los tratamientos oftalmológicos, ciertos procedimientos oftálmicos, en particular las intervenciones quirúrgicas, conllevan riesgos de efectos secundarios y complicaciones como infecciones, cicatrices o deterioro de la visión. Estos riesgos potenciales pueden disuadir a los pacientes de someterse a terapias específicas, especialmente aquellas que implican procedimientos invasivos. El miedo a los resultados adversos, como la reducción de la visión o tiempos de recuperación prolongados, puede generar dudas a la hora de buscar tratamiento, lo que limita la adopción general de ciertas terapias. Además, las complicaciones derivadas de las cirugías pueden requerir tratamientos adicionales, lo que aumenta aún más los costos de la atención médica y afecta la confianza de los pacientes en los tratamientos avanzados. Esta renuencia a someterse a tratamientos debido a la posibilidad de efectos secundarios negativos restringe el crecimiento general del mercado de la oftalmología al frenar la adopción de nuevas tecnologías y terapias.

Por ejemplo,

- En octubre de 2024, según el artículo publicado por Harvard Health, las cirugías oculares modernas, si bien son efectivas para tratar afecciones como las cataratas y el glaucoma, a menudo provocan complicaciones como la enfermedad del ojo seco, caracterizada por una sensación de ardor, arenilla o picazón. Este efecto secundario puede resultar incómodo y desalentador para los pacientes, lo que lleva a algunos a dudar o evitar las cirugías oculares. Como resultado, las complicaciones de los tratamientos actúan como un freno al crecimiento del mercado de la oftalmología.

- En julio de 2021, según el artículo publicado por Medical News Today, hasta el 95% de las personas que se someten a una cirugía ocular con láser pueden experimentar ojos secos, mientras que el 20% informa alteraciones visuales como deslumbramiento o halos. Además, 1 de cada 50 personas puede sufrir visión borrosa o síndrome de las “arenas del Sahara”. Estos efectos secundarios pueden disuadir a los pacientes de optar por la cirugía, lo que limita la adopción de procedimientos con láser y actúa como un freno al crecimiento del mercado de la oftalmología.

A pesar de los avances en oftalmología, algunos tratamientos quirúrgicos conllevan riesgos como infecciones, cicatrices o deterioro de la visión. Estas complicaciones pueden disuadir a los pacientes de optar por ciertas terapias, en particular los procedimientos invasivos. El miedo a los resultados adversos y a los costos adicionales del tratamiento puede obstaculizar la disposición de los pacientes a buscar atención, lo que frena la adopción de nuevos tratamientos. Esta renuencia limita el crecimiento del mercado de oftalmología en América del Norte.

- Acceso limitado a atención oftalmológica especializada en zonas rurales

A pesar de los avances en la infraestructura de atención médica, el acceso a la atención oftálmica especializada sigue siendo limitado en las áreas rurales y remotas, lo que obstaculiza significativamente el potencial de crecimiento del mercado de la oftalmología en estas regiones. Muchas poblaciones rurales aún enfrentan desafíos como la falta de profesionales capacitados en el cuidado de los ojos, instalaciones inadecuadas y acceso limitado a tecnologías avanzadas de diagnóstico y tratamiento. Como resultado, las personas en estas áreas a menudo tienen dificultades para recibir un diagnóstico y tratamiento oportunos para las afecciones oculares, lo que lleva a una mayor incidencia de ceguera evitable y deterioro de la visión. La disponibilidad limitada de atención especializada restringe la expansión del mercado al reducir la adopción de servicios y productos avanzados para el cuidado de los ojos. Esta barrera al acceso continúa actuando como una restricción importante para el crecimiento general del mercado de oftalmología de América del Norte.

Por ejemplo,

- En febrero de 2023, según el artículo publicado por NCBI, la gran población rural de la India enfrenta importantes necesidades de atención oftalmológica insatisfechas, y la mayoría de las instalaciones y profesionales se concentran en áreas urbanas y semiurbanas. La disparidad en el acceso a la atención oftalmológica entre las regiones rurales y urbanas sigue siendo un desafío, ya que limita la disponibilidad de tratamientos. Esta distribución desigual de los recursos de atención médica restringe el crecimiento del mercado de oftalmología de América del Norte al impedir el acceso generalizado a servicios esenciales en las áreas rurales.

- En marzo de 2024, según el artículo publicado por Research Gate, la falta de conectividad y personal capacitado en áreas remotas dificulta el acceso a la atención oftalmológica continua, incluso después de los campamentos oftalmológicos exitosos. Los pacientes en estas áreas tienen dificultades para recibir atención de seguimiento o tratamientos avanzados debido a la ausencia de la infraestructura adecuada. Esta brecha en la prestación de atención médica limita el alcance y la eficacia de los programas de atención oftalmológica, lo que actúa como una restricción para el crecimiento del mercado de oftalmología de América del Norte.

El acceso a la atención oftalmológica especializada sigue siendo limitado en las zonas rurales, a pesar de las mejoras en la atención sanitaria. La falta de profesionales de la atención oftalmológica, tecnología avanzada e instalaciones impide el tratamiento y el diagnóstico oportunos, lo que conduce a tasas más altas de ceguera evitable. Este acceso limitado obstaculiza el crecimiento del mercado de oftalmología en América del Norte al restringir la adopción de tratamientos y servicios avanzados en estas regiones.

Alcance del mercado de oftalmología en América del Norte

El mercado está segmentado en función de los productos, las enfermedades, el examen ocular completo, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por productos

- Dispositivo

- Dispositivo quirúrgico

- Dispositivos quirúrgicos para cataratas

- Dispositivos viscoelásticos oftálmicos

- Dispositivos de facoemulsificación

- Láseres quirúrgicos para cataratas

- Inyectores de LIO

- Dispositivos quirúrgicos vitreorretinianos

- Máquinas de vitrectomía

- Paquetes vítreorretinianos

- Láseres de fotocoagulación

- Sondas de vitrectomía

- Dispositivos de iluminación

- Dispositivos quirúrgicos refractivos

- Láseres de femtosegundo

- Láseres excimer

- Otros láseres quirúrgicos refractivos

- Dispositivos quirúrgicos para el glaucoma

- Dispositivos de drenaje para el glaucoma

- Dispositivos para cirugía microinvasiva de glaucoma

- Sistemas láser para el glaucoma

- Dispositivo de diagnóstico

- Tomografía de coherencia óptica (OCT)

- Autorefractores y queratómetros

- Tonómetros

- Forópteros

- Retinoscopios

- Oftalmoscopios

- Lámparas de hendidura

- Analizadores de perímetros/campos visuales

- Sistemas de topografía corneal

- Cámaras de fondo de ojo

- Sistemas de imágenes por ultrasonidos oftálmicos

- Sistema de imágenes A-Scan

- Sistema de imágenes B-Scan

- Paquímetros

- Biomicroscopios ultrasónicos

- Lensómetros

- Aberrómetros de frente de onda

- Sistemas de biometría óptica

- Microscopios especulares

- Proyectores de gráficos

- Accesorios quirúrgicos oftálmicos

- Instrumentos y kits quirúrgicos

- Pinzas oftálmicas

- Espátula oftálmica

- Puntas y mangos oftálmicos

- Cánulas oftálmicas

- Tijeras oftálmicas

- Otros accesorios quirúrgicos

- Microscopios oftálmicos

- Dispositivo quirúrgico

- Medicamentos, subproductos

- Medicamentos anti-VEGF

- Ranibizumab

- Bevacizumab

- Medicamentos para tratar los trastornos de la retina

- Medicamentos contra el glaucoma

- Análogos de prostaglandinas

- Latanoprost

- Bimatoprost

- Travoprost

- Tafluprost

- Latanoprosteno

- Antagonistas adrenérgicos BETA

- Maleato de timolal

- Betaxolol

- Agonistas alfa adrenérgicos

- Epinefrina

- Depiveprina

- Mióticos

- Pilocarpina

- Eserina

- Análogos de prostaglandinas

- Medicamentos para el ojo seco

- Medicamentos antiinflamatorios

- Medicamentos antiinflamatorios esteroides

- Medicamentos antiinflamatorios no esteroides

- Medicamentos para la conjuntivitis alérgica

- Otros

- Medicamentos anti-VEGF

- Medicamentos, por tipo de medicamento

- De marca

- Genérico

- Medicamentos, según el modo de prescripción

- Prescripción

- En el mostrador

- Medicamentos, por vía de administración

- Actual

- Gotas para los ojos

- Solución para los ojos

- Cremas y ungüentos

- Gel

- Otros

- Ocular local

- Intravítreo

- Subconjuntival

- Retrobulbar

- Intracameral

- Inyectables

- Intramuscular

- Intravenoso

- Otros

- Oral

- Tableta

- Cápsulas

- Otros

- Otros

- Actual

- Otros

- Productos para el cuidado de la vista

- Gafas

- Lentes de contacto

- Lentes de contacto blandas

- Lentes de contacto híbridos

- Lentes rígidos permeables al gas

- Otros

- Productos para el cuidado de la vista

Por enfermedades

- Catarata

- Trastornos refractivos

- Glaucoma

- Degeneración macular relacionada con la edad

- Enfermedades inflamatorias

- Otros

Mediante un examen ocular completo

- Refracción

- Refractómetros automáticos

- Juego de lentes de prueba

- Medicamentos ciclopléjicos

- Marco de prueba

- Retinoscopio autoiluminado/de espejo

- Cilindro de cruz de Jackson

- Prueba de agudeza visual

- Diagrama de Snellen

- Gráficos de visión cercana

- Presión intraocular

- Tonómetros (Goldmann, Tono-Pen, Perkins, Shiotz)

- Otros

- Examen del segmento anterior y pupilar

- Biomicroscopio con lámpara de hendidura

- Luz de antorcha

- Prueba de campos visuales

- Analizador de campo visual Humphrey de umbral completo Central 30-2

- Perímetro de duplicación de frecuencia

- Perímetro cinético de Goldmann

- Prueba de visión del color

- Otros

Por el usuario final

- Clínicas

- Hospitales

- Atención médica domiciliaria

- Otros

Por canal de distribución

- Ventas al por menor

- Tiendas minoristas

- Farmacia hospitalaria

- Farmacia en línea

- Licitación directa

- Otros

Análisis regional del mercado de oftalmología en América del Norte

El mercado está segmentado en función de productos, enfermedades, examen ocular integral, usuario final y canal de distribución.

Los países cubiertos en este mercado son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado debido a su avanzada infraestructura sanitaria, el elevado gasto en atención sanitaria y una gran población envejecida con una creciente prevalencia de enfermedades oculares. Además, las importantes inversiones en investigación, desarrollo y adopción de tecnologías de vanguardia impulsan el liderazgo del mercado en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de oftalmología en América del Norte

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de oftalmología de América del Norte que operan en el mercado son:

- Alcon (Suiza)

- Bausch + Lomb (Canadá)

- Carl Zeiss Meditec (Alemania)

- Corporación Hoya (Japón)

- Johnson & Johnson Services, Inc. (Estados Unidos)

- Essilor Internacional (Francia)

- Corporación Topcon (Japón)

- Corporación Glaukos (Estados Unidos)

- Grupo Haag-Streit (Suiza)

- Nidek Co., Ltd (Estados Unidos)

- Cirugía Staar (California)

- Ziemer Ophthalmic Systems Ag (Suiza)

- Cooper Companies (Estados Unidos)

- Lumenis Be Ltd. (Israel)

- Reichert Inc. (Nueva York)

- Bayer Ag (Alemania)

- Novartis Ag (Suiza)

- Abbvie Inc. (Estados Unidos)

- F. Hoffmann-La Roche Ltd. (Suiza)

- Dompé (Italia)

- Santen Pharmaceutical Co. (Japón), Ltd.

Últimos avances en el mercado de oftalmología en América del Norte

- En octubre de 2024, en la reunión AAO 2024, Alcon presentó sus innovaciones, incluido el Voyager DSLT para el tratamiento del glaucoma, los sistemas portátiles de suministro de gas UNIFEYE y UNIPEXY y datos fundamentales para AR-15512, un tratamiento para el ojo seco. Estos avances apuntaban a mejorar los resultados y la eficiencia quirúrgica.

- En septiembre de 2024, EssilorLuxottica y Meta ampliarán su colaboración y firmarán un acuerdo a largo plazo para desarrollar gafas inteligentes multigeneracionales. Basándose en el éxito de las gafas Ray-Ban Meta, las empresas aspiran a dar forma juntas al futuro de la tecnología portátil

- En OCTUBRE DE 2024, Bausch + Lomb presentó nuevos datos científicos y eventos educativos en la reunión de la AAO de 2024 en Chicago. Entre los aspectos más destacados se incluyeron estudios sobre la lente intraocular enVista Envy, el láser excimer TENEO, VYZULTA y presentaciones sobre Blink Nutritears, MIEBO y Xiidra.

- En abril de 2024, AbbVie completó la adquisición de Cerevel Therapeutics, lo que mejoró su cartera de productos en neurociencia. La adquisición incluye los prometedores activos en etapa clínica de Cerevel, como emraclidina para la esquizofrenia y tavapadon para la enfermedad de Parkinson, lo que fortalece la posición de AbbVie en neurología y psiquiatría.

- En septiembre de 2023, Novartis completó la desinversión de sus activos de oftalmología "front of eye" a Bausch + Lomb por hasta USD 2.500 millones, incluidos USD 1.750 millones en efectivo por adelantado y posibles pagos por hitos. El acuerdo incluyó Xiidra, SAF312, AcuStream y OJL332. Novartis avanzó en su estrategia para centrarse en áreas terapéuticas prioritarias para el crecimiento futuro

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 NORTH AMERICA OPHTHALMOLOGY MARKET : REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF EYE DISEASES

6.1.2 FOCUS ON PREVENTATIVE EYE CARE

6.1.3 GOVERNMENT EYECARE INITIATIVES

6.1.4 INNOVATIONS IN OPHTHALMIC SURGICAL TECHNIQUES

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS AND COMPLICATIONS RELATED TO EYE SURGERIES

6.2.2 LIMITED ACCESS TO SPECIALIZED OPHTHALMIC CARE IN RURAL AREAS

6.3 OPPORTUNITIES

6.3.1 RISE IN THE AGING POPULATION

6.3.2 RISE IN ONLINE RETAIL AND E-HEALTH PLATFORMS

6.3.3 ENHANCED PATIENT EDUCATION

6.4 CHALLENGES

6.4.1 RISING COSTS OF OPHTHALMIC TREATMENTS

6.4.2 SHORTAGE OF EYE CARE PROFESSIONALS

7 NORTH AMERICA OPHTHALMOLOGY MARKETNORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 DEVICE

7.2.1 SURGICAL DEVICE

7.2.1.1 CATARACT SURGICAL DEVICES

7.2.1.2 OPHTHALMIC VISCOELASTIC DEVICES

7.2.1.2.1 PHACOEMULSIFICATION DEVICES

7.2.1.2.2 CATARACT SURGICAL LASERS

7.2.1.2.3 IOL INJECTORS

7.2.1.3 VITREORETINAL SURGICAL DEVICES

7.2.1.3.1 VITREORETINAL PACKS

7.2.1.3.2 VITRECTOMY MACHINES

7.2.1.3.3 VITRECTOMY PROBES

7.2.1.3.4 PHOTOCOAGULATION LASERS

7.2.1.3.5 ILLUMINATION DEVICES

7.2.1.4 REFRACTIVE SURGICAL DEVICES

7.2.1.4.1 FEMTOSECOND LASERS

7.2.1.4.2 EXCIMER LASERS

7.2.1.4.3 OTHER REFRACTIVE SURGICAL LASERS

7.2.1.5 GLAUCOMA SURGICAL DEVICES

7.2.1.5.1 GLAUCOMA DRAINAGE DEVICES

7.2.1.5.2 GLAUCOMA LASER SYSTEMS

7.2.1.5.3 MICRO INVASIVE GLAUCOMA SURGERY DEVICES

7.2.2 DIAGNOSTIC DEVICE

7.2.2.1 OPTICAL COHERENCE TOMOGRAPHY (OCT) SCANNERS

7.2.2.2 AUTOREFRACTORS & KERATOMETERS

7.2.2.3 TONOMETERS

7.2.2.4 PHOROPTERS

7.2.2.5 RETINOSCOPES

7.2.2.6 OPHTHALMOSCOPES

7.2.2.7 SLIT LAMPS

7.2.2.8 PERIMETERS/VISUAL FIELD ANALYZERS

7.2.2.9 CORNEAL TOPOGRAPHY SYSTEMS

7.2.2.10 FUNDUS CAMERAS

7.2.2.11 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

7.2.2.11.1 A- SCAN IMAGING SYSTEM

7.2.2.11.2 B-SCAN IMAGING SYSTEM

7.2.2.11.3 PACHYMETERS

7.2.2.11.4 ULTRASOUND BIOMICROSCOPES

7.2.2.12 LENSMETERS

7.2.2.13 WAVEFRONT ABERROMETERS

7.2.2.14 OPTICAL BIOMETRY SYSTEMS

7.2.2.15 SPECULAR MICROSCOPES

7.2.2.16 CHART PROJECTORS

7.2.3 OPHTHALMIC SURGICAL ACCESSORIES

7.2.3.1 SURGICAL INSTRUMENTS & KITS

7.2.3.2 OPHTHALMIC FORCEPS

7.2.3.3 OPHTHALMIC SPATULA

7.2.3.4 OPHTHALMIC TIPS AND HANDLES

7.2.3.5 OPHTHALMIC CANNULAS

7.2.3.6 OPHTHALMIC SCISSORS

7.2.3.7 OTHERS SURGICAL ACCESSORIES

7.2.4 OPHTHALMIC MICROSCOPES

7.3 DRUGS

7.3.1 ANTI-VEGF DRUGS

7.3.1.1 RANIBIZUMAB

7.3.1.2 BEVACIZUMAB

7.3.2 ANTI-GLAUCOMA DRUGS

7.3.2.1 PROSTAGLANDIN ANALOGS

7.3.2.1.1 LATANOPROST

7.3.2.1.2 BIMATOPROST

7.3.2.1.3 TRAVOPROST

7.3.2.1.4 TAFLUPROST

7.3.2.1.5 LATANOPROSTENE

7.3.2.2 BETA ADRENERGIC ANTAGONISTS

7.3.2.2.1 TIMOLAL MALEATE

7.3.2.2.2 BETAXOLOL

7.3.2.3 ALPHA ADRENERGIC AGONISTS

7.3.2.3.1 EPINEPHRINE

7.3.2.3.2 DEPIVEPRINE

7.3.2.4 MIOTICS

7.3.2.4.1 PILOCARPINE

7.3.2.4.2 ESERINE

7.3.3 ANTI-INFLAMMATION DRUGS

7.3.3.1 STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.3.2 NON-STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.4 RETINAL DISORDER DRUGS

7.3.5 DRY EYE DRUGS

7.3.6 ALLERGIC CONJUCTIVITIS DRUGS

7.3.7 OTHERS

7.3.7.1 BRANDED

7.3.7.2 GENERIC

7.3.7.3 PRESCRIPTION

7.3.7.4 OVER THE COUNTER

7.3.7.5 TOPICAL

7.3.7.6 LOCAL OCULAR

7.3.7.7 INJECTABLES

7.3.7.8 ORAL

7.3.7.9 OTHERS

7.3.7.10 EYE DROPS

7.3.7.11 EYE SOLUTION

7.3.7.12 CREAM & OINTMENTS

7.3.7.13 GEL

7.3.7.14 OTHERS

7.3.7.15 INTRAVITREAL

7.3.7.16 SUBCONJUNCTIVAL

7.3.7.17 RETROBULBAR

7.3.7.18 INTRACAMERAL

7.3.7.19 INTRAMUSCULAR

7.3.7.20 INTRAVENOUS

7.3.7.21 OTHERS

7.3.7.22 TABLET

7.3.7.23 CAPSULES

7.3.7.24 OTHERS

7.4 OTHERS

7.4.1 VISION CARE PRODUCTS

7.4.1.1 SPECTACLES

7.4.1.2 CONTACT LENSES

7.4.1.2.1 SOFT CONTACT LENSES

7.4.1.2.2 HYBRID CONTACT LENSES

7.4.1.2.3 RIGID GAS PERMEABLE LENSES

7.4.2 OTHERS

8 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES

8.1 OVERVIEW

8.2 CATARACT

8.3 REFRACTIVE DISORDERS

8.4 GLAUCOMA

8.5 AGE-RELATED MACULAR DEGENERATION

8.6 INFLAMMATORY DISEASES

8.7 OTHERS

9 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION

9.1 OVERVIEW

9.2 REFRACTION

9.2.1 AUTOMATED REFRACTOMETERS

9.2.2 SET OF TRIAL LENSES

9.2.3 CYCLOPLEGIC DRUGS

9.2.4 TRIAL FRAME

9.2.5 SELF-ILLUMINATED/ MIRROR RETINOSCOPE

9.2.6 JACKSON CROSS CYLINDER

9.3 VISUAL ACUITY TEST

9.3.1 SNELLEN'S CHART

9.3.2 NEAR VISION CHARTS

9.4 INTRAOCULAR PRESSURE

9.4.1 TONOMETERS (GOLDMANN, TONO-PEN, PERKINS, SHIOTZ)

9.4.2 OTHERS

9.5 ANTERIOR SEGMENT AND PUPILLARY EXAMINATION

9.5.1 SLIT LAMP BIOMICROSCOPE

9.5.2 TORCH LIGHT

9.6 VISUAL FIELDS TEST

9.6.1 CENTRAL 30-2 FULL THRESHOLD HUMPHREY VISUAL FIELD ANALYZER

9.6.2 FREQUENCY DOUBLING PERIMETER

9.6.3 GOLDMANN KINETIC PERIMETER

9.7 COLOR VISION TEST

9.8 OTHERS

10 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICS

10.3 HOSPITALS

10.4 HOME HEALTHCARE

10.5 OTHERS

11 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 RETAIL SHOPS

11.2.2 HOSPITAL PHARMACY

11.2.3 ONLINE PHARMACY

11.3 DIRECT TENDER

11.4 OTHERS

12 NORTH AMERICA OPHTHALMOLOGY MARKET BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ALCON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON SERVICES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ESSILOR LUXOTTICA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 NOVARTIS AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BAUSCH + LOMB

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 REVENUE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABBVIE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BAYER AG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARL ZEISS MEDITEC AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COOPER COMPANIES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.1 DOMPÉ

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 F. HOFFMANN-LA ROCHE LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 GLAUKOS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 HAAG-STREIT

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 HOYA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LUMENIS BE LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NIDEK CO.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 REICHERT, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SANTEN PHARMACEUTICAL CO.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 STAAR SURGICAL

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TOPCON CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 ZIEMER OPHTHALMIC SYSTEMS AG

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 7 NORTH AMERICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 12 NORTH AMERICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 13 NORTH AMERICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 17 NORTH AMERICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 18 NORTH AMERICA ANTI INFLAMMATION DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 19 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA CATARACT IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA REFRACTIVE DISORDERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA GLAUCOMA IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA INFLAMMATORY DISEASES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA COLOR VISION TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA CLINICS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA HOME HEALTHCARE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA DIRECT TENDER IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 98 U.S. OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 99 U.S. DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 100 U.S. SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 101 U.S. OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 102 U.S. VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 103 U.S. REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 104 U.S. GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 105 U.S. DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 106 U.S. OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 107 U.S. OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 108 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 109 U.S. ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 110 U.S. ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 111 U.S. PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 112 U.S. BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 113 U.S. ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 114 U.S. MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 115 U.S. ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 116 U.S. OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 117 U.S. VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 118 U.S. CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 119 U.S. OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 120 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 121 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 122 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 123 U.S. TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 124 U.S. LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 125 U.S. INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 126 U.S. ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 127 U.S. OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 128 U.S. REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 129 U.S. VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 130 U.S. INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 131 U.S. ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 132 U.S. VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 133 U.S. OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 134 U.S. OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 135 U.S. RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 136 CANADA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 137 CANADA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 138 CANADA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 CANADA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 140 CANADA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 141 CANADA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 142 CANADA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 143 CANADA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 144 CANADA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 145 CANADA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 146 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 147 CANADA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 148 CANADA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 149 CANADA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 150 CANADA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 151 CANADA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 152 CANADA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 153 CANADA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 154 CANADA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 155 CANADA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 156 CANADA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 157 CANADA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 158 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 159 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 160 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 161 CANADA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 162 CANADA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 163 CANADA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 164 CANADA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 165 CANADA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 166 CANADA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 167 CANADA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 168 CANADA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 169 CANADA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 170 CANADA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 171 CANADA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 172 CANADA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 173 CANADA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 174 MEXICO OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 175 MEXICO DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 176 MEXICO SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 MEXICO OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 178 MEXICO VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 179 MEXICO REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 180 MEXICO GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 181 MEXICO DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 182 MEXICO OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 183 MEXICO OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 184 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 185 MEXICO ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 186 MEXICO ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 187 MEXICO PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 188 MEXICO BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 189 MEXICO ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 190 MEXICO MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 191 MEXICO ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 192 MEXICO OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 193 MEXICO VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 194 MEXICO CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 195 MEXICO OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 196 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 197 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 198 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 199 MEXICO TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 200 MEXICO LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 201 MEXICO INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 202 MEXICO ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 203 MEXICO OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 204 MEXICO REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 205 MEXICO VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 206 MEXICO INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 207 MEXICO ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 208 MEXICO VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 209 MEXICO OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 210 MEXICO OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 211 MEXICO RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA OPHTHALMOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA OPHTHALMOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING INCIDENCE OF EYE DISORDERS IS DRIVING THE GROWTH OF THE NORTH AMERICA OPHTHALMOLOGY MARKET FROM 2025 TO 2032

FIGURE 15 THE PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMOLOGY MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2024

FIGURE 18 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2025-2032 (USD MILLION)

FIGURE 19 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 21 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, 2024

FIGURE 22 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, 2025-2032 (USD MILLION)

FIGURE 23 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2024

FIGURE 26 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2025-2032 (USD MILLION)

FIGURE 27 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, 2024

FIGURE 30 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 31 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL ,2024

FIGURE 34 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 35 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA OPHTHALMOLOGY MARKET SNAPSHOT

FIGURE 38 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.