North America Omega 3 For Food Application Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

963.26 Million

USD

1,919.36 Million

2025

2033

USD

963.26 Million

USD

1,919.36 Million

2025

2033

| 2026 –2033 | |

| USD 963.26 Million | |

| USD 1,919.36 Million | |

|

|

|

|

Segmentación del mercado de omega-3 para aplicaciones alimentarias en América del Norte, por tipo ( ácido alfa-linolénico (ALA), ácido eicosapentaenoico (EPA), ácido docosahexaenoico (DHA) y ácido eicosapentaenoico (EPA) + ácido docosahexaenoico (DHA)), fuente (de origen marino, de algas y de origen vegetal), forma (aceite y polvo), aplicación ( alimentos funcionales , productos de confitería y chocolate, nutrición deportiva, suplementos dietéticos , fórmula infantil y otros), función (fortificación de alimentos, salud ósea y articular, salud de la piel, salud del cabello, salud de las uñas y otros) - Tendencias de la industria y pronóstico hasta 2033

¿Cuál es el tamaño y la tasa de crecimiento del mercado de aplicaciones alimentarias de Omega-3 en América del Norte?

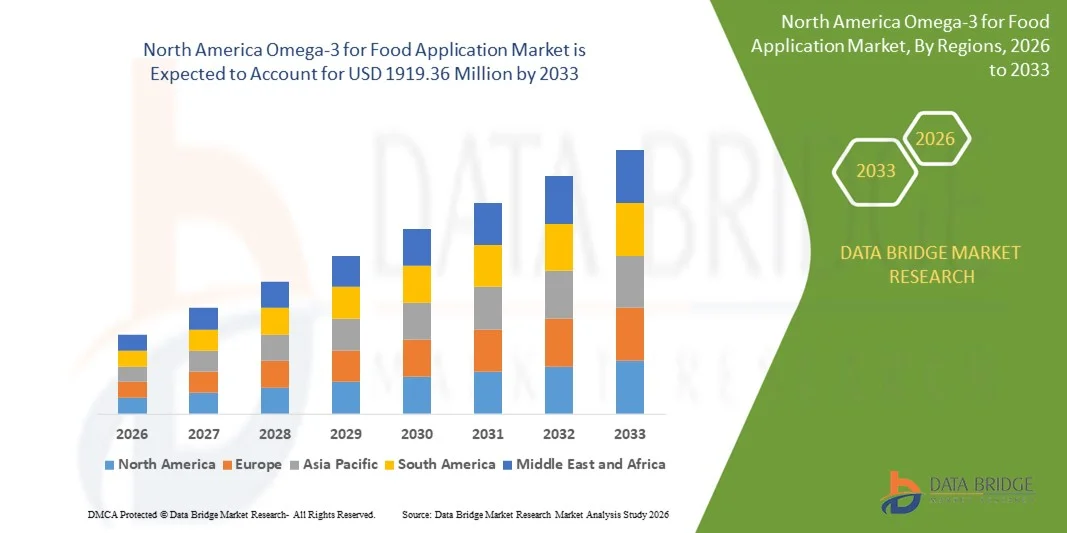

- El tamaño del mercado de Omega-3 para aplicaciones alimentarias de América del Norte se valoró en USD 963,26 millones en 2025 y se espera que alcance los USD 1919,36 millones para 2033 , con una CAGR del 9,0 % durante el período de pronóstico.

- La creciente demanda de alimentos funcionales, fortificados y saludables por parte de los consumidores está impulsando el crecimiento del mercado de Omega-3 para aplicaciones alimentarias. La creciente conciencia sobre la salud cardiovascular, el apoyo cognitivo y los beneficios antiinflamatorios de los ácidos grasos Omega-3 está animando a los fabricantes a incorporar estos ingredientes en productos de panadería, lácteos, bebidas y snacks.

- La creciente preferencia por los productos alimenticios naturales y orgánicos, sumada a la preocupación por el consumo de azúcar, la obesidad y la diabetes, está acelerando aún más la adopción de alimentos fortificados con Omega-3. Sus beneficios funcionales, como sus propiedades antiinflamatorias, cardioprotectoras y beneficiosas para la salud cerebral, están fortaleciendo su atractivo en el mercado norteamericano.

¿Cuáles son las principales conclusiones del mercado de aplicaciones de Omega-3 para alimentos?

- La creciente concienciación sobre la salud de los consumidores, el aumento de los ingresos disponibles y la evolución de las preferencias alimentarias son factores clave que impactan positivamente en el mercado de Omega-3 para aplicaciones alimentarias. Además, las innovaciones de productos y las nuevas estrategias de formulación presentan oportunidades lucrativas para los participantes del mercado.

- El alto costo de los ingredientes Omega-3 en comparación con las alternativas convencionales, sumado a la presencia de opciones de fortificación artificial más económicas, podría obstaculizar el crecimiento. Se prevé que la escasa concienciación de los consumidores en las regiones emergentes sobre los beneficios para la salud del Omega-3 dificulte su adopción generalizada.

- A pesar de los desafíos, se espera que la I+D en curso, la diversificación de productos y las iniciativas de marketing sostengan el crecimiento a largo plazo en el mercado de Omega-3 para aplicaciones alimentarias de América del Norte.

- Estados Unidos dominó el mercado de Omega-3 para aplicaciones alimentarias en América del Norte con una participación en los ingresos del 43,2 % en 2025, respaldado por una fuerte demanda de bebidas enriquecidas con Omega-3, refrigerios proteicos, alternativas lácteas, cereales y alimentos fortificados.

- Se proyecta que México registre la CAGR más rápida del 7,5 % entre 2026 y 2033, impulsada por la creciente conciencia sobre la salud, la urbanización y la creciente demanda de alimentos funcionales enriquecidos con EPA y DHA.

- El segmento DHA dominó el mercado con una participación en los ingresos del 45,6 % en 2025, respaldado por su amplio uso en fórmulas infantiles, productos lácteos fortificados, bebidas para la salud del cerebro y suplementos nutricionales.

Alcance del informe y segmentación del mercado de aplicaciones de Omega-3 para alimentos

|

Atributos |

Omega-3 para aplicaciones alimentarias: información clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Norteamérica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de aplicaciones de Omega-3 para alimentos?

Creciente demanda de ingredientes alimentarios enriquecidos con nutrientes y multi-omega-3

- El mercado de Omega-3 para aplicaciones alimentarias está experimentando un crecimiento significativo hacia formulaciones enriquecidas con nutrientes, multifuncionales y de etiqueta limpia, que incluyen mezclas con aceites vegetales, extractos de algas y fibras dietéticas para mejorar el valor nutricional, el sabor y los beneficios funcionales.

- Los fabricantes están desarrollando soluciones multipropósito de Omega-3 que apoyan la salud cardíaca, la función cognitiva, las propiedades antiinflamatorias y aplicaciones más amplias en panadería, lácteos, bebidas y productos de nutrición infantil.

- Los consumidores buscan cada vez más ingredientes Omega-3 naturales, seguros y funcionales en lugar de alternativas sintéticas, lo que impulsa su adopción en categorías de alimentos, bebidas y nutracéuticos.

- Por ejemplo, empresas como DSM, BASF, Croda, ADM y Aker BioMarine han ampliado sus carteras de productos Omega-3 al introducir aceites microencapsulados, en polvo y mezclados adecuados para alimentos y bebidas fortificados.

- La creciente conciencia sobre la salud cardiovascular, la nutrición infantil y el consumo de etiquetas limpias está acelerando la adopción en el mercado de América del Norte.

- A medida que se intensifica el enfoque del consumidor en la salud, la funcionalidad y los ingredientes naturales, se espera que Omega-3 para aplicaciones alimentarias siga siendo fundamental para la innovación de productos en las industrias alimentaria y nutracéutica.

¿Cuáles son los impulsores clave del mercado de aplicaciones alimentarias de Omega-3?

- La creciente demanda de ingredientes Omega-3 funcionales, de origen vegetal y marino, está impulsando una fuerte adopción de Omega-3 para aplicaciones alimentarias en América del Norte.

- Por ejemplo, en 2025, DSM, BASF y Croda ampliaron los productos Omega-3 microencapsulados y en polvo para aplicaciones de lácteos fortificados, bebidas y nutrición infantil.

- La creciente conciencia sobre la salud cardíaca, el desarrollo del cerebro infantil, los beneficios antiinflamatorios y el apoyo cognitivo está impulsando la demanda en Estados Unidos, América del Norte y América del Norte.

- Los avances en las técnicas de microencapsulación, extracción y mezcla han mejorado la estabilidad, el enmascaramiento del sabor y la versatilidad de aplicación en una amplia gama de alimentos.

- La creciente preferencia por productos alimenticios orgánicos, no modificados genéticamente y de etiqueta limpia respalda aún más la expansión del mercado, impulsada por consumidores conscientes de la salud y el medio ambiente.

- Con I+D continua, lanzamientos de nuevos productos, colaboraciones y una distribución ampliada en América del Norte, se espera que el mercado de Omega-3 para aplicaciones alimentarias mantenga un fuerte crecimiento durante el período de pronóstico.

¿Qué factor está desafiando el crecimiento del mercado de aplicaciones de Omega-3 en alimentos?

- Los altos costos de extracción, purificación y estabilización asociados con los aceites Omega-3 marinos y de origen vegetal limitan su asequibilidad en regiones sensibles a los precios.

- Por ejemplo, durante 2024-2025, las fluctuaciones en la producción de aceite de pescado y algas, la disponibilidad de materia prima y los costos de energía afectaron los volúmenes de fabricación de varias empresas.

- Los estrictos requisitos reglamentarios para la aprobación de nuevos alimentos, la seguridad alimentaria y el cumplimiento del etiquetado añaden complejidades operativas.

- La limitada conciencia de los consumidores en los mercados emergentes sobre los beneficios del Omega-3, incluido el apoyo cardiovascular, cognitivo y nutricional infantil, restringe su adopción.

- La competencia de alternativas más baratas, como el aceite de linaza, el aceite de chía y otros aceites vegetales, ejerce presión sobre los precios y la diferenciación.

- Las empresas están abordando estos desafíos centrándose en la extracción rentable, las formulaciones estables, la alineación regulatoria y la educación del consumidor para expandir la adopción de Omega-3 de alta calidad para aplicaciones alimentarias en América del Norte.

¿Cómo está segmentado el mercado de aplicaciones de Omega-3 para alimentos?

El mercado está segmentado según tipo, fuente, forma, aplicaciones y función .

- Por tipo

El mercado de omega-3 para aplicaciones alimentarias está segmentado en ácido alfa-linolénico (ALA), ácido eicosapentaenoico (EPA), ácido docosahexaenoico (DHA) y EPA+DHA. El segmento de DHA dominó el mercado con una participación en los ingresos del 45.6 % en 2025, respaldado por su amplio uso en fórmulas infantiles, lácteos fortificados, bebidas para la salud cerebral y suplementos nutricionales. El DHA es ampliamente preferido debido a sus beneficios comprobados para el desarrollo cognitivo, la salud ocular y el apoyo neurológico. Su alta estabilidad en formatos microencapsulados y su compatibilidad con formulaciones de panadería, bebidas y en polvo amplían aún más su adopción industrial

Se proyecta que el segmento EPA+DHA crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda de mezclas sinérgicas en alimentos funcionales para la salud cardiovascular, nutrición deportiva y formulaciones antiinflamatorias. La creciente concienciación sobre la nutrición preventiva, el aumento de la incidencia de enfermedades cardiovasculares y la innovación de productos de origen marino y algas seguirán impulsando la demanda en los mercados de Norteamérica.

- Por fuente

El mercado de omega-3 para aplicaciones alimentarias está segmentado en productos marinos, de algas y de plantas. El segmento de productos marinos tuvo la mayor participación, con un 58.3 %, en 2025, impulsado por la fuerte disponibilidad de aceite de pescado, aceite de krill y triglicéridos marinos concentrados utilizados en bebidas fortificadas, lácteos, productos para untar y suplementos dietéticos. Los omega-3 de origen marino siguen siendo la fuente más establecida debido a su alto contenido de EPA y DHA y a su amplia aceptación regulatoria en las industrias alimentarias de América del Norte

Se espera que el segmento de productos a base de algas registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por la creciente preferencia por alternativas de origen vegetal, sostenibles, sin OMG y veganas, aptas para fórmulas infantiles, bebidas funcionales, alimentos de etiqueta limpia y productos nutricionales premium. El aumento de las inversiones en la fermentación de microalgas, la producción rentable y la sostenibilidad ambiental impulsan aún más su adopción en Estados Unidos y Norteamérica.

- Por forma

El mercado está segmentado en formas de aceite y polvo. El segmento de aceite dominó el mercado con una participación en los ingresos del 67.2% en 2025, atribuido a su alta utilización en bebidas fortificadas, productos lácteos, fórmulas infantiles y aplicaciones culinarias. Los aceites ofrecen una absorción superior, altos niveles de pureza y una aplicabilidad más amplia en los sistemas alimentarios tradicionales. Los aceites Omega-3 marinos y a base de algas siguen siendo el estándar de la industria para la fortificación con EPA y DHA, particularmente en las categorías de alimentos y nutracéuticos premium

Se proyecta que el segmento de polvos crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por una creciente adopción en productos horneados, gomitas, confitería, mezclas secas, sustitutos de comidas y bebidas en polvo. El Omega-3 en polvo ofrece mayor estabilidad, enmascaramiento del sabor, mayor vida útil y facilidad de mezcla, lo que lo hace ideal para el uso industrial a gran escala y para fabricantes de alimentos de origen vegetal.

- Por aplicaciones

El mercado de omega-3 para aplicaciones alimentarias está segmentado en alimentos funcionales, productos de confitería y chocolate, nutrición deportiva, suplementos dietéticos, fórmulas infantiles y otros. El segmento de alimentos funcionales lideró el mercado con una participación en los ingresos del 36.4 % en 2025, impulsado por la creciente demanda de alimentos para la salud del corazón, bebidas que estimulan el cerebro, alternativas lácteas fortificadas, productos para untar, cereales y barritas saludables. La creciente preferencia de los consumidores por la nutrición preventiva y basada en el estilo de vida respalda la expansión continua

Se proyecta que el segmento de Nutrición Deportiva crecerá a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2026 y 2033, debido al creciente interés en los beneficios antiinflamatorios, la recuperación muscular, la mejora de la resistencia y el apoyo a la salud articular. El creciente consumo de proteínas en polvo, geles, bebidas hidratantes y alimentos de alto rendimiento con Omega-3 está impulsando un rápido crecimiento en Norteamérica.

- Por función

El mercado está segmentado en fortificación de alimentos, salud ósea y articular, salud de la piel, salud capilar, salud de las uñas y otros. El segmento de fortificación de alimentos dominó el mercado con una participación en los ingresos del 44.8 % en 2025, respaldado por la creciente incorporación de omega-3 en productos lácteos, bebidas, productos de panadería, fórmulas infantiles, cereales y refrigerios nutricionales. El creciente enfoque del gobierno en la mejora nutricional, las formulaciones de etiqueta limpia y la salud preventiva impulsa la adopción industrial generalizada

Se proyecta que el segmento de Salud de la Piel crecerá a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda de productos de belleza desde el interior, alimentos funcionales antienvejecimiento, mezclas de colágeno y nutrición con apoyo dermatológico. El papel del Omega-3 en la hidratación, la reducción de la inflamación y la reparación de la barrera cutánea acelera su integración en snacks, bebidas y dulces funcionales fortificados.

¿Qué región posee la mayor participación en el mercado de aplicaciones de Omega-3 para alimentos?

- Estados Unidos dominó el mercado de Omega-3 para aplicaciones alimentarias en América del Norte con una participación en los ingresos del 43,2 % en 2025, respaldado por una fuerte demanda de bebidas enriquecidas con Omega-3, refrigerios proteicos, alternativas lácteas, cereales y alimentos fortificados.

- Los fabricantes están invirtiendo en tecnologías avanzadas de extracción de lípidos, fermentación de algas y microencapsulación para mejorar la pureza, el sabor y la biodisponibilidad. La adopción generalizada del comercio electrónico, el creciente interés en los alimentos funcionales y la atención de los consumidores a la salud cardiovascular y el bienestar cognitivo impulsan el crecimiento del mercado tanto en los segmentos general como premium.

Análisis del mercado canadiense de aplicaciones de omega-3 en alimentos

Canadá muestra un crecimiento sostenido, impulsado por la creciente preferencia de los consumidores por ingredientes Omega-3 naturales, de origen sostenible y orgánicos. Los fabricantes de alimentos y bebidas están ampliando sus portafolios de bebidas fortificadas, productos lácteos y nutrición infantil. La creciente conciencia sobre el bienestar cardiovascular, las dietas ricas en omega y la atención médica preventiva está fomentando su adopción en supermercados, tiendas especializadas y canales en línea, mientras que las iniciativas gubernamentales de salud fortalecen aún más la expansión del mercado.

Análisis del mercado de Omega-3 en alimentos en México

Se proyecta que México registrará la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7.5%, entre 2026 y 2033, impulsada por una mayor concienciación sobre la salud, la urbanización y la creciente demanda de alimentos funcionales enriquecidos con EPA y DHA. La incorporación de omega-3 en bebidas, productos de panadería, suplementos dietéticos y fórmulas infantiles aumenta constantemente. La expansión del comercio electrónico, el marketing digital y el lanzamiento de productos premium está acelerando la accesibilidad y la adopción en diversos segmentos de consumidores.

¿Cuáles son las principales empresas en el mercado de aplicaciones alimentarias de Omega-3?

La industria de Omega-3 para aplicaciones alimentarias está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DSM (Países Bajos)

- BASF SE (Alemania)

- Croda International Plc (Reino Unido)

- Aker BioMarine (Noruega)

- ADM (Archer Daniels Midland Company) (EE. UU.)

- Cellana Inc. (EE. UU.)

- HUTAI Biopharm Resource Co. Ltd (China)

- AlaskOmega (EE. UU.)

- KinOmega Biopharm Inc. (EE. UU.)

- Pharma Marine AS (Noruega)

- GC Rieber VivoMega AS (Noruega)

- Sanmark LLC (EE. UU.)

- Arjuna Natural Pvt Ltd (India)

- ConnOils LLC (EE. UU.)

- Kingdomway Nutrition, Inc. (China)

- Polaris Inc. (EE. UU.)

- Biosearch Life (España)

¿Cuáles son los desarrollos recientes en el mercado norteamericano de omega-3 para aplicaciones alimentarias?

- En marzo de 2025, Natac presentó su producto Omega-3 Star, elaborado con aceite de pescado de primera calidad y formulado para aplicaciones en las industrias alimentaria, nutracéutica y de nutrición para mascotas. Este lanzamiento fortalece la posición de la compañía en el creciente mercado de soluciones omega-3.

- En octubre de 2023, dsm-firmenich lanzó OMEGA O3020 de life en el mercado norteamericano, presentando el primer omega-3 de algas de origen único que iguala la proporción natural de EPA y DHA del aceite de pescado estándar, a la vez que ofrece una eficacia superior. Se espera que este producto impulse la adopción de alternativas vegetales al omega-3.

- En mayo de 2023, Nuseed Norteamérica presentó su aceite vegetal Nuseed Nutriterra enriquecido con omega-3, diseñado específicamente para satisfacer las necesidades cambiantes de los sectores de la nutrición humana y los suplementos dietéticos. Esta innovación mejora la disponibilidad de fuentes sostenibles de omega-3 no marinas.

- En marzo de 2023, Epax invirtió 40 millones de dólares en tecnologías de destilación molecular para mejorar la producción y la pureza de ingredientes omega-3 altamente concentrados. Esta inversión subraya el compromiso de la empresa con el desarrollo de soluciones omega-3 de alta calidad.

- En octubre de 2022, Nature's Bounty lanzó un nuevo suplemento dietético de omega-3 de origen vegetal formulado con 1000 mg de aceite de algas vegetarianas para favorecer la salud del corazón, las articulaciones y la piel. Este lanzamiento de producto destaca la creciente demanda de opciones de omega-3 veganas y de etiqueta limpia.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.