Mercado de tecnología operativa de América del Norte, por componente ( hardware , software/plataforma, servicios), implementación (local, híbrida, en la nube), tamaño de la organización (pequeñas y medianas empresas, grandes empresas), conectividad (cableada, inalámbrica), tecnología (control de supervisión y adquisición de datos (SCADA), sistemas de control distribuido (DCS), dominios de control de procesos (PCD), controladores lógicos programables (PLC), sistemas instrumentados de seguridad (SIS), sistemas de automatización/gestión de edificios (BAS)), usuario final (automotriz y transporte, construcción e infraestructura, energía y servicios públicos, alimentos y bebidas, ciencias biológicas, marina y puertos, metales y minería, petróleo y gas, productos químicos, pulpa y papel, otros), país (EE. UU., Canadá y México), tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de tecnología operativa de América del Norte

Análisis y perspectivas del mercado: mercado de tecnología operativa de América del Norte

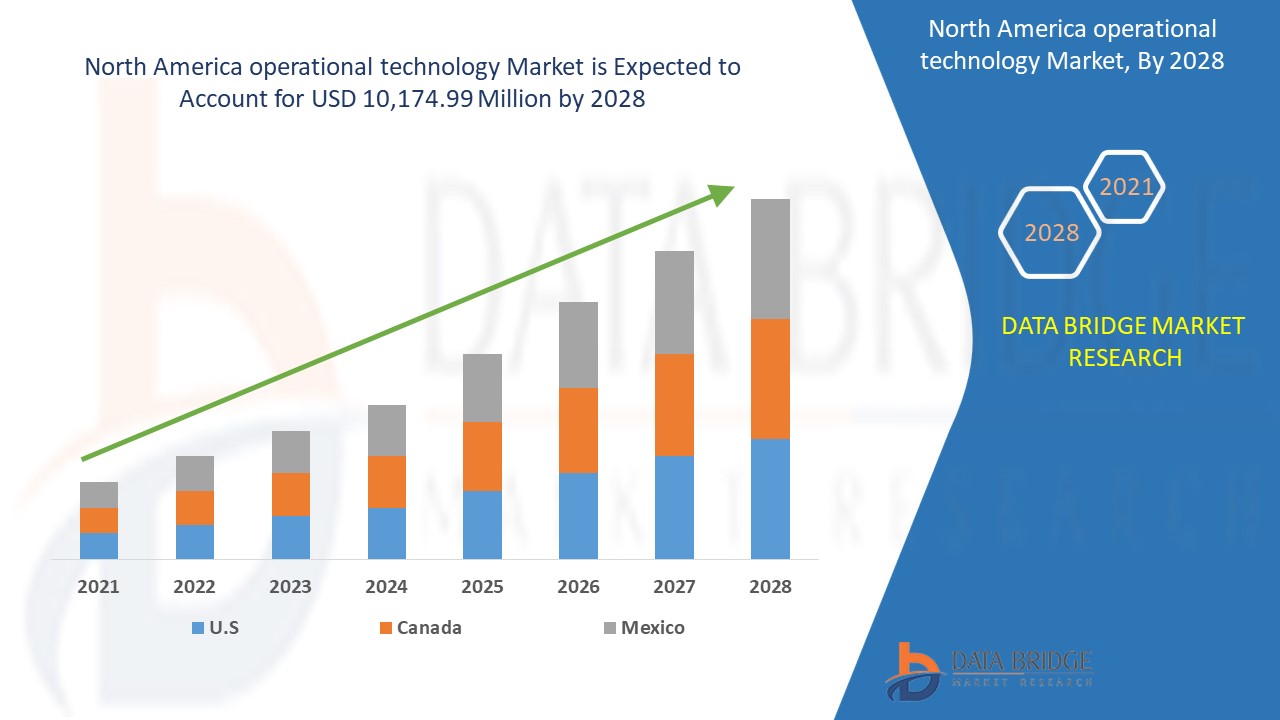

Se espera que el mercado de tecnología operativa de América del Norte gane un crecimiento sustancial en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,4% en el período de pronóstico y se espera que alcance los USD 10 174,99 millones para 2028.

Los sistemas de tecnología operativa son hardware y software que detectan la causa del cambio a través de la monitorización directa mediante un dispositivo físico. La tecnología operativa (OT) utiliza diversas tecnologías como el control de supervisión y adquisición de datos (SCADA), los sistemas de control distribuido (DCS), los dominios de control de procesos (PCD) y los controladores lógicos programables (PLC) para realizar sus aplicaciones. Se utiliza popularmente en sistemas de control industrial, que se pueden implementar en cualquier lugar, incluidas las centrales eléctricas, las industrias papeleras y otras. En los últimos tiempos, la fusión o convergencia de la tecnología operativa con los sistemas de tecnología de la información (TI) ha llevado al desarrollo de la Internet industrial de las cosas (IIOT).

Algunos de los factores que están aumentando la adopción de tecnología operativa son la automatización, los servicios instrumentados de seguridad y los avances técnicos en hardware y software. La creciente adopción de soluciones automatizadas y sistemas mejorados de control y monitoreo está impulsando el crecimiento del mercado. Sin embargo, la falla del funcionamiento crítico de los sistemas OT es un desafío importante para el crecimiento del mercado.

Este informe sobre el mercado de tecnología operativa proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de tecnología operativa en América del Norte

Alcance y tamaño del mercado de tecnología operativa en América del Norte

El mercado de tecnología operativa de América del Norte está segmentado en función de los componentes, la implementación, la conectividad, la tecnología y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de los componentes , el mercado global de tecnología operativa se segmenta en hardware, software/plataforma y servicios. Se espera que el segmento de hardware tenga la mayor participación del mercado durante 2021, ya que la tecnología operativa depende del hardware, como sensores, conmutadores, controladores y otros, que son componentes esenciales para el mercado de tecnología operativa.

- En función de la implementación, el mercado global de tecnología operativa se segmenta en nube , híbrido y local. Se espera que el segmento de la nube tenga la mayor participación del mercado durante 2021, ya que la nube proporciona una mayor escalabilidad en comparación con otros modelos de implementación.

- En función del tamaño de la organización, el mercado de tecnología operativa de América del Norte se segmenta en grandes empresas y pequeñas y medianas empresas. Se espera que el segmento de grandes empresas tenga la mayor participación del mercado durante 2021, ya que las grandes empresas están equipadas con instrumentos de seguridad de alta precisión y calidad.

- En función de la conectividad , el mercado global de tecnología operativa se segmenta en inalámbrico y cableado. Se espera que el segmento de conectividad inalámbrica ocupe la mayor participación del mercado durante 2021, ya que la conectividad inalámbrica ayuda a aumentar la eficiencia, ahorrar costos y requiere menos mantenimiento.

- En función de la tecnología, el mercado está segmentado en Control de Supervisión y Adquisición de Datos (SCADA), Controladores Lógicos Programables (PLC), Sistemas Instrumentados de Seguridad (SIS), Sistemas de Control Distribuido (DCS), Sistemas de Gestión/Automatización de Edificios (BAS) y Dominios de Control de Procesos (PCD). Se espera que el segmento SCADA tenga la mayor participación del mercado durante 2021, ya que ofrece varias ventajas, como mayor confiabilidad, menores costos, mayor seguridad para los trabajadores, mayor satisfacción del cliente y mejor utilización.

- En función del usuario final, el mercado de tecnología operativa de América del Norte se segmenta en petróleo y gas, productos químicos, marina y puertos, energía y servicios públicos, metales y minería, automoción y transporte, pulpa y papel, alimentos y bebidas, ciencias biológicas, edificios e infraestructura, entre otros. Se espera que el segmento de petróleo y gas tenga la mayor participación del mercado durante 2021, ya que la tecnología OT se utiliza principalmente para la detección de fugas, la seguridad de procesos y las mejoras de procesos, que están dominadas por la industria del petróleo y el gas.

Análisis a nivel de país del mercado de tecnología operativa de América del Norte

Se analiza el mercado de tecnología operativa y se proporciona información sobre el tamaño del mercado por país, componentes, aplicación, vertical y producto.

Los países cubiertos en el informe del mercado de tecnología operativa de América del Norte son EE. UU., Canadá y México.

Estados Unidos representó la mayor participación en el mercado de tecnología operativa de América del Norte debido a factores como la presencia de un gran número de empresas que fabrican hardware y software de tecnologías operativas y la creciente automatización en la seguridad y mejora de procesos.

La sección de países del informe sobre el mercado de tecnología operativa de América del Norte también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las nuevas ventas, las ventas de reemplazo, la demografía del país, las leyes regulatorias y el análisis de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Creciente adopción de la fabricación por contrato

El mercado de tecnología operativa de América del Norte también le ofrece un análisis detallado del mercado para cada país: el crecimiento de la base instalada de diferentes tipos de productos para el mercado de tecnología operativa, el impacto de la tecnología mediante curvas de línea de vida y cambios en los requisitos de productos abrasivos, escenarios regulatorios y su impacto en el mercado. Los datos están disponibles para el período histórico de 2019.

Análisis del panorama competitivo y de la cuota de mercado de la tecnología operativa

El panorama competitivo del mercado de tecnología operativa de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de marcas, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de tecnología operativa de América del Norte.

Algunos de los principales actores que operan en el mercado de tecnología operativa de América del Norte son Fortinet, Inc., Gray Matter Systems LLC, Forcepoint, IBM, ABB, General Electric, Schneider Electric, Rockwell Automation, Inc., Emerson Electric Co., Advantech Co., Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., Oracle, Wipro Limited, SCADAfence, SAP SE, Cisco Systems, Accenture, Wunderlich-Malec Engineering, Inc., Yokogawa Electric Corporation y otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En octubre de 2019, ABB se asoció con Operational Technology Cyber Security Alliance (OTCSA). Esta asociación se centró en la seguridad de la tecnología operativa en infraestructuras críticas y sistemas de control industrial (ICS). Esta solución abordará los problemas de ciberseguridad en sistemas y soluciones para infraestructuras e industrias. Ambas empresas se beneficiarán mutuamente, lo que les ayudará a ampliar su mercado.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a la organización el beneficio de mejorar su oferta para el mercado de tecnología operativa mediante una gama de productos ampliada.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY LANDSCAPE

4.2 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

4.3 DISTRIBUTED CONTROL SYSTEMS (DCS)

4.4 PROCESS CONTROL DOMAINS (PCD)

4.5 PROGRAMMABLE LOGIC CONTROLLERS (PLC)

4.6 SAFETY INSTRUMENTED SYSTEMS (SIS)

4.7 BUILDING MANAGEMENT/ AUTOMATION SYSTEMS (BAS)

4.8 COMPUTER NUMERICAL CONTROL (CNC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR MERGING OPERATIONAL TECHNOLOGY (OT) & INFORMATION TECHNOLOGY (IT)

5.1.2 GROWING DEMAND FOR SMART AUTOMATED SOLUTIONS

5.1.3 RAPID INDUSTRIALIZATION IN EMERGING ECONOMIES

5.1.4 INCREASING POPULARITY OF CONTROLLING AND MONITORING EQUIPMENT

5.1.5 QUICK RESOLUTION TIME AND COST EFFECTIVENESS OF OPERATIONAL TECHNOLOGY

5.2 RESTRAINTS

5.2.1 SECURITY RISK IN OT OVER DATA PLATFORM.

5.2.2 MULTI-LEVEL DEPENDENCY INVOLVED IN OPERATIONAL TECHNOLOGY (OT)

5.2.3 ISSUES RELATED TO INTEROPERABILITY WHILE CONNECTING NEW SYSTEM WITH EARLIER INSTALLED SYSTEMS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND IN FOOD, PULP & PAPER INDUSTRIES FOR OPERATIONAL TECHNOLOGY

5.3.2 INCREASE IN OPERATIONAL TECHNOLOGY DEPLOYMENTS IN BUILDINGS AND INFRASTRUCTURE INDUSTRIES

5.3.3 OPERATIONAL TECHNOLOGY AS A SERVICE FOR RAPIDLY GROWING LIFE SCIENCES INDUSTRY

5.3.4 GROWING DEMAND IN OIL & GAS INDUSTRY FOR OPERATIONAL TECHNOLOGY

5.4 CHALLENGES

5.4.1 UPGRADATION OF OT SYSTEMS WITH ZERO PRODUCTION LOSS

5.4.2 FAILURES IN CRITICAL FUNCTIONING OF OT SYSTEMS

5.4.3 LACK OF SKILLED WORK FORCE FOR OPERATIONAL TECHNOLOGY SYSTEMS

6 IMPACT OF COVID-19 ON NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON OPERATIONAL TECHNOLOGY MARKET

6.2 IMPACT ON PRICE

6.3 IMPACT ON DEMAND AND SUPPLY CHAIN

6.4 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.5 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.6 CONCLUSION

7 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.3 SOFTWARE/PLATFORM

7.3.1 INCIDENT RESPONSE

7.3.2 ANOMALY DETECTION

7.3.3 OT ENDPOINT SECURITY

7.3.4 OT NETWORK SEGMENTATION

7.3.5 OTHERS

7.4 SERVICES

7.4.1 PROFESSIONAL SERVICES

7.4.2 MANAGED SERVICES

8 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 CLOUD

8.3 HYBRID

8.4 ON-PREMISE

9 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 SMALL & MEDIUM SIZE BUSINESS

10 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY

10.1 OVERVIEW

10.2 WIRELESS

10.2.1 WHART

10.2.2 ISA 100

10.2.3 WIFI

10.2.4 BLUETOOTH

10.2.5 ZIGBEE

10.2.6 SATELLITE TECHNOLOGIES

10.2.7 CELLULAR TECHNOLOGIES

10.3 WIRED

10.3.1 ETHERNET

10.3.2 PROFINET

10.3.3 MODBUS

10.3.4 FOUNDATION FIELDBUS

10.3.5 OTHERS

11 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.3 PROGRAMMABLE LOGIC CONTROLLERS (PLC)

11.4 SAFETY INSTRUMENTED SYSTEMS (SIS)

11.5 DISTRIBUTED CONTROL SYSTEMS (DCS)

11.6 BUILDING MANAGEMENT / AUTOMATION SYSTEMS (BAS)

11.7 PROCESS CONTROL DOMAINS (PCD)

12 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY END-USER

12.1 OVERVIEW

12.2 OIL & GAS

12.2.1 HARDWARE

12.2.2 SOFTWARE/PLATFORM

12.2.3 SERVICES

12.3 CHEMICALS

12.3.1 HARDWARE

12.3.2 SOFTWARE/PLATFORM

12.3.3 SERVICES

12.4 MARINE & PORTS

12.4.1 HARDWARE

12.4.2 SOFTWARE/PLATFORM

12.4.3 SERVICES

12.5 ENERGY & UTILITIES

12.5.1 HARDWARE

12.5.2 SOFTWARE/PLATFORM

12.5.3 SERVICES

12.6 METALS AND MINING

12.6.1 HARDWARE

12.6.2 SOFTWARE/PLATFORM

12.6.3 SERVICES

12.7 AUTOMOTIVE AND TRANSPORTATION

12.7.1 HARDWARE

12.7.2 SOFTWARE/PLATFORM

12.7.3 SERVICES

12.8 PULP AND PAPER

12.8.1 HARDWARE

12.8.2 SOFTWARE/PLATFORM

12.8.3 SERVICES

12.9 FOOD & BEVERAGE

12.9.1 HARDWARE

12.9.2 SOFTWARE/PLATFORM

12.9.3 SERVICES

12.1 LIFE SCIENCES

12.10.1 HARDWARE

12.10.2 SOFTWARE/PLATFORM

12.10.3 SERVICES

12.11 BUILDINGS AND INFRASTRUCTURE

12.11.1 HARDWARE

12.11.2 SOFTWARE/PLATFORM

12.11.3 SERVICES

12.12 OTHERS

12.12.1 HARDWARE

12.12.2 SOFTWARE/PLATFORM

12.12.3 SERVICES

13 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HONEYWELL INTERNATIONAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT & SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ABB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 EMERSON ELECTRIC CO.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SCHNEIDER ELECTRIC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ROCKWELL AUTOMATION, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL ELECTRIC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SOLUTION & SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ADVANTECH CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ACCENTURE

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SOLUTION/ SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 CISCO SYSTEMS, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 FORCEPOINT

16.10.1 COMPANY SNAPSHOT

16.10.2 INDUSTRIAL SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 FORTINET, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SOLUTION PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 GRAYMATTER

16.12.1 COMPANY SNAPSHOT

16.12.2 SOLUTION PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HUAWEI TECHNOLOGIES CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 IBM CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 ORACLE

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SOLUTION PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 SAP SE

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SCADAFENCE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT & SOLUTION PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 WIPRO LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 WUNDERLICH-MALEC ENGINEERING, INC

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 YOKOGAWA ELECTRIC CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT/ SOLUTION PORTFOLIO

16.20.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA SOFTWARE/PLATFORM IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE/PLATFORM IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT,2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA CLOUD IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA HYBRID IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA ON-PREMISE IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA LARGE ENTERPRISE IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA SMALL & MEDIUM SIZE BUSINESS IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA WIRELESS IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA WIRELESS IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA WIRED IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA WIRED IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA PROGRAMMABLE LOGIC CONTROLLERS (PLC) IN OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA SAFETY INSTRUMENTED SYSTEMS (SIS) IN OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA DISTRIBUTED CONTROL SYSTEMS (DCS) IN OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA BUILDING MANAGEMENT / AUTOMATION SYSTEMS (BAS) IN OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA PROCESS CONTROL DOMAINS (PCD) IN OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA OIL & GAS IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA OIL & GAS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA CHEMICALS IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA CHEMICALS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA MARINE & PORTS IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA MARINE & PORTS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA ENERGY & UTILITIES IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA ENERGY & UTILITIES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA METALS AND MINING IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA METALS AND MINING IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA PULP AND PAPER IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA PULP AND PAPER IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA FOOD & BEVERAGE IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA FOOD & BEVERAGE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA LIFE SCIENCES IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA LIFE SCIENCES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA BUILDINGS AND INFRASTRUCTURE IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA BUILDINGS AND INFRASTRUCTURE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN OPERATIONAL TECHNOLOGY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA SOFTWARE/PLATFORM IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA SERVICES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA WIRELESS IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA WIRED IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 58 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 59 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 60 NORTH AMERICA OIL & GAS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA CHEMICALS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 62 NORTH AMERICA MARINE AND PORTS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA ENERGY & UTILITIES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 64 NORTH AMERICA METALS AND MINING IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 66 NORTH AMERICA PULP AND PAPER IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 67 NORTH AMERICA FOOD AND BEVERAGE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA LIFE SCIENCES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA BUILDING AND INFRASTRUCTURE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 71 U.S. OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 72 U.S. SOFTWARE/PLATFORM IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 73 U.S. SERVICES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 74 U.S. OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 75 U.S. OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 76 U.S. OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 77 U.S. WIRELESS IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 78 U.S. WIRED IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 79 U.S. OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 80 U.S. OPERATIONAL TECHNOLOGY MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 81 U.S. OIL & GAS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 82 U.S. CHEMICALS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 83 U.S. MARINE AND PORTS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 84 U.S. ENERGY & UTILITIES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 85 U.S. METALS AND MINING IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 86 U.S. AUTOMOTIVE AND TRANSPORTATION IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 87 U.S. PULP AND PAPER IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 88 U.S. FOOD AND BEVERAGE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 89 U.S. LIFE SCIENCES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 90 U.S. BUILDING AND INFRASTRUCTURE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 91 U.S. OTHERS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 92 CANADA OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 93 CANADA SOFTWARE/PLATFORM IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 94 CANADA SERVICES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 95 CANADA OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 96 CANADA OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 97 CANADA OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 98 CANADA WIRELESS IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 99 CANADA WIRED IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 100 CANADA OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 101 CANADA OPERATIONAL TECHNOLOGY MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 102 CANADA OIL & GAS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 103 CANADA CHEMICALS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 104 CANADA MARINE AND PORTS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 105 CANADA ENERGY & UTILITIES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 106 CANADA METALS AND MINING IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 107 CANADA AUTOMOTIVE AND TRANSPORTATION IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 108 CANADA PULP AND PAPER IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 109 CANADA FOOD AND BEVERAGE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 110 CANADA LIFE SCIENCES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 111 CANADA BUILDING AND INFRASTRUCTURE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 112 CANADA OTHERS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 113 MEXICO OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 114 MEXICO SOFTWARE/PLATFORM IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 115 MEXICO SERVICES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 116 MEXICO OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 117 MEXICO OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 118 MEXICO OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 119 MEXICO WIRELESS IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 120 MEXICO WIRED IN OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2019-2028 (USD MILLION)

TABLE 121 MEXICO OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 122 MEXICO OPERATIONAL TECHNOLOGY MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 123 MEXICO OIL & GAS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 124 MEXICO CHEMICALS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 125 MEXICO MARINE AND PORTS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 126 MEXICO ENERGY & UTILITIES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 127 MEXICO METALS AND MINING IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 128 MEXICO AUTOMOTIVE AND TRANSPORTATION IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 129 MEXICO PULP AND PAPER IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 130 MEXICO FOOD AND BEVERAGE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 131 MEXICO LIFE SCIENCES IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 132 MEXICO BUILDING AND INFRASTRUCTURE IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 133 MEXICO OTHERS IN OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 THE RISE IN DEMAND FOR MERGING OPERATIONAL TECHNOLOGY (OT) & INFORMATION TECHNOLOGY (IT) IS EXPECTED TO DRIVE THE NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 HARDWARE COMPONENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA OPERATIONAL TECHNOLOGYMARKET

FIGURE 14 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT, 2020

FIGURE 15 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY DEPLOYMENT, 2020

FIGURE 16 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020

FIGURE 17 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY CONNECTIVITY, 2020

FIGURE 18 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2020

FIGURE 19 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: BY, END-USER 2020

FIGURE 20 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: SNAPSHOT (2020)

FIGURE 21 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: BY COUNTRY (2020)

FIGURE 22 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 23 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 24 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: BY COMPONENT (2021-2028)

FIGURE 25 NORTH AMERICA OPERATIONAL TECHNOLOGY MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.